A Order W-2 Wage and Tax Statement Copy allows employees to obtain an official duplicate of their W-2 form for tax filing or record-keeping purposes. This document is crucial for accurately reporting income and taxes withheld to the IRS. Employers or the Social Security Administration typically provide these copies upon request.

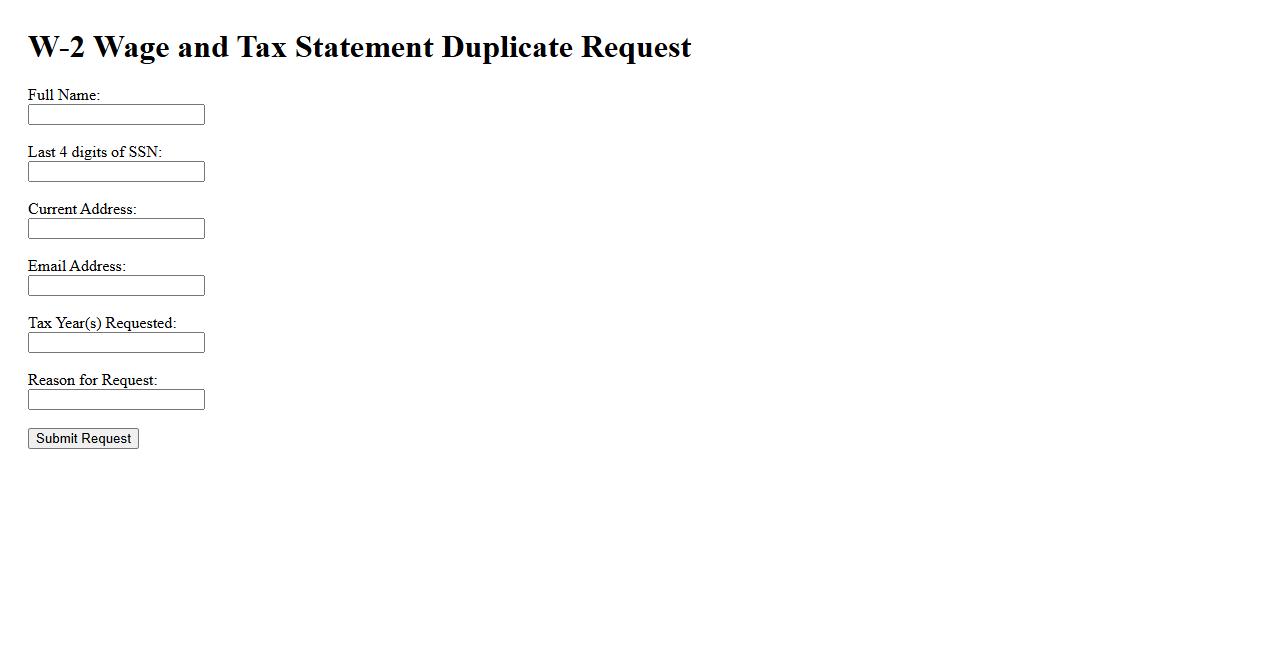

W-2 Wage and Tax Statement Duplicate Request

The W-2 Wage and Tax Statement Duplicate Request allows employees to obtain a copy of their original W-2 form for tax filing purposes. This service is essential for individuals who have lost or did not receive their W-2 from their employer. Requesting a duplicate ensures accurate reporting of income and taxes withheld to the IRS.

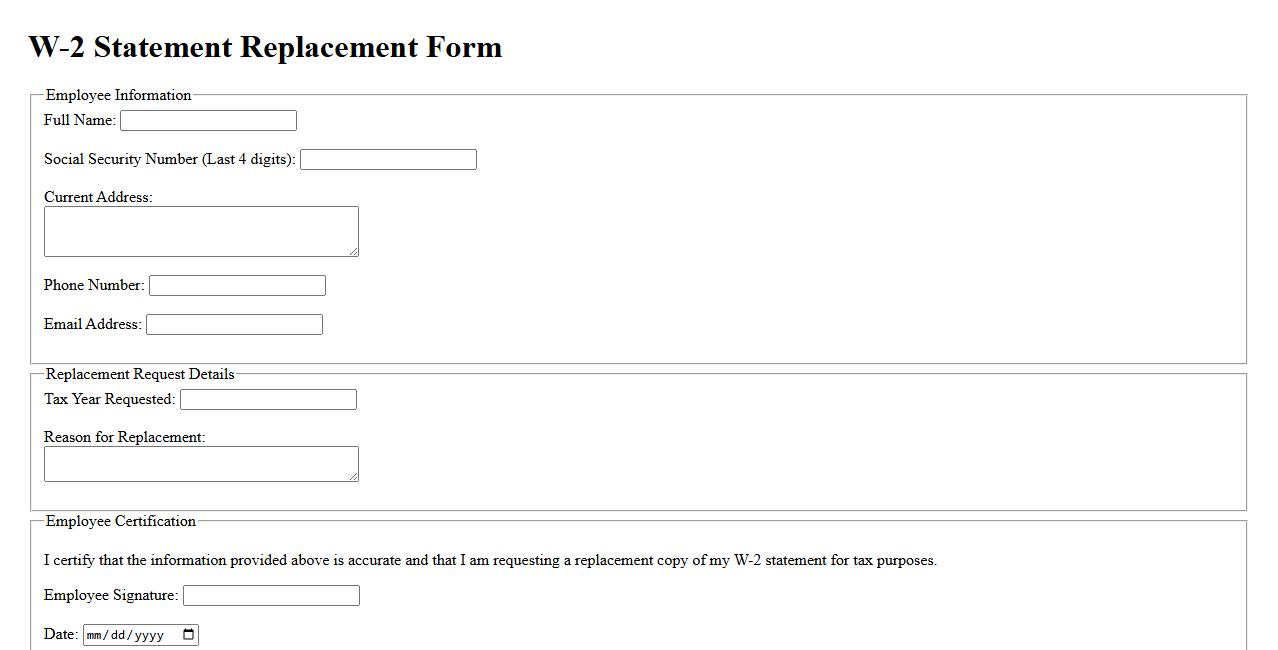

W-2 Statement Replacement Form

The W-2 Statement Replacement Form allows employees to request a duplicate copy of their W-2 wage and tax statement. This form is essential for those who have lost or not received their original document from their employer. Timely submission ensures accurate filing of federal and state tax returns.

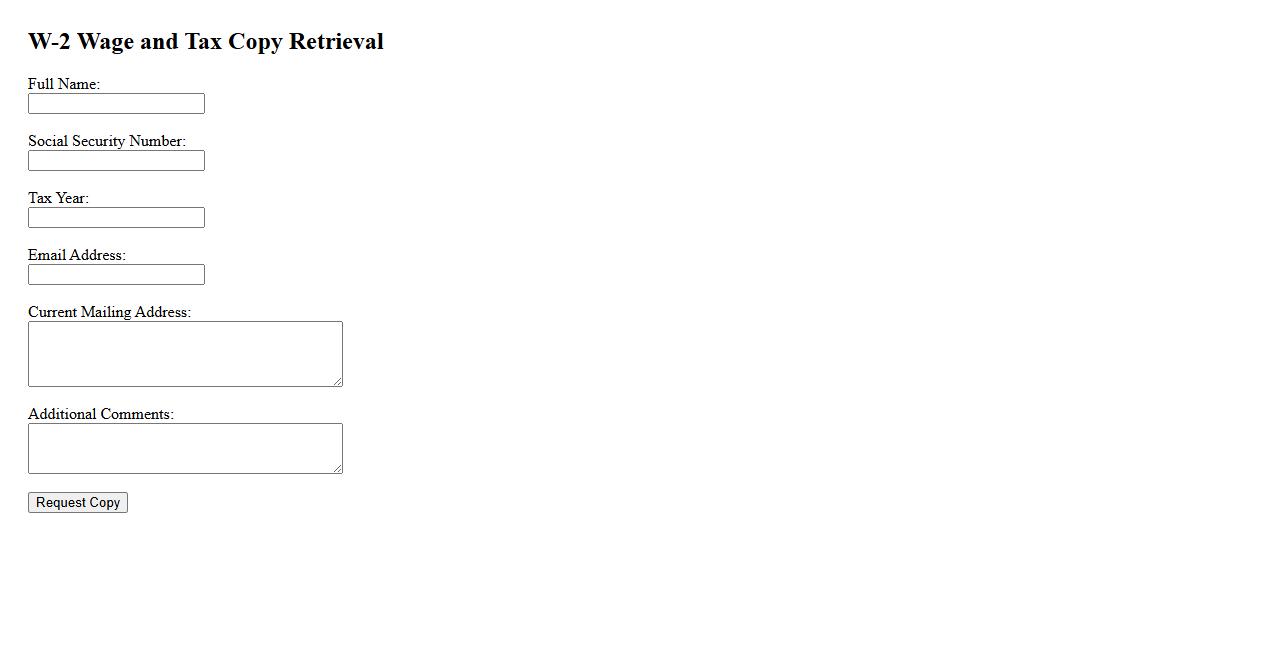

W-2 Wage and Tax Copy Retrieval

Retrieve your W-2 wage and tax copies quickly and securely using our online service. Access past or current year documents essential for filing taxes and maintaining accurate financial records. Our easy-to-use platform ensures you receive official wage statements directly from your employer or IRS records.

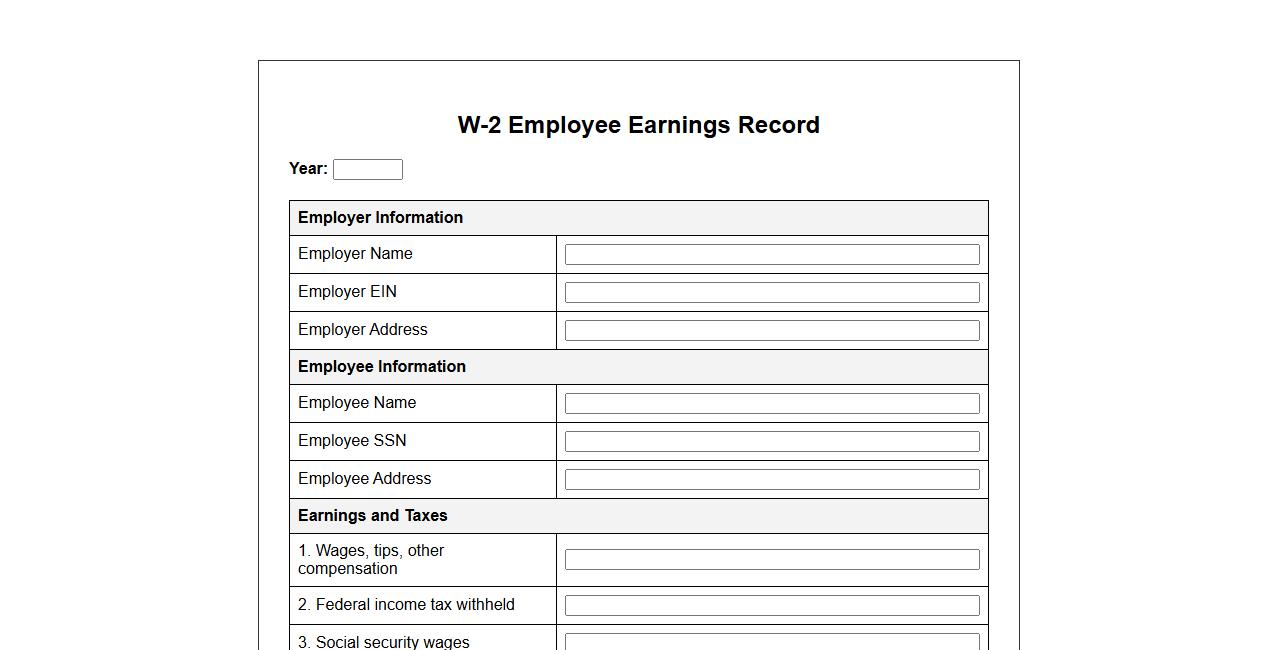

W-2 Employee Earnings Record Copy

The W-2 Employee Earnings Record Copy provides a detailed summary of an employee's annual wages and the taxes withheld throughout the year. It is essential for both employees and employers during tax filing and verification processes. Keeping a copy ensures accurate record-keeping and timely submission to tax authorities.

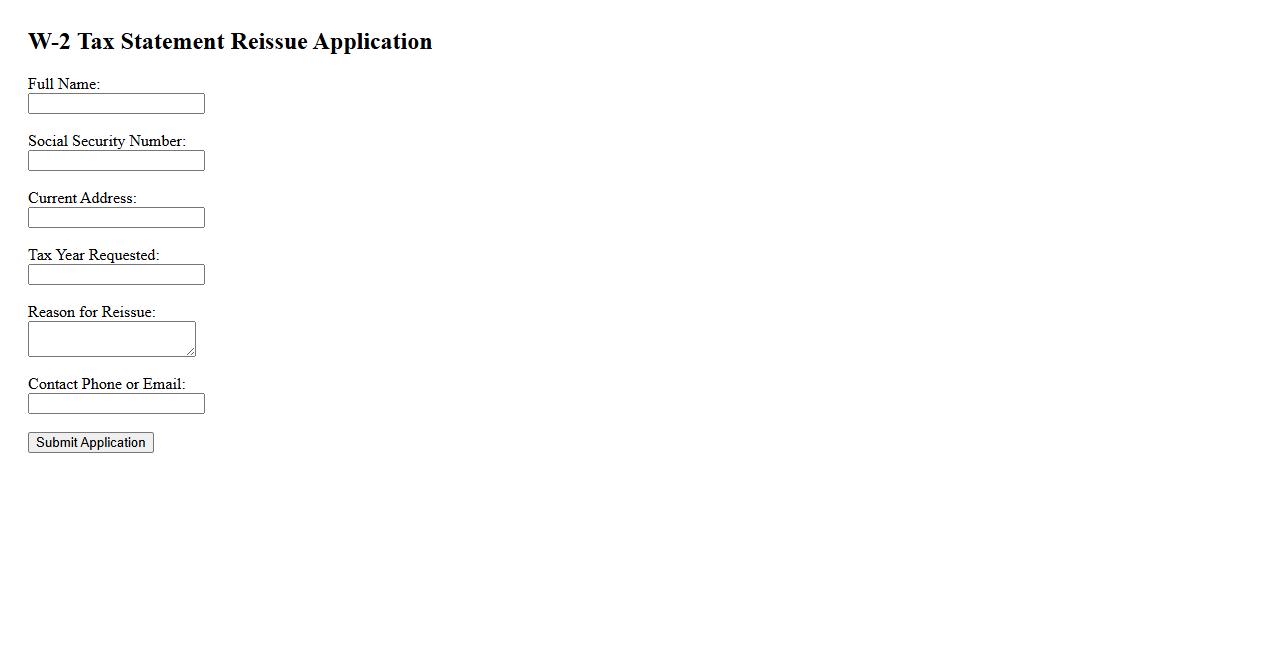

W-2 Tax Statement Reissue Application

The W-2 Tax Statement Reissue Application allows employees to request a replacement of their original W-2 form if it was lost, damaged, or never received. This application ensures access to accurate tax documents needed for filing annual tax returns. Timely submission of the form can prevent delays in tax processing and refunds.

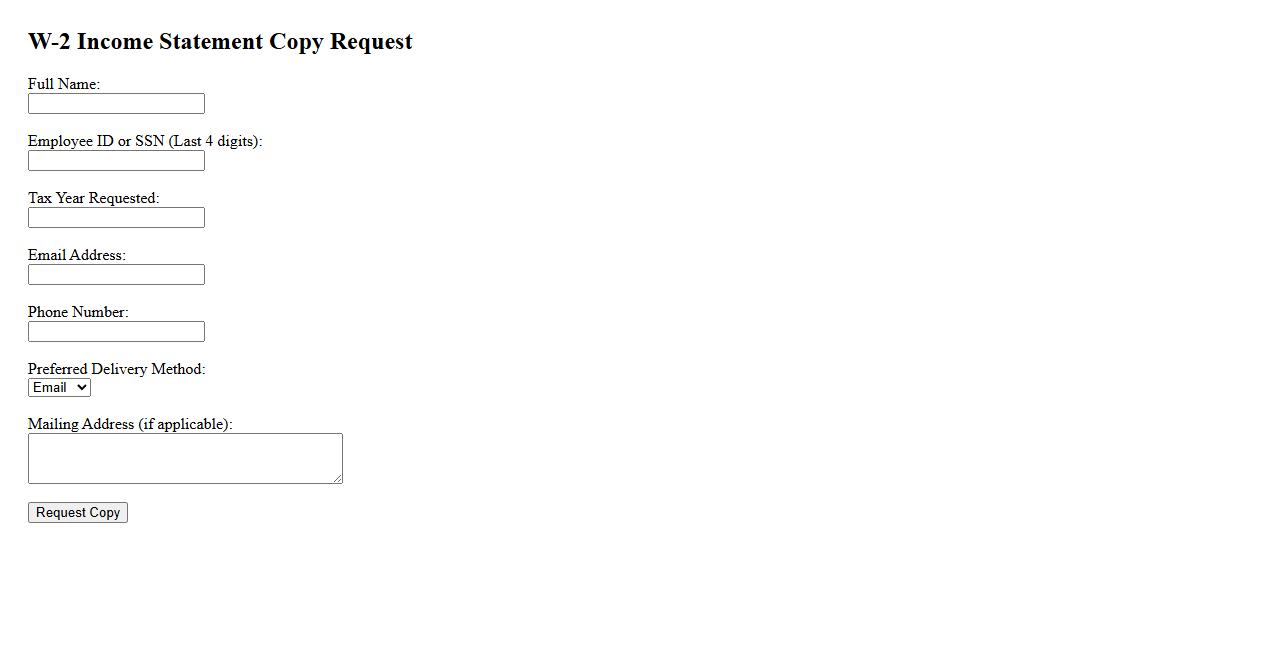

W-2 Income Statement Copy Request

Requesting a W-2 Income Statement Copy allows employees to obtain a duplicate of their wage and tax statement from their employer or the IRS. This document is essential for tax filing, loan applications, and verifying employment income. It ensures accurate reporting of annual earnings and withheld taxes.

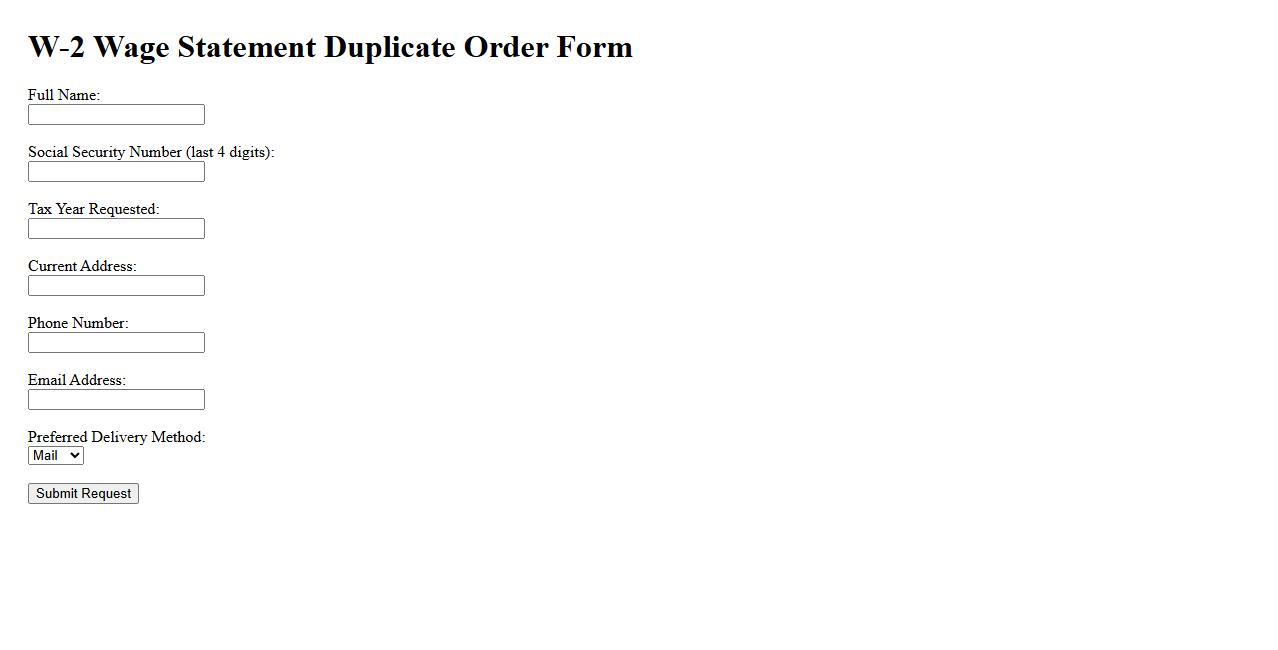

W-2 Wage Statement Duplicate Order

Request a W-2 Wage Statement Duplicate Order if you need an additional copy of your original W-2 form for tax or employment purposes. This duplicate provides the same detailed earnings and tax withholding information reported by your employer. Obtaining a duplicate ensures you have the necessary documents to file taxes or apply for financial services.

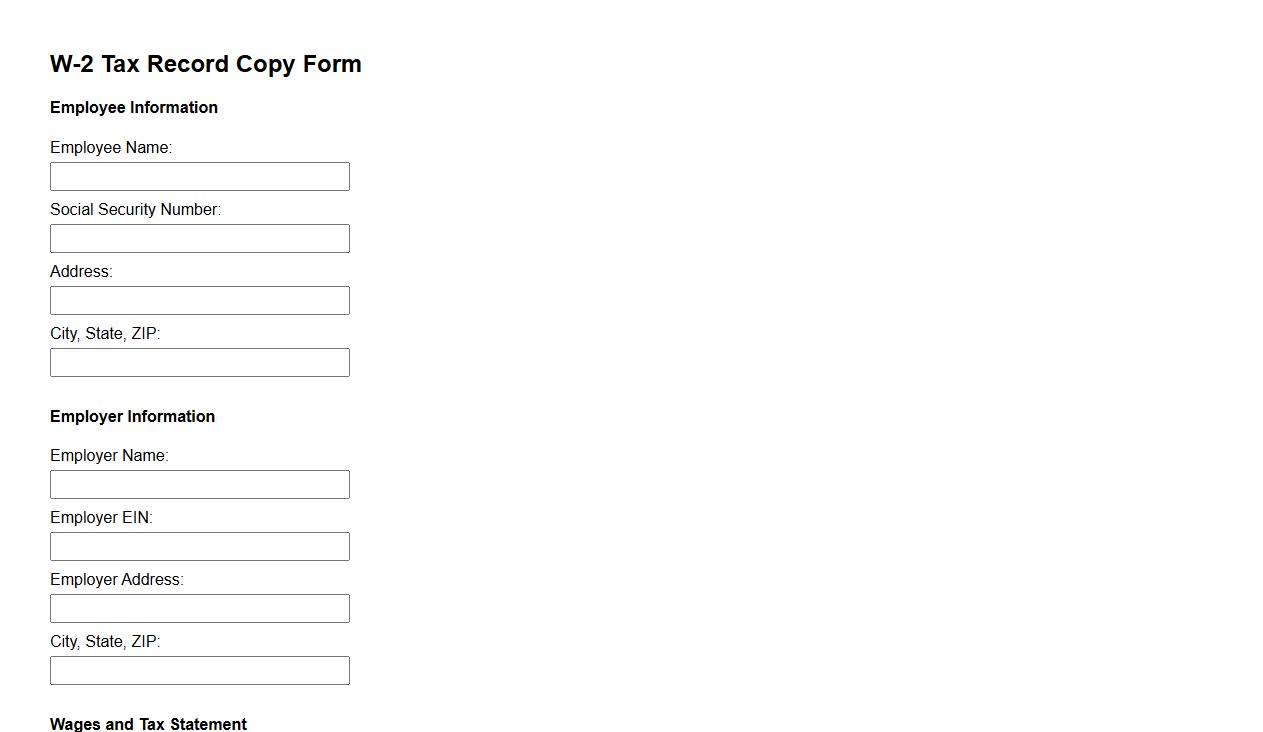

W-2 Tax Record Copy Form

The W-2 Tax Record Copy Form is an essential document used to report an employee's annual wages and the amount of taxes withheld from their paycheck. Employers are required to provide this form to employees for filing income tax returns accurately. It serves as official proof of income for tax reporting and financial verification purposes.

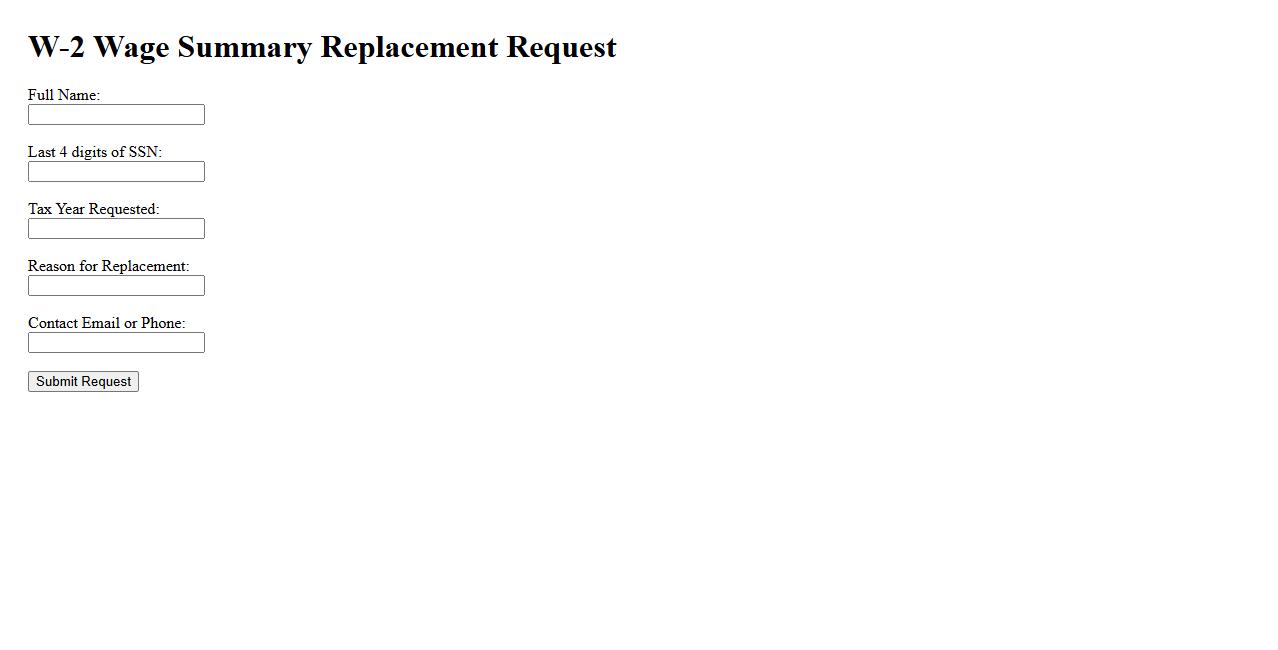

W-2 Wage Summary Replacement Request

A W-2 Wage Summary Replacement Request is a formal process to obtain a duplicate copy of your original W-2 form. This document summarizes your yearly earnings and taxes withheld, essential for filing accurate tax returns. If your W-2 is lost or damaged, submitting this request ensures you receive a replacement promptly.

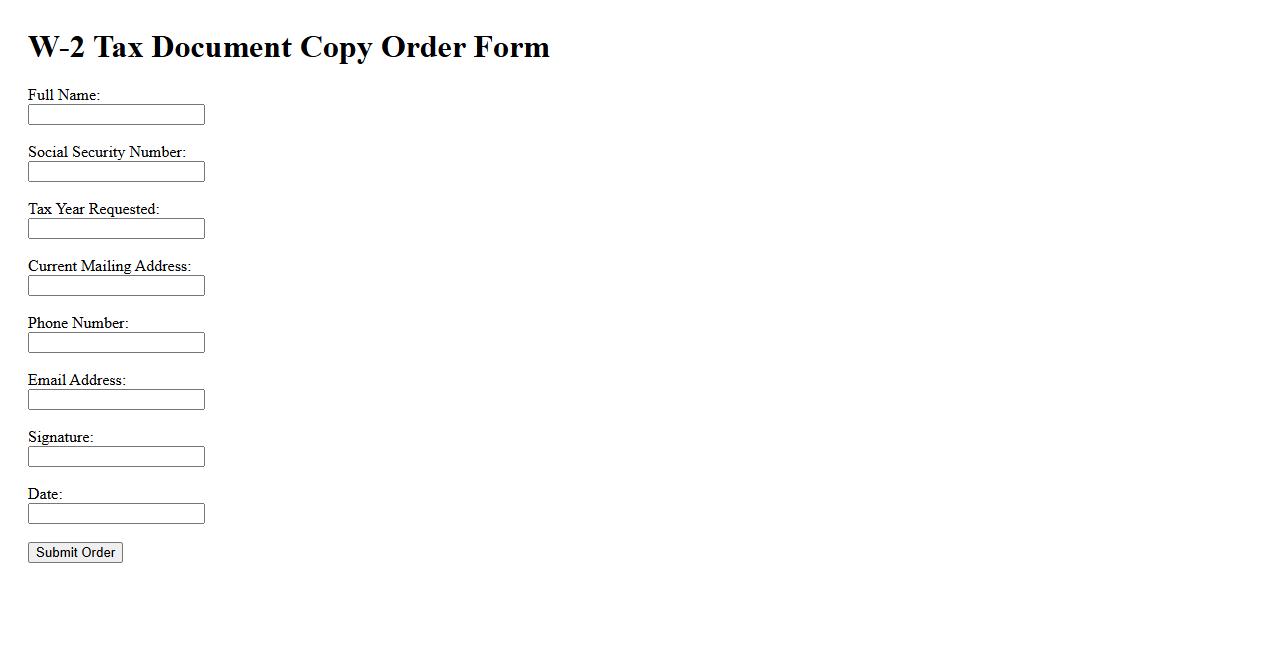

W-2 Tax Document Copy Order

Request a W-2 Tax Document Copy Order to obtain an official duplicate of your W-2 form from your employer or the IRS. This document is essential for accurately filing your annual tax return and verifying income reported. Ensure timely submission to avoid delays in your tax processing.

What information is required to order a W-2 Wage and Tax Statement copy?

To order a W-2 Wage and Tax Statement copy, you need to provide your full name, Social Security Number, and current mailing address. Additionally, your employer's name, address, and Employer Identification Number (EIN) must be included. This information helps to verify your identity and process the request accurately.

Which tax year(s) can you request a W-2 copy for?

You can request a W-2 copy for the current tax year as well as past years, typically up to four years prior. The IRS and employers usually keep records for several years, allowing you to obtain copies for previous tax periods. It is essential to specify the exact year(s) needed when submitting your request.

What are the accepted methods for submitting an order for a W-2 copy?

The accepted methods to submit a W-2 copy request include online forms, mail, or phone requests directed to your employer or the IRS. Many employers provide online platforms to facilitate retrieval, while the IRS requires Form 4506-T for official copies. Choose the method that best suits your convenience and official requirements.

Are there any fees or identification documents needed to obtain a W-2 copy?

Typically, there are no fees charged by employers for providing a W-2 copy, but some third-party services may impose charges. Identification documents like a valid photo ID or Social Security card may be required to confirm your identity. Always check with the employer or IRS for specific documentation requirements.

How long does it typically take to receive a W-2 Wage and Tax Statement copy?

Processing time for a W-2 copy usually takes between 2 to 6 weeks after the request is received. The exact duration depends on the method of request and the responsiveness of the employer or IRS. Planning ahead ensures timely receipt of your tax documents for filing purposes.