Order for Wage Garnishment is a legal directive that requires an employer to withhold a portion of an employee's earnings to pay off a debt. This process ensures creditors receive payments directly from the debtor's paycheck until the obligation is satisfied. Wage garnishment typically applies to debts such as child support, taxes, or unpaid loans.

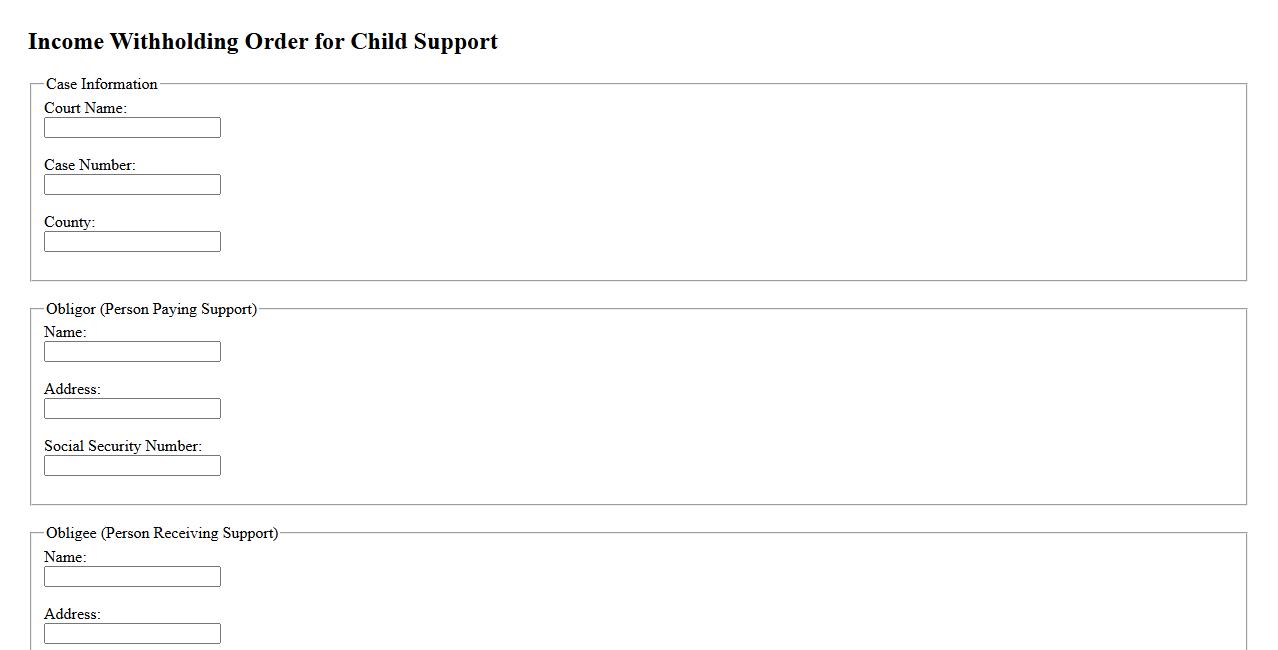

Income Withholding Order for Child Support

An Income Withholding Order for Child Support is a legal document used to ensure child support payments are automatically deducted from the noncustodial parent's wages. This process helps maintain consistent and timely financial support for the child. Employers are required to comply with these orders to facilitate reliable payment distribution.

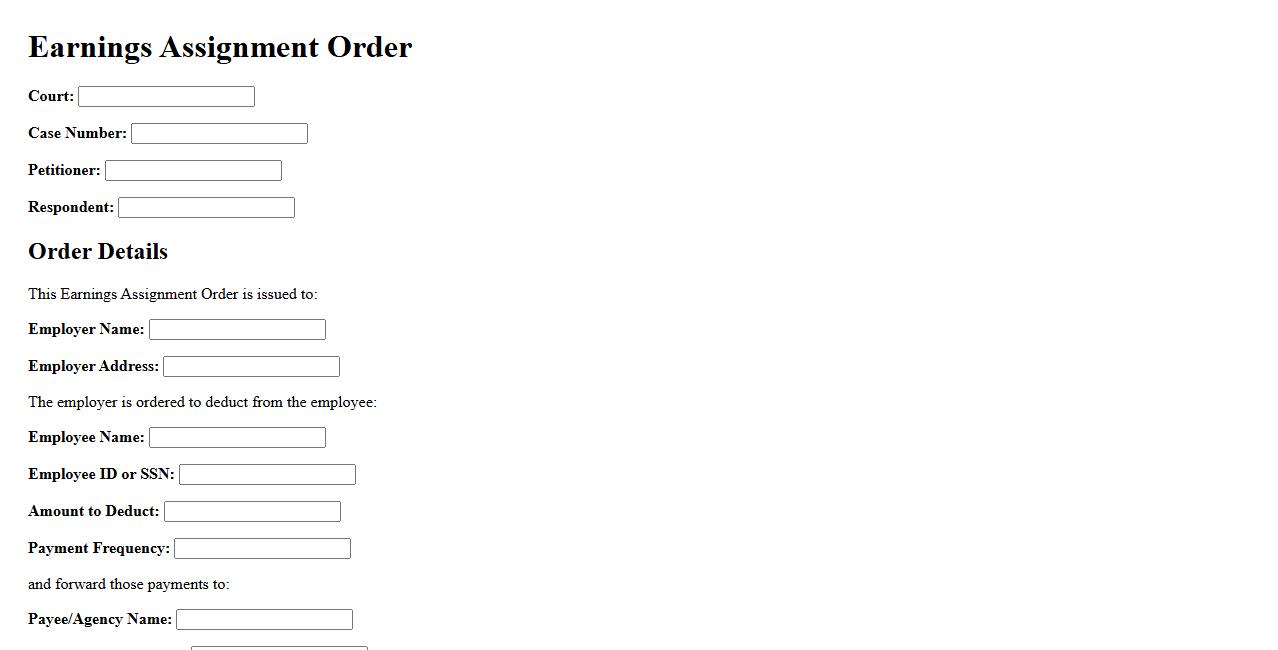

Earnings Assignment Order

An Earnings Assignment Order is a legal directive that requires an employer to deduct a portion of an employee's wages for debt repayment. It ensures creditors receive payments directly from the employee's earnings. This order helps streamline debt collection efficiently and lawfully.

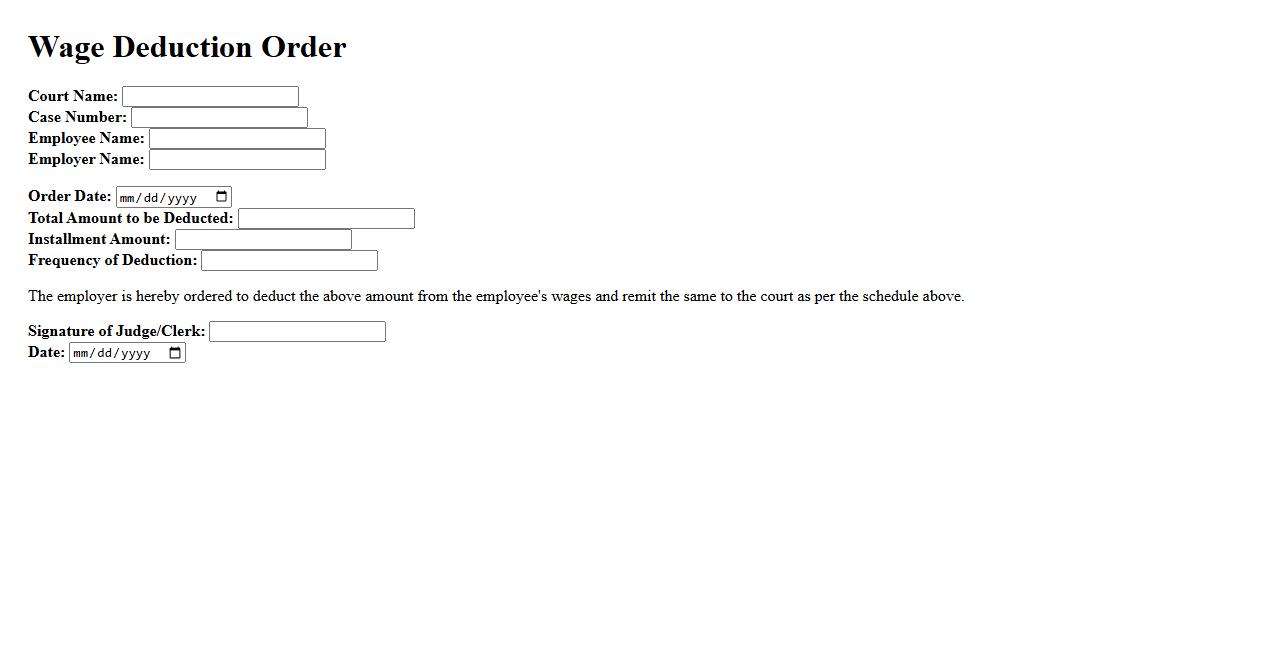

Wage Deduction Order

A Wage Deduction Order is a legal directive that mandates an employer to withhold a portion of an employee's wages to satisfy a debt or obligation. This order ensures creditors receive payments directly from the debtor's earnings. It is commonly used for debt repayments, child support, or tax obligations.

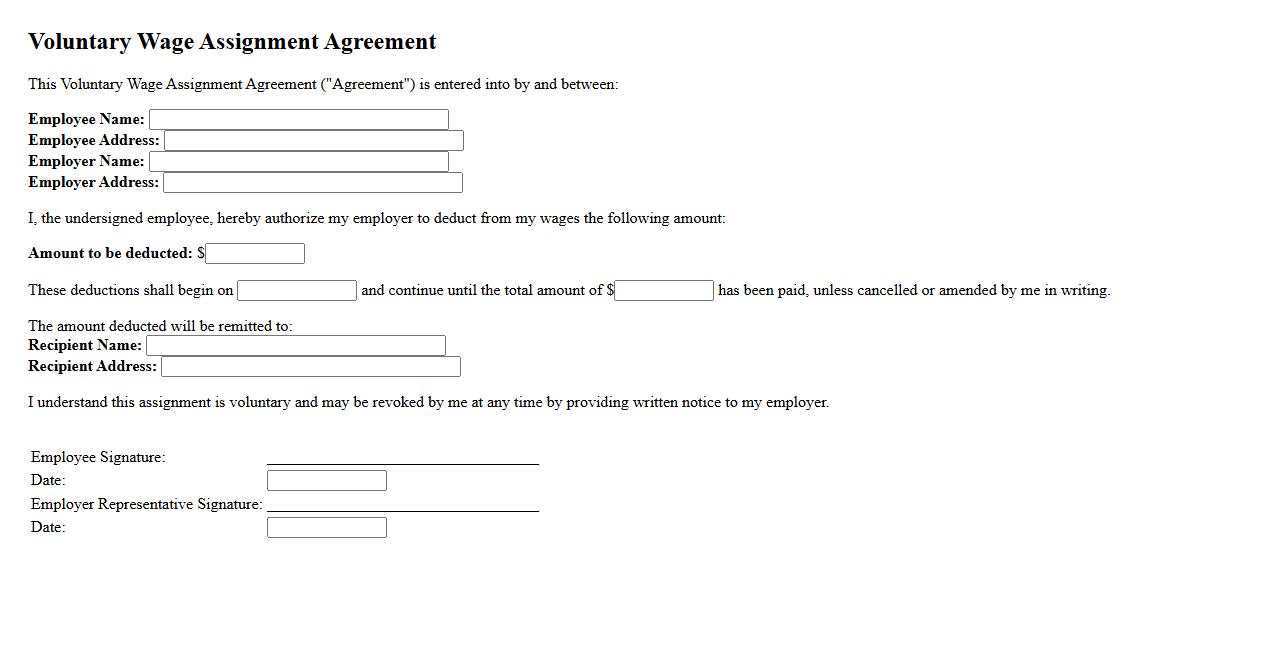

Voluntary Wage Assignment Agreement

A Voluntary Wage Assignment Agreement is a legal document where an employee consents to have a portion of their wages deducted by the employer to repay a debt. This agreement ensures clear terms between both parties, promoting transparency and responsibility in debt repayment. It is often used to avoid legal actions and maintain a positive financial relationship.

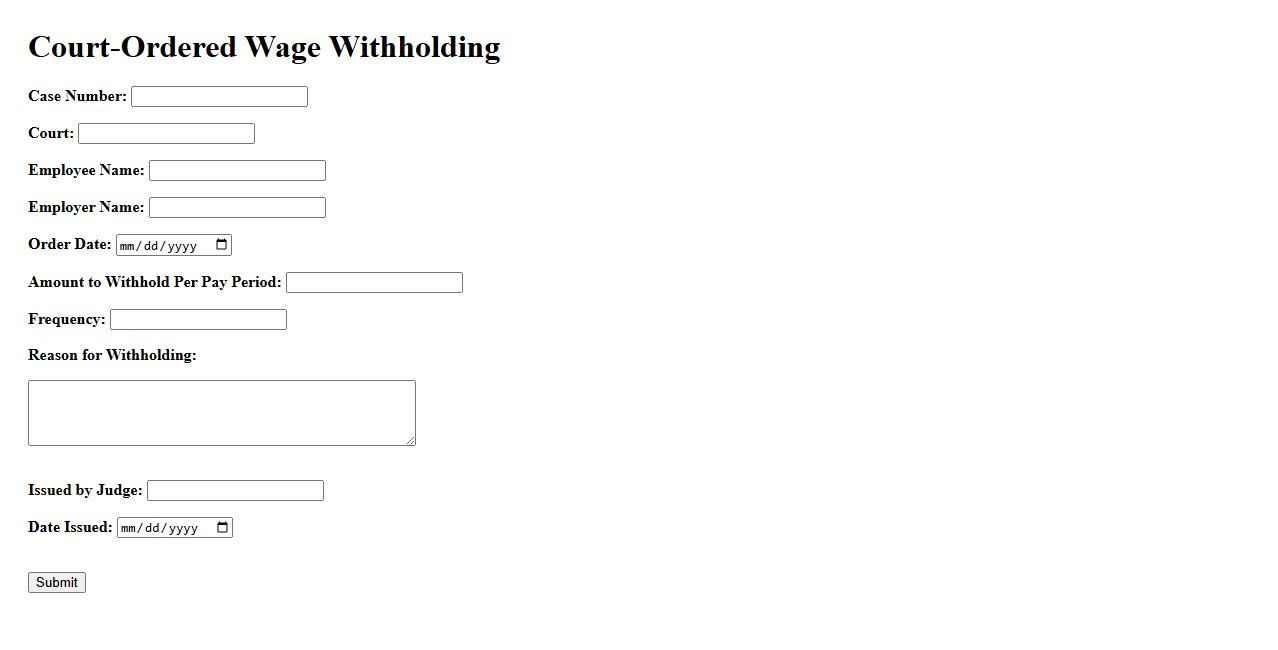

Court-Ordered Wage Withholding

Court-Ordered Wage Withholding is a legal process where a portion of an individual's earnings is automatically deducted by their employer to satisfy a debt or financial obligation. This method ensures timely payments for child support, tax debts, or other court-mandated financial responsibilities. It provides a reliable way to enforce payment without requiring direct action from the creditor.

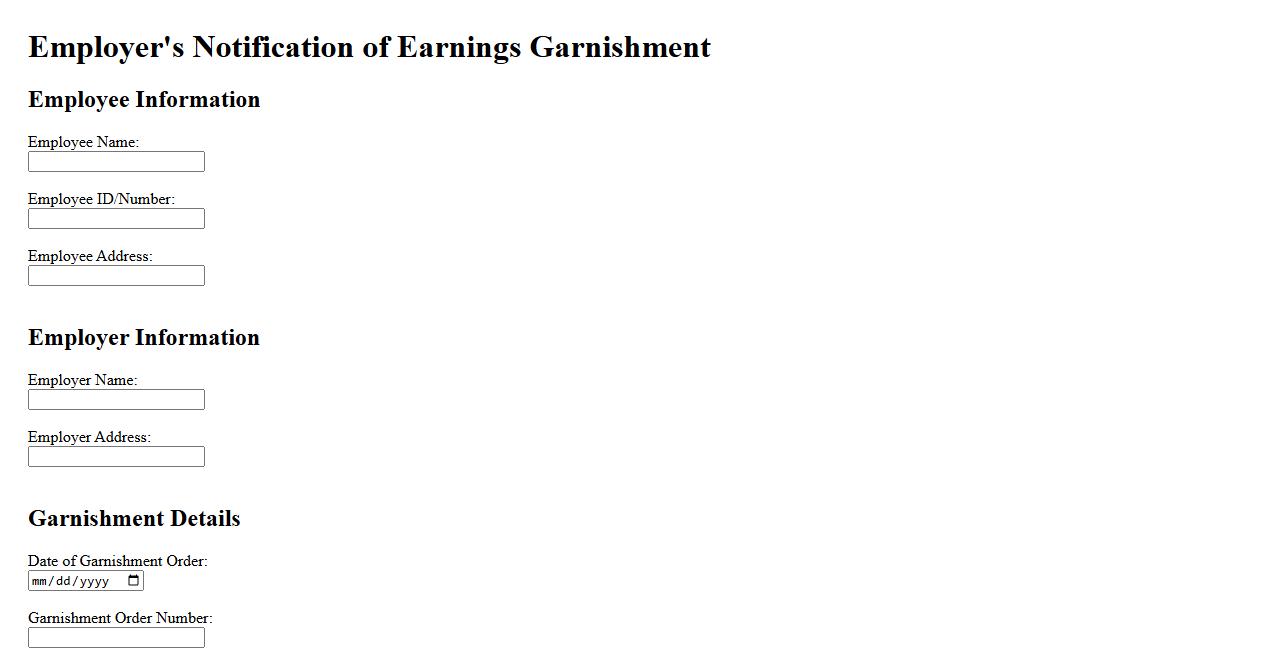

Employer's Notification of Earnings Garnishment

Employer's Notification of Earnings Garnishment is a formal document sent to employers to inform them of a legal obligation to withhold a portion of an employee's wages. This notification details the amount to be garnished and the duration of the deduction. Employers are required to comply promptly to ensure lawful wage withholding procedures.

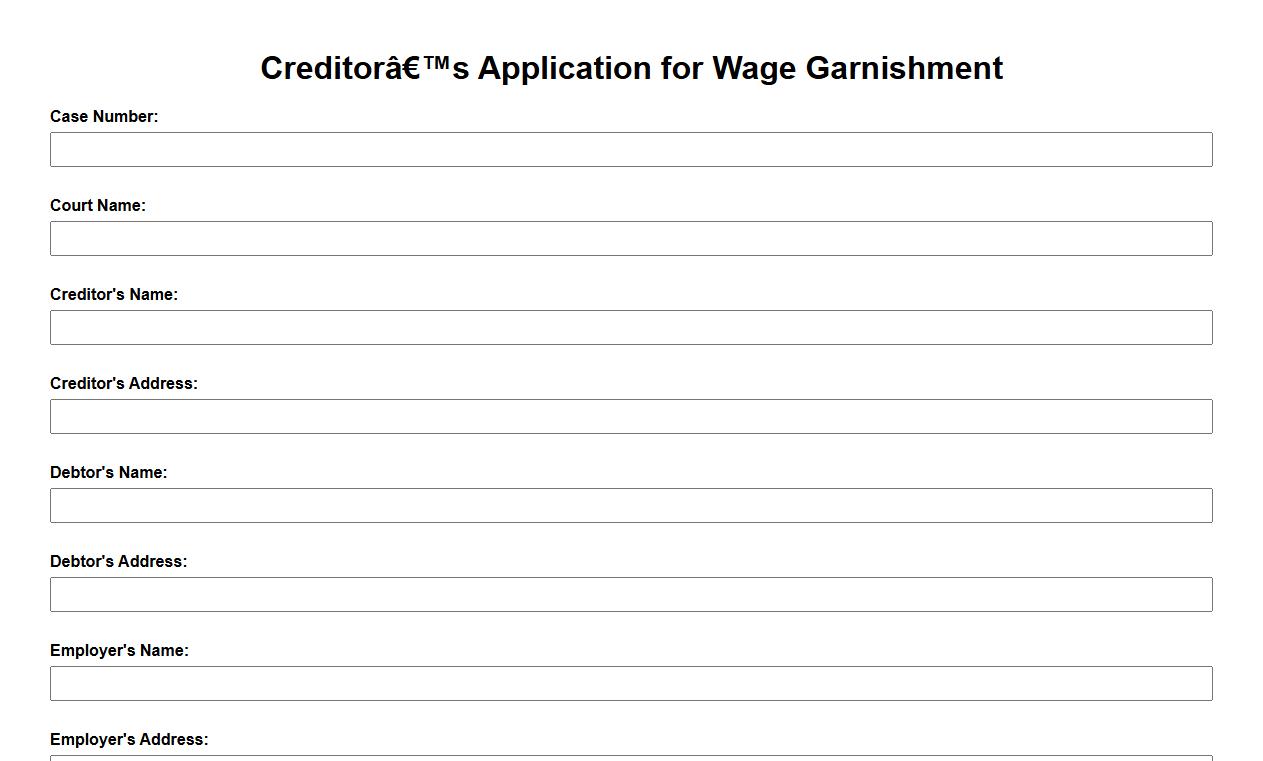

Creditor’s Application for Wage Garnishment

A creditor's application for wage garnishment is a legal request filed by a creditor to collect a debt by deducting funds directly from a debtor's paycheck. This process ensures the creditor receives payment until the owed amount is fully recovered. It is governed by federal and state laws to protect both parties' rights.

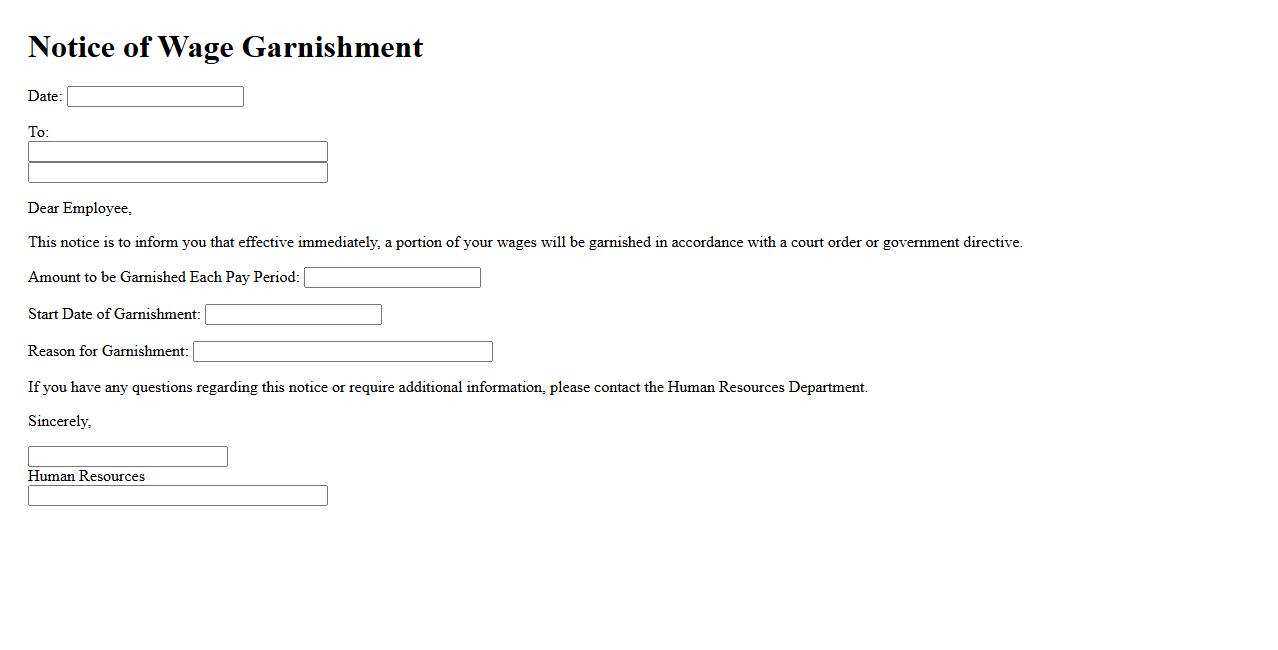

Notice of Wage Garnishment to Employee

Notice of Wage Garnishment to an employee is a formal document informing them that a portion of their earnings will be withheld to satisfy a debt. This notification ensures the employee understands their rights and the garnishment process. Timely communication helps maintain transparency between employer and employee.

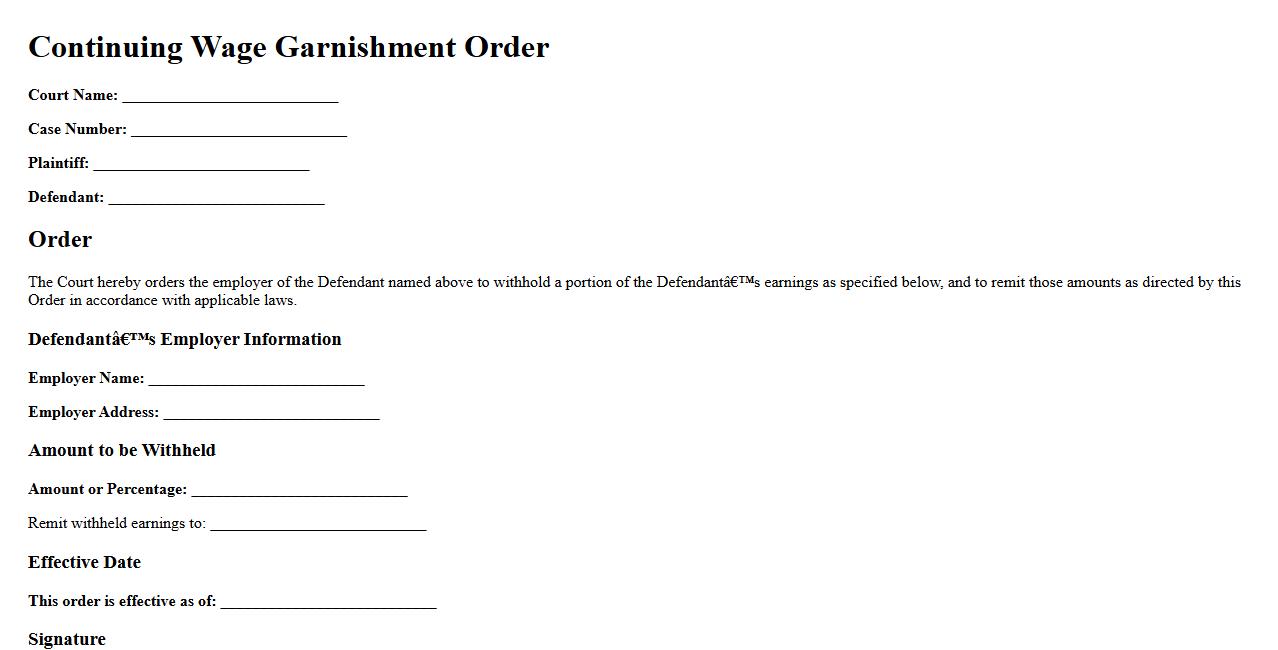

Continuing Wage Garnishment Order

A Continuing Wage Garnishment Order is a legal directive requiring an employer to withhold a portion of an employee's wages to satisfy a debt. This order remains in effect until the full amount owed is paid or the court rescinds it. It ensures consistent repayment while protecting the employee's remaining income.

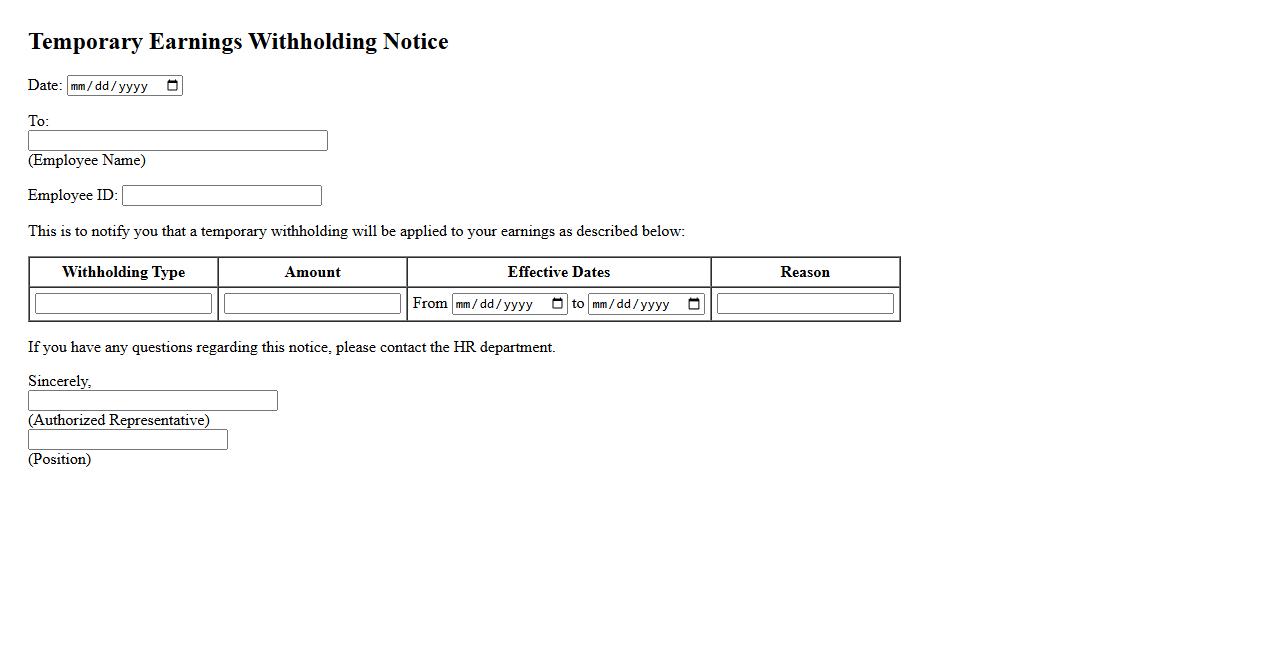

Temporary Earnings Withholding Notice

The Temporary Earnings Withholding Notice is an official document informing an individual about the temporary withholding of their wages. This notice typically arises due to court orders related to child support, tax liens, or other legal obligations. Employers are instructed to deduct a specified amount from the employee's earnings until further notice.

What is the primary purpose of an Order for Wage Garnishment?

The primary purpose of an Order for Wage Garnishment is to legally require an employer to withhold a portion of an employee's earnings. This withheld amount is used to repay creditors or satisfy debts owed by the employee. It ensures debt collection is enforced through payroll deductions without the employee having to take direct action.

Which parties are typically involved in a wage garnishment order?

Typically, the parties involved in a wage garnishment order include the employee debtor, the employer, and the creditor or court issuing the order. The court or creditor sends the order to the employer, who is then responsible for deducting wages. The employee is the individual whose wages are garnished to satisfy the debt.

What type of debts commonly lead to a wage garnishment order?

Common debts leading to wage garnishment orders include unpaid child support, tax debts, student loans, and defaulted consumer debts like credit cards. Court judgments for various financial obligations can also trigger garnishment. These debts necessitate legal action allowing creditors to recover owed sums directly from wages.

How does an employer respond to receiving a wage garnishment order?

Upon receiving a wage garnishment order, an employer must notify the employee and begin withholding the specified amount from their paycheck. The employer then forwards these funds to the appropriate agency or creditor. Failure to comply can result in legal penalties against the employer.

What are the legal limits on the amount that can be garnished from an employee's wages?

Legal limits on wage garnishment amounts protect employees from excessive paycheck deductions. Typically, garnishments cannot exceed 25% of disposable earnings or the amount by which disposable earnings exceed 30 times the federal minimum wage. These limits ensure the employee retains sufficient income for living expenses.