The Order 1099 Form Copy allows individuals and businesses to request an official duplicate of their 1099 tax form from the IRS. This copy is essential for accurate tax reporting, ensuring all income details are correctly documented. Timely access to the Order 1099 Form Copy helps prevent errors and facilitates smooth filing of tax returns.

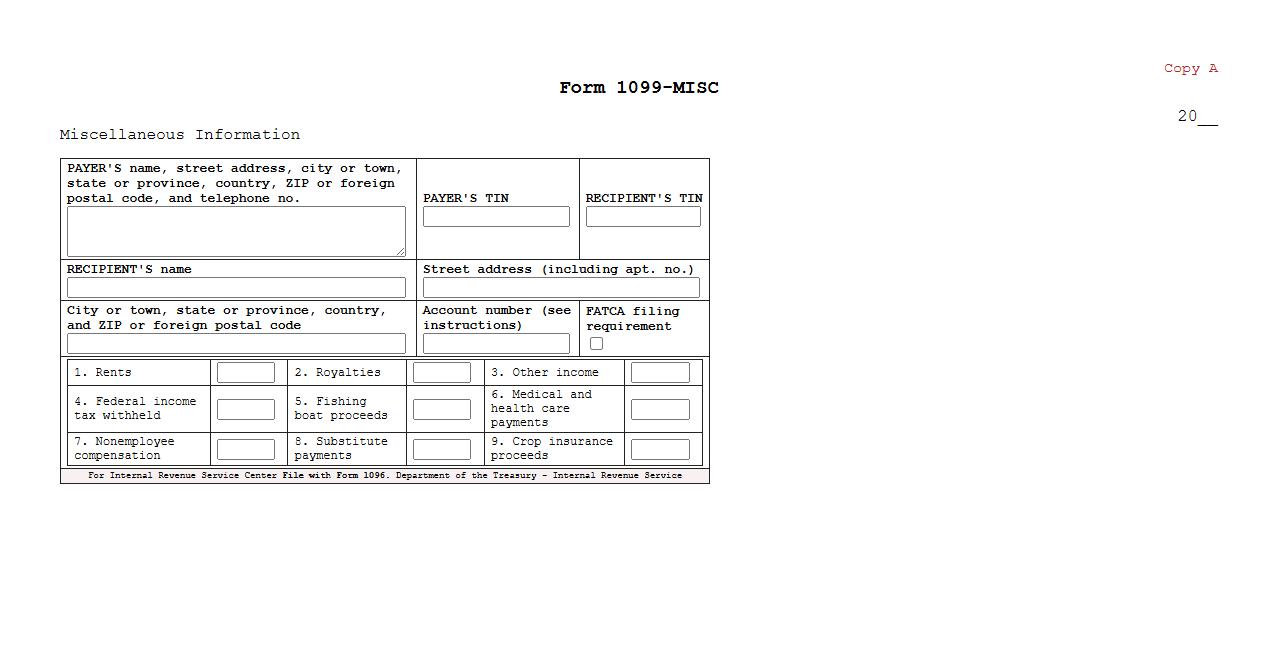

IRS 1099 Form Copy A

The IRS 1099 Form Copy A is the official document submitted to the Internal Revenue Service to report various types of income beyond wages. This copy includes critical details such as payer and recipient information, income amounts, and federal tax withheld. It ensures accurate tax reporting and compliance for both taxpayers and the IRS.

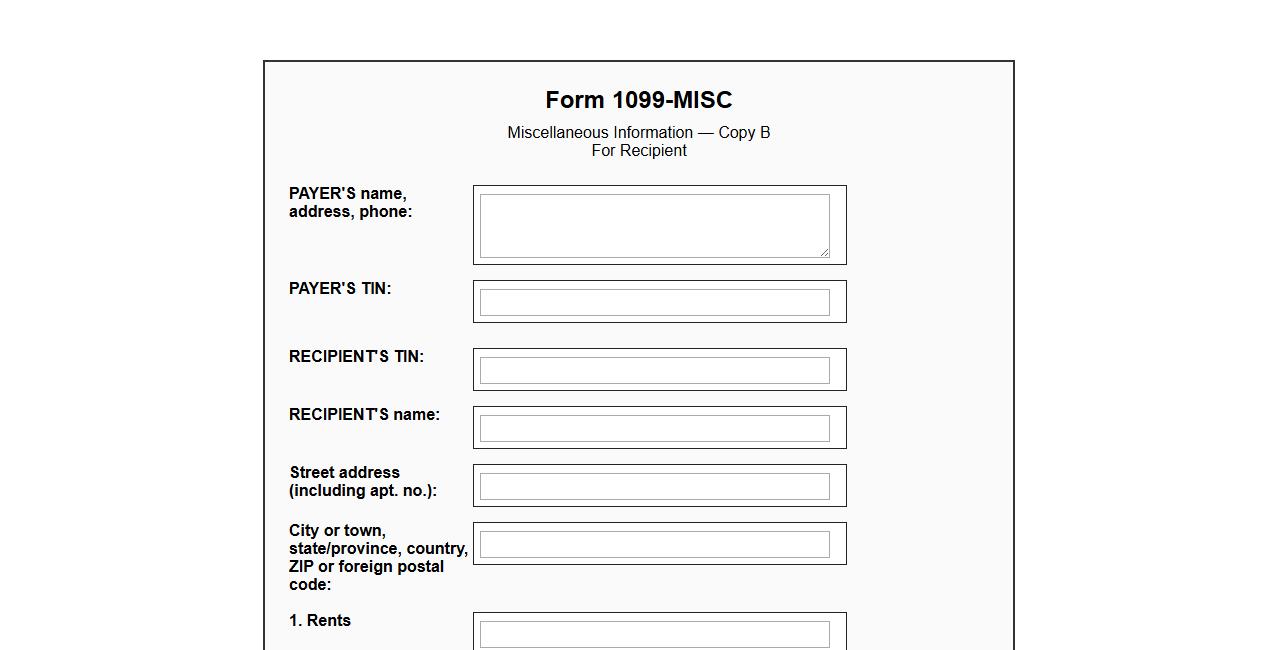

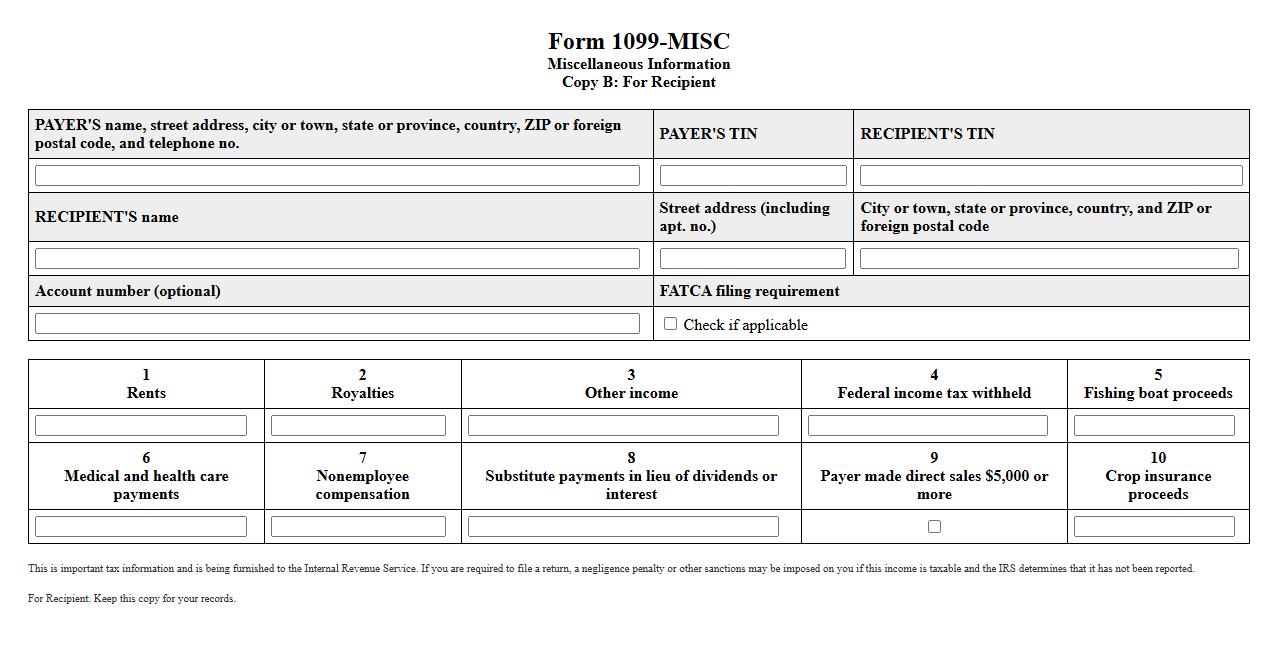

IRS 1099 Form Copy B

The IRS 1099 Form Copy B is the version of the form provided to taxpayers for their records. It details income received from non-employment sources, such as freelance work or interest payments. This copy is essential for accurate tax filing and record-keeping.

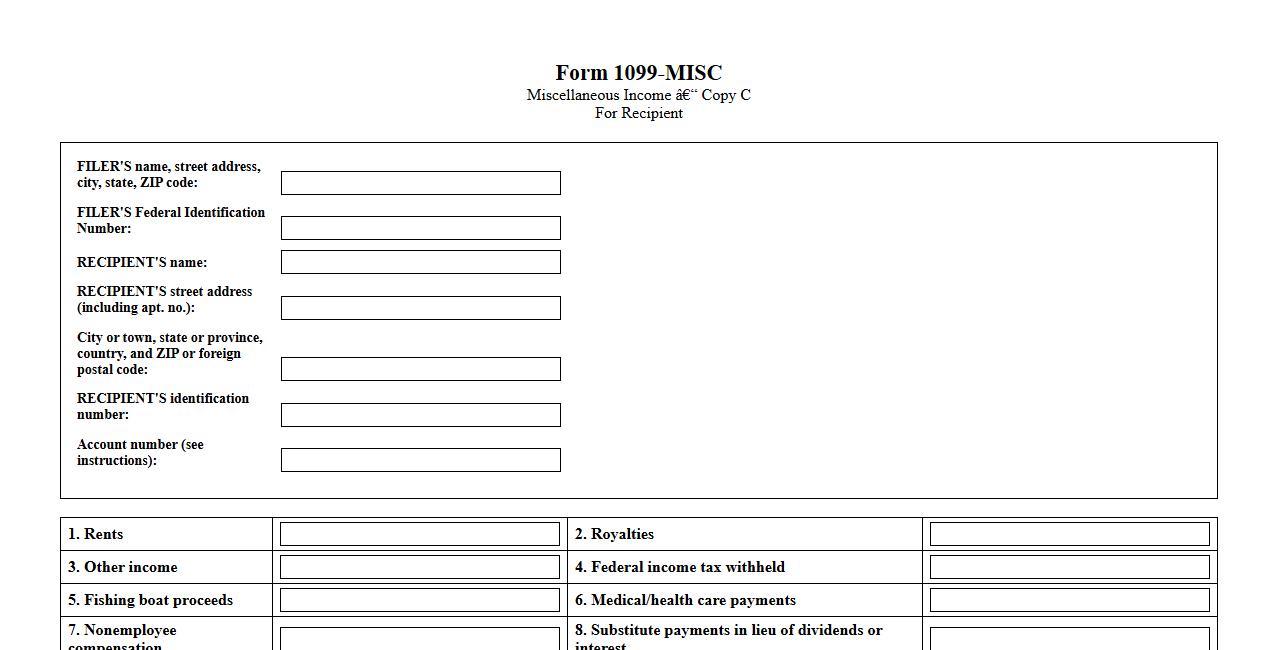

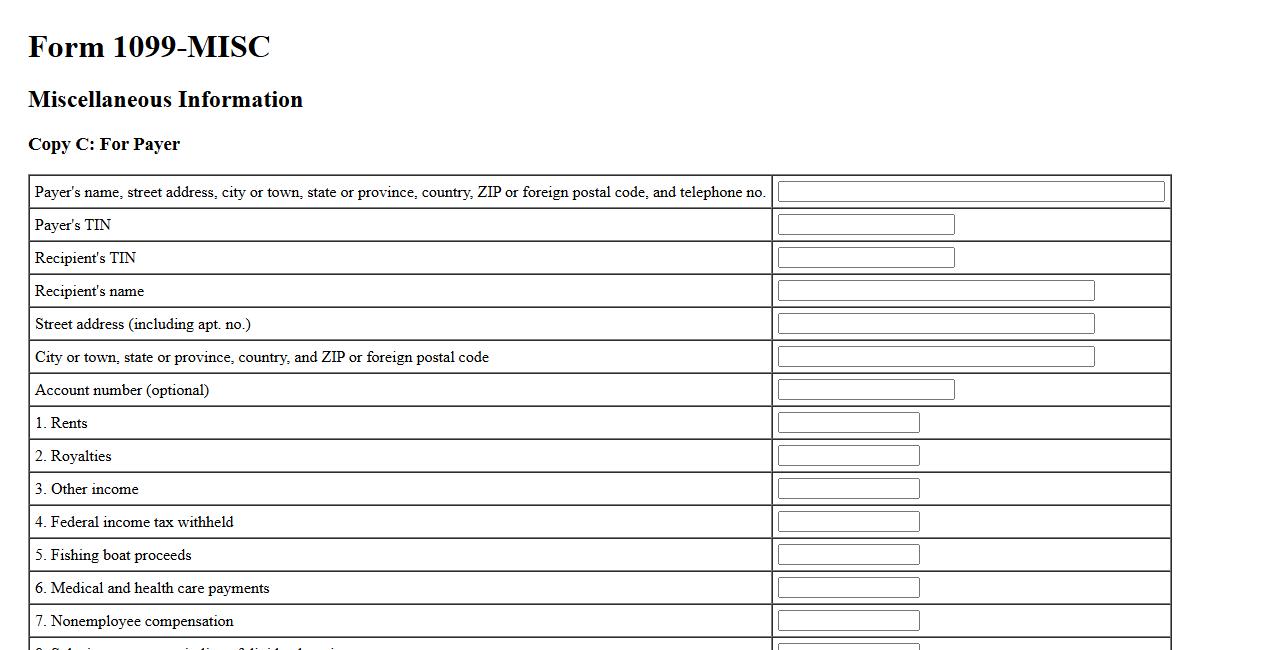

IRS 1099 Form Copy C

The IRS 1099 Form Copy C is an essential document used by businesses to report payments made to independent contractors and other non-employees. This copy is kept by the payer for their records and ensures accurate tax reporting. Proper handling of Form 1099 Copy C helps maintain compliance with IRS regulations.

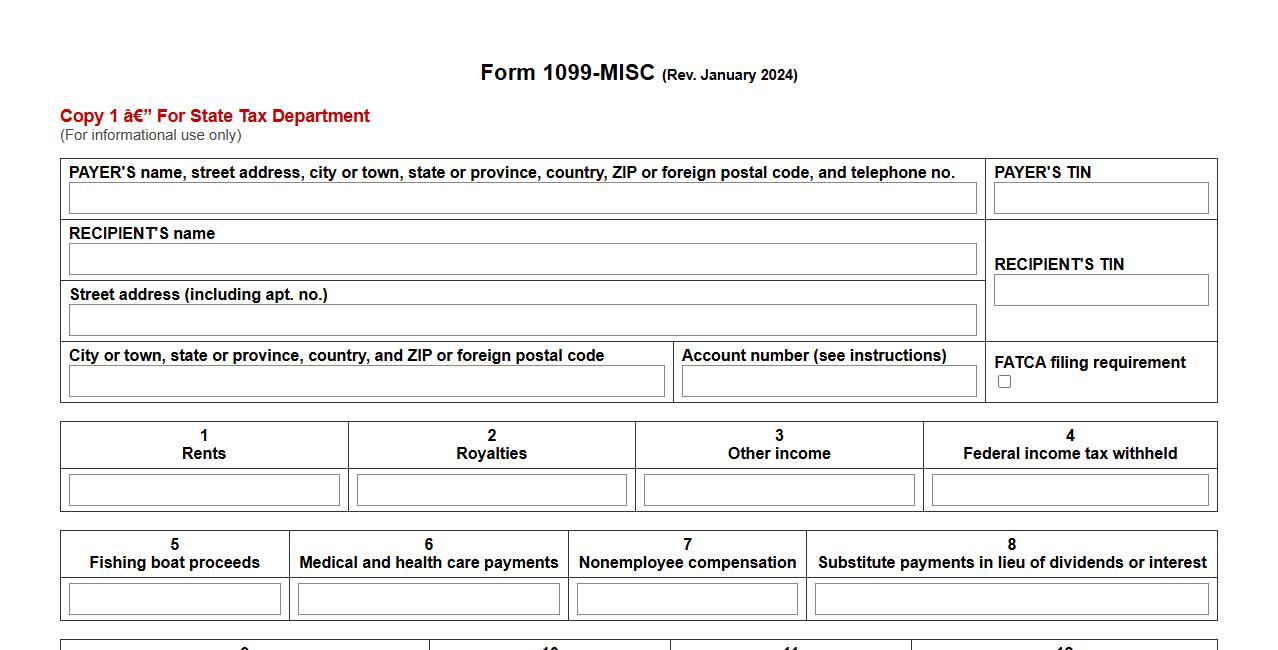

IRS 1099 Form Copy 1

The IRS 1099 Form Copy 1 is used by businesses to report non-employee compensation and other payments made to individuals or entities. This copy is specifically submitted to state tax departments, ensuring proper tax documentation and compliance at the state level. Timely and accurate filing of Form 1099 Copy 1 helps prevent penalties and supports efficient tax processing.

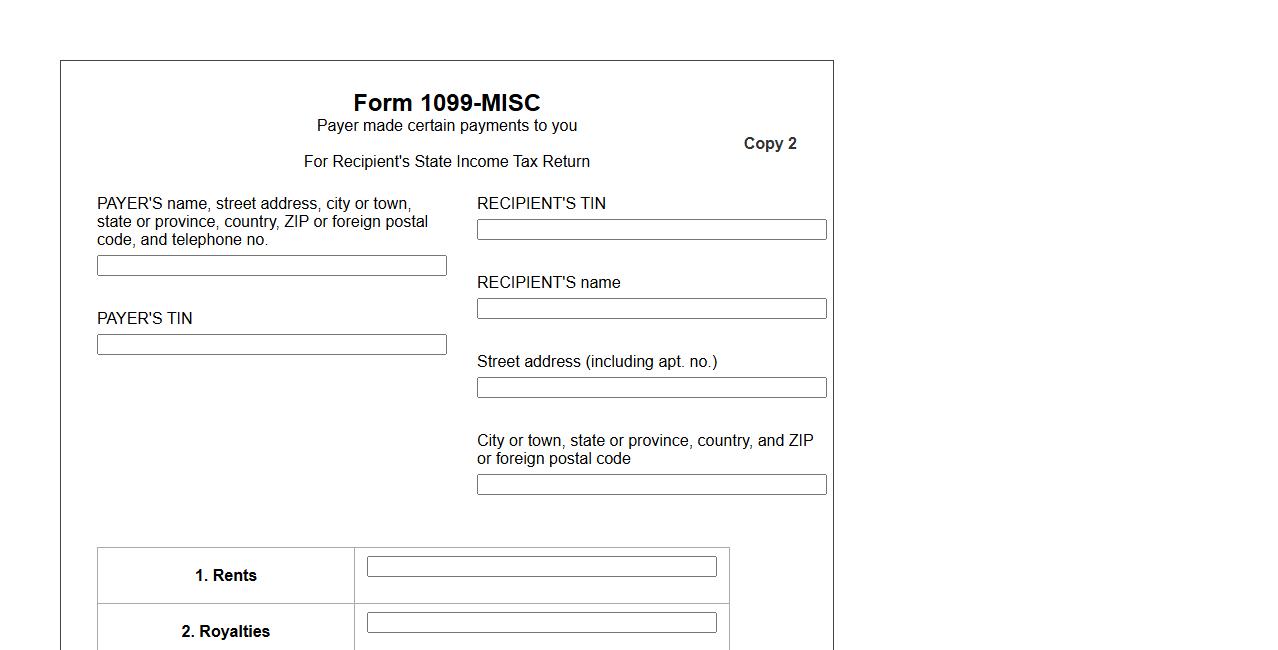

IRS 1099 Form Copy 2

The IRS 1099 Form Copy 2 is a crucial document provided to taxpayers for reporting income received from sources other than wages or salaries. This copy is specifically used for filing state tax returns, ensuring accurate reporting to state tax authorities. Proper handling of Copy 2 helps in maintaining compliance with both federal and state tax regulations.

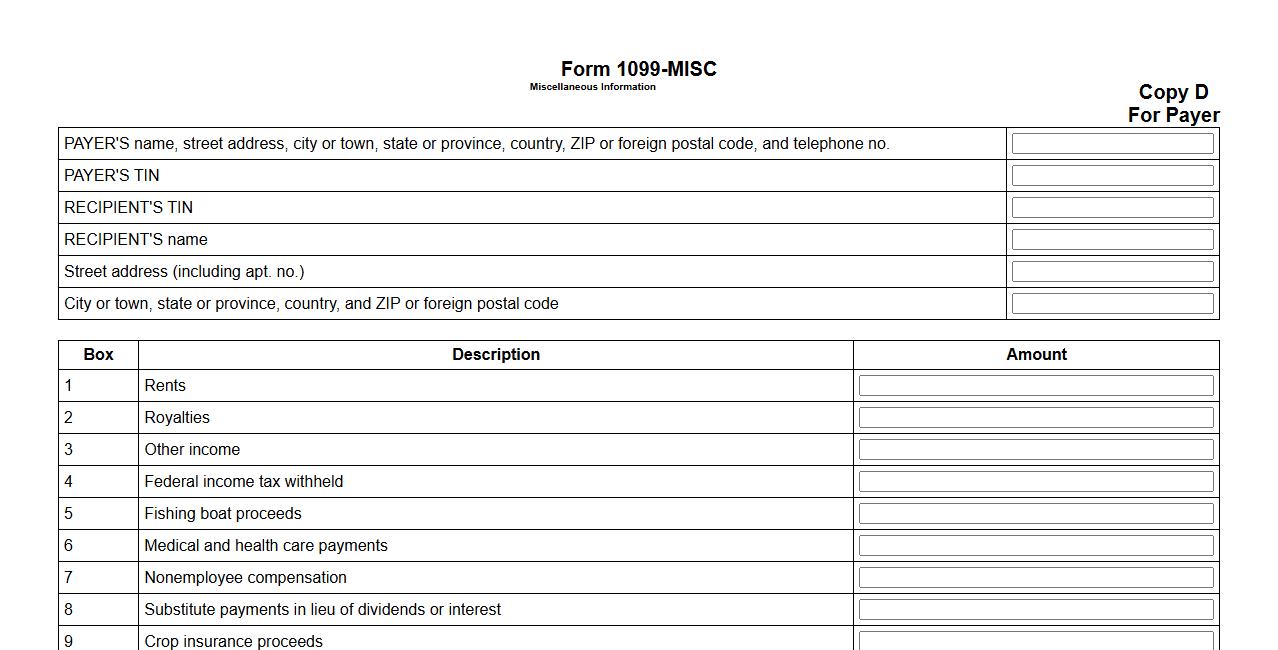

IRS 1099 Form Copy D

The IRS 1099 Form Copy D is a crucial document used by businesses to report various types of income other than wages, salaries, and tips. This copy is retained by the payer for their records to ensure compliance with federal tax regulations. Proper handling of Copy D helps maintain accurate financial documentation and supports the integrity of tax reporting processes.

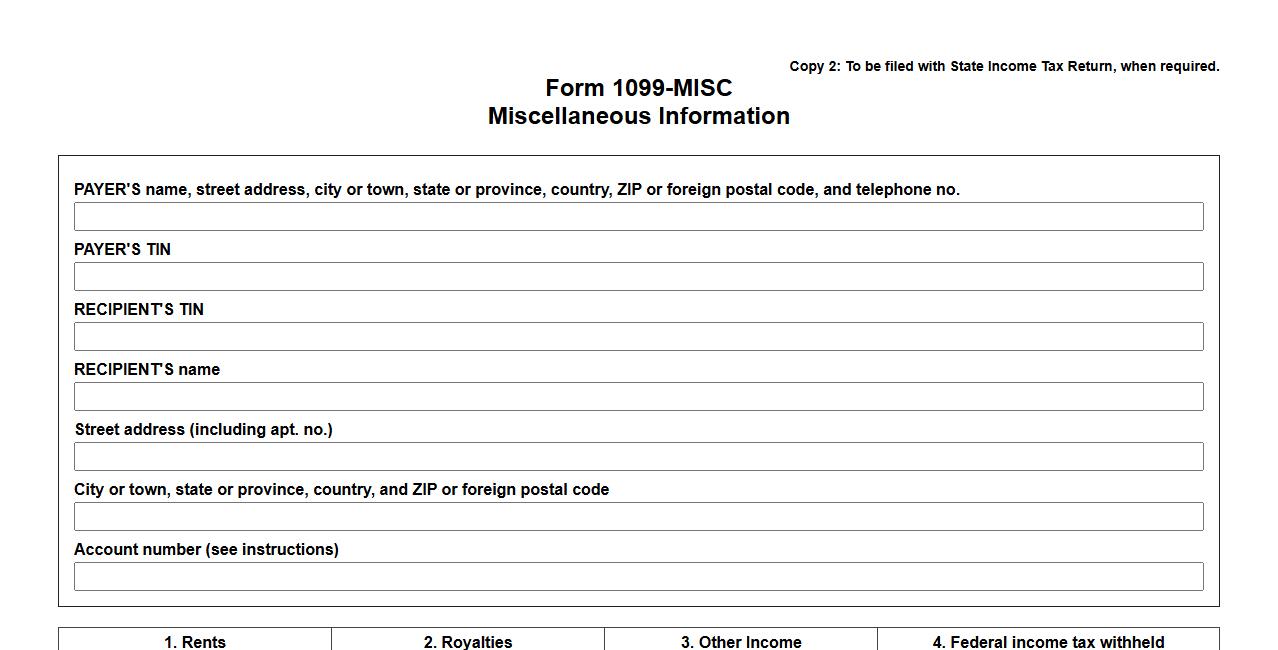

IRS 1099 Form Copy for State

The IRS 1099 Form Copy for State is used to report various types of income to state tax authorities. It ensures that income information is accurately communicated for state tax filing purposes. This form helps in matching state tax returns with federal records to avoid discrepancies.

IRS 1099 Form Copy for Recipient

The IRS 1099 Form Copy for Recipient is a crucial document sent to individuals who have received income outside of regular employment. This copy provides detailed information on the amount earned and must be used when filing federal tax returns. Recipients should review it carefully to ensure accurate reporting to the IRS.

IRS 1099 Form Copy for Payer

The IRS 1099 Form Copy for Payer is a crucial document provided to the individual or business that made payments during the tax year. This copy helps the payer keep accurate financial records and report payments to the IRS properly. It ensures compliance with tax regulations and simplifies tax filing processes.

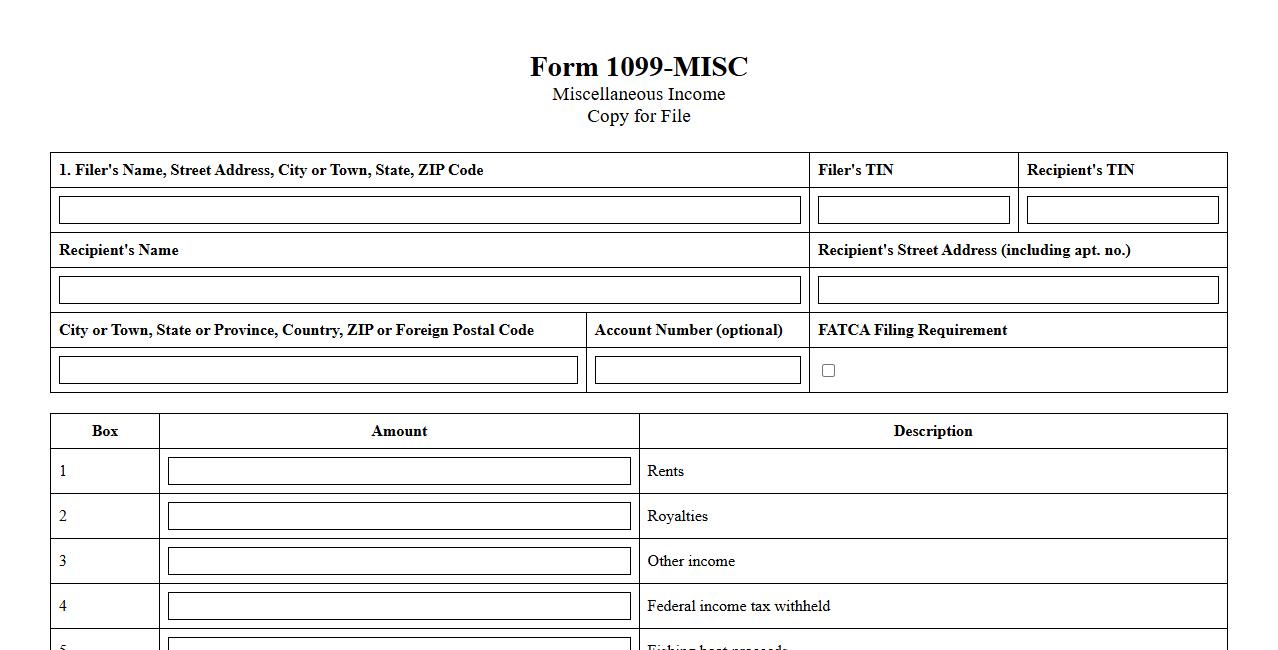

IRS 1099 Form Copy for File

The IRS 1099 Form Copy for File is an essential document that taxpayers use to keep records of various income types not reported on a W-2. This copy helps individuals and businesses verify income and ensure accurate tax reporting. Retaining this form aids in resolving discrepancies and preparing for future tax filings.

What information is required to complete an Order 1099 Form Copy request?

To complete an Order 1099 Form Copy request, you need to provide the payer's name, address, and taxpayer identification number (TIN). Additionally, the recipient's name, address, and TIN are required to verify the requested form. You must also specify the tax year and type of 1099 form needed for the request.

Which types of 1099 forms can be ordered as copies from the IRS?

The IRS allows ordering copies of various 1099 forms, including 1099-MISC, 1099-INT, 1099-DIV, and 1099-R. These forms cover a range of income types such as miscellaneous income, interest, dividends, and retirement distributions. However, not all 1099 variants may be available, so checking specific availability is essential before ordering.

Who is authorized to request a copy of a 1099 form?

Only the taxpayer identified on the 1099 form or their authorized representative can request a copy from the IRS. This ensures privacy and security of sensitive financial information. Proper authorization documentation must be provided if a third party submits the request on behalf of the taxpayer.

What is the standard processing time for receiving a 1099 form copy after ordering?

The standard processing time for receiving a 1099 form copy from the IRS is generally 75 calendar days. This period accounts for the form retrieval, verification, and mailing processes. Urgent requests may take longer depending on IRS workload and seasonal demand.

Are there any fees or identification requirements for ordering a 1099 form copy?

There are typically no fees charged by the IRS to order a 1099 form copy, but verification of identity is strictly required. Requestors must submit valid identification such as a Social Security Number and a government-issued ID. This measure protects against unauthorized access to confidential tax information.