The Order W-2 Form Copy service allows employees to request a duplicate of their W-2 tax document for accurate tax filing and record-keeping. This copy contains essential information such as wages earned, tax withholdings, and social security contributions. Accessing a W-2 Form Copy ensures compliance with IRS requirements and helps resolve any discrepancies in income reporting.

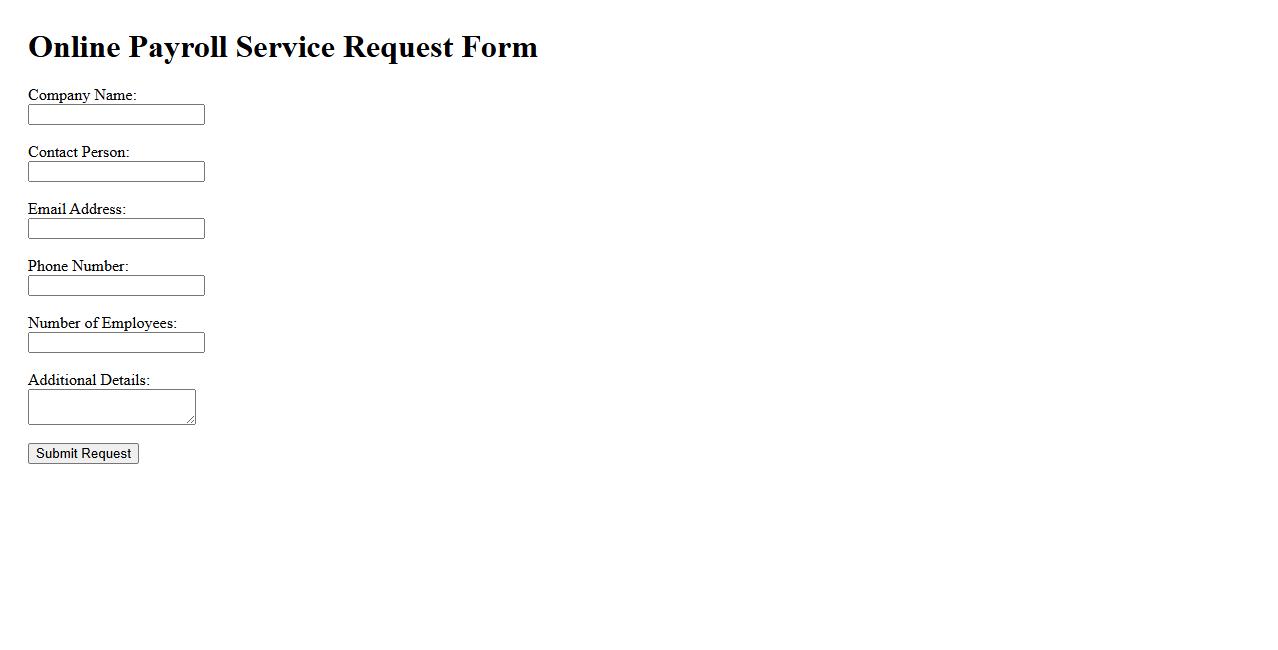

Online payroll service request

Request an online payroll service to streamline your employee payment process efficiently. Our platform ensures accurate calculations, timely deposits, and compliance with tax regulations. Experience hassle-free payroll management anytime, anywhere.

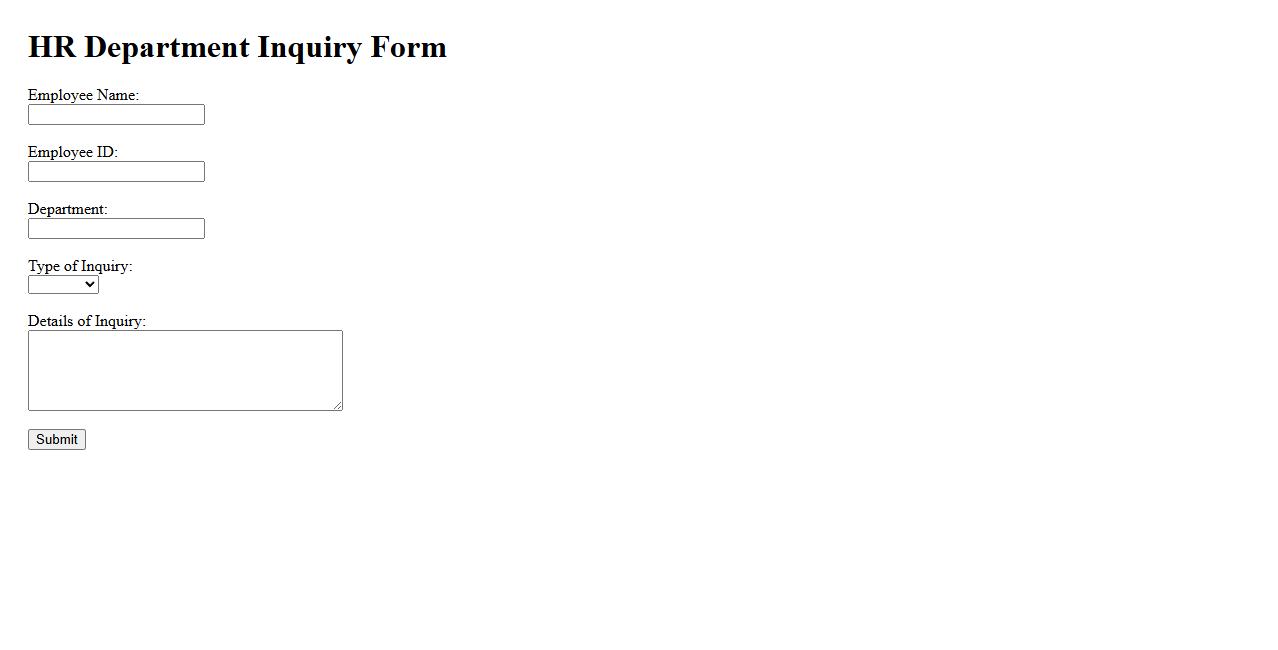

Employer HR department inquiry

The Employer HR department inquiry is a process where employees or external parties seek information regarding human resources policies, benefits, or employment verification. It ensures clear communication and efficient resolution of workplace-related questions. This inquiry helps maintain transparency and supports employee satisfaction within the organization.

IRS transcript request

Requesting an IRS transcript allows taxpayers to obtain a summary of their tax returns and account activities directly from the Internal Revenue Service. This document is essential for verifying income, tax filings, and payments without providing the full tax return. It simplifies processes like loan applications and tax audits by offering an official record of tax-related information.

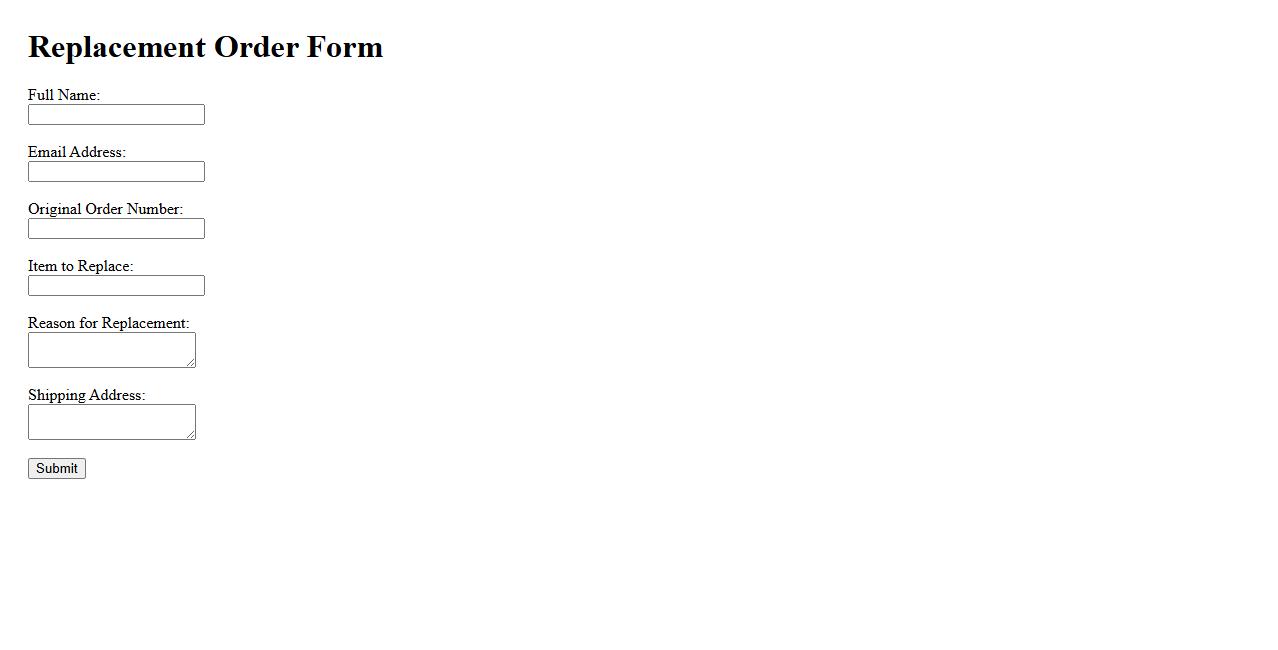

Replacement form order

The replacement form order is a crucial document used to request a substitute product or service. It ensures a smooth and efficient process for correcting errors or receiving damaged items. This form helps businesses maintain customer satisfaction by facilitating quick and accurate replacements.

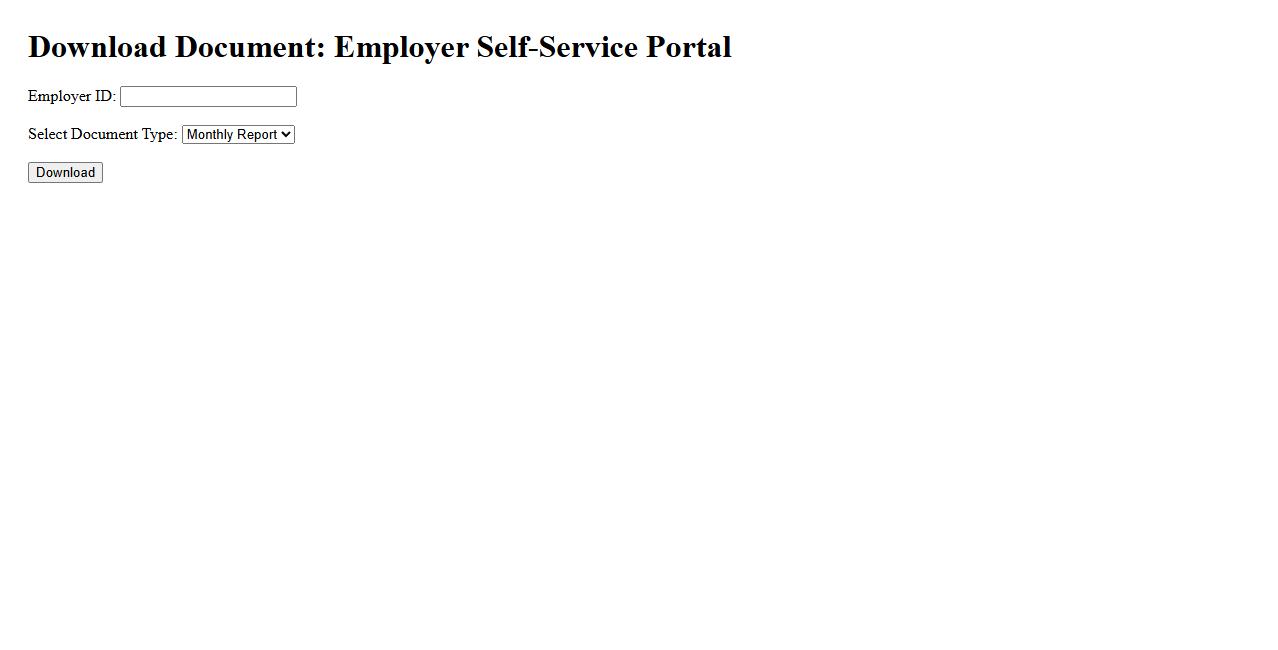

Employer self-service portal download

The Employer self-service portal download provides easy access to manage employee information and payroll details efficiently. This portal streamlines administrative tasks, enabling employers to update records and submit reports instantly. By downloading the portal, users can enhance productivity and ensure accurate data management.

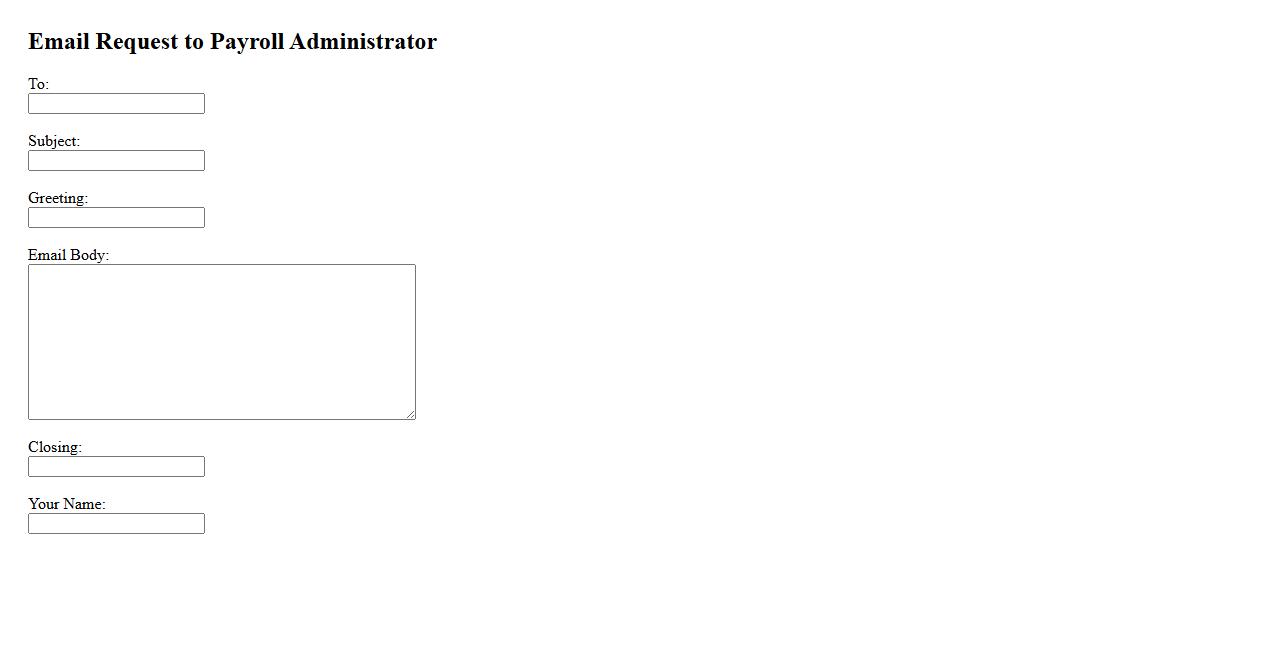

Email request to payroll administrator

When sending an email request to payroll administrator, clarity and professionalism are essential. Clearly state the purpose of your request, such as salary inquiries or payment corrections, and provide necessary details for efficient processing. A well-structured message ensures timely and accurate responses from the payroll team.

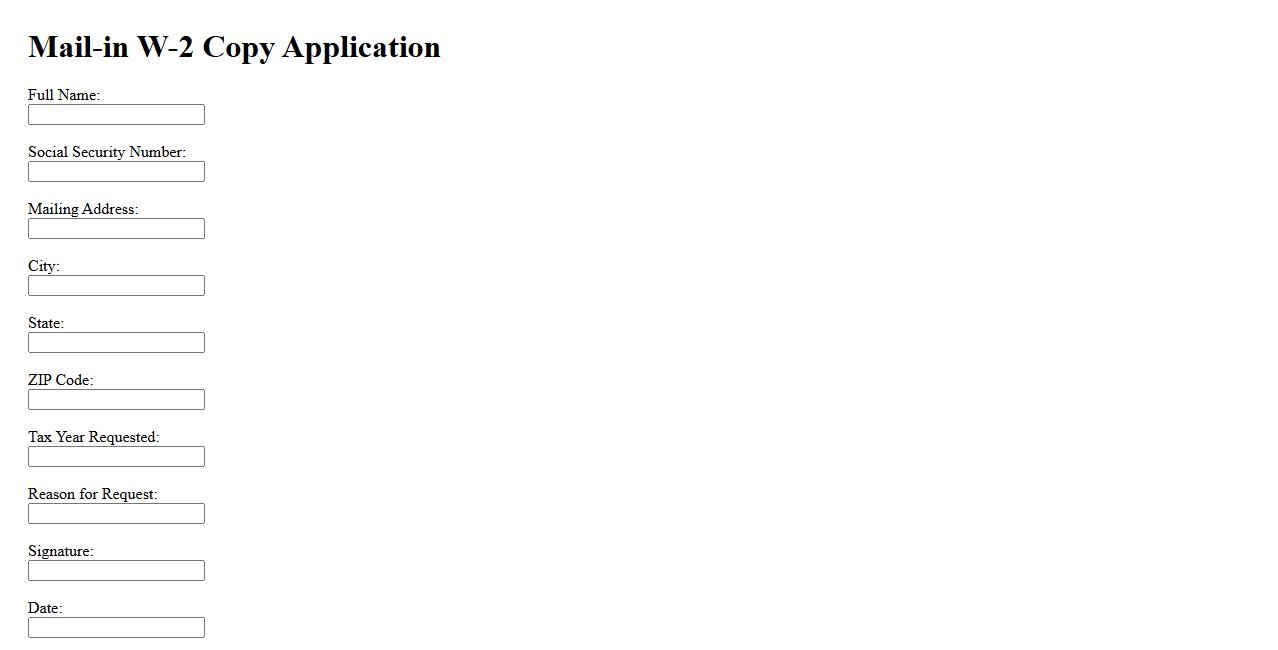

Mail-in W-2 copy application

Submitting a Mail-in W-2 copy application allows employees to request a duplicate of their W-2 form if the original is lost or misplaced. This process involves filling out a request form and mailing it to the employer or the IRS. It ensures timely access to important tax documents necessary for filing tax returns.

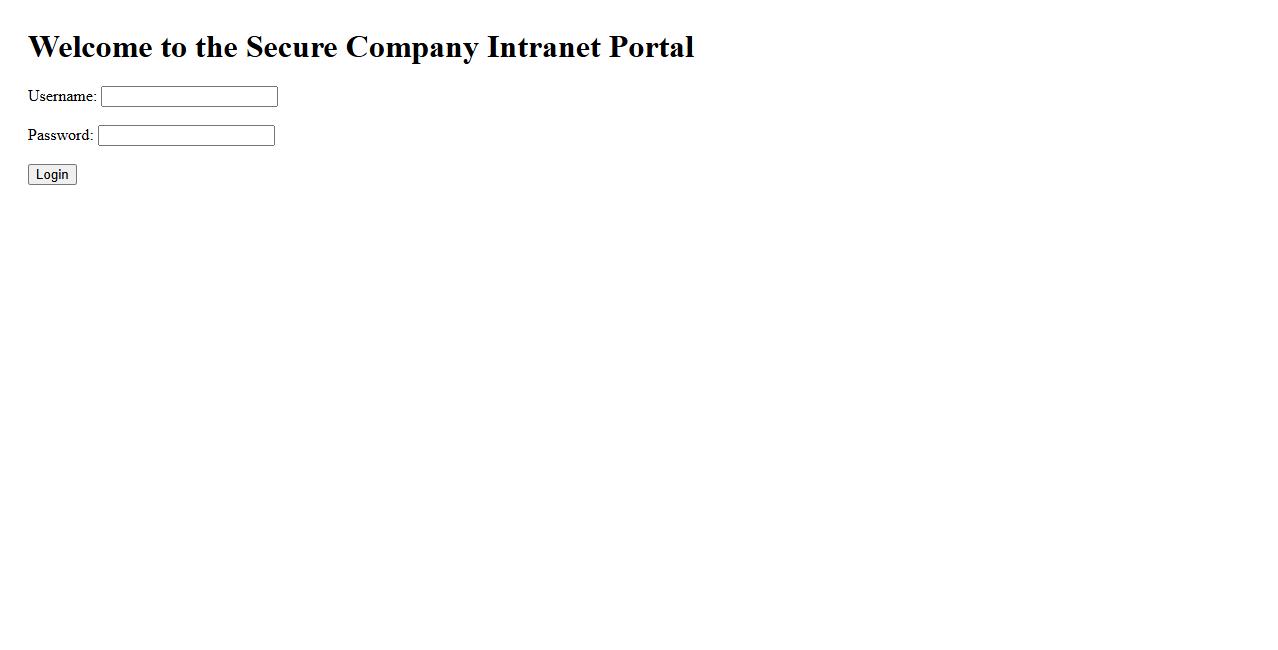

Secure company intranet portal

Our secure company intranet portal ensures safe and efficient communication within the organization. It provides controlled access to sensitive information, fostering collaboration while protecting data privacy. Designed with advanced encryption and user authentication, the portal maintains a trustworthy environment for all employees.

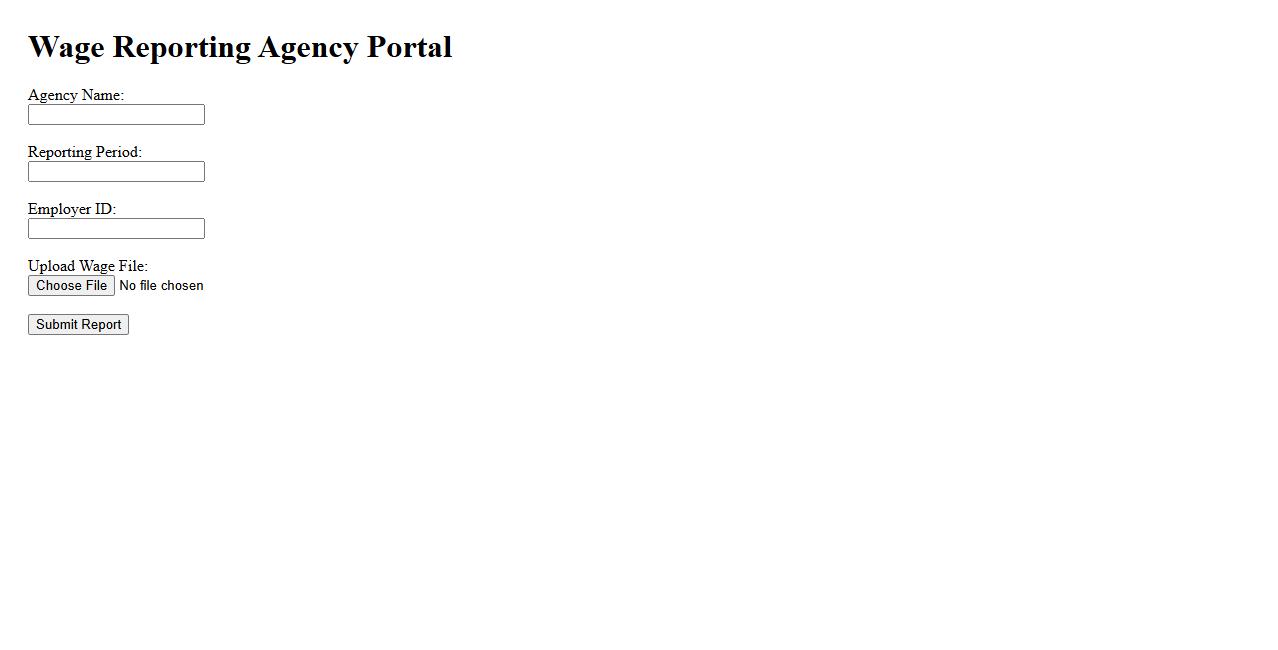

Wage reporting agency portal

The wage reporting agency portal streamlines the submission and management of employee wage data for regulatory compliance. This secure online platform allows agencies to easily upload, track, and verify payroll information in real time. By centralizing wage reporting, it enhances accuracy and simplifies government reporting requirements.

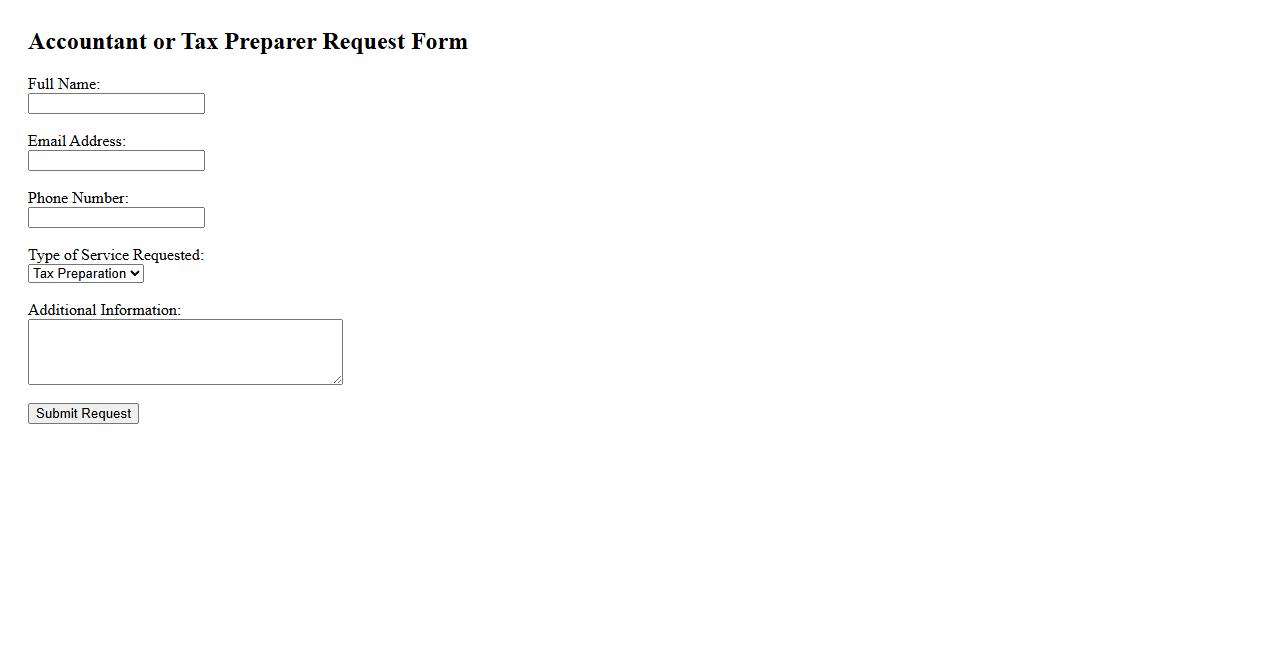

Accountant or tax preparer request

An accountant or tax preparer request involves seeking professional assistance to manage financial records and file accurate tax returns. These experts ensure compliance with tax laws and optimize financial outcomes. Utilizing their services can save time and reduce the risk of errors during tax season.

What information is required to order a copy of a W-2 Form?

To order a copy of a W-2 Form, you need to provide the employee's full name, Social Security Number (SSN), and current address. Additionally, the employer's name, address, and Employer Identification Number (EIN) may be required. This information helps verify the identity and ensures the correct W-2 Form copy is retrieved.

Which tax year's W-2 Form copy are you requesting?

You must specify the exact tax year for which you need the W-2 Form copy. Providing the correct year ensures you receive accurate wage and tax information relevant to that period. This helps avoid delays or confusion during the processing of your request.

Who is authorized to request a W-2 Form copy for an employee?

Only the employee or an authorized representative, such as a legal guardian or power of attorney holder, can request a W-2 Form copy. Employers typically cannot request their employee's W-2 without proper authorization. Verification of authorization is usually required to protect the employee's privacy.

What are the available methods for receiving the W-2 Form copy (mail, electronic, in-person)?

W-2 Form copies can be delivered via mail, electronically through secure portals, or picked up in-person at authorized locations. Electronic delivery is often faster and more convenient, while mail is a traditional option for paper copies. Options may vary depending on the employer or issuing agency's policies.

What is the processing time and fee (if any) for obtaining a W-2 Form copy?

The typical processing time for a W-2 Form copy ranges from 7 to 14 business days after the request is submitted. Some agencies or employers may charge a nominal fee, but often the service is free. It is advisable to check the specific processing time and fee details before placing the order.