A Order Bank Statement serves as an official document detailing all transactions within a specified period for a particular bank account. It provides a comprehensive summary of deposits, withdrawals, and balances, aiding in financial tracking and account reconciliation. Businesses and individuals often use this statement to verify expenses, detect discrepancies, and support accounting records.

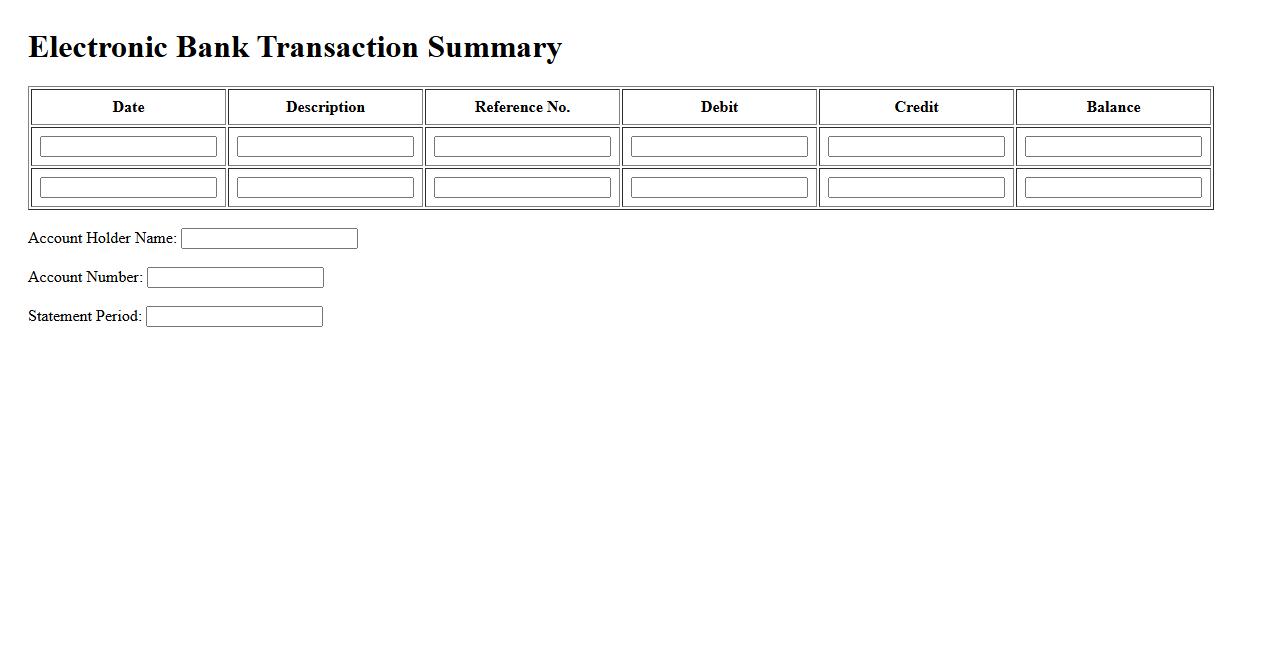

Electronic bank transaction summary

An electronic bank transaction summary provides a concise overview of all financial activities within a specified period. It details deposits, withdrawals, transfers, and payments, helping users track their account balance effectively. This summary enhances transparency and simplifies financial management.

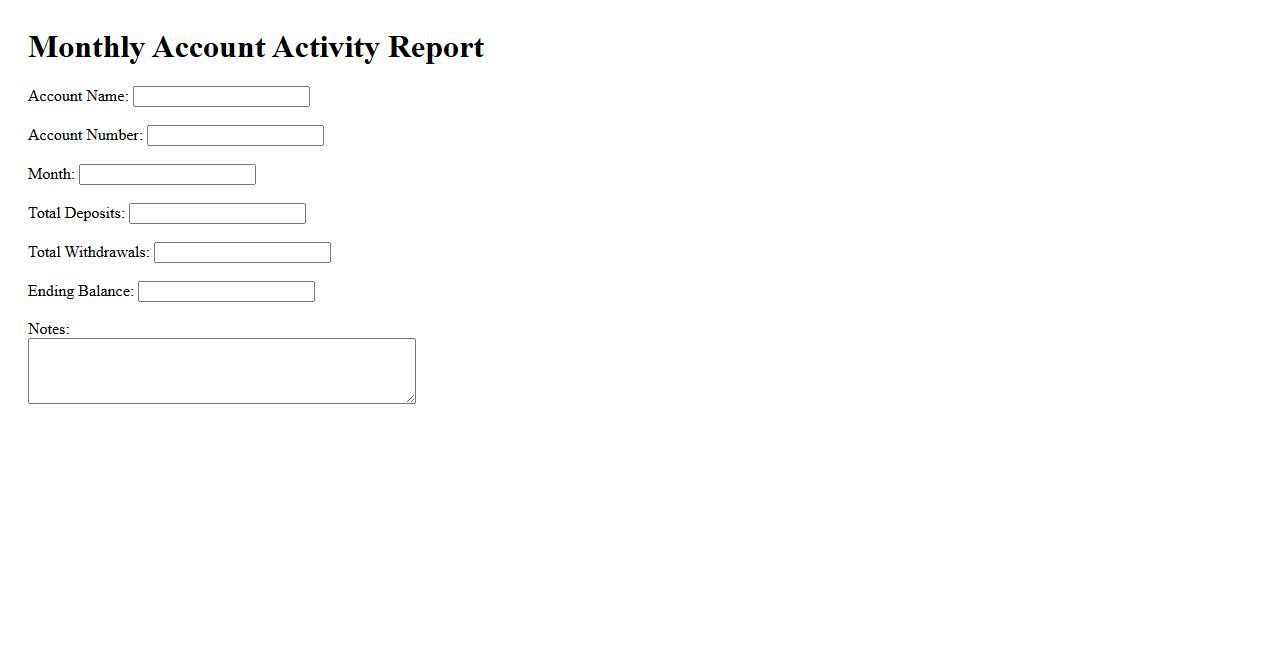

Monthly account activity report

The Monthly account activity report provides a comprehensive overview of all transactions and updates within your account for the month. This report helps you track spending, monitor deposits, and detect any unusual activity. Stay informed and maintain control over your finances with detailed monthly insights.

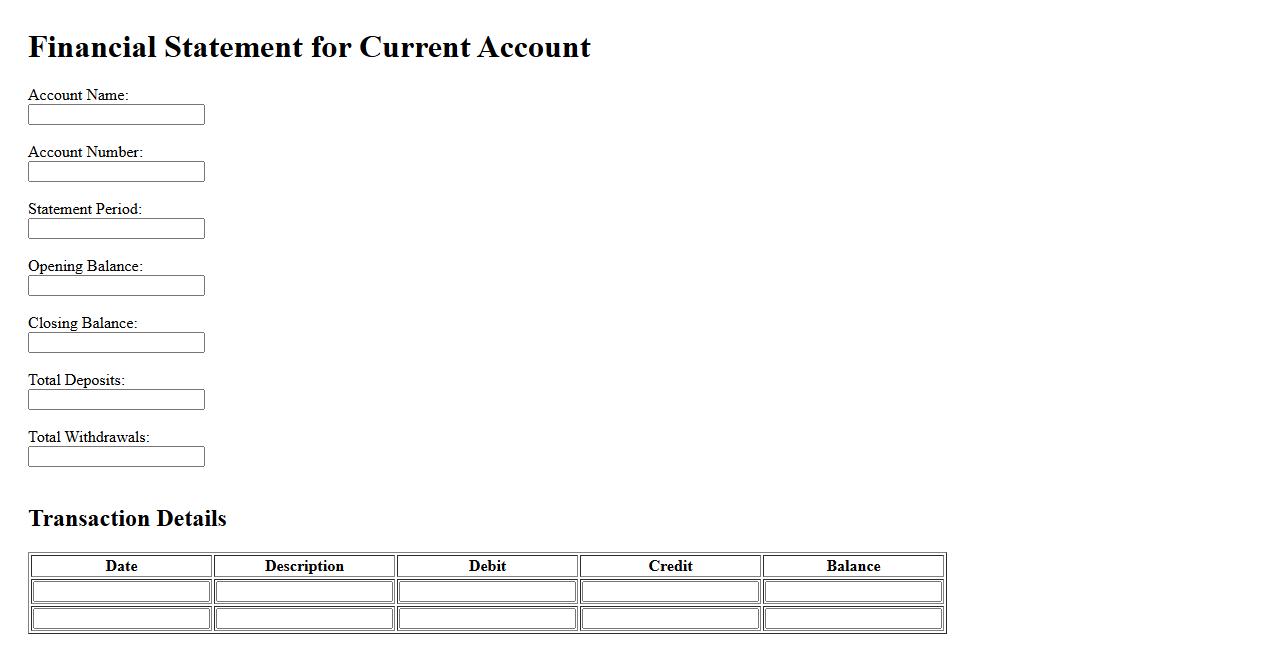

Financial statement for current account

A financial statement for a current account provides a detailed summary of all transactions, including deposits, withdrawals, and fees, within a specific period. It helps individuals and businesses monitor their cash flow and manage their finances effectively. Regular review of this statement ensures accurate tracking of account activities and balances.

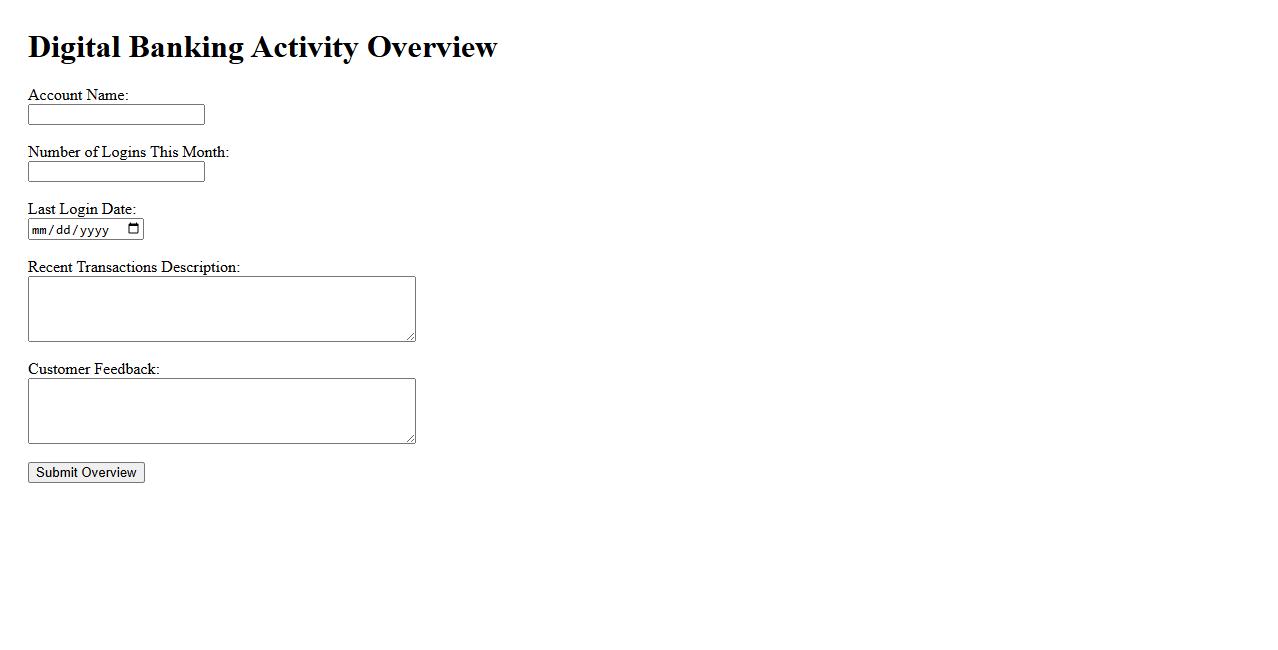

Digital banking activity overview

Digital banking activity encompasses a wide range of online financial services, including account management, transfers, and payments. It offers convenience and real-time access to banking services through secure platforms. Understanding digital banking activity is essential for analyzing customer behavior and improving user experience.

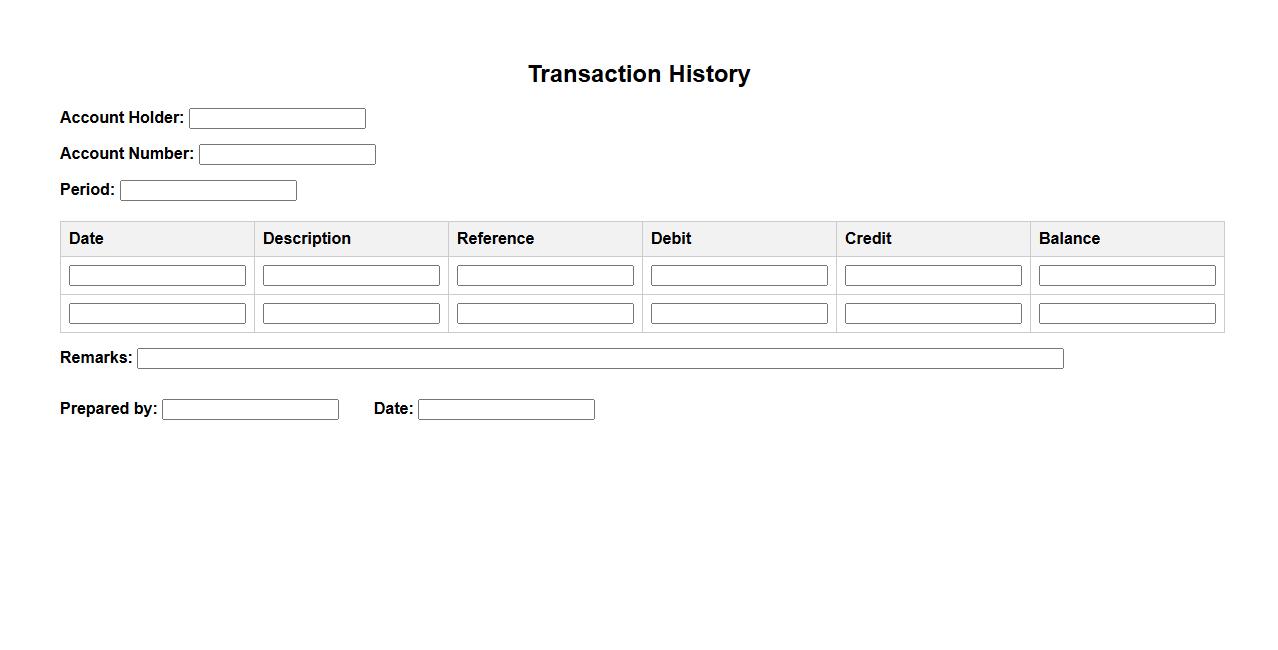

Transaction history document

The Transaction history document provides a detailed record of all financial transactions over a specific period. It helps individuals and businesses track payments, deposits, and withdrawals accurately. This document is essential for auditing, budgeting, and financial planning purposes.

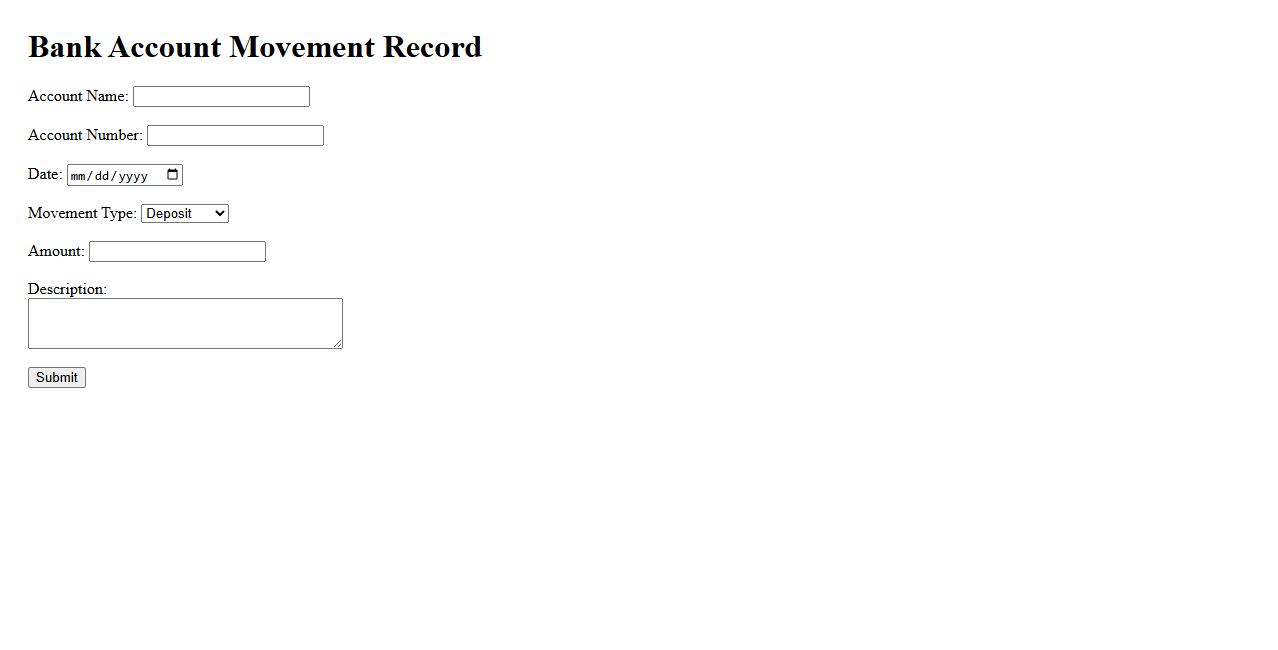

Bank account movement record

The bank account movement record provides a detailed history of all transactions within a specific account. It includes deposits, withdrawals, and transfers, helping users track financial activity accurately. This record is essential for budgeting and verifying any discrepancies in account statements.

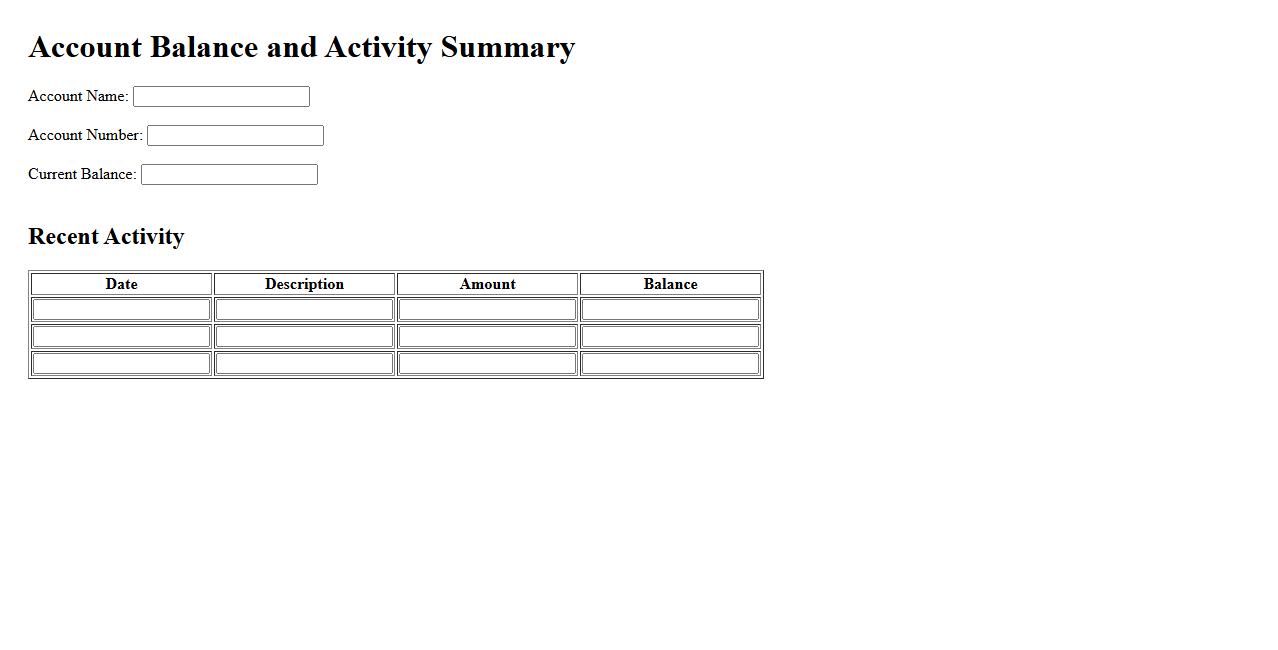

Account balance and activity summary

The account balance provides a real-time snapshot of your available funds, helping you to manage your finances effectively. The activity summary offers a detailed overview of recent transactions, including deposits, withdrawals, and payments. Together, they ensure you stay informed and in control of your financial status.

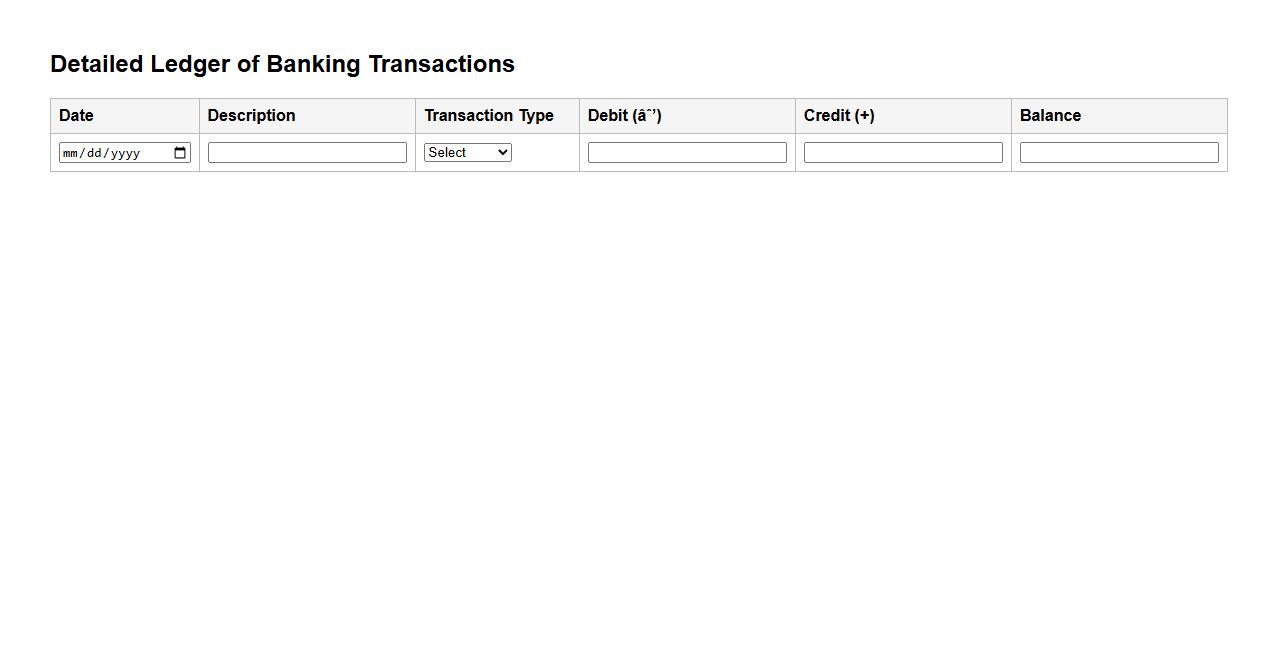

Detailed ledger of banking transactions

A detailed ledger of banking transactions provides a comprehensive record of all financial activities within an account. It includes deposits, withdrawals, transfers, and fees, organized chronologically for easy tracking. This ledger ensures transparency and accuracy in managing personal or business finances.

Banking activity snapshot

A banking activity snapshot provides a concise summary of recent financial transactions and account movements. It helps customers quickly understand their spending, deposits, and overall account status. This overview is essential for effective money management and financial planning.

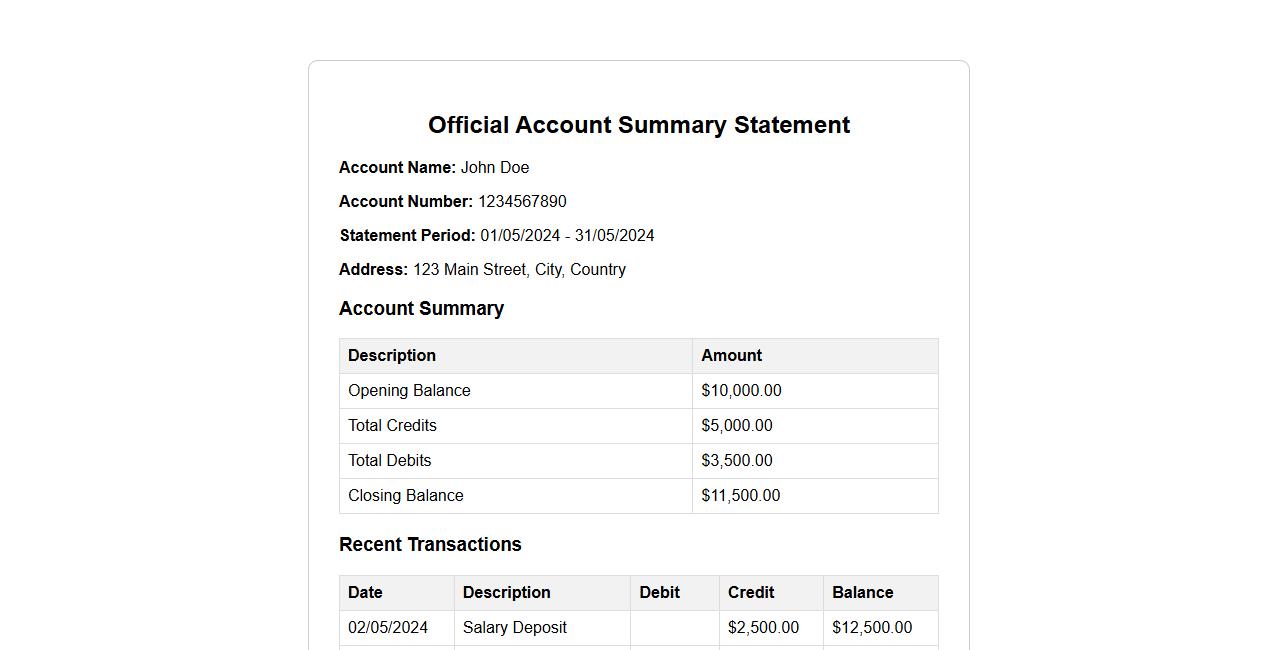

Official account summary statement

An Official account summary statement provides a detailed overview of all transactions and balances within a specified account during a given period. It helps users track their financial activities and verify their records accurately. This document is essential for maintaining transparency and managing personal or business finances effectively.

What details are required to successfully order a bank statement?

To successfully order a bank statement, you must provide the account number associated with the request. Additionally, identification information such as your full name and date of birth is often required. Banks may also require the specific date range for the statement you wish to receive.

Which formats are available when requesting a bank statement?

Bank statements are typically available in various formats including PDF, CSV, and Paper. PDF is the most common digital format for easy downloading and printing. Some banks may also offer statements in Excel or other customizable formats for detailed financial analysis.

How can the frequency of receiving bank statements be customized?

Customers can usually customize the frequency of their bank statements through their online banking portal. Options include monthly, quarterly, or annual statements sent via email or postal mail. Many banks also allow customers to opt for on-demand statement delivery at any time.

What security measures are in place when ordering bank statements online?

Ordering bank statements online is protected by secure encryption protocols to ensure data privacy. Multi-factor authentication (MFA) is often required to verify the customer's identity before access is granted. Banks also monitor for suspicious activity to safeguard sensitive financial information.

Who is authorized to request or access a bank statement for an account?

Only the account holder or individuals authorized through a power of attorney can request or access bank statements. Joint account holders may also have access rights depending on the account agreement. Financial institutions strictly enforce these rules to protect account confidentiality.