The Order 1099 Tax Form Copy allows individuals and businesses to request official copies of their 1099 forms for tax reporting purposes. These copies are essential for accurate income reporting and verification during tax filing. Access to a 1099 form copy ensures compliance with IRS regulations and aids in resolving any discrepancies.

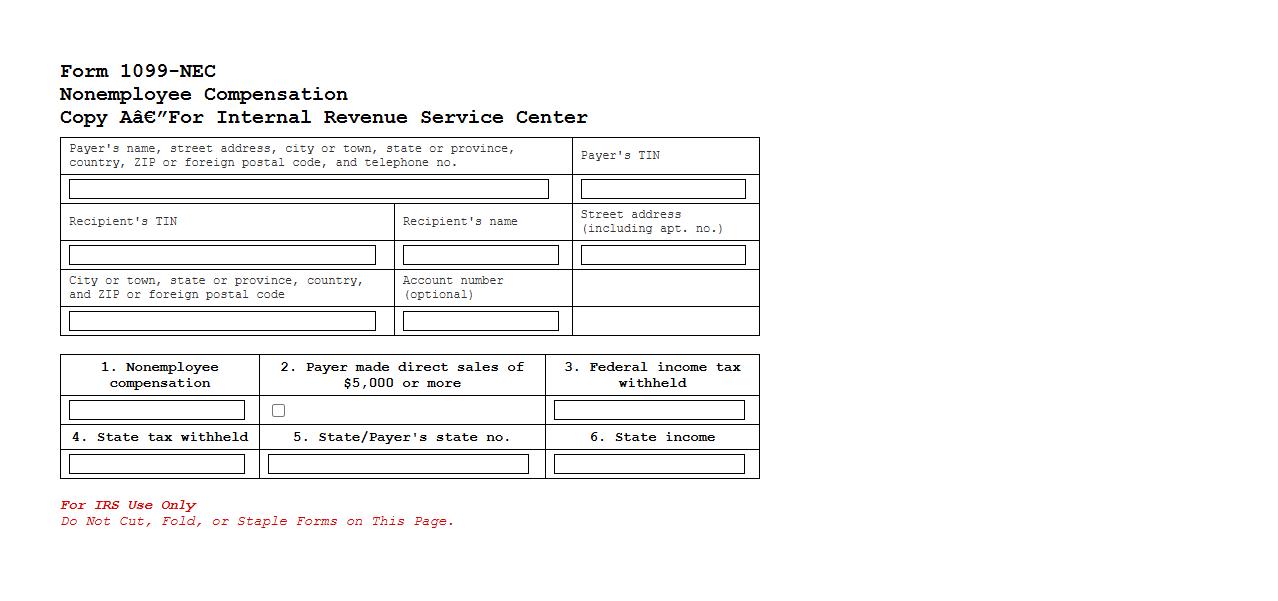

Federal 1099 Form Copy A

The Federal 1099 Form Copy A is a crucial document used by businesses to report various types of income to the IRS. It includes essential payer and recipient information along with income details. This copy is submitted directly to the IRS for official record-keeping and tax processing.

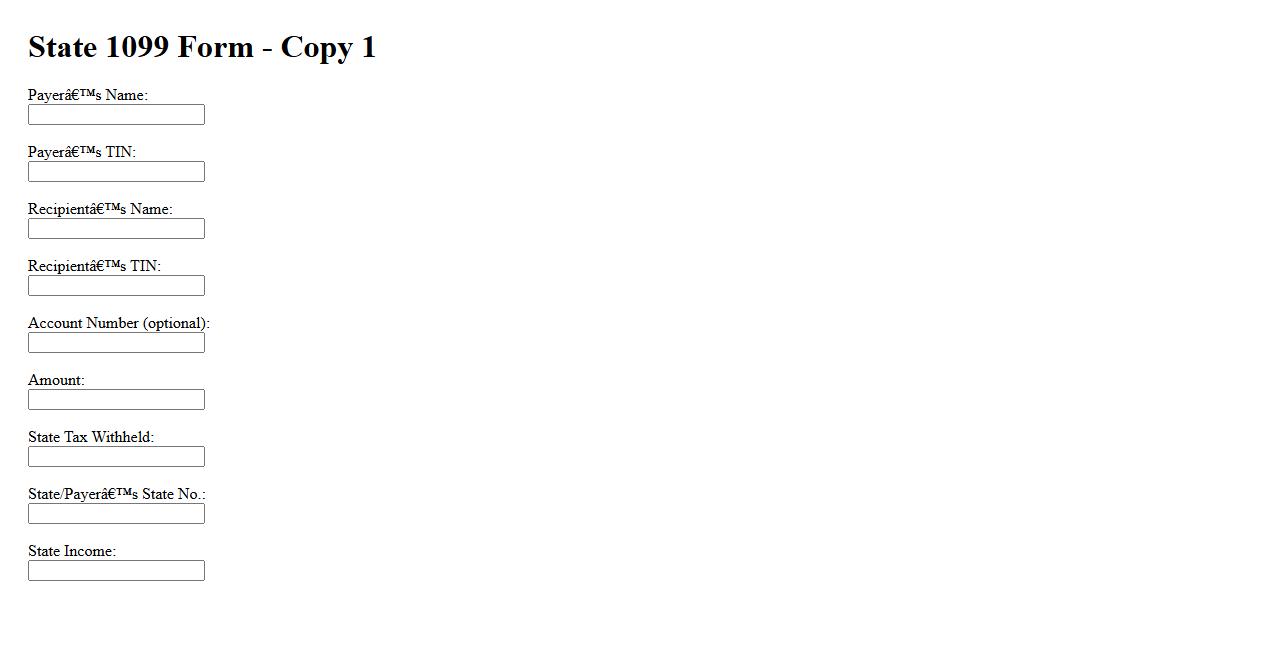

State 1099 Form Copy 1

The State 1099 Form Copy 1 is used by state tax departments for reporting income information. This form helps in tracking earnings that may be subject to state taxes. Employers and payers must submit Copy 1 to comply with state reporting requirements.

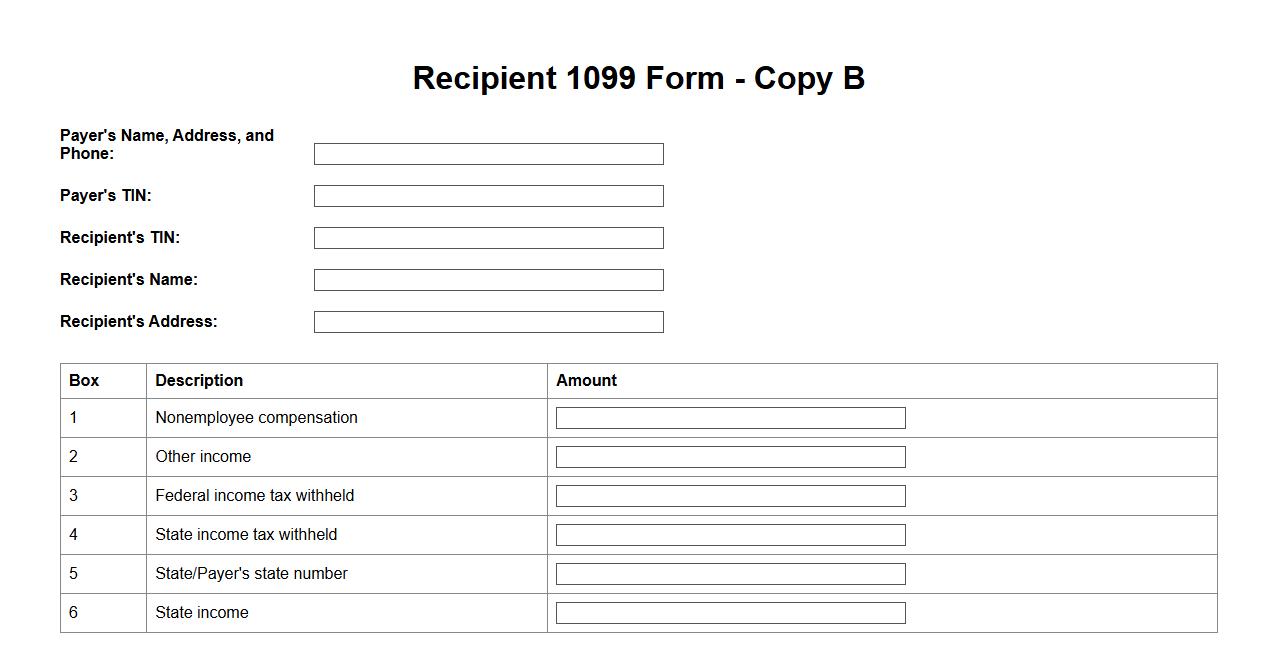

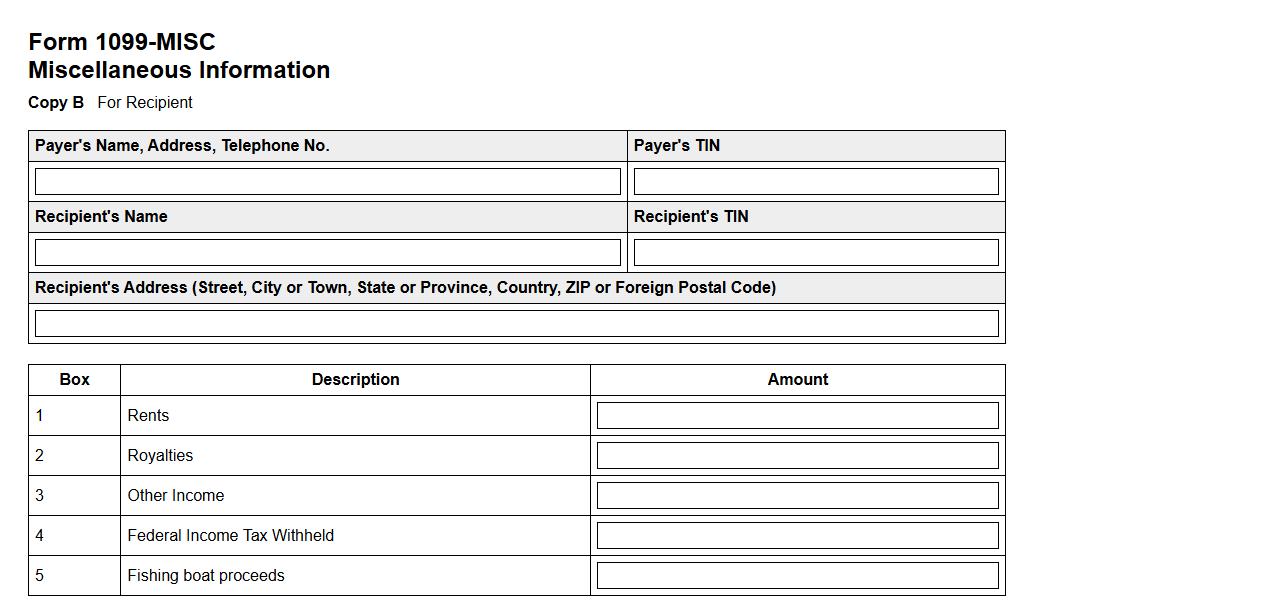

Recipient 1099 Form Copy B

The Recipient 1099 Form Copy B is a crucial document provided to individuals who have received income outside of regular employment. It outlines the amount paid to the recipient, which must be reported on their tax return. This copy ensures the recipient has accurate information for tax filing purposes.

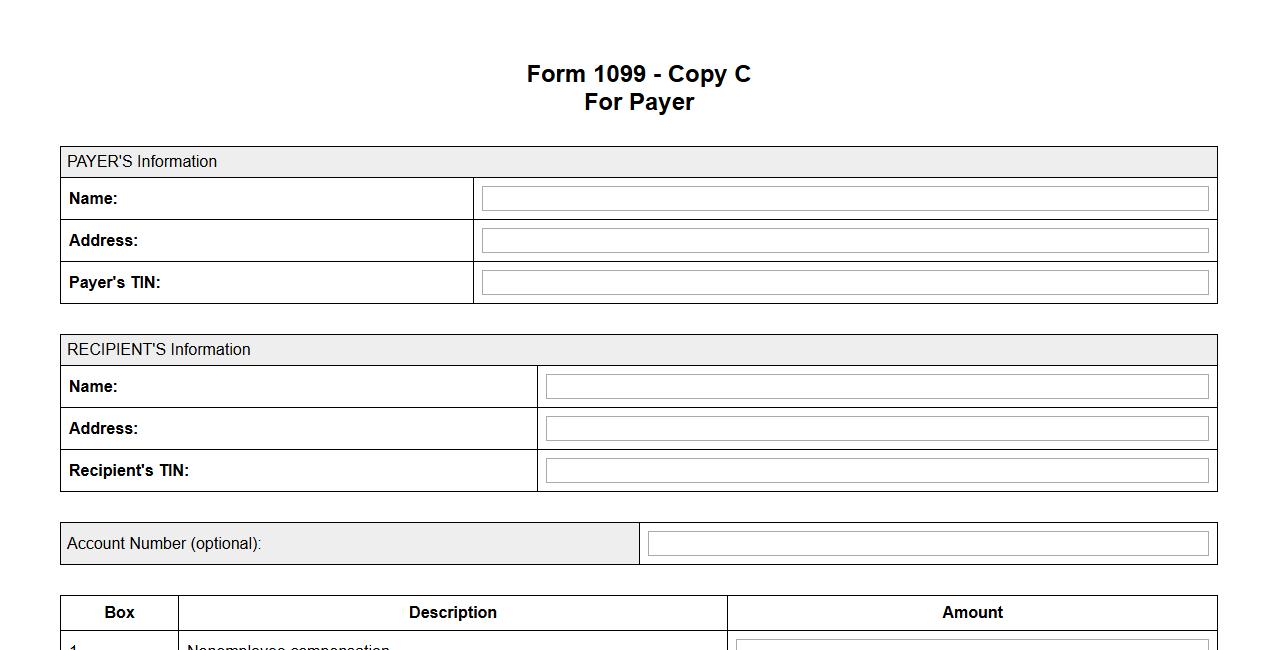

Payer 1099 Form Copy C

The Payer 1099 Form Copy C is a crucial document used by payers to report various types of income paid to contractors and freelancers. It must be submitted to the Internal Revenue Service (IRS) to ensure proper tax reporting and compliance. Accurate completion of Copy C helps avoid penalties and facilitates smooth tax processing.

IRS 1099 Form Copy

The IRS 1099 Form Copy is an essential document used to report various types of income other than wages, salaries, and tips. It must be provided to recipients and filed with the IRS to ensure accurate income reporting. Proper handling of this form is crucial for tax compliance and avoiding penalties.

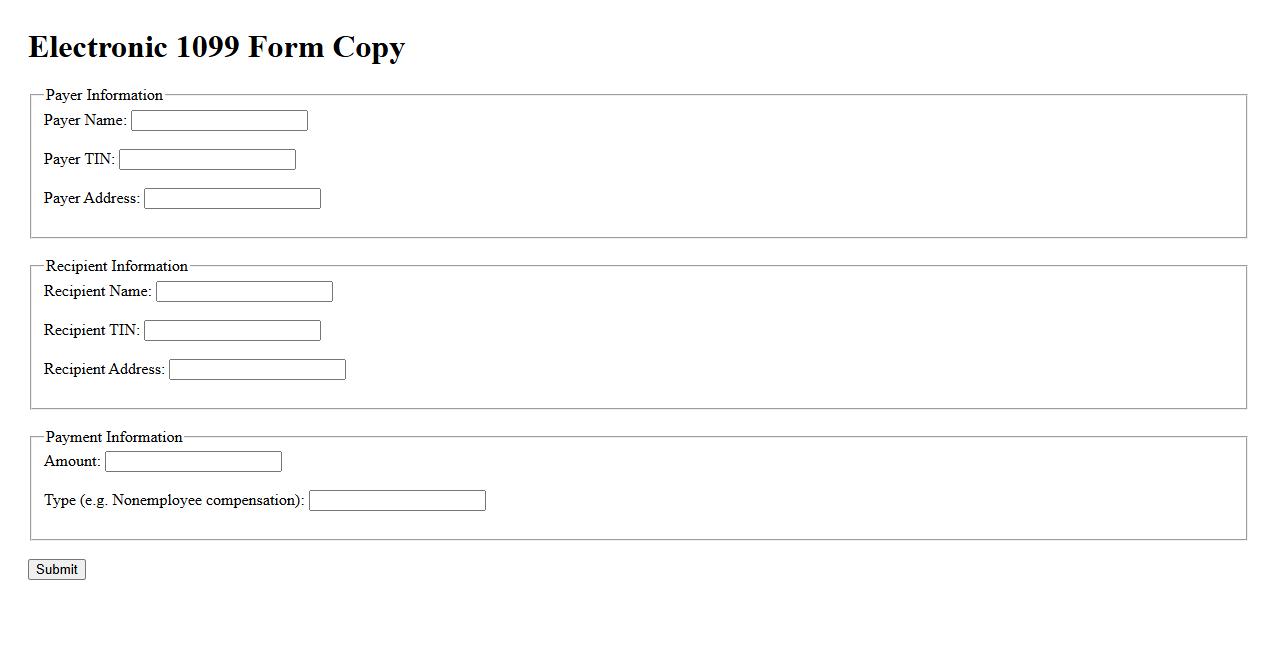

Electronic 1099 Form Copy

The Electronic 1099 Form Copy provides a digital version of the tax document required for reporting various types of income. It ensures accurate and timely submission to the IRS and recipients. Utilizing electronic copies simplifies record-keeping and enhances accessibility for both businesses and individuals.

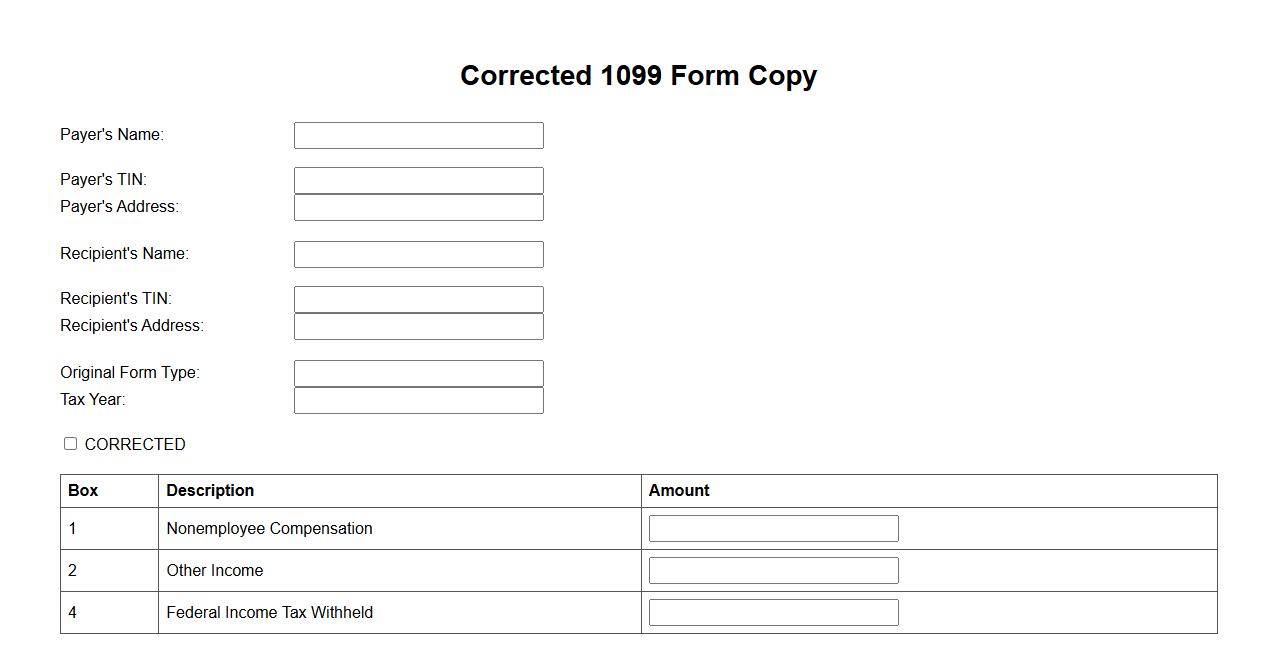

Corrected 1099 Form Copy

The Corrected 1099 Form Copy is an essential document used to amend errors found on the original 1099 form. It ensures accurate reporting of income to the IRS and recipients. Timely submission of this corrected copy helps avoid potential penalties and confusion during tax filing.

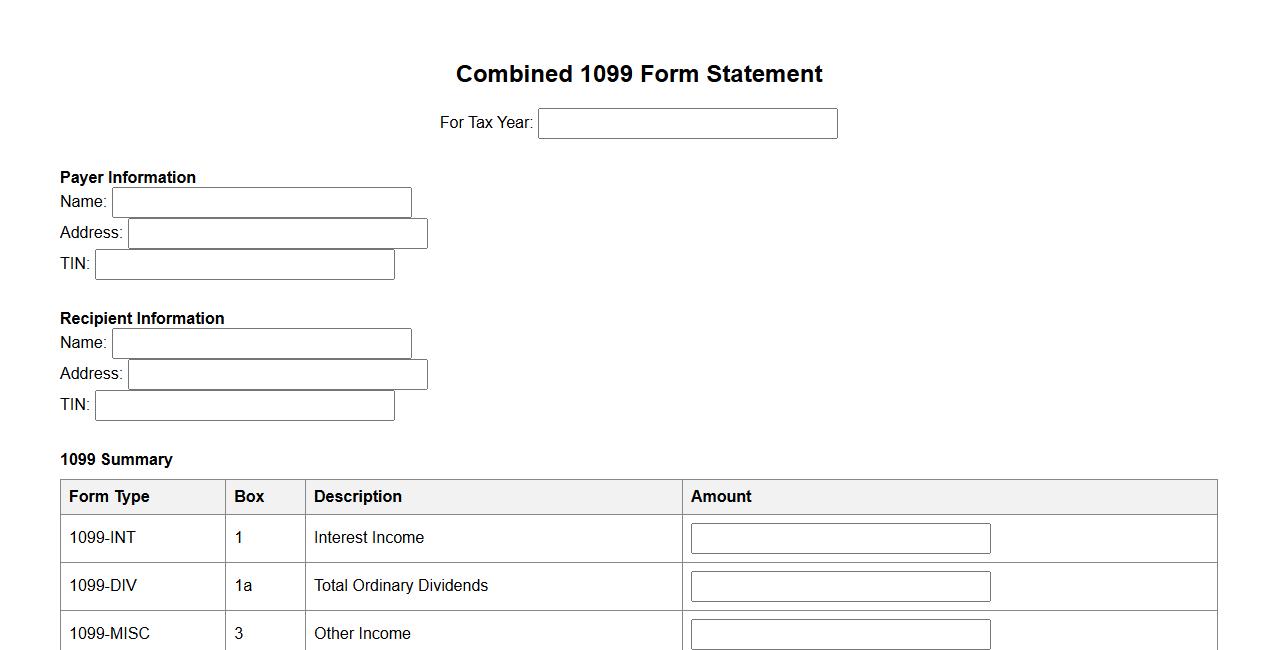

Combined 1099 Form Statement

The Combined 1099 Form Statement consolidates multiple 1099 forms into a single document for easier tax reporting. This summary helps taxpayers and the IRS accurately track income from various sources. It simplifies record-keeping and ensures compliance with tax regulations.

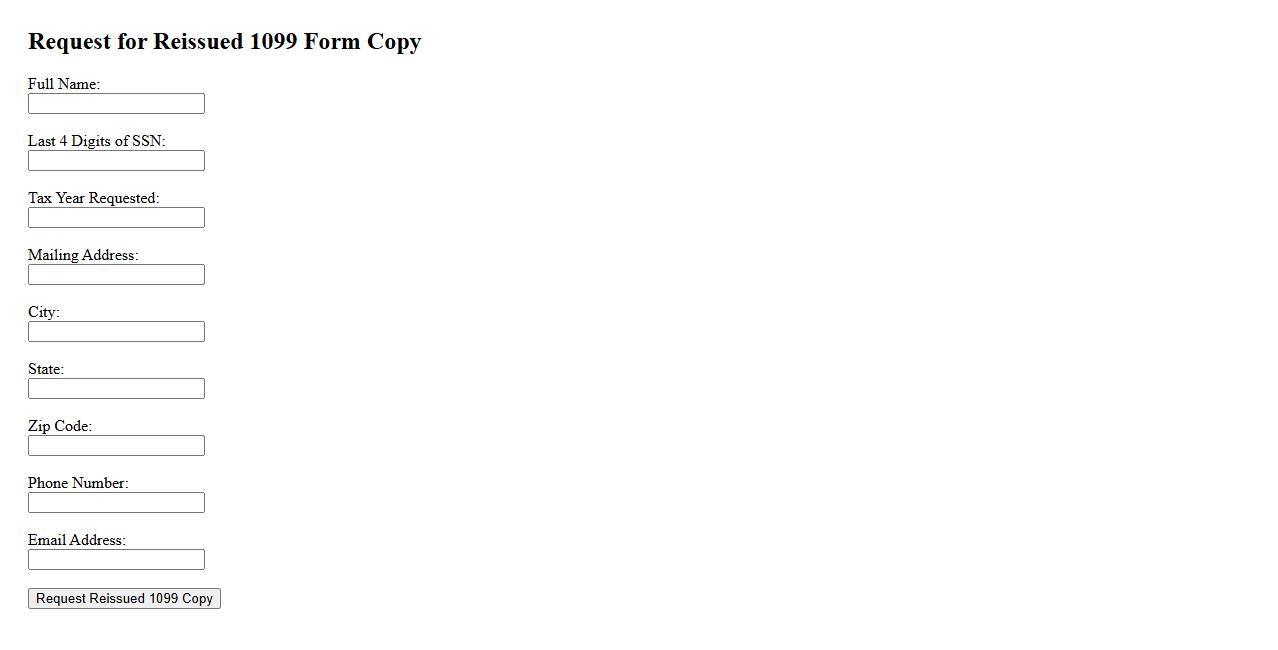

Reissued 1099 Form Copy

The Reissued 1099 Form Copy is an important document provided to recipients when the original 1099 form needs correction or replacement. It ensures accurate reporting of income for tax purposes and helps prevent filing errors. Receiving a reissued copy allows individuals to update their tax records promptly.

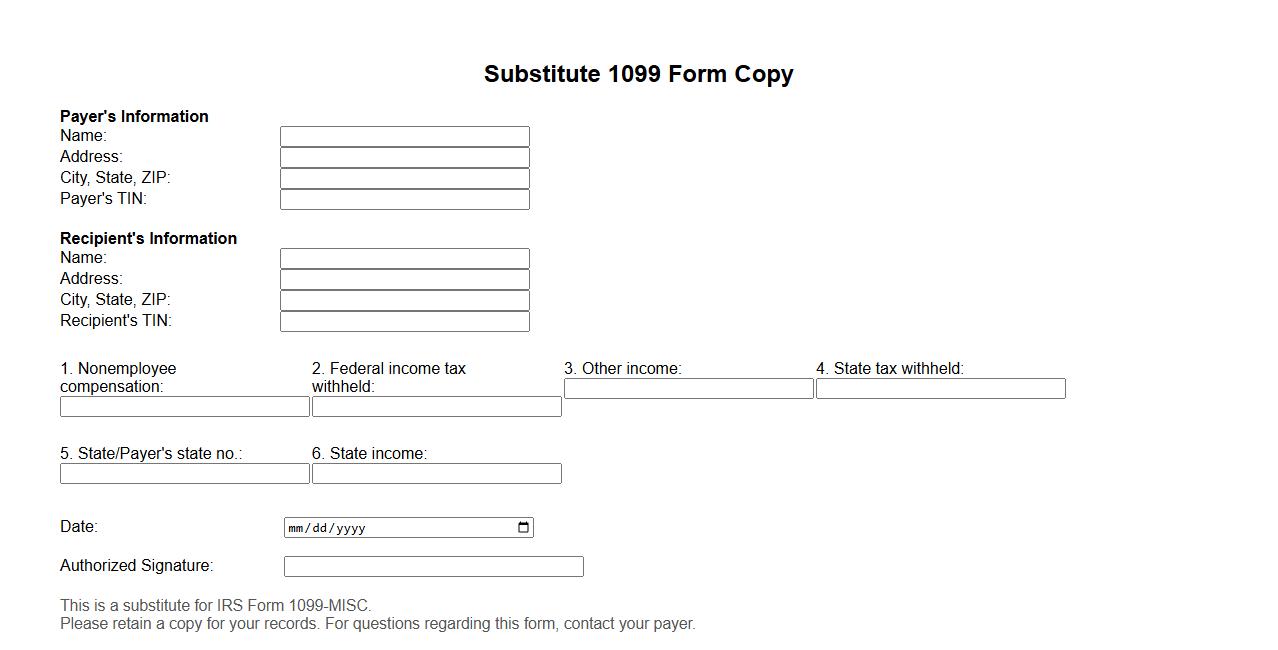

Substitute 1099 Form Copy

The Substitute 1099 Form Copy serves as an exact replacement for the official 1099 form, providing a convenient way to report income for tax purposes. It includes all required details to ensure proper documentation and submission to the IRS. This copy helps both payers and recipients maintain accurate financial records easily.

What essential information is required to order a copy of a 1099 tax form?

To order a copy of a 1099 tax form, you need to provide your full name, Social Security number (SSN), and the tax year for which the form is requested. Additionally, supplying your current address and contact information helps ensure accurate processing. Having details about the payer, such as their name and identification number, can also expedite the request.

Which entities should you contact to request a duplicate 1099 tax form?

You should first contact the payer or issuer of the original 1099 form, such as an employer or financial institution. If the payer cannot provide a copy, you can request a transcript or copy from the Internal Revenue Service (IRS). The IRS offers specific services to obtain copies of 1099 forms upon verifying the taxpayer's identity.

How can you verify the authenticity of a received 1099 tax form copy?

Check for official IRS formatting and details, including accurate payee and payer information, correct tax year, and official IRS forms. Matching the data with your records, such as year-end statements or bank documents, helps confirm legitimacy. If in doubt, contact the issuer or IRS to validate the form's authenticity.

What are common reasons for needing a copy of a 1099 tax form?

Individuals often need a copy of their 1099 tax form for lost or misplaced documents during tax filing. It is also required to verify income reported when resolving discrepancies or for applying for loans or financial aid. Additionally, tax professionals may request copies to accurately prepare tax returns or amendments.

What are the IRS procedures and timelines for processing 1099 tax form copy requests?

The IRS requires taxpayers to submit a Form 4506-T to request a transcript or copy of a 1099 form, which can take up to 75 calendar days for processing. Transcripts are typically faster than full copies and often suffice for income verification. It's recommended to request early to allow for processing times, especially during tax season.