A Order Pay Stub Copy is a detailed document that provides a record of an employee's earnings and deductions for a specific pay period. It serves as proof of income and is often required for loan applications, tax filing, or personal record-keeping. Employers can typically request a duplicate copy to ensure accurate financial documentation.

Payroll Statement Version

The Payroll Statement Version provides a detailed summary of an employee's earnings, deductions, and net pay for a specific pay period. It ensures clear and transparent communication of salary details to both employees and employers. This version helps maintain accurate financial records and simplifies payroll management processes.

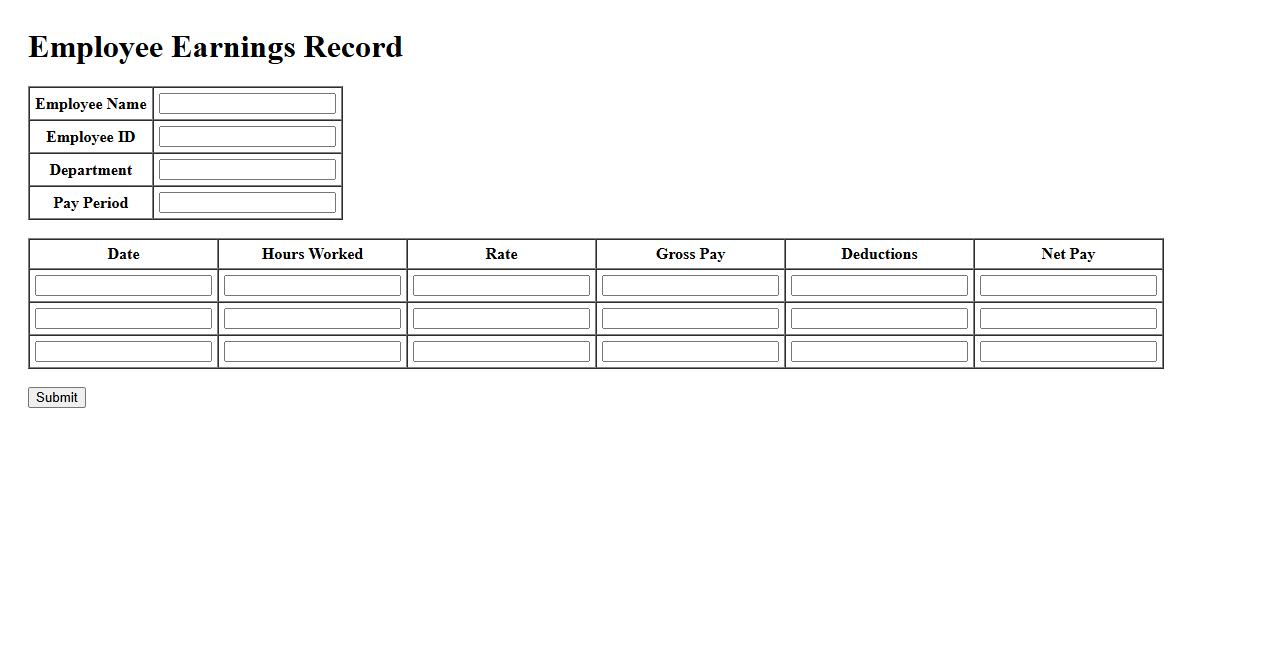

Employee Earnings Record

The Employee Earnings Record is a detailed document that tracks an employee's wages, bonuses, and deductions over a specific period. It serves as a crucial reference for payroll accuracy, tax reporting, and benefits administration. Maintaining an accurate earnings record ensures compliance with labor laws and helps resolve any compensation disputes.

Salary Slip Form

The Salary Slip Form is an essential document used by employers to provide employees with a detailed summary of their earnings and deductions for a specific pay period. It typically includes information such as basic salary, allowances, taxes, and net pay. This form ensures transparency and helps in maintaining accurate payroll records.

Wage Summary Sheet

The Wage Summary Sheet provides a detailed overview of employee earnings, including hourly rates, hours worked, and total wages. It is essential for accurate payroll processing and financial record-keeping. This document helps ensure transparency and compliance with labor regulations.

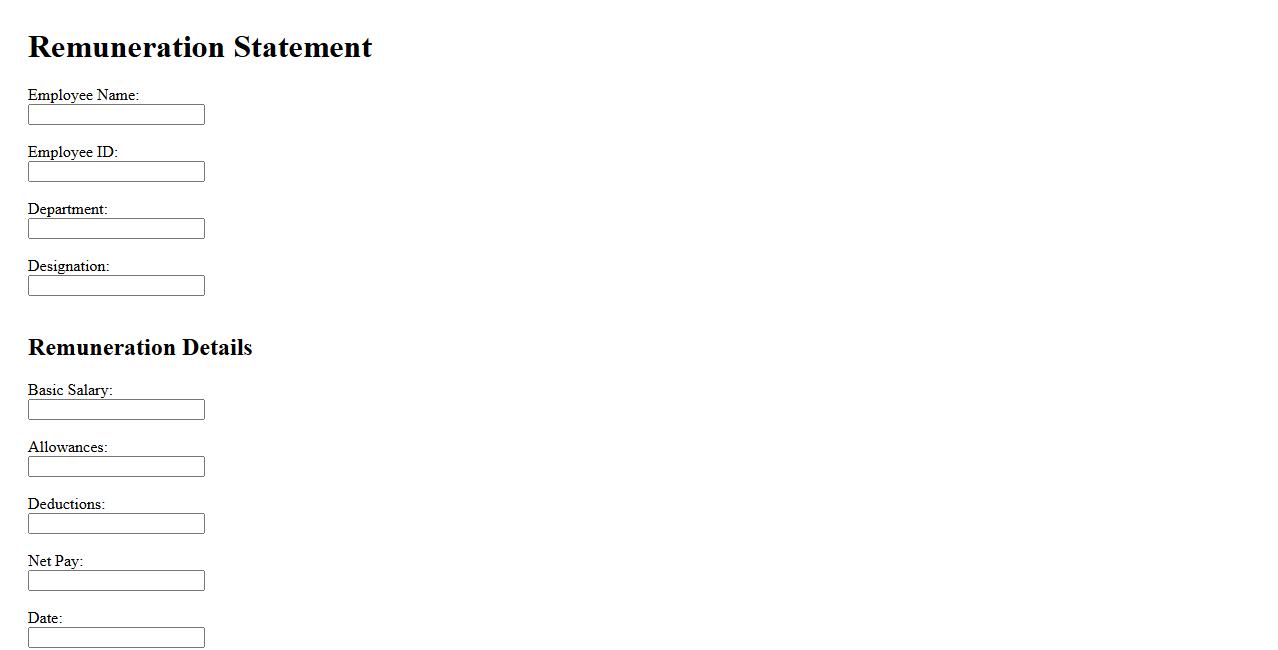

Remuneration Statement

A Remuneration Statement provides a detailed summary of an employee's total compensation, including salary, bonuses, and benefits. It serves as a transparent record for both the employer and employee, outlining all monetary and non-monetary rewards. This document helps ensure clarity and trust regarding employee earnings and entitlements.

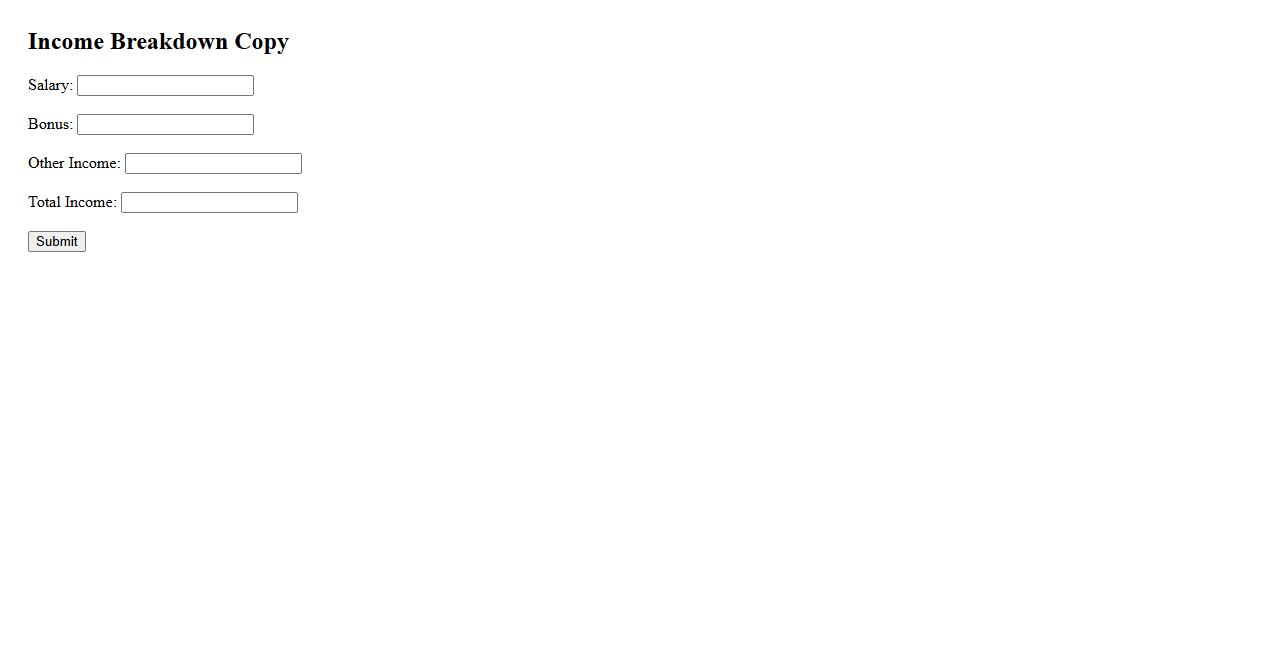

Income Breakdown Copy

The Income Breakdown Copy provides a clear and concise representation of various income sources. It helps users understand the distribution of their earnings across different categories. This organized format aids in better financial planning and decision-making.

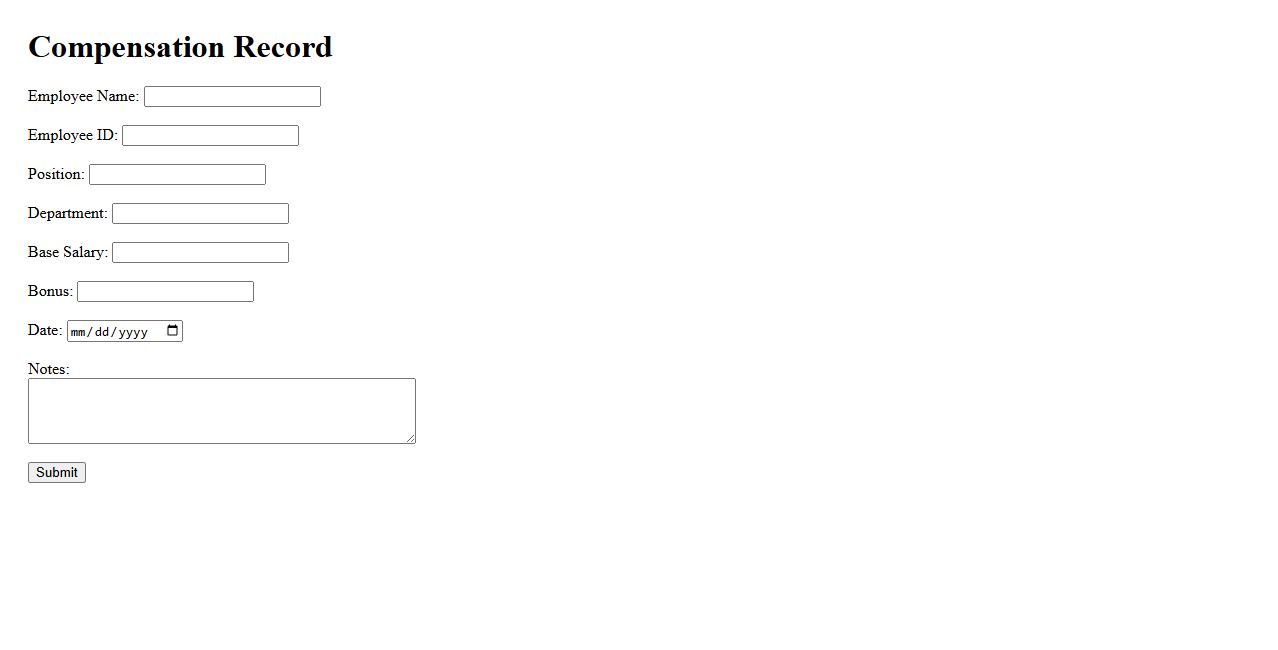

Compensation Record

Compensation record refers to the detailed documentation of employee earnings, including wages, bonuses, and benefits. It ensures accurate tracking and compliance with payroll regulations. Maintaining a comprehensive compensation record is essential for both employers and employees.

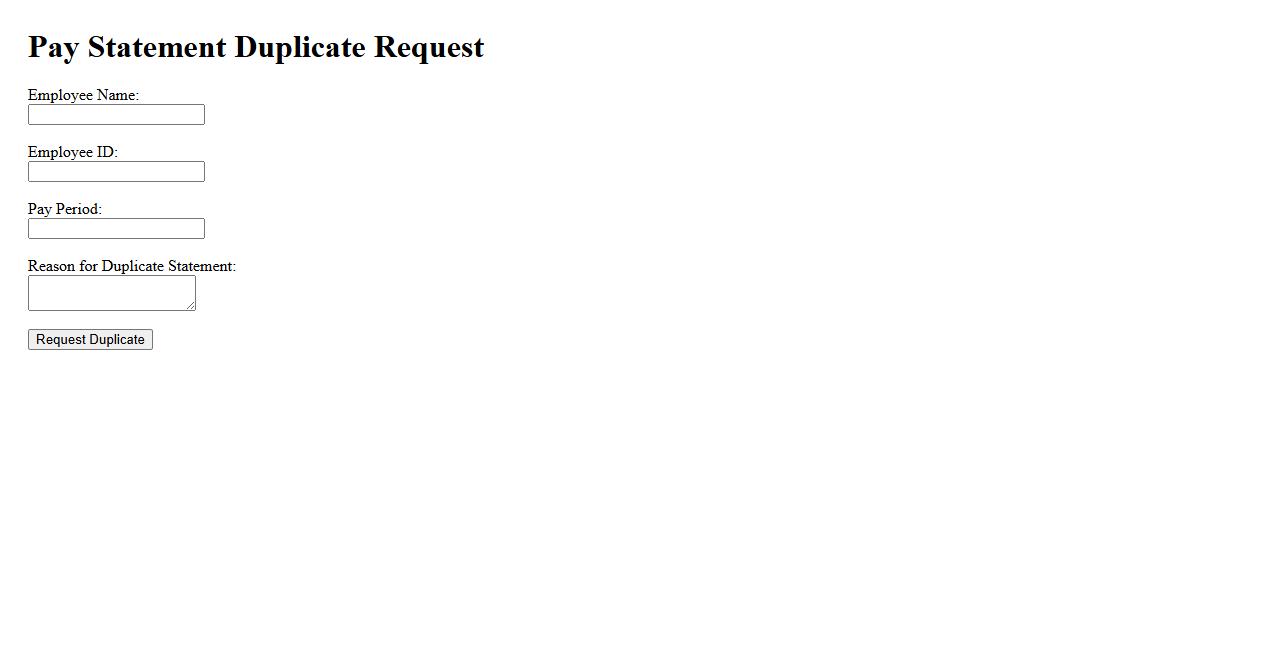

Pay Statement Duplicate

A Pay Statement Duplicate is an exact copy of your original pay statement, providing detailed information about your earnings and deductions for a specific pay period. This document is useful for record-keeping, tax purposes, or resolving any payroll discrepancies. Accessing a duplicate ensures you have reliable documentation when needed.

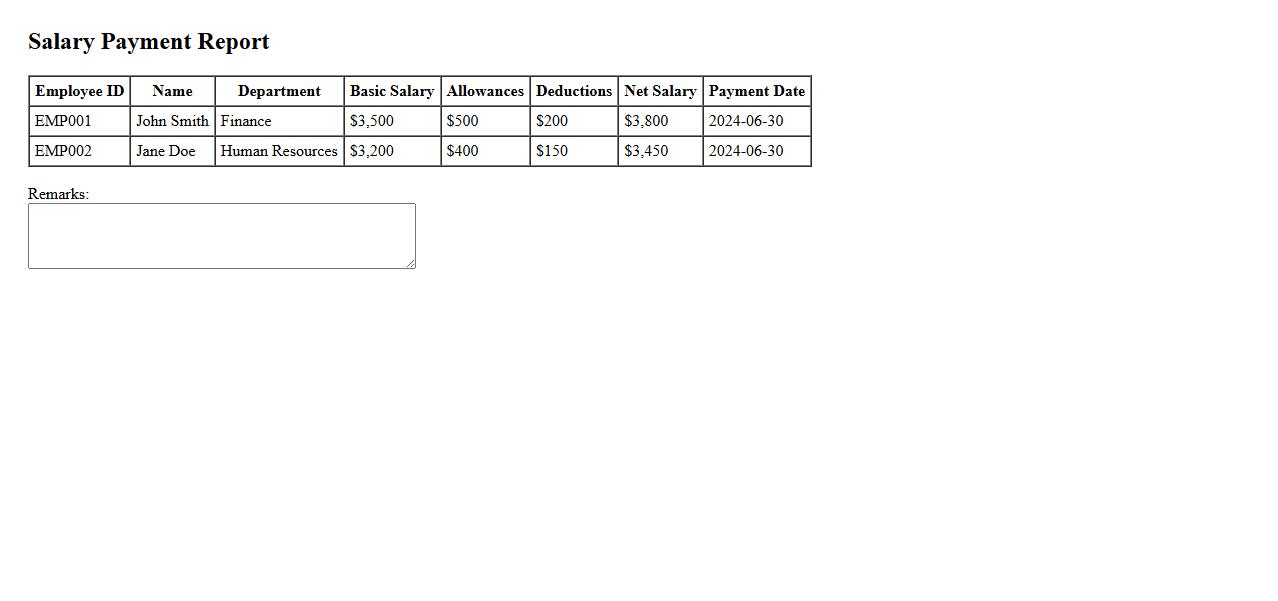

Salary Payment Report

The Salary Payment Report provides a detailed overview of employee salary disbursements within a specified period. It includes information on payment dates, amounts, and payment methods to ensure accurate financial tracking. This report is essential for payroll management and auditing processes.

Wage Receipt Form

The Wage Receipt Form is a crucial document that outlines the details of an employee's earnings and deductions. It serves as proof of payment and helps both employers and employees maintain accurate financial records. This form promotes transparency and compliance with labor laws.

What information is required to request a pay stub copy from our document system?

To request a pay stub copy, users must provide their full name and employee ID number. Additionally, the specific pay period dates for the requested stub are necessary. This information ensures accurate retrieval from the document system.

How can users verify the authenticity of an ordered pay stub copy?

Users can verify authenticity by checking the official watermark and digital signature on the pay stub copy. The document system also offers an online verification tool linked to employee records. These measures guarantee that the pay stub is genuine and unaltered.

Which departments are authorized to access and process pay stub copy requests?

The Human Resources and Payroll departments are authorized to access and process pay stub copy requests. They maintain strict protocols to ensure only authorized personnel handle sensitive information. This authorization protects employee privacy and data security.

What is the standard turnaround time for processing a pay stub copy order?

The standard turnaround time for processing a pay stub copy order is typically 3 to 5 business days. However, urgent requests may be expedited based on company policies. Users receive a confirmation email once their request is completed.

How is confidential employee information protected when fulfilling pay stub copy requests?

Confidential employee information is protected through encrypted data transmission and secure access controls within the document system. Only authorized personnel can view or distribute pay stub copies. Regular audits ensure compliance with data protection regulations.