![]()

The Invoice Tracking Form is an essential tool for managing and monitoring outstanding invoices efficiently. It helps businesses keep accurate records of payment statuses, due dates, and client information to streamline financial operations. Using this form reduces errors and ensures timely follow-up on pending payments.

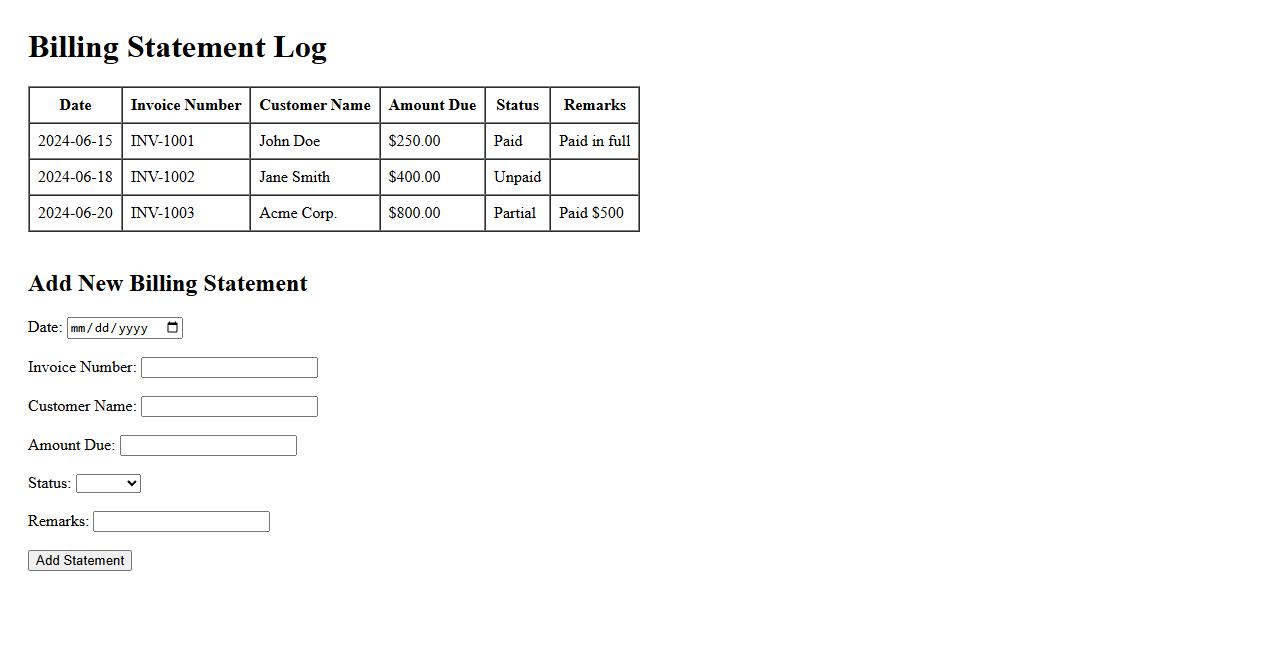

Billing Statement Log

The Billing Statement Log provides a detailed record of all billing activities and transactions. It ensures transparency and accuracy by tracking each statement issued to clients. This log serves as an essential tool for financial management and auditing purposes.

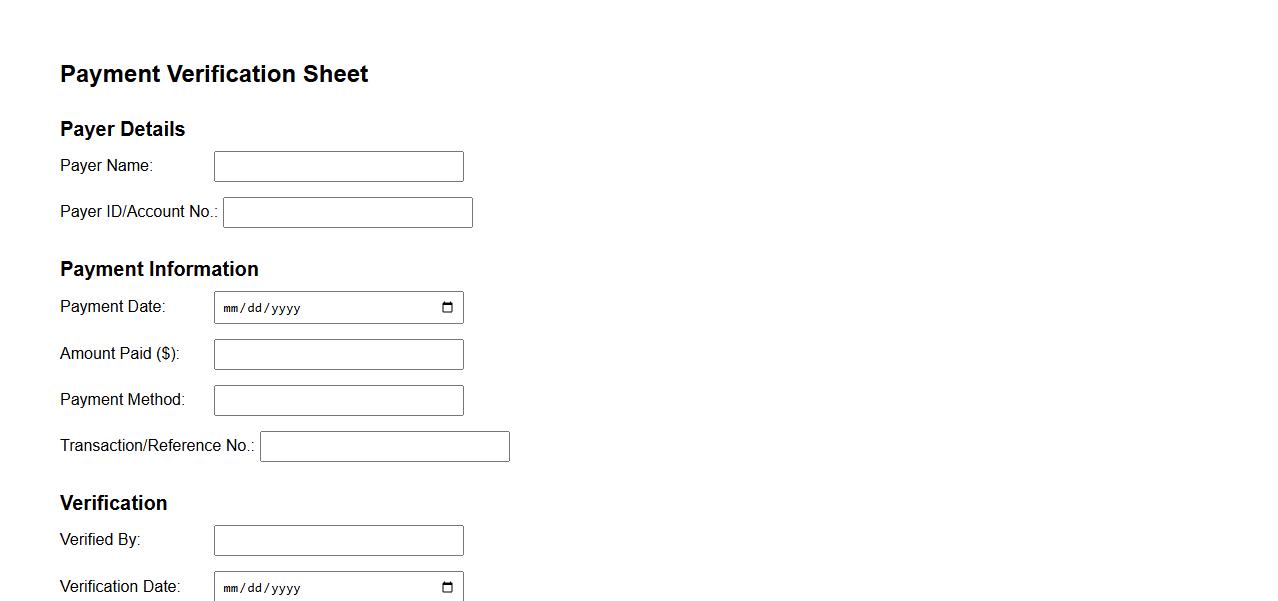

Payment Verification Sheet

The Payment Verification Sheet is a crucial document used to confirm the accuracy and authenticity of payment transactions. It ensures that all payments received or made are properly recorded and validated. This sheet helps streamline financial auditing and improve accountability in business processes.

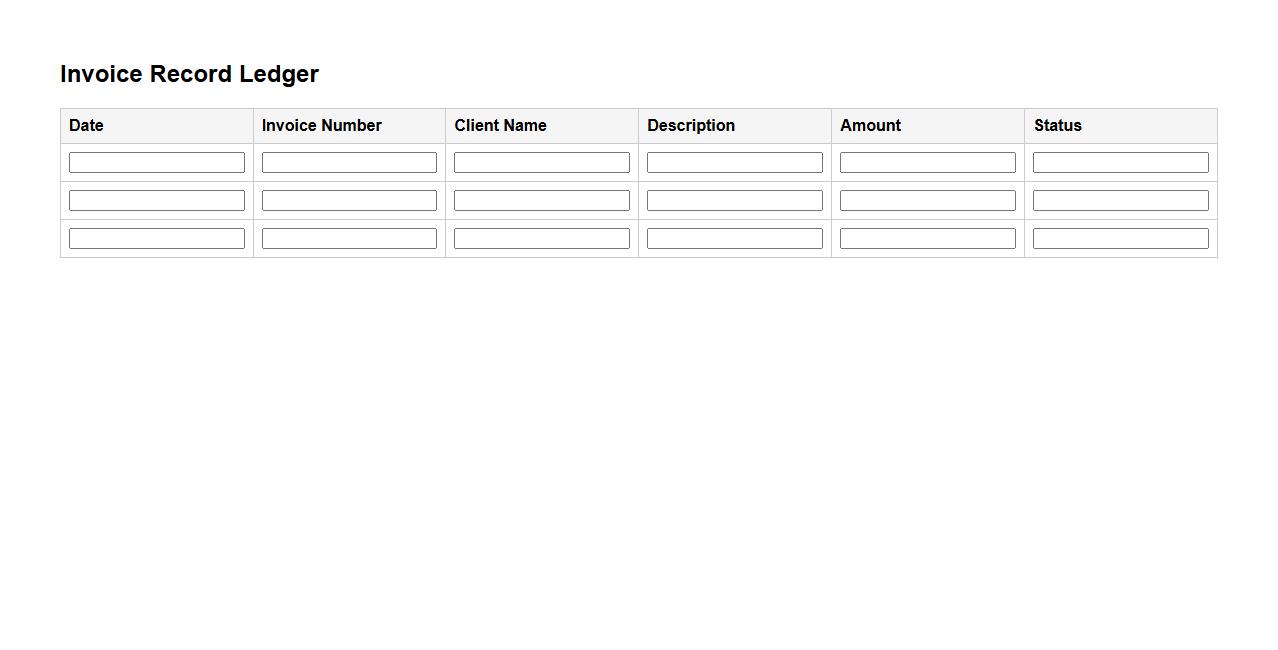

Invoice Record Ledger

The Invoice Record Ledger is a crucial tool for tracking all issued invoices systematically. It ensures accurate financial management by maintaining organized records of transactions. This ledger helps businesses monitor payments and outstanding balances efficiently.

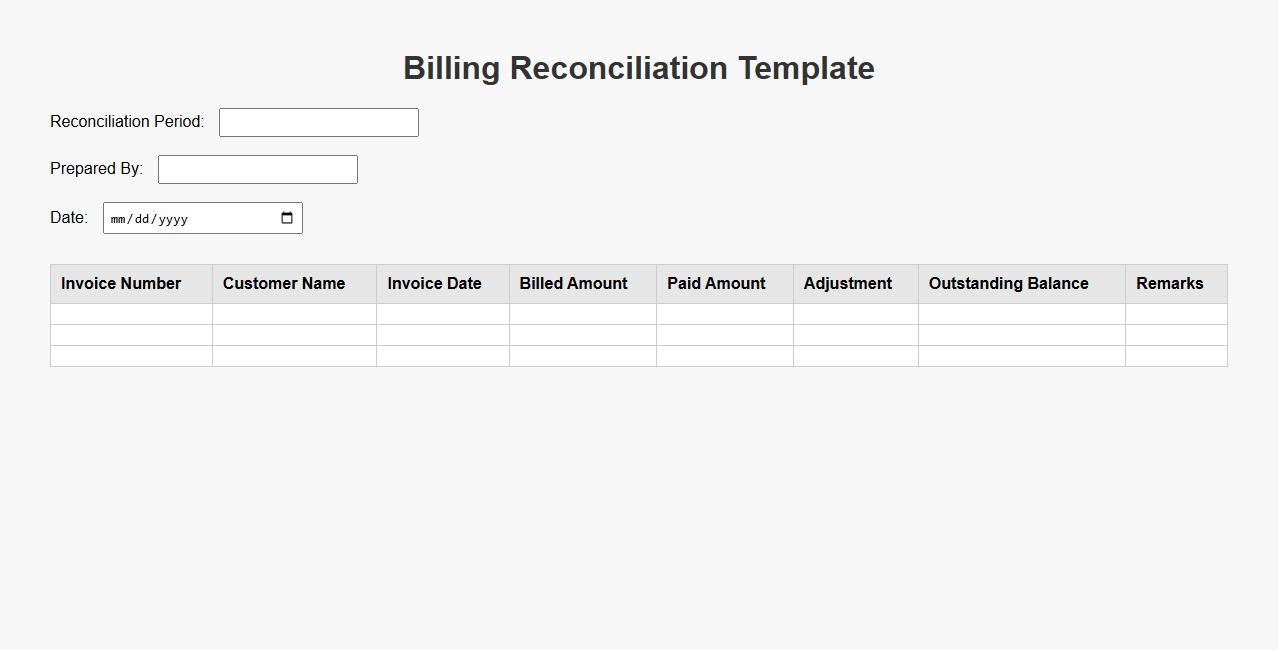

Billing Reconciliation Template

The Billing Reconciliation Template simplifies the process of matching invoices with payments to ensure accuracy and transparency. It helps businesses identify discrepancies quickly and maintain organized financial records. Using this template enhances efficiency and reduces errors in billing operations.

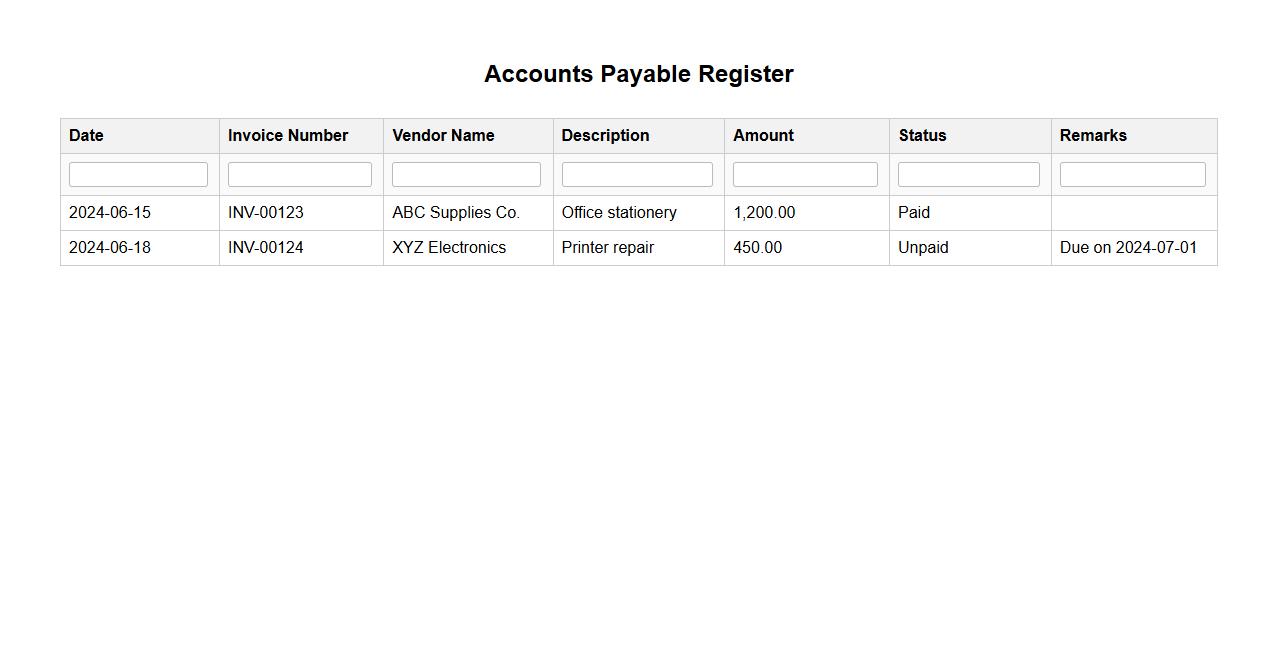

Accounts Payable Register

The Accounts Payable Register is a detailed record of all outstanding bills and invoices a company owes to its suppliers. It helps businesses track due payments, manage cash flow efficiently, and maintain good vendor relationships. Regularly updating this register ensures accurate financial reporting and timely settlements.

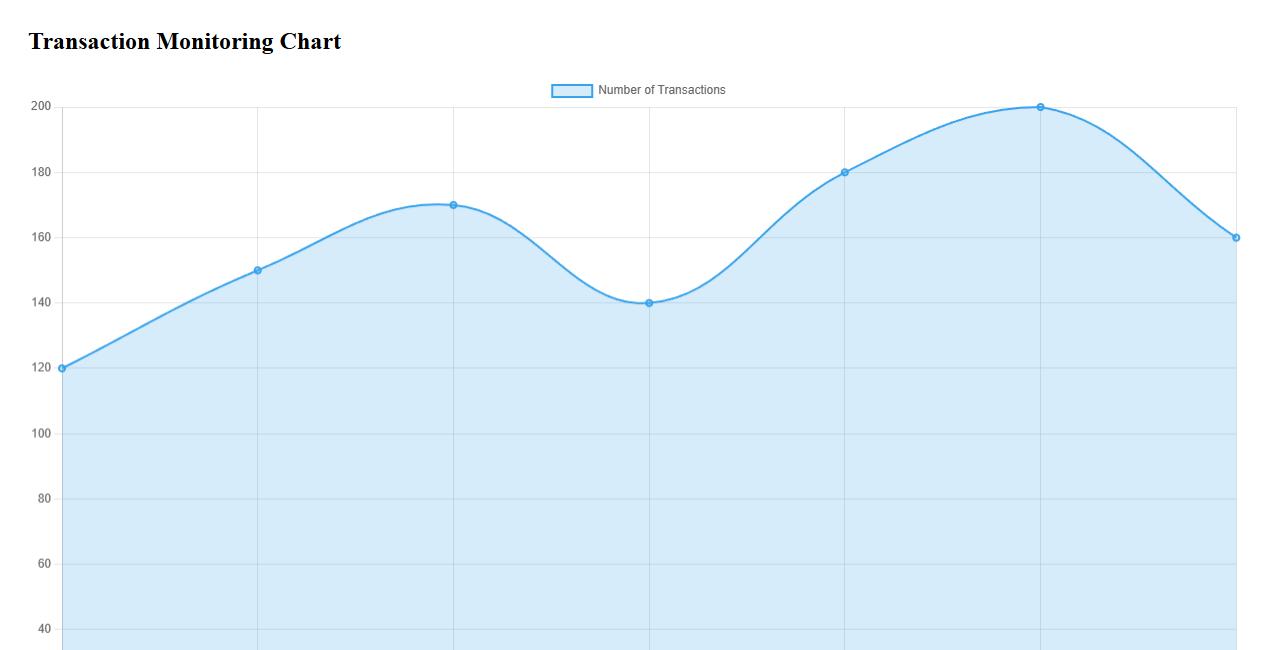

Transaction Monitoring Chart

The Transaction Monitoring Chart provides a clear visual representation of financial activities over time, helping businesses detect suspicious patterns quickly. It enables real-time analysis of transactions to ensure compliance and prevent fraud. This tool is essential for maintaining transparency and security in financial operations.

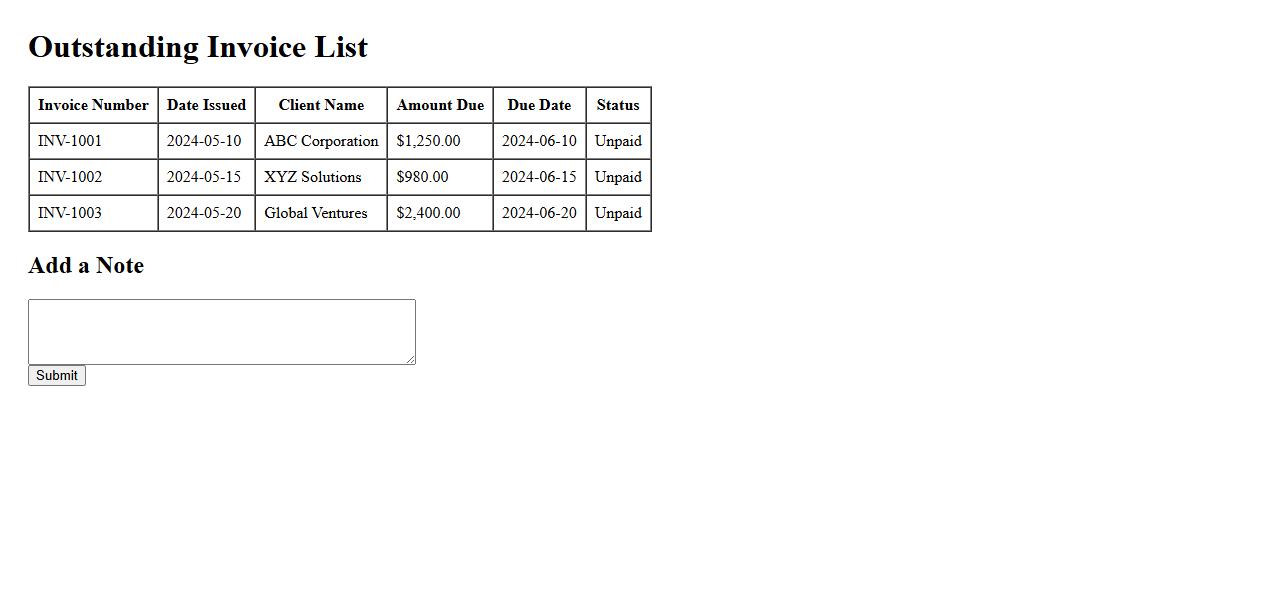

Outstanding Invoice List

The Outstanding Invoice List provides a comprehensive overview of all unpaid invoices, helping businesses track their receivables efficiently. It allows easy identification of overdue payments and supports effective cash flow management. Staying updated with this list ensures timely follow-ups and improved financial control.

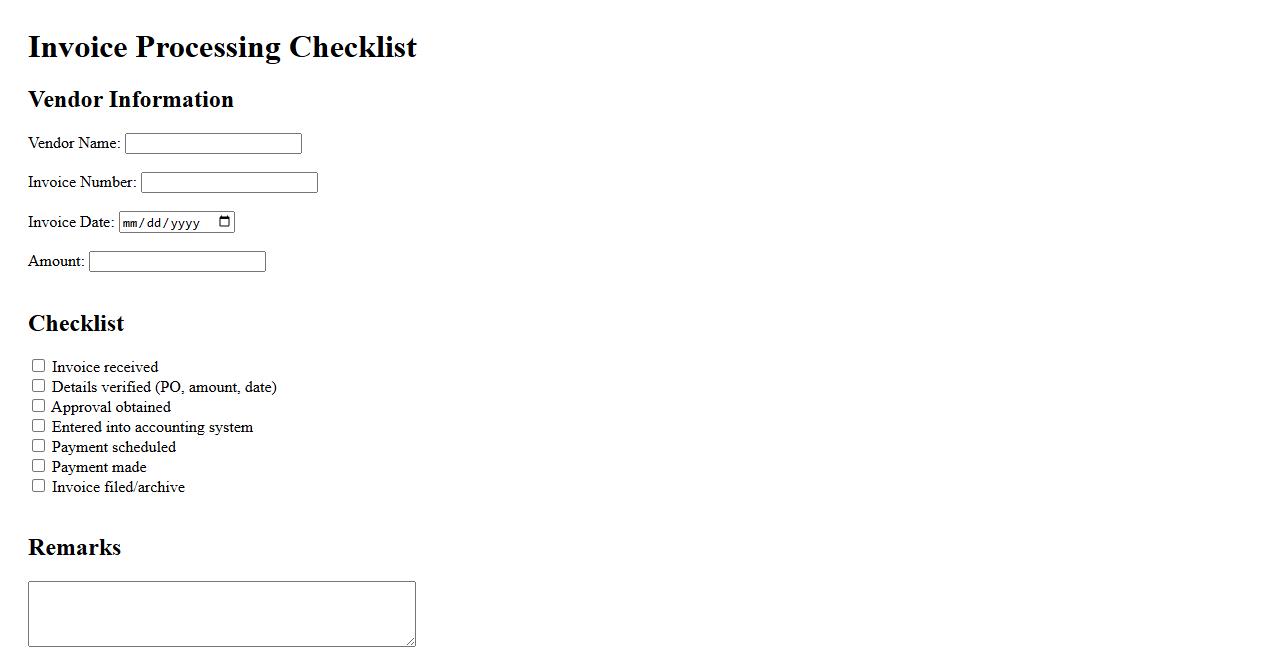

Invoice Processing Checklist

An Invoice Processing Checklist ensures accurate and efficient handling of vendor invoices. It helps streamline verification, approval, and payment procedures to minimize errors and delays. Using this checklist improves financial accountability and supports timely bookkeeping.

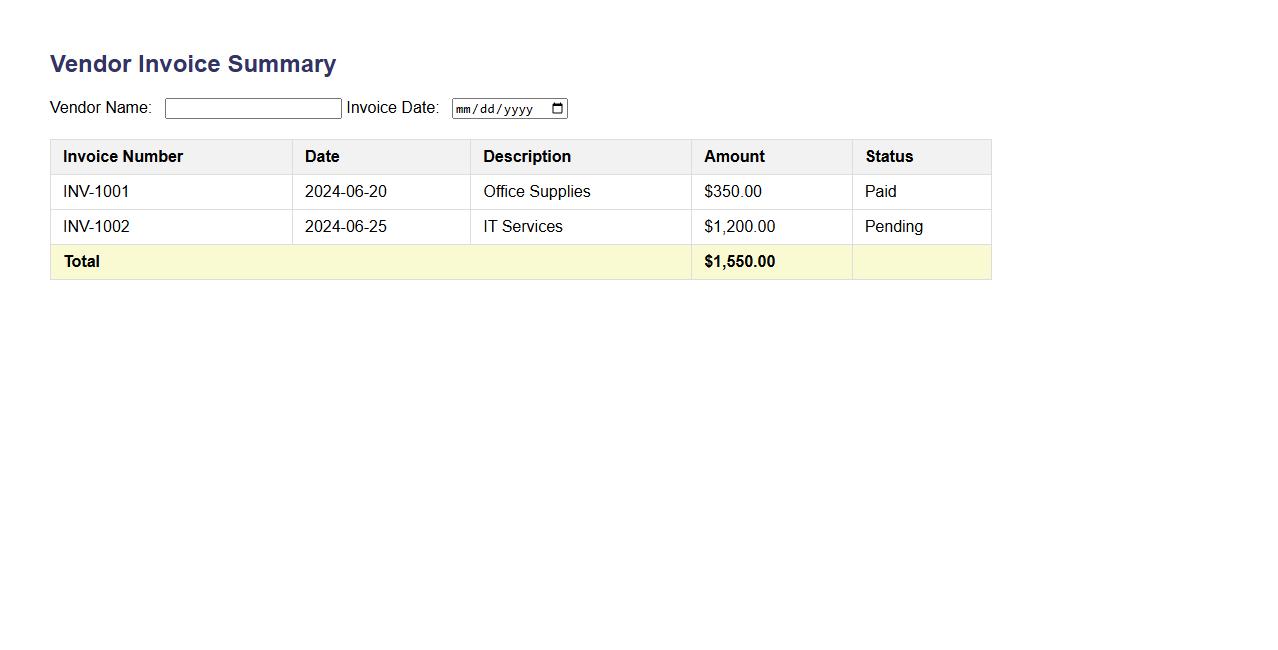

Vendor Invoice Summary

The Vendor Invoice Summary provides a concise overview of all invoices received from suppliers, highlighting payment status and total amounts due. It streamlines financial tracking by consolidating relevant invoice details into a single report. This summary helps businesses maintain accurate accounts payable records and ensure timely payments.

Receivables Tracking Table

The Receivables Tracking Table efficiently monitors outstanding payments owed by customers. It helps businesses manage cash flow by organizing invoice statuses, due dates, and payment amounts. This tool is essential for maintaining accurate financial records and ensuring timely collections.

What information is essential to accurately identify each invoice on the form?

The form requires a unique Invoice Number to accurately identify each invoice. Additional essential details include the Invoice Date and Purchase Order Number, which help validate and track the invoice. Together, these key fields ensure precise invoice identification and prevent duplication.

How does the form record and track the payment status of each invoice?

The form includes a dedicated Payment Status field that indicates whether an invoice is paid, pending, or overdue. It also often records the Payment Date to update the timing of the completed transaction. These fields enable effective tracking of payment progress and financial management.

Which fields on the form are used to associate invoices with specific vendors or clients?

Invoices are linked to vendors or clients through fields such as Vendor Name or Client Name. The form also captures a Vendor ID or Client Account Number for unique identification. These associations help in organizing and managing invoice records by party.

How does the form document approval or review steps for each invoice?

The form typically contains an Approval Status field indicating whether the invoice is approved, rejected, or under review. It may also include an Approver's Name and Approval Date to record who authorized payment and when. These fields ensure accountability and maintain an audit trail.

What sections of the form ensure compliance with organizational or regulatory requirements?

Compliance is ensured through sections that capture Tax Information, such as VAT or GST numbers, reflecting regulatory mandates. The form may also include fields for Terms and Conditions and Legal Disclaimers to align with organizational policies. These components guarantee adherence to both internal and external standards.