An Invoice for Bookkeeping Services details the charges for professional financial record-keeping and management provided to clients. It typically includes a breakdown of hours worked, service rates, and payment terms to ensure clear communication and prompt payment. This document is essential for maintaining accurate financial records and facilitating transparent business transactions.

Invoice for Monthly Bookkeeping Services

This Invoice for Monthly Bookkeeping Services provides a clear breakdown of all charges related to the accounting and financial record maintenance conducted throughout the month. It ensures transparency and accuracy, allowing clients to review and verify the services rendered. Timely payment of this invoice supports the continuity and quality of professional bookkeeping assistance.

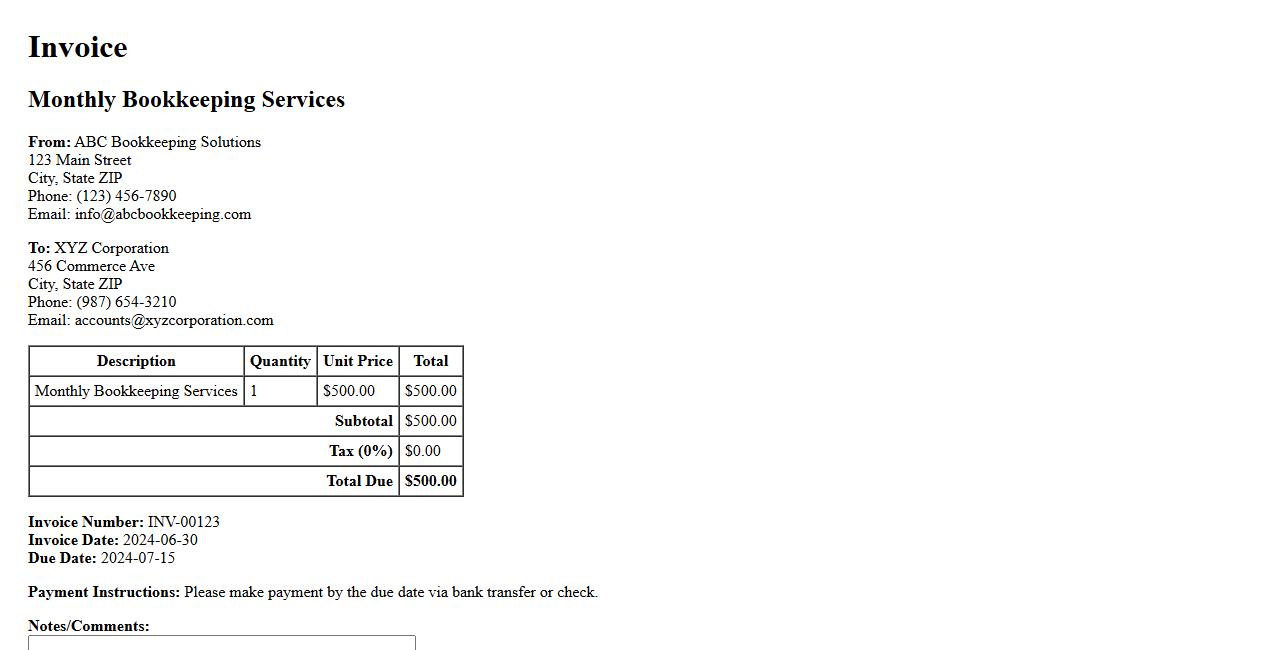

Itemized Billing Statement for Accounting Assistance

An Itemized Billing Statement provides a detailed breakdown of charges for accounting assistance, ensuring transparency and clarity in financial transactions. This document lists each service provided along with its corresponding cost, helping clients understand where fees are applied. It is essential for accurate record-keeping and budgeting.

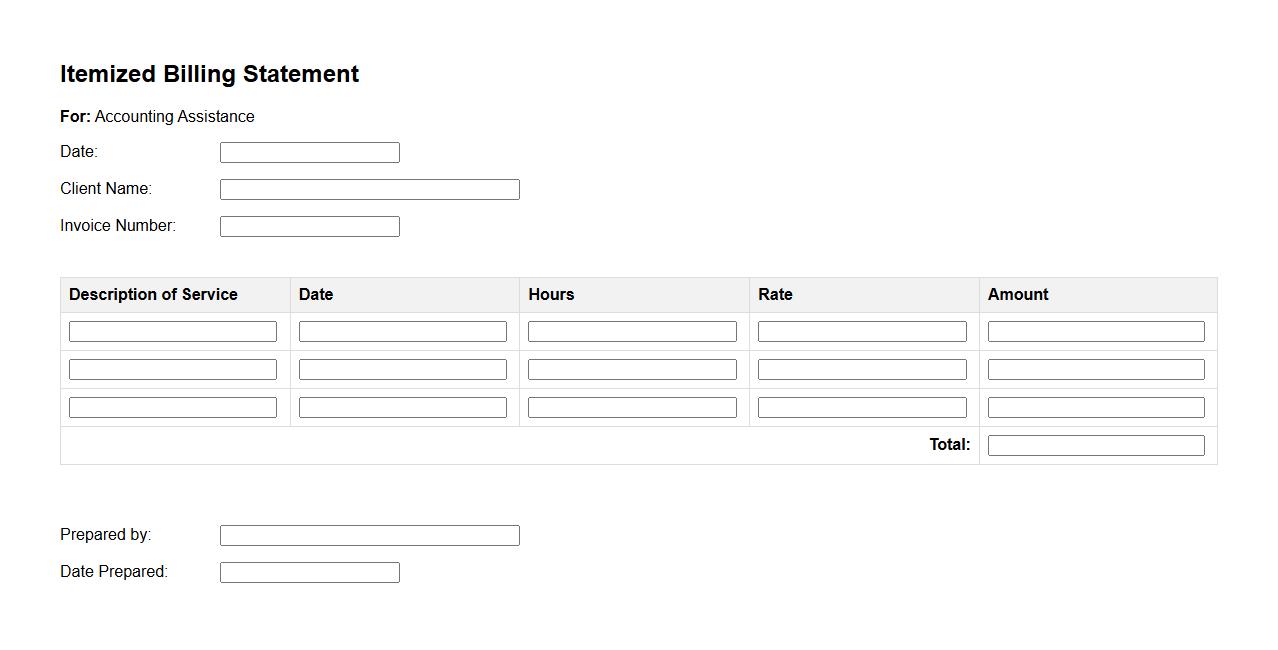

Detailed Charge Sheet for Financial Record Management

The Detailed Charge Sheet for Financial Record Management provides a comprehensive breakdown of all financial transactions and associated charges. It ensures transparency and accuracy in tracking expenses and payments. This document is essential for auditing and maintaining organized financial records.

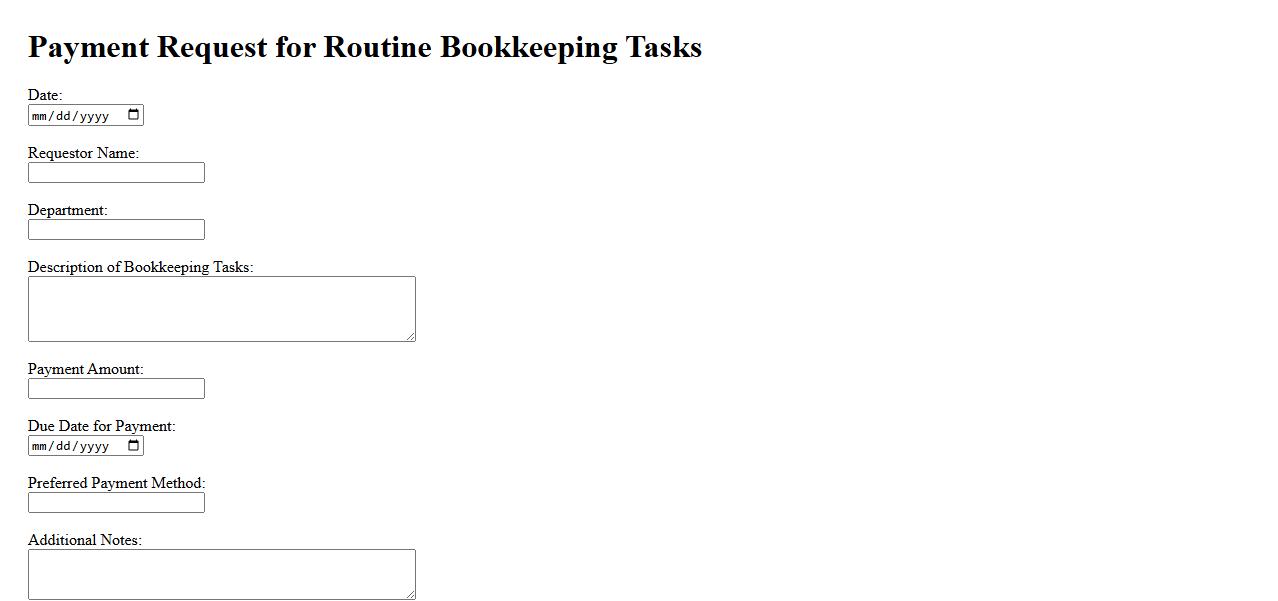

Payment Request for Routine Bookkeeping Tasks

Our Payment Request for Routine Bookkeeping Tasks ensures accurate and timely compensation for the essential financial services provided. This document outlines the fees associated with regular bookkeeping activities, facilitating transparent and efficient transaction processes. Prompt payment supports continuous management of your accounts with precision and reliability.

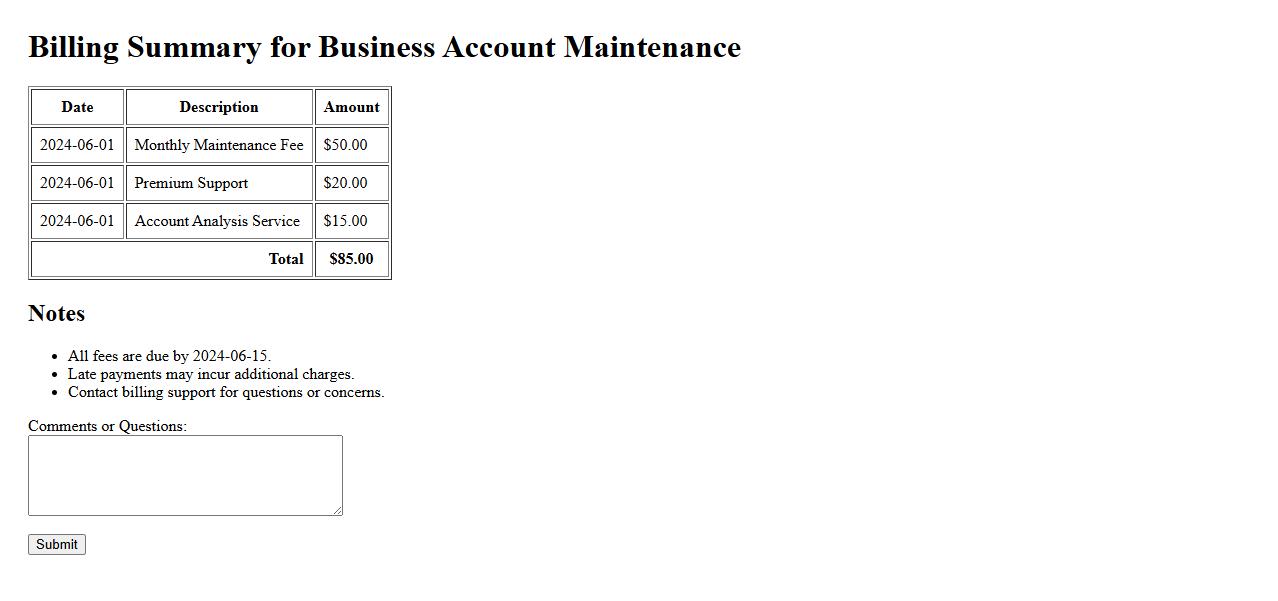

Billing Summary for Business Account Maintenance

The Billing Summary for Business Account Maintenance provides a detailed overview of all charges and payments associated with your business account. It helps you track expenses and ensure accurate financial management. Stay informed about your account status and upcoming dues with this comprehensive summary.

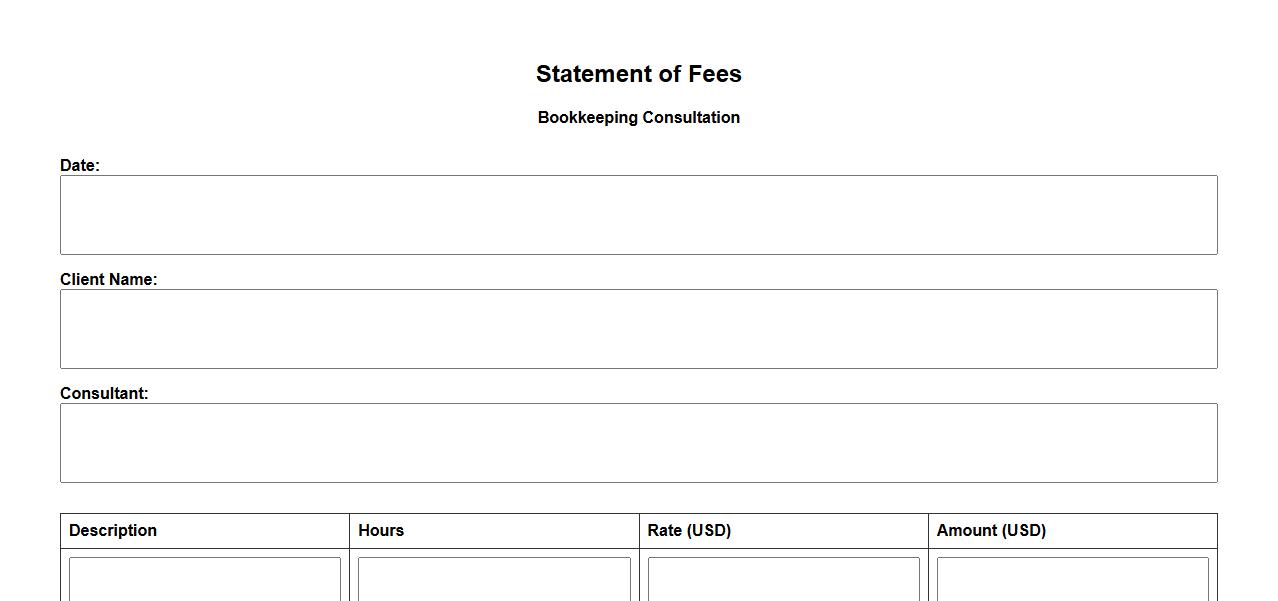

Statement of Fees for Bookkeeping Consultation

The statement of fees for bookkeeping consultation outlines the charges for professional services provided. It includes detailed cost breakdowns to ensure transparency and clarity for clients. This document helps businesses manage their budgeting effectively while receiving expert financial guidance.

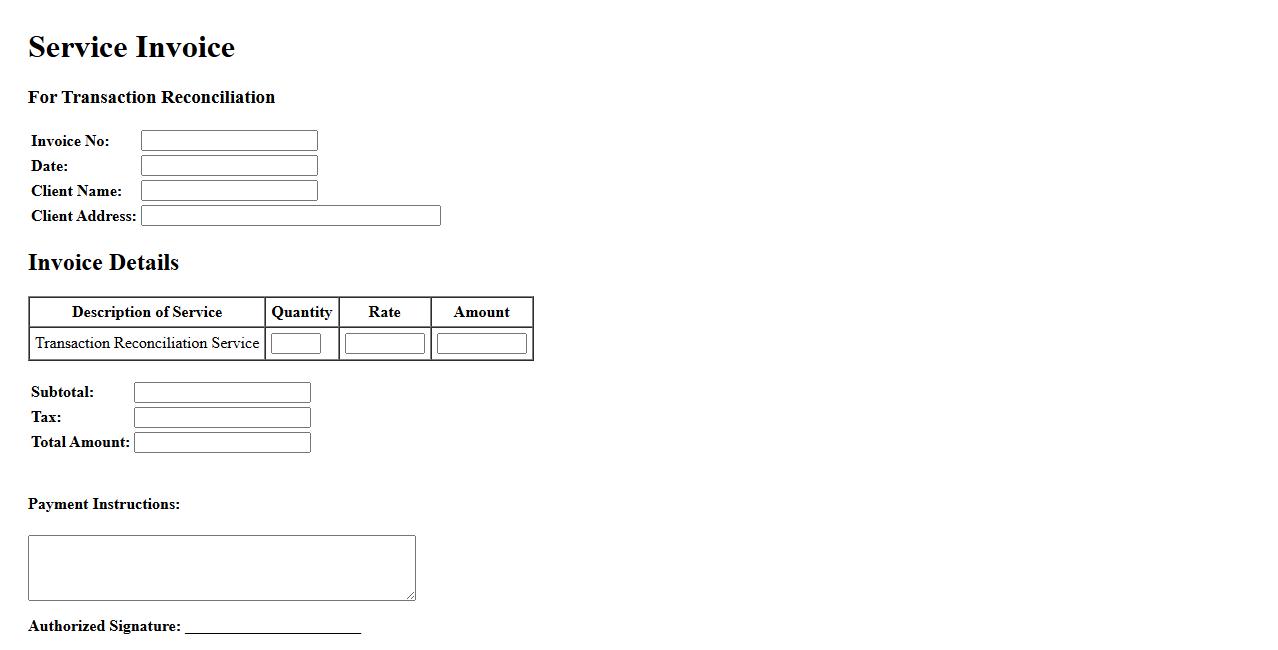

Service Invoice for Transaction Reconciliation

Efficient Service Invoice for Transaction Reconciliation ensures accurate record-keeping and financial clarity. This document details all services rendered and payments made, facilitating seamless verification. It helps businesses maintain balanced accounts and resolve discrepancies promptly.

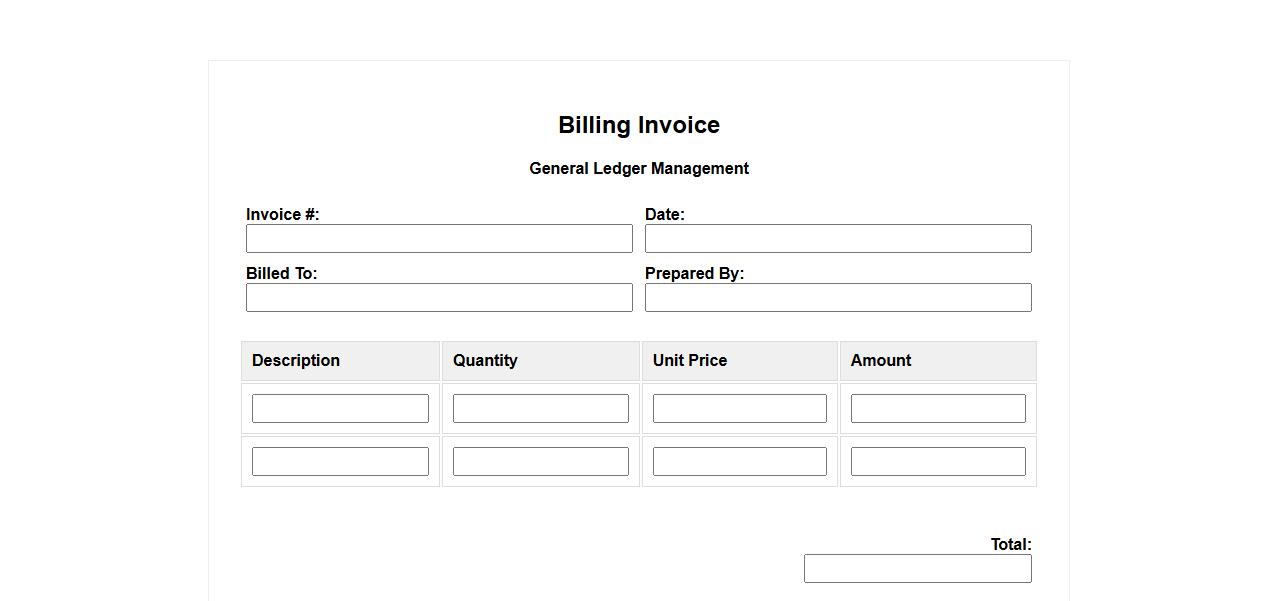

Billing Invoice for General Ledger Management

The Billing Invoice is a crucial document in General Ledger Management that ensures accurate recording of financial transactions. It provides a detailed account of charges and payments, facilitating transparent and organized bookkeeping. Proper handling of billing invoices supports efficient financial reconciliation and reporting.

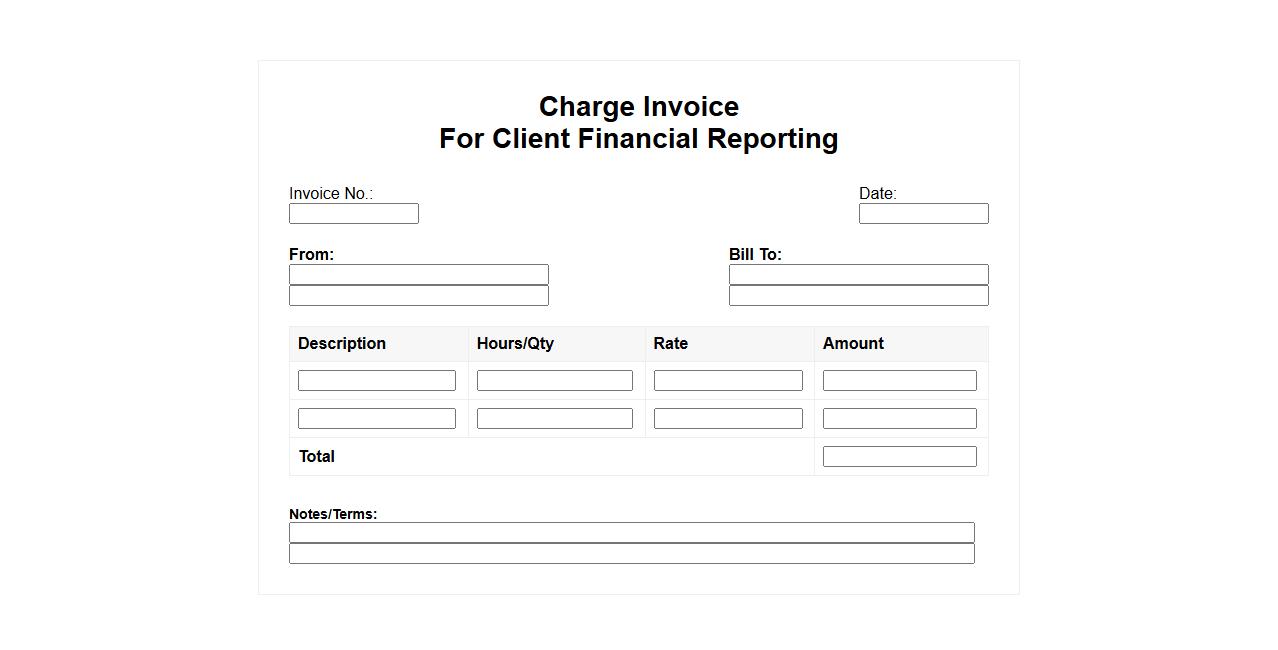

Charge Invoice for Client Financial Reporting

The Charge Invoice for Client Financial Reporting is a detailed document that summarizes all billable services and expenses for a specified period. It ensures accurate tracking of financial transactions, aiding clients in their budget management and accounting processes. This invoice enhances transparency and supports efficient financial analysis for both clients and service providers.

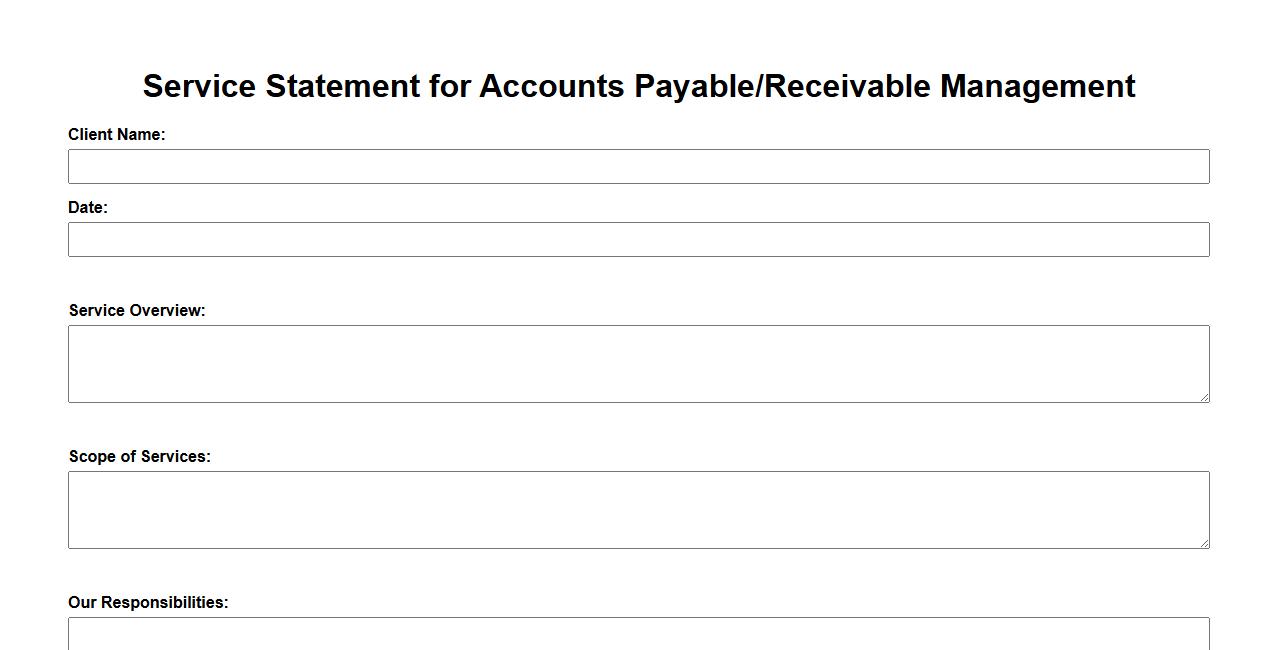

Service Statement for Accounts Payable/Receivable Management

The Service Statement for Accounts Payable/Receivable Management outlines the procedures and commitments for accurate and timely processing of financial transactions. It ensures efficient cash flow management, timely payments to vendors, and prompt collection of receivables. This statement guarantees transparency and accountability in all accounts-related activities.

What essential information must be included in an invoice for bookkeeping services?

An invoice for bookkeeping services must include the service provider's name, contact details, and a unique invoice number. It should clearly state the client's information alongside the date of the invoice and the period the services cover. Additionally, a detailed list of services rendered with corresponding costs and the total amount due must be present.

How does an invoice for bookkeeping services differ from invoices for other professional services?

Invoices for bookkeeping services often emphasize detailed transaction records and reconciliations, unlike other professional services which may bill by project milestones or deliverables. They typically include line items specifying hours worked, types of bookkeeping tasks, and any software or tools used. This level of detail ensures transparency and aligns with accounting standards specific to bookkeeping.

What payment terms are commonly specified in bookkeeping service invoices?

Common payment terms in bookkeeping invoices include net 30 or net 15 days, indicating when the payment is due after receipt of the invoice. Late payment fees or discounts for early payments might also be clearly stated to encourage timely settlements. These terms help maintain consistent cash flow and clarify expectations between the service provider and client.

How should billable hours and service descriptions be itemized on the invoice?

Billable hours should be broken down by date and task type, providing a transparent account of time spent on each bookkeeping activity. Each service description must be concise yet descriptive enough to reflect the work done, such as bank reconciliations, payroll processing, or financial reporting. This structure helps clients understand the charges and justifies the fees.

What legal or tax compliance details must be present on a bookkeeping services invoice?

An invoice must include the provider's tax identification number or VAT number, complying with local tax regulations. It should also specify the applicable taxes charged, such as sales tax or VAT, and adhere to invoicing laws relevant to the jurisdiction where services are rendered. Including these details ensures the invoice is legally valid and suitable for tax reporting purposes.