An Invoice for Advertising Services details the charges for promotional activities provided by an agency or freelancer. It outlines the scope of services, dates, and payment terms to ensure clear financial transactions. Accurate invoicing helps maintain transparency and timely compensation for marketing efforts.

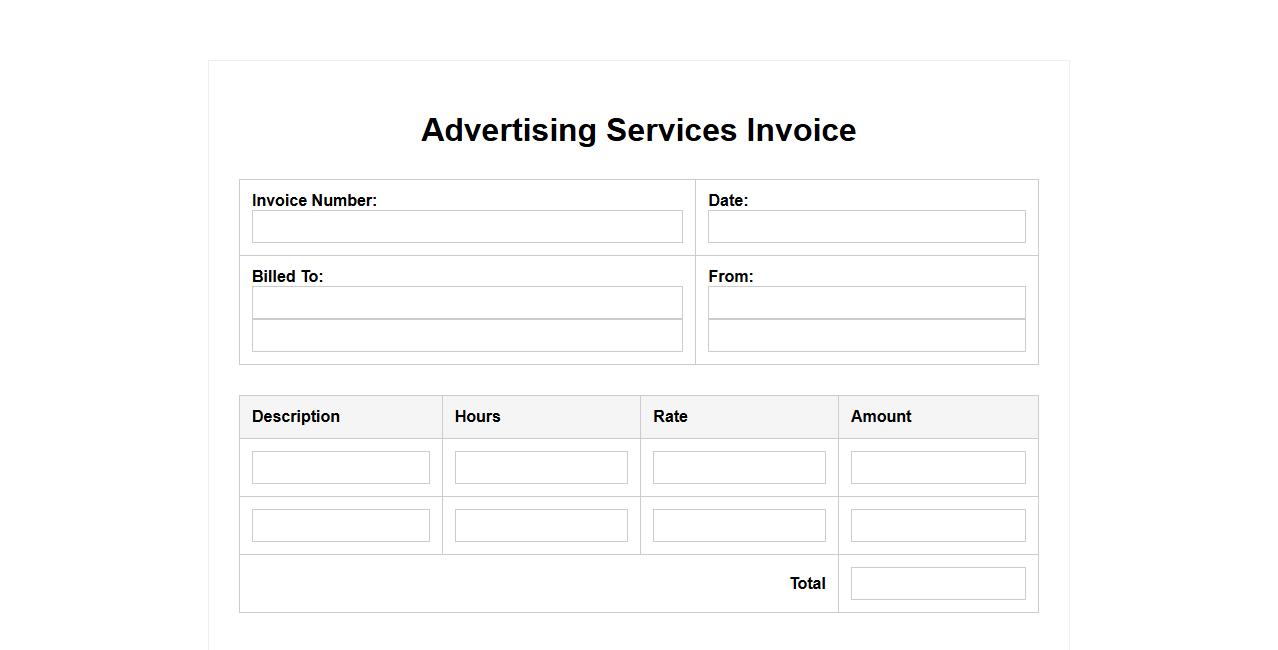

Advertising Services Invoice

An Advertising Services Invoice is a detailed document issued by marketing agencies to clients, outlining the costs of advertising campaigns and services provided. It includes itemized charges, payment terms, and deadlines to ensure transparent financial transactions. This invoice serves as a formal request for payment and a record for both parties involved.

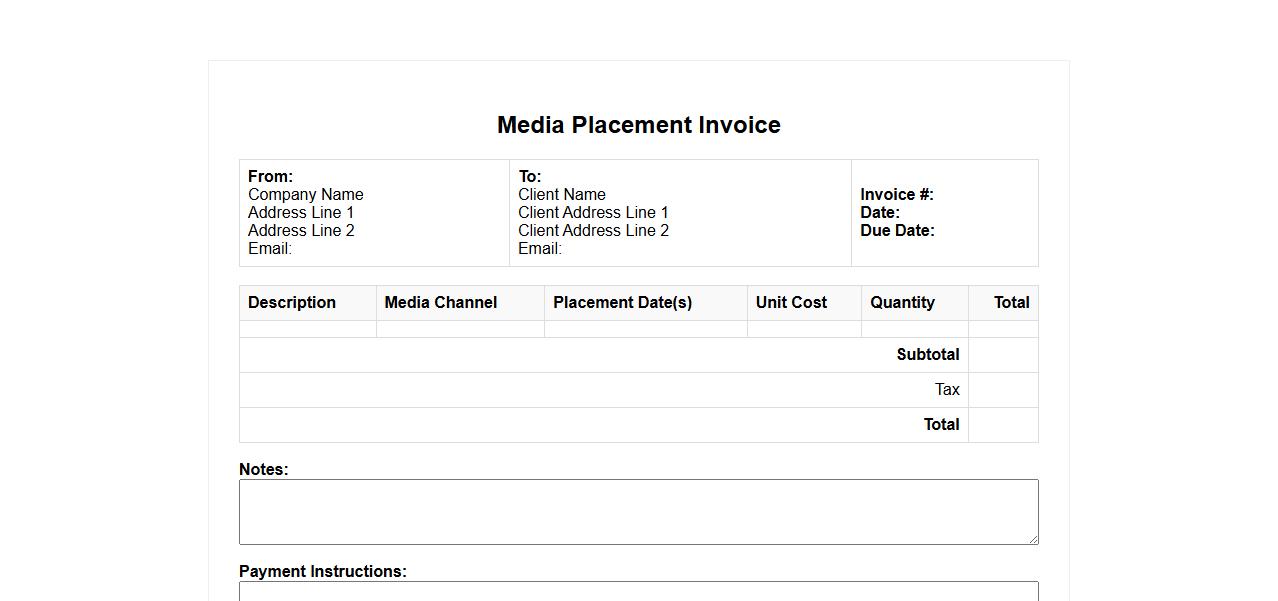

Media Placement Invoice

A Media Placement Invoice is a detailed billing document issued by advertising agencies to clients for services related to placing advertisements across various media channels. It outlines costs for ad space, airtime, or digital placements, ensuring transparency in media buying transactions. This invoice helps both parties track expenses and confirm payment for advertising campaigns.

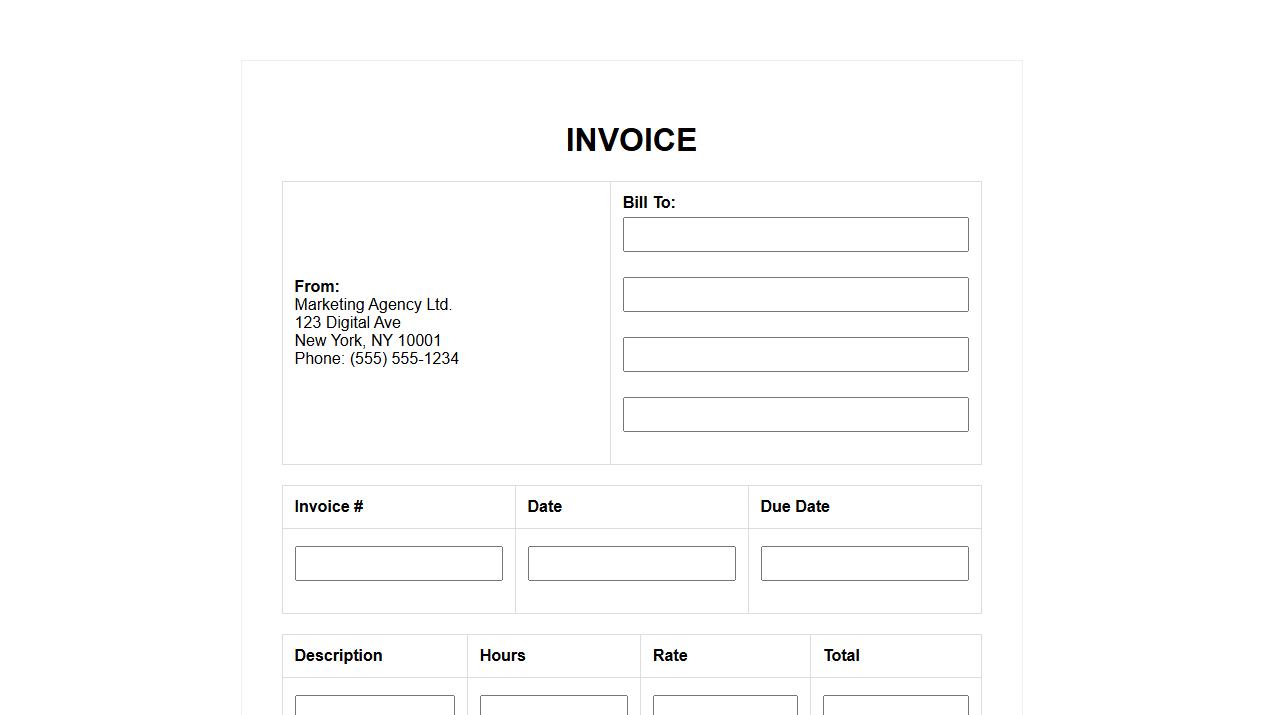

Digital Marketing Services Invoice

An Digital Marketing Services Invoice is a detailed bill provided by marketing agencies to their clients for services rendered, including SEO, content creation, and social media management. It outlines the scope of work, pricing, and payment terms to ensure clear communication and prompt payment. This document is essential for maintaining transparent financial transactions in digital marketing projects.

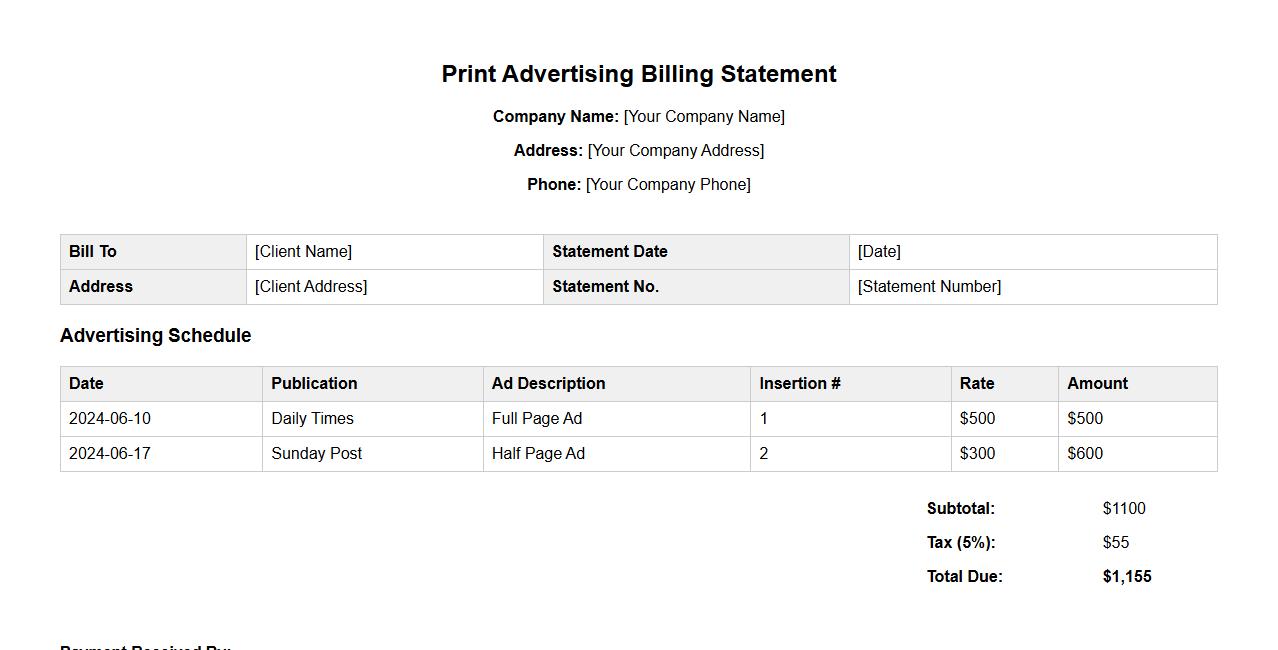

Print Advertising Billing Statement

The Print Advertising Billing Statement provides a detailed summary of charges related to print media advertisements. It includes information such as publication dates, ad sizes, and total costs to ensure transparent billing. This statement helps businesses track their advertising expenses effectively.

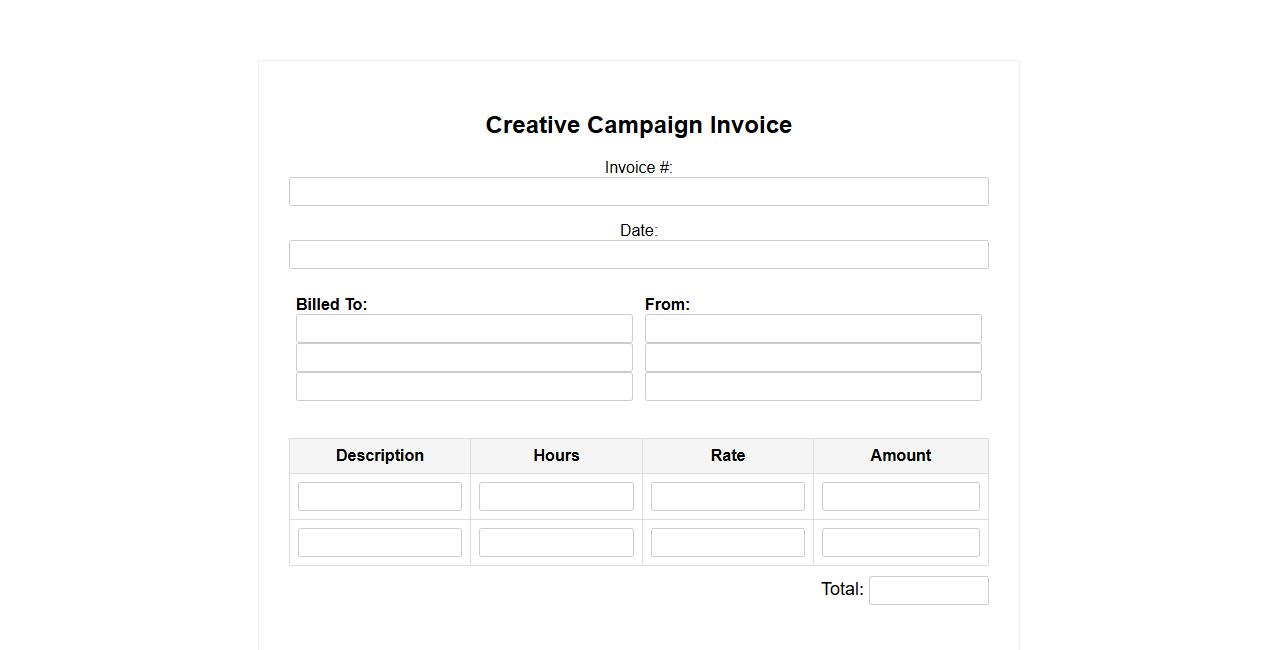

Creative Campaign Invoice

An Creative Campaign Invoice is a detailed document outlining the costs associated with advertising and marketing projects. It includes expenses such as design, production, and media placement to ensure transparent billing. This invoice helps both clients and agencies track payments and manage budgets effectively.

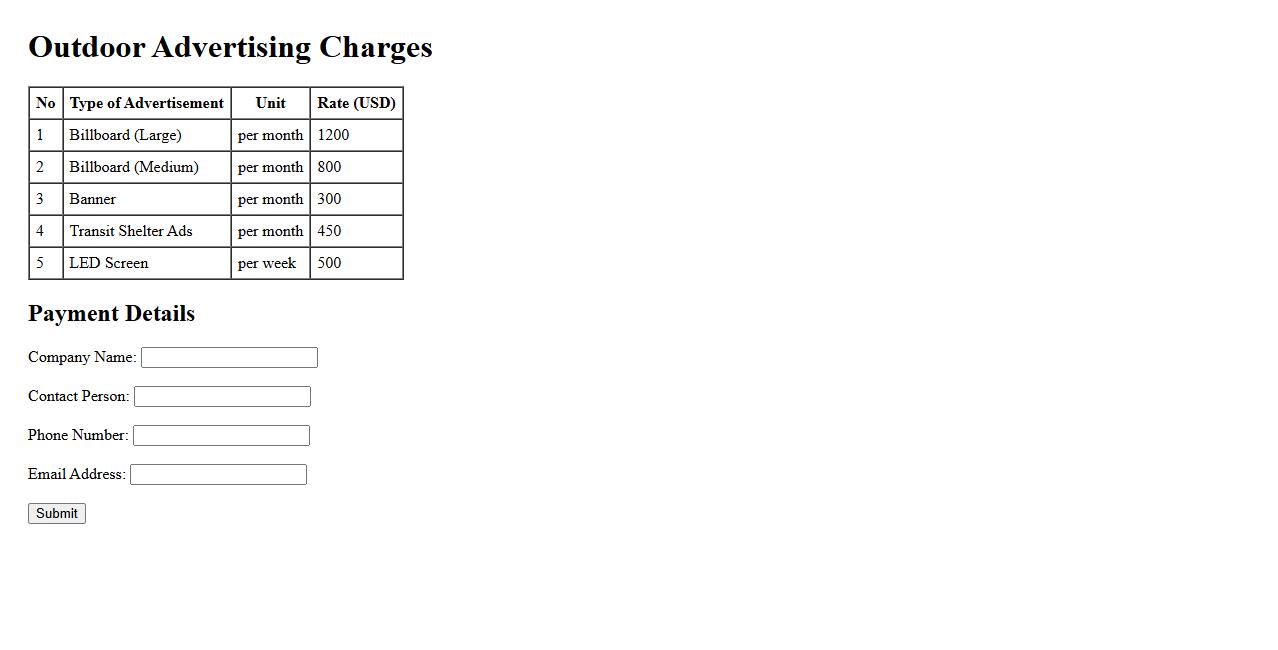

Outdoor Advertising Charges

Outdoor advertising charges refer to the fees businesses pay to display their promotional content on various external platforms like billboards, transit ads, and posters. These charges vary based on location, size, and duration of the advertisement. Investing in outdoor advertising can significantly boost brand visibility and audience engagement.

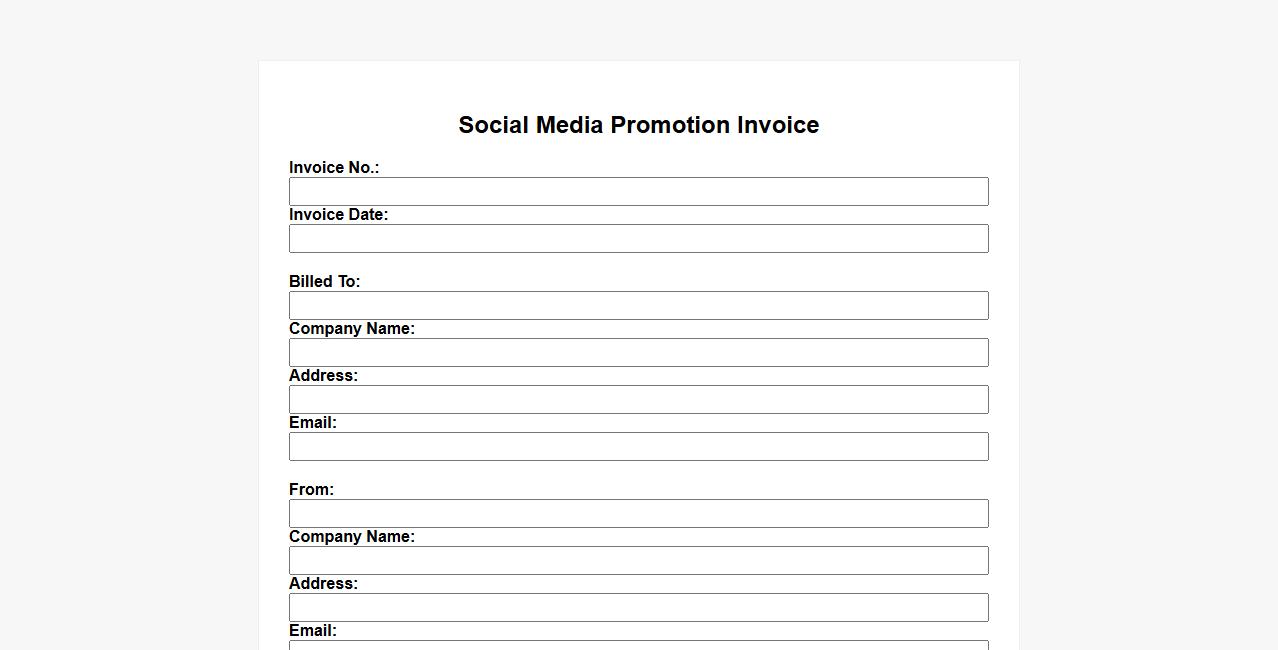

Social Media Promotion Invoice

An Social Media Promotion Invoice is a detailed document sent to clients outlining the costs associated with marketing campaigns on social media platforms. It ensures transparency by listing services provided, campaign duration, and payment terms. This invoice helps businesses track expenses and maintain professional financial records.

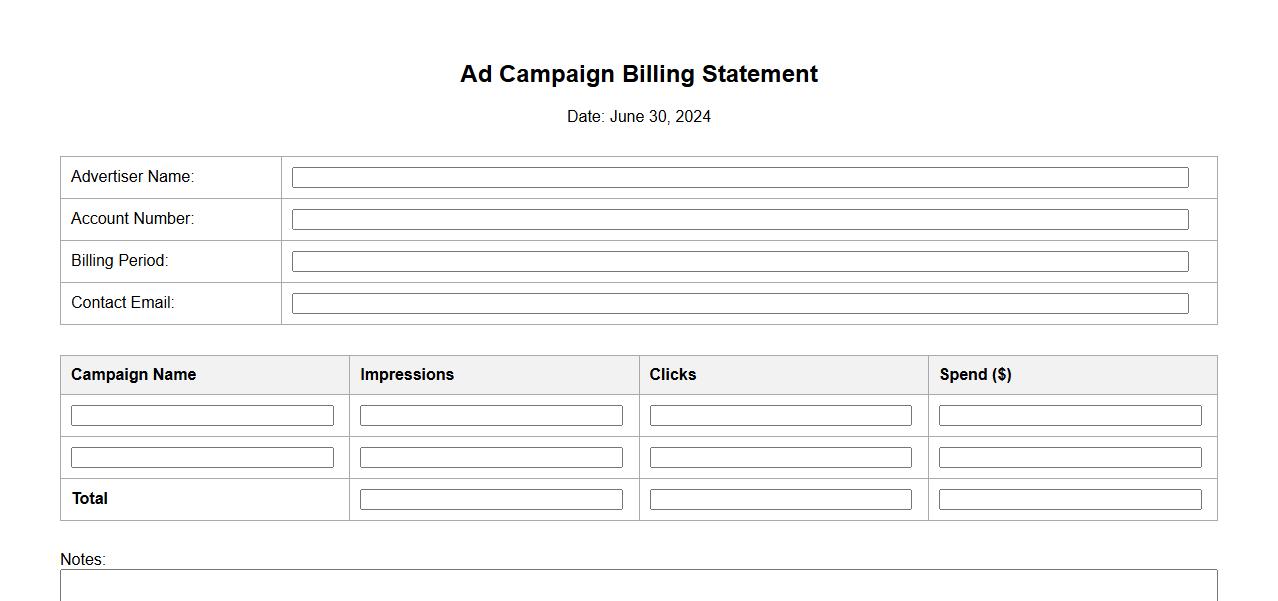

Ad Campaign Billing Statement

The Ad Campaign Billing Statement provides a detailed summary of costs incurred during a specific advertising period. It includes charges for impressions, clicks, and other relevant metrics to ensure transparent billing. This statement helps advertisers track their spending and optimize future campaigns effectively.

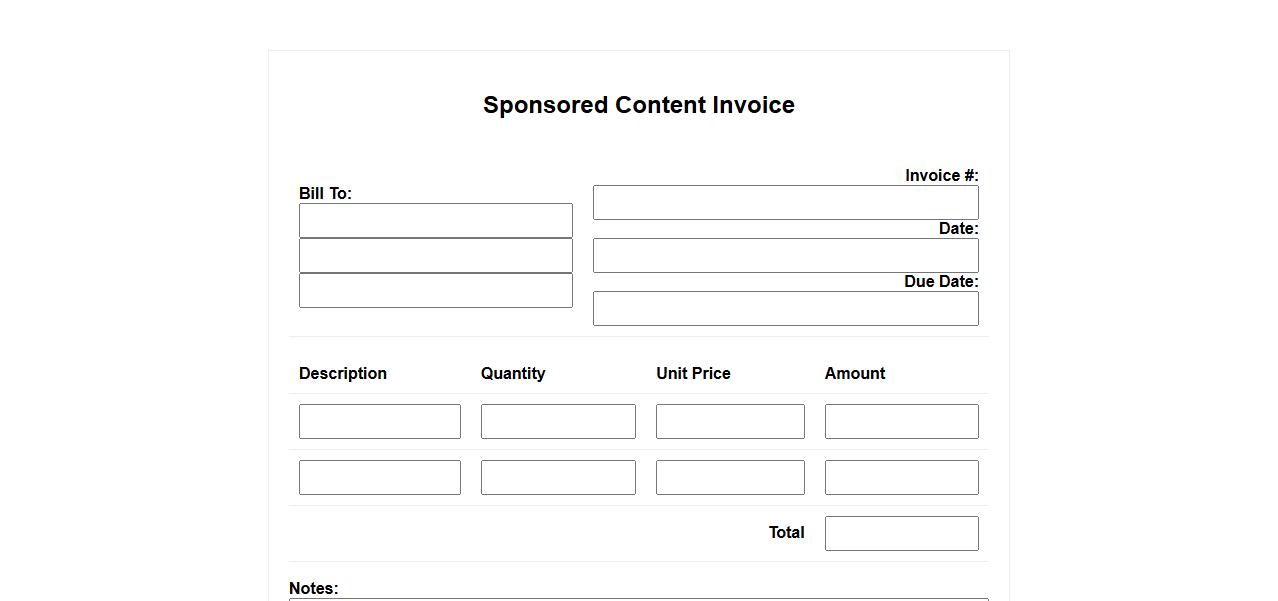

Sponsored Content Invoice

An Sponsored Content Invoice is a detailed document that outlines the charges for promotional articles or posts created and published on behalf of a brand. It serves as a formal request for payment, specifying the scope, delivery dates, and agreed fees. This invoice ensures clear communication and smooth financial transactions between content creators and sponsors.

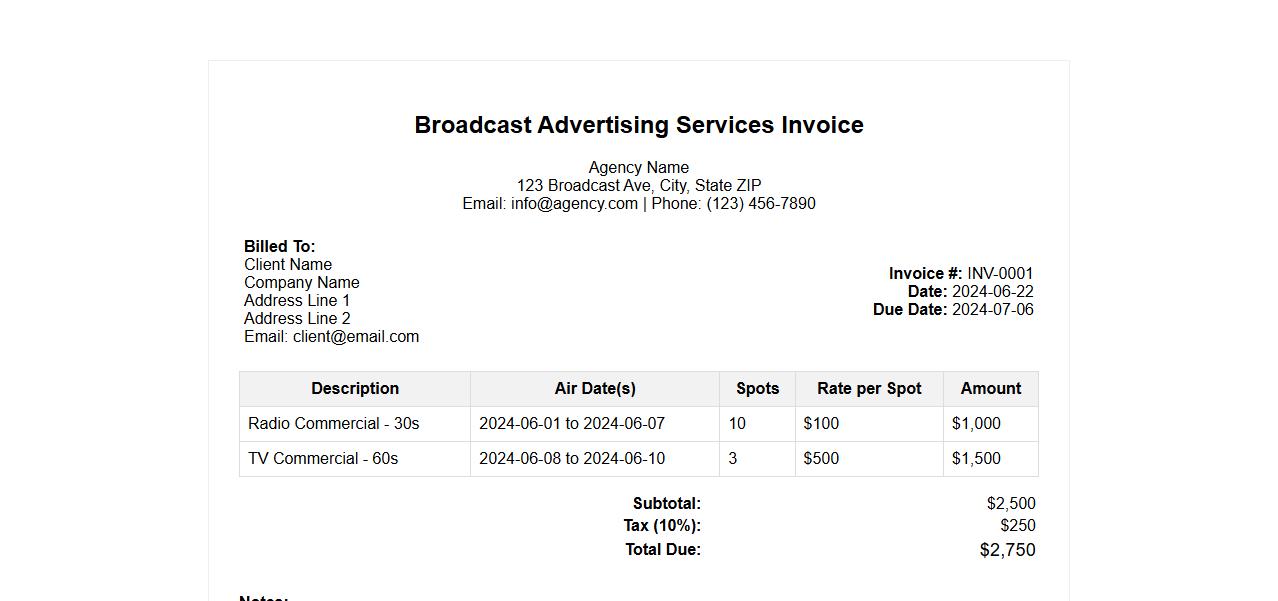

Broadcast Advertising Services Invoice

The Broadcast Advertising Services Invoice details the charges for marketing campaigns aired on television, radio, or digital broadcasts. It outlines costs related to airtime, production, and media placement for seamless billing. This document ensures transparency and accuracy in tracking advertising expenses.

What are the essential components included in an invoice for advertising services?

An invoice for advertising services typically includes the client's information, service provider details, and a unique invoice number for reference. It also lists the specific advertising services rendered, including descriptions, dates, and quantities. The total amount payable, along with applicable taxes and payment instructions, are crucial components on the invoice.

How does the invoice specify the duration and scope of the advertising services provided?

The invoice clearly outlines the duration of the advertising campaign or services by specifying start and end dates. It provides detailed descriptions of the scope, such as media types used, number of ads run, or service milestones achieved. This clarity helps clients understand exactly what services they are being billed for within the stated timeframe.

What payment terms and methods are detailed in the invoice for advertising services?

Payment terms such as due date, early payment discounts, or late fee penalties are explicitly stated on the invoice. Accepted payment methods like bank transfers, credit cards, or digital wallets are also detailed for convenience. Clear payment terms help facilitate timely and secure transactions between parties.

How is the cost breakdown for various advertising activities represented on the invoice?

The invoice provides a detailed cost breakdown that itemizes charges for different advertising activities, including creative development, media placement, and production costs. Each activity is listed with its corresponding price, quantity, and subtotal. This transparency ensures clients can verify charges and understand the value of each component.

How does the invoice ensure compliance with tax and regulatory requirements for advertising services?

The invoice includes mandatory tax information such as tax identification numbers, applicable tax rates, and totals for tax amounts. It complies with local and international regulatory standards by incorporating any required disclosures or legal statements. Accurate tax details on the invoice help maintain legal compliance and facilitate auditing processes.