An invoice for consulting fees outlines the charges for professional advisory services provided to a client. It details the scope of work, hourly rates or fixed fees, and payment terms to ensure clarity and prompt payment. This document serves as a formal request for compensation based on the agreed consulting arrangement.

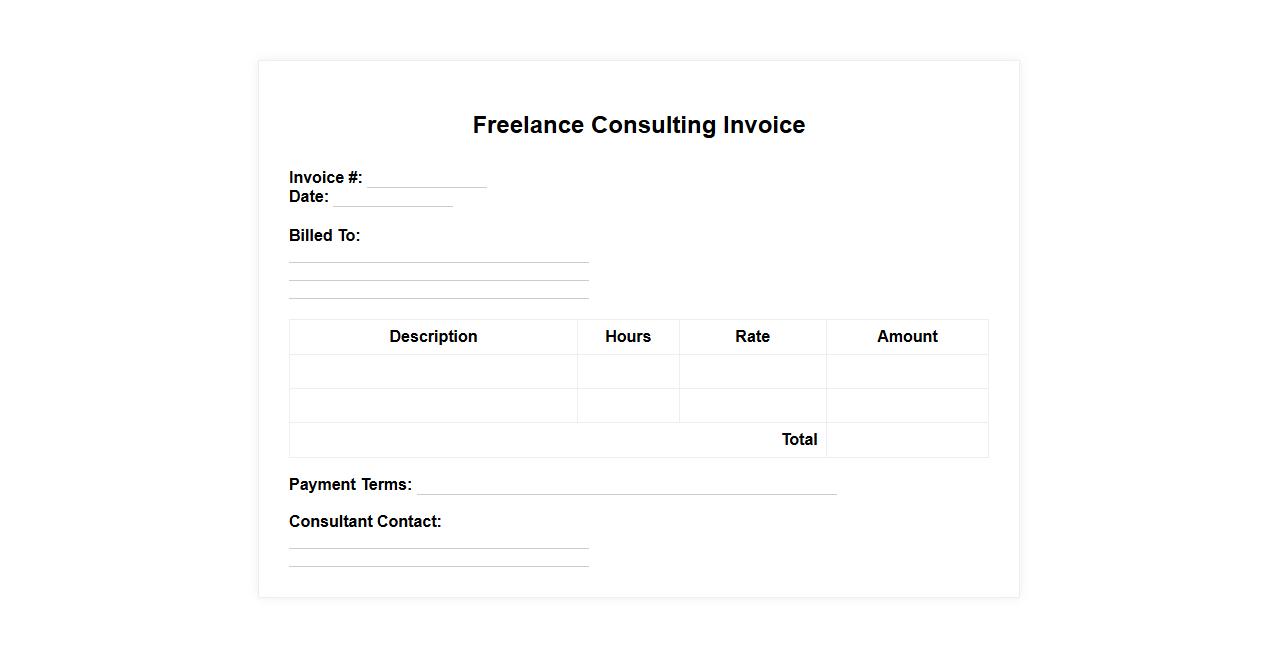

Freelance Consulting Invoice

A Freelance Consulting Invoice is a professional document used by independent consultants to bill clients for services rendered. It details the work performed, hours spent, and the total amount due. This invoice ensures clear communication and timely payment for consulting projects.

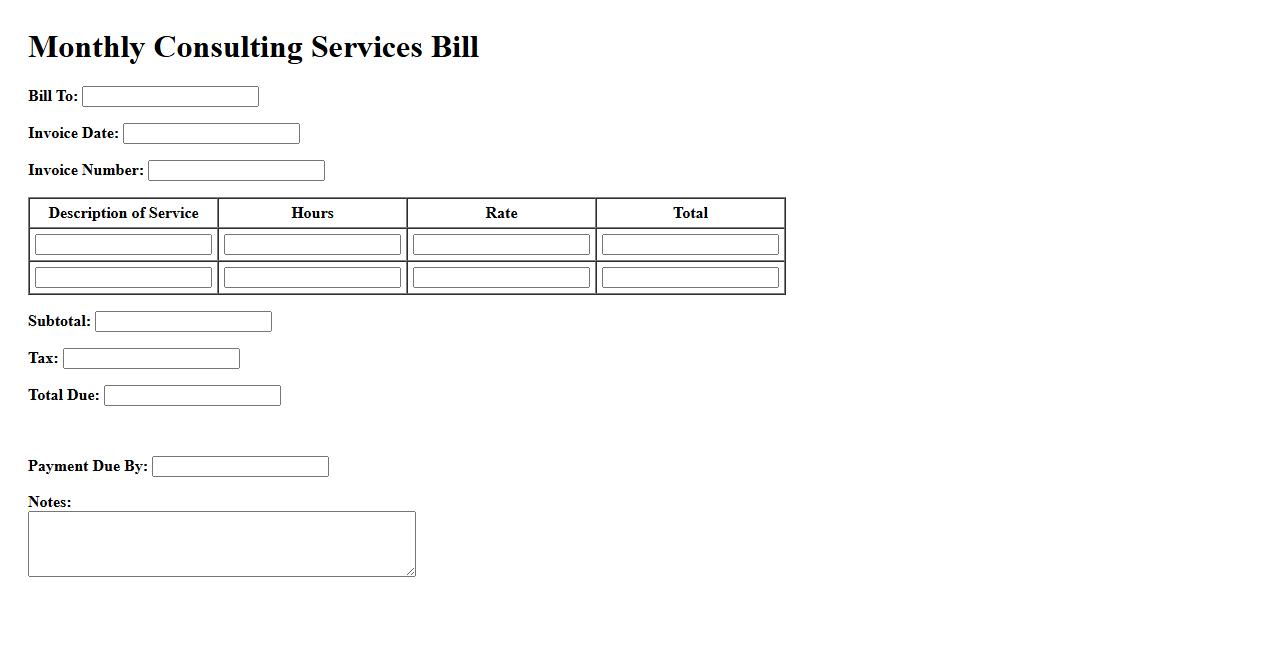

Monthly Consulting Services Bill

The Monthly Consulting Services Bill provides a detailed summary of all consulting activities and charges incurred during the billing cycle. It ensures transparent communication of services rendered and payment expectations. Clients can easily review the invoice for accuracy and budgeting purposes.

Retainer Consulting Fee Statement

The Retainer Consulting Fee Statement outlines the pre-agreed fees paid in advance for ongoing consulting services. It details the services covered, the payment schedule, and any remaining balance. This statement ensures transparency and clear communication between consultant and client.

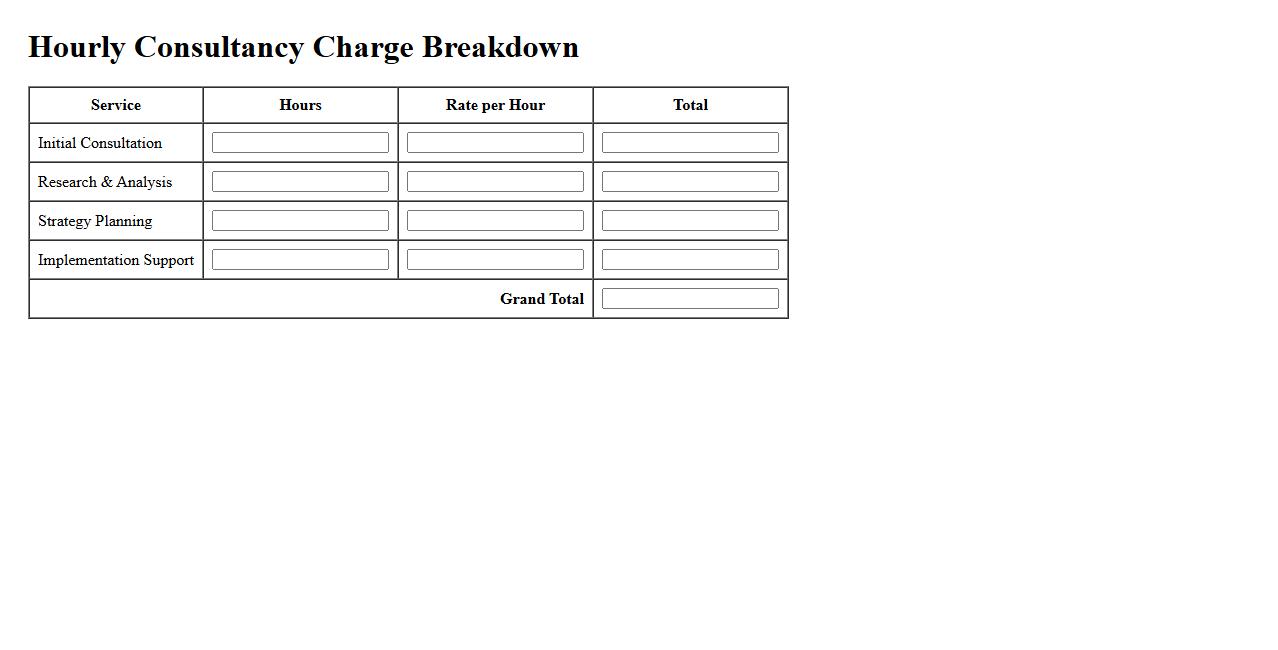

Hourly Consultancy Charge Breakdown

This document provides a detailed hourly consultancy charge breakdown to ensure transparency and clarity in billing. It outlines the specific services rendered and corresponding rates applied per hour. Clients can easily understand how their fees are calculated and justified.

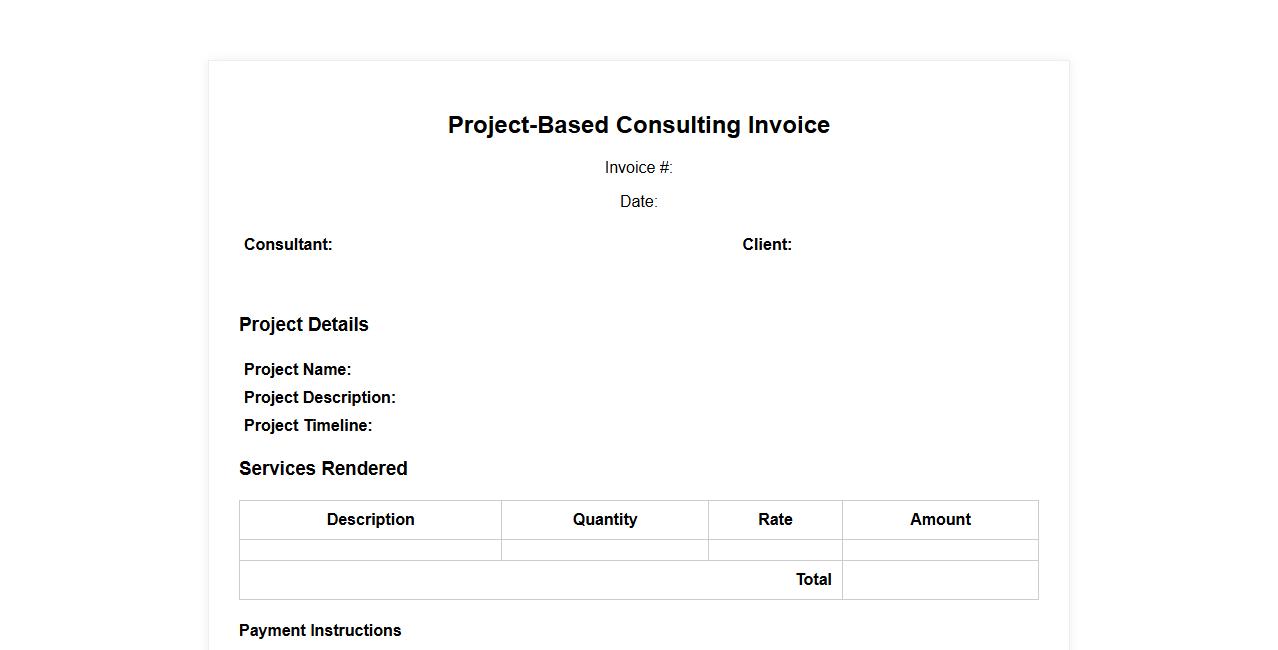

Project-Based Consulting Invoice

A Project-Based Consulting Invoice details the fees and services provided for a specific consulting project. It ensures clear communication of costs, timelines, and deliverables between the consultant and client. This invoice type streamlines payment processing by itemizing project milestones and associated charges.

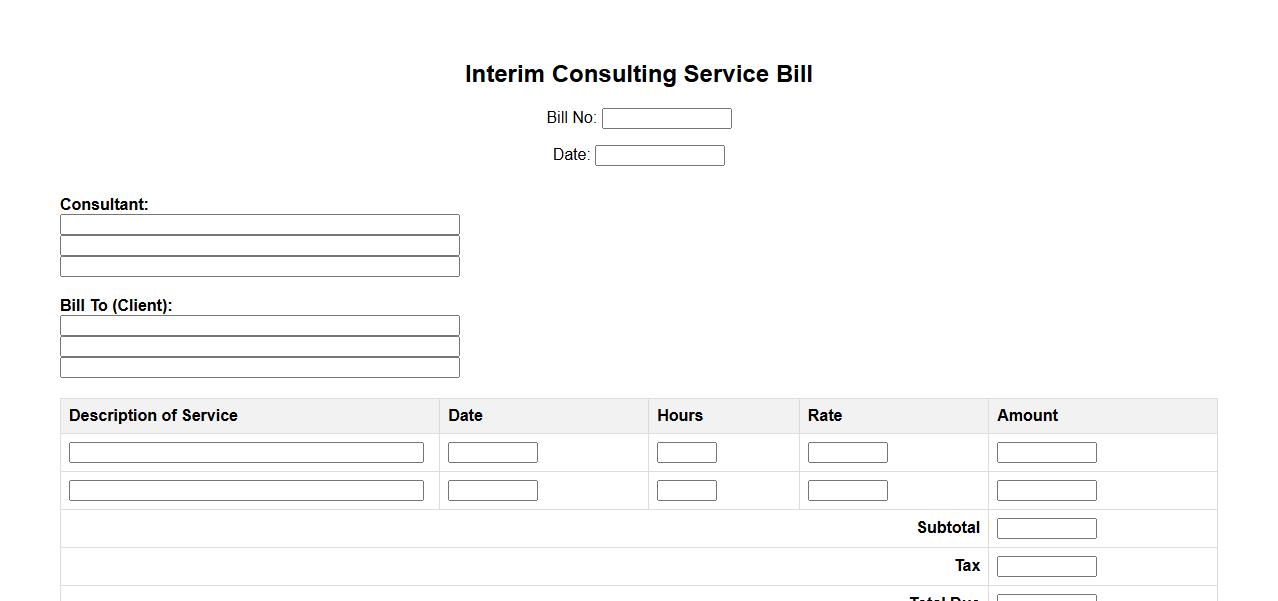

Interim Consulting Service Bill

An Interim Consulting Service Bill outlines the charges for temporary consulting services provided during a specific period. It details the consultant's fees, hours worked, and any additional expenses incurred. This document ensures transparent billing between the client and consultant for interim project support.

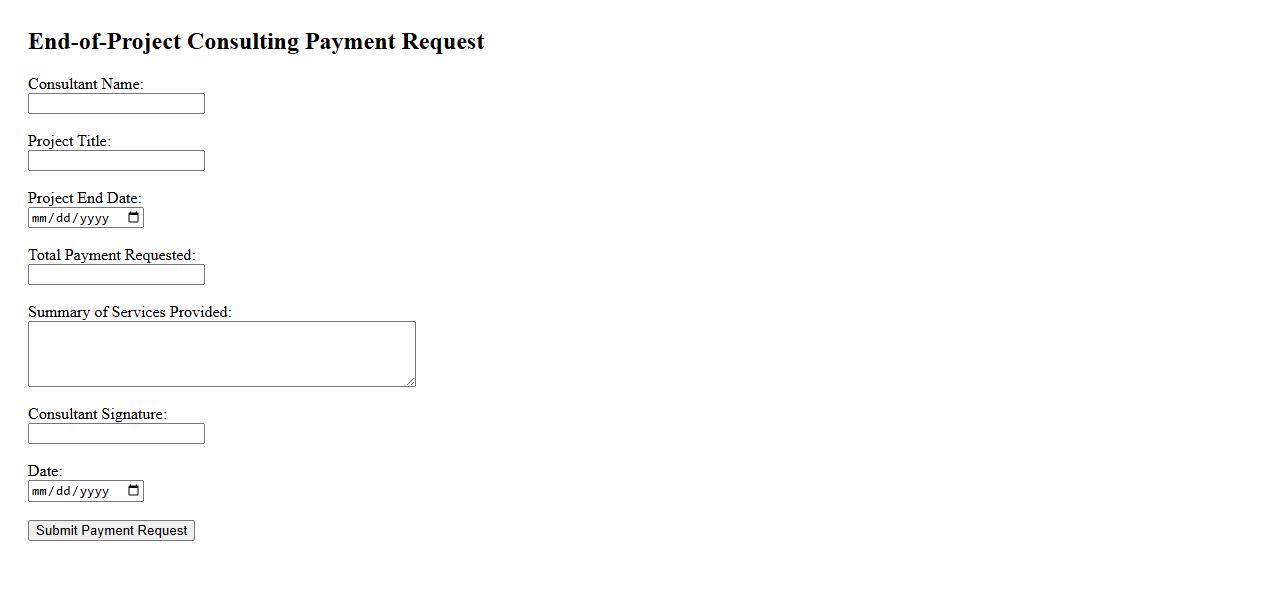

End-of-Project Consulting Payment Request

The End-of-Project Consulting Payment Request is a formal document submitted by consultants to claim payment upon successful completion of a project. It outlines the services rendered, hours worked, and any agreed-upon fees or expenses. This request ensures transparent and timely compensation for consulting efforts.

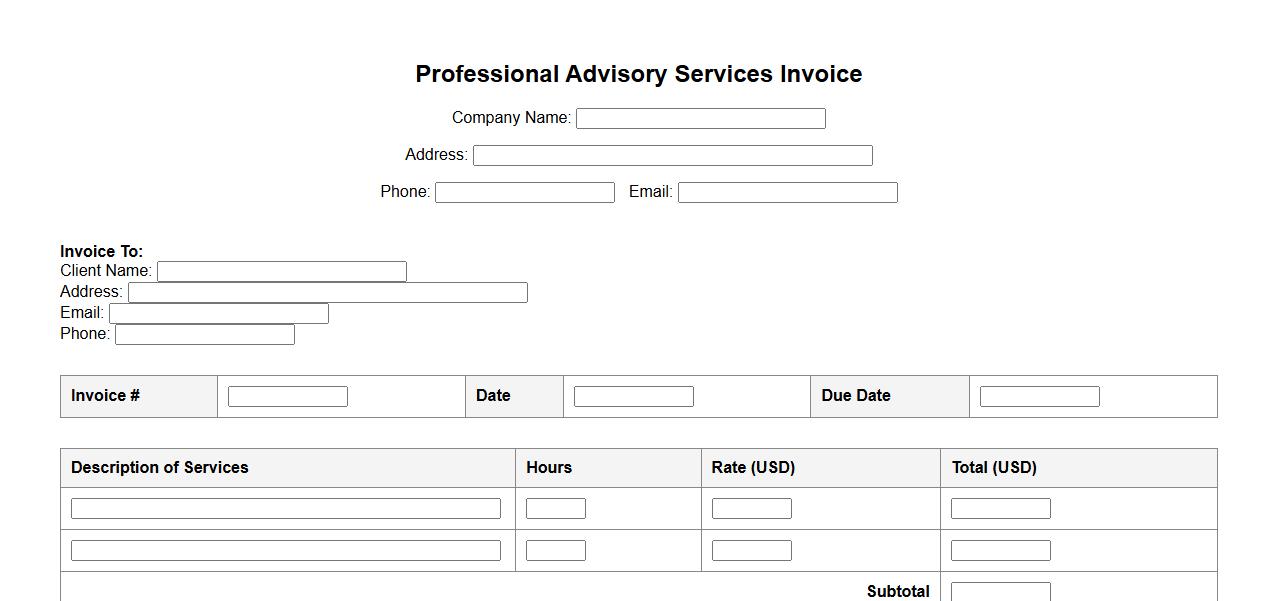

Professional Advisory Services Invoice

An Professional Advisory Services Invoice is a detailed document used to bill clients for expert consulting and advisory work. It outlines the services provided, the duration, and the total amount due. This invoice ensures clear communication and timely payment for professional advice rendered.

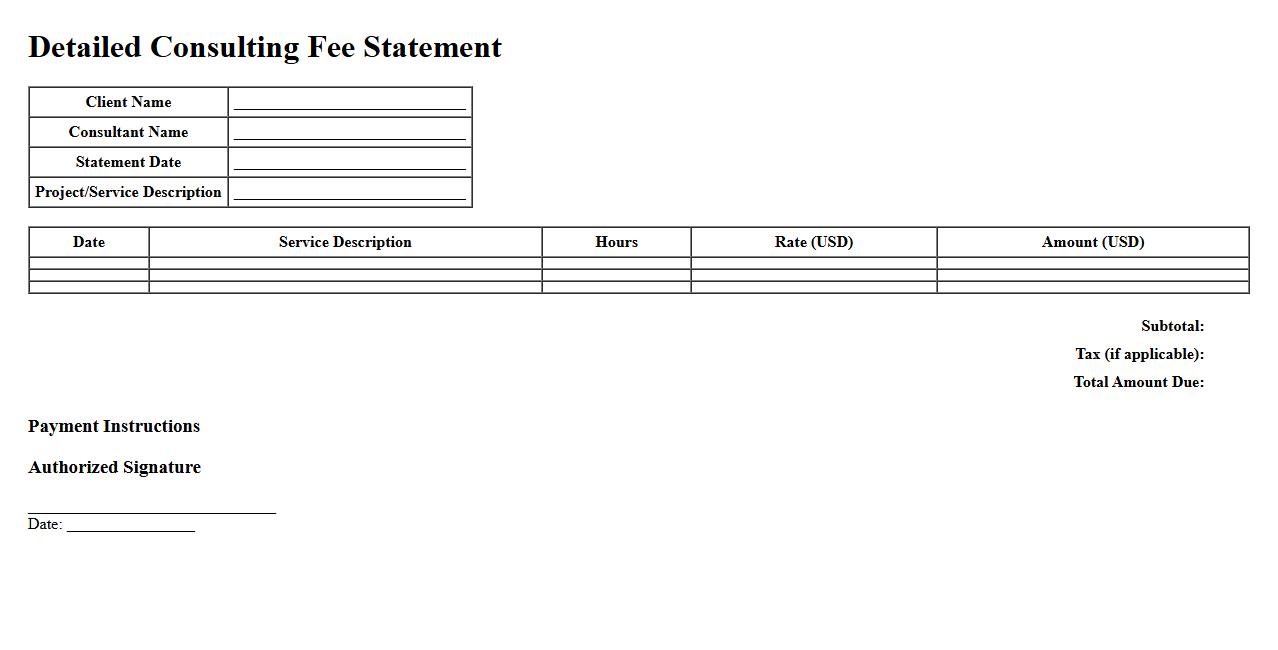

Detailed Consulting Fee Statement

The Detailed Consulting Fee Statement provides a comprehensive breakdown of all consulting charges, ensuring transparency and clarity for clients. It itemizes each service rendered along with corresponding fees, making it easy to review and verify costs. This document facilitates accurate billing and fosters trust between consultants and clients.

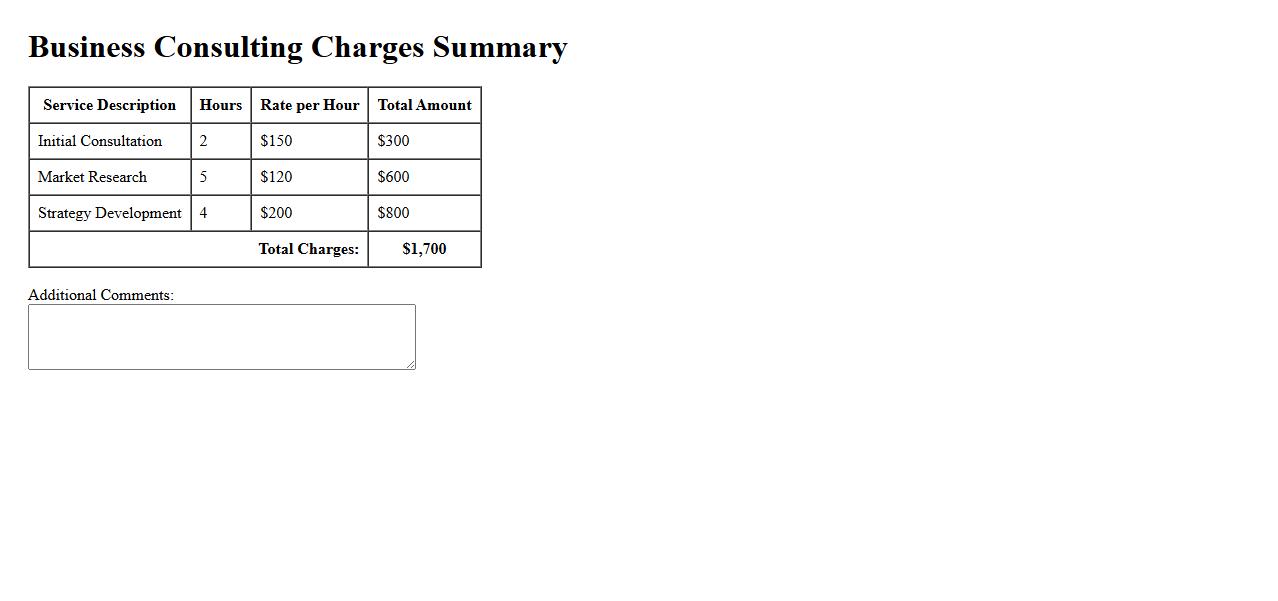

Business Consulting Charges Summary

The Business Consulting Charges Summary provides a clear overview of the fees associated with professional consulting services. It outlines the cost structure, including hourly rates, project-based fees, and any additional expenses. This summary helps clients understand the financial commitments involved in engaging consulting expertise.

What essential information must be included in a consulting fee invoice to ensure clarity and compliance?

An invoice for consulting fees must clearly display the consultant's and client's contact information, including full names, addresses, and tax identification numbers. It should also feature a unique invoice number and the date of issue to track payments accurately. Additionally, the description of services and the corresponding total amount charged must be prominently detailed to avoid confusion.

How does the invoice specify the scope and period of consulting services provided?

The invoice should include a detailed description of consulting services outlining the tasks performed or objectives achieved. It must also specify the timeframe or dates during which the consulting services were rendered. This clarity ensures both parties understand the context and limits of the charged work.

In what ways are payment terms and methods detailed on the invoice for consulting fees?

The invoice should state clear payment terms, such as net 30 days or due upon receipt, to set expectations for timely payment. It must also specify acceptable payment methods, including bank transfer details, check instructions, or online payment options. Including late payment penalties or discounts for early payment can further streamline the transaction process.

How is tax or VAT information documented on a consulting invoice?

The invoice must clearly show any applicable tax or VAT rates applied to the consulting fees, including the percentage rate and tax amount. It should list the tax identification numbers of both consultant and client, if relevant, to maintain legal compliance. Proper tax documentation ensures transparency and adherence to regulatory requirements.

Which elements on the invoice directly support dispute resolution or future reference?

Key elements supporting dispute resolution include a detailed description of services and the exact period of work performed. The inclusion of contact information and clear payment records also facilitates communication in case of discrepancies. Lastly, the presence of terms and conditions or reference to contractual agreements helps clarify rights and obligations, minimizing conflicts.