The Invoice Remittance Form is a crucial document used to provide payment details for settled invoices, ensuring accurate processing by vendors or suppliers. It typically includes information such as invoice number, payment amount, and remitter details, facilitating timely reconciliation and reducing payment errors. Proper use of the Invoice Remittance Form streamlines financial transactions and improves account management efficiency.

Payment Advice Slip

Payment Advice Slip is a document provided by a payer to the payee detailing the payment made. It typically includes information such as the amount paid, date of payment, and invoice references. This slip helps both parties reconcile and verify transactions efficiently.

Billing Statement

A Billing Statement is a detailed summary of charges and payments associated with an account. It provides clear information on outstanding balances, due dates, and recent transactions. This document helps customers stay informed and manage their financial obligations efficiently.

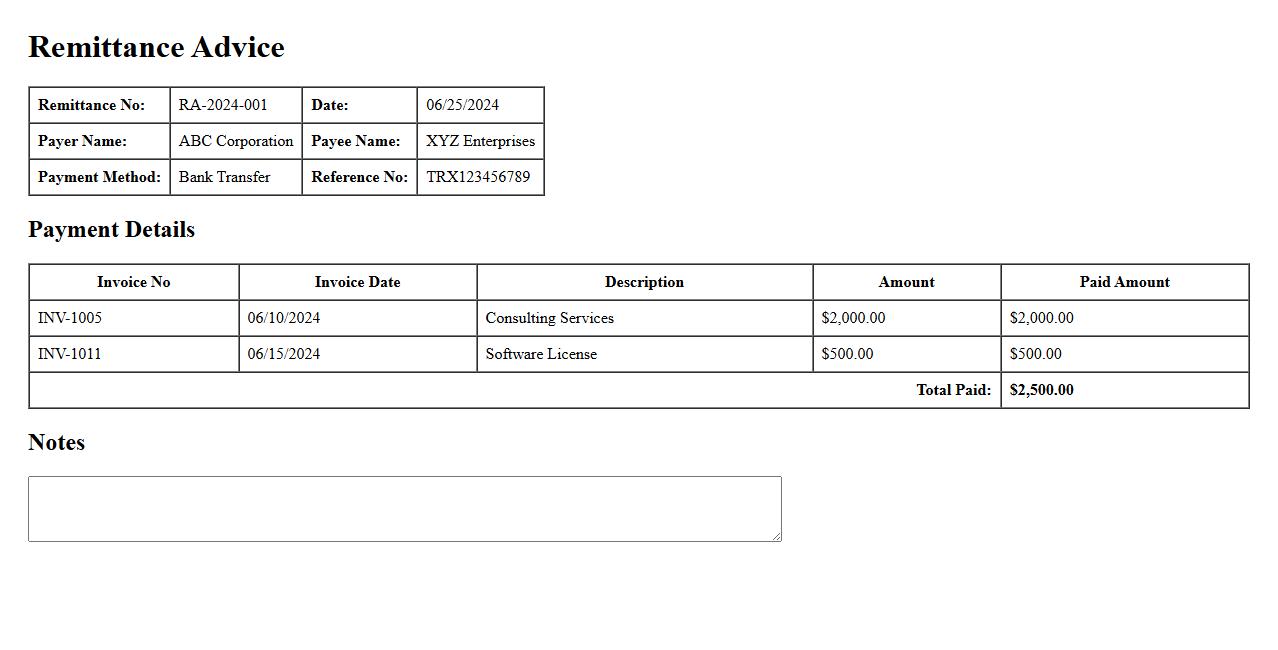

Remittance Advice

Remittance Advice is a document sent by a customer to a supplier, indicating the details of a payment made. It helps in matching the payment with the corresponding invoice, ensuring accurate financial record-keeping. This notice streamlines the reconciliation process for both parties.

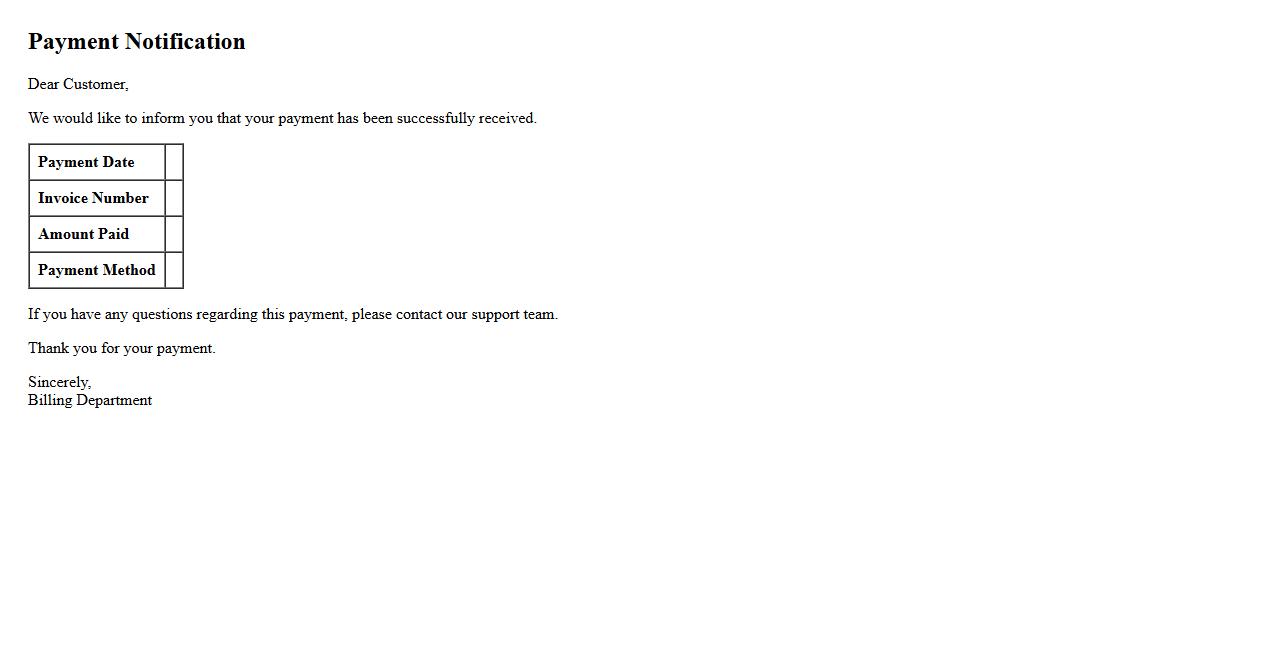

Payment Notification

Payment Notification is an alert sent to confirm that a financial transaction has been successfully completed. It ensures both parties are informed about the payment status promptly. This notification helps maintain transparency and trust in monetary exchanges.

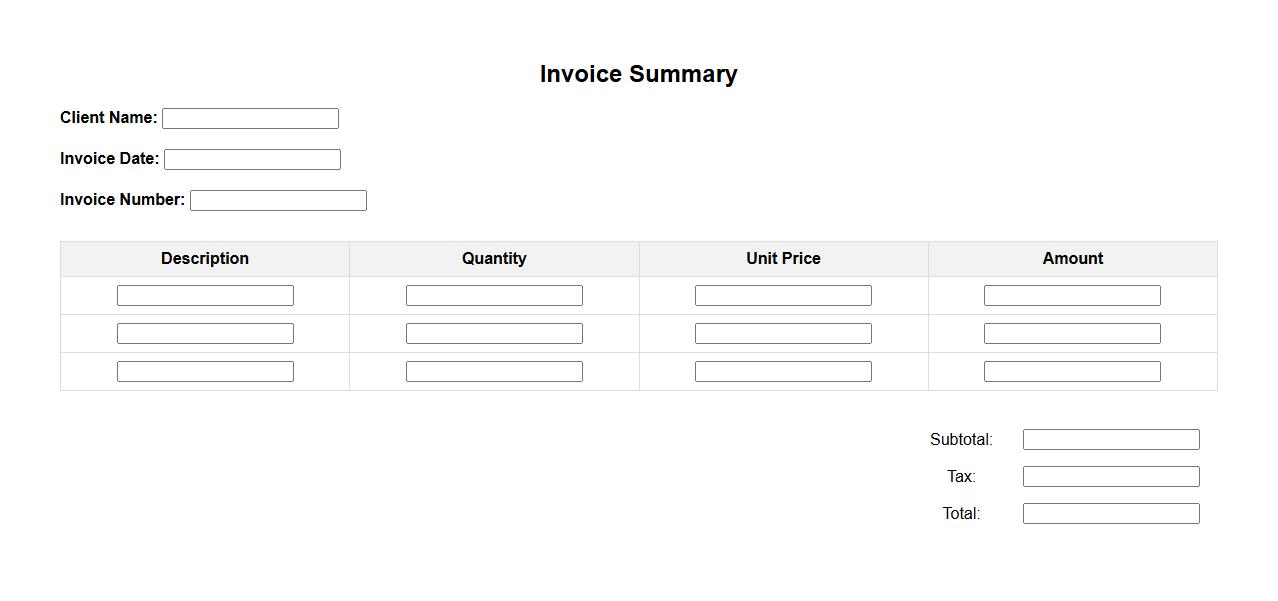

Invoice Summary

The Invoice Summary provides a concise overview of all billed items and payments within a transaction. It highlights the total amount due, taxes applied, and any discounts or credits. This summary ensures clarity and transparency for both the buyer and seller.

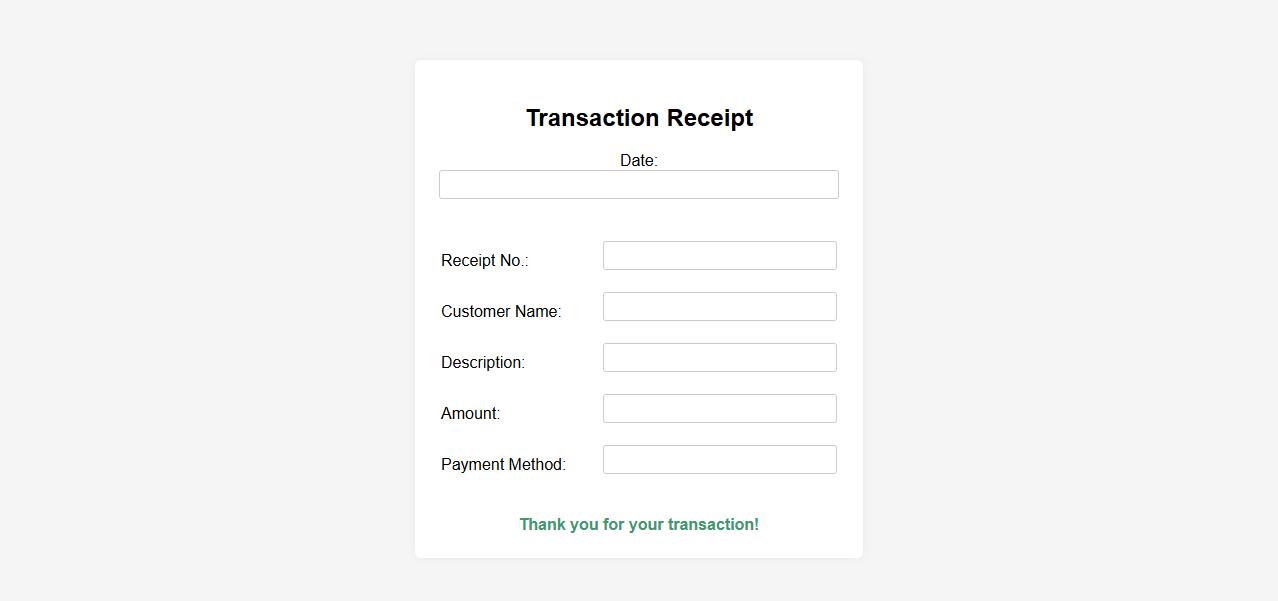

Transaction Receipt

A transaction receipt provides a detailed record of a purchase or payment made. It includes essential information such as the transaction date, amount, and payment method. This receipt serves as proof of payment and helps with record-keeping and returns.

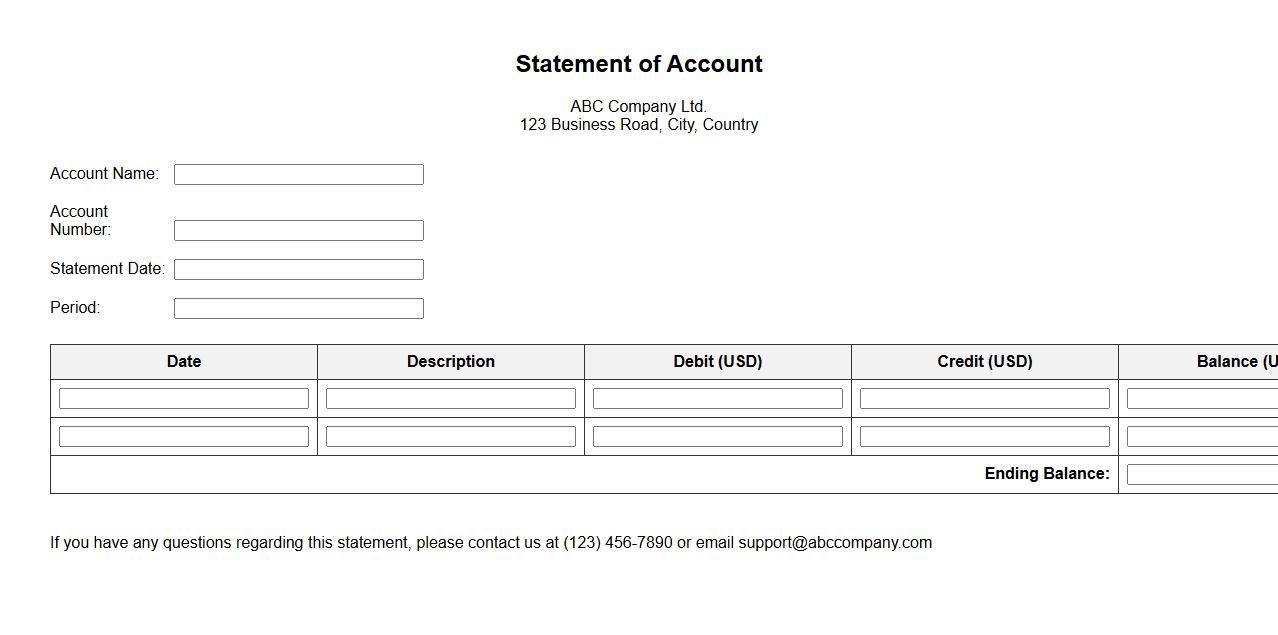

Statement of Account

A Statement of Account is a detailed summary of all transactions between a customer and a business over a specific period. It provides an overview of debits, credits, and the current balance, helping both parties track financial activity. This document is essential for maintaining accurate records and ensuring transparency in billing.

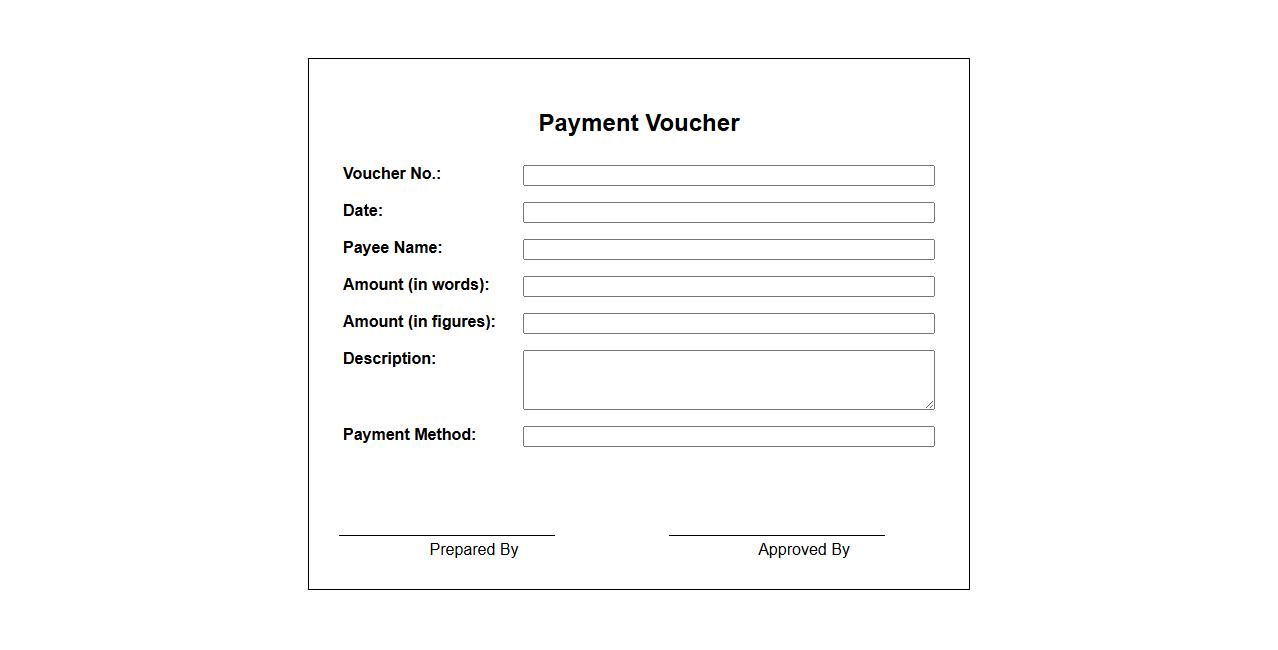

Payment Voucher

A payment voucher is a financial document used to authorize and record payment transactions. It serves as proof of payment and helps maintain accurate accounting records. Payment vouchers typically include details such as the amount paid, payee information, and payment date.

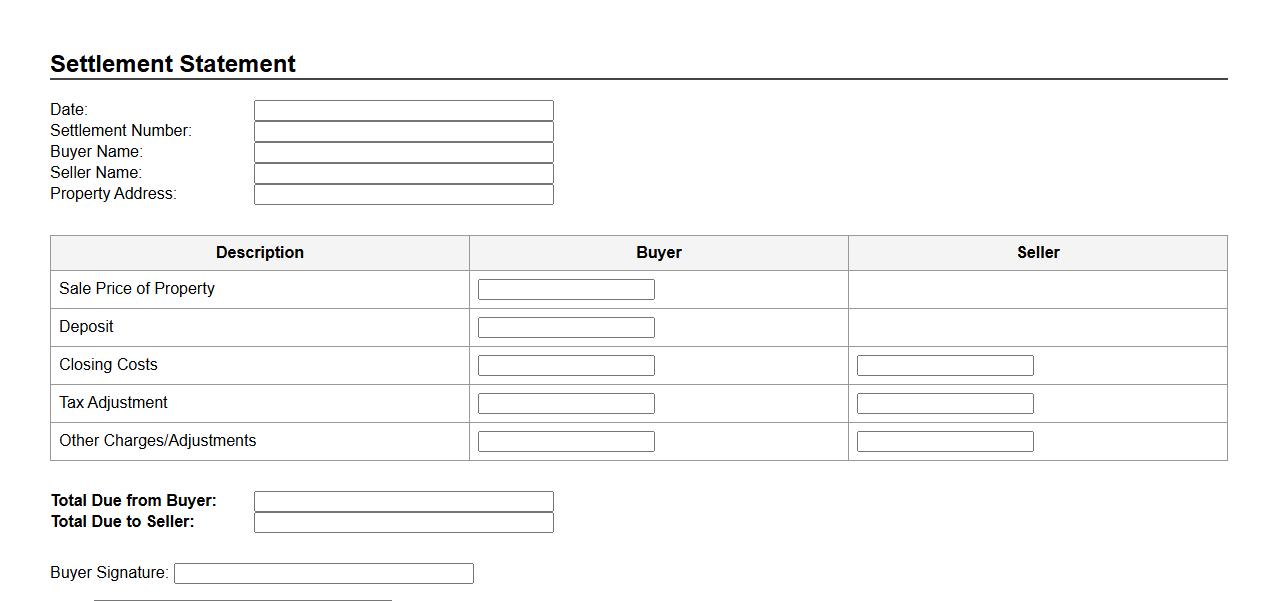

Settlement Statement

A Settlement Statement is a detailed document used in real estate transactions that outlines the final terms and costs for both buyers and sellers. It includes information such as the purchase price, loan amounts, fees, and credits, ensuring transparency and clarity. This statement is essential for verifying all financial aspects before closing the deal.

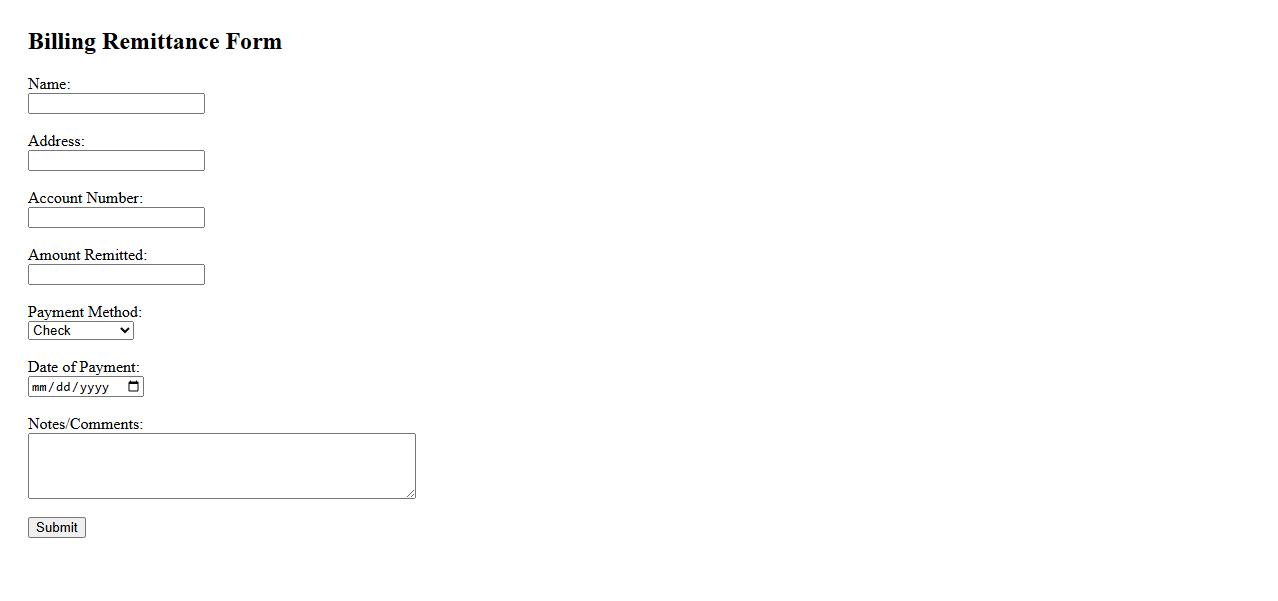

Billing Remittance Form

The Billing Remittance Form is a crucial document used to detail the payment information for invoices. It ensures accurate processing of payments by providing essential details such as invoice numbers and payment amounts. Using this form helps streamline financial transactions and maintain organized accounting records.

What specific information is required to complete an Invoice Remittance Form?

To complete an Invoice Remittance Form, key information such as the invoice number, payment amount, and payment date must be provided. Additionally, the payer's details and contact information are essential for verification purposes. Including a clear reference to the related purchase order can also help ensure accuracy.

How does the Invoice Remittance Form facilitate tracking of payments against invoices?

The Invoice Remittance Form links payments directly to specific invoices, enabling precise tracking in accounting systems. This connection helps prevent duplicate payments and eases the reconciliation process. It also provides a transparent audit trail for both vendors and payers.

Which supporting documents, if any, should accompany the Invoice Remittance Form?

Supporting documents such as the original invoice, payment proof, or purchase order copies should accompany the Invoice Remittance Form. These documents validate the payment and clarify discrepancies or disputes. Ensuring all required attachments are included speeds up processing and approval.

What common errors should be avoided when filling out an Invoice Remittance Form?

Common errors to avoid include incorrect invoice numbers, mismatched payment amounts, and missing payer information on the Invoice Remittance Form. Omitting key references or attaching incorrect documents can delay payment processing. Double-checking all entries ensures swift and accurate submission.

How is the submitted Invoice Remittance Form processed within the financial workflow?

Upon submission, the Invoice Remittance Form is reviewed by the accounts payable team for validation and matching with invoices. The form and associated documents are entered into the financial system for payment authorization. After approval, payment is scheduled and recorded, completing the transaction cycle.