A Invoice Correction Request is a formal submission made to rectify errors or discrepancies found in an issued invoice. This process ensures accurate billing, maintaining clear communication between the buyer and seller. Proper handling of a Invoice Correction Request prevents payment delays and supports accurate financial records.

Invoice Adjustment Request

An Invoice Adjustment Request is a formal document submitted to correct or update billing information on an existing invoice. It ensures accurate financial records by addressing discrepancies such as pricing errors or incorrect quantities. This process is essential for maintaining transparent and trustworthy business transactions.

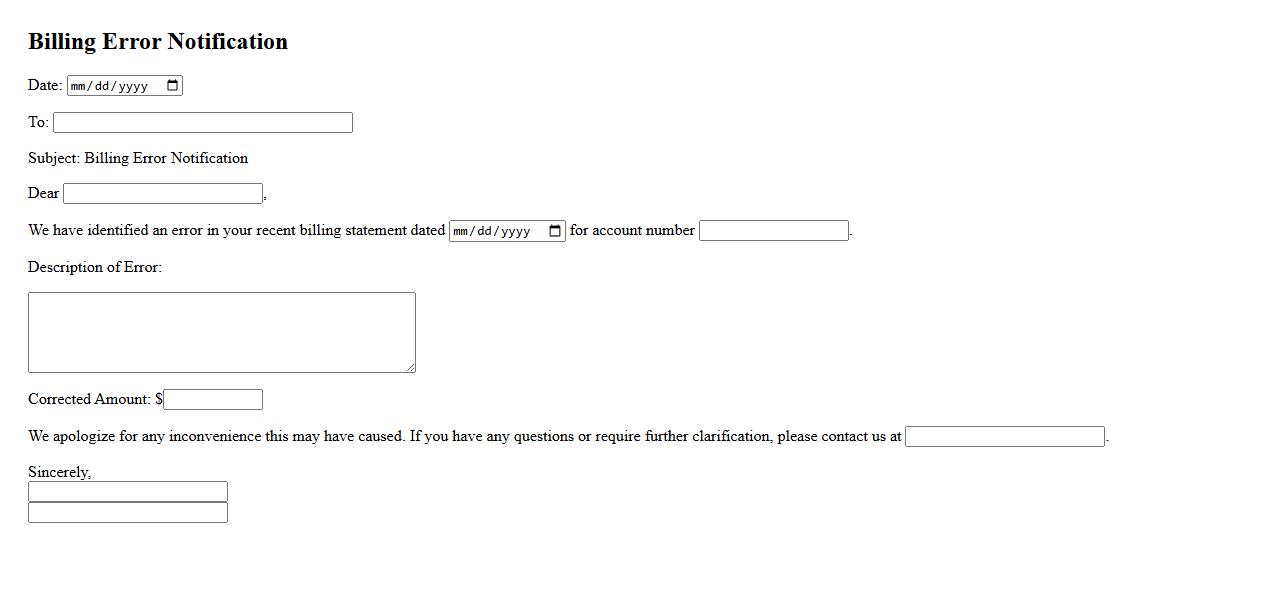

Billing Error Notification

Receiving a billing error notification alerts you to discrepancies in your invoice or payment details. It helps ensure accurate financial records by prompting timely review and correction. Addressing these notifications promptly avoids potential service interruptions or additional fees.

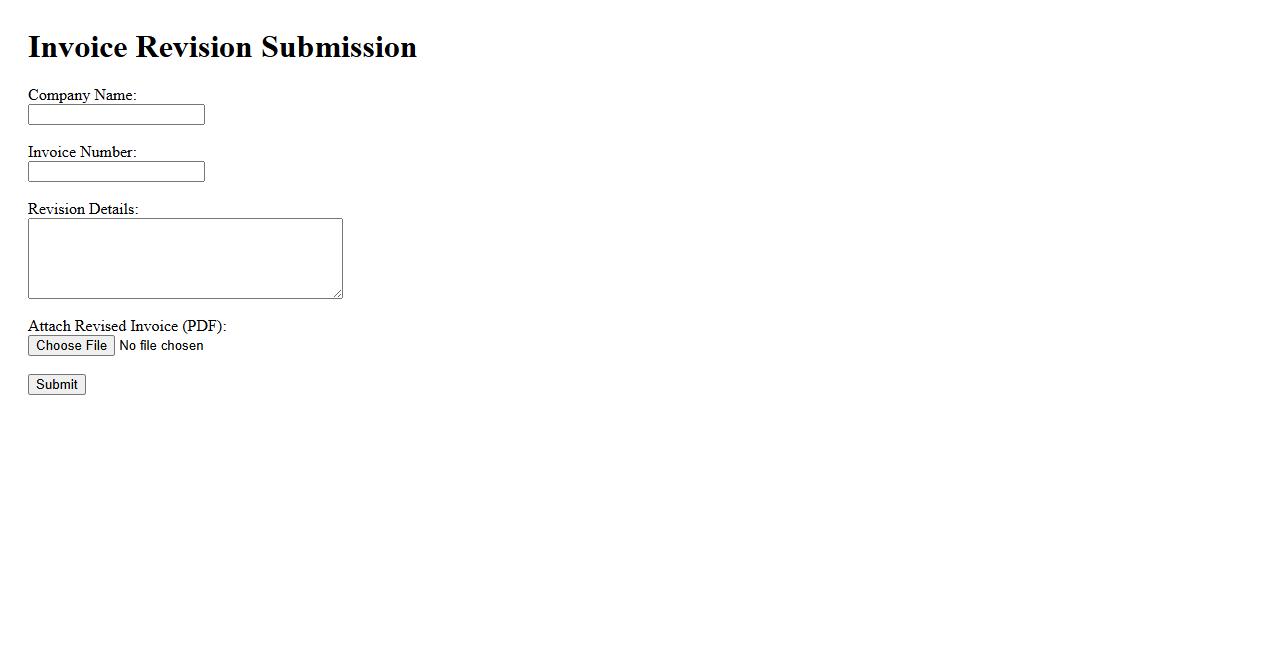

Invoice Revision Submission

The Invoice Revision Submission process allows clients to request corrections or updates to previously issued invoices. This ensures that all billing information is accurate and up-to-date for financial records. Timely submission helps maintain transparency and smooth payment processing.

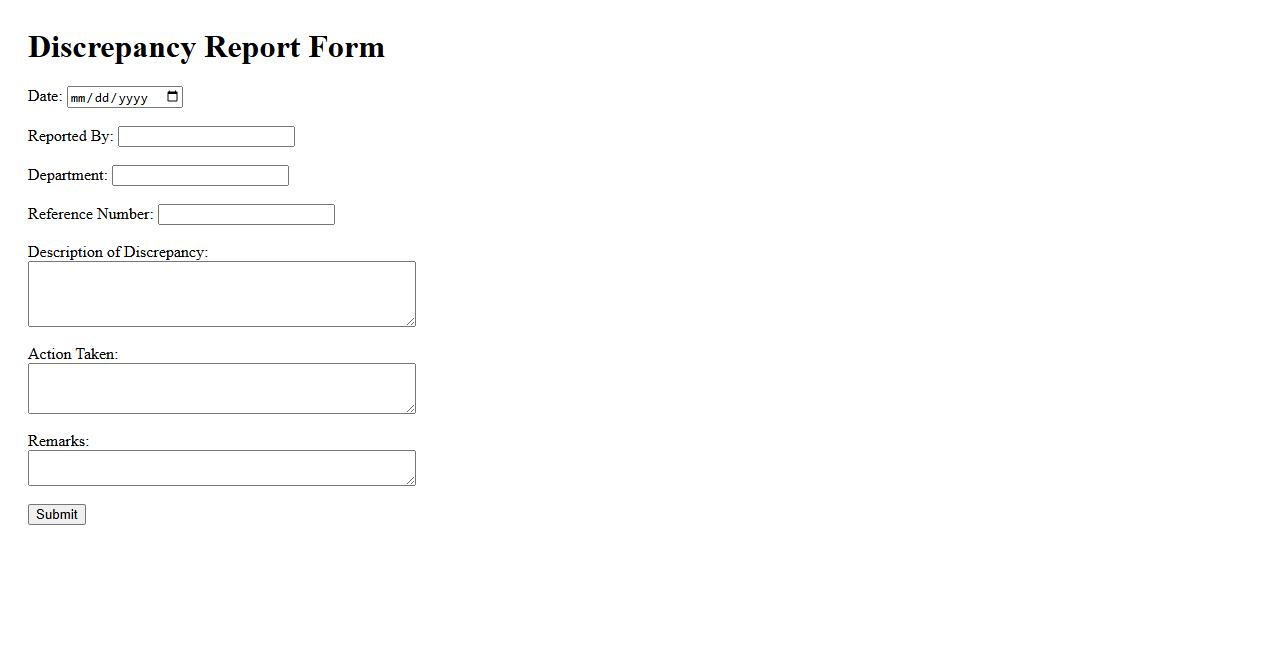

Discrepancy Report Form

The Discrepancy Report Form is used to document and address inconsistencies or errors identified in processes or products. It facilitates clear communication between teams to ensure timely resolution. This form is essential for maintaining quality control and improving overall workflow efficiency.

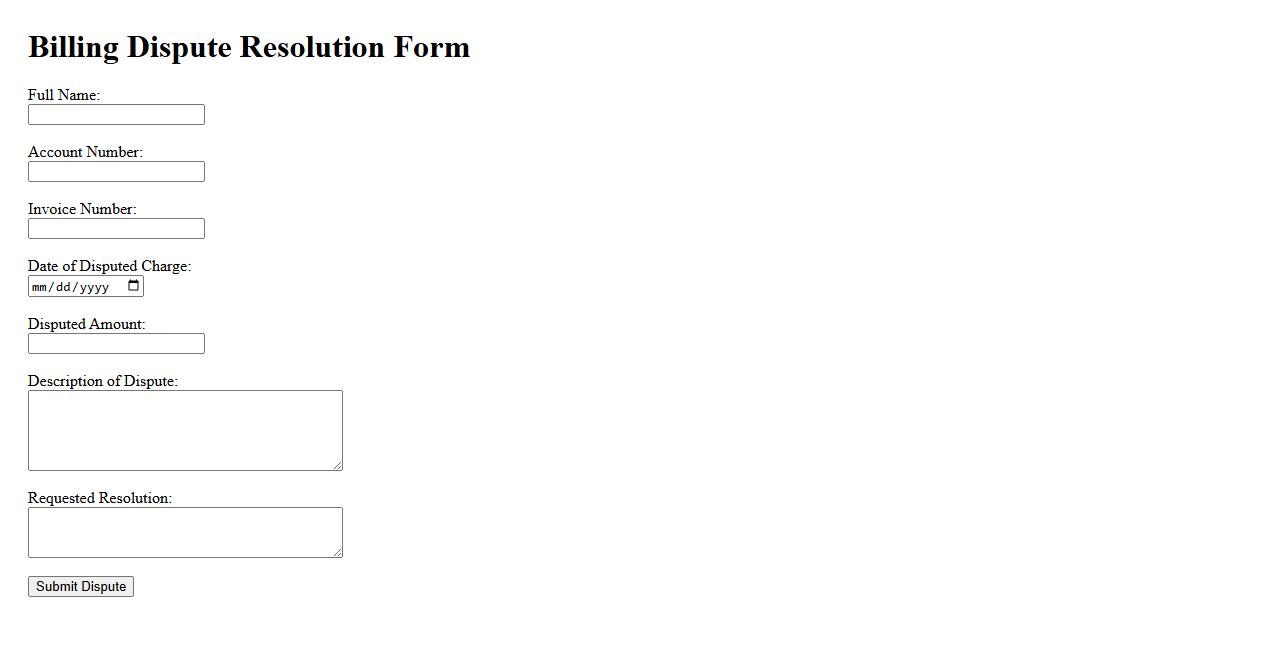

Billing Dispute Resolution

Billing Dispute Resolution is the process of addressing and resolving discrepancies or errors in billing statements between a customer and a service provider. It ensures fair handling of disputes by reviewing charges and correcting mistakes promptly. Effective resolution improves customer satisfaction and maintains trust in financial transactions.

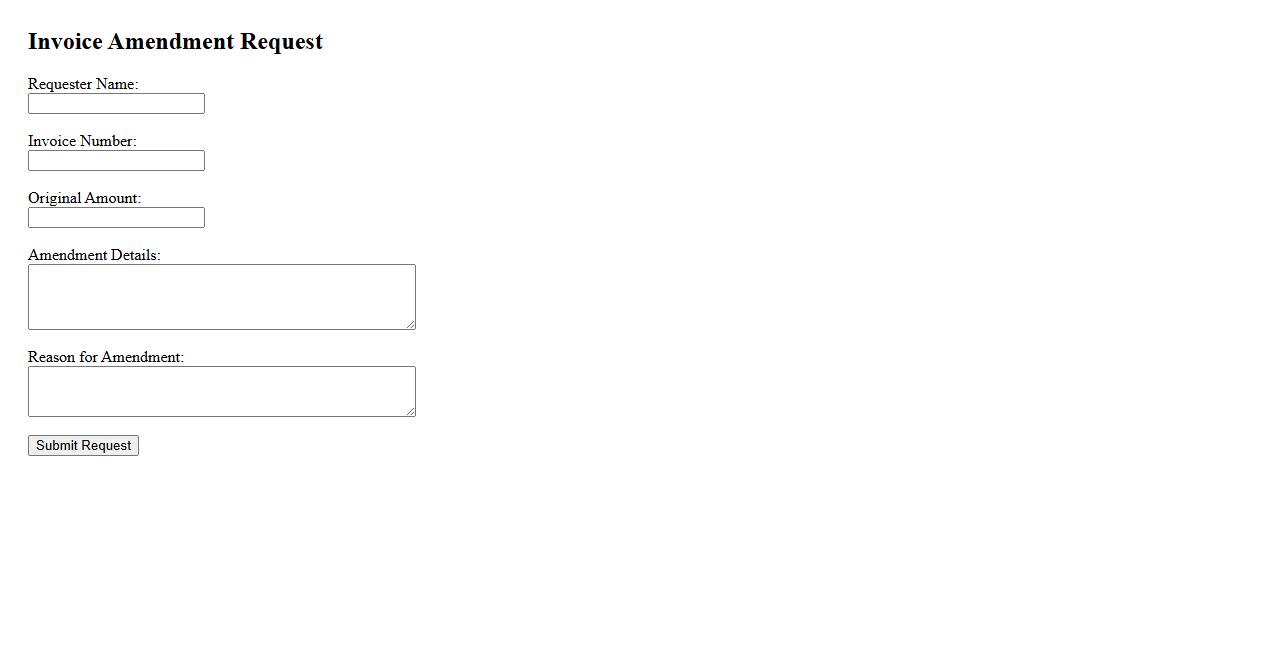

Invoice Amendment Request

An Invoice Amendment Request is a formal document submitted to correct errors or update details on an existing invoice. It ensures accurate billing and maintains clear financial records between parties. This process helps resolve discrepancies efficiently and supports smooth business transactions.

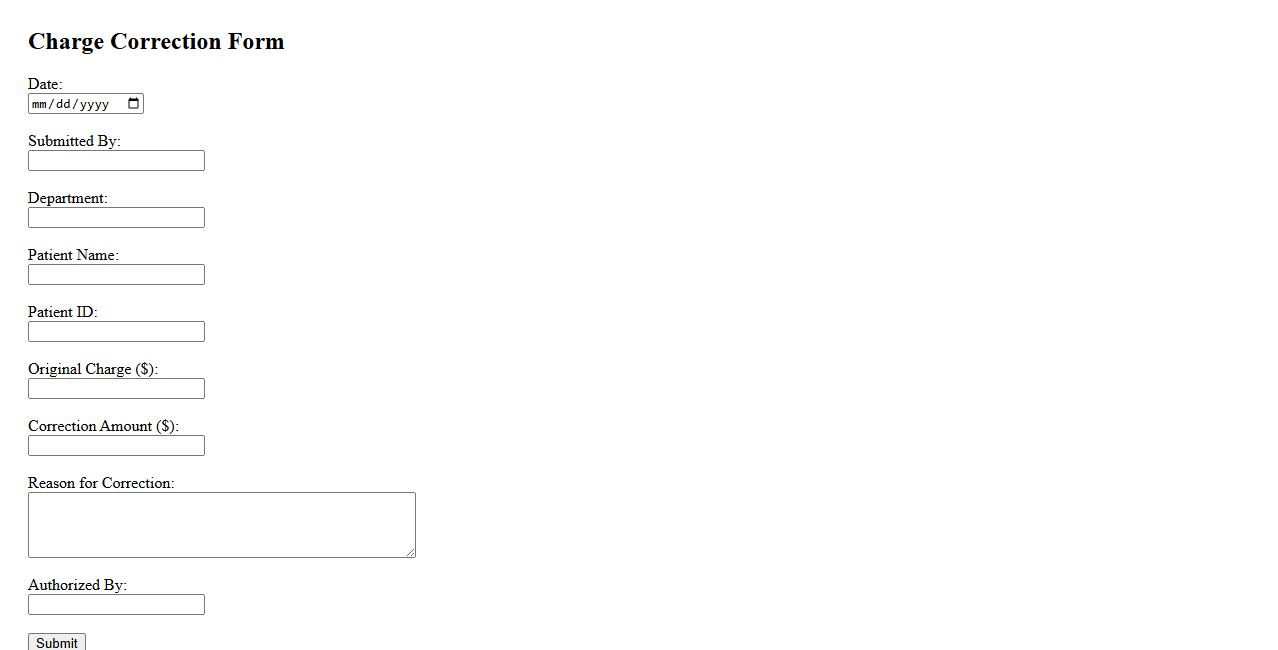

Charge Correction Form

The Charge Correction Form is a document used to rectify billing errors or update incorrect charges on an account. It ensures accurate financial records by allowing adjustments to previous invoices. This form is essential for maintaining transparent and precise transaction details.

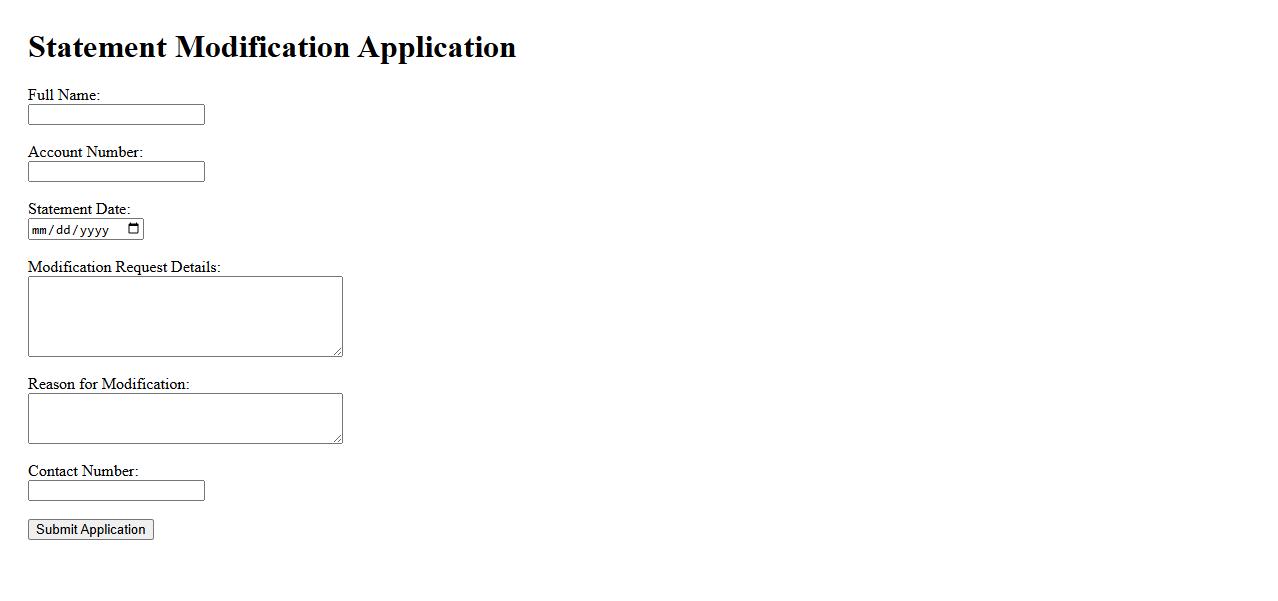

Statement Modification Application

The Statement Modification Application allows users to easily update or correct their financial or legal statements online. It streamlines the process by providing an intuitive interface and secure data handling. This application is essential for maintaining accurate and up-to-date records efficiently.

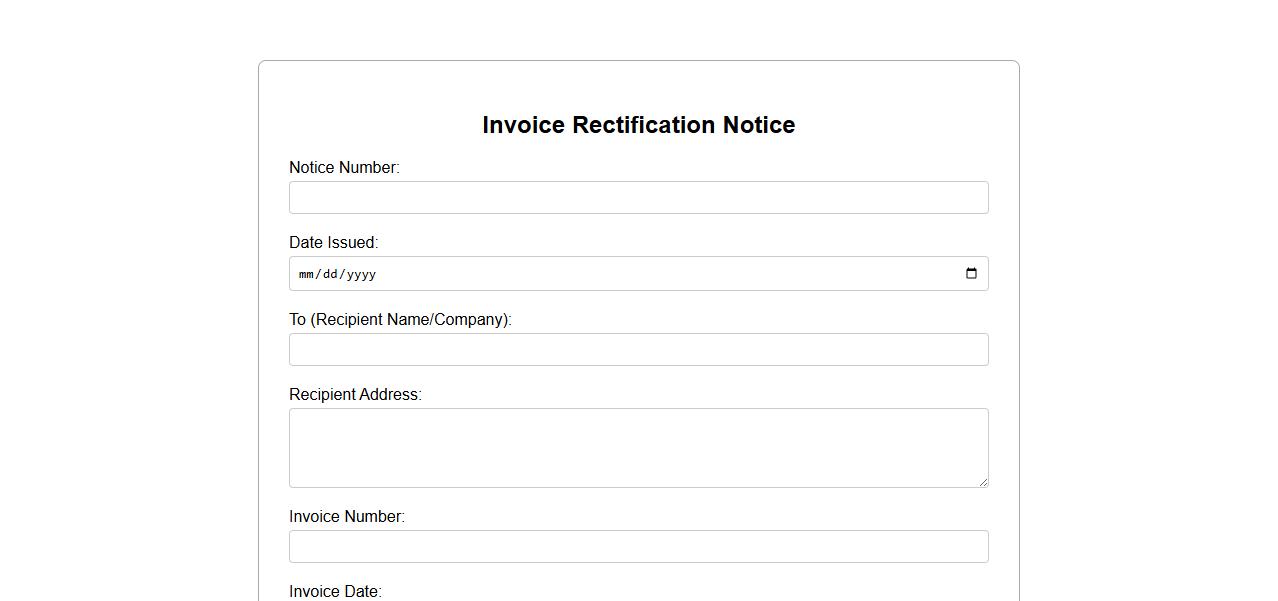

Invoice Rectification Notice

An Invoice Rectification Notice is an official communication sent to correct errors or discrepancies in a previously issued invoice. It ensures accurate financial records and compliance with tax regulations. This notice helps maintain transparent and error-free transaction documentation.

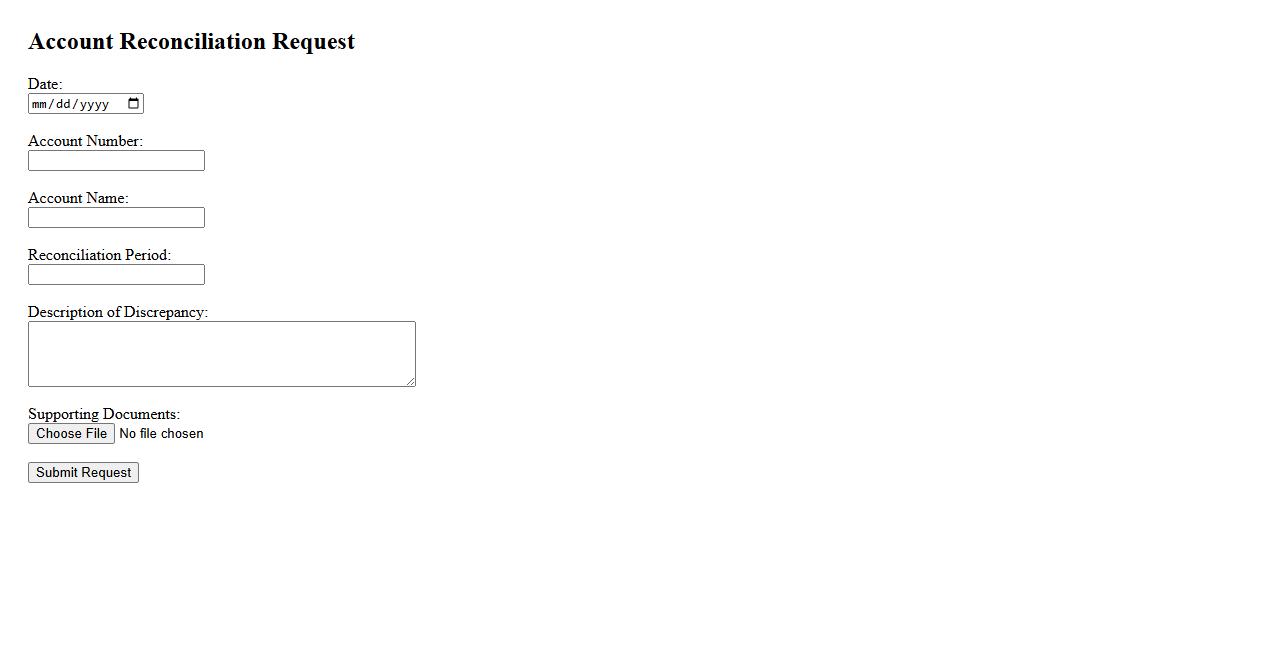

Account Reconciliation Request

An Account Reconciliation Request is a formal process used to verify and resolve discrepancies in financial records. It ensures that account balances are accurate and consistent between different statements. This helps maintain the integrity of financial data and supports accurate reporting.

What specific error is present in the original invoice?

The original invoice contains a discrepancy in the billed amount that does not align with the agreed contract terms. This error impacts the overall financial records and payment schedules. Identifying this mistake is crucial for accurate invoicing and accounting.

Which invoice number and date does the correction request pertain to?

The correction request refers specifically to invoice number 12345 dated March 15, 2024. This identification is essential for tracking and applying the necessary adjustments. Ensuring the correct invoice is addressed prevents confusion and errors in financial reconciliation.

What revised information should be reflected in the corrected invoice?

The corrected invoice must include the updated billing amount consistent with contract terms and any applicable taxes recalculated. Additionally, it should reflect the accurate service descriptions and dates of provision. This ensures transparency and compliance with accounting standards.

Who is the authorized requester for the invoice correction?

The authorized requester for the correction is the finance manager, John Smith, who has official approval to make such amendments. His authorization guarantees that the correction is legitimate and properly documented. This oversight is vital for maintaining audit trails.

What supporting documents are attached to validate the correction request?

The correction request is supported by contract amendments, payment receipts, and email correspondence confirming the agreed changes. These documents provide proof and justification for the invoice adjustment. Attaching these ensures the correction is transparent and verifiable.