The Invoice Payment Application streamlines the process of managing and processing payments for invoices, ensuring accuracy and timely transactions. It automates payment tracking, sends reminders, and integrates with accounting systems to enhance financial management. Businesses benefit from reduced errors and improved cash flow by using this efficient tool.

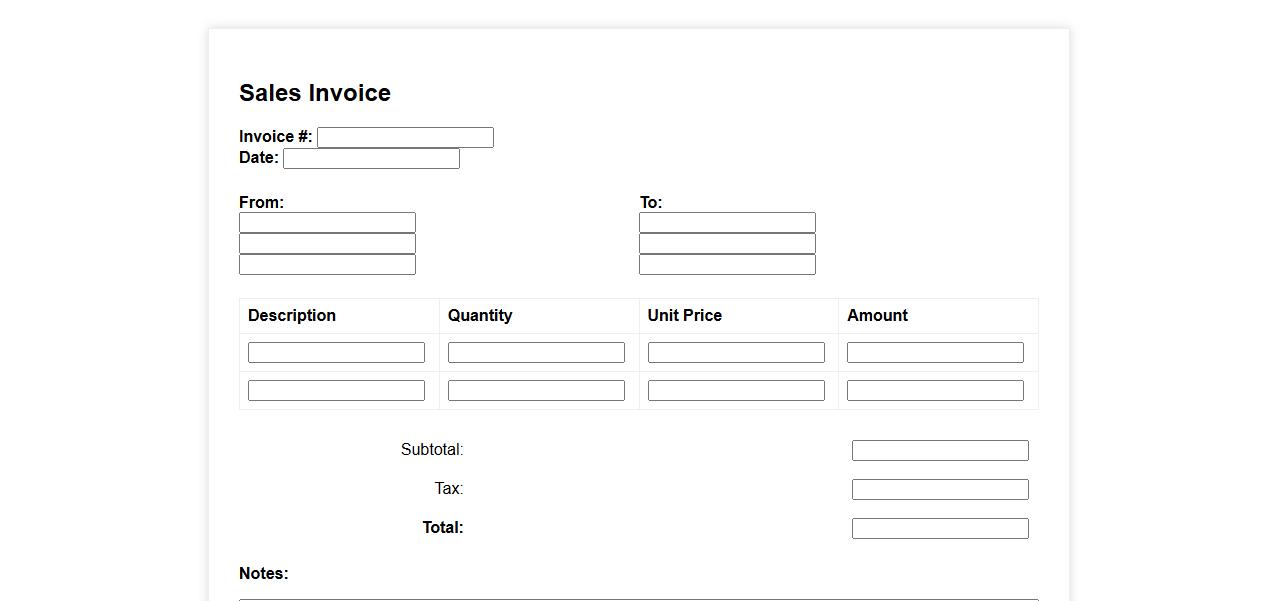

Sales Invoice

A Sales Invoice is a detailed document issued by a seller to a buyer, outlining the products or services provided along with their costs. It serves as an official request for payment and includes important information such as the invoice number, date, and terms of sale. Properly managing sales invoices is crucial for accurate financial records and timely cash flow.

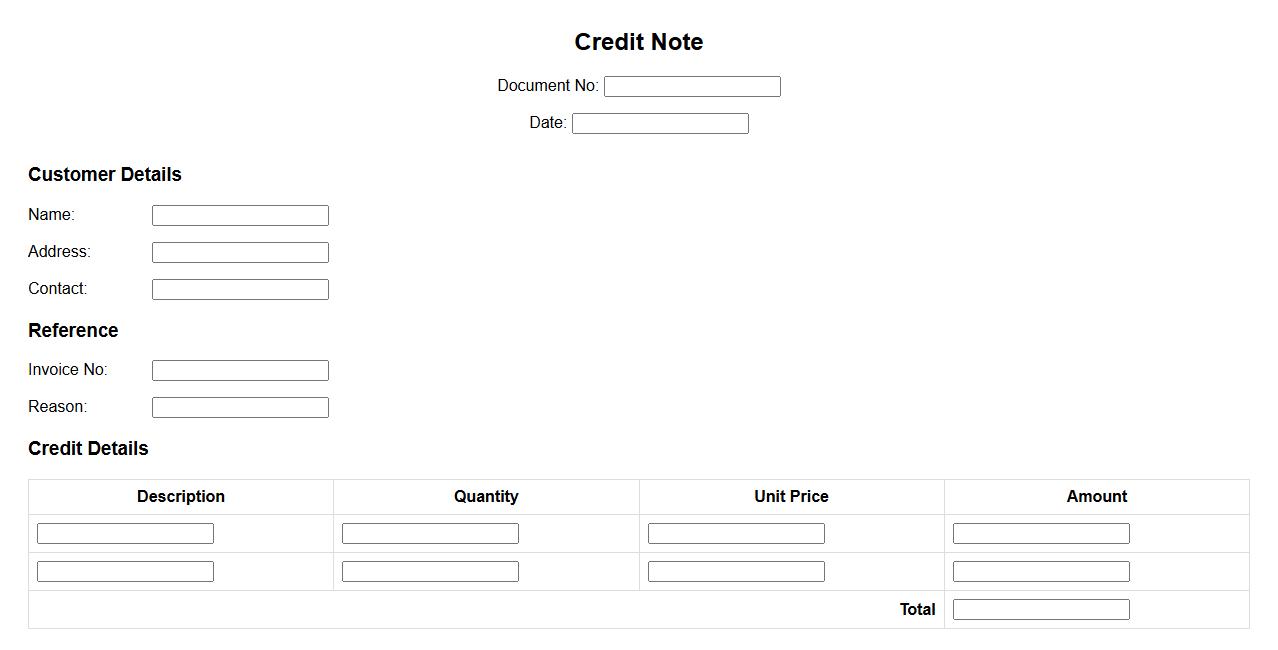

Credit Note

A Credit Note is a financial document issued by a seller to a buyer, acknowledging that a certain amount has been credited to the buyer's account. It is typically used to correct invoice errors, return goods, or provide refunds. This document helps maintain accurate accounting records and improves transparency between trading partners.

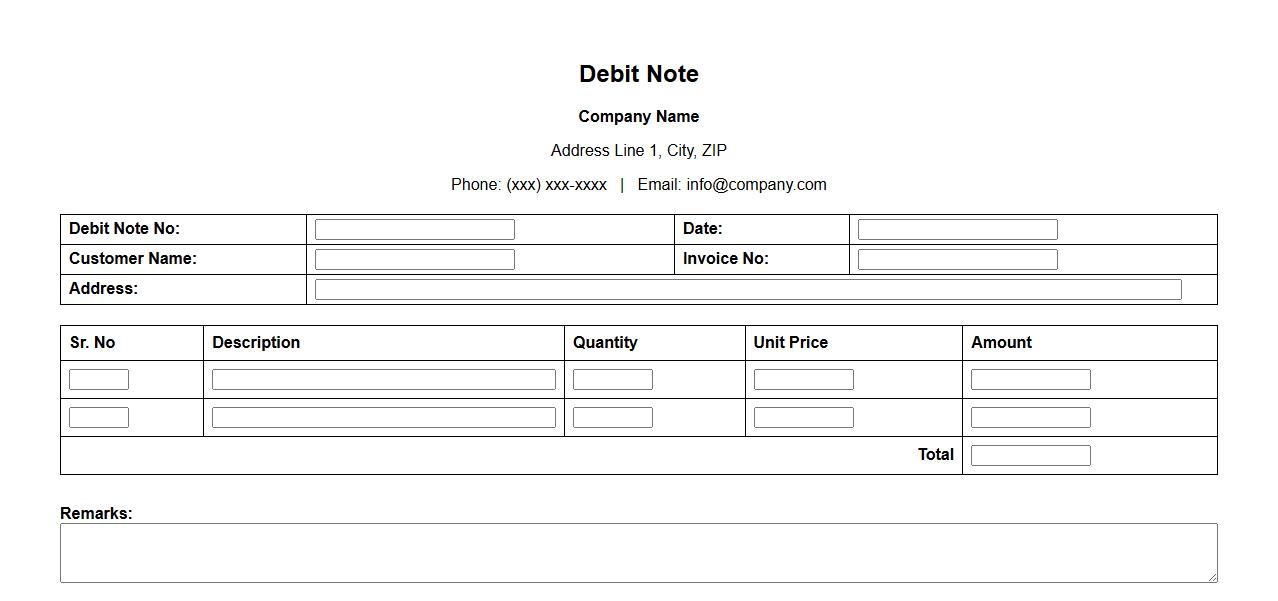

Debit Note

A Debit Note is a commercial document issued by a buyer to a seller as a formal request for a credit note. It is used to notify the seller of returned goods or an adjustment in the amount owed due to discrepancies. This helps maintain accurate records and clear communication in business transactions.

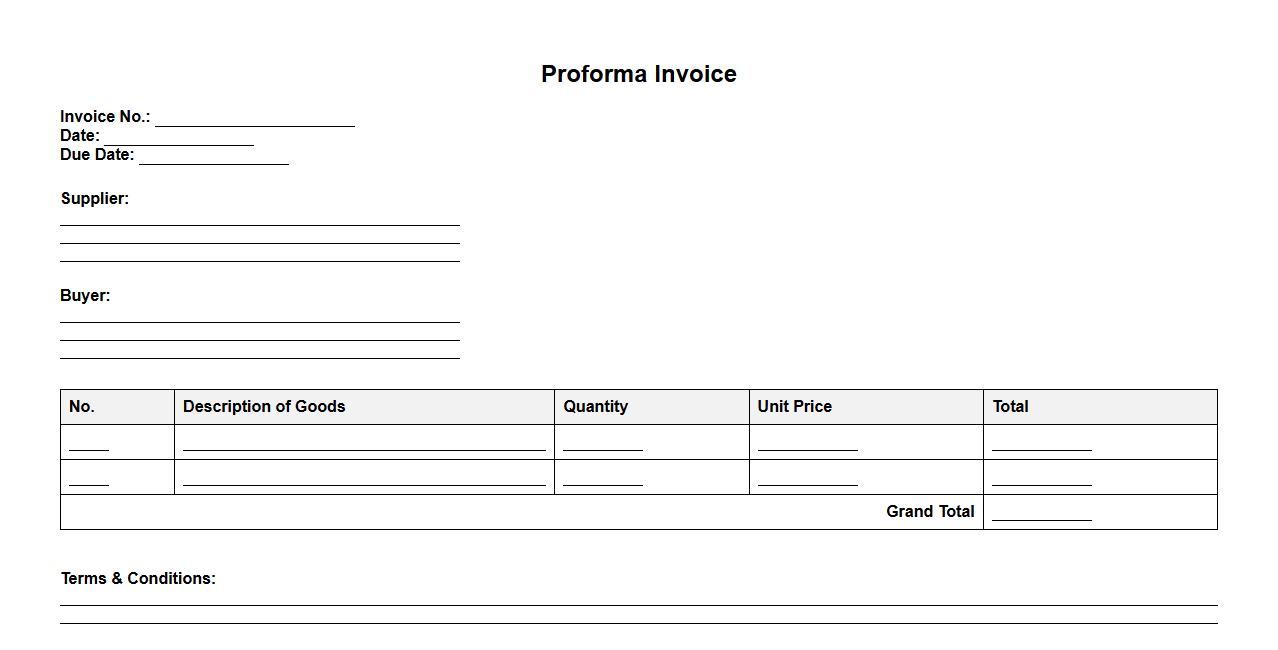

Proforma Invoice

A Proforma Invoice is a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It outlines the terms of the transaction, including the price, quantity, and specifications, but is not a demand for payment. This document helps both parties agree on the details before finalizing the purchase.

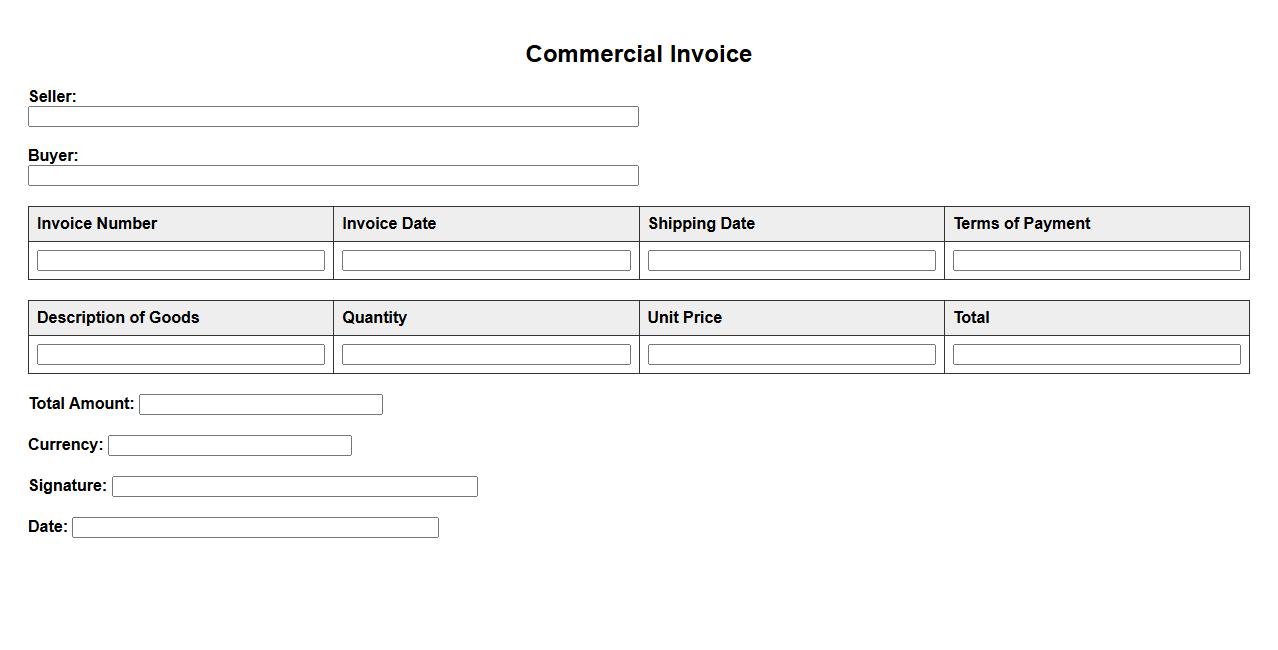

Commercial Invoice

A Commercial Invoice is a crucial document used in international trade that details the transaction between the buyer and seller. It includes information such as the description of goods, quantity, price, and payment terms. This invoice serves as proof of sale and is essential for customs clearance and shipping processes.

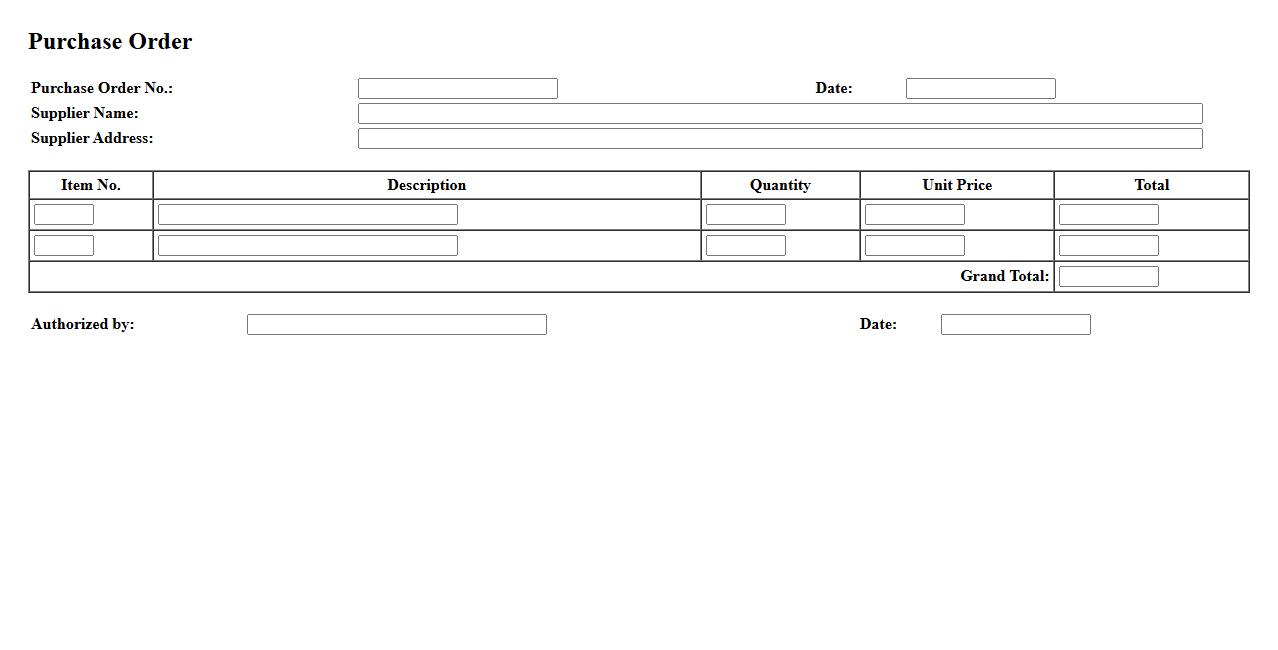

Purchase Order

A Purchase Order is a formal document issued by a buyer to a seller, outlining the types, quantities, and agreed prices for products or services. It serves as a legally binding contract once accepted, ensuring clarity and mutual agreement in business transactions. Purchase Orders help streamline procurement processes and improve inventory management.

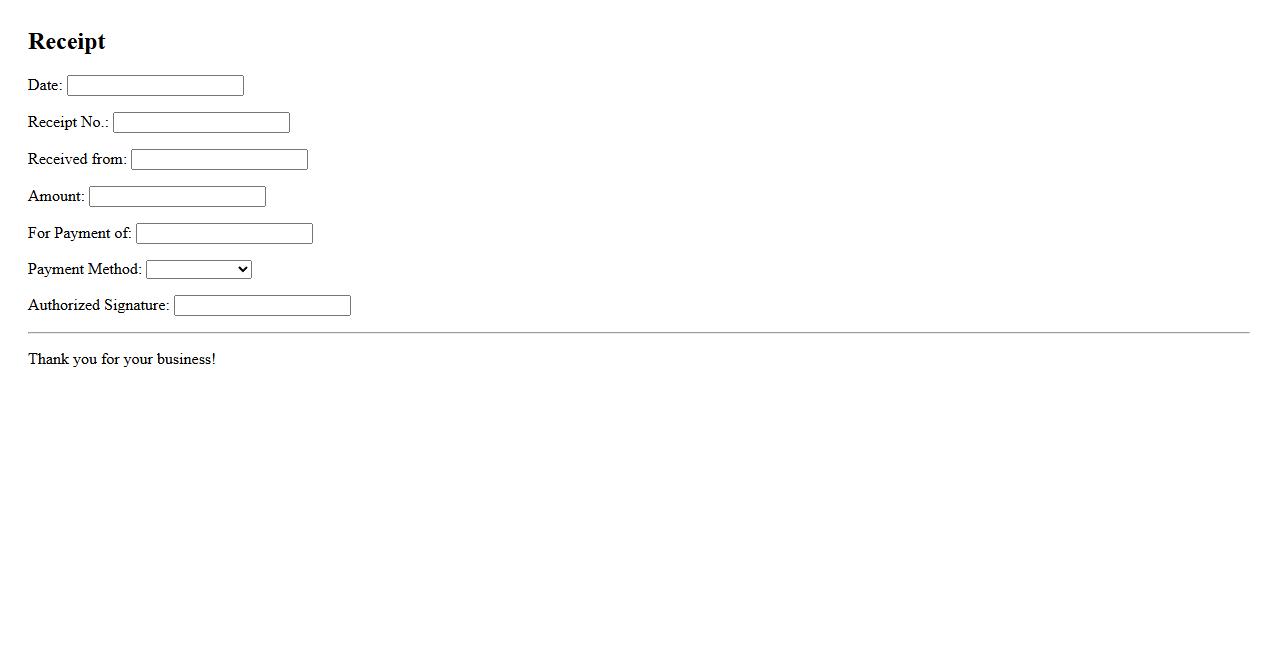

Receipts

Receipts are essential documents that provide proof of purchase for goods or services. They help track expenses and validate transactions for both buyers and sellers. Keeping receipts organized is crucial for budgeting and accounting purposes.

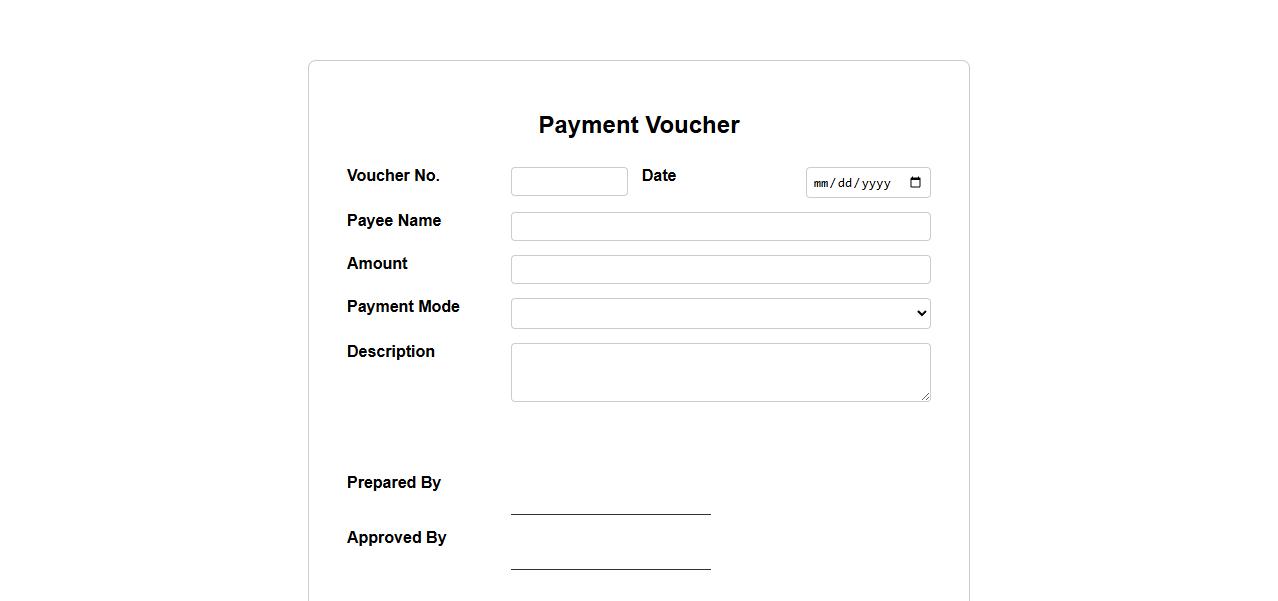

Payment Voucher

A Payment Voucher is a document that serves as proof of payment for goods or services. It details the amount paid, date, and the parties involved in the transaction. This voucher helps in maintaining accurate financial records and ensuring transparency in payments.

Remittance Advice

Remittance Advice is a document sent by a customer to a supplier, confirming that a payment has been made. It helps the supplier reconcile the payment with the corresponding invoice. This ensures accurate record-keeping and smooth financial transactions.

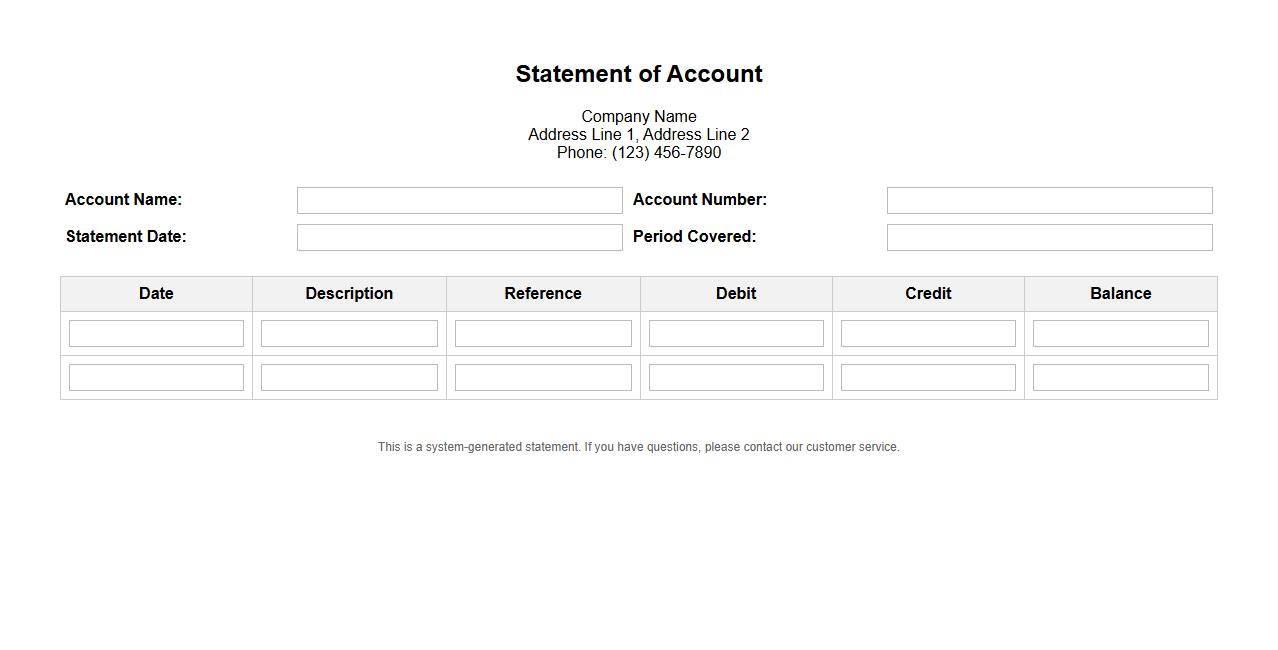

Statement of Account

A Statement of Account is a detailed summary of all financial transactions between a customer and a business over a specific period. It helps in tracking payments, outstanding balances, and credits. This document ensures transparency and accurate record-keeping for both parties.

What entities are involved in the Invoice Payment Application document process?

The primary entities involved in the Invoice Payment Application process include the payer, the payee, and the invoice issuer. Additional entities such as the financial institution and accounting system play crucial roles in processing and recording payments. Collaboration among these entities ensures accurate and timely payment application and reconciliation.

What data fields are mandatory for processing invoice payments?

Mandatory data fields for processing invoice payments include the invoice number, payment amount, and payer details. Additionally, fields such as payment date and currency are essential for accurate processing. These core fields ensure that payments are applied correctly to their corresponding invoices.

How is the payment status tracked and updated in the document?

The payment status is tracked using specific data fields like payment state or status code within the invoice payment document. Status updates occur automatically upon receipt of payment confirmation or manual intervention during reconciliation. Accurate status tracking enables real-time visibility into pending and completed payments.

What validation rules apply to the invoice numbers within the application?

Invoice numbers in the application must adhere to format validation rules such as specific length, allowed characters, and checksum verification. Additionally, the system checks for uniqueness to prevent duplicates and ensures the invoice number corresponds with existing records. These validations maintain data integrity and prevent payment misapplication.

How are payment terms and due dates represented in the document structure?

Payment terms and due dates are typically represented as distinct fields within the invoice payment document structure. The payment terms define the agreed timeline for payment, while due date fields specify the exact deadline for settlement. Proper representation ensures compliance with contractual obligations and guides automated payment reminders.