A Invoice Cancellation Request is a formal procedure used to void an issued invoice due to errors or changes in the transaction details. It ensures accurate financial records and prevents discrepancies in accounting systems. Businesses typically require valid reasons and proper authorization before processing the cancellation.

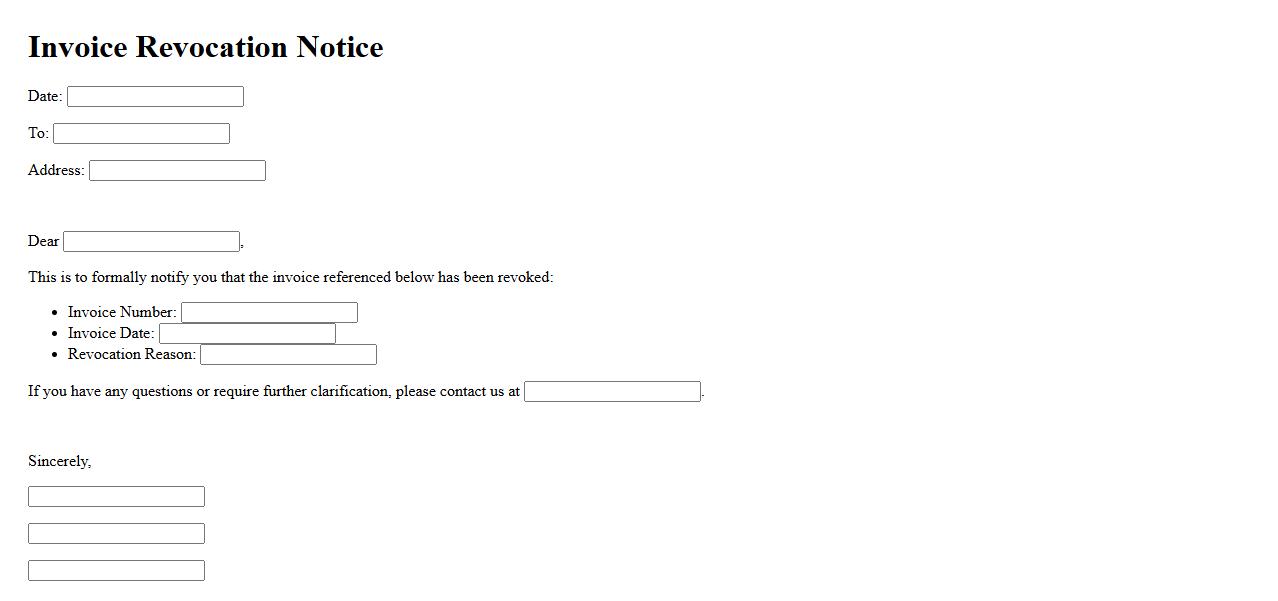

Invoice Revocation Notice

An Invoice Revocation Notice is a formal document issued to cancel or withdraw a previously sent invoice. It ensures that both parties acknowledge the change and prevents any payment processing based on the revoked invoice. This notice helps maintain accurate financial records and clear communication between businesses.

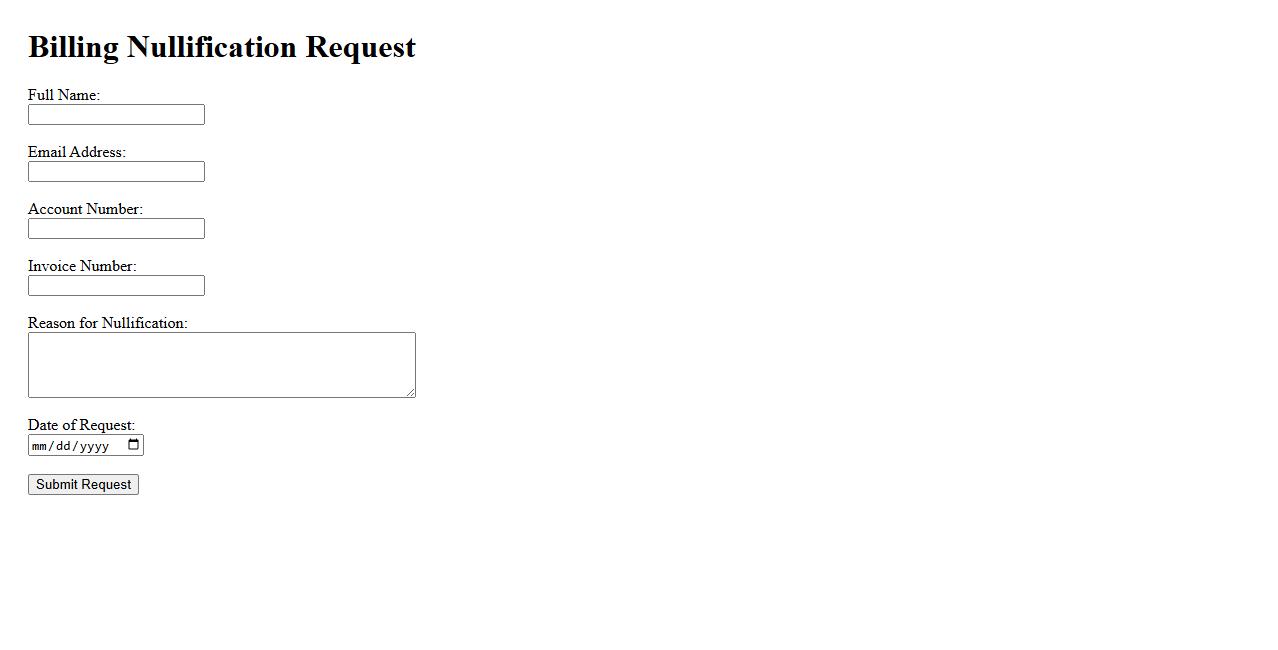

Billing Nullification Request

A Billing Nullification Request is a formal process used to cancel or invalidate a previously issued invoice. This request is typically submitted when an error is found in billing details or when services were not rendered as billed. It ensures accurate financial records and prevents incorrect charges to customers.

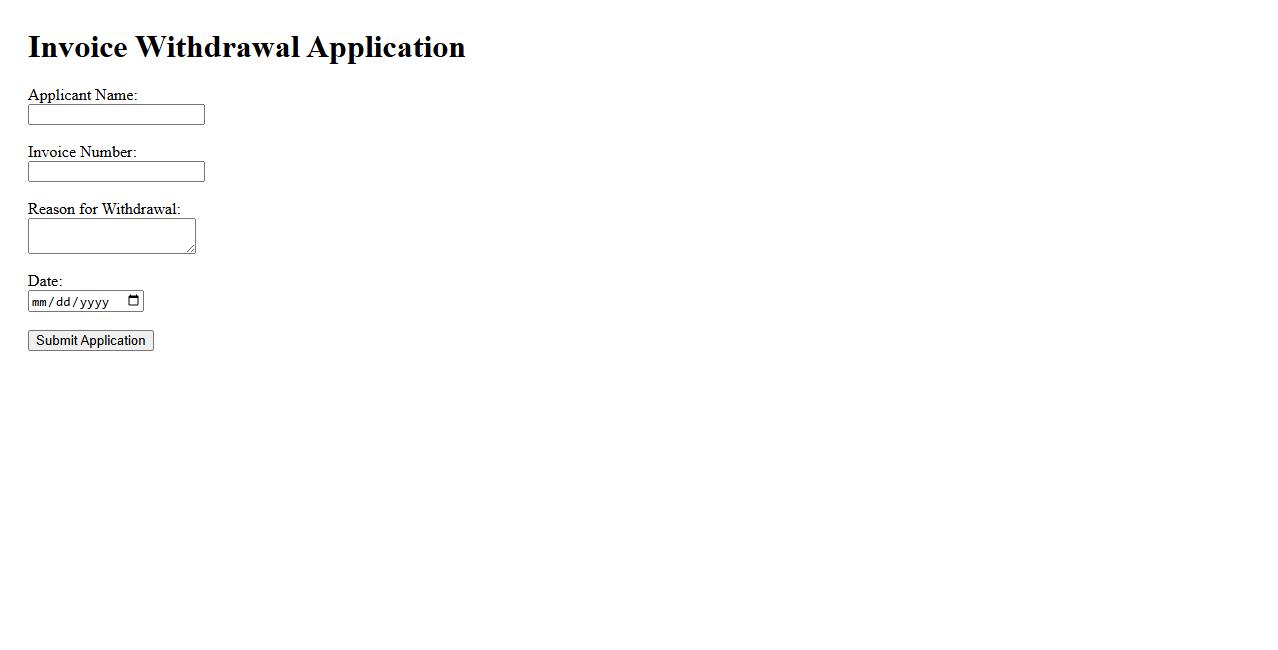

Invoice Withdrawal Application

The Invoice Withdrawal Application allows users to request the cancellation or modification of previously submitted invoices efficiently. This process ensures accurate financial records and streamlines administrative workflows. By using this application, businesses can maintain compliance and reduce errors in billing.

Charge Void Request

A Charge Void Request is a transaction process used to cancel a previously authorized payment before it is settled. This request ensures that the funds are not captured, effectively reversing the initial authorization. It is commonly used to prevent duplicate charges or correct errors in payment processing.

Invoice Annulment Form

The Invoice Annulment Form is used to officially cancel or void an issued invoice, ensuring accurate financial records. This form helps businesses correct errors and prevent payment confusion. Proper use of the form maintains transparency and compliance with accounting regulations.

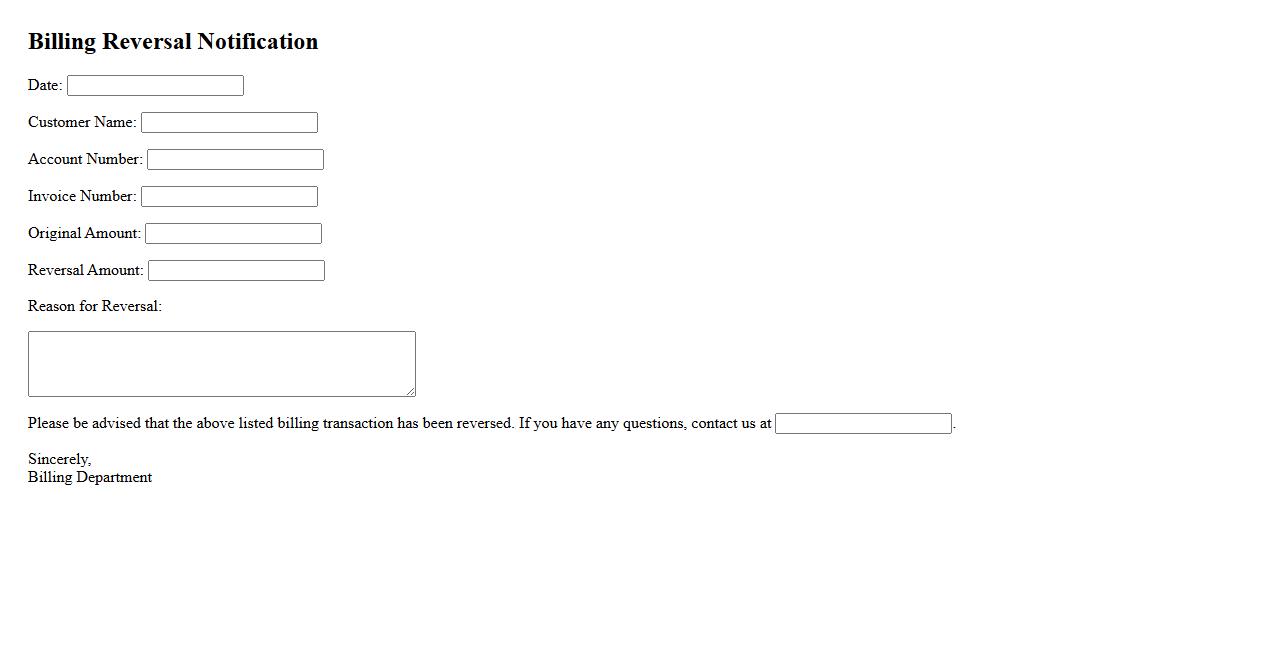

Billing Reversal Notification

A Billing Reversal Notification informs customers of a recent transaction reversal due to errors or disputes. This notification ensures transparency and keeps users updated on their account status. Prompt awareness helps resolve any billing issues efficiently.

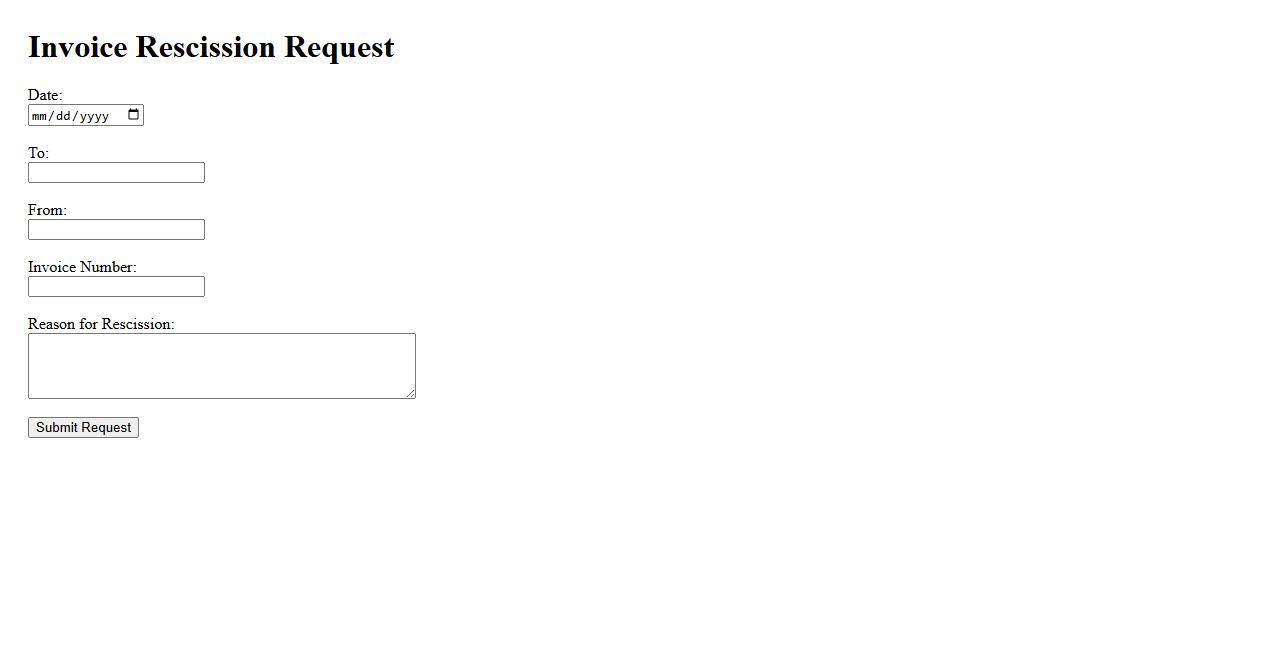

Invoice Rescission Request

An Invoice Rescission Request is a formal appeal to cancel or reverse a previously issued invoice due to errors or disputes. This process helps maintain accurate financial records and ensures both parties agree on the transaction details. Timely submission of the request is essential for effective resolution.

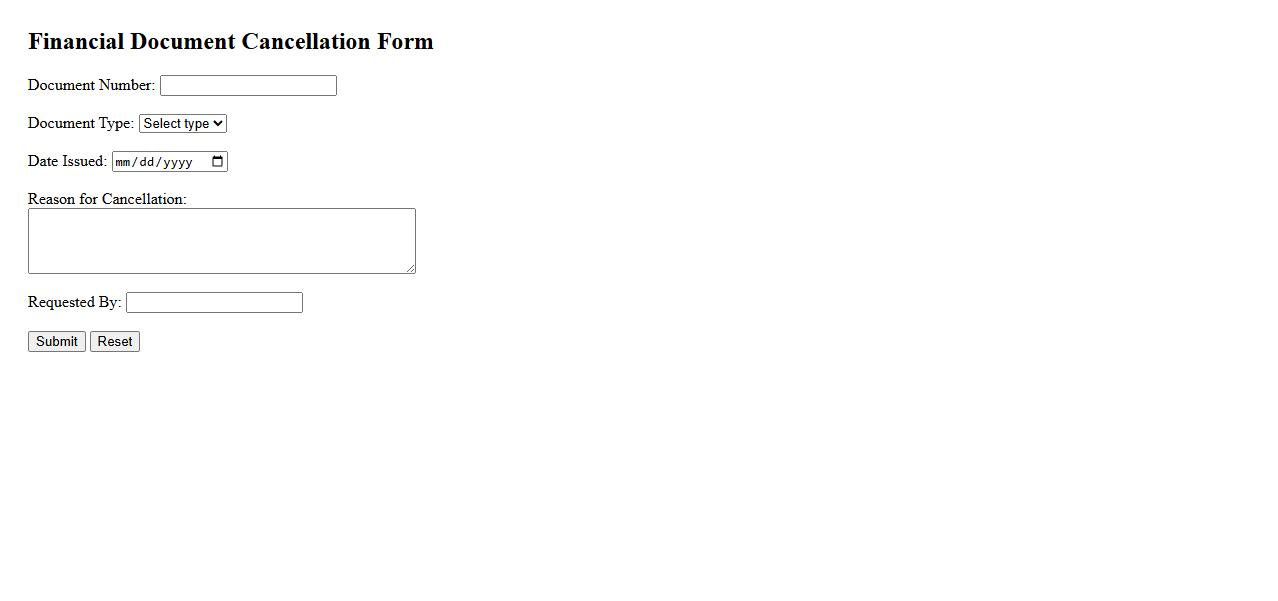

Financial Document Cancellation Form

The Financial Document Cancellation Form is used to officially void or cancel a financial record such as invoices, checks, or transaction receipts. This form ensures accurate record-keeping and prevents unauthorized use of the canceled documents. It is essential for maintaining transparent and compliant financial processes within an organization.

Invoice Deletion Request

An Invoice Deletion Request is a formal application submitted to remove an invoice from a company's financial records. This process ensures accuracy in billing and accounting by eliminating incorrect or duplicate invoices. Proper documentation and approval are required to validate the deletion.

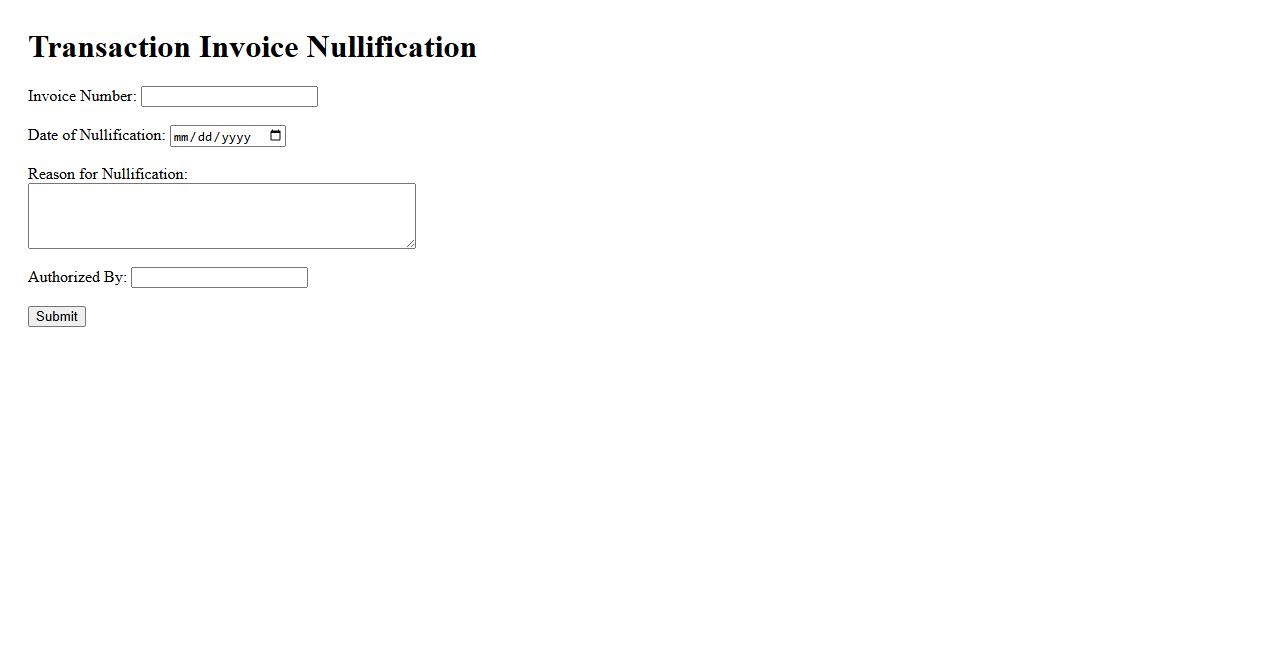

Transaction Invoice Nullification

Transaction Invoice Nullification is the process of canceling or voiding a previously issued invoice to correct errors or invalid transactions. This ensures accurate financial records and compliance with accounting standards. It is essential for maintaining transparent and reliable business accounting practices.

What is the primary reason for submitting an Invoice Cancellation Request?

The primary reason for submitting an Invoice Cancellation Request is to correct errors found in an invoice after it has been issued. This may include incorrect amounts, wrong client details, or duplicated invoices. Canceling the invoice ensures accurate billing and prevents financial discrepancies.

Which mandatory details must be included in an Invoice Cancellation Request document?

A valid Invoice Cancellation Request must include the invoice number, date of issue, and the reason for cancellation. Additionally, the request should contain the details of the issuing party and the recipient to verify the invoice status. Clear and complete information helps in processing the cancellation efficiently.

Who is authorized to approve an Invoice Cancellation Request?

The approval of an Invoice Cancellation Request is typically granted by the finance manager or an authorized accounting officer. This ensures that cancellations are reviewed and validated by responsible personnel. Authorization prevents unauthorized modifications to financial records.

What impact does canceling an invoice have on financial records and reporting?

Canceling an invoice directly affects the accuracy of financial records and reporting by removing incorrect entries from the accounting system. It ensures that revenue and tax reporting reflect the true transactional data. Proper cancellation helps maintain compliance with regulatory requirements.

Are there any time restrictions or conditions for requesting an invoice cancellation?

There are generally specific timeframes and conditions for requesting an invoice cancellation to ensure regulatory compliance. Requests must be submitted promptly after invoice issuance, often within a stipulated period set by local tax laws or company policies. Adhering to these limits avoids penalties and processing delays.