The Invoice Receipt Form serves as a crucial document that records the details of a financial transaction between a buyer and a seller. It typically includes information such as the invoice number, date, items or services purchased, quantities, prices, taxes, and the total amount paid. This form helps ensure accurate bookkeeping, facilitates payment tracking, and provides proof of purchase for both parties.

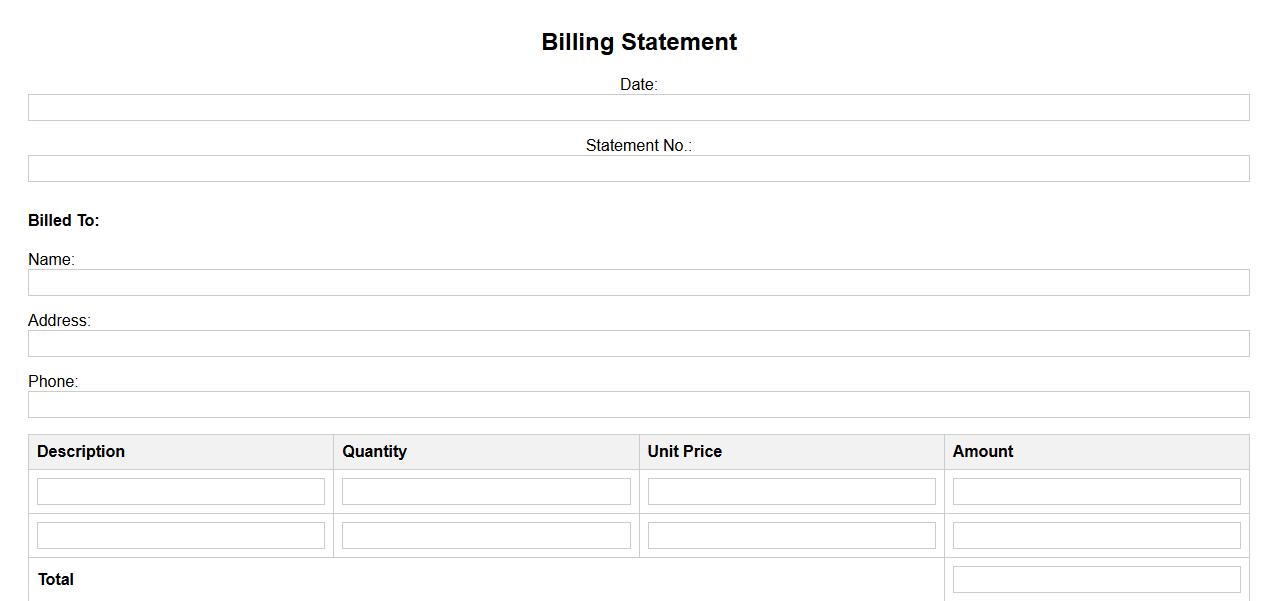

Billing Statement

A Billing Statement is a detailed document that summarizes charges, payments, and outstanding balances for a specific billing period. It provides clarity on the services or products billed and helps customers track their financial transactions. Regularly reviewing your billing statement ensures accurate payment and avoids discrepancies.

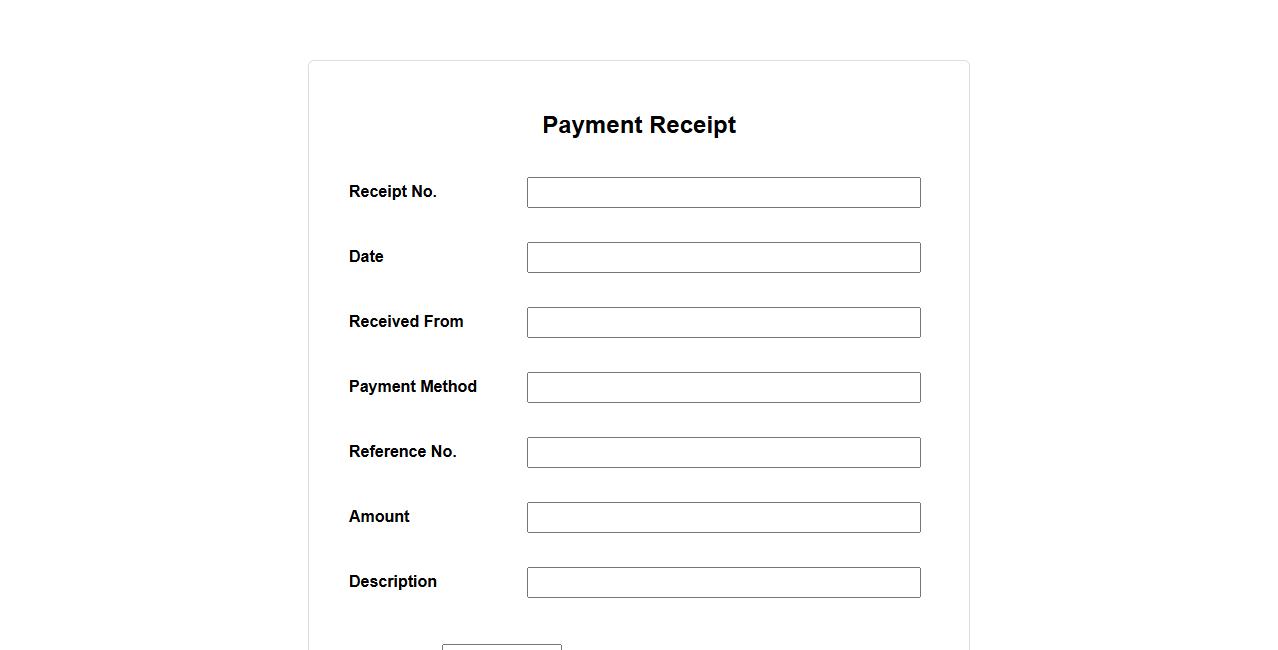

Payment Receipt

A payment receipt is an official document that confirms a transaction has been completed. It serves as proof of payment for both the buyer and the seller, detailing the amount paid and the date of the transaction. This receipt is essential for record-keeping and resolving any future disputes.

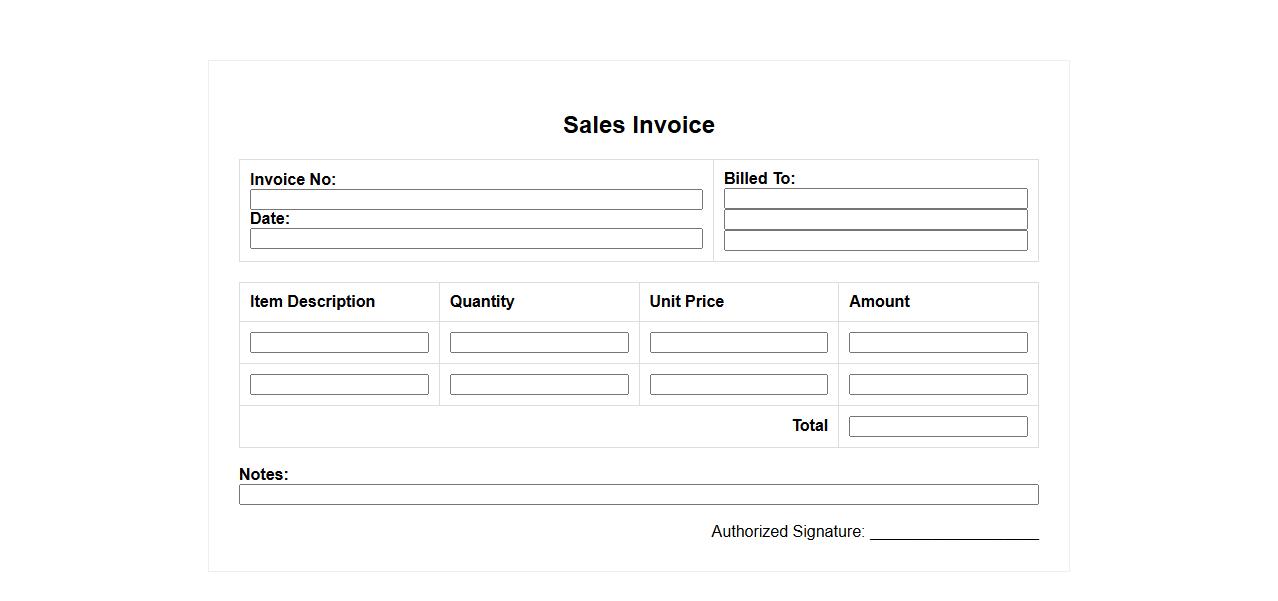

Sales Invoice

A Sales Invoice is a crucial document issued by a seller to a buyer, detailing the products or services provided, their quantities, and agreed prices. It serves as a formal request for payment and helps both parties keep accurate financial records. This document ensures transparency and legal validity in commercial transactions.

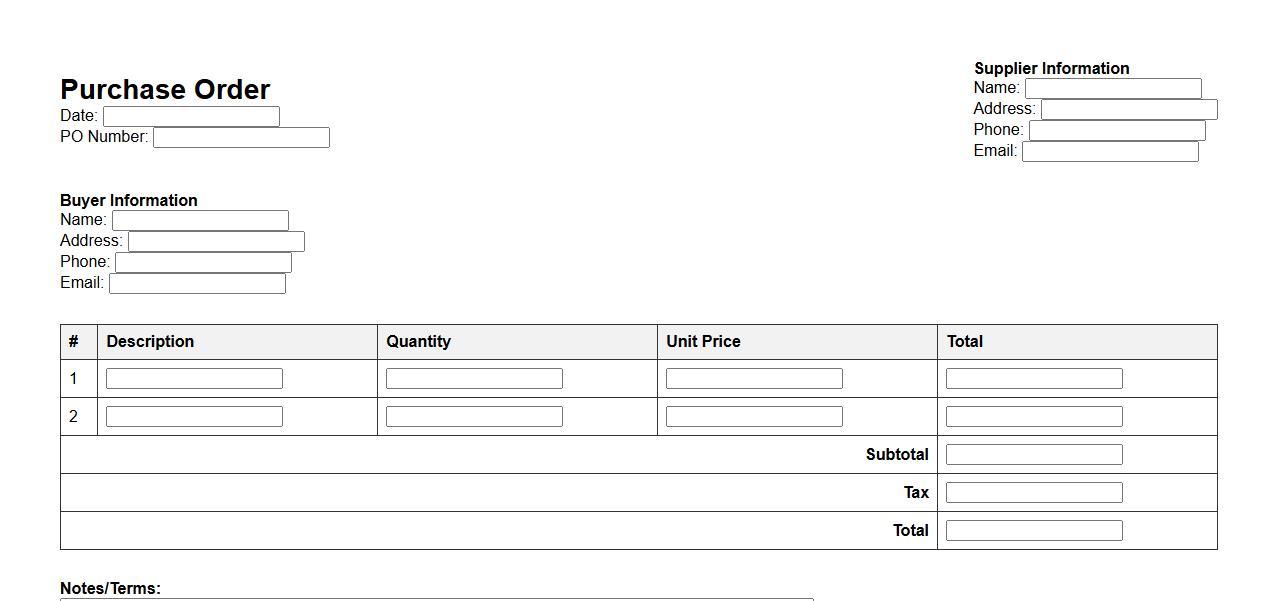

Purchase Order

A Purchase Order is a formal document issued by a buyer to a seller, outlining the products or services required. It serves as a legally binding agreement, detailing quantities, prices, and delivery terms. This ensures clear communication and facilitates smooth transaction processes between businesses.

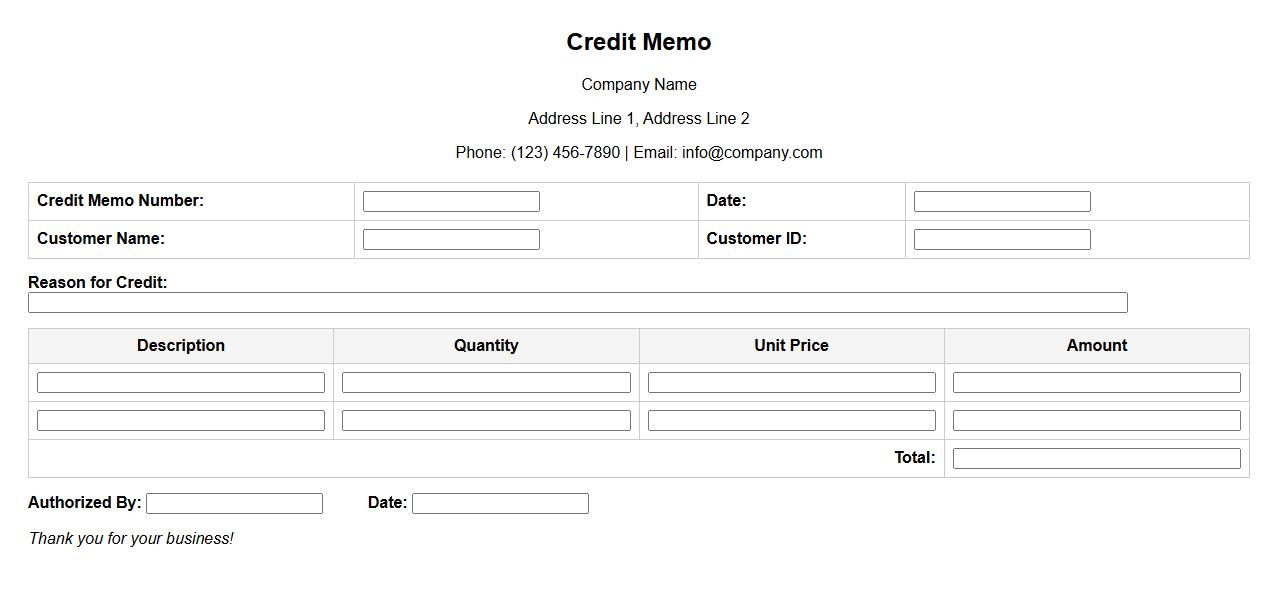

Credit Memo

A Credit Memo is a document issued by a seller to a buyer, reducing the amount owed due to returns, errors, or adjustments. It serves as a formal notification that a credit has been applied to the buyer's account. This helps maintain accurate financial records and facilitates smooth transaction reconciliations.

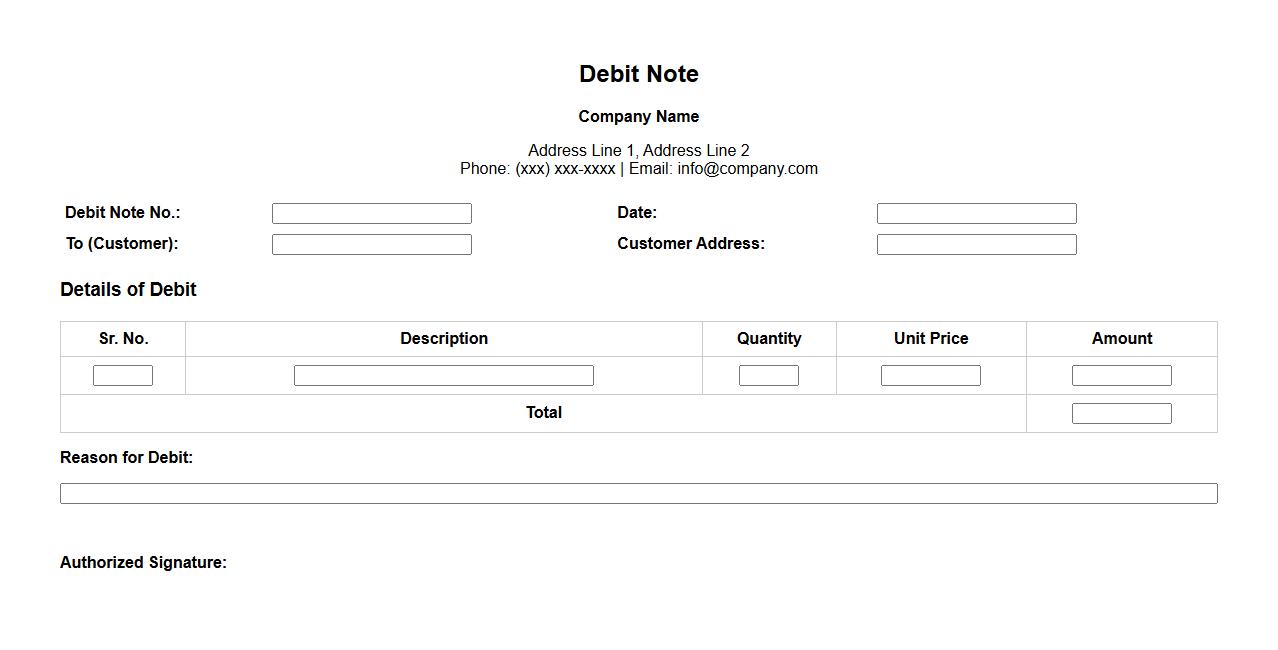

Debit Note

A Debit Note is a commercial document issued by a buyer to a seller as a formal request for a credit note. It typically indicates returns, allowances, or price adjustments related to a previous invoice. This document helps maintain accurate financial records and resolve discrepancies between parties.

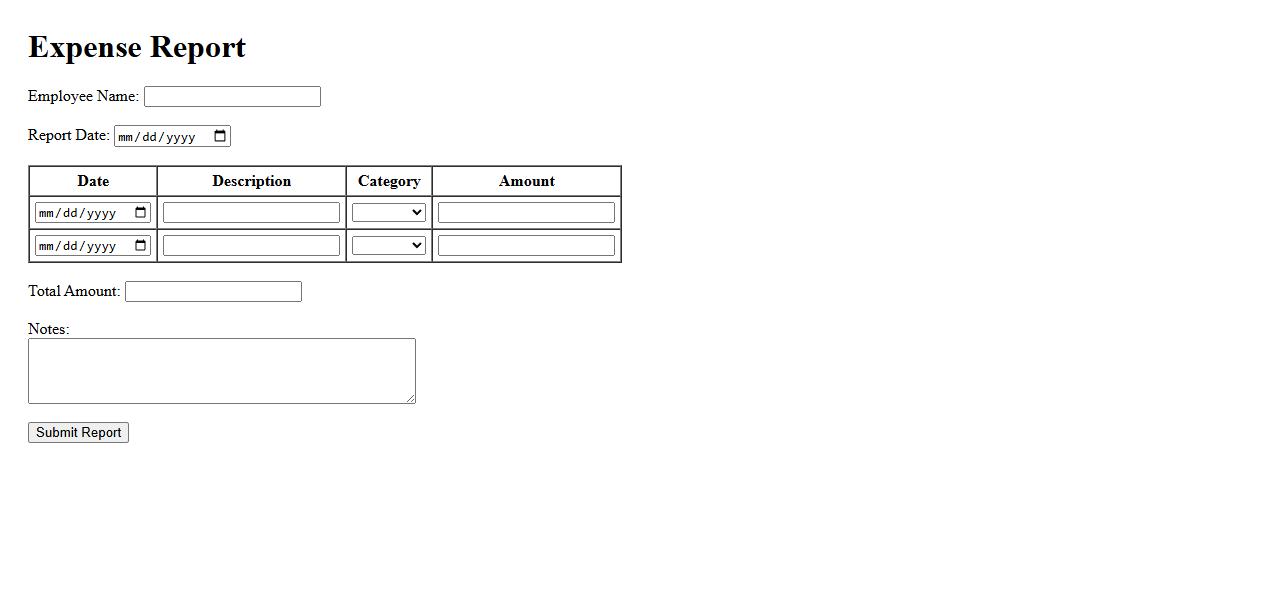

Expense Report

An expense report is a detailed document that tracks and itemizes all business-related expenditures. It helps organizations monitor spending, ensure budget compliance, and facilitate reimbursement processes. Accurate expense reports are essential for financial transparency and effective cost management.

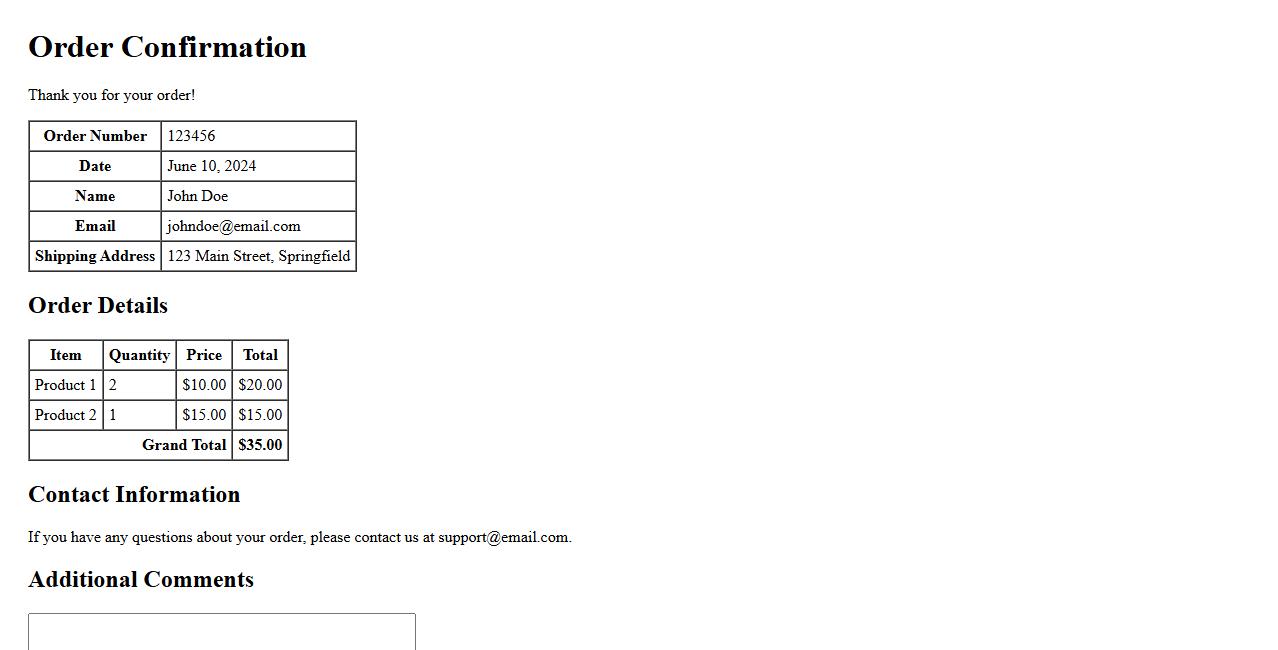

Order Confirmation

Your order confirmation is an important receipt that verifies your purchase and provides all the essential details. You will receive an email summarizing your items, shipping address, and estimated delivery date. Keep this confirmation for your records and future reference.

Remittance Advice

Remittance Advice is a document sent by a customer to a supplier, detailing the payment made for an invoice. It helps the supplier reconcile payments and update their accounts receivable. This notice ensures clear communication and accurate financial records.

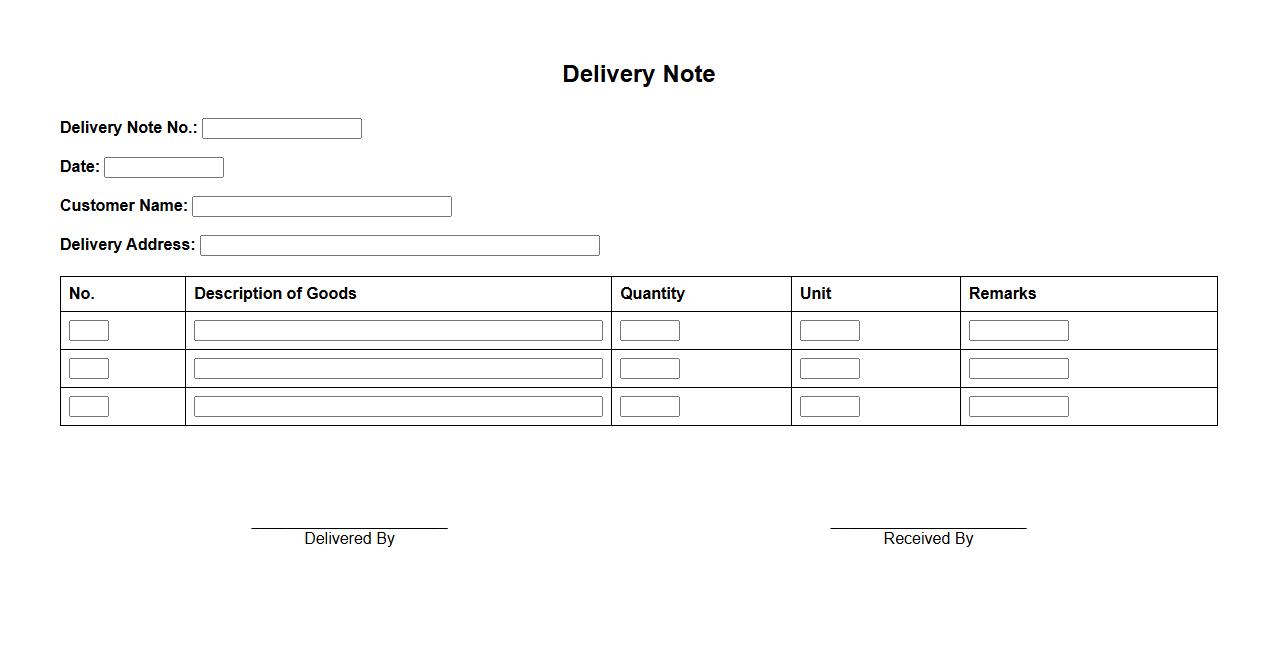

Delivery Note

A Delivery Note is a crucial document issued during the shipment of goods, detailing the items delivered to the recipient. It serves as proof of delivery and helps verify the quantity and condition of products received. This document facilitates smooth transactions and ensures transparency between the sender and the receiver.

What information is required to identify the invoice sender on the receipt form?

The invoice sender's details include the company name, address, and contact information. This ensures clarity on who issued the invoice. Proper identification aids in verifying the authenticity of the invoice.

Which details on the form verify the invoice amount and payment terms?

The form must display the invoice total amount, including taxes and discounts. Payment terms such as due date and payment method are also essential. These details confirm accurate billing and clarify financial expectations.

How does the form capture the date and method of invoice receipt?

The form includes fields for the date the invoice was received to track timely processing. It also records the method of receipt, such as email, postal mail, or hand delivery. This helps maintain a clear record for audit and follow-up purposes.

What fields ensure alignment between received goods/services and invoice items?

Fields like description of goods or services, quantities, and unit prices are critical. These enable verification that billed items match what was delivered or rendered. Accurate matching prevents payment errors and discrepancies.

How does the form support approval and authorization of the invoice?

The form includes sections for signatures, dates, and approver names to document authorization. This process ensures that invoices are reviewed and approved by responsible personnel. It establishes accountability before payment is processed.