The Invoice Delivery Confirmation Form ensures that the recipient has received the invoice accurately and on time, serving as a vital proof of transaction completion. This form helps streamline accounting processes by verifying delivery details and minimizing disputes related to payment delays. Businesses rely on it to maintain transparent communication and secure prompt payment confirmations.

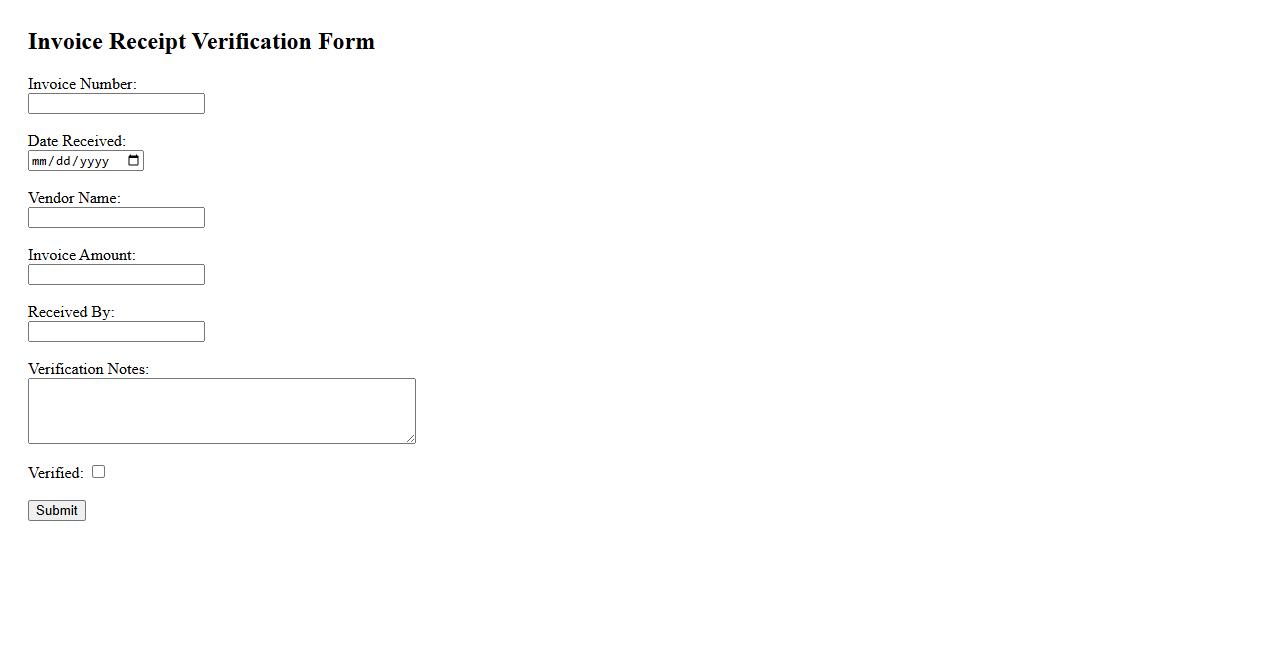

Invoice Receipt Verification Form

The Invoice Receipt Verification Form ensures accurate tracking and validation of purchased goods or services. It helps confirm that all items invoiced have been received and match the agreed terms. This form is essential for maintaining transparency in financial transactions and preventing discrepancies.

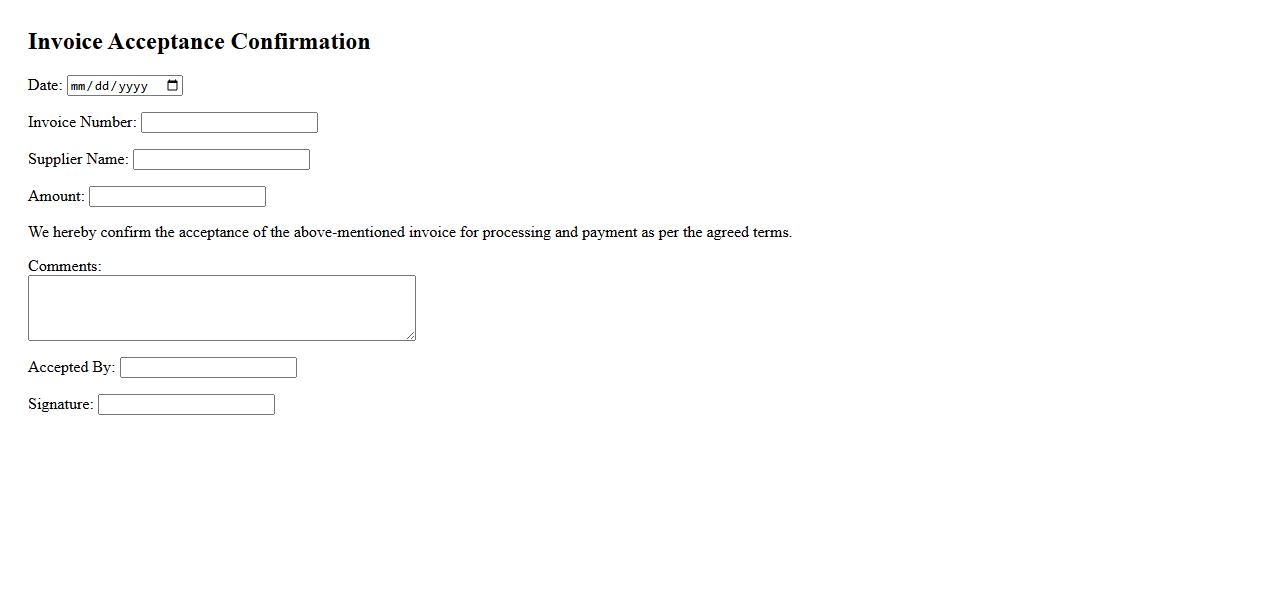

Invoice Acceptance Confirmation

The Invoice Acceptance Confirmation is a crucial document that verifies the receipt and approval of an invoice by the recipient. It ensures that all billing details are accurate and accepted before proceeding with payment. This confirmation helps maintain transparency and accountability in financial transactions.

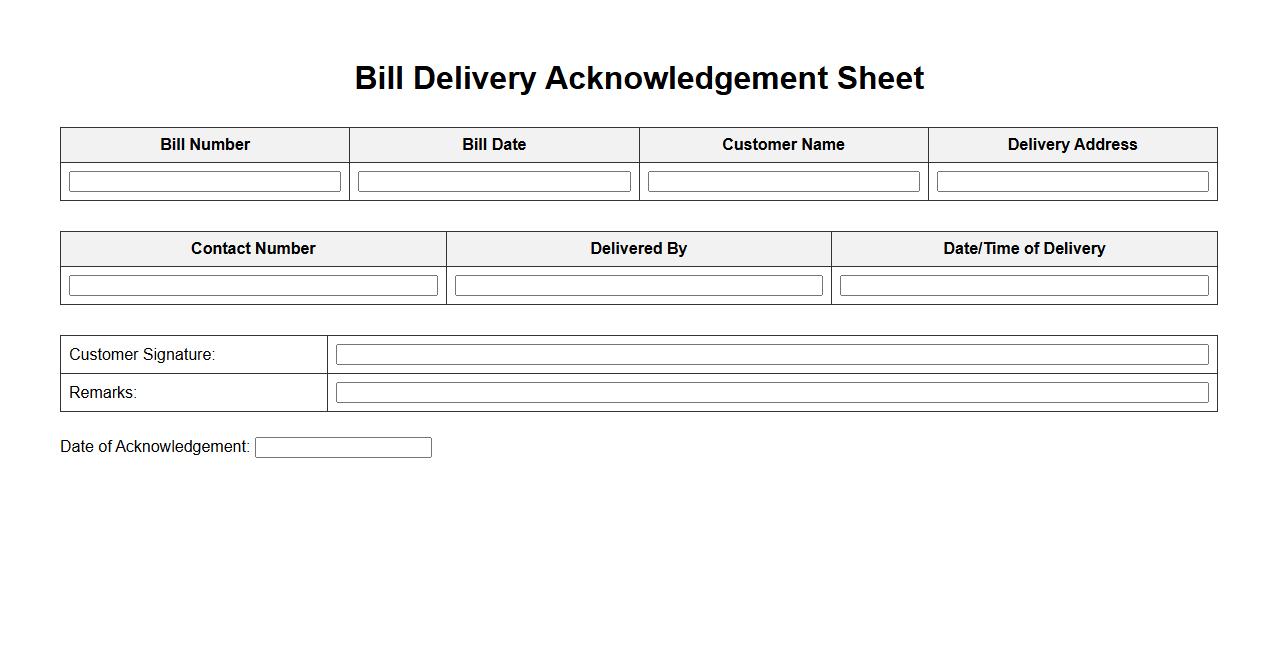

Bill Delivery Acknowledgement Sheet

The Bill Delivery Acknowledgement Sheet serves as a formal document verifying the receipt of goods or services along with the corresponding bill. It ensures accurate record-keeping and protects both parties by confirming delivery details. This sheet is essential for maintaining transparent business transactions and payment processing.

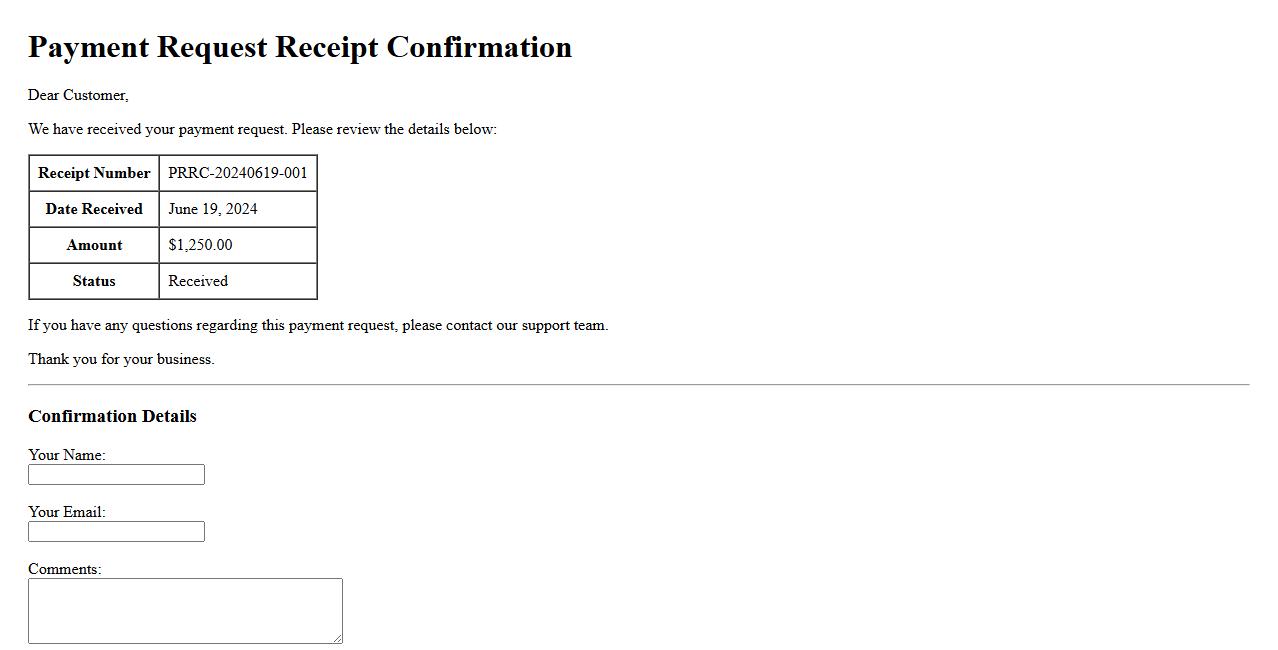

Payment Request Receipt Confirmation

The Payment Request Receipt Confirmation ensures that your transaction has been successfully received and processed. It provides a secure acknowledgment for both the payer and the recipient, confirming payment details instantly. This confirmation enhances transparency and trust in your financial exchanges.

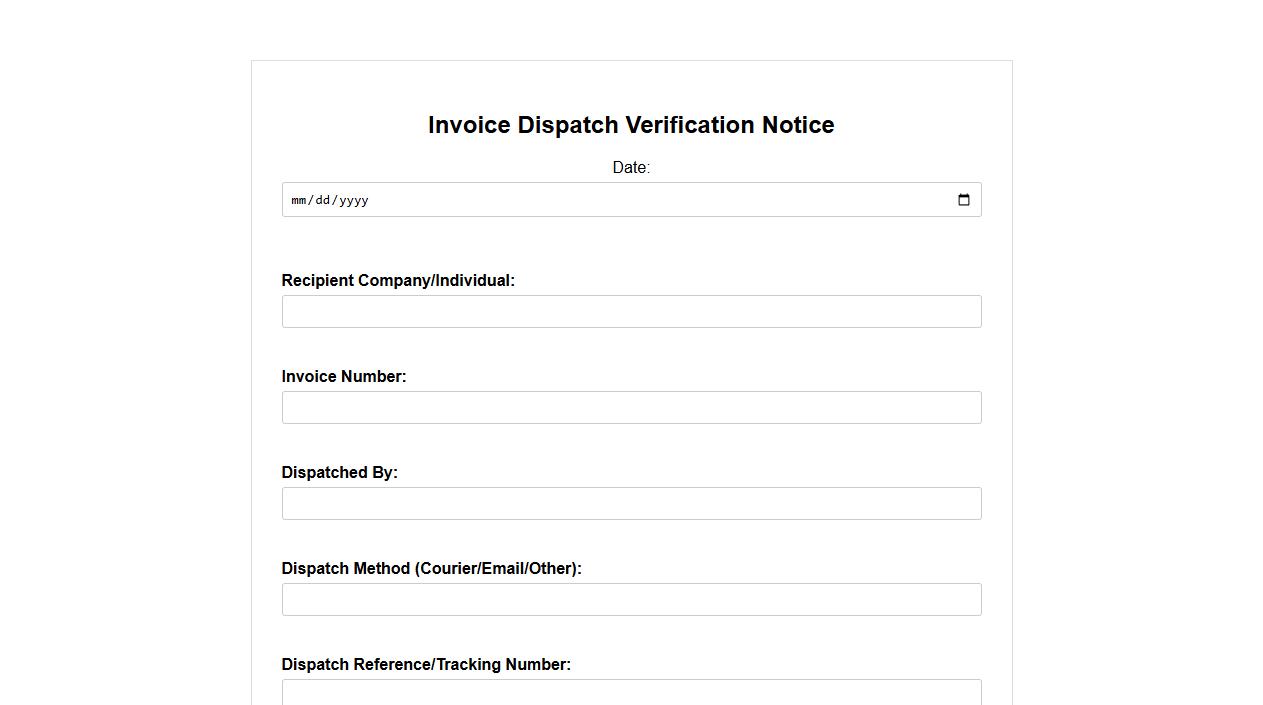

Invoice Dispatch Verification Notice

The Invoice Dispatch Verification Notice serves as an official confirmation that an invoice has been successfully sent to the recipient. This notice ensures transparency and helps both parties track the status of financial documents. It is essential for maintaining accurate records and facilitating prompt payment processing.

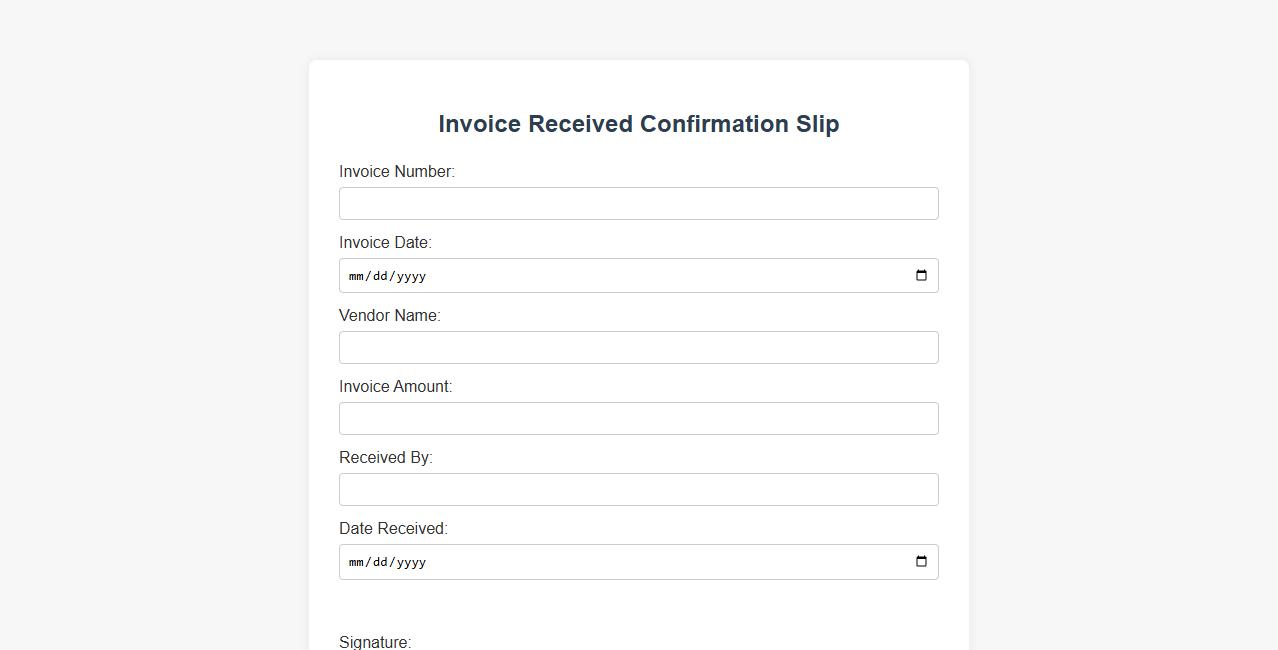

Invoice Received Confirmation Slip

The Invoice Received Confirmation Slip serves as an official acknowledgment that a specific invoice has been received by the accounts department. This document helps streamline payment processes and ensures accurate record-keeping. It acts as proof for both the sender and receiver, minimizing disputes and enhancing financial transparency.

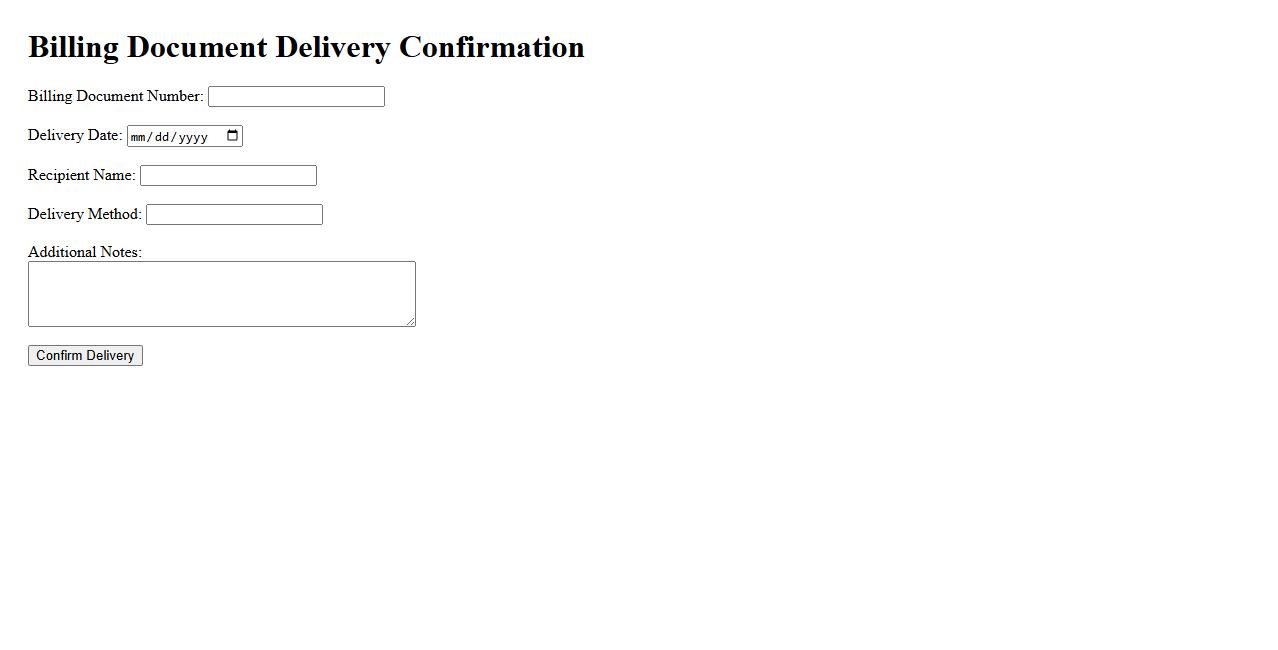

Billing Document Delivery Confirmation

The Billing Document Delivery Confirmation ensures that invoices and billing statements have been successfully received by the designated recipients. This confirmation provides a reliable audit trail for financial transactions and aids in maintaining accurate accounting records. It enhances communication efficiency between businesses and clients by verifying document delivery status.

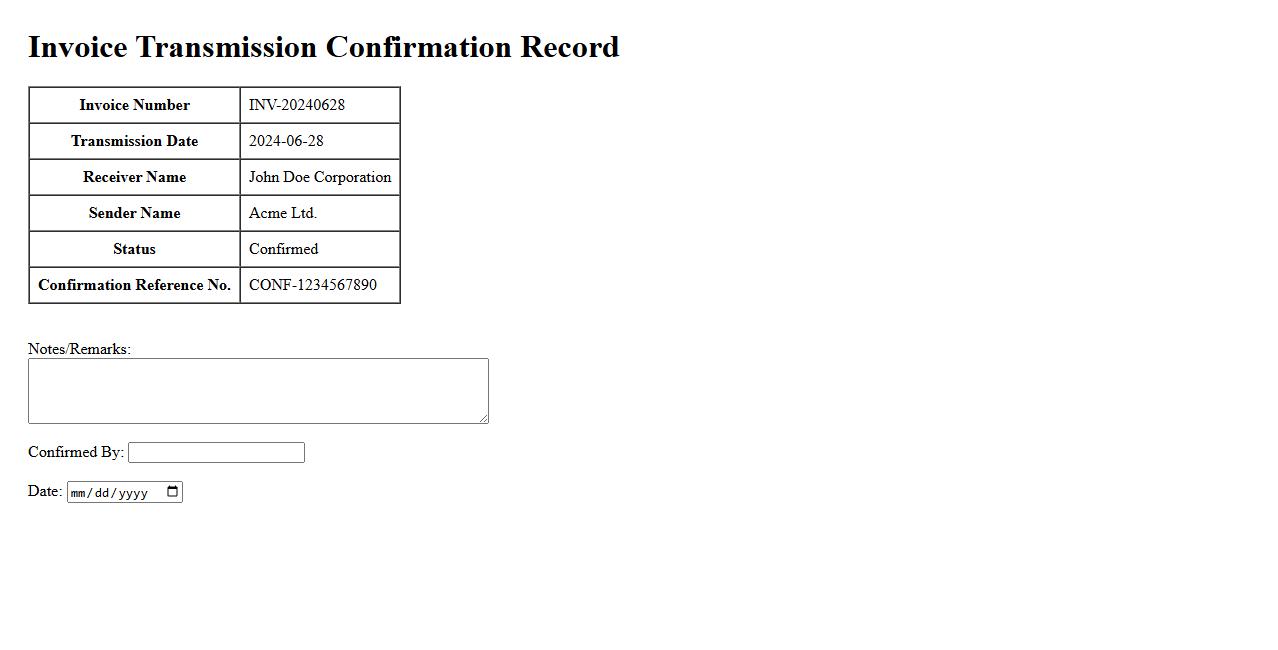

Invoice Transmission Confirmation Record

The Invoice Transmission Confirmation Record serves as a vital document verifying that an invoice has been successfully sent and received. It provides a timestamp and delivery status, ensuring transparency in financial transactions. This record helps streamline accounting processes and resolve disputes efficiently.

Invoice Distribution Acknowledgment Form

The Invoice Distribution Acknowledgment Form ensures that all parties have received and reviewed the invoice accurately. This document serves as a confirmation of receipt, helping to streamline payment processes and reduce disputes. Timely acknowledgment supports efficient financial management and record keeping.

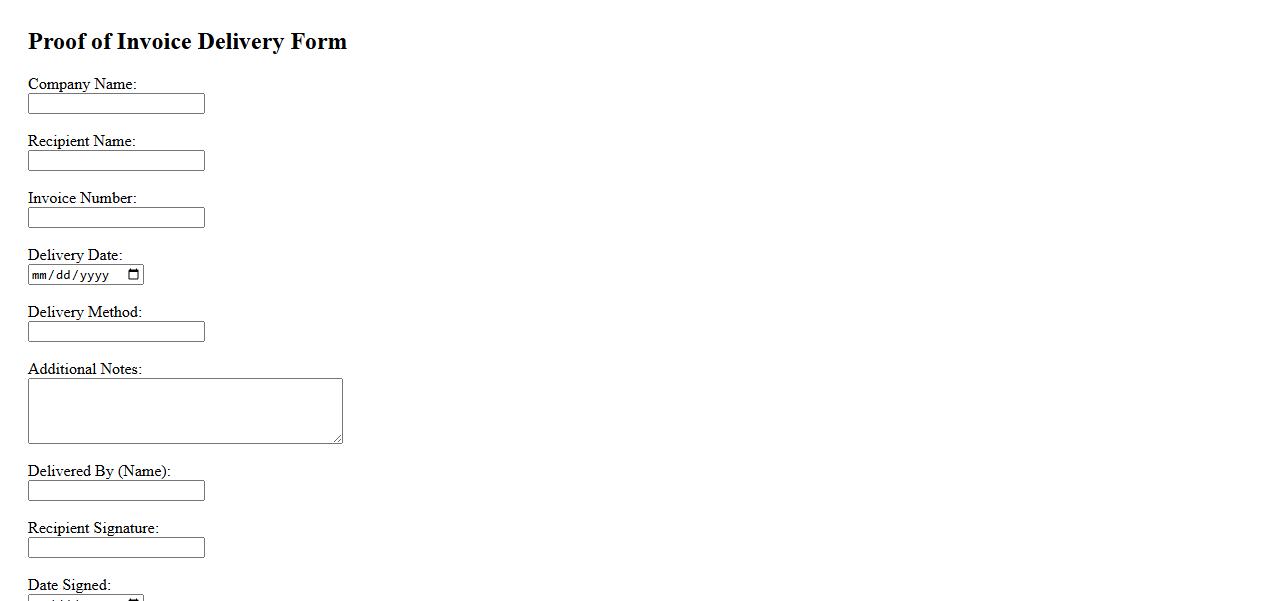

Proof of Invoice Delivery Form

The Proof of Invoice Delivery Form is a crucial document used to confirm that an invoice has been successfully delivered to the intended recipient. It helps ensure transparency and accountability in financial transactions by providing a record of delivery. This form is essential for both businesses and clients to verify the receipt of billing statements promptly.

What is the primary purpose of the Invoice Delivery Confirmation Form?

The primary purpose of the Invoice Delivery Confirmation Form is to ensure that the invoice has been successfully delivered and received by the intended recipient. This form acts as proof of delivery, helping to establish clear communication between the sender and receiver. It also aids in preventing any disputes related to invoice receipt and payment delays.

Which details are required to confirm the receipt of an invoice?

To confirm the receipt of an invoice, essential details such as the invoice number, delivery date, recipient's name, and contact information are required. Additionally, the form may require specific information regarding the invoice amount and description of goods or services. These details help verify the authenticity and accuracy of the delivered invoice.

Who is authorized to sign or acknowledge the Invoice Delivery Confirmation Form?

The person authorized to sign or acknowledge the Invoice Delivery Confirmation Form is typically an employee or representative of the receiving department responsible for processing invoices. This might include a finance officer, accounts payable manager, or other authorized personnel. Their signature acts as official confirmation that the invoice was received in good order.

How does the form verify the date and method of invoice delivery?

The form records the exact delivery date and specifies the method of delivery, such as email, postal mail, or courier service. This information is crucial for tracking the invoice's transit and confirming timely receipt. Verification of these details ensures transparency and accountability in the invoice delivery process.

What steps should be taken if there is a discrepancy noted on the confirmation form?

If a discrepancy is noted on the Invoice Delivery Confirmation Form, the recipient should immediately inform the sender or the accounts payable department. The issue must be documented and investigated to resolve errors related to invoice amounts, delivery dates, or invoice contents. Prompt corrective actions help maintain accurate records and prevent payment delays.