An Invoice for Freelance Services PDF is a professional document that outlines the details of work completed, including services provided, rates, and payment terms. This format ensures easy sharing and printing while maintaining a clear and organized presentation for both the freelancer and client. Using a PDF invoice helps streamline the billing process and supports accurate financial record-keeping.

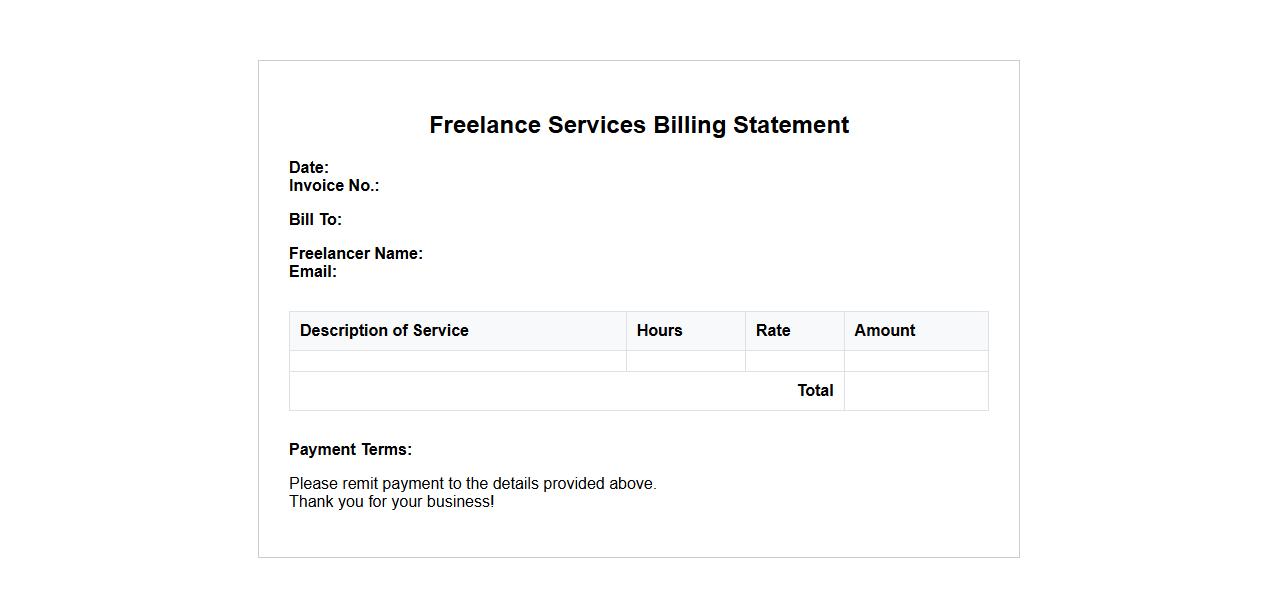

Freelance Services Billing Statement

The Freelance Services Billing Statement provides a clear and detailed summary of services rendered along with the corresponding charges. It ensures transparent communication between freelancers and clients, facilitating timely payments. This document is essential for maintaining accurate financial records and building professional trust.

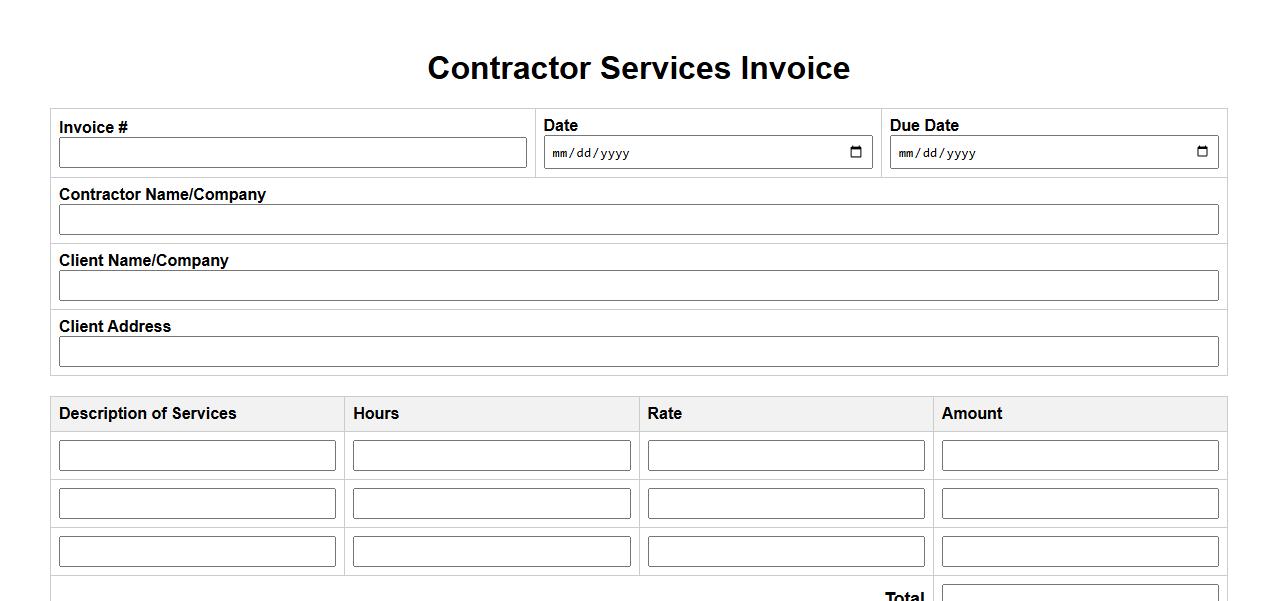

Contractor Services Invoice

An Contractor Services Invoice is a detailed billing document provided by contractors to clients for completed work or services. It outlines the scope of work, labor charges, materials used, and payment terms. This invoice ensures clear communication and timely payment for contracted projects.

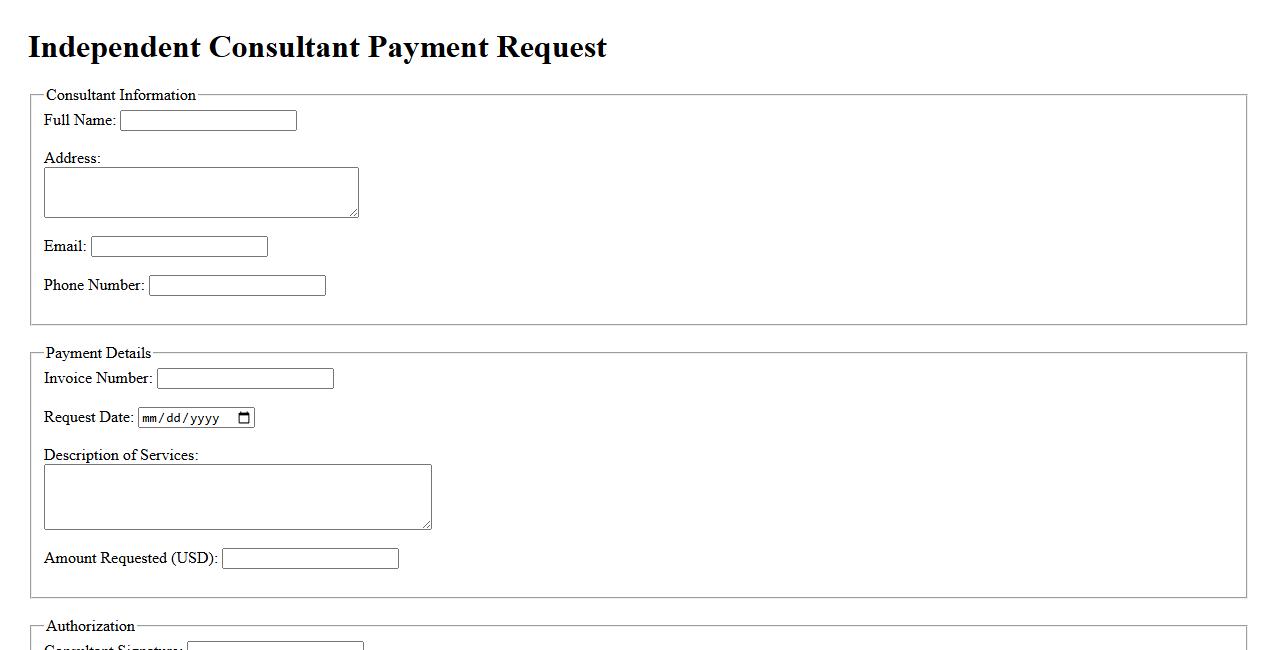

Independent Consultant Payment Request

An Independent Consultant Payment Request is a formal document submitted by a consultant to request compensation for services rendered. It typically includes details such as the project description, hours worked, and agreed-upon rates. This ensures timely and accurate payment processing between consultants and clients.

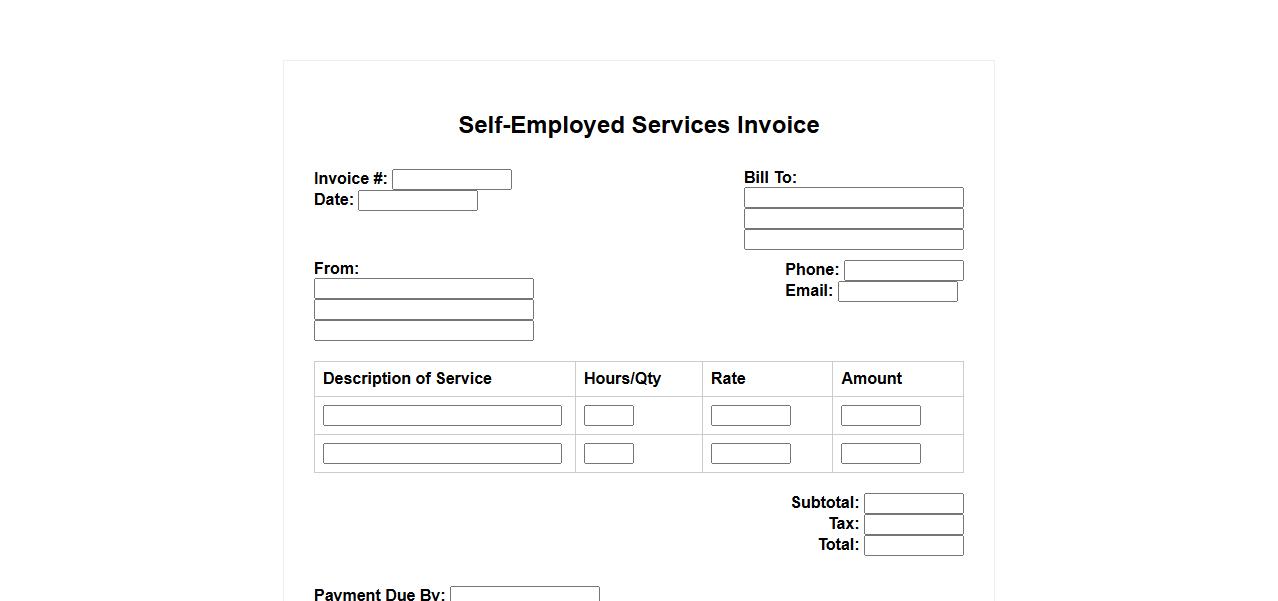

Self-Employed Services Invoice

A Self-Employed Services Invoice is a formal document used by freelancers or independent contractors to bill clients for completed work. It outlines the services provided, rates, and total amount due, ensuring clear communication and payment terms. This invoice helps maintain professional records and facilitates timely payments.

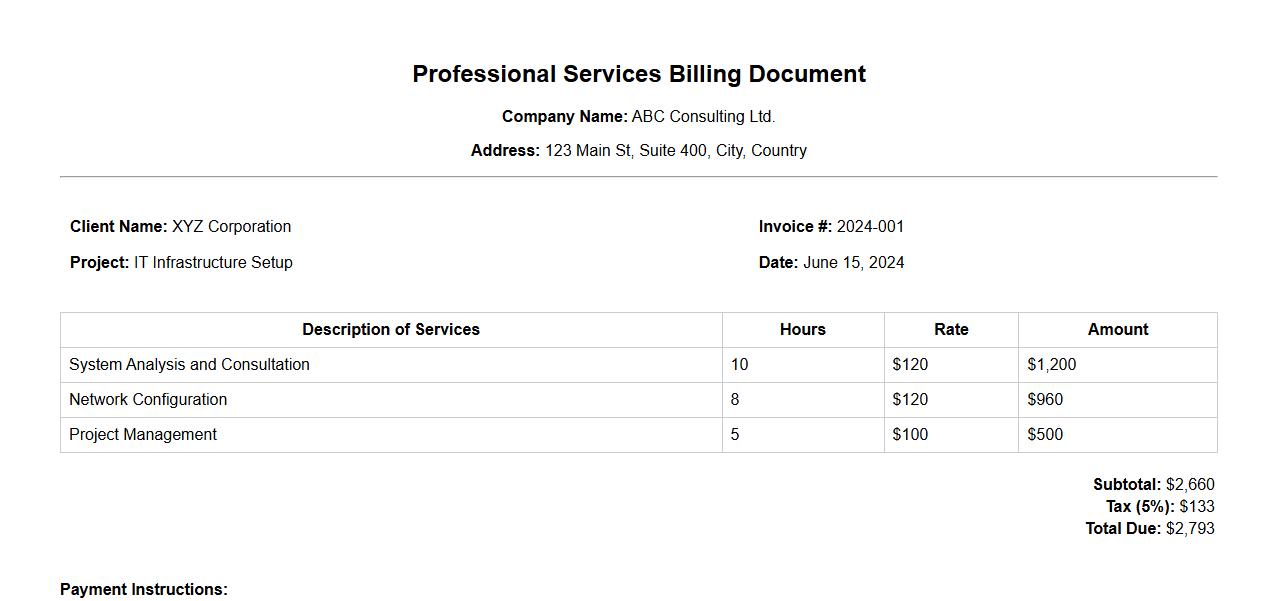

Professional Services Billing Document

The Professional Services Billing Document details all charges for specialized services rendered by experts. It ensures transparent communication of fees, hours worked, and project specifics to clients. This document aids in accurate invoicing and financial record-keeping.

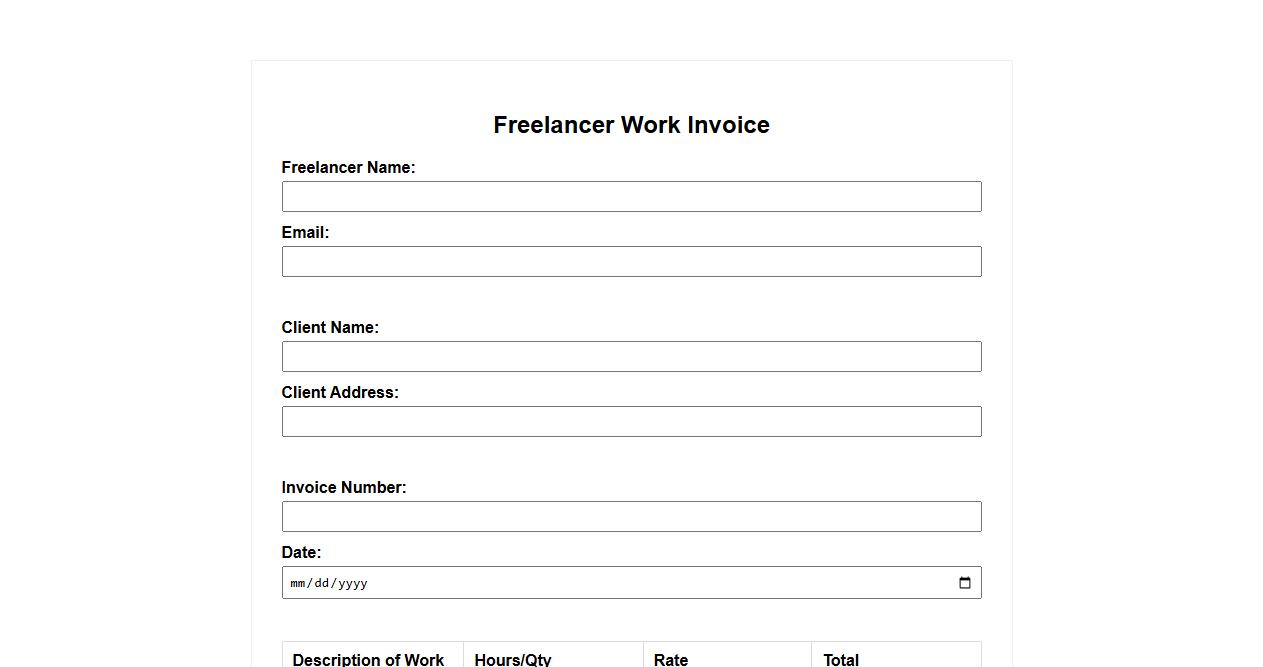

Freelancer Work Invoice

An Freelancer Work Invoice is a detailed document that outlines the services provided by a freelancer, including the agreed-upon rates and payment terms. It serves as a formal request for payment and helps keep financial transactions organized. Using a clear and professional invoice ensures timely compensation and enhances client communication.

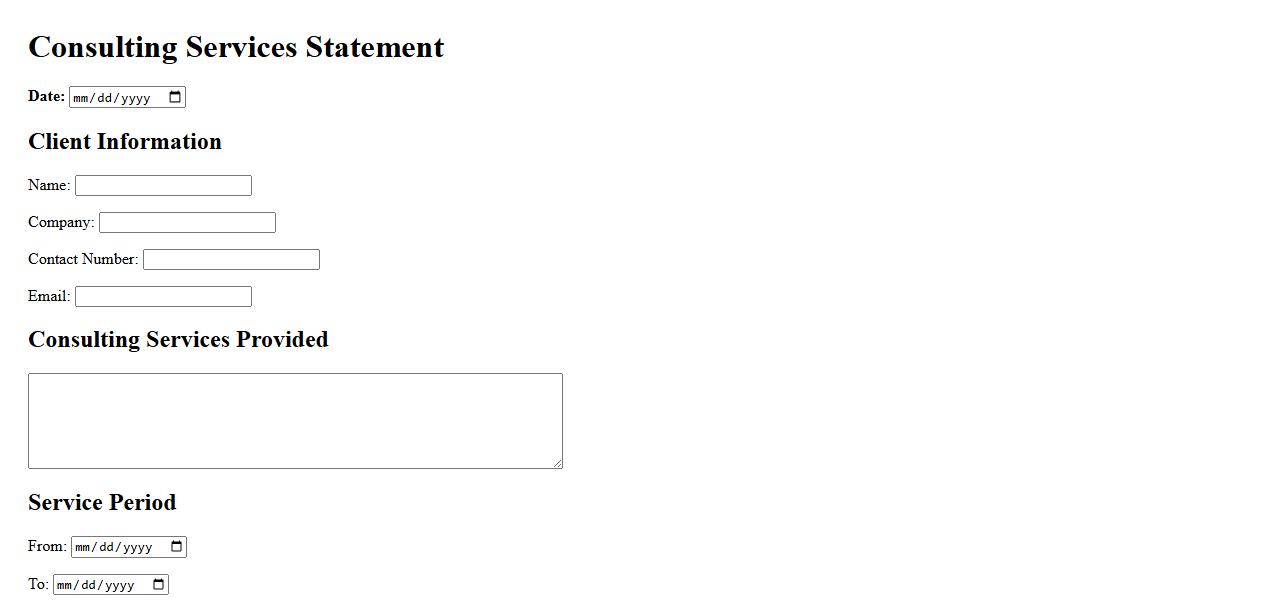

Consulting Services Statement

Our Consulting Services Statement outlines the core principles and commitments we adhere to when providing expert guidance. It ensures transparency, professionalism, and tailored solutions that meet client needs. Trust us to deliver strategic insights that drive success.

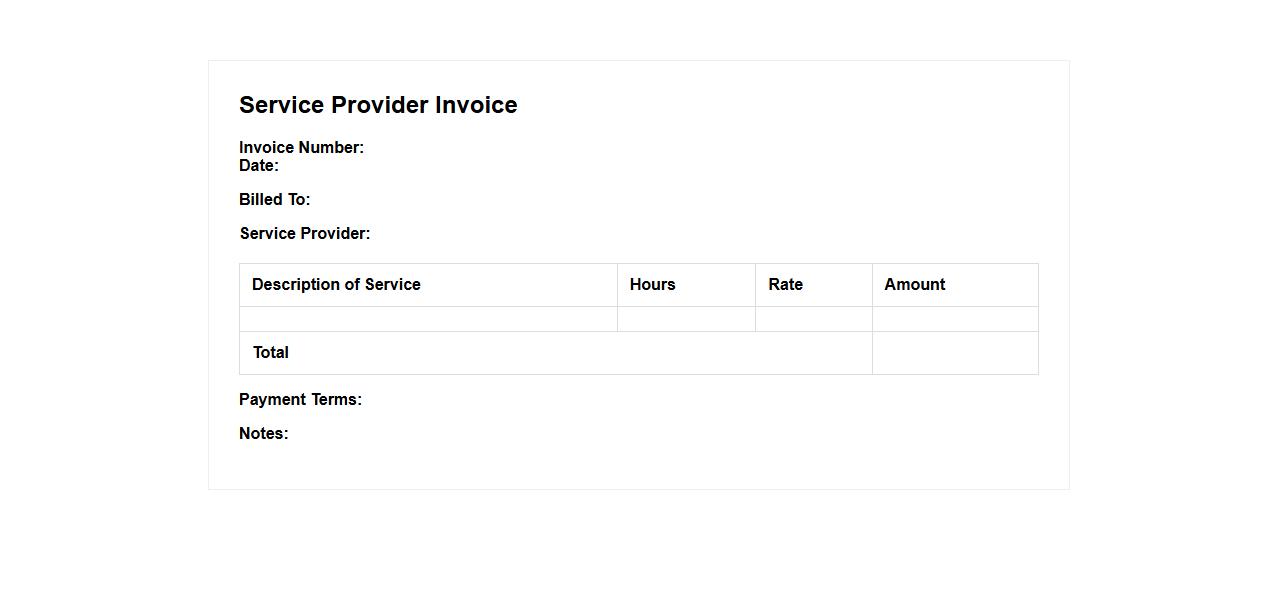

Service Provider Invoice

Service Provider Invoice is a detailed document issued by a service provider to their client, listing the services rendered and the corresponding charges. It serves as a formal request for payment and includes key information such as service descriptions, dates, and payment terms. This invoice helps maintain clear communication and ensures timely compensation for services delivered.

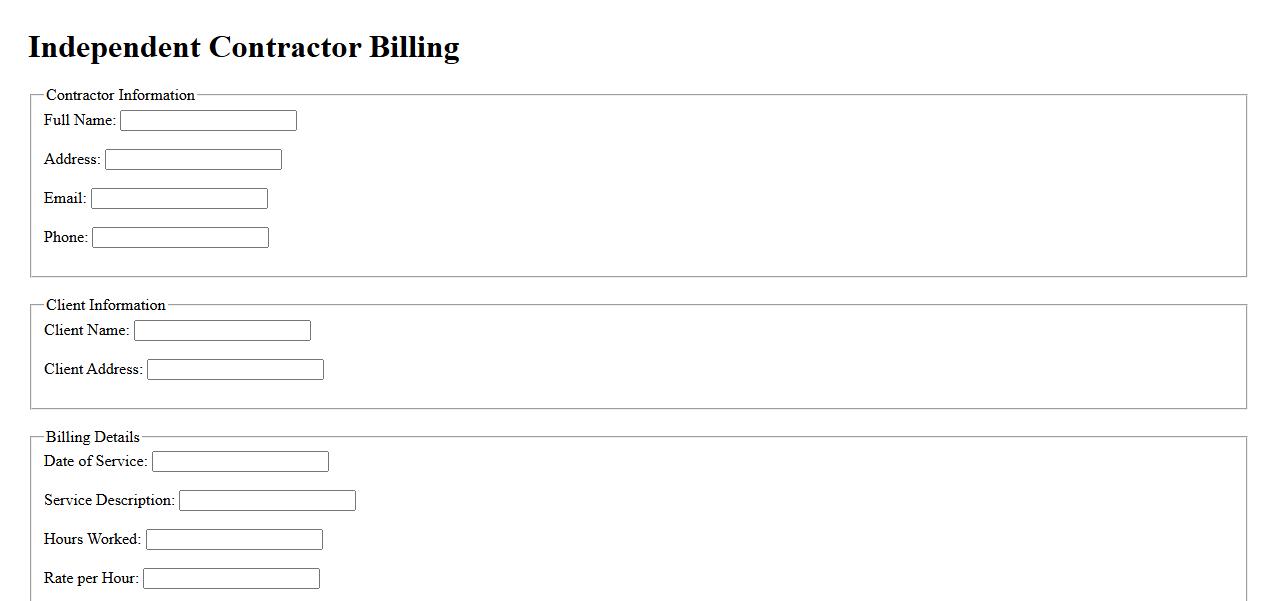

Independent Contractor Billing

Independent Contractor Billing involves managing invoices and payments for services provided by freelancers or self-employed professionals. This process ensures accurate tracking of work completed and timely compensation. Efficient billing practices help maintain clear financial records and foster positive contractor relationships.

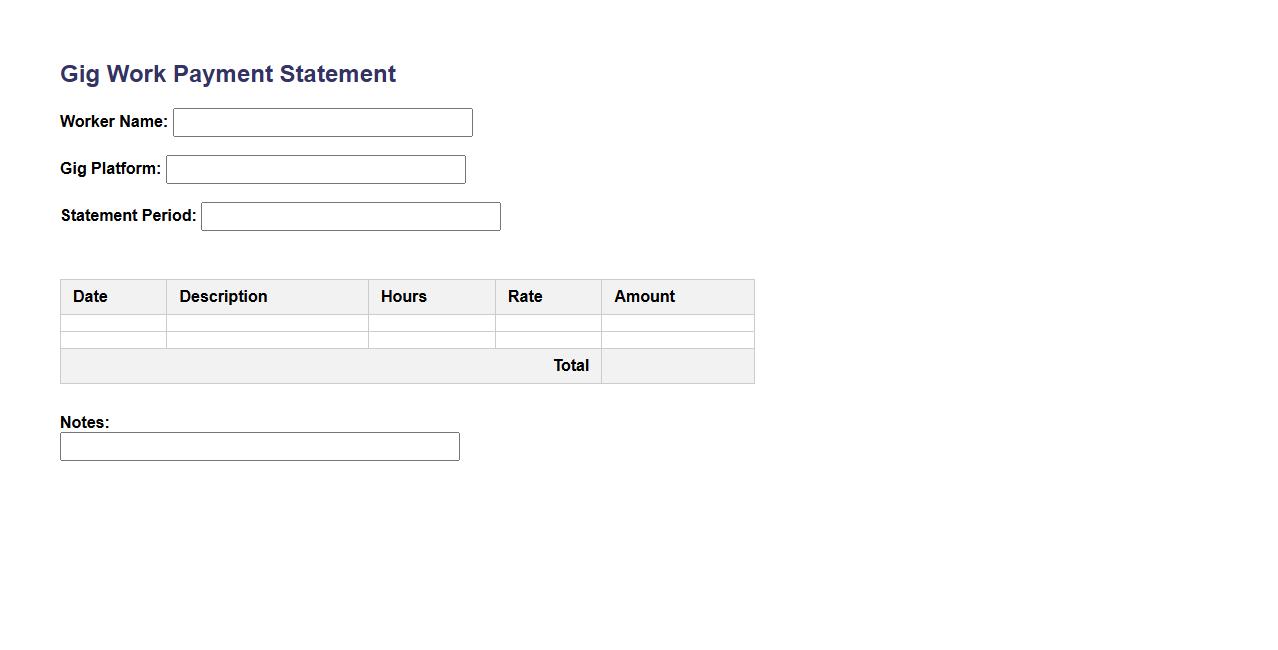

Gig Work Payment Statement

The Gig Work Payment Statement provides a detailed overview of earnings and transactions for freelancers or independent contractors. It helps track payment history, including project fees, bonuses, and deductions. This statement ensures transparency and aids in financial management for gig workers.

What are the essential elements that must be included in a freelance service invoice PDF?

An essential freelance service invoice PDF must include invoice number and date for proper tracking. It should clearly list the freelancer's contact details alongside the client's information. Lastly, the invoice requires a detailed breakdown of the services provided and the total amount due.

How does the invoice specify payment terms and methods for freelance services?

Payment terms in the invoice must state the due date to ensure timely payment. It should mention accepted payment methods such as bank transfer, PayPal, or credit card. Additionally, the invoice may include late fees or discounts related to early payment.

In what sections does the document identify both the freelancer and the client?

The invoice PDF includes separate sections titled "From" and "Bill To" to clearly identify the freelancer and client. Each section contains the respective names, company names, addresses, phone numbers, and email addresses. This identification ensures clarity for record-keeping and communication.

How are services rendered and corresponding fees detailed in the invoice PDF?

Services are listed line-by-line with descriptions, quantities, and rates, creating a clear cost breakdown. Each service fee is calculated and shown alongside applicable taxes if relevant. The invoice concludes with a total amount due summarizing all charges.

What information in the invoice supports compliance with tax and legal requirements?

The invoice must include the freelancer's tax identification number and any relevant registration details. It should clearly show the tax rate applied and the exact tax amount charged on services. Including legal disclaimers or terms of service further ensures compliance with regulatory requirements.