The Invoice Withholding Tax Declaration Form is a document used to report and declare tax withheld on payments made to suppliers or service providers. This form ensures compliance with tax regulations by documenting the amount withheld at the source, facilitating accurate tax reporting for both businesses and tax authorities. Proper submission of this form helps avoid tax penalties and supports transparent financial record-keeping.

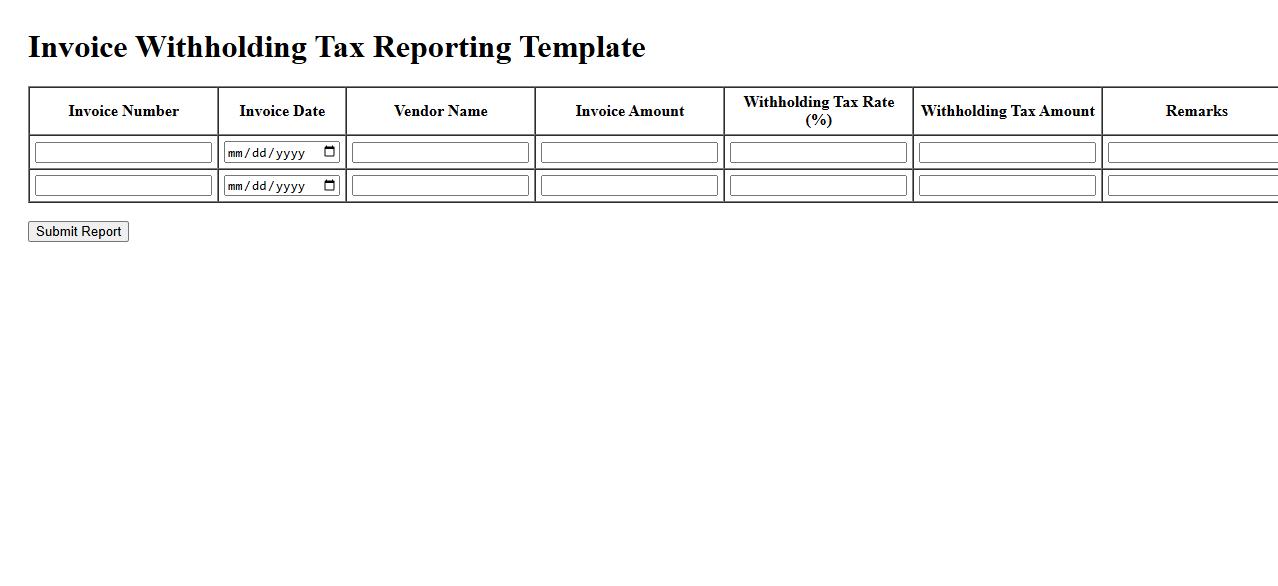

Invoice Withholding Tax Reporting Template

The Invoice Withholding Tax Reporting Template simplifies tracking and managing tax deductions on invoices. It ensures accurate and timely reporting for compliance with tax regulations. This template is essential for businesses to maintain organized financial records and avoid penalties.

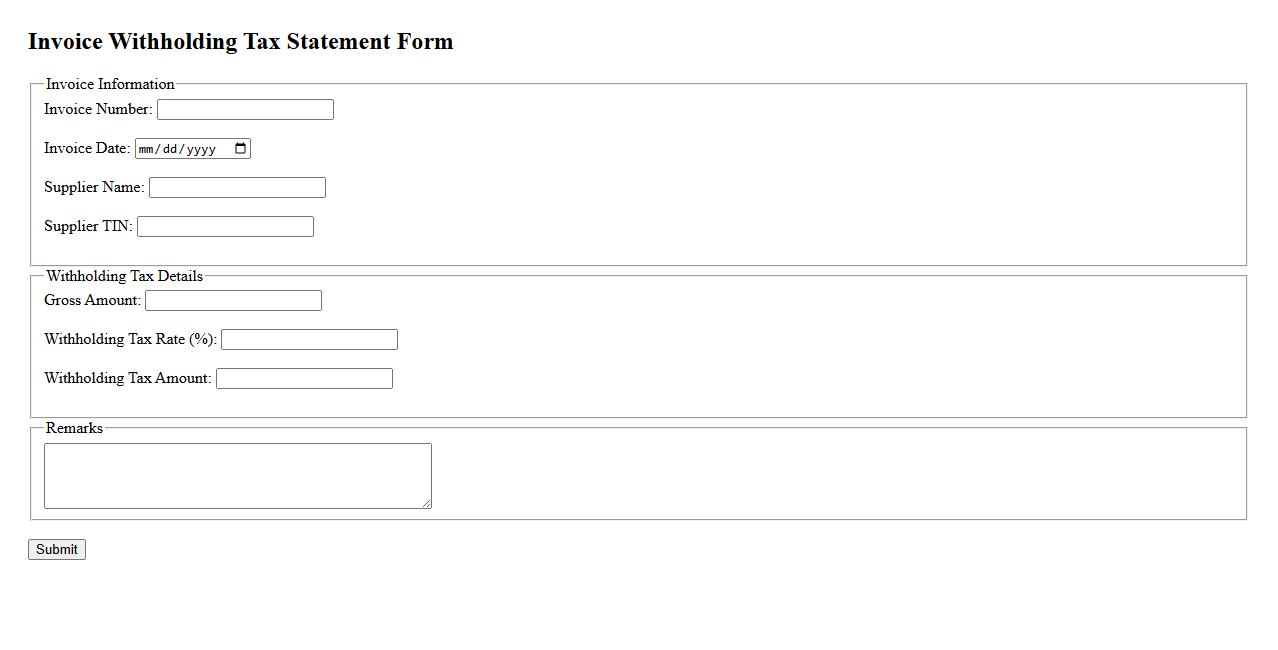

Invoice Withholding Tax Statement Form

The Invoice Withholding Tax Statement Form is an essential document used to record tax withheld on payments made to suppliers or contractors. It helps businesses comply with tax regulations by providing detailed information on withheld amounts. Proper use of this form ensures accurate tax reporting and facilitates smooth financial transactions.

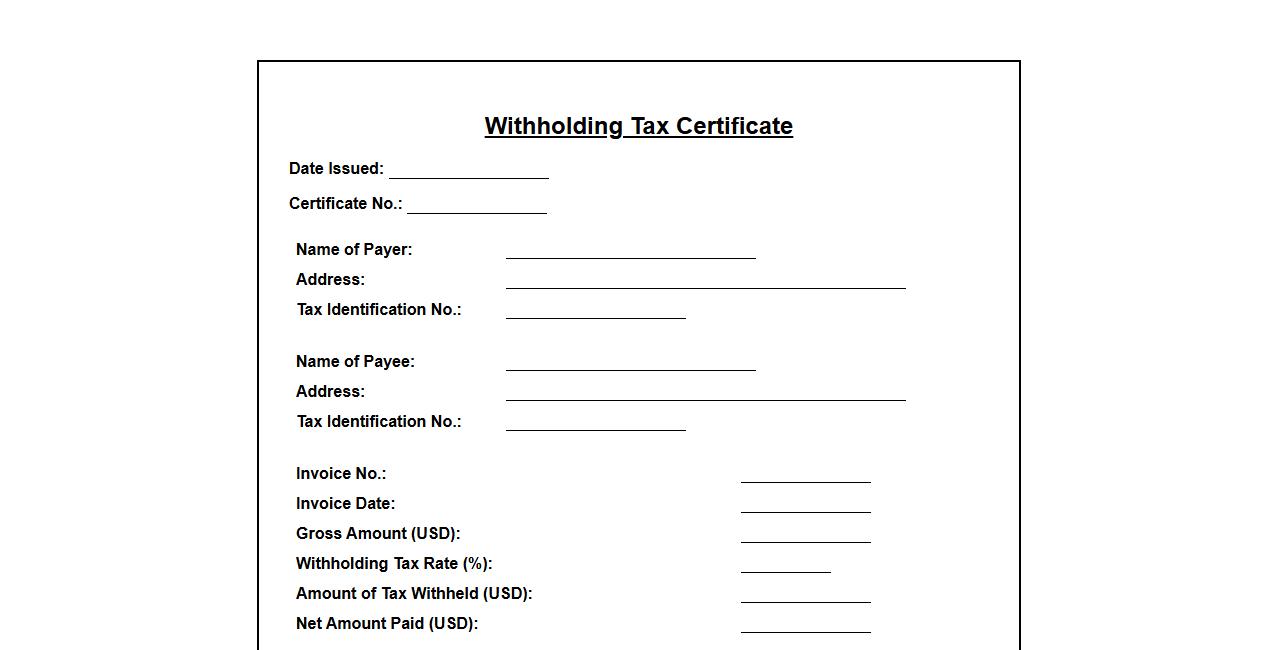

Withholding Tax Certificate for Invoice

The Withholding Tax Certificate for Invoice serves as an official document verifying the amount of tax withheld at source during a transaction. It ensures compliance with tax regulations and provides proof for both the payer and the recipient. This certificate is essential for accurate accounting and tax reporting purposes.

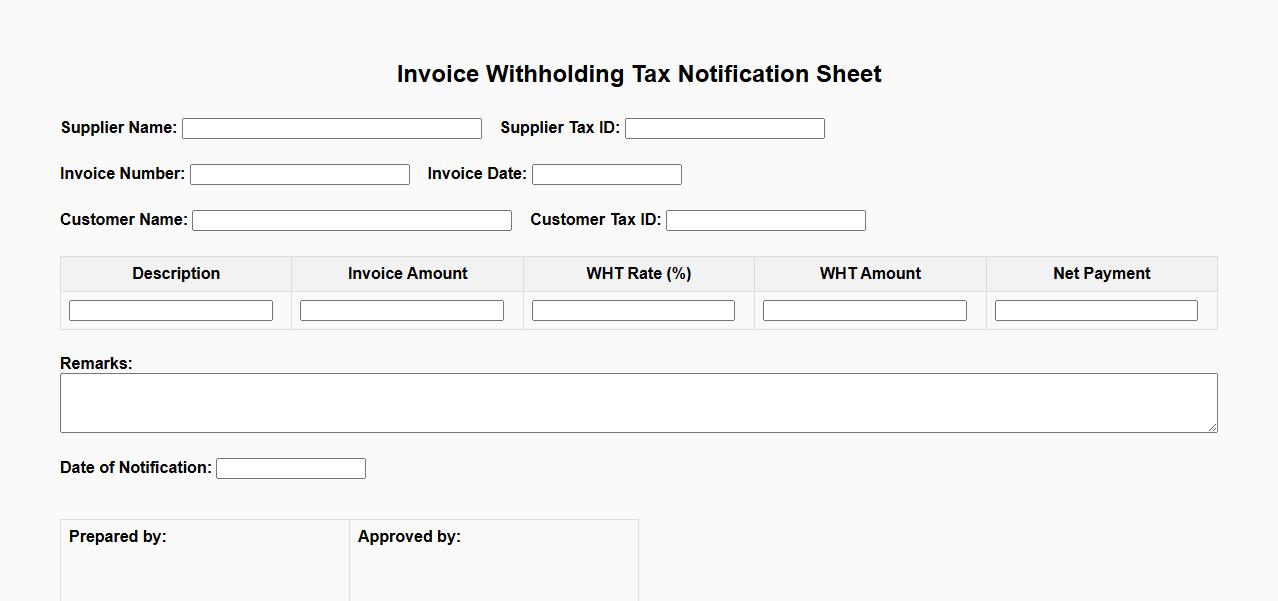

Invoice Withholding Tax Notification Sheet

The Invoice Withholding Tax Notification Sheet is a crucial document used to inform vendors about the tax withheld from their payments. It ensures transparency and compliance with tax regulations by detailing the amount deducted at source. This sheet helps both parties maintain accurate financial records and simplifies tax reporting obligations.

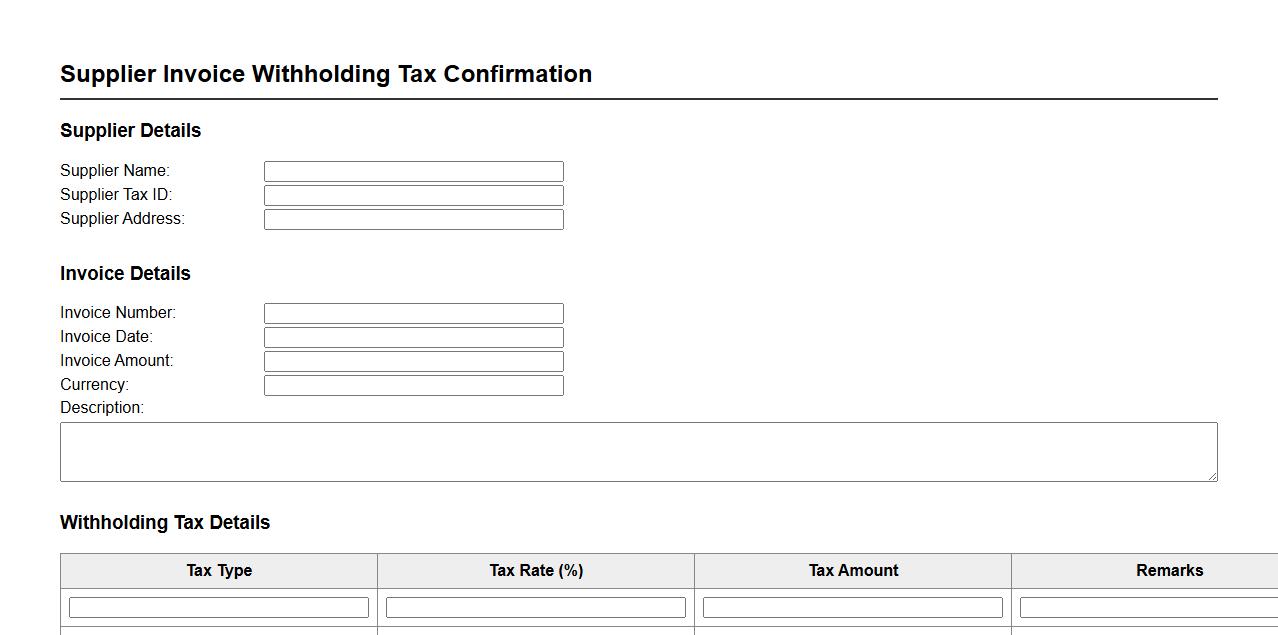

Supplier Invoice Withholding Tax Confirmation

The Supplier Invoice Withholding Tax Confirmation ensures accurate tax deductions on payments made to suppliers. This process validates the withholding tax details, helping businesses remain compliant with tax regulations. It streamlines financial operations by confirming the correct tax rates and amounts withheld.

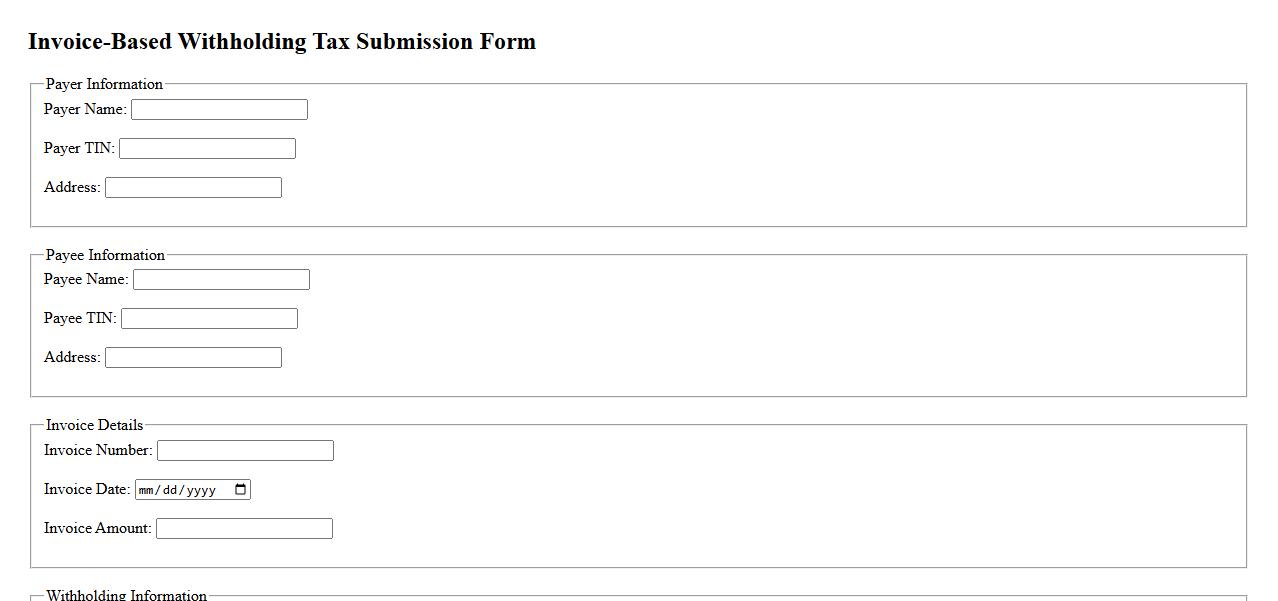

Invoice-Based Withholding Tax Submission Form

The Invoice-Based Withholding Tax Submission Form is designed to streamline the process of reporting and submitting withholding taxes directly linked to issued invoices. It ensures accurate calculation and timely payment of taxes deducted at source. This form helps businesses maintain compliance with tax regulations efficiently.

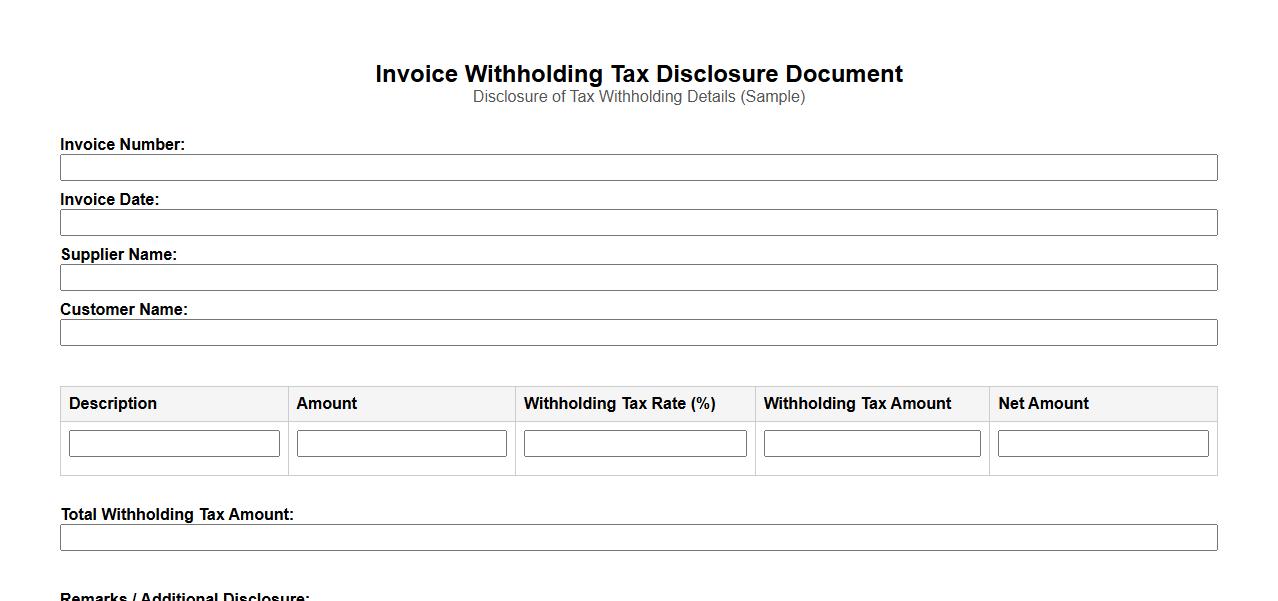

Invoice Withholding Tax Disclosure Document

The Invoice Withholding Tax Disclosure Document outlines the details of tax deductions applied at the source during transactions. It ensures transparency between buyers and sellers by specifying withheld tax amounts on invoices. This document is essential for accurate tax reporting and compliance with legal requirements.

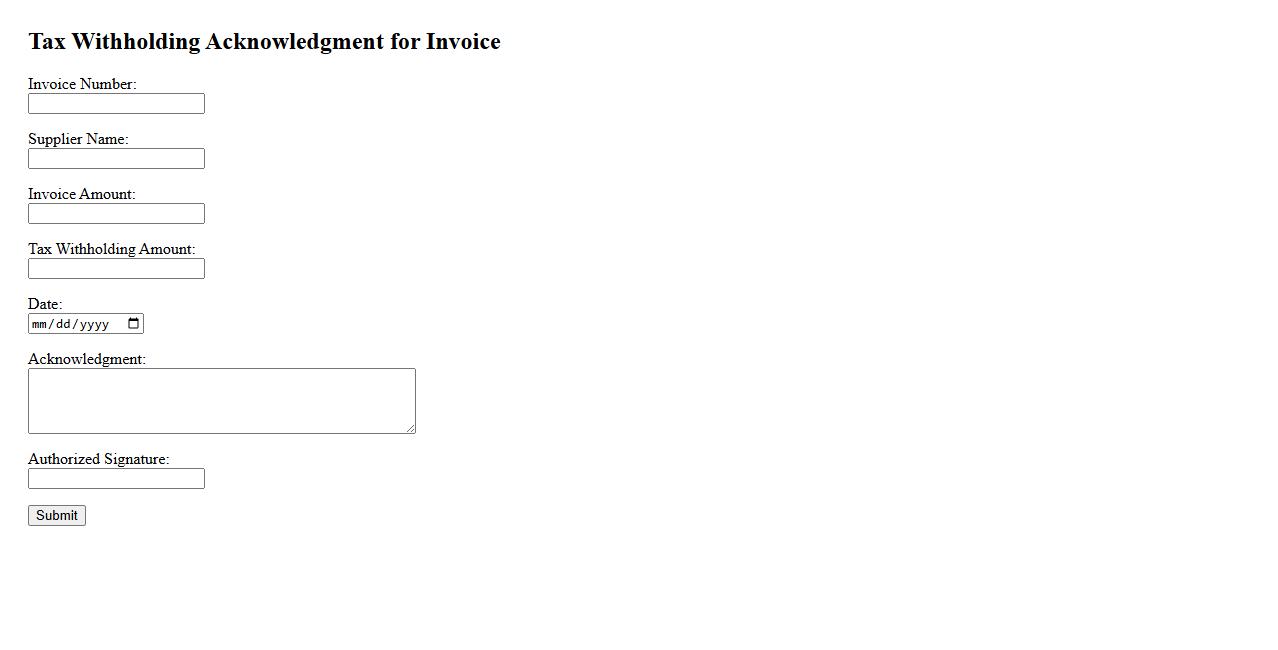

Tax Withholding Acknowledgment for Invoice

The Tax Withholding Acknowledgment for an invoice ensures that the appropriate amount of tax has been correctly deducted and documented. This acknowledgment helps maintain compliance with tax regulations and provides transparency between the parties involved. It is essential for accurate financial records and timely tax reporting.

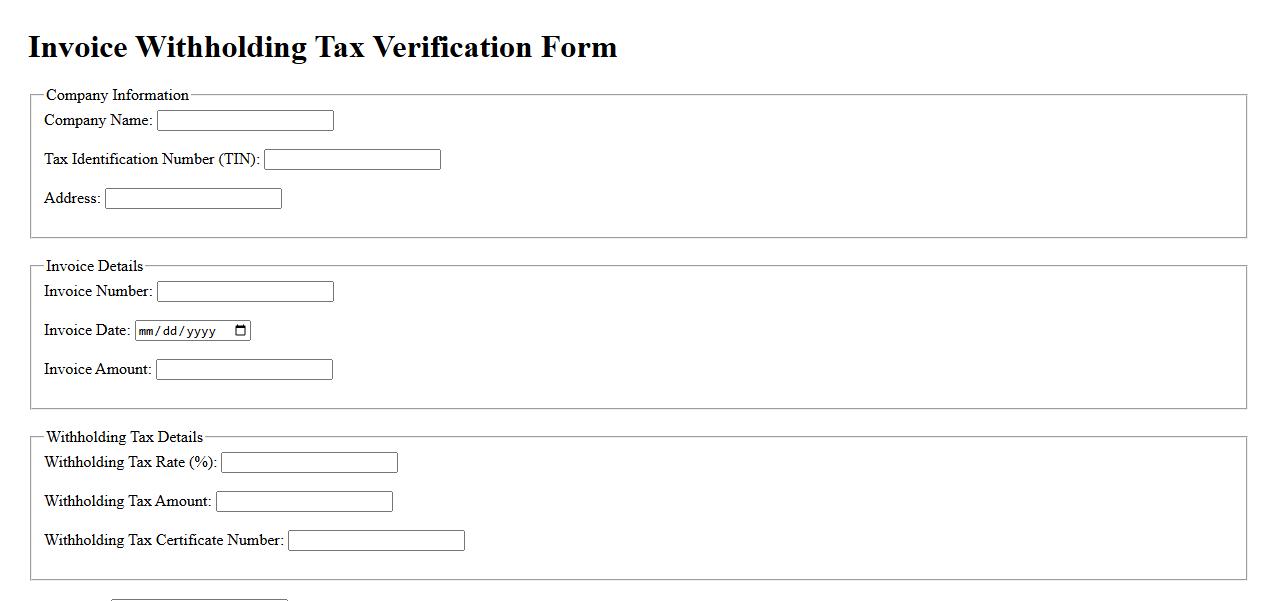

Invoice Withholding Tax Verification Form

The Invoice Withholding Tax Verification Form is a crucial document used to confirm the accuracy of withheld taxes on invoices. It ensures compliance with tax regulations by validating the deducted amounts. This form helps both businesses and tax authorities maintain transparent financial records.

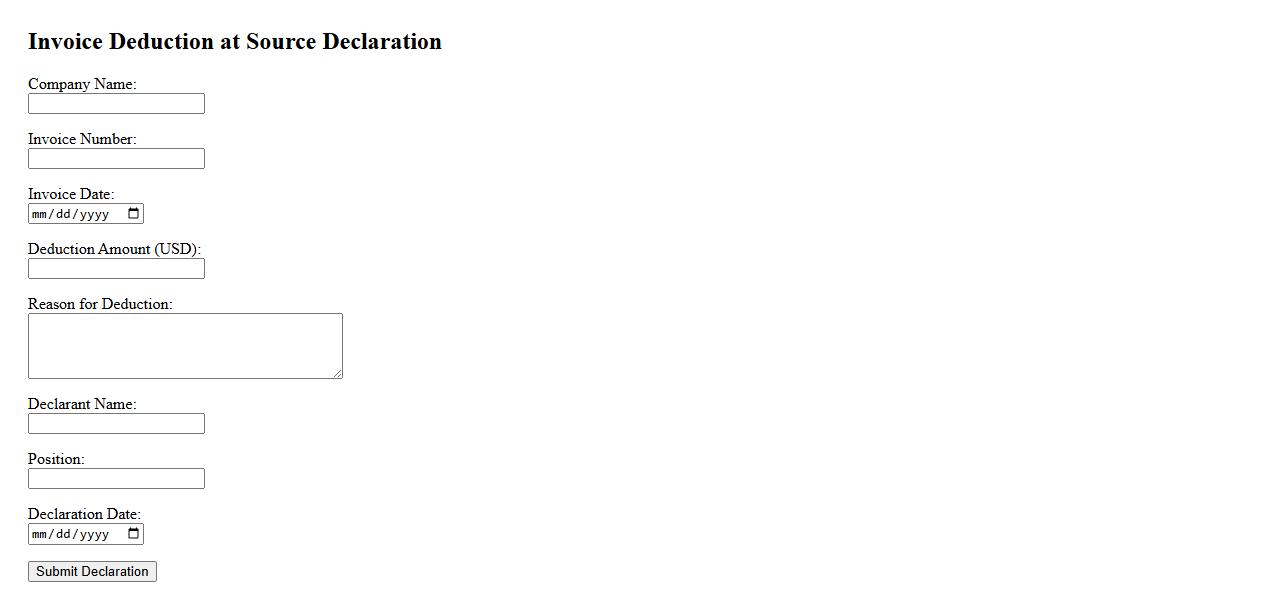

Invoice Deduction at Source Declaration

The Invoice Deduction at Source Declaration is a formal statement ensuring that any tax deducted at source on an invoice is accurately reported. This declaration helps maintain transparency between buyers and sellers, facilitating smooth financial transactions. It is essential for complying with tax regulations and proper accounting practices.

What is the purpose of the Invoice Withholding Tax Declaration Form in financial transactions?

The Invoice Withholding Tax Declaration Form serves to declare the amount of withholding tax deducted at source during a financial transaction. It ensures transparency between the parties involved and the tax authorities. This form helps both businesses and government agencies track tax obligations effectively.

Which parties are required to complete and submit the Invoice Withholding Tax Declaration Form?

The withholding agent responsible for deducting the tax must complete and submit the form. Typically, this includes businesses or individuals making payments subject to withholding tax. The payee may also need to acknowledge the declaration, ensuring proper compliance.

What specific details about the transaction must be included on the Invoice Withholding Tax Declaration Form?

The form requires key transaction details such as the vendor's name, taxpayer identification number (TIN), and the amount paid. It must also specify the basis for withholding tax and the exact sum withheld. Including the date of payment and invoice number is crucial for record accuracy.

How does the Invoice Withholding Tax Declaration Form ensure compliance with tax regulations?

This form guarantees compliance by documenting the amount of tax withheld and reported to tax authorities. It acts as proof of tax remittance and prevents tax evasion during transactions. The form aligns with local tax codes, ensuring that withholding tax obligations are met promptly.

What supporting documentation is typically required when filing the Invoice Withholding Tax Declaration Form?

Supporting documents usually include the original invoice, payment receipts, and proof of tax remittance. These attachments validate the withheld tax amounts declared on the form. Proper documentation facilitates audit trails and government verification.