The Invoice Tax Exemption Form allows businesses or individuals to purchase goods or services without paying sales tax when they qualify for exemptions. This form must be completed accurately and submitted to the seller to avoid unnecessary tax charges. Proper use of the Invoice Tax Exemption Form ensures compliance with tax regulations while reducing costs for eligible transactions.

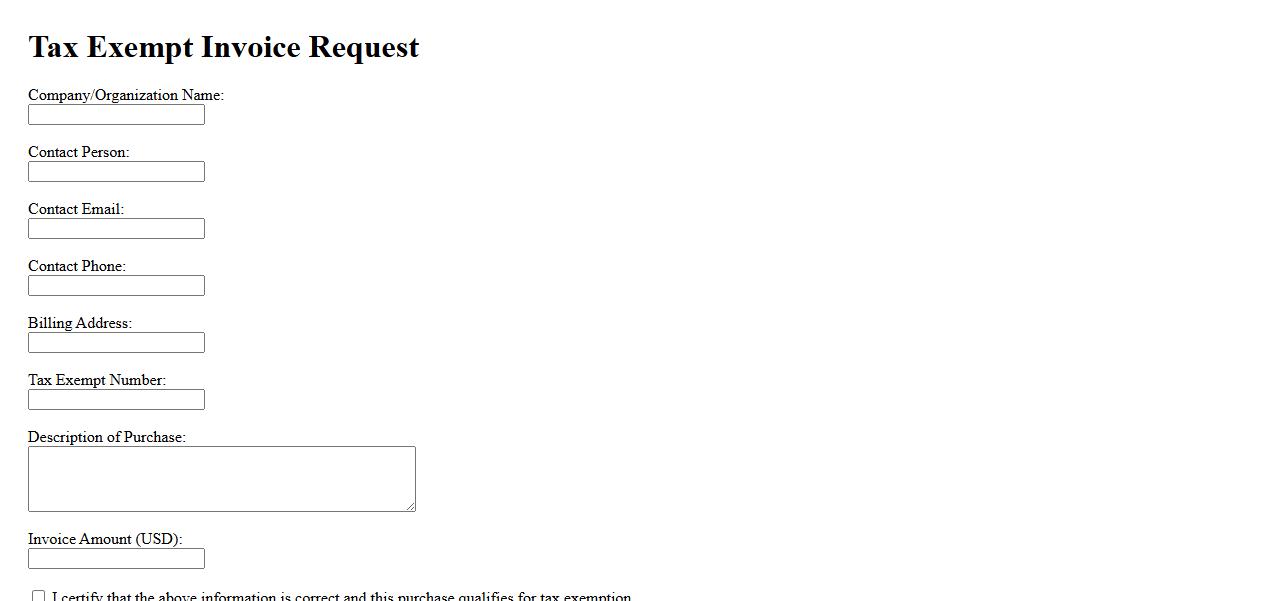

Tax Exempt Invoice Request

A Tax Exempt Invoice Request allows businesses or individuals to receive an invoice without tax charges by providing valid exemption documentation. This process ensures compliance with tax regulations while facilitating accurate financial record-keeping. Submitting this request typically requires approval from the vendor or tax authority.

Sales Tax Exemption Certificate

A Sales Tax Exemption Certificate allows eligible organizations or individuals to purchase goods without paying sales tax. This certificate is typically issued by a government authority to nonprofit organizations, resale businesses, or government entities. It helps reduce costs by legally exempting qualified purchases from tax obligations.

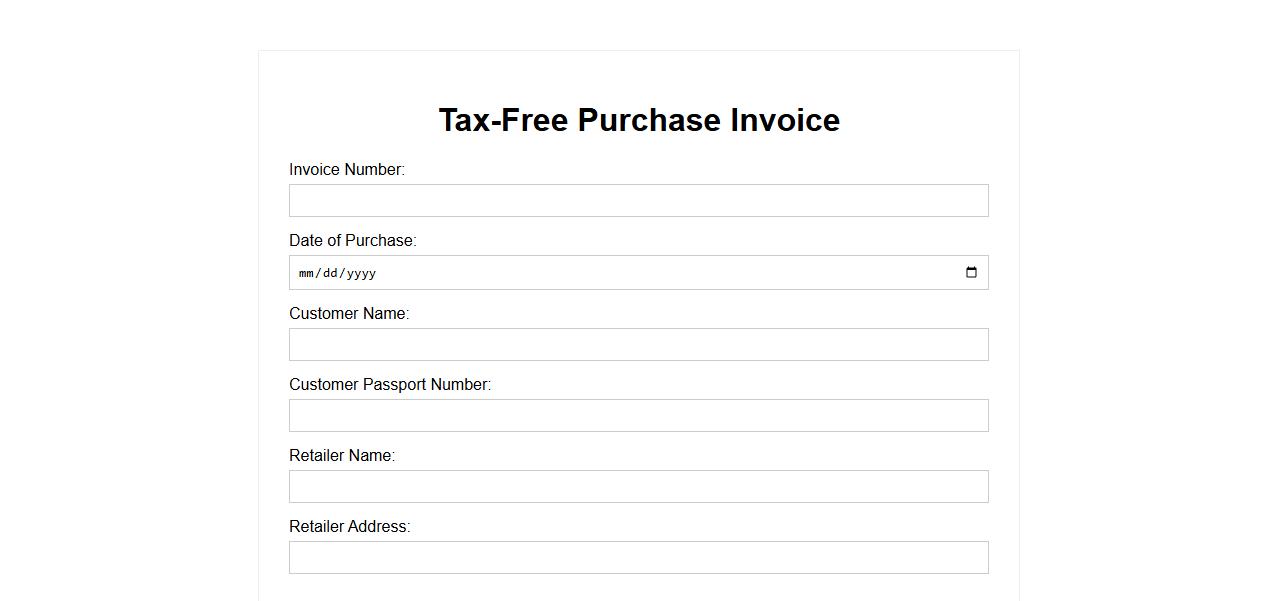

Tax-Free Purchase Invoice

A Tax-Free Purchase Invoice is a document that allows buyers, especially tourists, to make purchases without paying local sales tax. This invoice serves as proof of purchase and is essential for claiming tax refunds. It simplifies international shopping by reducing the overall cost for eligible customers.

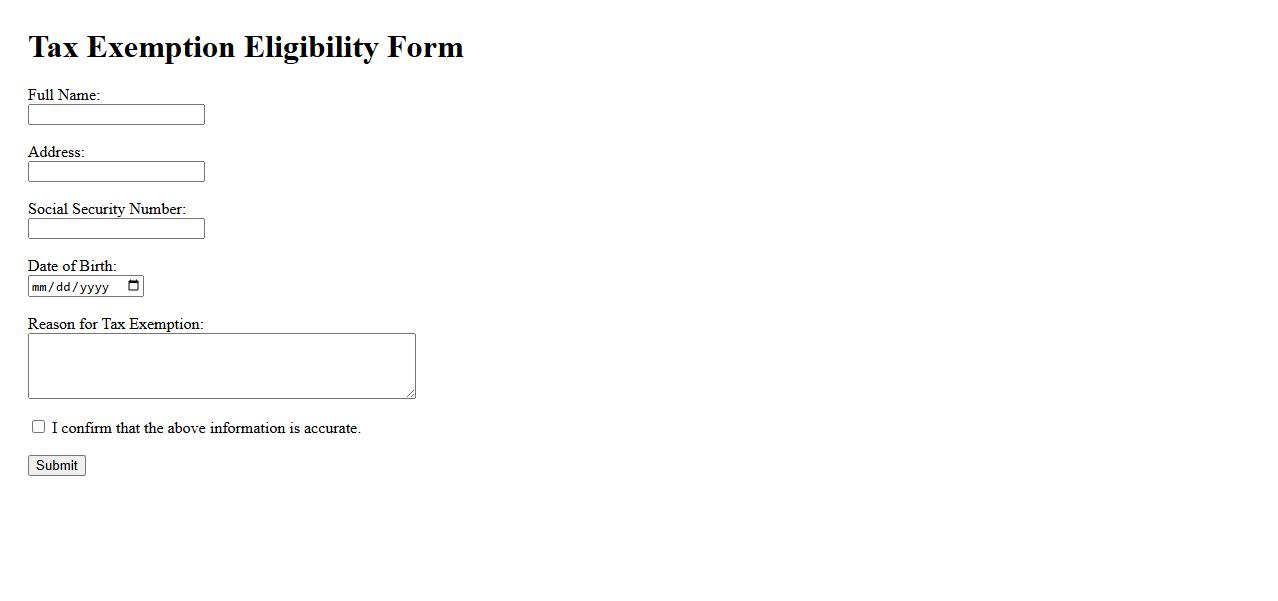

Tax Exemption Eligibility Form

The Tax Exemption Eligibility Form is a crucial document used to determine whether an individual or organization qualifies for tax exemptions. It collects essential information to assess eligibility based on specific criteria set by tax authorities. Completing this form accurately ensures that applicants can benefit from applicable tax reliefs and avoid unnecessary tax liabilities.

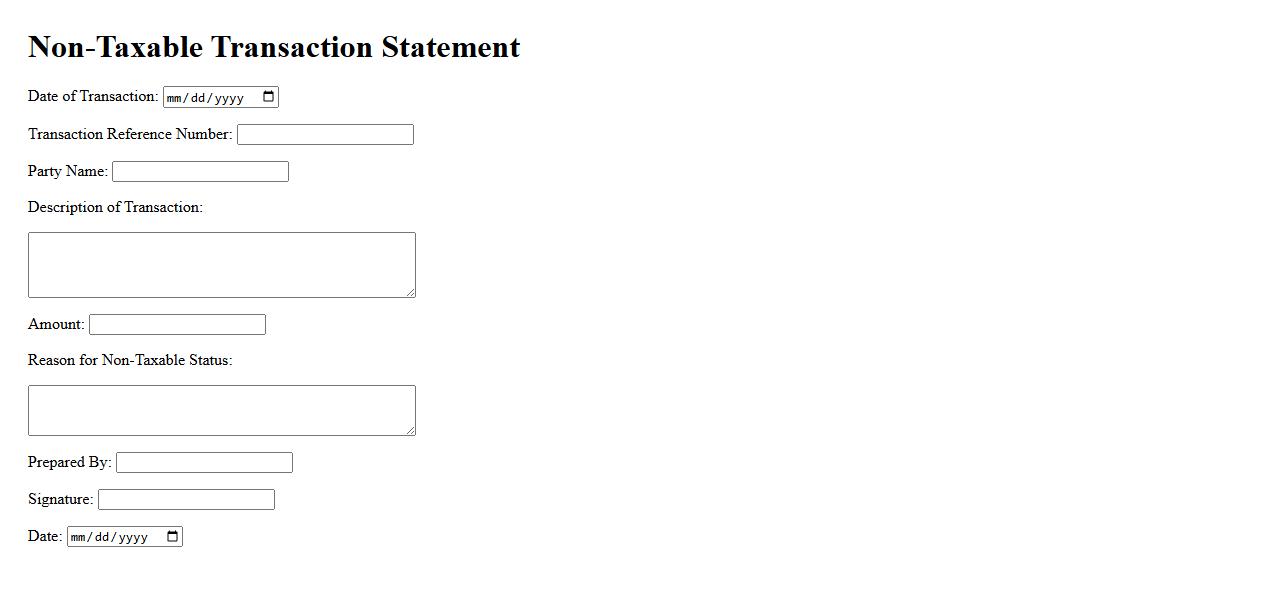

Non-Taxable Transaction Statement

A Non-Taxable Transaction Statement is a document used to certify that a transaction is exempt from sales tax. It provides necessary details to support the tax-exempt status, ensuring compliance with tax regulations. This statement helps businesses avoid incorrect tax charges on qualifying purchases.

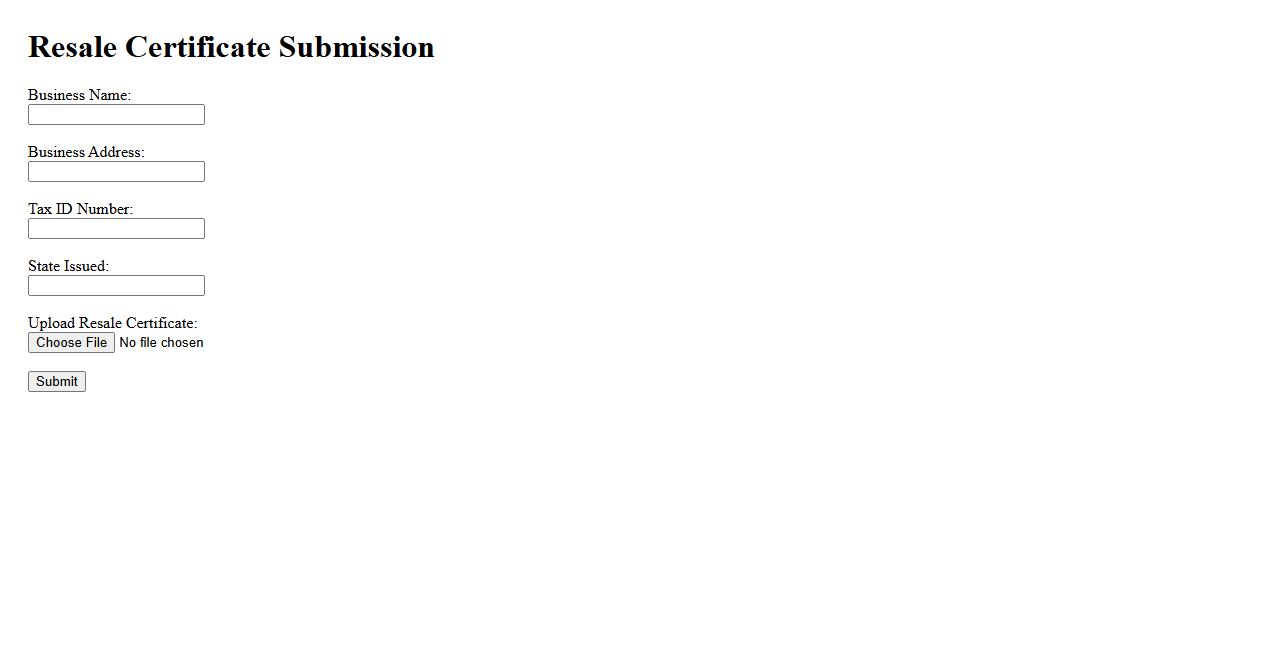

Resale Certificate Submission

Submitting a Resale Certificate is essential for businesses purchasing goods tax-free for resale purposes. This certificate verifies the buyer's exemption from sales tax on items intended for resale. Proper submission ensures compliance with state tax regulations and avoids unnecessary tax charges.

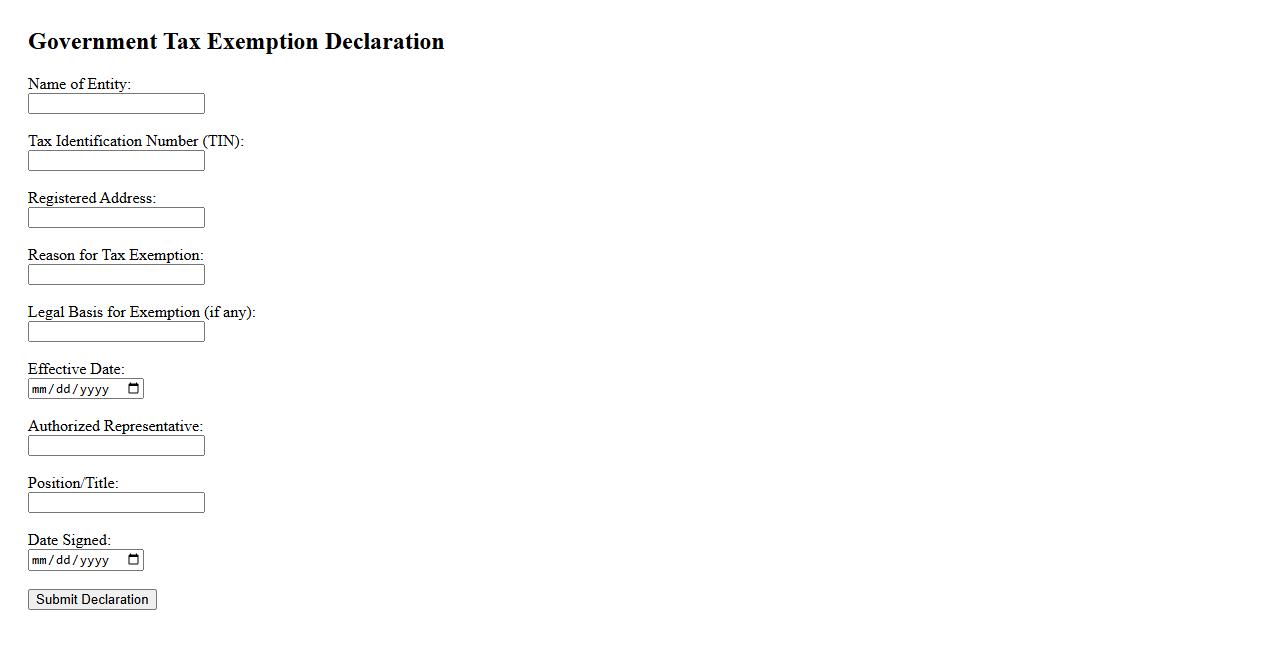

Government Tax Exemption Declaration

The Government Tax Exemption Declaration is an official document that allows individuals or organizations to certify their eligibility for tax exemptions. It ensures compliance with tax regulations while enabling tax-free transactions on qualified purchases. This declaration is essential for benefiting from specific government tax relief programs.

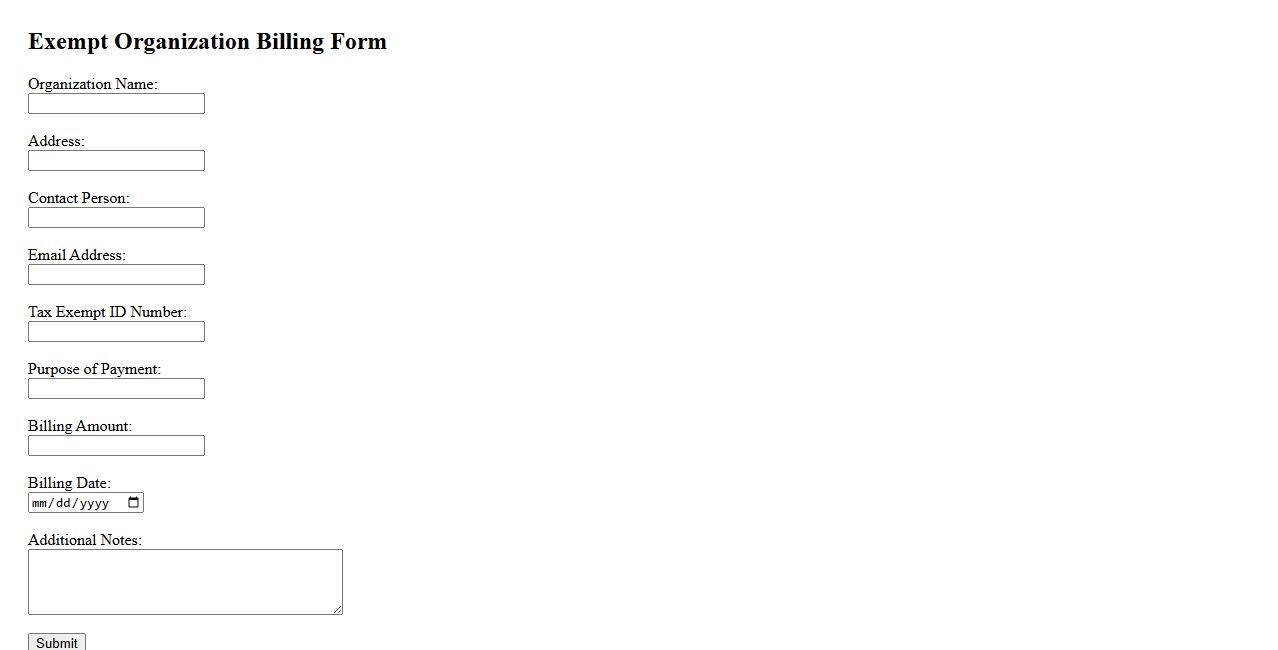

Exempt Organization Billing Form

The Exempt Organization Billing Form is a specialized document designed to facilitate accurate billing for organizations with tax-exempt status. It ensures proper documentation and compliance with financial regulations while streamlining payment processing. This form is essential for maintaining transparency and accountability in organizational transactions.

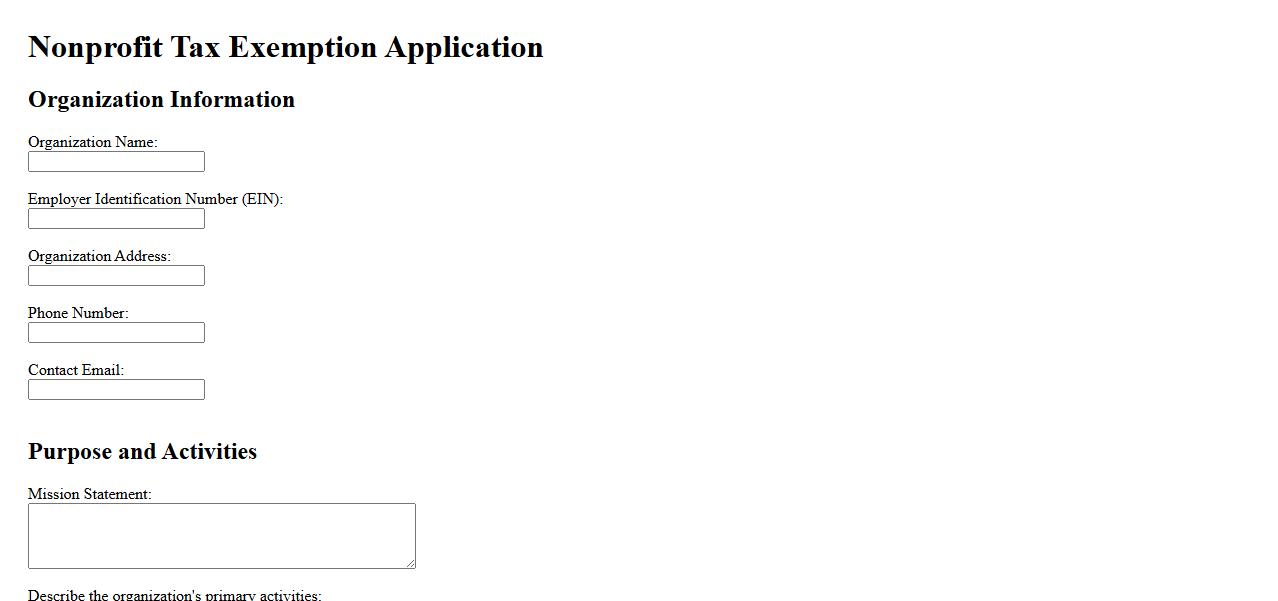

Nonprofit Tax Exemption Application

The Nonprofit Tax Exemption Application is a crucial document that organizations must submit to obtain tax-exempt status from the government. This exemption allows nonprofits to be free from paying federal and sometimes state income taxes, enabling them to allocate more resources to their mission. Properly completing and filing this application ensures compliance with legal requirements and maximizes funding opportunities.

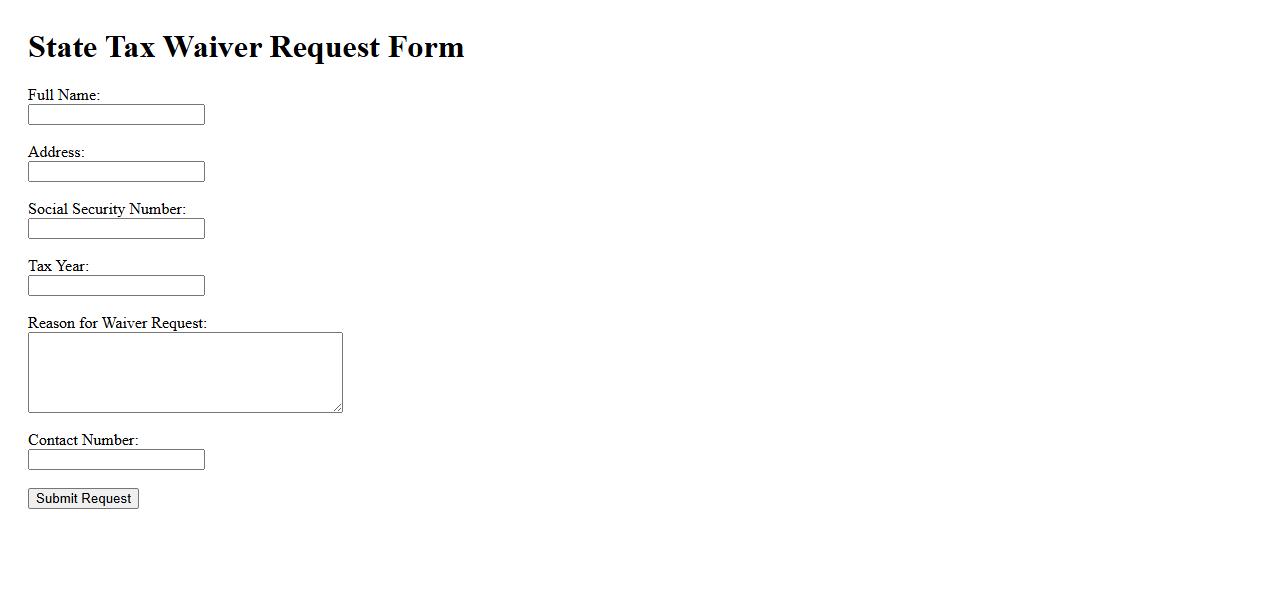

State Tax Waiver Request

A State Tax Waiver Request allows individuals or businesses to formally ask the state government for exemption from certain tax obligations. This process often requires submitting specific documentation to demonstrate eligibility. Successfully obtaining a waiver can result in significant financial relief and compliance benefits.

What criteria must be met for an invoice to qualify for tax exemption on this form?

To qualify for a tax exemption on this form, the invoice must meet specific legal and regulatory requirements established by the tax authority. The invoice should clearly indicate the nature of the transaction that justifies exemption, such as sales to exempt entities or products. Additionally, the invoice must be issued in compliance with all applicable invoicing standards and must not include any taxable amounts.

Which supporting documents are required when submitting a tax exemption request?

When submitting a tax exemption request, it is essential to provide all relevant supporting documents, such as exemption certificates, proof of entity status, or authorization letters. These documents serve as evidence to validate the exemption claim and ensure compliance with tax regulations. Failure to submit adequate documentation may result in denial or delay of the exemption approval.

How should the exemption reason be explicitly stated on the form?

The exemption reason must be clearly and explicitly stated on the form to avoid ambiguities during processing. It should detail the specific legal or regulatory basis for the tax exemption, referencing applicable laws or clauses when possible. This explicit statement ensures transparency and facilitates quicker verification by tax authorities.

Who is authorized to approve or validate a tax-exempt invoice?

The approval or validation of a tax-exempt invoice must be performed by an authorized individual within the organization, usually someone from the finance or tax department. Additionally, external tax authorities or government representatives may have the authority to verify and endorse the exemption status. Proper authorization ensures that the exemption claim adheres to regulatory standards and internal controls.

What steps should be followed if an invoice is incorrectly marked as tax-exempt?

If an invoice is incorrectly marked as tax-exempt, the first step is to notify the finance or tax compliance team immediately. Corrective action involves revising the invoice to reflect the accurate tax status and resubmitting it for approval if necessary. Documentation of the error and the corrective process should be maintained to ensure audit trails and prevent recurrence.