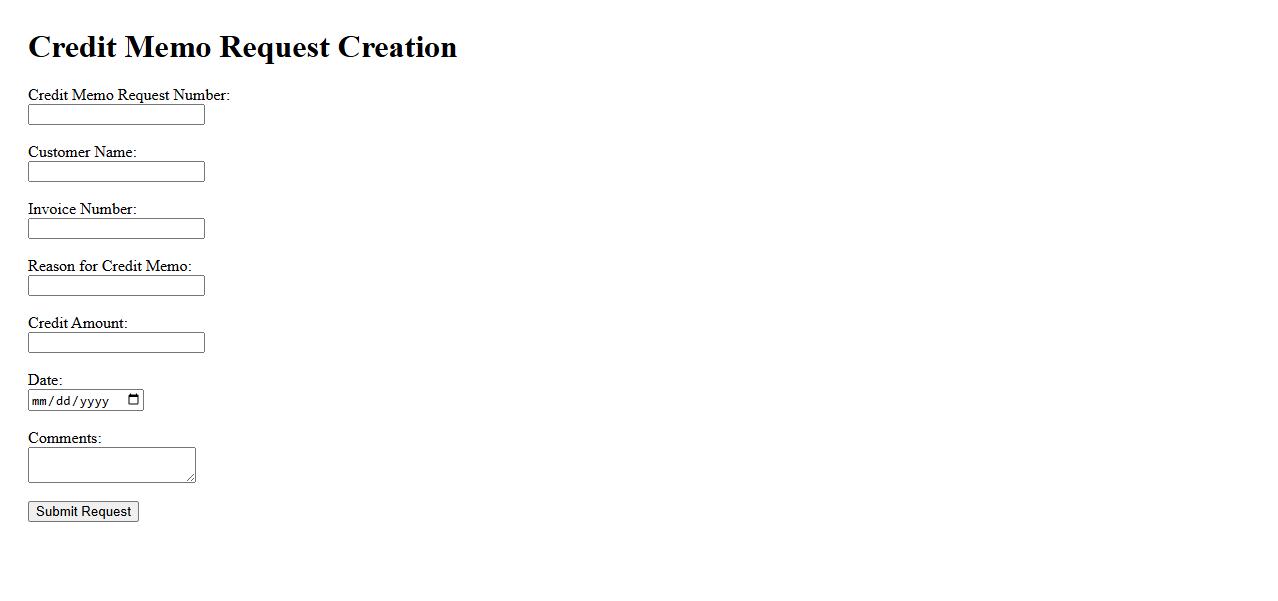

A Invoice Credit Memo Request is a formal document submitted by a buyer or customer to a seller, requesting a credit adjustment to a previously issued invoice. This request typically arises due to errors, returns, or overcharges on the original invoice and helps maintain accurate financial records. Processing the credit memo ensures proper refund or credit application to the customer's account.

Invoice Generation

Invoice Generation is the process of creating detailed billing documents for goods or services provided. It ensures accurate record-keeping and timely payment collection. Efficient invoice generation helps businesses maintain financial clarity and professional communication with clients.

Credit Memo Request Creation

The process of Credit Memo Request Creation involves generating a formal document to request a correction or refund for a customer account. This ensures accurate financial records and resolves discrepancies promptly. Proper creation of credit memo requests helps improve customer satisfaction and maintain transparent accounting practices.

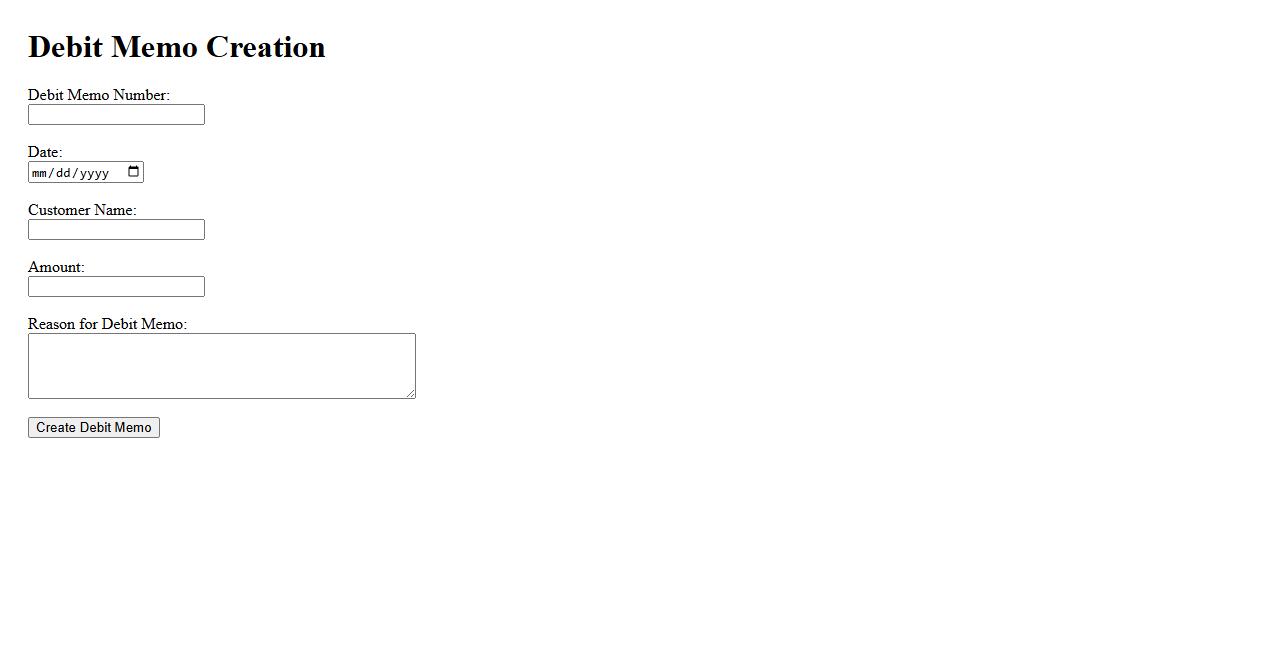

Debit Memo Creation

Debit Memo Creation is the process of generating a document that records a reduction in the amount owed by a customer or client. It is commonly used to adjust invoices due to discrepancies, returns, or additional charges. This ensures accurate financial records and effective communication between businesses.

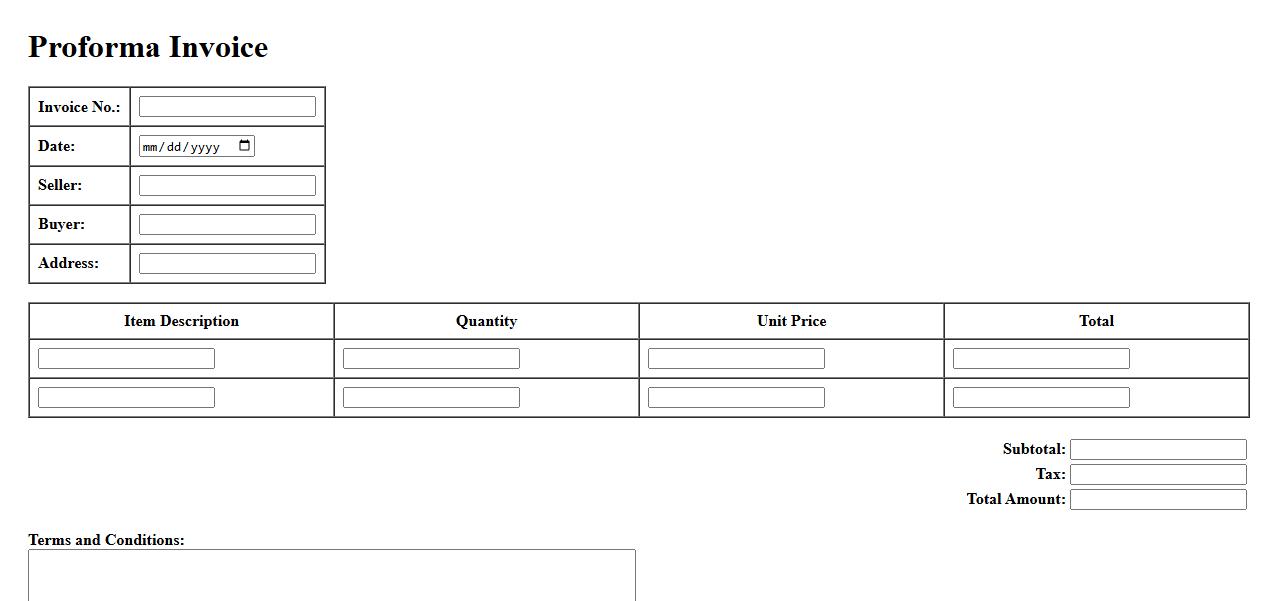

Proforma Invoice Issuance

The Proforma Invoice Issuance is a critical step in international trade, providing a preliminary bill of sale that outlines the terms of a transaction. This document helps buyers understand the costs involved before the final sale, ensuring transparency and facilitating customs clearance. Issuing a proforma invoice accurately prevents disputes and streamlines the payment process.

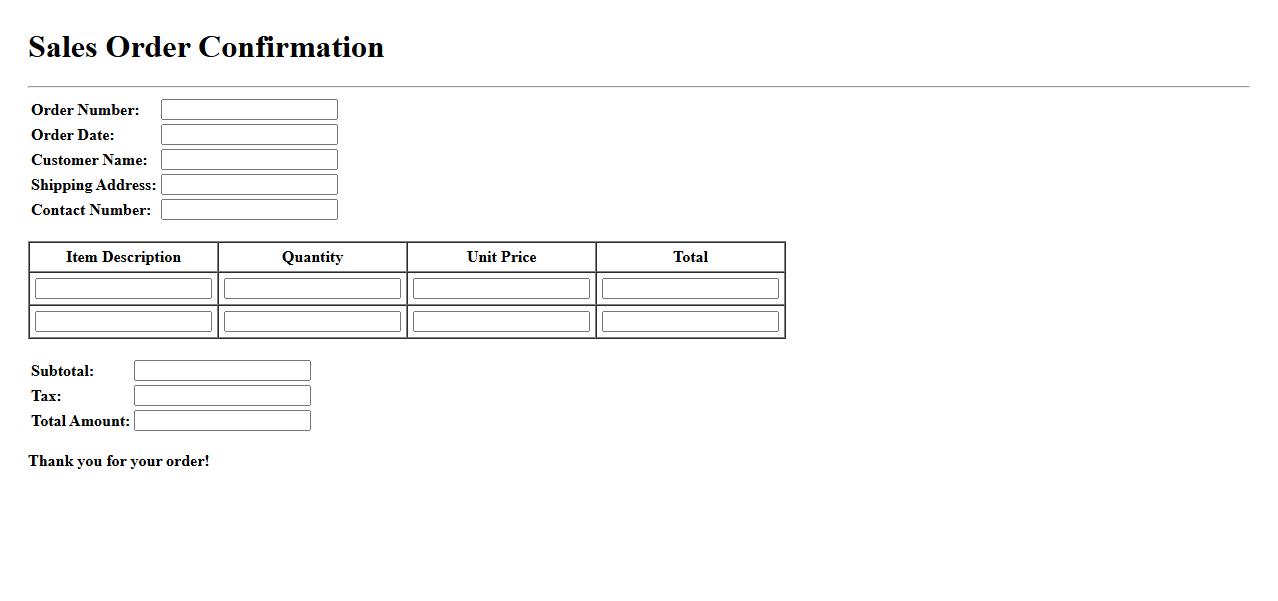

Sales Order Confirmation

The Sales Order Confirmation is a crucial document that verifies the details of a customer's purchase. It ensures both parties agree on the order specifics, such as quantities, prices, and delivery dates. This confirmation helps prevent misunderstandings and facilitates smooth transaction processing.

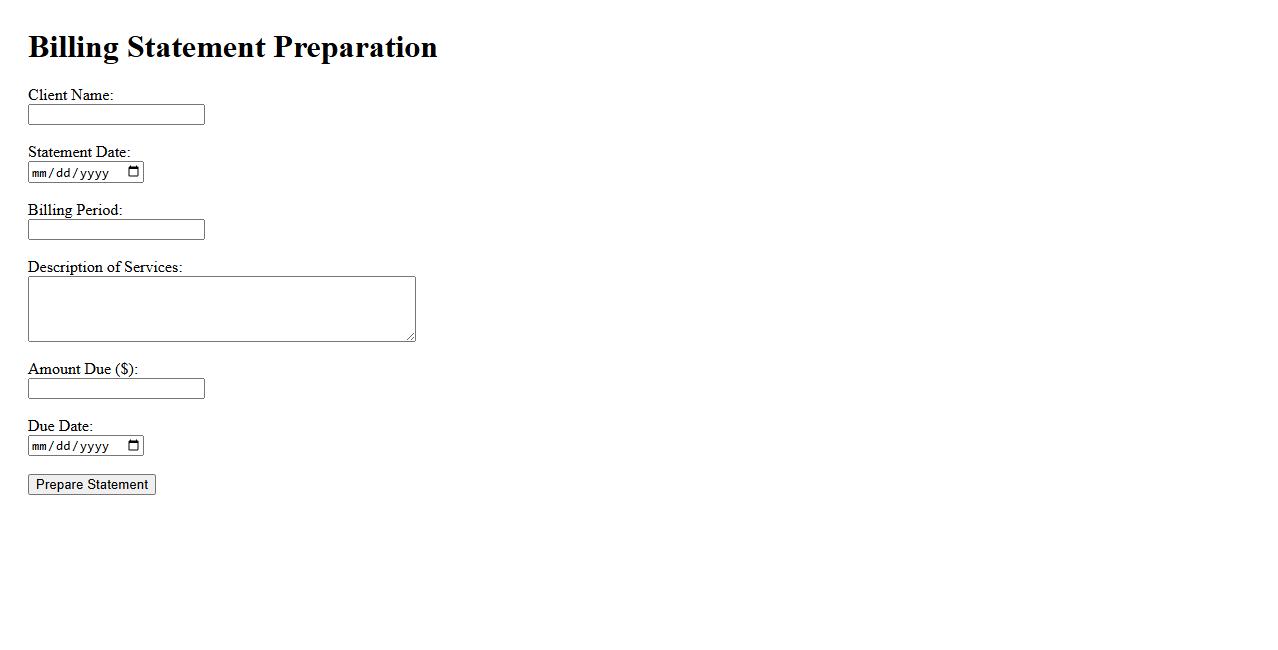

Billing Statement Preparation

Billing Statement Preparation involves accurately compiling all financial transactions and charges into a detailed document for customers. This process ensures clarity and transparency in invoicing, helping businesses maintain proper financial records. Efficient preparation reduces errors and accelerates payment cycles.

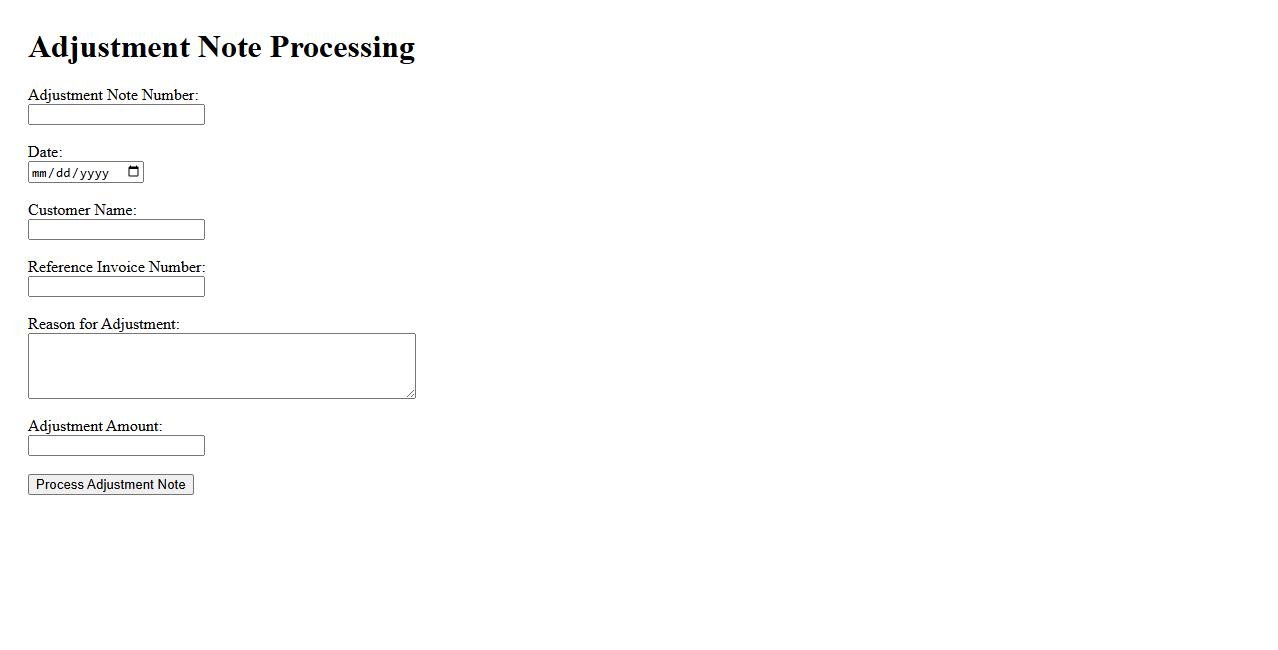

Adjustment Note Processing

Adjustment Note Processing refers to the systematic handling of credit or debit notes issued to correct discrepancies in invoices. This process ensures accurate financial records by updating accounts payable and receivable promptly. Efficient adjustment note processing helps maintain transparent and error-free accounting practices.

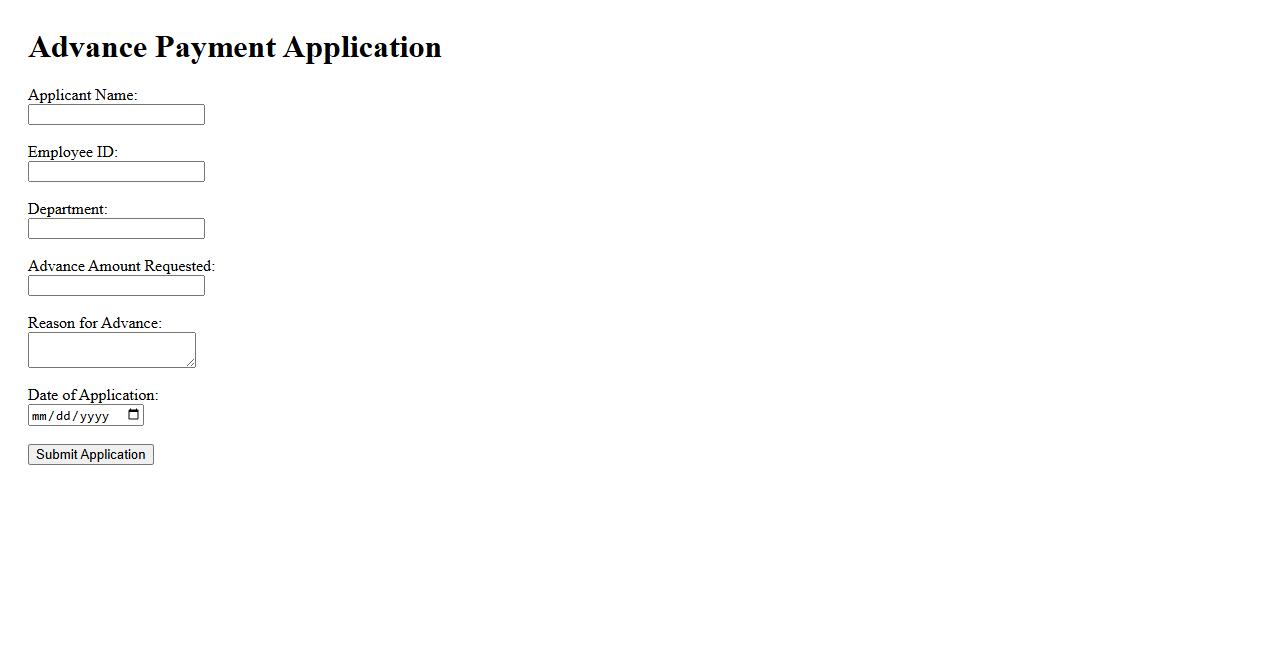

Advance Payment Application

The Advance Payment Application is a crucial process that allows businesses to request funds before goods or services are delivered. This streamlined application ensures financial security and smooth project execution. Proper use of advance payments helps maintain cash flow and build trust between parties.

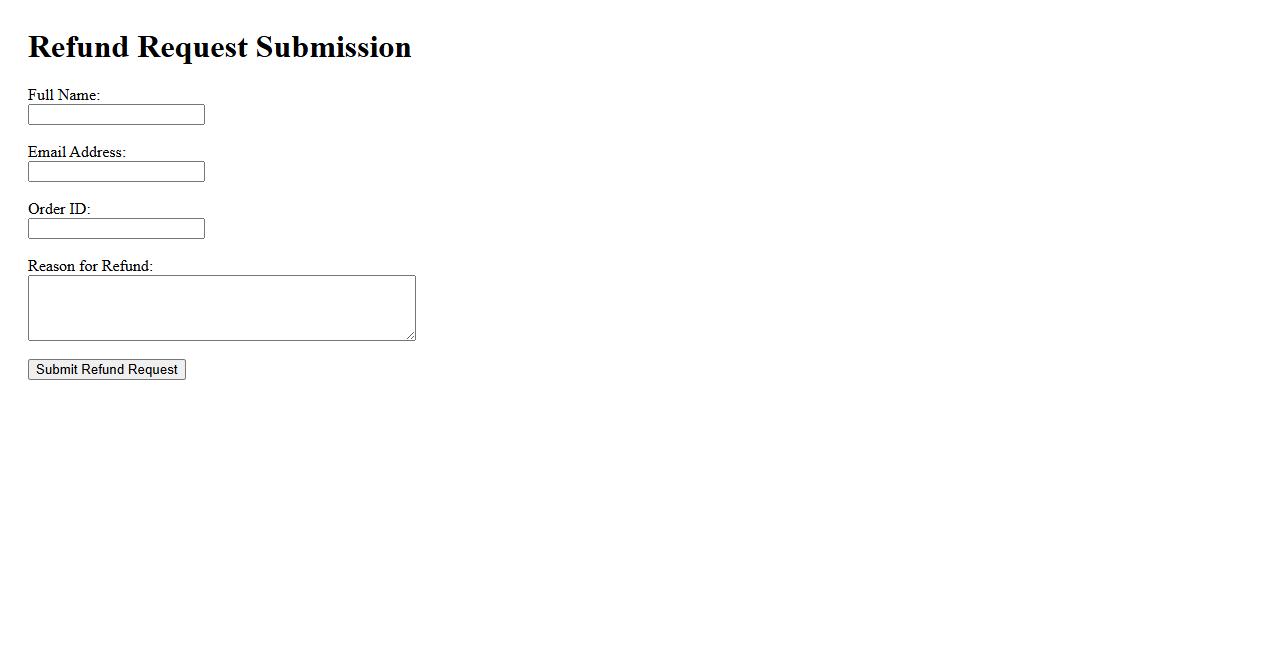

Refund Request Submission

To initiate a refund request submission, please complete the required form with accurate details. Ensure all purchase information and reasons for the refund are clearly stated. Our team will process your request promptly and notify you of the outcome.

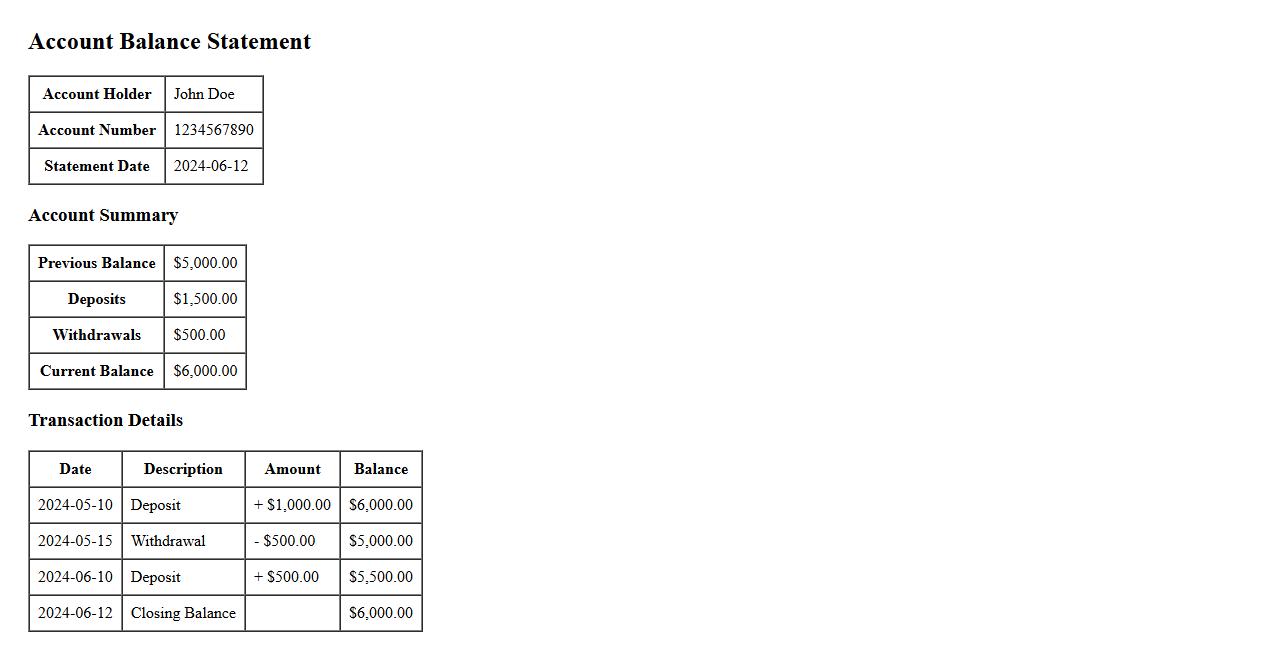

Account Balance Statement

An Account Balance Statement provides a detailed summary of the current financial status of an account, including deposits, withdrawals, and the remaining balance. This document is essential for tracking transactions and ensuring accurate record-keeping. It helps users monitor their financial activity over a specific period.

What key differences distinguish an Invoice from a Credit Memo Request in document processing?

An Invoice is a document issued to request payment for goods or services provided, while a Credit Memo Request is used to document a refund or reduction in the amount previously invoiced. The Invoice typically increases accounts receivable, whereas the Credit Memo Request decreases it. These documents serve opposite financial purposes within the accounting process.

How does a Credit Memo Request affect the balance of an existing Invoice in the system?

A Credit Memo Request adjusts the balance of the original Invoice by reducing the amount owed by the customer. It effectively reflects returns, discounts, or billing errors that require correction. As a result, it lowers the accounts receivable balance associated with the Invoice.

Which essential data fields are mandatory when creating an Invoice versus a Credit Memo Request?

When creating an Invoice, mandatory fields typically include customer details, invoice date, product or service description, and total amount due. For a Credit Memo Request, essential fields include reference to the original Invoice, reason for credit, quantity, and credit amount. Both require accurate identification to ensure proper financial recording.

In what scenarios should a Credit Memo Request be triggered instead of canceling an Invoice?

A Credit Memo Request should be issued when partial refunds, product returns, or billing corrections are necessary without voiding the entire Invoice. Canceling an Invoice is usually reserved for errors that invalidate the transaction completely. Credit Memos maintain the audit trail by adjusting rather than eliminating the original document.

What approval workflow variations exist between processing an Invoice and a Credit Memo Request?

The approval process for an Invoice often focuses on verifying goods or services delivered before payment is authorized. For a Credit Memo Request, the workflow typically involves validating return reasons or error justifications prior to approval. This distinction helps control financial accuracy and prevents unauthorized adjustments.