The Invoice Adjustment Form is a crucial document used to correct errors or update details on previously issued invoices. It helps businesses maintain accurate financial records by allowing adjustments for discrepancies such as pricing errors, returned goods, or billing mistakes. This form ensures transparency and smooth communication between vendors and clients during the invoicing process.

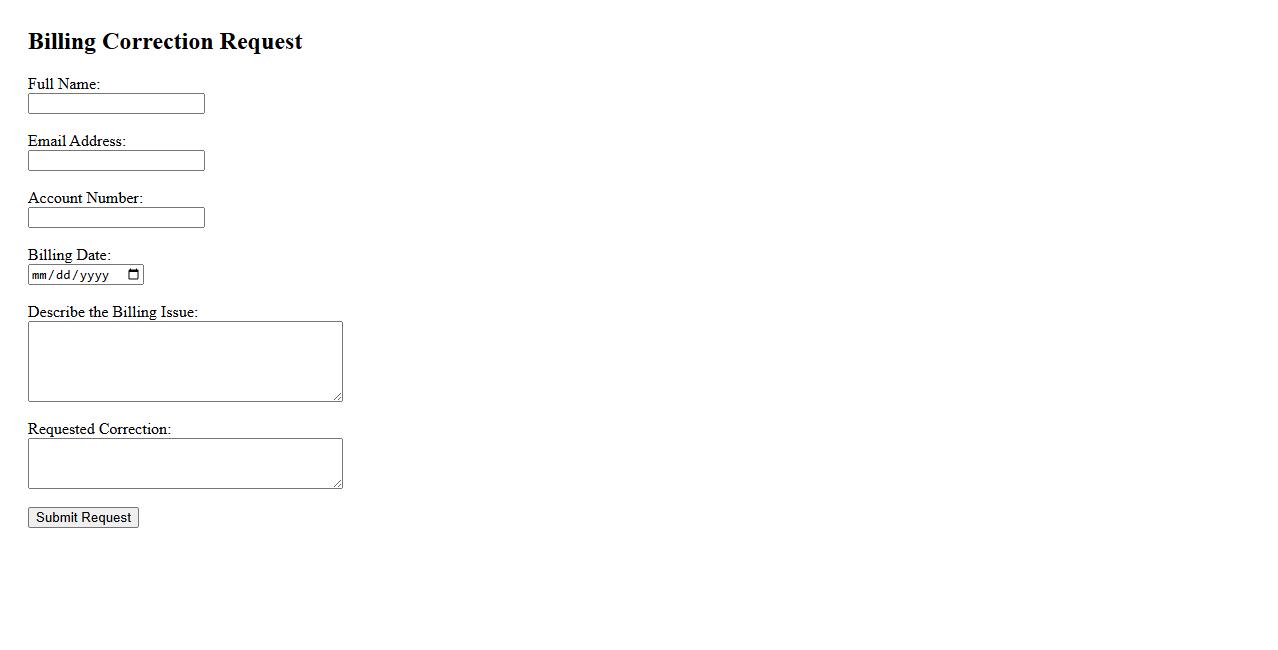

Billing Correction Request

A Billing Correction Request is a formal appeal to rectify errors found in an invoice or billing statement. It ensures that any discrepancies, such as incorrect charges or missing credits, are promptly addressed. This process helps maintain accurate financial records and prevents payment delays.

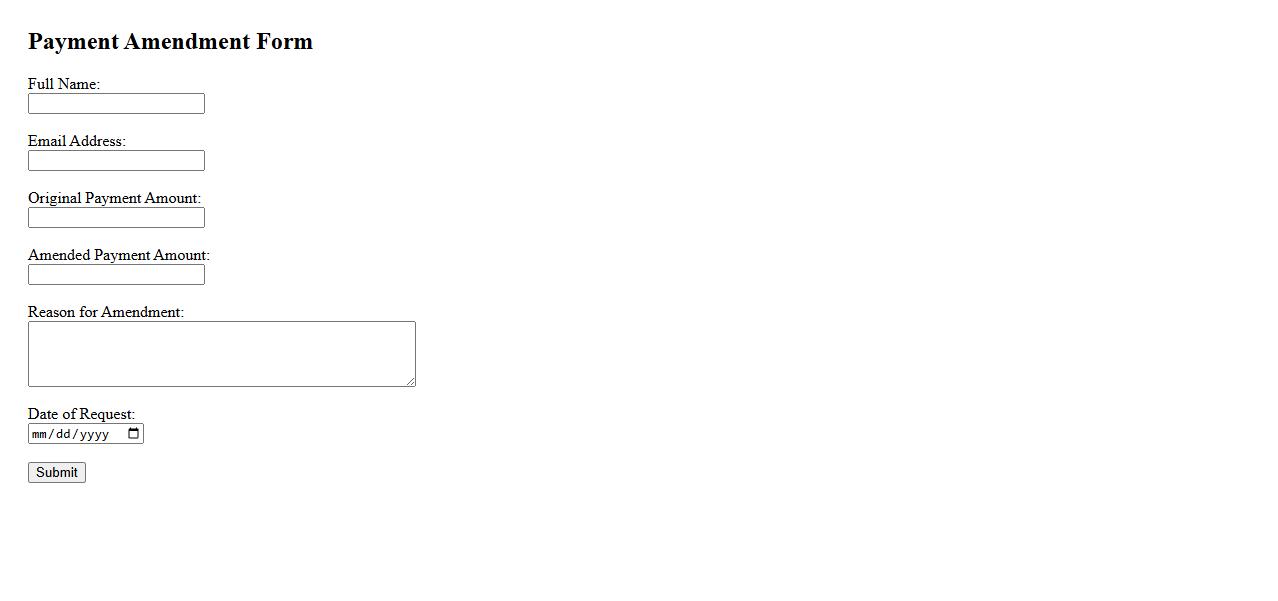

Payment Amendment Form

The Payment Amendment Form is designed to facilitate changes to existing payment details quickly and securely. This form ensures that all modifications are accurately recorded to prevent processing errors. It is essential for updating payment methods, amounts, or schedules in a timely manner.

Invoice Revision Application

The Invoice Revision Application streamlines the process of updating and correcting invoices efficiently. It allows users to submit, track, and approve changes seamlessly, reducing errors and delays. This tool ensures accurate financial documentation and enhances workflow productivity.

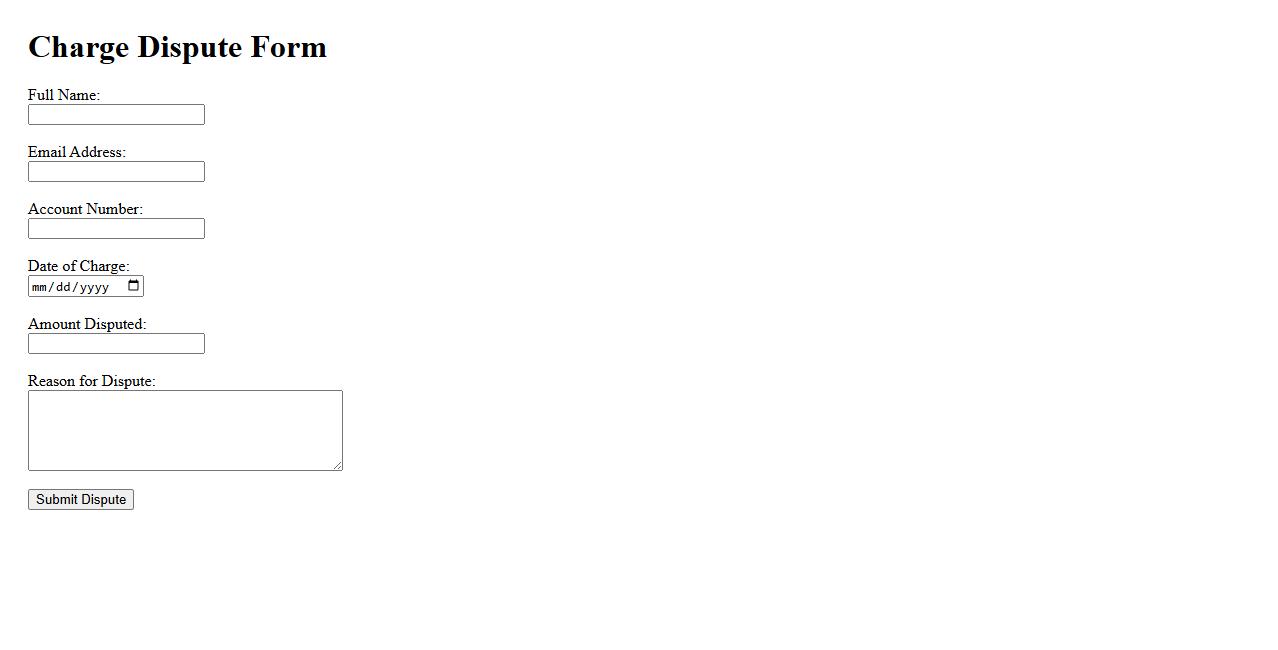

Charge Dispute Form

The Charge Dispute Form is used to formally contest unauthorized or incorrect transactions on your account. It allows you to provide necessary details and evidence to initiate an investigation. Completing this form promptly helps ensure timely resolution of the dispute.

Invoice Modification Request

An Invoice Modification Request is a formal document submitted to amend errors or update details on an existing invoice. It ensures accurate billing by correcting amounts, dates, or client information. This process helps maintain transparent financial records between businesses and clients.

Statement Update Form

The Statement Update Form allows users to request changes or corrections to their account statements efficiently. This form ensures accurate and timely updates, helping maintain clear financial records. Submitting the form promptly can prevent discrepancies and enhance account management.

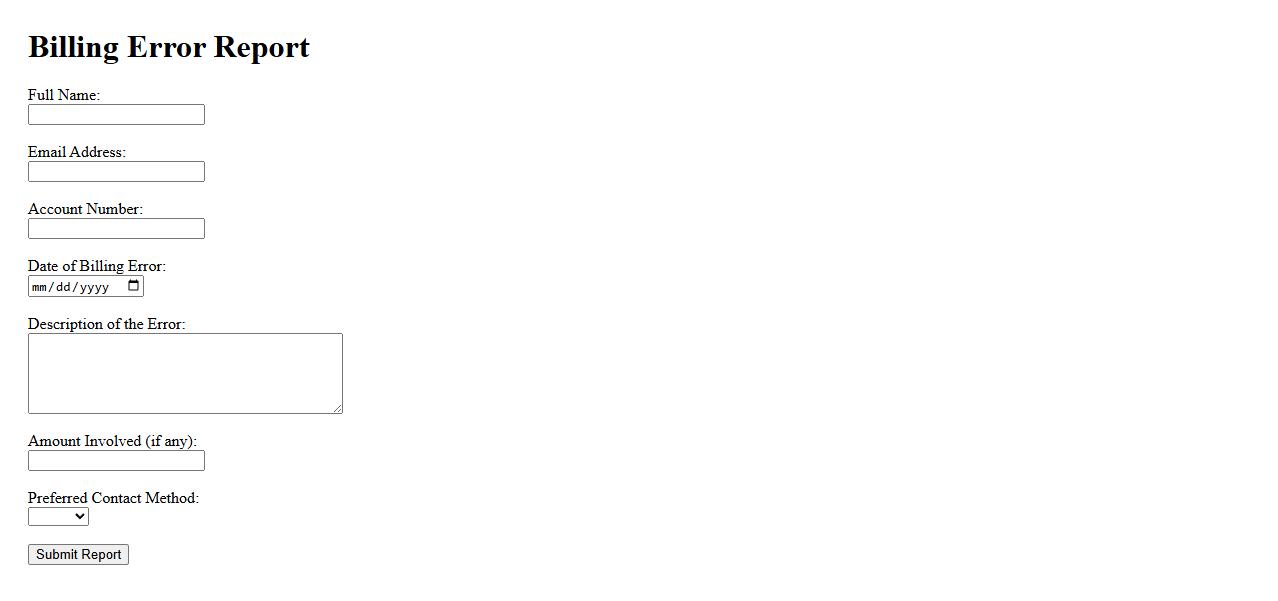

Billing Error Report

The Billing Error Report provides a detailed summary of discrepancies identified within financial transactions. It helps businesses quickly pinpoint and resolve invoicing mistakes to ensure accurate account management. Regular use of this report enhances transparency and improves the overall billing process.

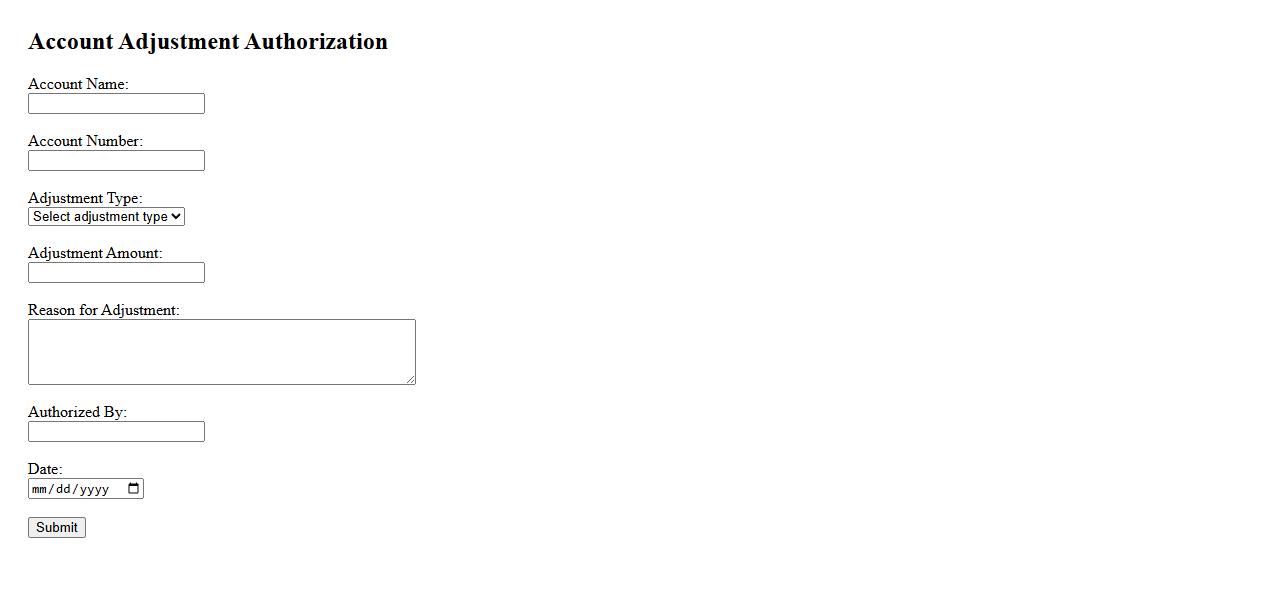

Account Adjustment Authorization

The Account Adjustment Authorization is a formal process that allows individuals or businesses to request modifications to their account details or balances. This authorization ensures that any changes made are properly documented and approved to maintain accuracy and accountability. It is essential for resolving discrepancies and updating account information securely.

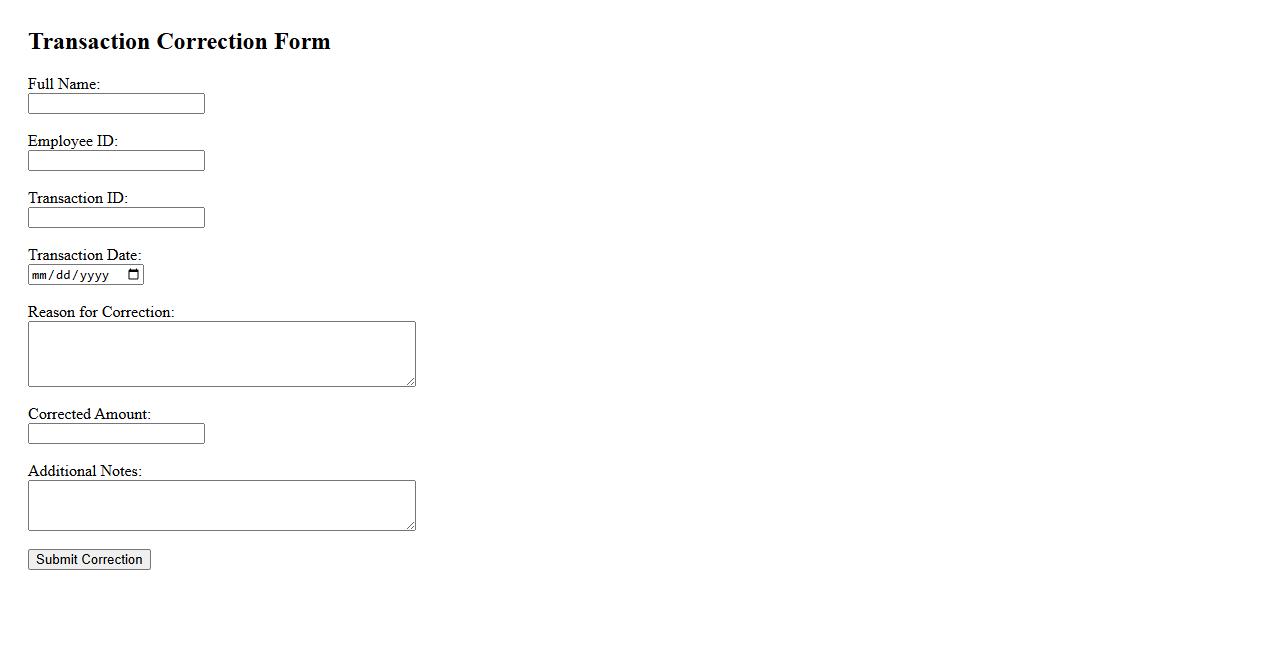

Transaction Correction Form

The Transaction Correction Form is used to rectify errors in financial transactions efficiently. This form ensures accurate record-keeping by allowing users to submit corrections with necessary details. It streamlines the process of amending transaction discrepancies to maintain data integrity.

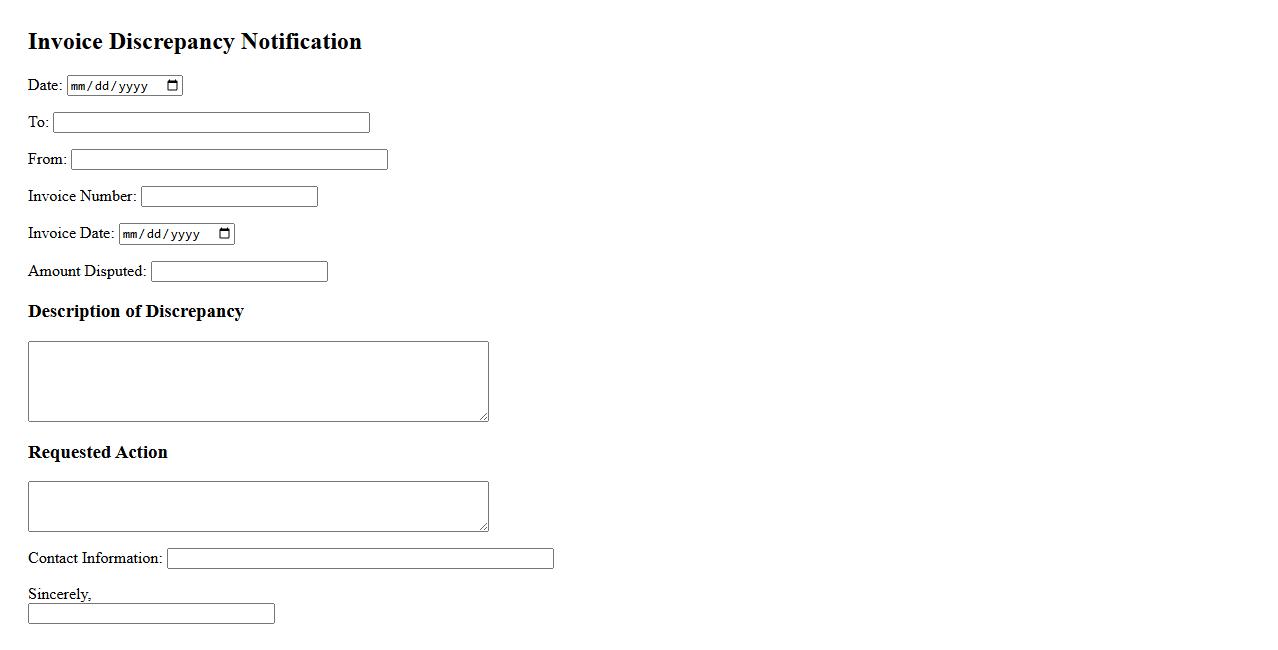

Invoice Discrepancy Notification

An Invoice Discrepancy Notification is a formal message sent to alert parties about inconsistencies found in billing statements. It helps ensure accurate payment processing and timely resolution of errors. Prompt attention to these notifications prevents financial misunderstandings and maintains smooth business operations.

What essential details are required to complete the Invoice Adjustment Form?

To complete the Invoice Adjustment Form, you must provide the invoice number and the date of the original invoice. The form also requires a clear description of the adjustment reason along with the precise amount to be corrected. Additionally, contact information for the submitter is essential to facilitate any necessary follow-up.

Which types of invoice discrepancies can be addressed using this form?

The form is designed to handle common discrepancies like billing errors, incorrect amounts, and missing items on the invoice. It can also address issues related to duplicate billing or invoices that do not match purchase orders. Adjustments requested for tax or discount errors are valid reasons for submitting this form.

Who is authorized to approve and process an Invoice Adjustment Form?

Typically, the accounts payable manager or a designated finance officer has the authority to approve the form. Approval often requires review by the department head associated with the original expenses for verification. The processing is usually handled by the accounts payable team to ensure consistency and accuracy.

What documentation must be attached to support an invoice adjustment request?

Attached documentation may include the original invoice, purchase orders, and any email correspondence related to the discrepancy. Supporting documents should clearly justify the reason for the adjustment request, such as shipping receipts or contract terms. Proper documentation helps to expedite the approval process and minimizes disputes.

How does submitting an Invoice Adjustment Form impact the payment timeline?

Submitting this form can temporarily delay the payment of the invoice until the adjustment is reviewed and approved. However, once processed, the correction ensures accurate payment amounts and prevents future billing issues. Prompt submission of the form and complete documentation can help minimize any delays to the overall payment schedule.