The Invoice Cancellation Form is a crucial document used to officially void a previously issued invoice, ensuring accurate financial records and preventing discrepancies. It includes essential details such as the invoice number, reason for cancellation, and authorized signatures. Proper use of this form helps maintain compliance with accounting standards and streamlines the audit process.

Invoice Void Form

The Invoice Void Form is used to formally cancel an issued invoice that contains errors or is no longer valid. This document ensures accurate financial records and helps maintain clear communication between the company and its clients. Filling out the form properly is essential for auditing and bookkeeping purposes.

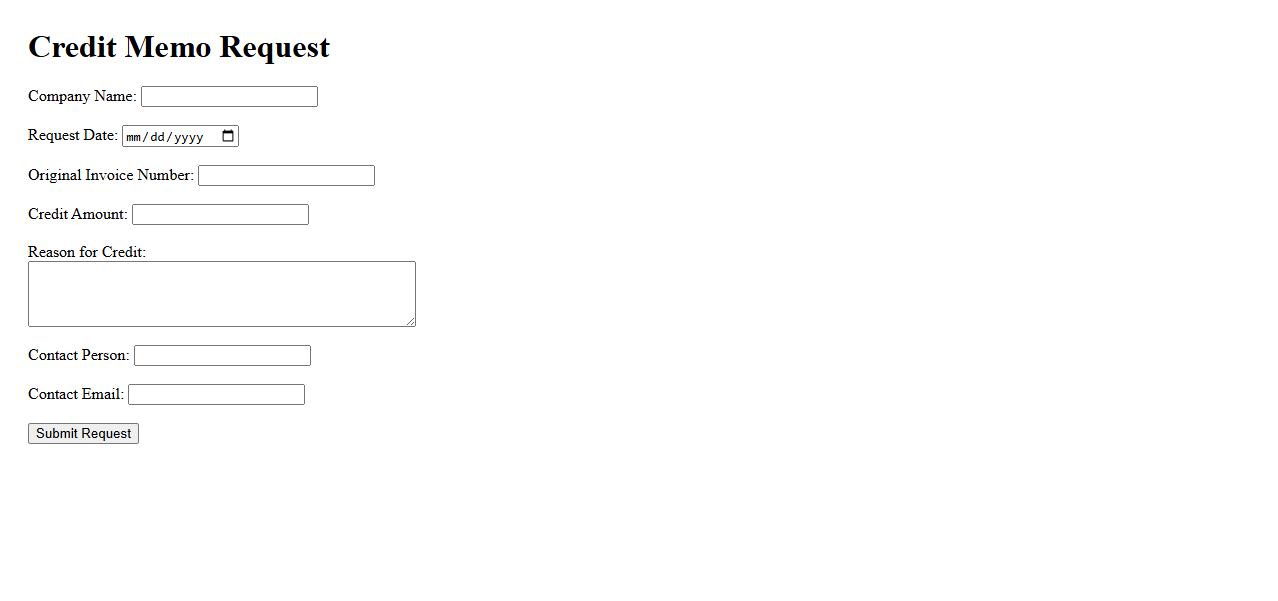

Credit Memo Request

A Credit Memo Request is a formal document used by customers to request a refund or credit adjustment from a seller due to returned goods, billing errors, or service issues. It helps streamline the resolution process by clearly stating the reasons for the credit. This request ensures accurate financial records and customer satisfaction.

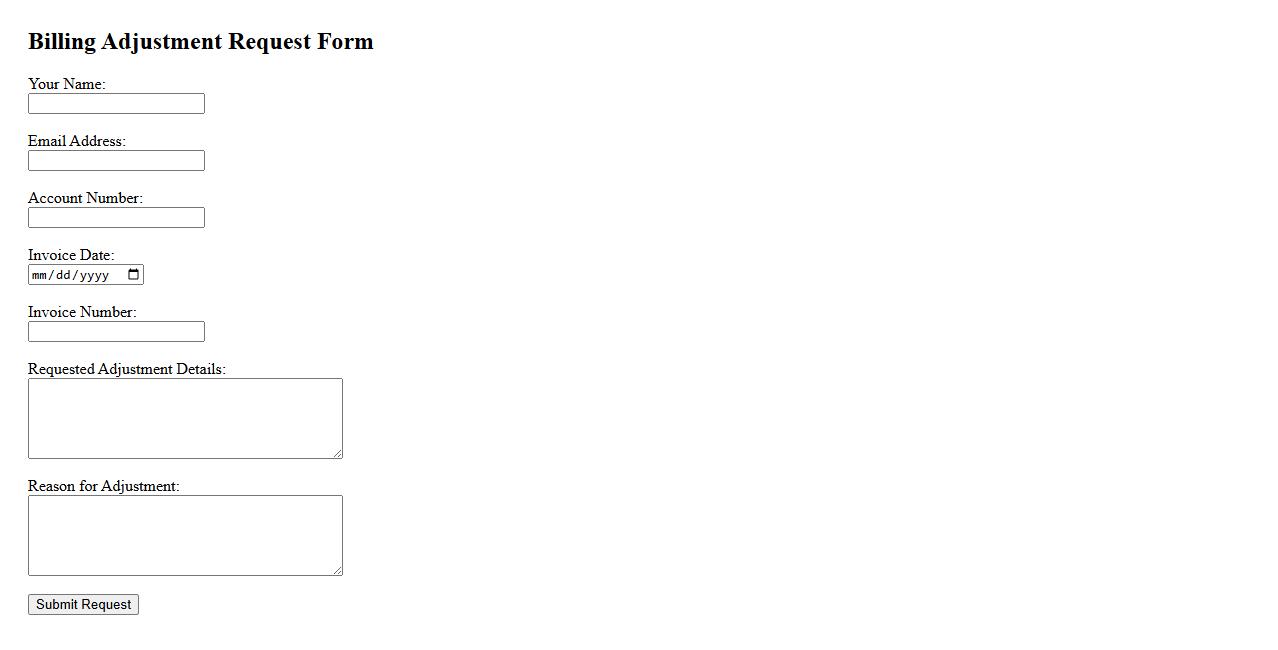

Billing Adjustment Request

A Billing Adjustment Request is a formal process used to correct errors or discrepancies in an invoice. It ensures accurate billing by allowing customers or businesses to request changes to charges. This helps maintain transparent financial records and resolves disputes efficiently.

Invoice Reversal Form

The Invoice Reversal Form is used to correct billing errors by nullifying previously issued invoices. It ensures accurate financial records and prevents discrepancies in accounting. This form is essential for maintaining transparent and organized transaction histories.

Invoice Correction Form

The Invoice Correction Form is used to rectify errors on previously issued invoices quickly and accurately. It ensures proper documentation and helps maintain accurate financial records. This form is essential for both vendors and clients to resolve discrepancies efficiently.

Invoice Annulment Form

The Invoice Annulment Form is a crucial document used to cancel or void issued invoices. It ensures proper record-keeping and compliance with accounting standards. This form helps businesses rectify errors and maintain accurate financial records efficiently.

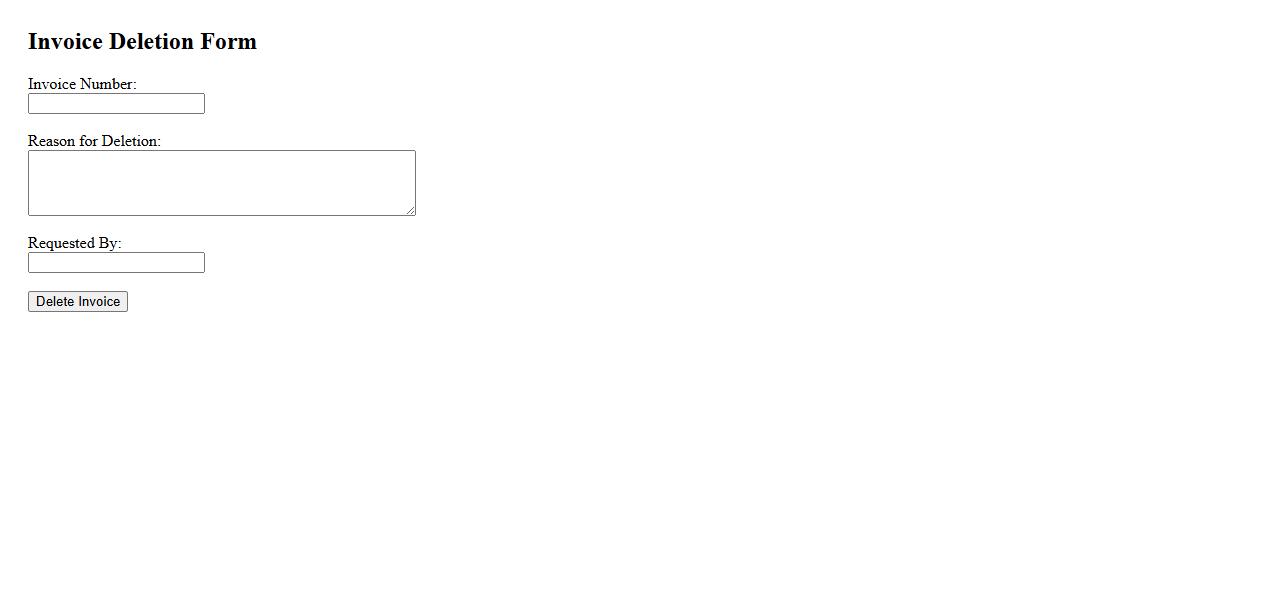

Invoice Deletion Form

The Invoice Deletion Form is a crucial document used to request the removal of an invoice from the accounting system. It ensures proper authorization and auditing before any data is permanently deleted. Utilizing this form helps maintain accurate financial records and prevents unauthorized modifications.

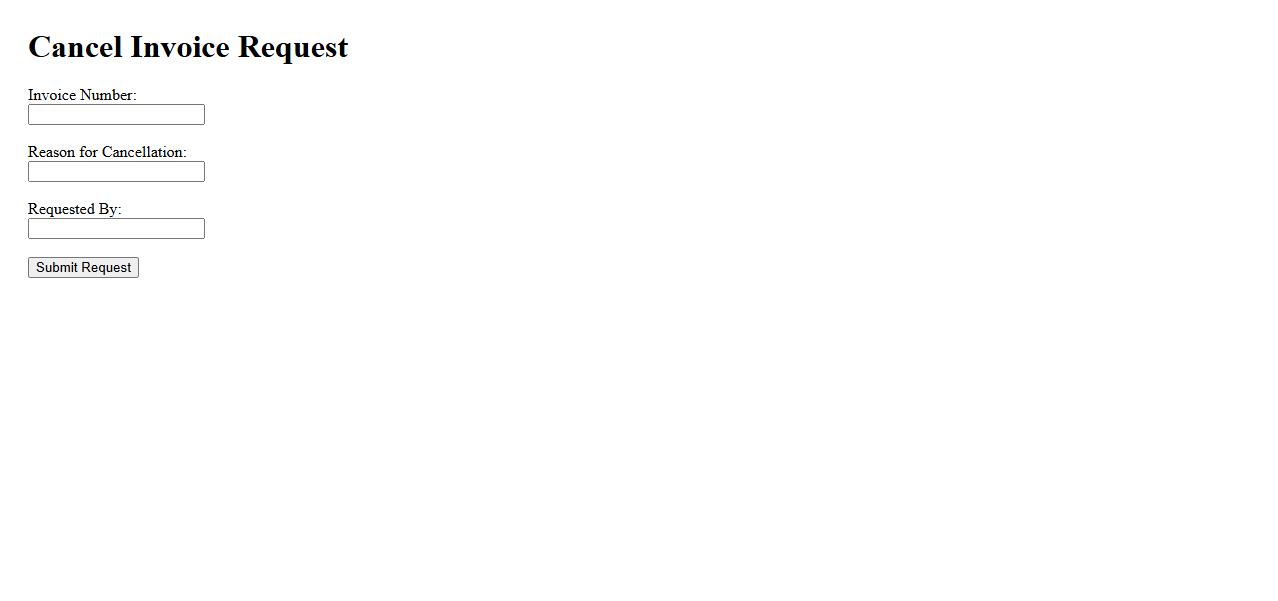

Cancel Invoice Request

The Cancel Invoice Request allows users to formally request the cancellation of an issued invoice. This process ensures accurate financial records and prevents discrepancies in billing. Timely submission of a cancellation request is essential for proper accounting adjustments.

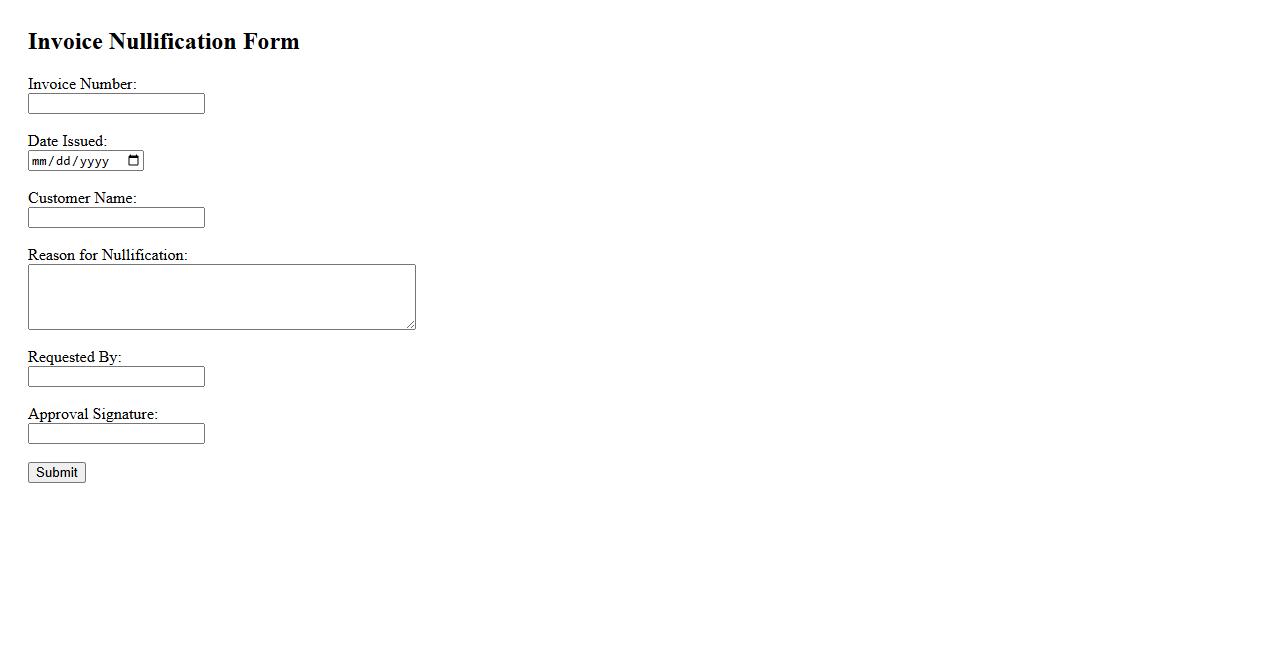

Invoice Nullification Form

The Invoice Nullification Form is used to officially cancel or invalidate an issued invoice. This document ensures proper record-keeping and compliance with financial regulations. It helps businesses correct billing errors and maintain accurate accounting.

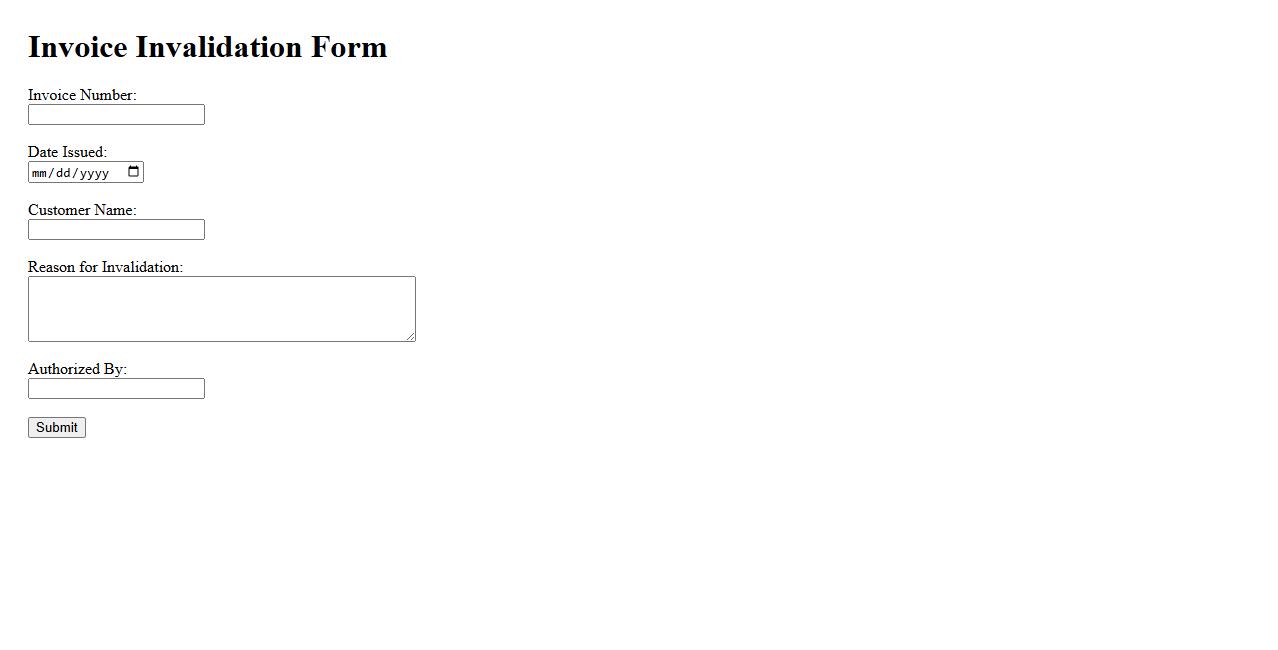

Invoice Invalidation Form

The Invoice Invalidation Form is used to formally cancel or void an issued invoice that contains errors or is no longer valid. This form ensures proper documentation and compliance with accounting standards. It helps maintain accurate financial records by preventing incorrect invoices from being processed.

What is the purpose of an Invoice Cancellation Form?

The primary purpose of an Invoice Cancellation Form is to officially document the voiding of a previously issued invoice. This form ensures that both parties acknowledge the cancellation and helps maintain accurate financial records. It serves as a formal record to prevent accounting discrepancies and future disputes.

Which details from the original invoice are required on the cancellation form?

The cancellation form must include key details from the original invoice, such as the invoice number, date of issuance, and total amount. Additionally, information about the billing and shipping parties is essential for accurate cross-referencing. This ensures clarity and proper tracking in the accounting system.

What reasons are typically accepted for invoice cancellation?

Common acceptable reasons for invoice cancellation include errors in billing, duplicate invoices, or order cancellations. Another typical reason is a change in the order details that invalidates the original invoice. These reasons must be clearly stated on the form to justify the cancellation officially.

Who is authorized to approve an Invoice Cancellation Form?

The authority to approve an Invoice Cancellation Form usually lies with the finance manager or an authorized accounting officer. Approval ensures that cancellations are controlled and genuine, safeguarding the organization's financial integrity. Some companies also require dual authorization for higher-value invoices.

What are the potential effects on accounting records after submitting this form?

After submission, the invoice cancellation form leads to adjustments in the accounting records, such as reversing revenue or accounts receivable entries. This ensures the financial statements accurately reflect the company's financial position. Proper documentation also aids in audit trails and compliance with legal requirements.