An Invoice for Tax Preparation outlines the charges and services provided by a tax professional during the preparation of tax returns. This document details fees, hours worked, and any additional expenses incurred, ensuring clear communication between the client and the service provider. Accurate invoicing helps maintain transparency and supports efficient financial record-keeping.

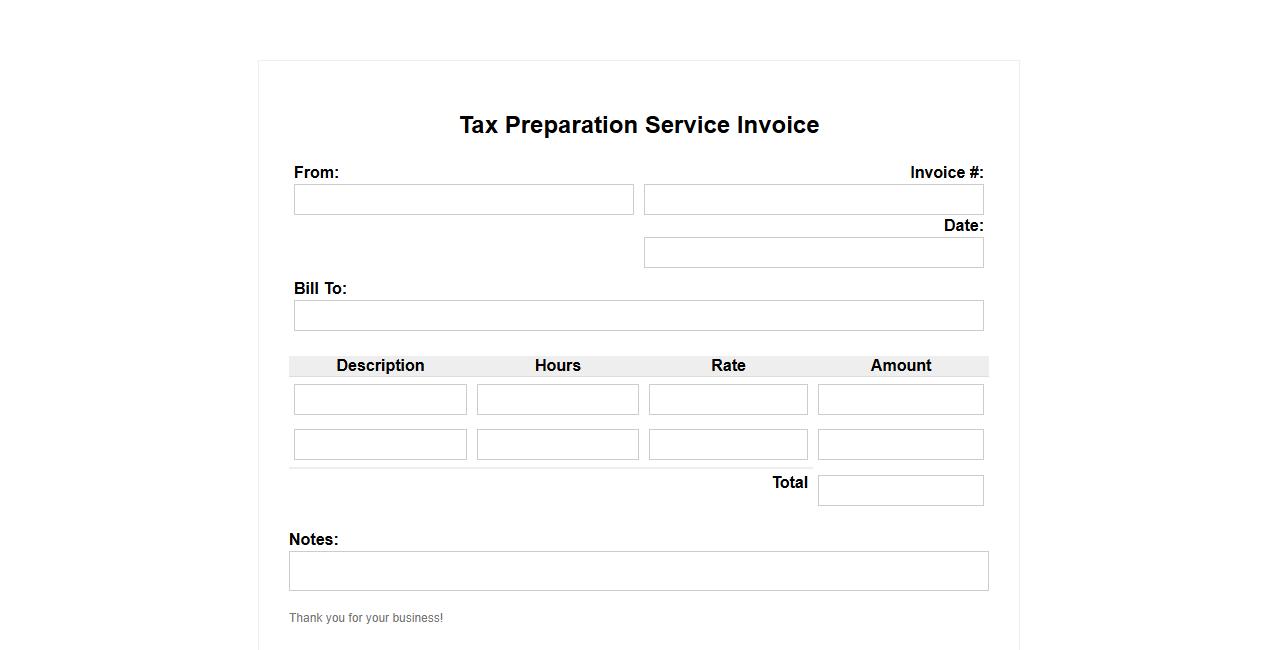

Tax Preparation Service Invoice

Our Tax Preparation Service Invoice provides a clear breakdown of all charges related to tax filing assistance. It ensures transparency and helps clients understand the cost of services rendered. This invoice serves as an official record for both the service provider and the client.

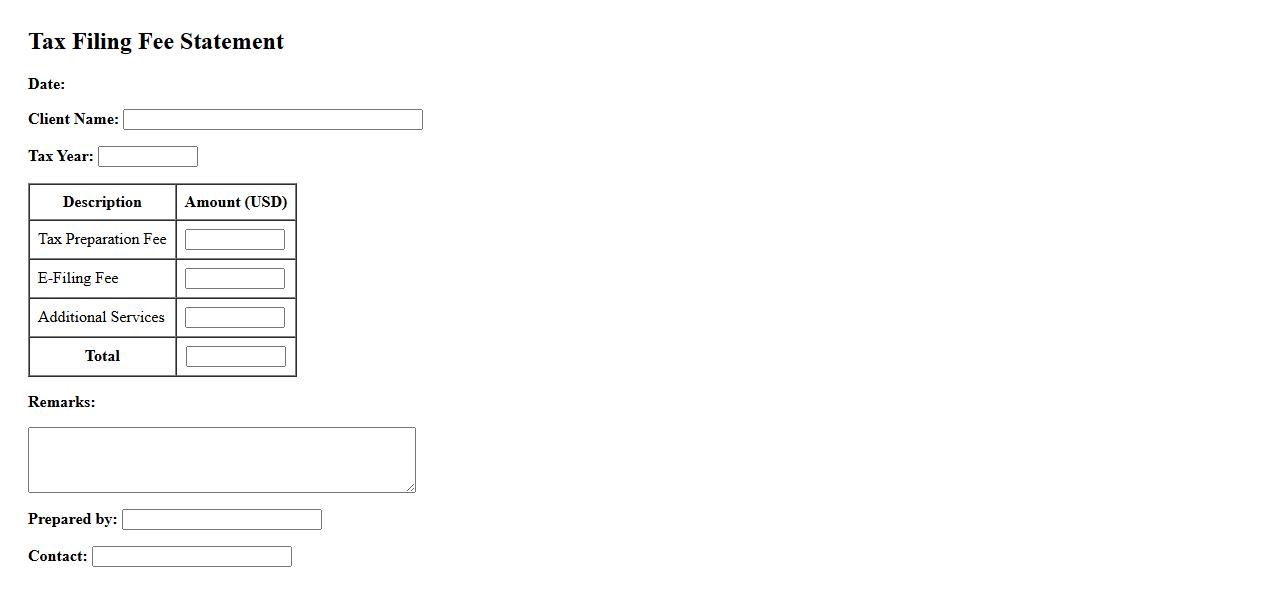

Tax Filing Fee Statement

The Tax Filing Fee Statement outlines the charges associated with processing your tax return. It provides a clear summary of any fees incurred during the submission and review of tax documents. This statement helps ensure transparency and accurate accounting of tax-related expenses.

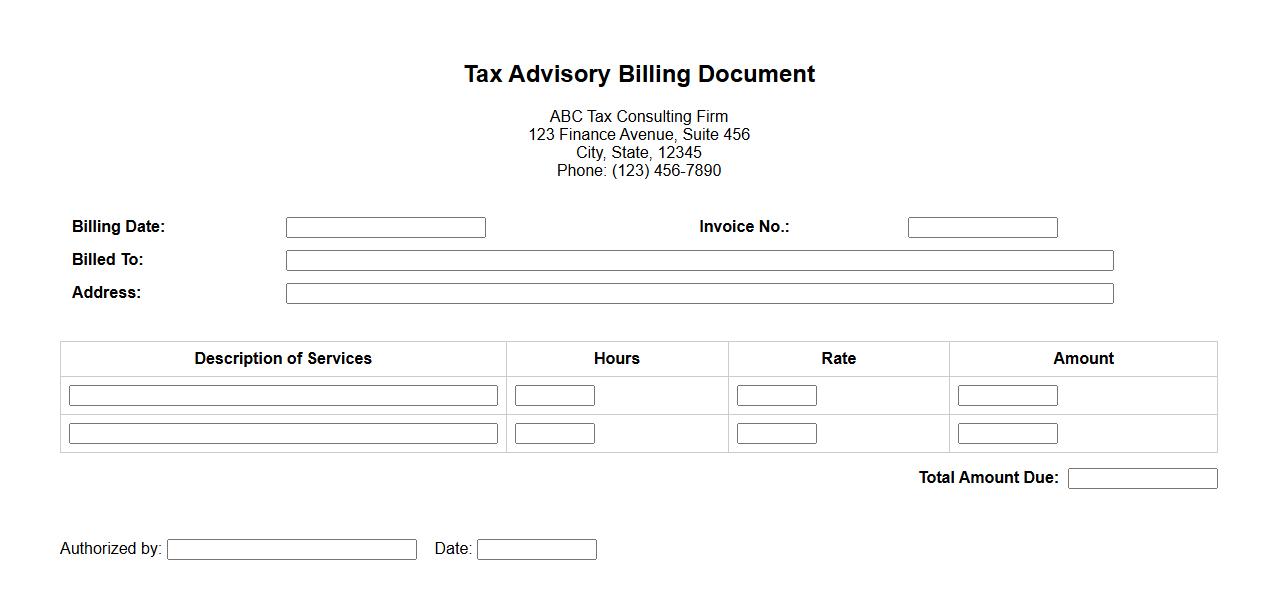

Tax Advisory Billing Document

The Tax Advisory Billing Document provides a detailed summary of services rendered and associated fees for tax consulting. It ensures transparency and accuracy in financial transactions between clients and advisors. This document is essential for proper record-keeping and tax compliance.

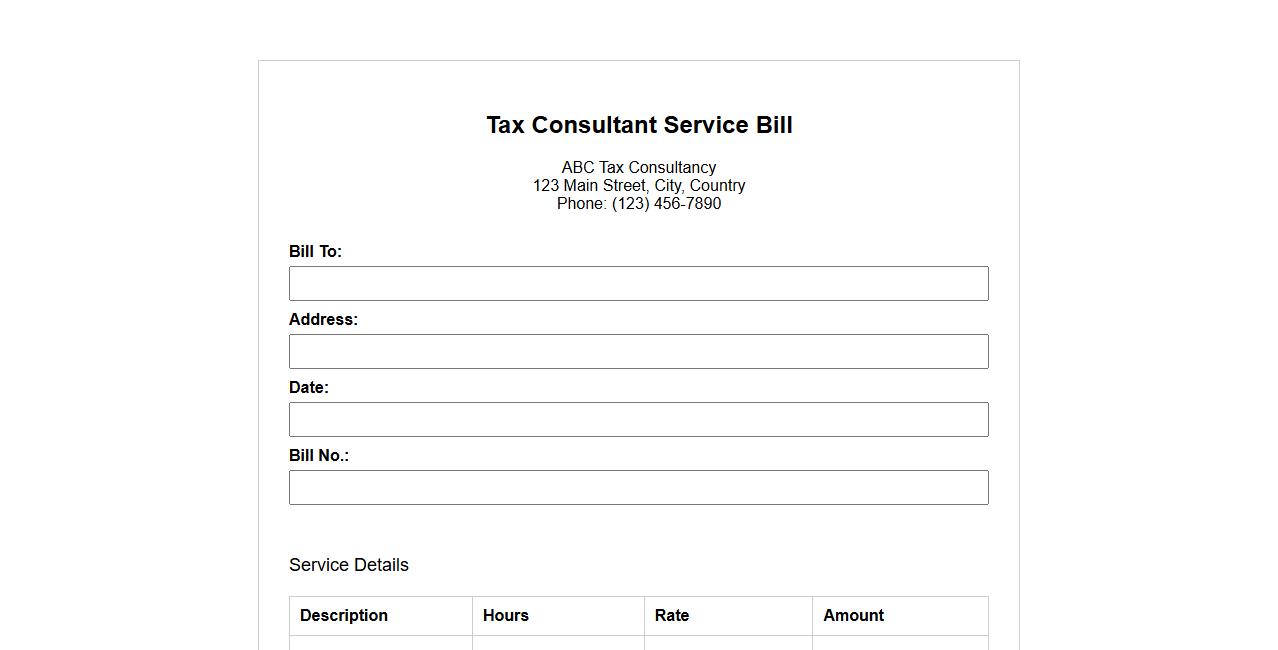

Tax Consultant Service Bill

Tax Consultant Service Bill outlines the fees charged for professional assistance in managing and filing taxes. This document details the scope of services provided, including tax planning, preparation, and advisory support. It ensures clear communication between the consultant and client regarding payment terms and obligations.

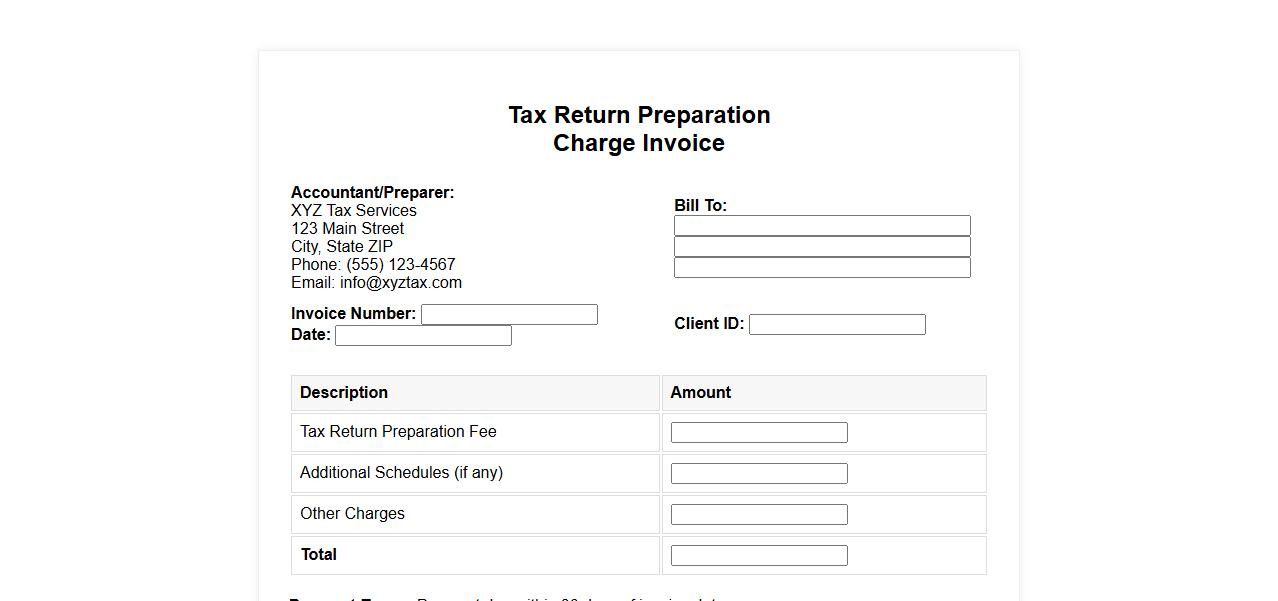

Tax Return Preparation Charge Invoice

The Tax Return Preparation Charge Invoice outlines the fees associated with the accurate filing of your tax documents. It details the cost of services provided, ensuring transparency and clear communication between the client and the tax professional. This invoice is essential for record-keeping and financial planning purposes.

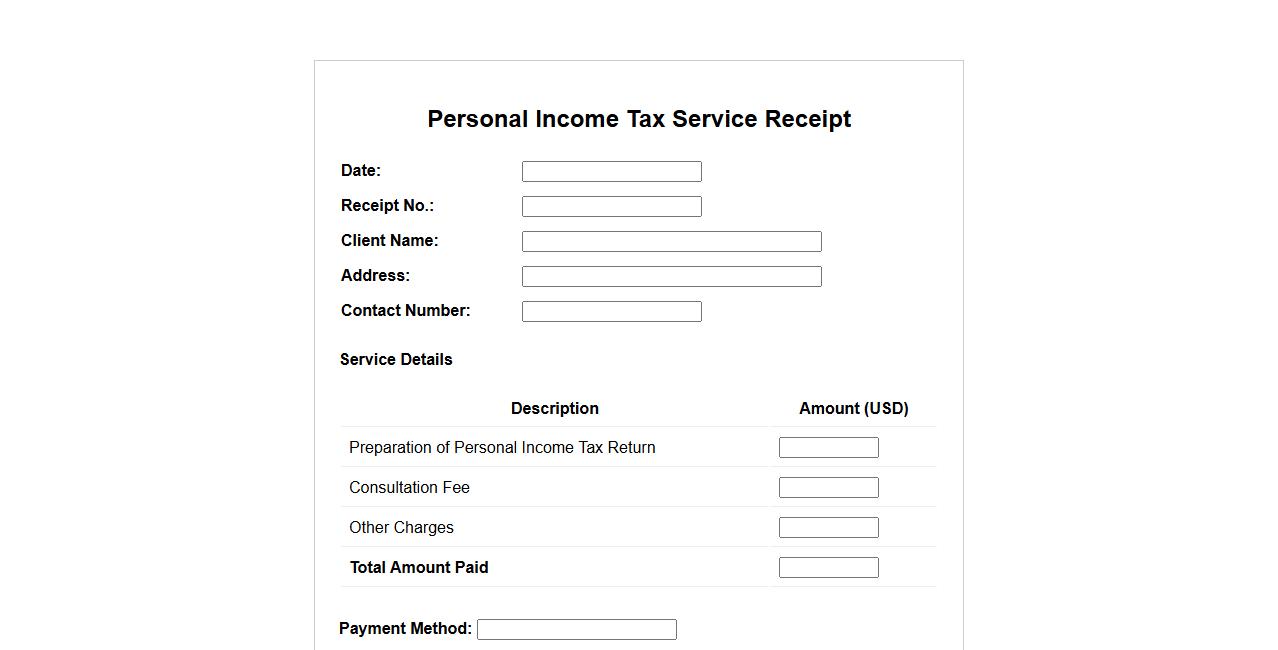

Personal Income Tax Service Receipt

The Personal Income Tax Service Receipt serves as an official document confirming the payment or processing of individual income tax services. It includes essential details such as the taxpayer's name, payment amount, and transaction date. This receipt is crucial for record-keeping and tax filing purposes.

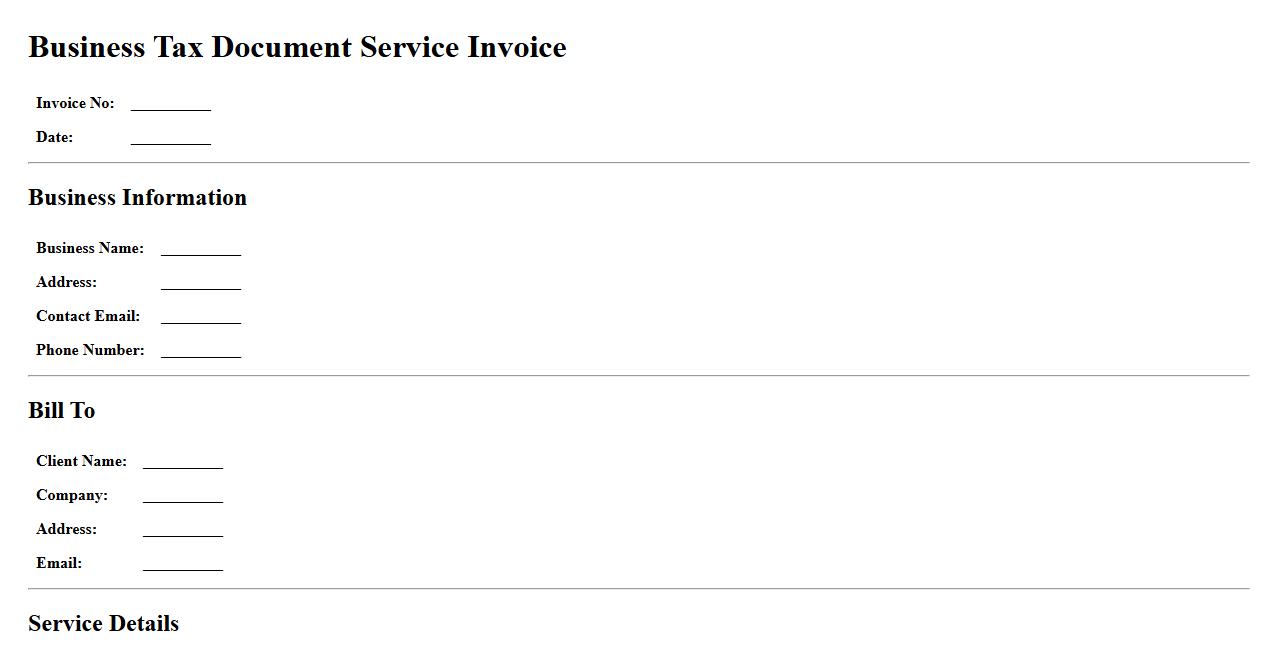

Business Tax Document Service Invoice

The Business Tax Document Service Invoice outlines the charges for professional financial services related to tax preparation and filing. It serves as an official record for businesses to track expenses and comply with tax regulations. Accurate invoices help ensure transparency and smooth financial audits.

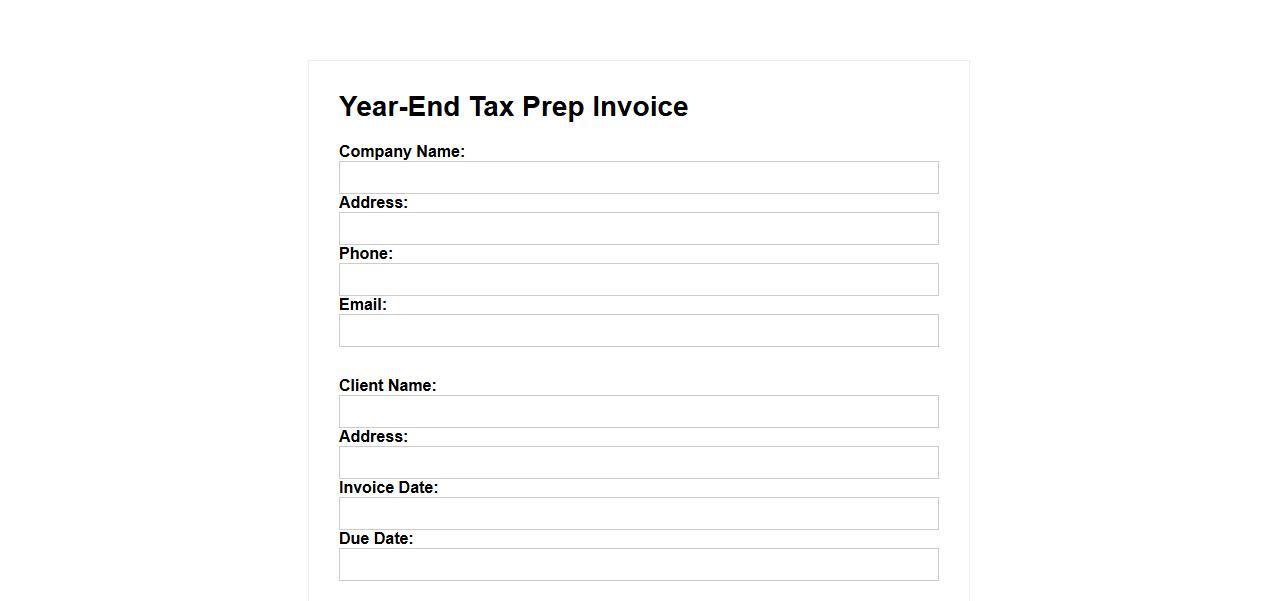

Year-End Tax Prep Invoice

Efficiently organize your finances with a Year-End Tax Prep Invoice, designed to outline all services rendered for tax preparation. This document ensures clear communication between the accountant and client, detailing expenses and fees incurred throughout the year. Proper invoicing simplifies the tax filing process and helps maintain accurate financial records.

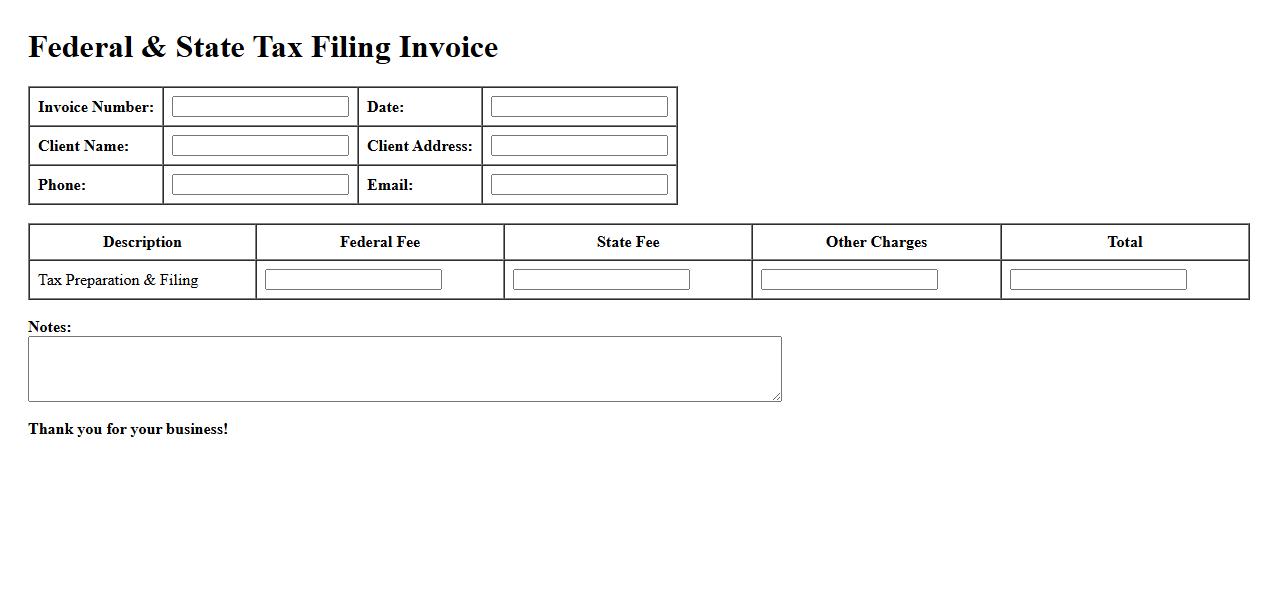

Federal & State Tax Filing Invoice

The Federal & State Tax Filing Invoice provides a detailed summary of charges related to the preparation and submission of tax returns. It outlines specific fees for both federal and state tax services, ensuring transparency and accuracy. This document is essential for record-keeping and financial reconciliation during tax season.

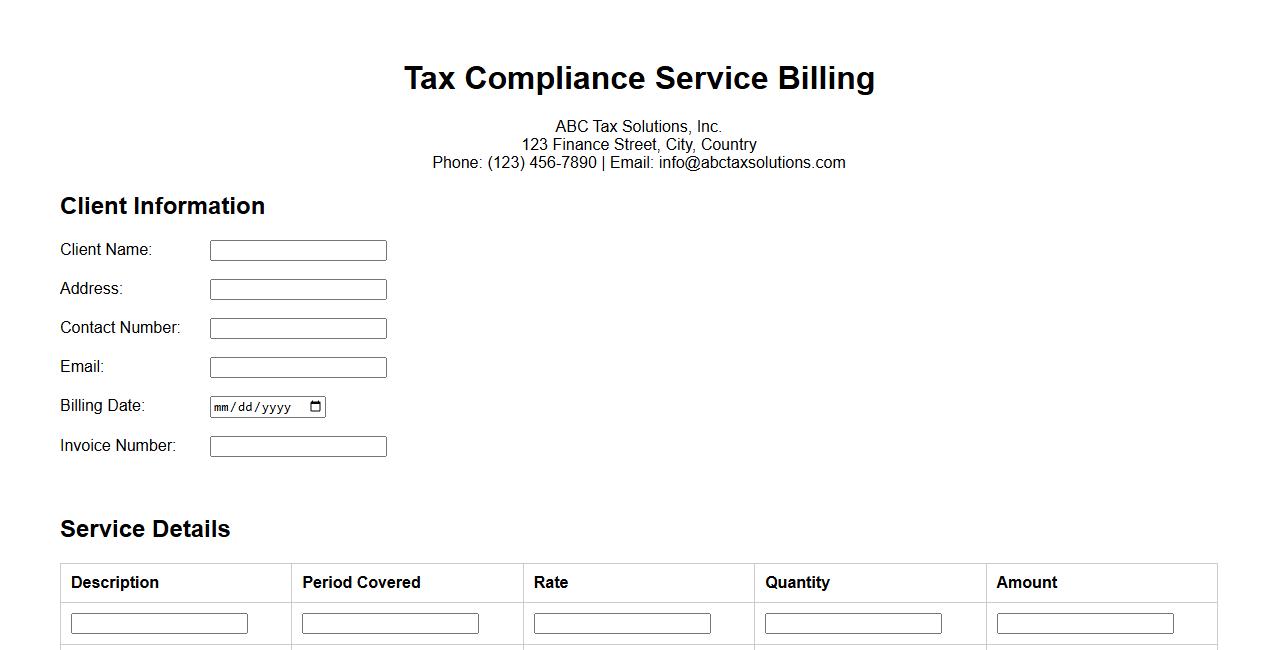

Tax Compliance Service Billing

Our Tax Compliance Service Billing ensures accurate and timely invoicing for all tax-related services, helping businesses meet regulatory requirements efficiently. We streamline the billing process to minimize errors and ensure transparency. Trust us to handle your tax compliance costs with professionalism and precision.

What specific tax services are being billed on this invoice?

The invoice clearly states the tax preparation services provided. These services include detailed preparation and filing of federal and state income tax returns. Additional consulting or advisory services may also be itemized if applicable.

Which tax year is covered by the tax preparation invoice?

This invoice applies specifically to the tax year 2023. All calculations, forms, and submissions pertain to this period. It ensures compliance with all relevant tax regulations for the stated year.

Who is identified as the client receiving the tax preparation services?

The client listed on the invoice is John Doe, the individual or entity receiving the tax services. The invoice includes the client's contact information and billing address. This identification is essential for accurate record-keeping and tax filing purposes.

What is the total amount due for the tax preparation on this invoice?

The total amount due for the tax preparation services is $750.00. This figure includes all applicable fees, taxes, and any additional charges. It reflects the comprehensive cost for completing the tax return accurately.

What are the payment terms and due date stated on the invoice?

The invoice specifies a payment due date of May 31, 2024. Payment terms require full settlement within 30 days from the invoice issue date. Late payments may incur additional fees or interest charges as outlined in the terms.