An Invoice for Goods Sold PDF serves as a detailed document outlining the transaction between a seller and buyer, listing items, quantities, prices, and total cost. This format ensures easy sharing, printing, and record-keeping while maintaining a professional appearance. It helps streamline payment processes and provides legal proof of the sale.

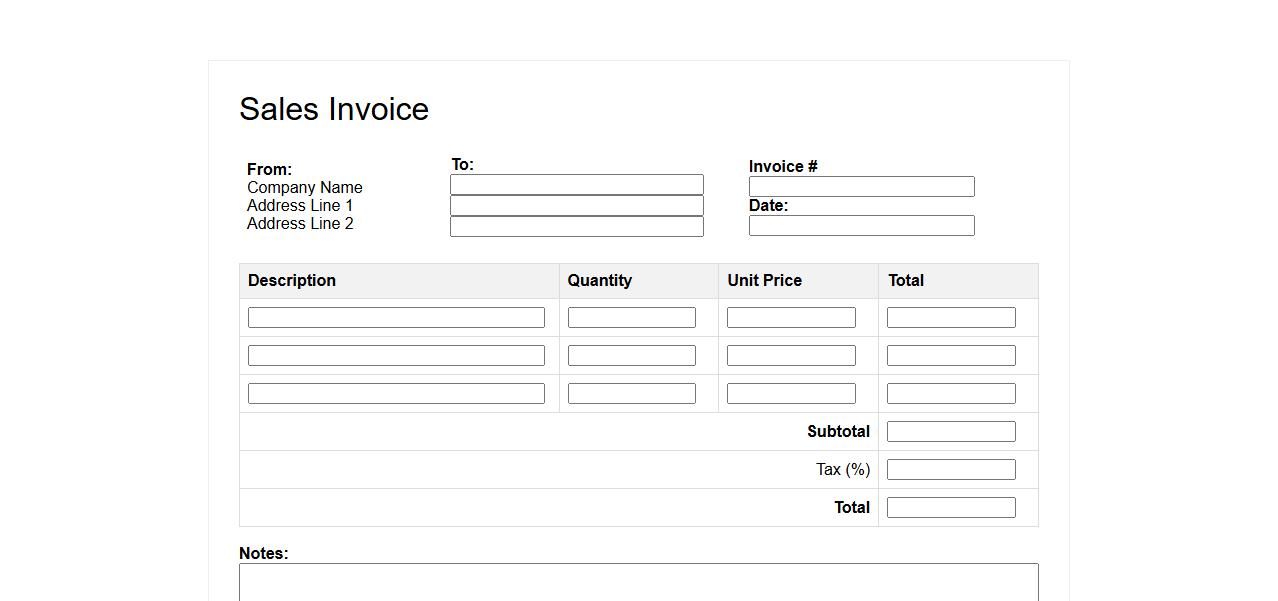

Sales Invoice Template

A sales invoice template is a preformatted document used to itemize and record the details of a sales transaction. It helps businesses maintain accurate billing information and streamline payment processing. This template typically includes sections for product descriptions, quantities, prices, and total amount due.

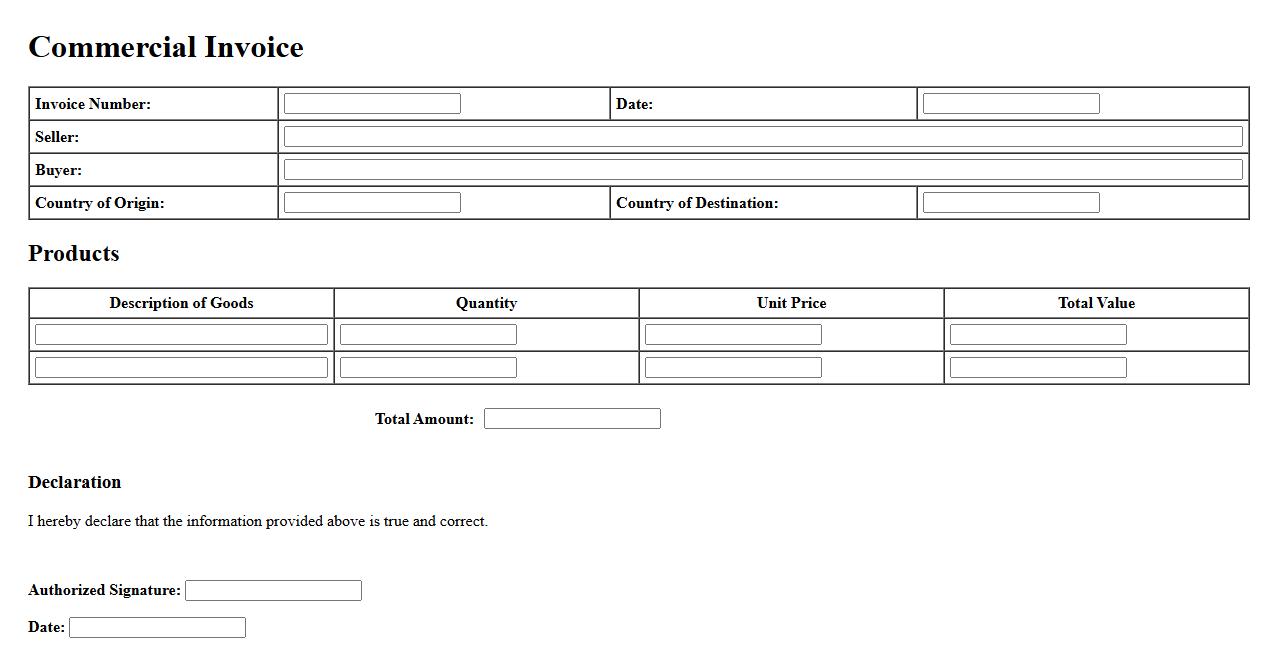

Commercial Invoice for Products

A Commercial Invoice for products is an essential document used in international trade to detail the transaction between the seller and buyer. It provides information such as product description, quantity, price, and terms of sale. This invoice ensures smooth customs clearance and accurate taxation during shipment.

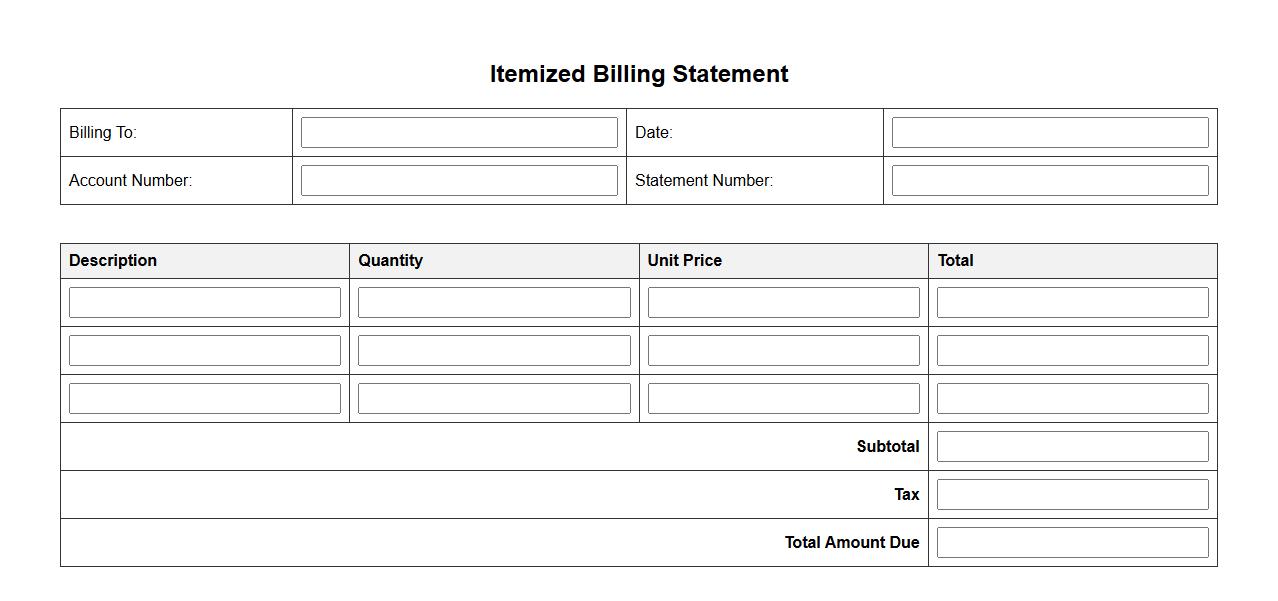

Itemized Billing Statement

An itemized billing statement provides a detailed breakdown of charges for products or services rendered. It lists each item separately, including quantities, prices, and any applicable taxes or fees. This clear format helps customers understand exactly how their total amount is calculated.

Goods Purchase Receipt

The Goods Purchase Receipt is a crucial document issued by a seller to the buyer as proof of purchased items. It details the quantity, description, and price of goods exchanged to ensure transparency and record-keeping. This receipt aids in tracking inventory and resolving any disputes related to the transaction.

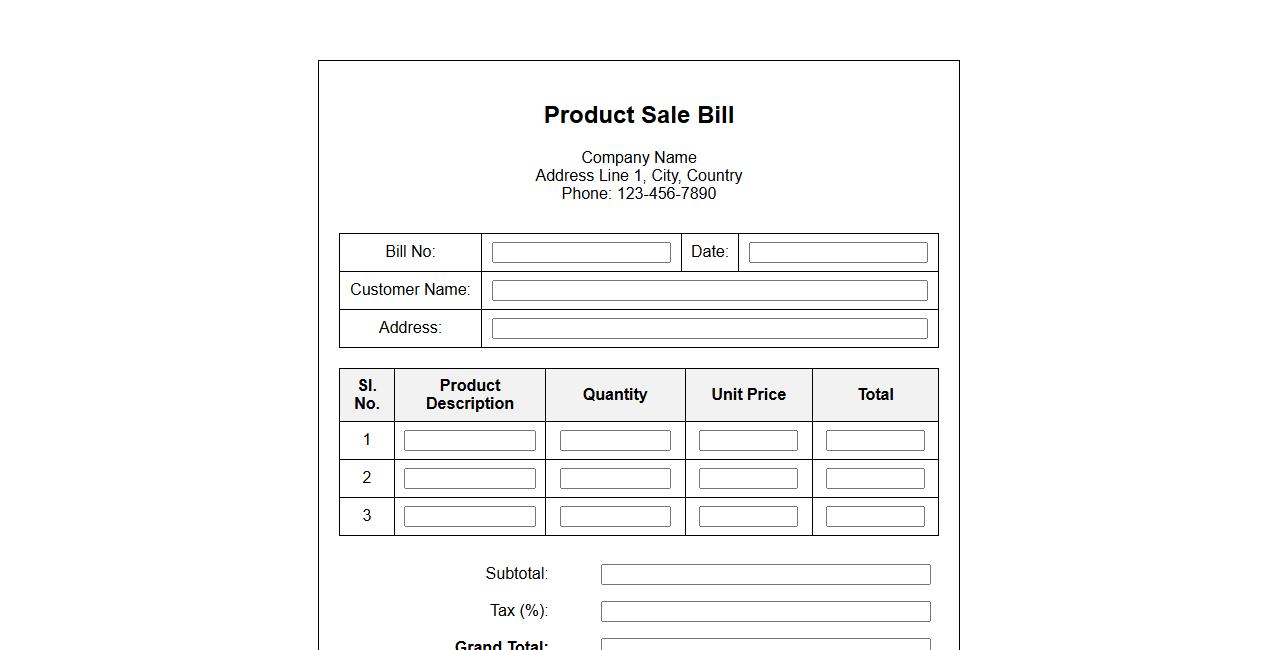

Product Sale Bill

The Product Sale Bill serves as an official document detailing the transaction between the seller and buyer. It includes essential information such as product descriptions, quantities, prices, and payment terms. This bill ensures transparency and aids in record-keeping for both parties involved.

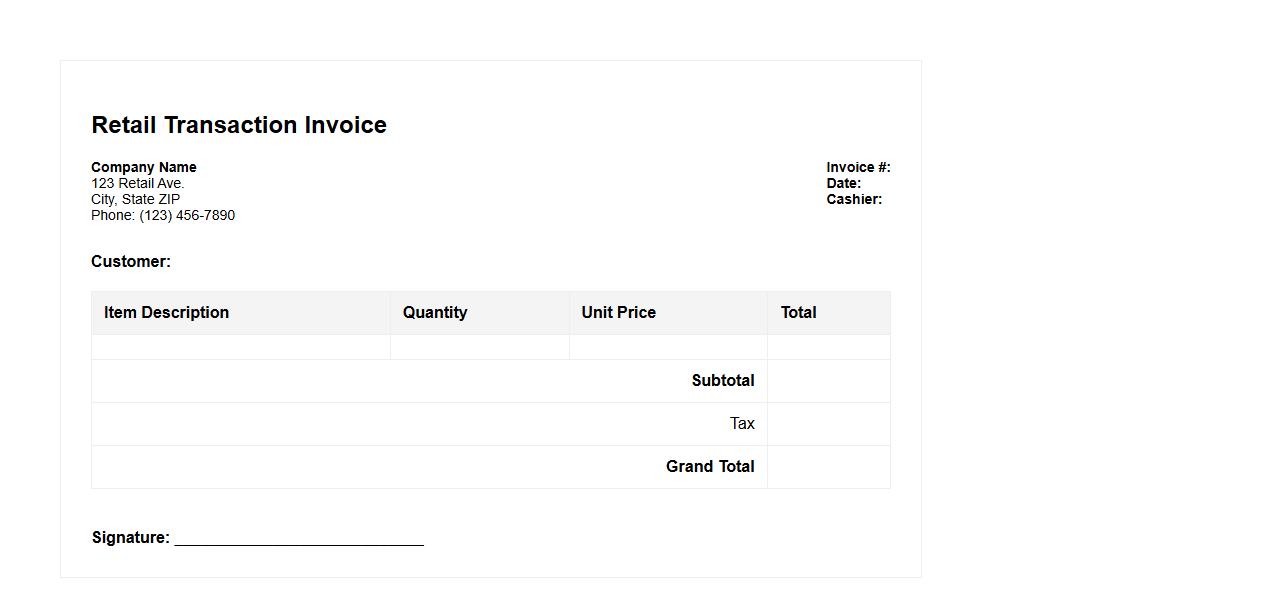

Retail Transaction Invoice

A Retail Transaction Invoice is a detailed document provided to customers after a purchase, outlining the items bought, their prices, and the total amount paid. It serves as proof of purchase and is essential for returns or warranty claims. Retailers use it to maintain accurate sales records and manage inventory efficiently.

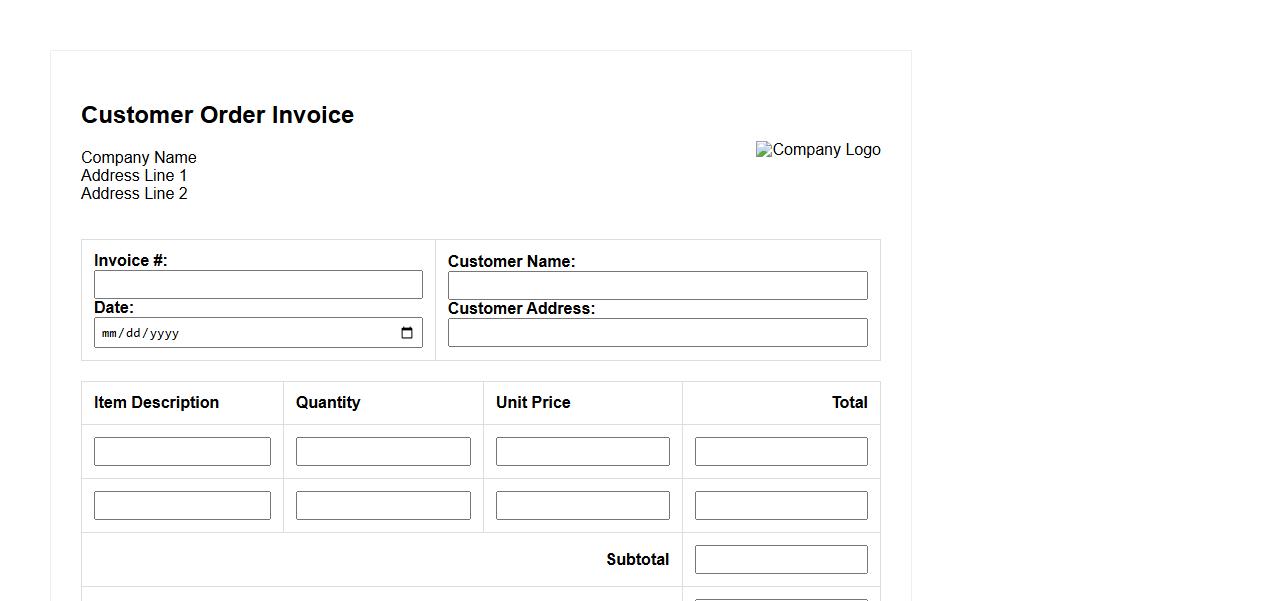

Customer Order Invoice

A Customer Order Invoice is a detailed document provided to buyers outlining the products or services purchased, their quantities, and the total payment due. It serves as a formal record for both the customer and the seller, ensuring transparency in the transaction. This invoice helps in tracking orders and facilitating smooth payment processes.

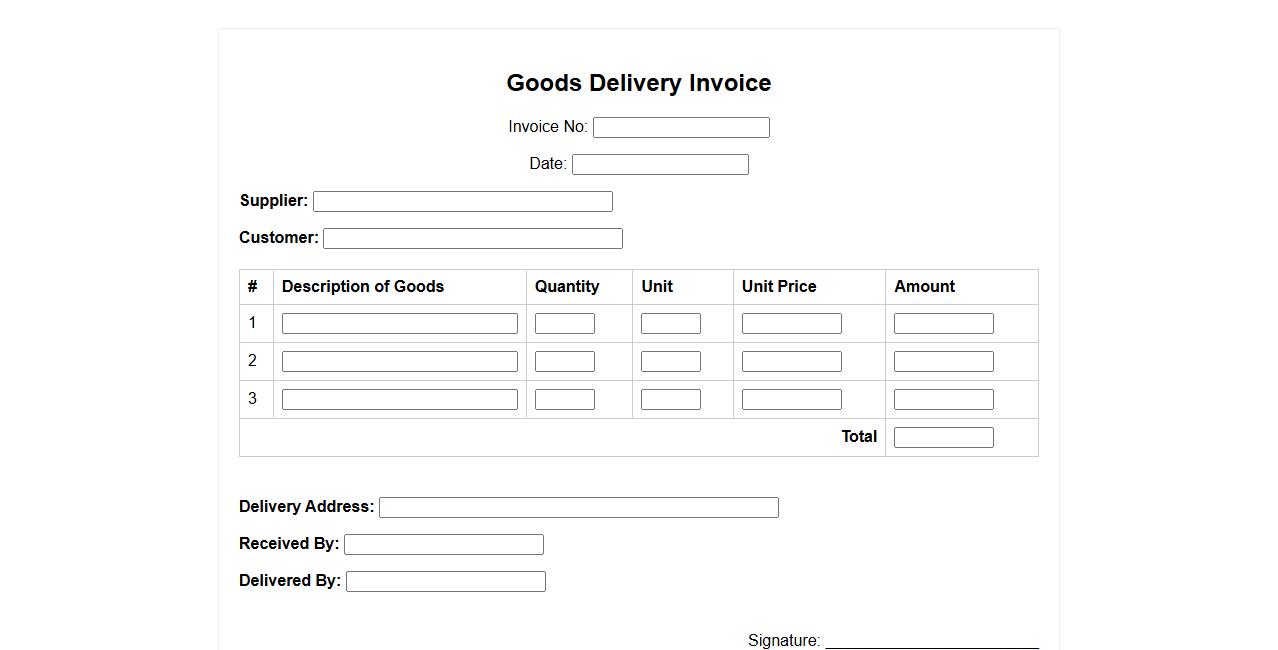

Goods Delivery Invoice

A Goods Delivery Invoice is a document that details the items delivered to a customer, including quantities and descriptions. It serves as proof of delivery and helps in tracking shipments accurately. This invoice is essential for both the seller and buyer to confirm the receipt of goods.

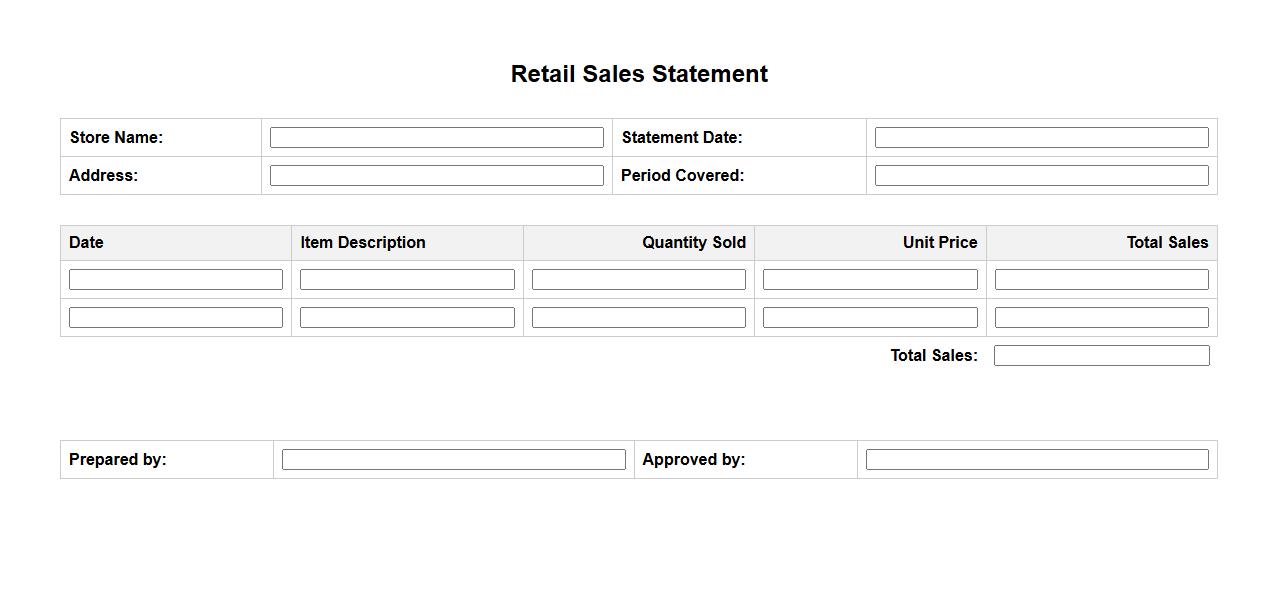

Retail Sales Statement

The Retail Sales Statement provides a detailed summary of daily or monthly sales transactions within a retail business. It helps track revenue, monitor inventory turnover, and analyze sales performance to inform business decisions. Accurate statements enable retailers to optimize stock management and improve customer satisfaction.

Merchandise Invoice Form

The Merchandise Invoice Form is a crucial document used in business transactions to detail the items sold, quantities, prices, and total amount due. It ensures transparency between sellers and buyers by providing an official record of the purchase. This form helps streamline accounting and inventory management processes efficiently.

What crucial details must be included in an Invoice for Goods Sold PDF to ensure legal compliance?

An Invoice for Goods Sold PDF must include the seller's and buyer's contact information, including names, addresses, and tax identification numbers. It should clearly list the description, quantity, unit price, and total price for each item sold. Additionally, the invoice must display the invoice number, date of issue, and applicable taxes to meet legal compliance standards.

How does an Invoice for Goods Sold PDF differentiate between taxable and non-taxable items?

An Invoice for Goods Sold PDF separates items by labeling each product or service with clear indications of its tax status. Taxable items include the applicable tax rate and amount next to them, while non-taxable items show a zero or "exempt" status. This differentiation ensures accurate tax calculation and legal clarity within the invoice.

What methods can be used to verify the authenticity of an Invoice for Goods Sold PDF?

To verify the authenticity of an Invoice for Goods Sold PDF, one can check for a digital signature or watermark embedded within the document. Cross-referencing the invoice number and date with the issuing company's records or accounting system provides additional verification. Moreover, examining metadata and verifying the sender's email or contact information is crucial for ensuring genuine authenticity.

How are payment terms and deadlines typically represented within an Invoice for Goods Sold PDF?

The payment terms and deadlines in an Invoice for Goods Sold PDF are commonly found in a dedicated section labeled "Payment Terms" or "Due Date." This section specifies the acceptable payment methods and the date by which payment must be made to avoid penalties. Clear expression of these terms ensures timely payment and avoids misunderstandings.

Which document fields in an Invoice for Goods Sold PDF are essential for audit and record-keeping purposes?

Essential fields for audit and record-keeping in an Invoice for Goods Sold PDF include the invoice number, issue date, seller and buyer details, and itemized description of goods sold. The tax amounts, total amount due, and payment terms must also be included to comply with financial regulations. Proper documentation of these fields facilitates seamless auditing and accurate financial reporting.