An Invoice for Consulting Services PDF is a professionally formatted document used to request payment for consulting work provided. It typically includes detailed descriptions of services rendered, hours worked, rates, and total amounts due, ensuring clear communication between consultants and clients. This format allows easy sharing and printing while maintaining a consistent and organized presentation.

Consulting Fee Invoice Document

The Consulting Fee Invoice Document is a formal record that outlines the payment details for professional consulting services provided. It specifies the fee charged, service description, and payment terms. This document ensures transparent and accurate financial transactions between consultants and clients.

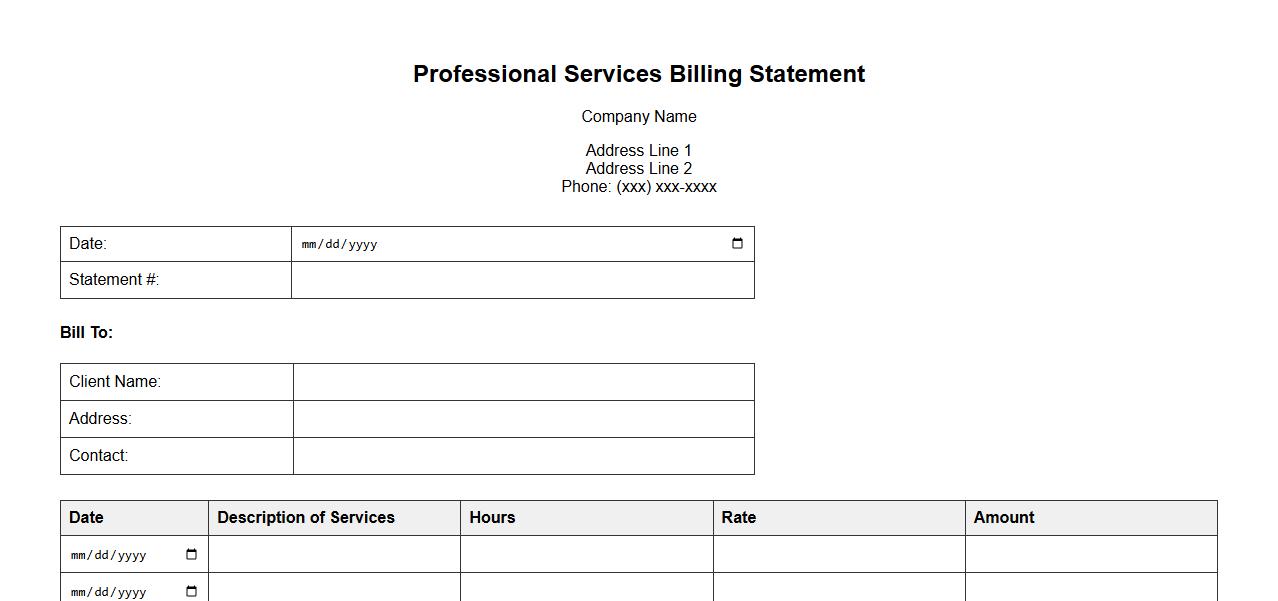

Professional Services Billing Statement

The Professional Services Billing Statement provides a clear and detailed record of charges for expert services rendered. It ensures transparency by itemizing fees and payment terms. Clients can easily review and verify the billing information for accuracy.

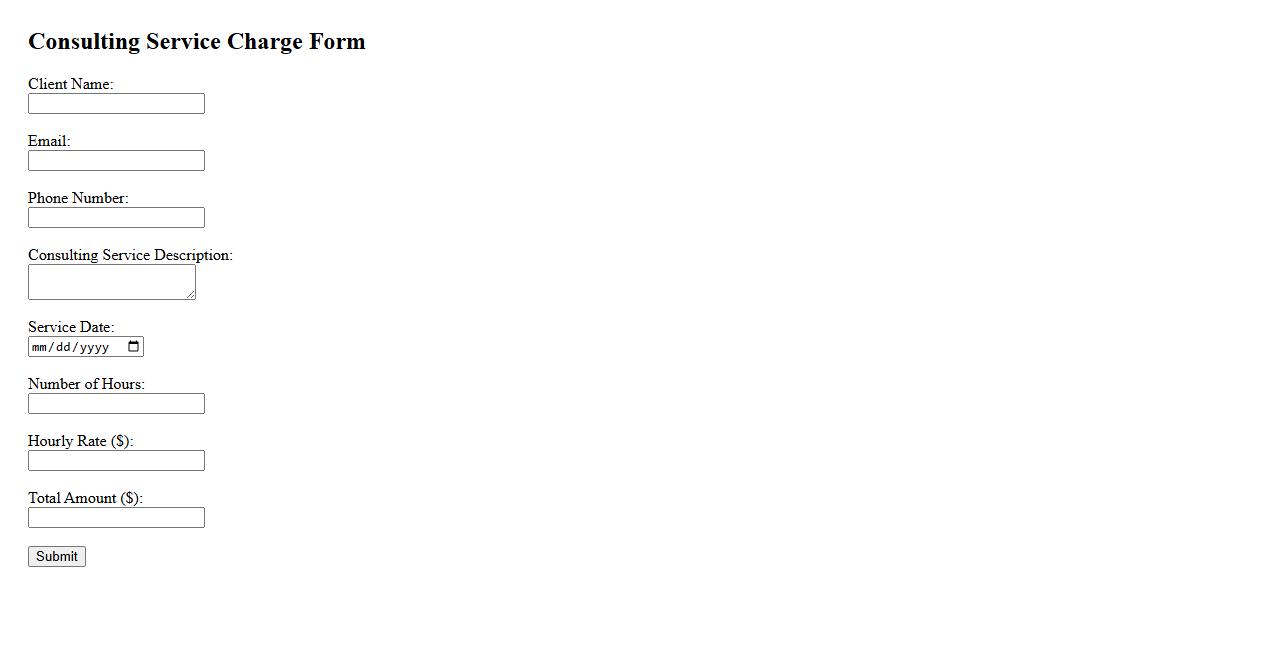

Consulting Service Charge Form

The Consulting Service Charge Form is designed to accurately document fees related to professional consulting services. It ensures clarity and transparency between consultants and clients by itemizing charges and terms. This form streamlines billing processes and supports effective financial management.

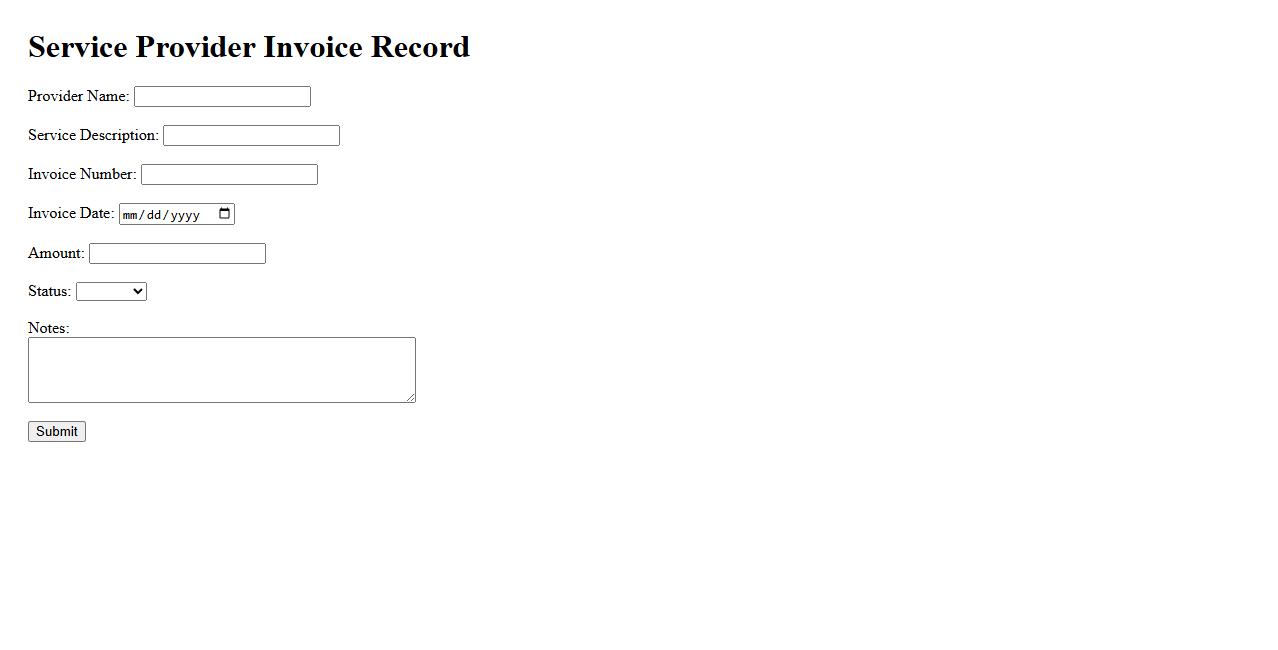

Service Provider Invoice Record

The Service Provider Invoice Record is a detailed document that tracks all billing transactions between service providers and clients. It ensures accurate payment processing and serves as a reference for financial audits. Maintaining these records helps streamline invoice management and improves transparency in business operations.

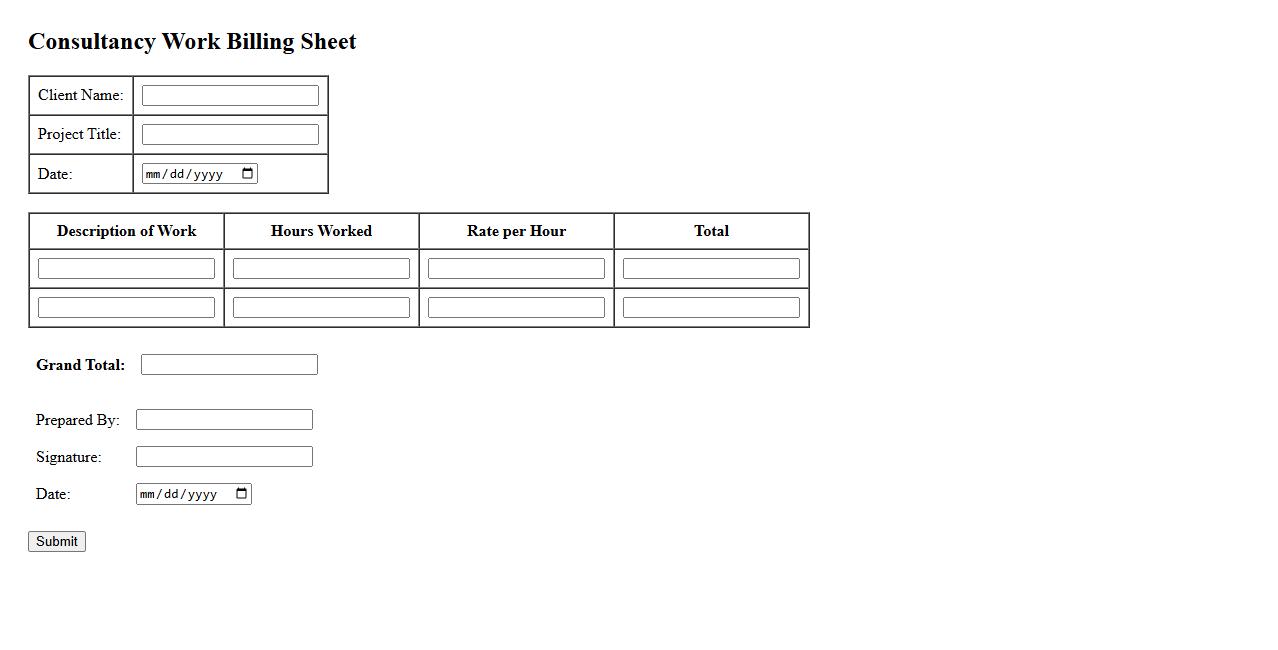

Consultancy Work Billing Sheet

The Consultancy Work Billing Sheet is an essential document used to record hours worked, services provided, and corresponding charges for consultancy projects. It ensures transparent and accurate invoicing between consultants and clients. This sheet streamlines payment processing and helps maintain clear financial records.

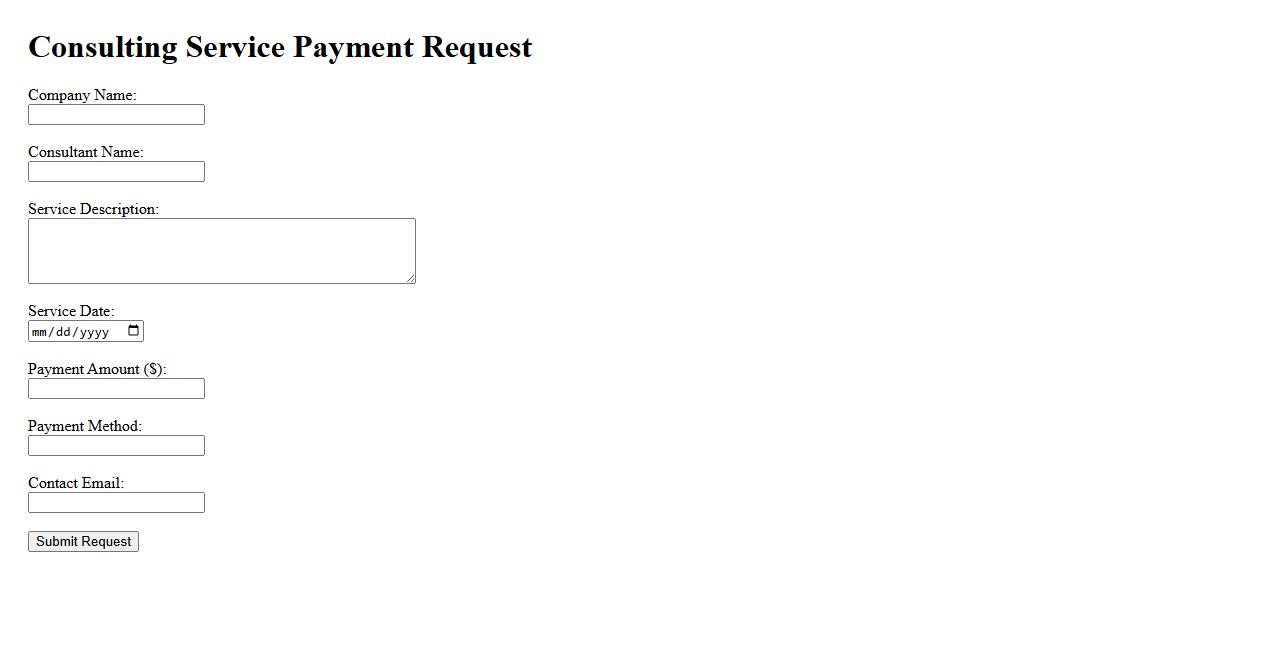

Consulting Service Payment Request

Submitting a Consulting Service Payment Request ensures timely and accurate compensation for professional expertise provided. This process streamlines billing by detailing services rendered and agreed-upon fees. Proper documentation facilitates smooth financial transactions between consultants and clients.

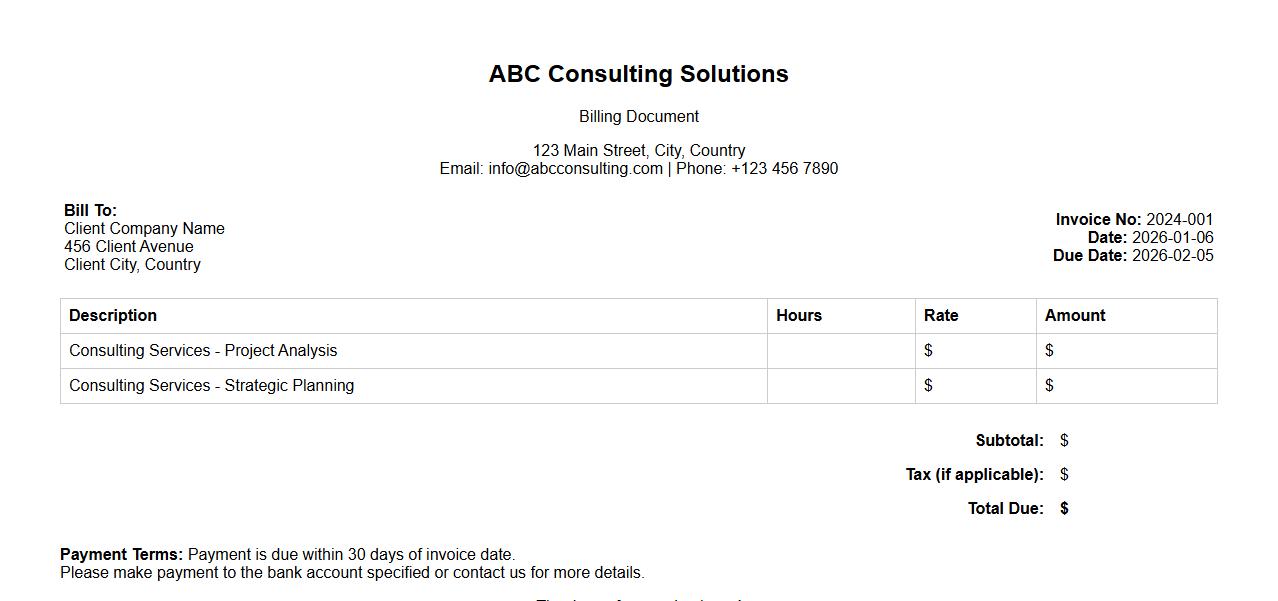

Professional Consulting Billing Document

The Professional Consulting Billing Document serves as a detailed record of services provided, ensuring accurate and transparent invoicing. It outlines the scope of work, hours billed, and payment terms for seamless client communication. This document is essential for maintaining clear financial agreements between consultants and clients.

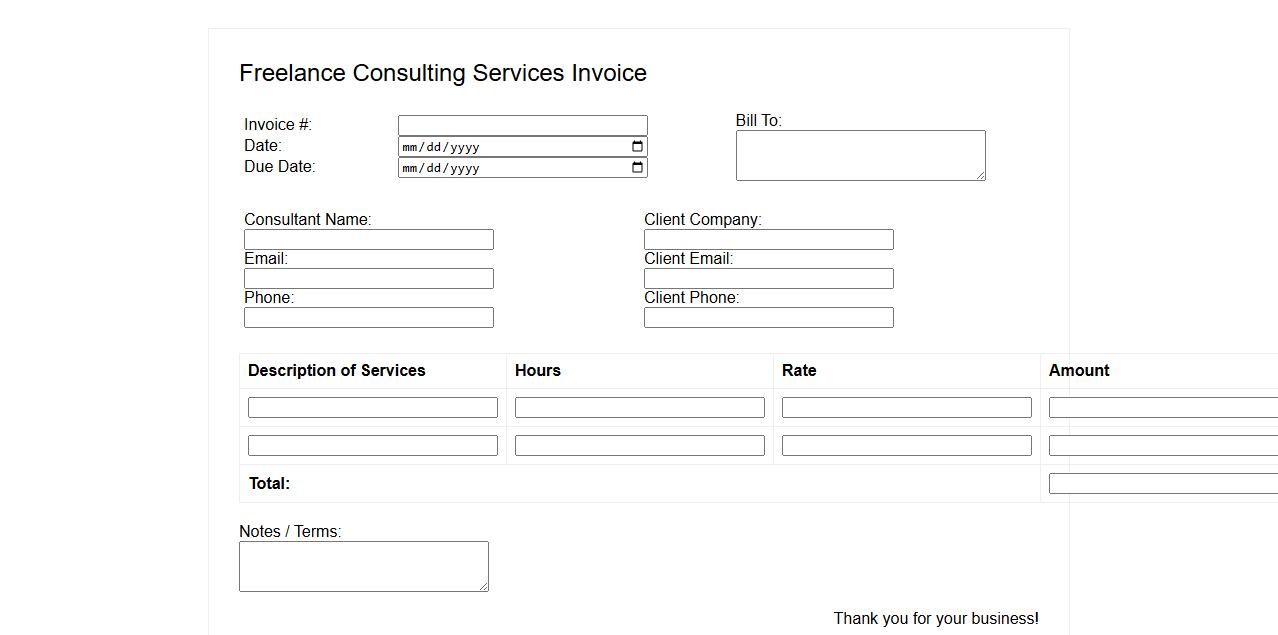

Freelance Consulting Services Invoice

An invoice for Freelance Consulting Services outlines the detailed charges for the professional advice and expertise provided. It serves as a formal request for payment, specifying the scope of work, hours spent, and agreed rates. Clear and concise invoicing helps ensure timely and accurate compensation for consulting services rendered.

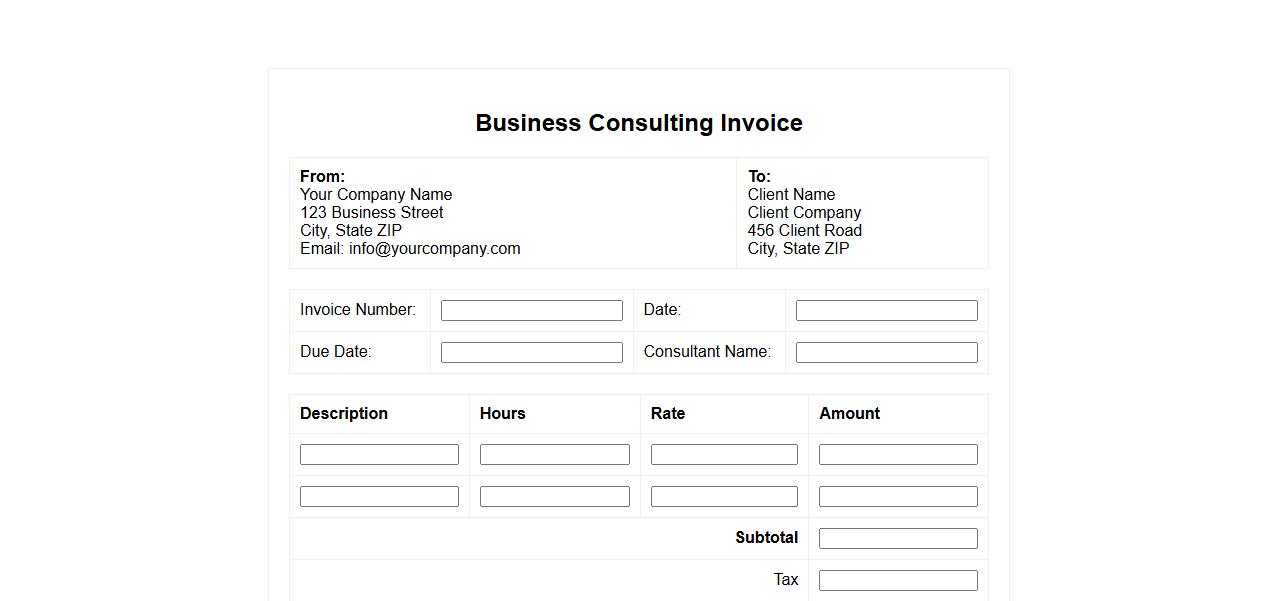

Business Consulting Invoice Template

Our Business Consulting Invoice Template is designed to streamline your billing process with a professional and clear format. It allows consultants to easily itemize services and track payments, ensuring timely and accurate invoicing. Customize the template to suit your unique business needs and enhance client communication.

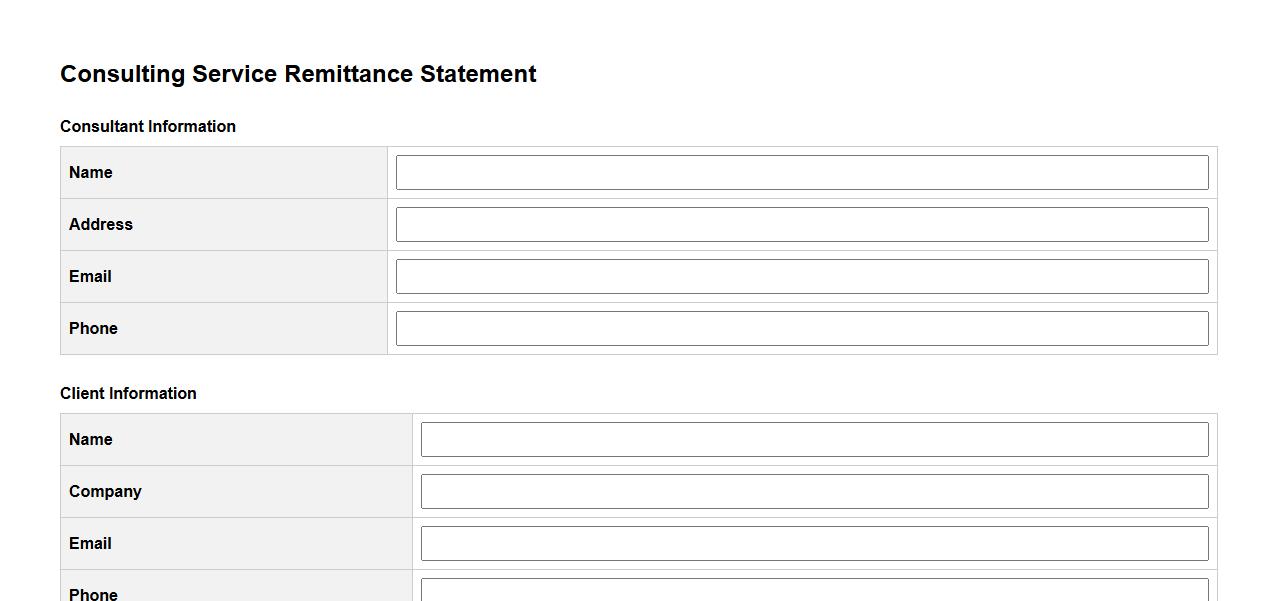

Consulting Service Remittance Statement

A Consulting Service Remittance Statement provides a detailed summary of payments made for consulting services rendered. It itemizes each transaction, ensuring transparency and accurate financial tracking. This document is essential for both consultants and clients to reconcile accounts efficiently.

What key client and consultant information is required on an Invoice for Consulting Services PDF?

An Invoice for Consulting Services must include detailed client and consultant information to ensure clarity and professionalism. Essential details include the full legal names, addresses, and contact information of both parties. Including the invoice number, date, and purchase order (if applicable) is crucial for tracking and record-keeping.

How should the services rendered be itemized and described in a consulting invoice PDF?

Services rendered should be clearly itemized with distinct descriptions for each task performed. Each item should include the date of service, a concise description, hourly rates or flat fees, and the total amount charged. This transparency helps clients understand the billing and facilitates easier dispute resolution.

What are the standard payment terms and due dates typically included on a consulting invoice document?

Standard payment terms often specify the due date, commonly net 30 days, meaning payment is expected within 30 days of the invoice date. Some invoices may include early payment discounts or late payment penalties. Clearly stating these terms prevents confusion and promotes timely payments.

Which tax details or identification numbers must be clearly displayed on an Invoice for Consulting Services PDF?

Invoices must prominently display relevant tax information such as the consultant's tax identification number (TIN), VAT number, or GST number if applicable. This ensures compliance with local tax laws and enables proper tax reporting. Including these details also validates the invoice for accounting purposes.

How can consultants ensure invoice PDF compliance with legal and accounting standards?

Consultants should use templates that adhere to legal and accounting standards, incorporating all mandatory details such as client/consultant information, service descriptions, payment terms, and tax identifiers. Regular updates to reflect current regulations and proper digital signatures or authentication methods improve validity. Maintaining accurate and clear records supports audit readiness and professional integrity.