The Invoice Information Sheet provides essential details related to billing, including invoice numbers, dates, payment terms, and itemized charges. It serves as a critical document for tracking transactions and ensuring accurate financial records. Proper organization of this sheet facilitates smooth payment processing and dispute resolution.

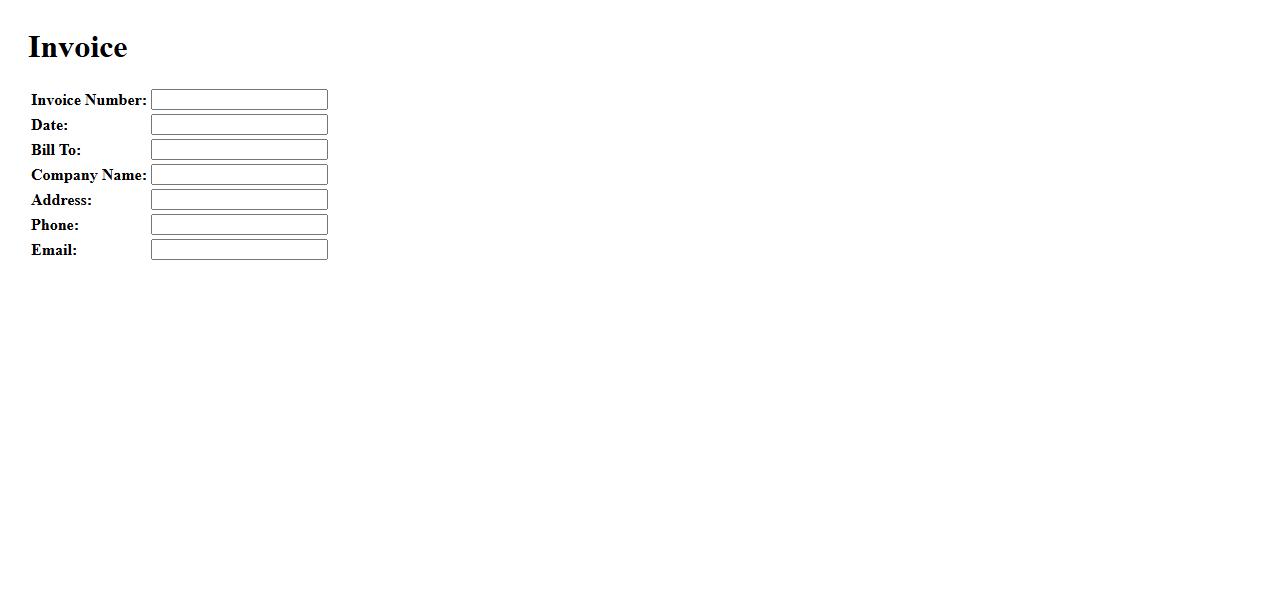

Invoice Header

The Invoice Header contains essential information such as the company name, invoice number, and date, providing clear identification of the document. It sets the tone for the entire invoice and helps streamline record-keeping and payment processing. This section ensures both parties can easily reference the transaction details.

Vendor Details

Vendor Details provide essential information about suppliers, including their contact data, business credentials, and product offerings. This information helps streamline procurement processes and ensures transparency in vendor management. Effective vendor details enhance communication and facilitate better decision-making for businesses.

Buyer Information

Buyer Information is essential for understanding customer details and transaction history. It helps businesses tailor their services and improve customer satisfaction. Accurate buyer data ensures smooth communication and efficient order processing.

Invoice Number

The Invoice Number is a unique identifier assigned to each invoice for tracking and reference purposes. It helps ensure accurate record-keeping and simplifies payment processing. This number is essential for both the vendor and customer to manage financial transactions efficiently.

Invoice Date

The Invoice Date is the specific day when the invoice is generated and issued to the customer. It serves as a reference point for payment terms and deadlines. Accurate recording of the invoice date ensures proper financial tracking and compliance.

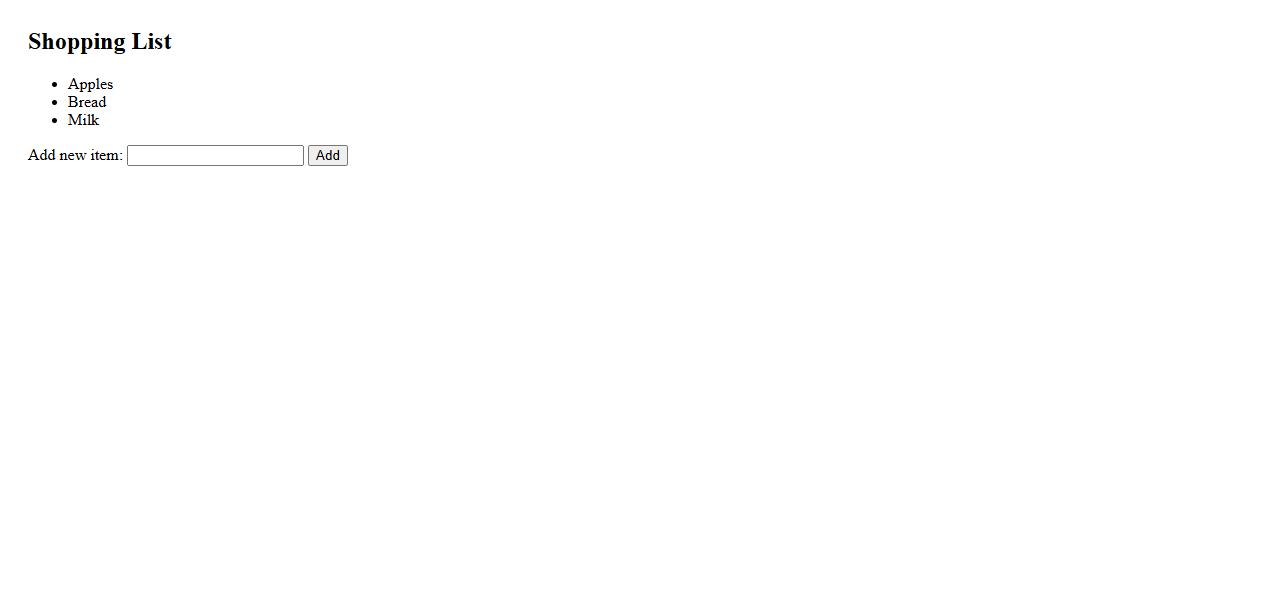

Itemized List

An Itemized List presents information in a clear, organized format by breaking content into individual points. This format enhances readability and helps users quickly scan through important details. Using an itemized list is ideal for summaries, instructions, or feature highlights.

Tax Breakdown

The Tax Breakdown provides a clear analysis of how taxes are distributed across various categories, helping individuals and businesses understand their financial obligations. It simplifies complex tax data into comprehensible sections, highlighting key components such as income tax, sales tax, and property tax. This detailed overview aids in better financial planning and compliance.

Payment Terms

Payment Terms define the conditions under which a buyer agrees to pay a seller for goods or services. These terms specify the payment schedule, methods accepted, and any penalties for late payment. Clear payment terms help ensure smooth financial transactions and maintain positive business relationships.

Total Amount Due

The Total Amount Due represents the complete sum that must be paid by the customer. This includes all charges, taxes, and fees applied to the transaction. It is important to review this amount carefully before making a payment.

Contact Information

For easy communication, please refer to our contact information. Reach out via phone, email, or visit our office during business hours. We are committed to providing prompt and helpful responses.

What essential details must be included on the Invoice Information Sheet?

The Invoice Information Sheet must include the invoice number, date of issue, and payment due date. It should also clearly state the names and addresses of both the seller and the buyer. Additionally, a detailed description of the goods or services provided, along with their quantities and prices, is essential.

How should invoice numbers be structured for consistent tracking?

Invoice numbers should be unique and sequential to ensure consistent tracking and prevent duplication. A common structure includes a prefix denoting the year or department followed by a serial number (e.g., 2024-00123). This systematic approach helps maintain organized records and simplifies invoice retrieval.

What is the required format for listing payment terms on the invoice?

Payment terms must be clearly stated in a concise and standardized format, such as "Net 30 days" or "Due within 15 days." They should specify the time frame for payment and any applicable penalties for late payment. Clear terms help both parties understand expectations and avoid disputes.

Which party's contact information is mandatory on the sheet?

The invoice must include the contact information of both the seller and the buyer, including names, addresses, phone numbers, and email addresses. This ensures clarity in communication and facilitates any necessary follow-up regarding the invoice. Accurate contact details also support verification and record-keeping processes.

How should tax and VAT amounts be represented on the Invoice Information Sheet?

Tax and VAT amounts should be clearly itemized and displayed separately from the subtotal on the invoice. The applicable tax rate and total tax amount must be specified to comply with legal requirements. This transparency allows buyers to verify tax calculations and ensures compliance with financial regulations.