A Certificate of Tax Exemption is an official document issued by tax authorities that allows individuals or organizations to be exempt from paying certain taxes. It serves as proof that the holder qualifies for tax relief based on specific criteria such as nonprofit status or government affiliation. Possessing this certificate ensures compliance with tax laws while benefiting from authorized tax exemptions.

Tax Exemption Approval Certificate

The Tax Exemption Approval Certificate is an official document that grants an individual or organization exemption from certain tax obligations. This certificate validates eligibility for tax benefits and ensures compliance with relevant tax laws. It is essential for businesses and nonprofits seeking financial relief and legal recognition.

Tax Exemption Authorization Letter

A Tax Exemption Authorization Letter is a formal document that grants permission to an individual or organization to claim tax-exempt status on behalf of another party. This letter is essential for legal and financial processes involving tax benefits. It ensures that tax authorities recognize the authorized entity's right to exemption claims.

Tax Exempt Status Notification

The Tax Exempt Status Notification informs organizations of their official exemption from certain taxes. This document is essential for nonprofit entities to validate their eligibility for tax benefits. Timely receipt ensures compliance with tax regulations and smooth financial operations.

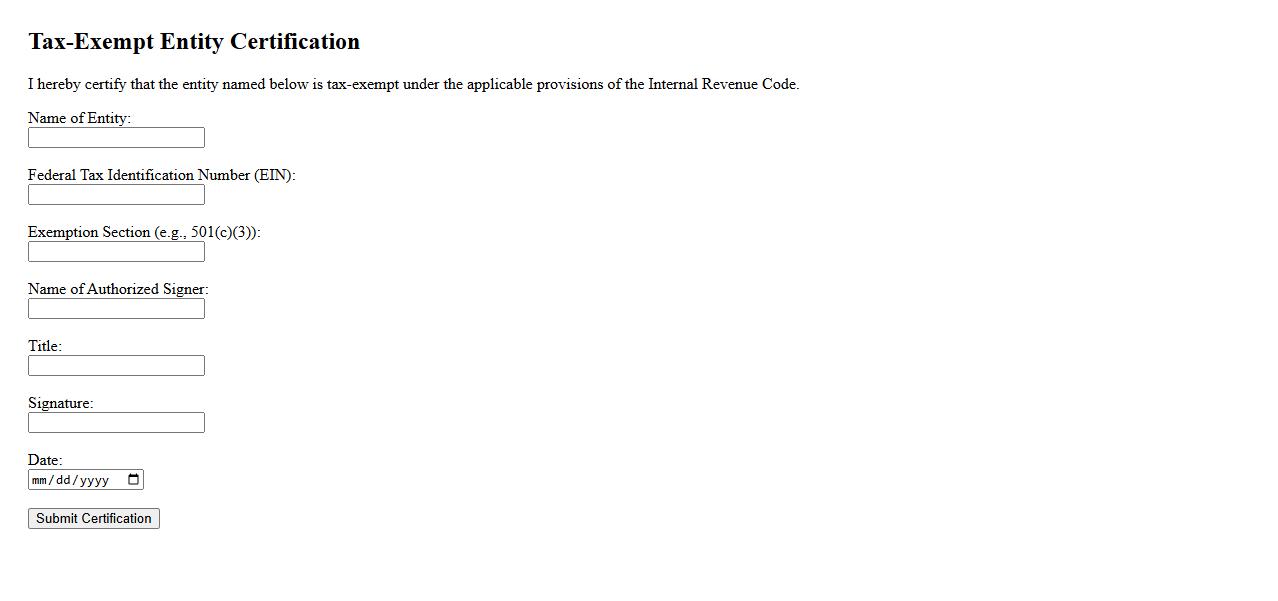

Tax-Exempt Entity Certification

Tax-exempt entity certification is a crucial document that verifies an organization's eligibility for tax-exempt status under IRS regulations. This certification allows entities to be exempt from certain federal, state, and local taxes. Obtaining a tax-exempt entity certification helps nonprofits and other qualified organizations maintain compliance and benefit from financial advantages.

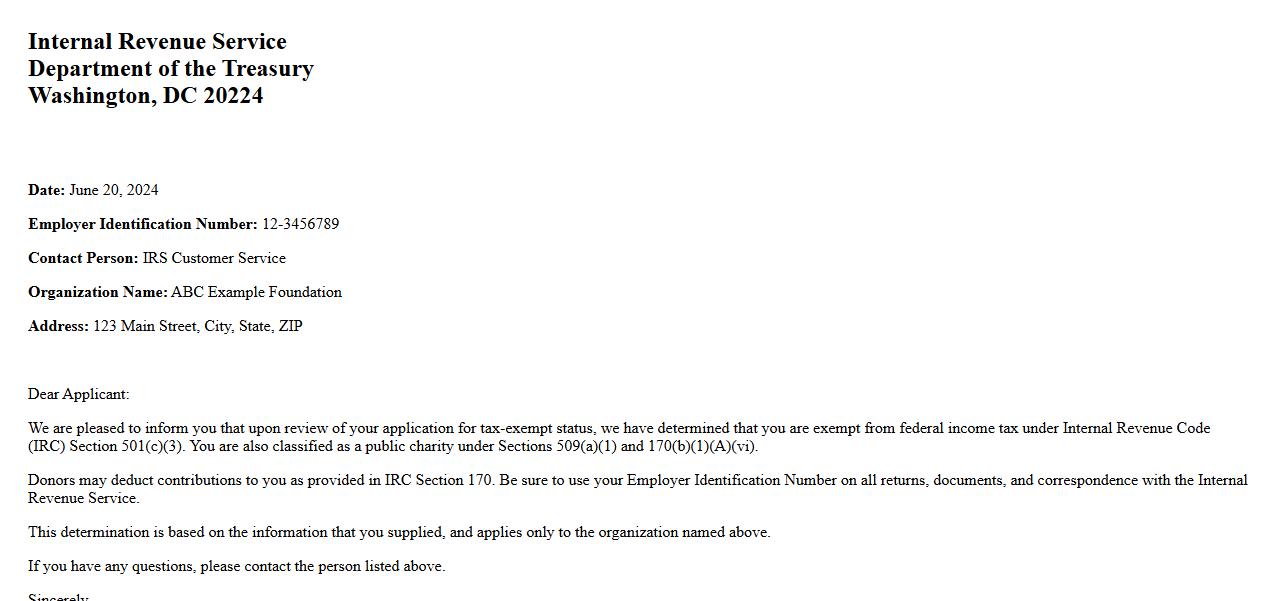

Exempt Organization Status Letter

An Exempt Organization Status Letter is an official document issued by the IRS confirming a nonprofit organization's tax-exempt status. This letter is essential for organizations seeking grants and tax-deductible donations. It verifies compliance with federal regulations and supports transparency with donors and stakeholders.

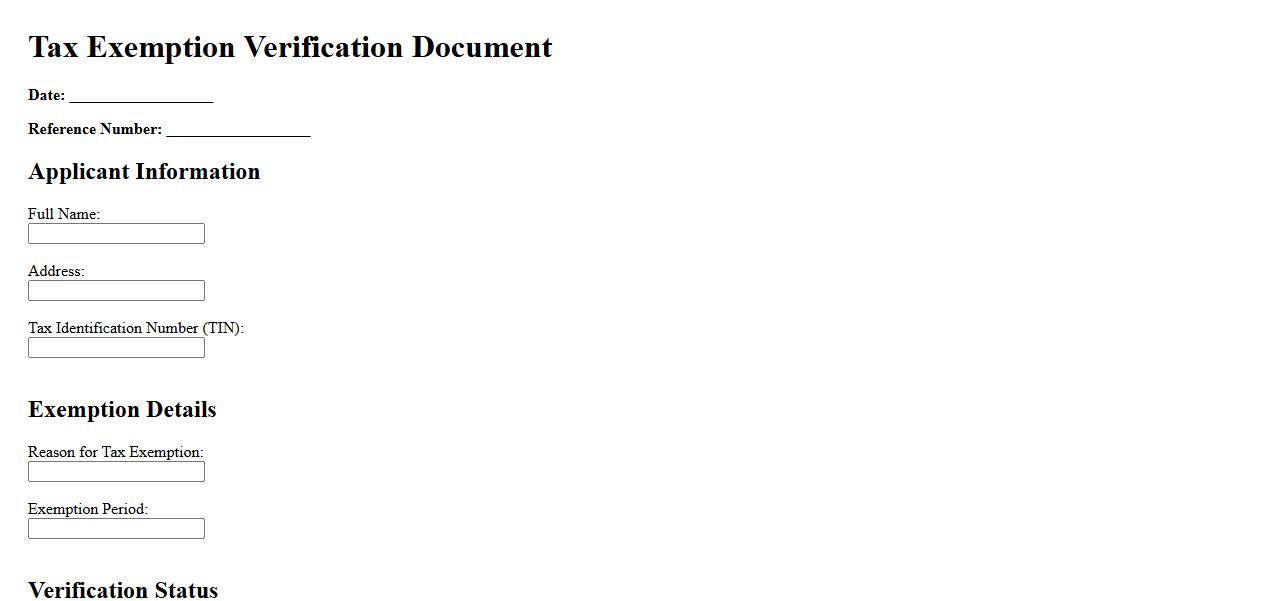

Tax Exemption Verification Document

The Tax Exemption Verification Document confirms an entity's eligibility for tax-exempt status, ensuring compliance with tax regulations. It serves as official proof to avoid unnecessary tax charges during transactions. This document is essential for businesses and organizations claiming tax exemptions.

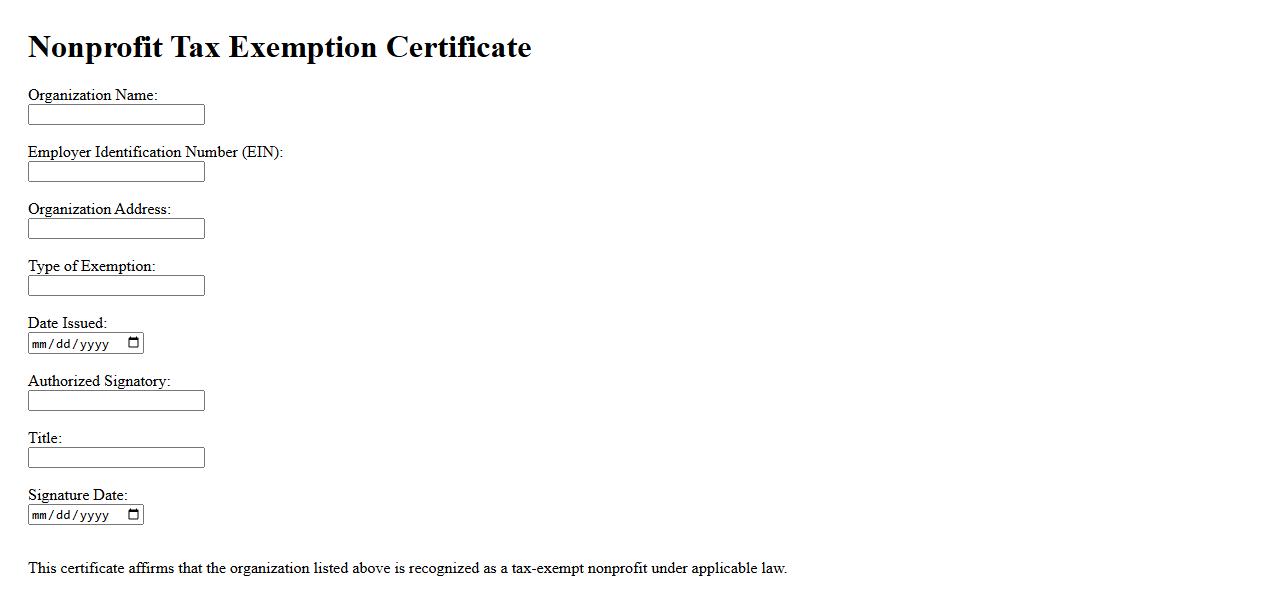

Nonprofit Tax Exemption Certificate

The Nonprofit Tax Exemption Certificate is an official document that grants tax-exempt status to eligible nonprofit organizations. This certificate allows nonprofits to make purchases without paying sales tax, supporting their mission-driven activities. Obtaining this exemption is essential for managing operational costs and ensuring compliance with tax regulations.

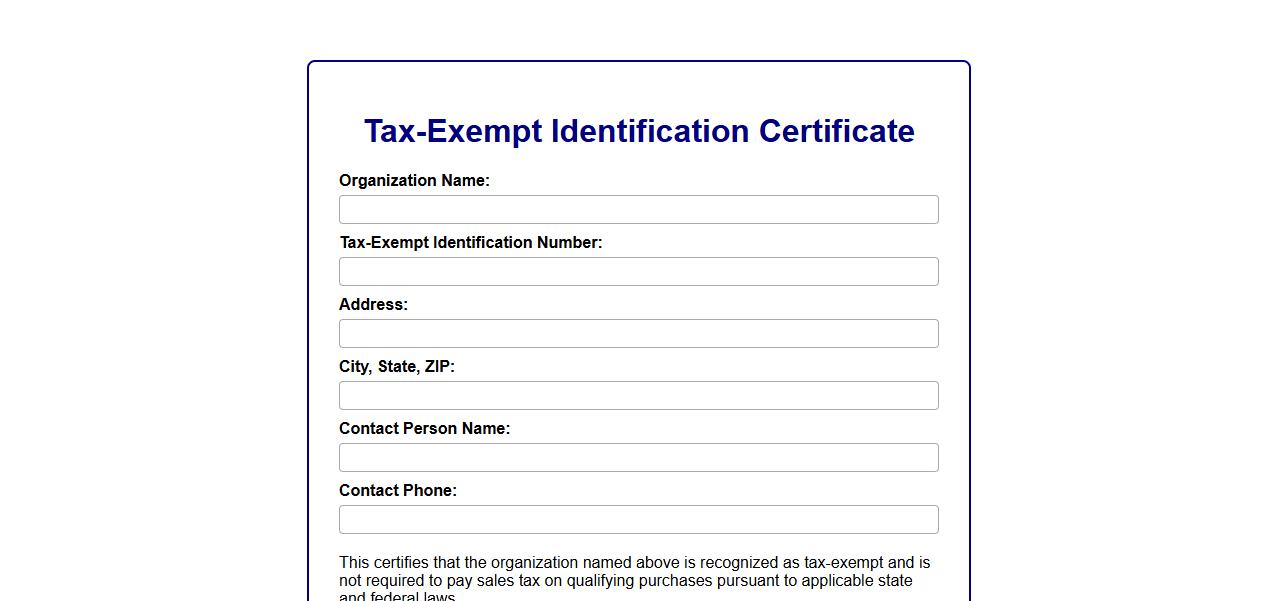

Tax-Exempt Identification Certificate

The Tax-Exempt Identification Certificate is an official document issued by tax authorities that allows organizations to make purchases without paying sales tax. It is typically used by non-profits, government entities, and certain qualifying businesses. This certificate helps reduce costs by confirming eligibility for tax exemption during transactions.

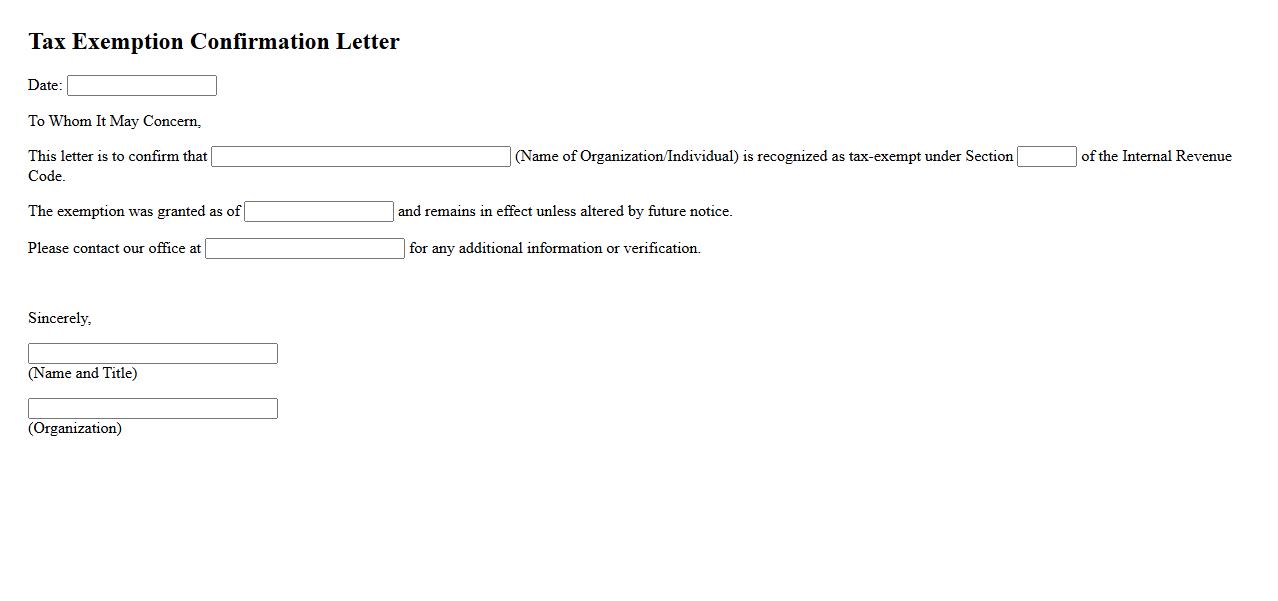

Tax Exemption Confirmation Letter

A Tax Exemption Confirmation Letter is an official document issued by tax authorities confirming that an individual or organization is exempt from certain taxes. This letter serves as proof of exemption and is often required for regulatory or financial purposes. It helps streamline transactions by verifying tax status quickly and accurately.

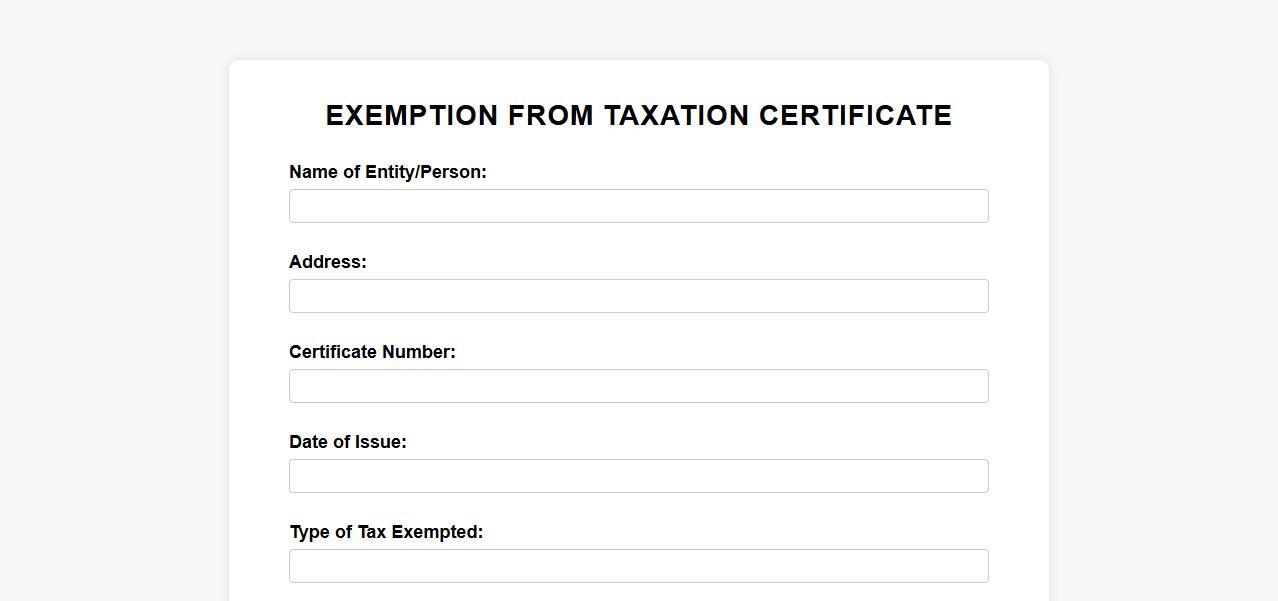

Exemption from Taxation Certificate

An Exemption from Taxation Certificate is an official document that allows individuals or organizations to be exempt from paying certain taxes. This certificate is often required by tax authorities to validate eligibility for tax-free status. It helps streamline financial transactions and ensures compliance with tax regulations.

What is the primary legal purpose of a Certificate of Tax Exemption?

The primary legal purpose of a Certificate of Tax Exemption is to provide official documentation that allows entities or individuals to purchase goods or services without paying sales or use taxes. This certificate serves as proof that the buyer qualifies for tax-exempt status under applicable laws. It helps streamline tax compliance by clearly identifying exempt transactions.

Which entities or individuals are typically eligible to apply for a Certificate of Tax Exemption?

Entities such as government agencies, nonprofit organizations, and qualified religious institutions are commonly eligible to apply for a Certificate of Tax Exemption. Additionally, certain businesses engaged in resale or manufacturing may qualify based on jurisdiction-specific tax codes. Eligibility requirements vary but generally focus on the purpose and nature of the entity's activities.

How does a Certificate of Tax Exemption impact the collection of sales, use, or income taxes?

A Certificate of Tax Exemption exempts the holder from paying specific state and local taxes on qualifying purchases. This exemption directly reduces the amount of sales, use, or income taxes the seller must collect from the buyer. It ensures compliance with tax regulations while preventing the collection of taxes where exemptions legally apply.

What specific information must be included on a valid Certificate of Tax Exemption?

A valid Certificate of Tax Exemption must include the name and address of the exempt entity, the tax identification number, and the specific reason for the exemption. It should also contain a signature from an authorized representative and the date of issuance. This information certifies legitimacy and facilitates auditing by tax authorities.

Under what conditions can a Certificate of Tax Exemption be revoked or invalidated?

A Certificate of Tax Exemption can be revoked or invalidated if the holder no longer meets eligibility criteria or uses the certificate for non-exempt purchases. Fraudulent use, expiration of the certificate, or failure to comply with regulatory requirements may also lead to revocation. Tax authorities monitor these conditions to maintain proper tax enforcement.