A Certificate of Non-Residence is an official document issued by a tax authority confirming that an individual or entity is not a tax resident in that jurisdiction. This certificate is often required to avoid double taxation and claim tax treaty benefits. It serves as proof for foreign tax authorities to exempt the holder from local tax obligations.

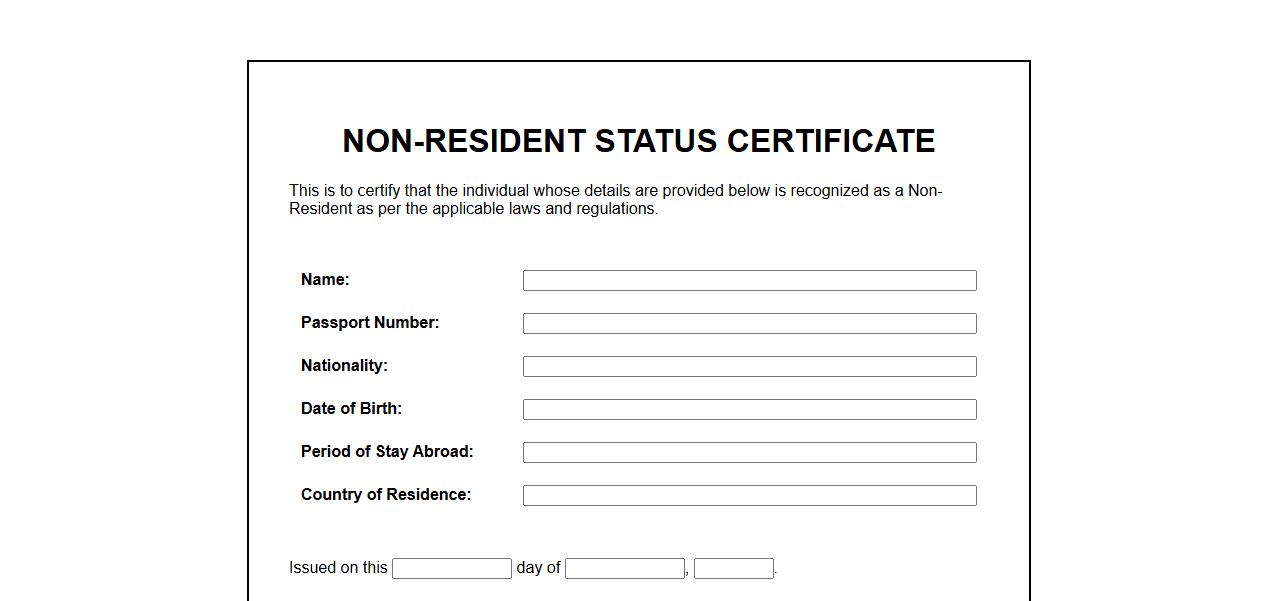

Non-Resident Status Certificate

A Non-Resident Status Certificate is an official document issued by tax authorities to individuals who reside outside their home country but earn income within it. This certificate helps in availing tax benefits and avoiding double taxation under international agreements. It is essential for non-residents to validate their tax status and comply with legal requirements.

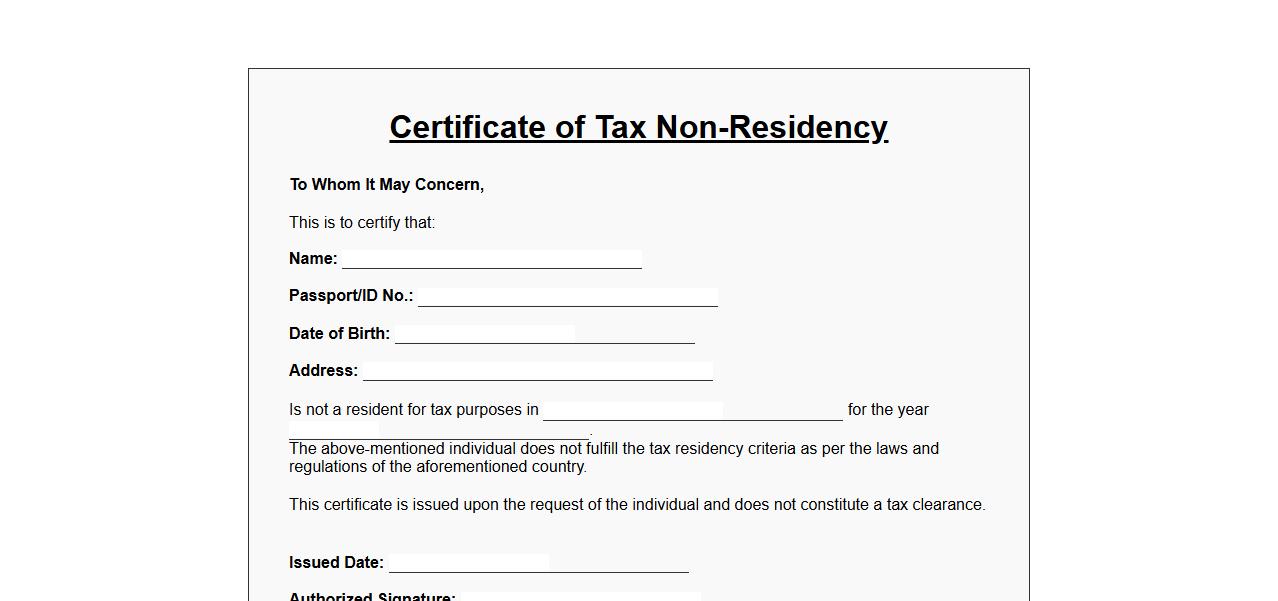

Certificate of Tax Non-Residency

The Certificate of Tax Non-Residency is an official document issued to confirm an individual's or entity's tax residency status outside a specific jurisdiction. This certificate helps in avoiding double taxation and ensures compliance with international tax laws. It is often required for claiming tax treaty benefits or exemptions.

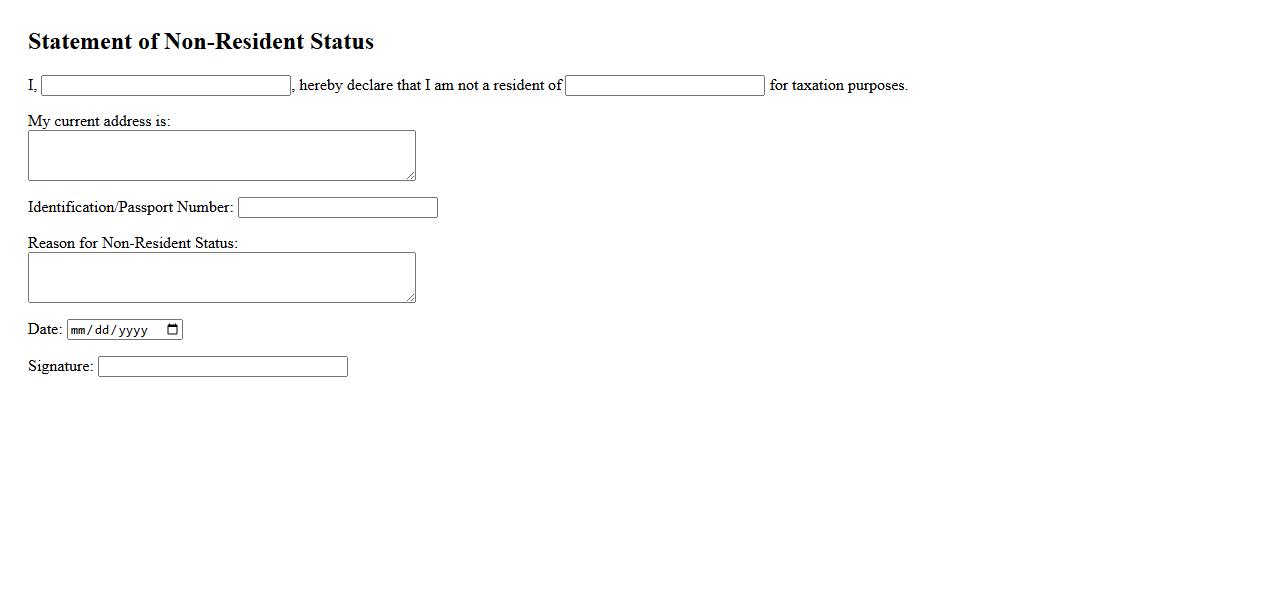

Statement of Non-Resident Status

The Statement of Non-Resident Status is a formal document used to declare an individual's residency status for tax or legal purposes. It confirms that the person does not reside within the jurisdiction, affecting tax obligations and reporting requirements. This statement is essential for accurate compliance with local laws and regulations.

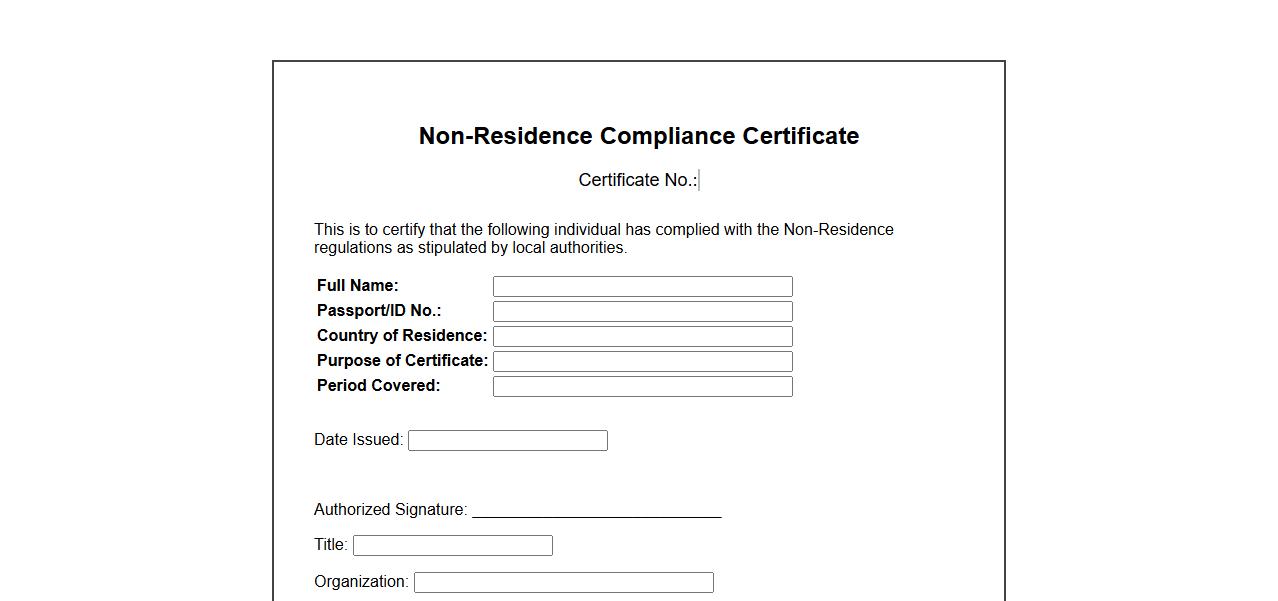

Non-Residence Compliance Certificate

The Non-Residence Compliance Certificate is an essential document for individuals or entities residing outside a country to verify adherence to tax and legal obligations. This certificate ensures that non-residents comply with local regulations, facilitating smooth financial and administrative transactions. Obtaining this certificate helps in avoiding penalties and promotes transparency in cross-border dealings.

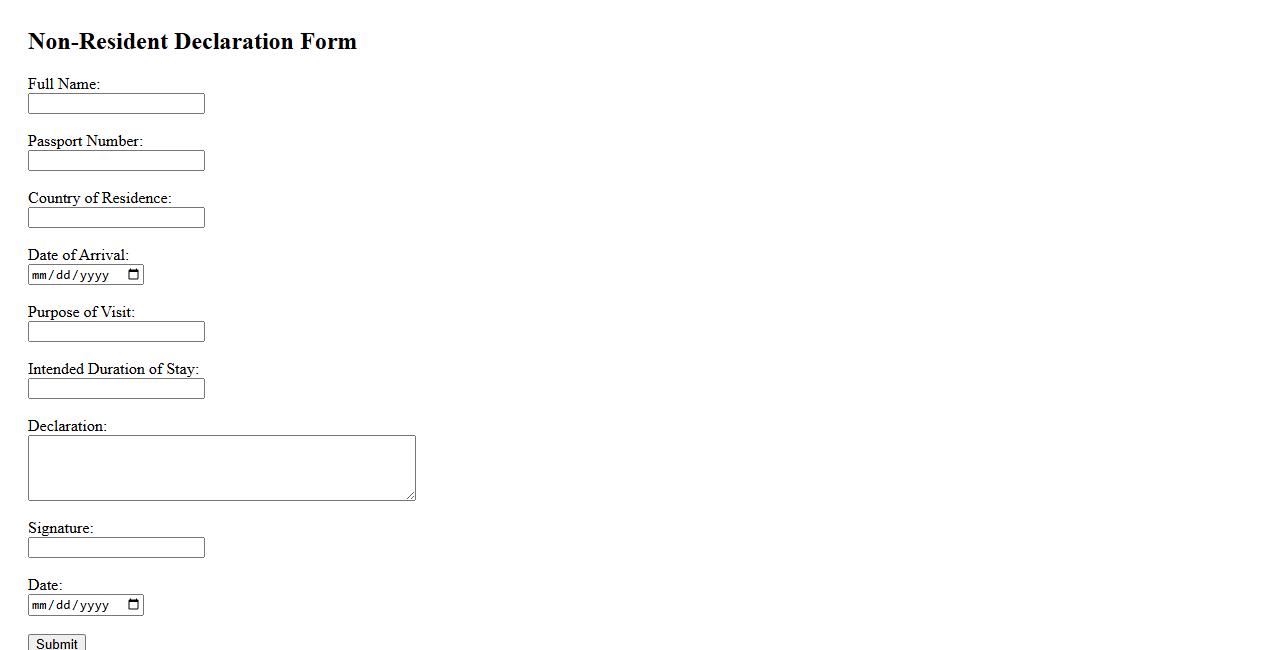

Non-Resident Declaration Form

The Non-Resident Declaration Form is a crucial document used to declare the status of individuals or entities residing outside a particular country. It ensures compliance with local tax regulations and helps in determining applicable tax treatments. Accurate completion of this form is essential for avoiding penalties and ensuring proper legal standing.

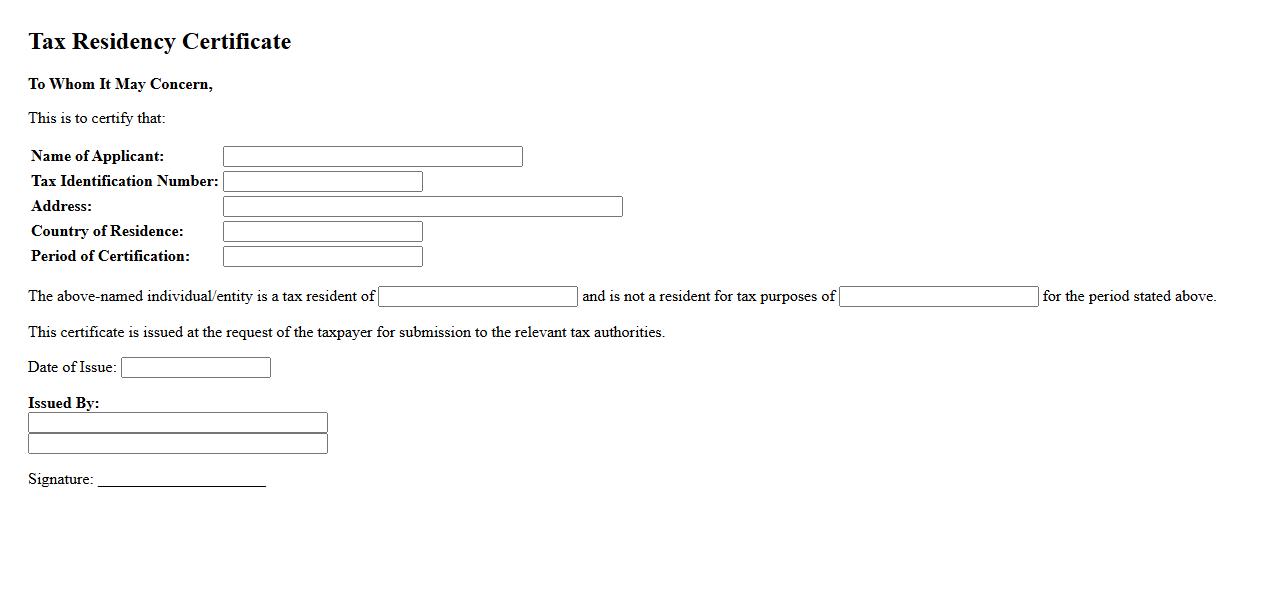

Tax Residency Certificate, Non-Resident

A Tax Residency Certificate for Non-Residents is an official document issued by tax authorities confirming an individual's or entity's residence status for tax purposes outside the country. This certificate helps avoid double taxation and facilitates compliance with international tax treaties. It is essential for non-residents to provide this proof when claiming treaty benefits or exemptions.

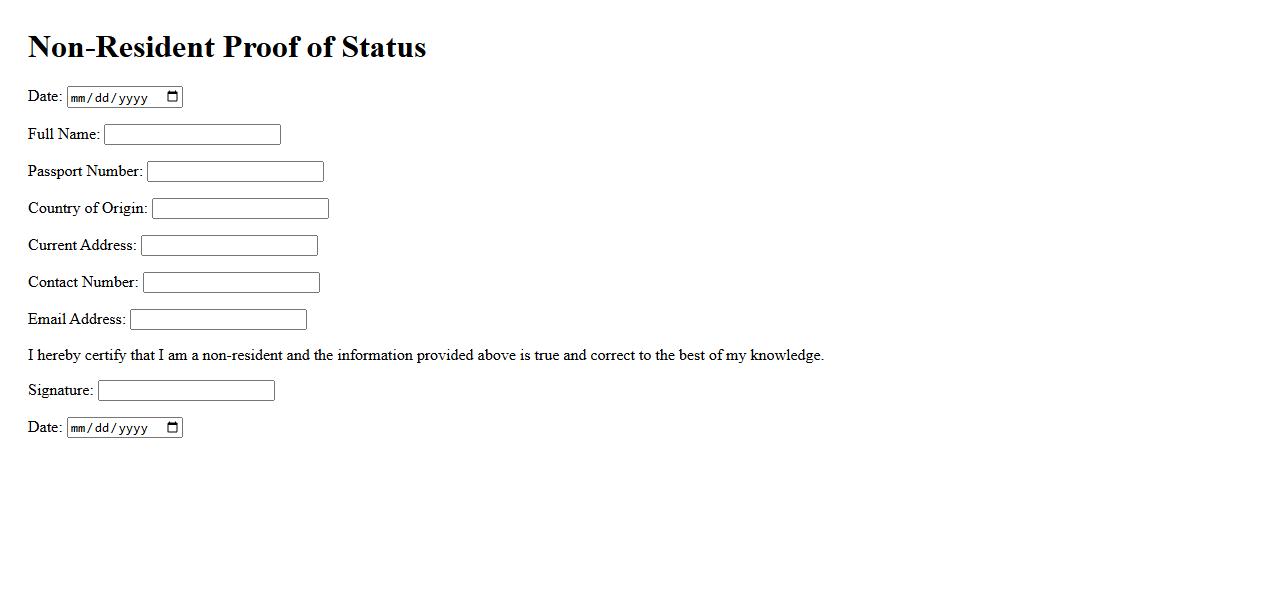

Non-Resident Proof of Status

Non-Resident Proof of Status is an official document verifying an individual's non-resident status for tax and legal purposes. It helps differentiate between residents and non-residents in financial and governmental transactions. This proof is essential for accessing certain benefits and complying with international regulations.

Certificate of Foreign Residency

The Certificate of Foreign Residency is an official document issued by a foreign tax authority to certify an individual's or entity's tax residence in that country. This certificate helps avoid double taxation and ensures compliance with international tax treaties. It is commonly required for claiming tax benefits and exemptions when conducting business or investments abroad.

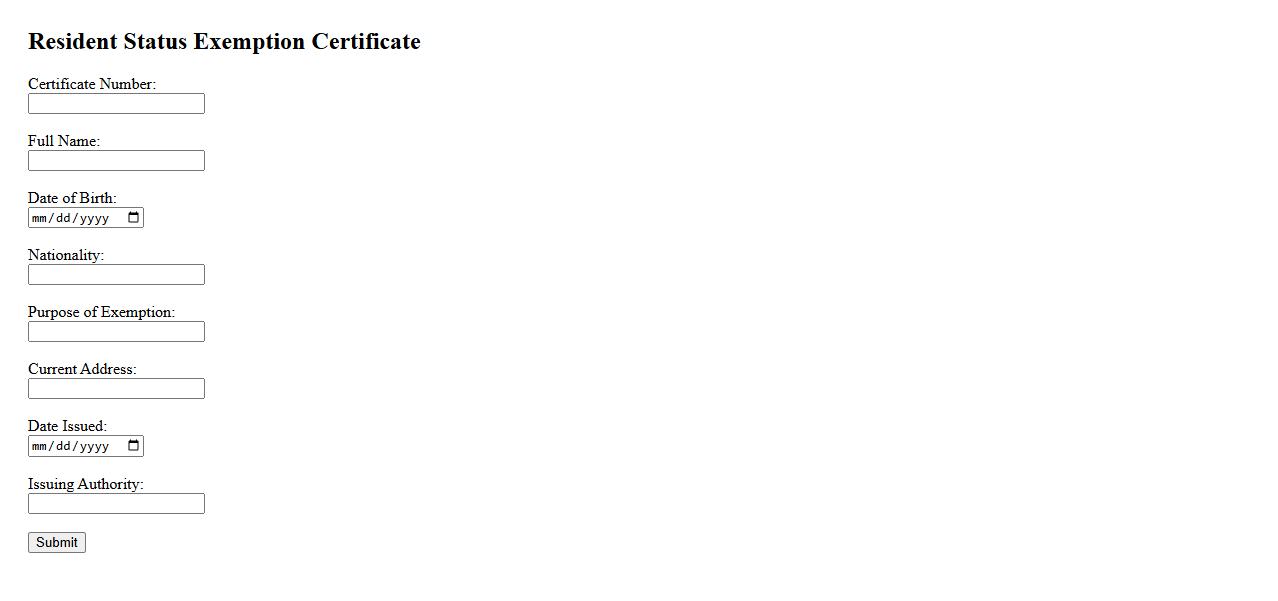

Resident Status Exemption Certificate

The Resident Status Exemption Certificate is an official document that certifies an individual's residency status for tax and legal purposes. This certificate helps in claiming exemptions and benefits offered to residents under various governmental schemes. Obtaining this document is essential for accurate tax filing and compliance with local regulations.

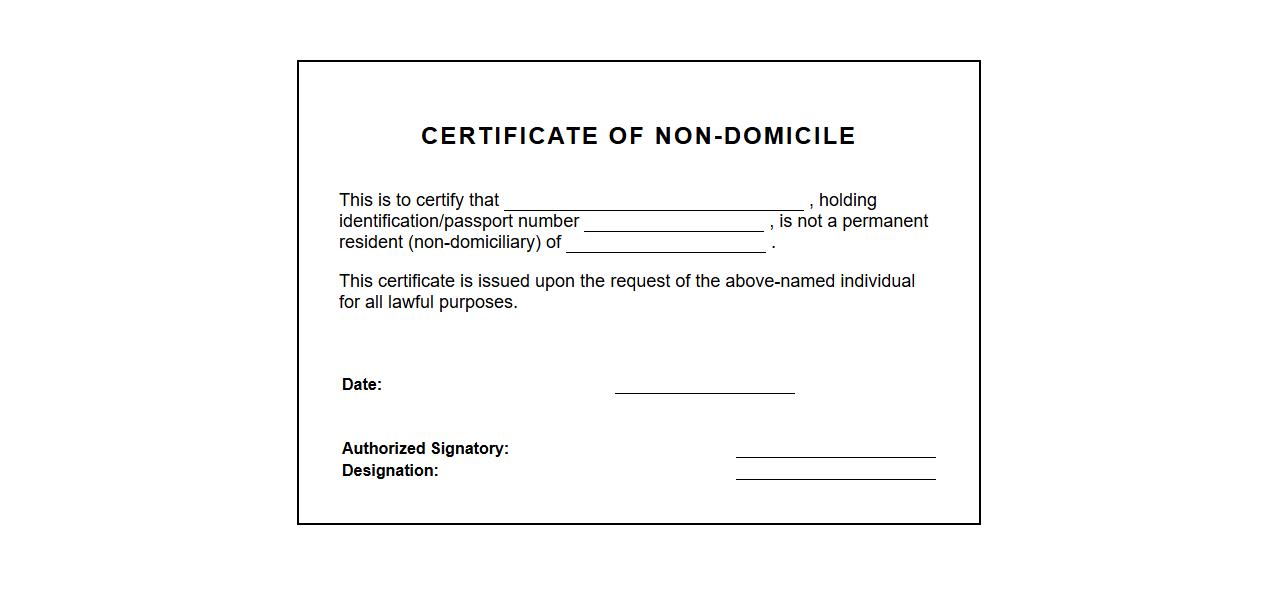

Certificate of Non-Domicile

The Certificate of Non-Domicile is an official document that certifies an individual's residency status outside a particular jurisdiction. It is often required for tax purposes to confirm that the holder does not reside within that area. This certificate helps clarify tax obligations and residency rights.

What is the primary purpose of a Certificate of Non-Residence?

The primary purpose of a Certificate of Non-Residence is to prove that an individual or entity is not a resident of a particular country for tax purposes. This document helps prevent double taxation by clarifying tax residency status. It is commonly used in international financial and tax transactions.

Which authority or institution typically issues a Certificate of Non-Residence?

The Certificate of Non-Residence is usually issued by the tax authority or revenue department of a country. In most cases, this is the government agency responsible for tax collection and administration. Applicants must submit relevant documentation to obtain the certificate from the appropriate authority.

What essential information must be included in a Certificate of Non-Residence?

A Certificate of Non-Residence must include the applicant's full name, tax identification number, and country of residence. It should also clearly state the period during which the non-resident status is applicable. Additionally, the certificate must be signed and stamped by the issuing tax authority.

For which situations is a Certificate of Non-Residence commonly required?

This certificate is commonly required in cross-border financial transactions, such as opening foreign bank accounts or claiming tax treaty benefits. It is essential for businesses and individuals to avoid withholding taxes on income earned abroad. The document is also used during the submission of tax returns to prove non-resident status.

What eligibility criteria must an applicant meet to obtain a Certificate of Non-Residence?

To be eligible for a Certificate of Non-Residence, the applicant must demonstrate that they do not meet the tax residency criteria of the issuing country. This often includes providing proof of residence in another country and evidence of income sources. Compliance with local tax laws and submission of accurate documentation are mandatory for approval.