A Certificate of Liability Insurance serves as official proof that an individual or business holds active liability insurance coverage. It outlines the policy limits, coverage dates, and insured parties, ensuring protection against potential claims for bodily injury or property damage. This document is often required by clients, contractors, or regulatory agencies to confirm financial responsibility.

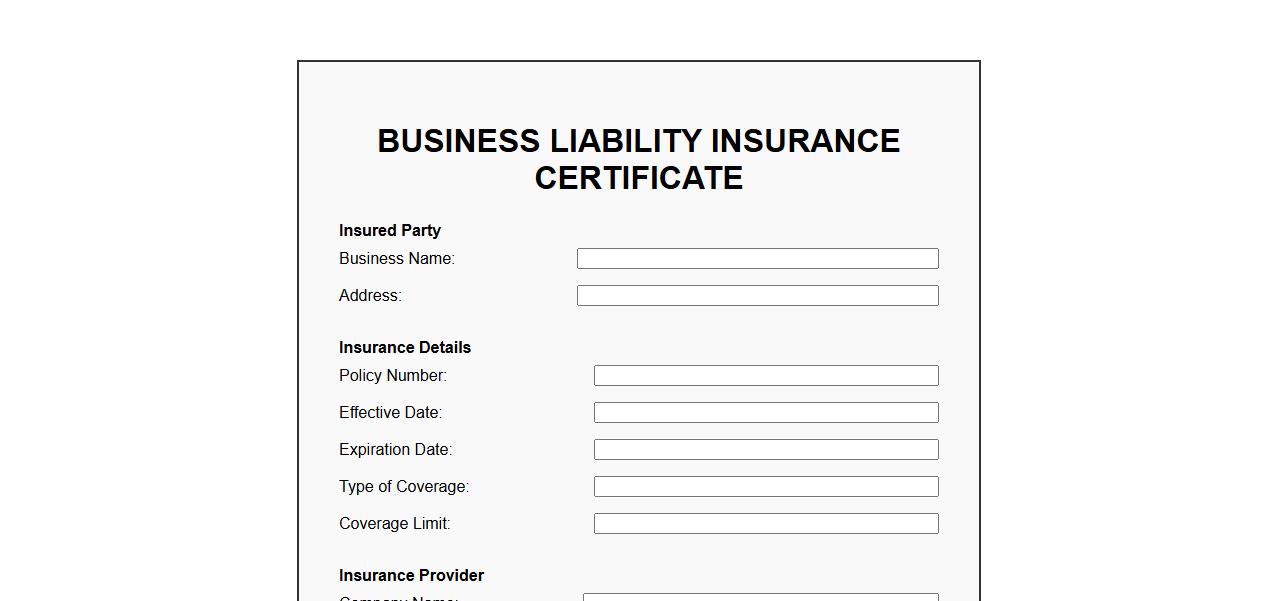

Business Liability Insurance Certificate

A Business Liability Insurance Certificate serves as official proof that a company holds liability insurance coverage. This document is essential for demonstrating financial protection against potential claims of property damage, bodily injury, or legal fees. Often required by clients or regulatory bodies, it ensures trust and compliance in business operations.

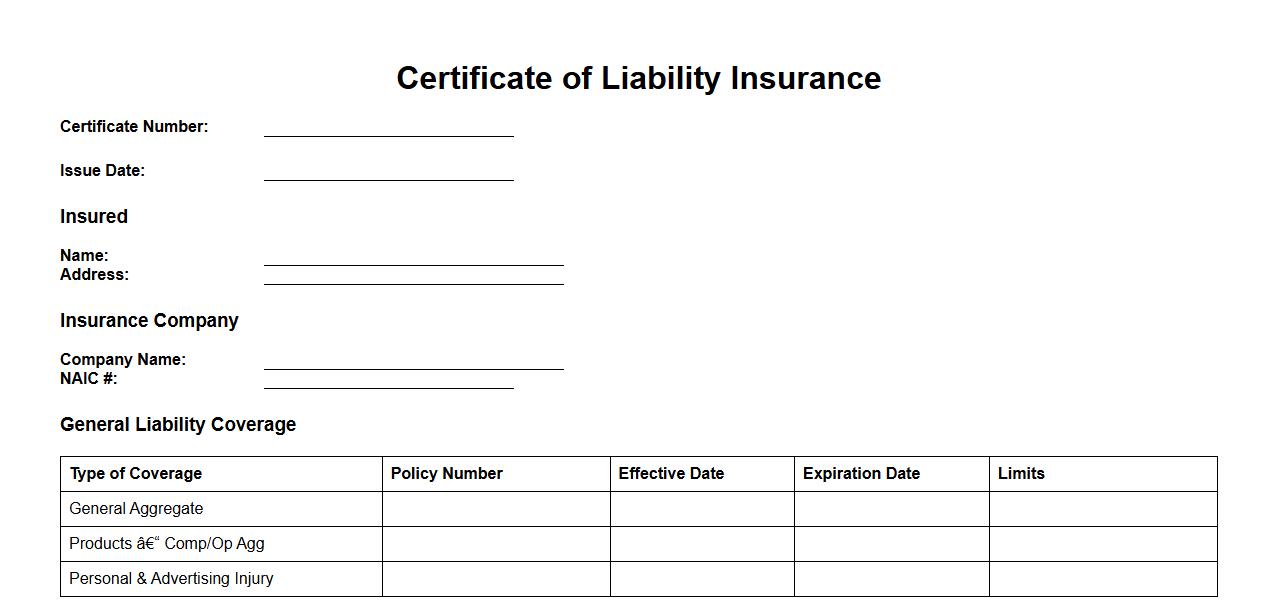

General Liability Insurance Certificate

A General Liability Insurance Certificate serves as official proof that a business holds liability insurance coverage. It verifies protection against claims of bodily injury, property damage, and related risks. This certificate is essential for contractors, vendors, and businesses to demonstrate financial responsibility and credibility.

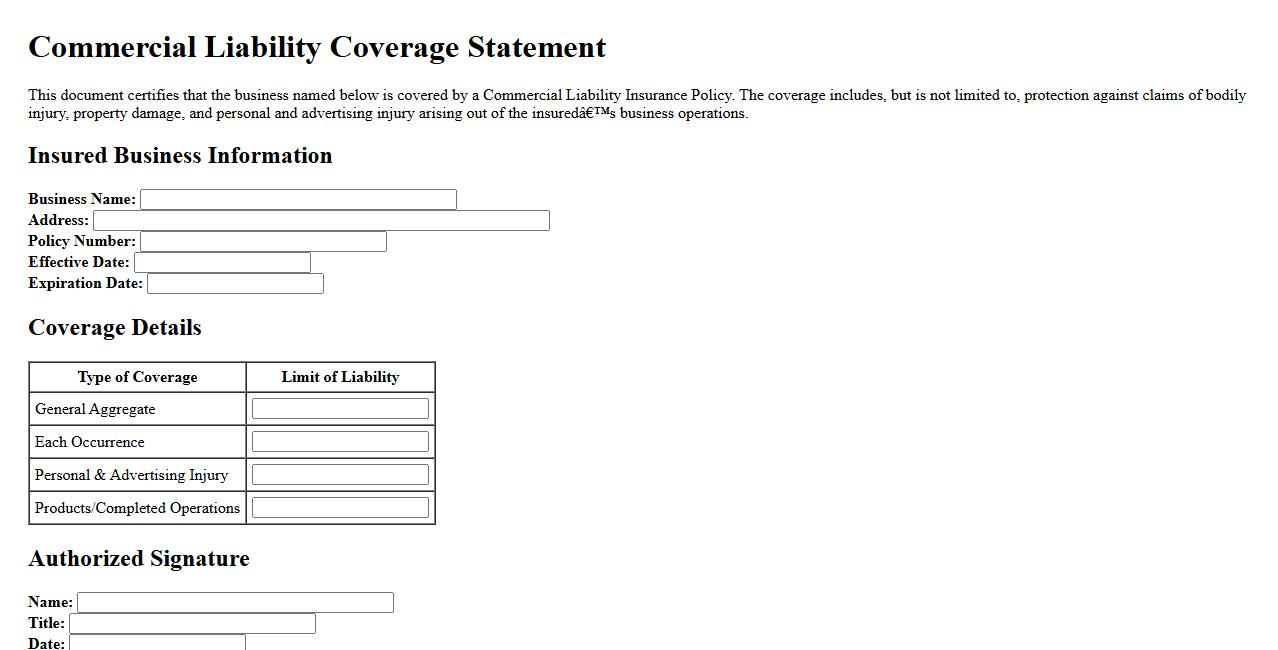

Commercial Liability Coverage Statement

Commercial Liability Coverage Statement outlines the protection a business holds against claims of property damage, bodily injury, or negligence. It ensures the company is financially secured against potential lawsuits or damages arising from operational activities. This documentation is essential for maintaining transparency and trust with clients and partners.

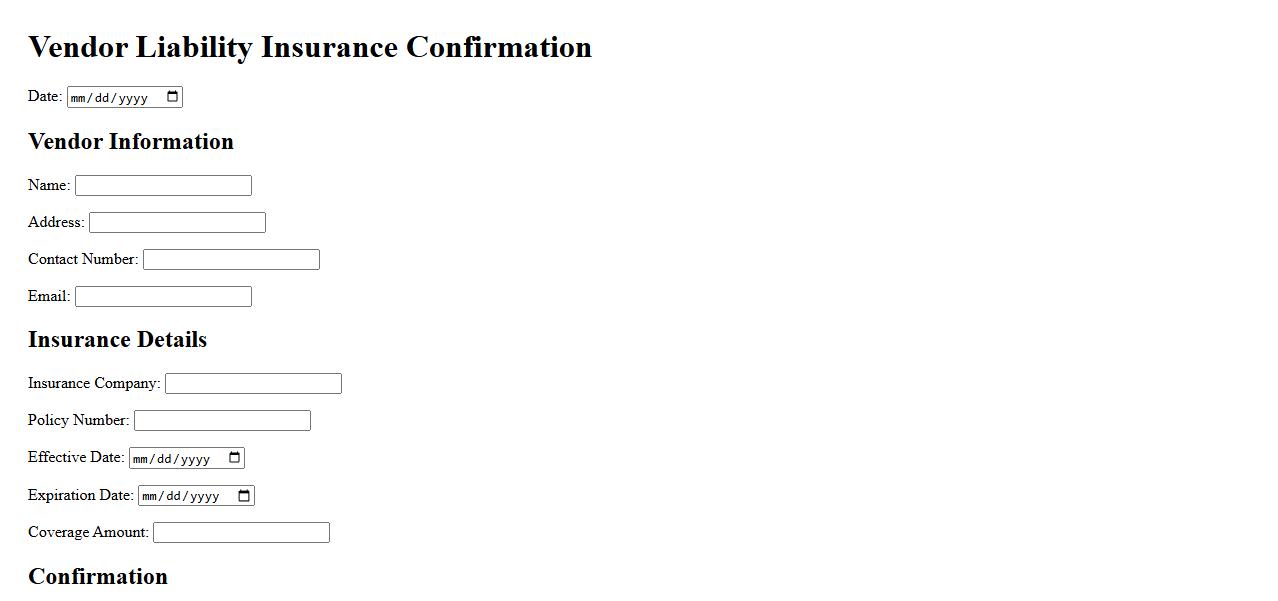

Vendor Liability Insurance Confirmation

Vendor Liability Insurance Confirmation is a crucial document that verifies a vendor's coverage for potential damages or injuries on a job site. It ensures that the vendor assumes financial responsibility, protecting both parties in contractual agreements. This confirmation is essential for mitigating risks and maintaining legal compliance in business transactions.

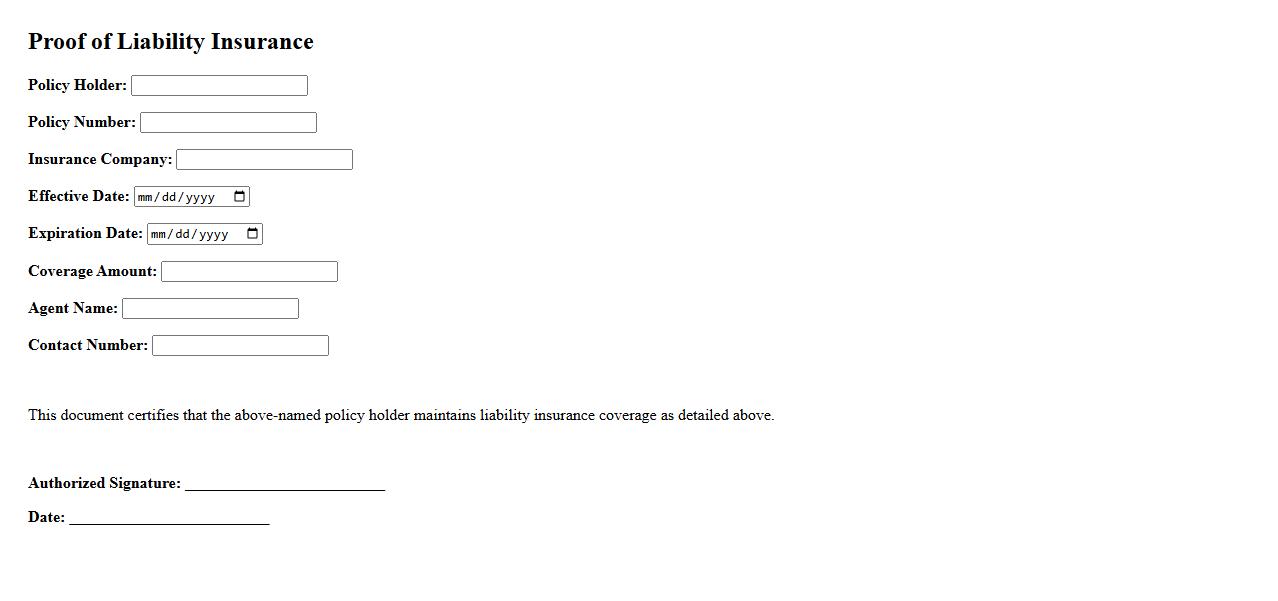

Proof of Liability Insurance

Proof of Liability Insurance is a vital document that verifies an individual or business holds valid liability coverage. This proof ensures protection against claims of property damage or bodily injury caused to others. It is often required when entering contracts or conducting business transactions.

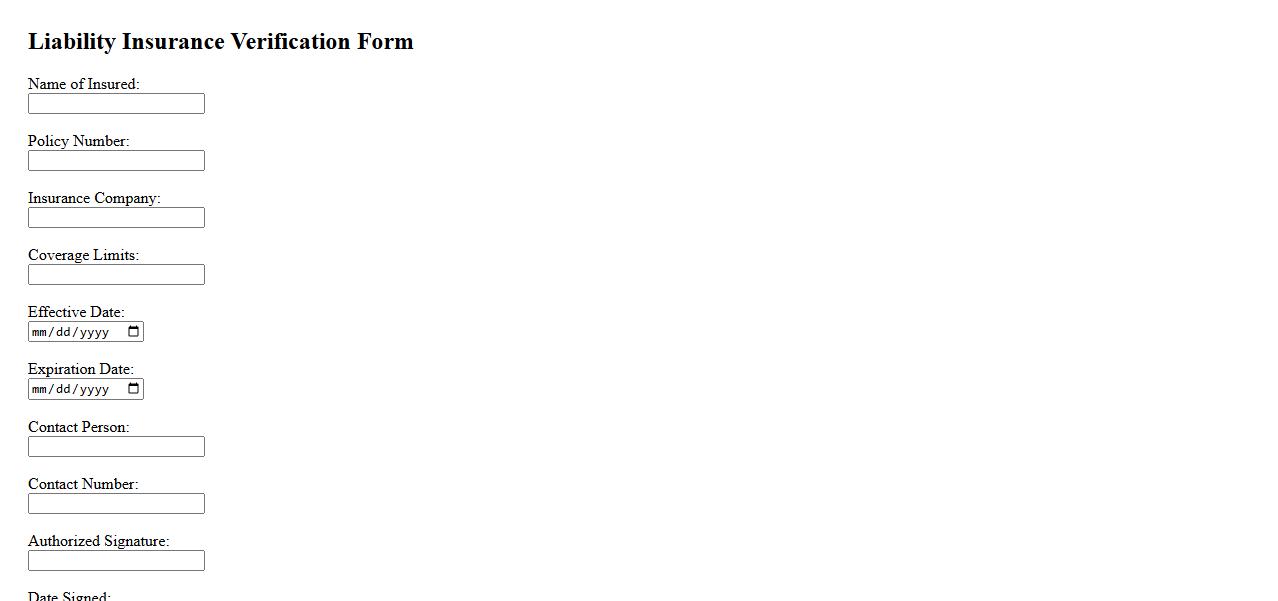

Liability Insurance Verification Form

The Liability Insurance Verification Form is essential for confirming coverage details and verifying the validity of an insurance policy. This document ensures that individuals or businesses meet required liability insurance standards before engaging in specific activities. Accurate completion of the form helps mitigate potential legal and financial risks.

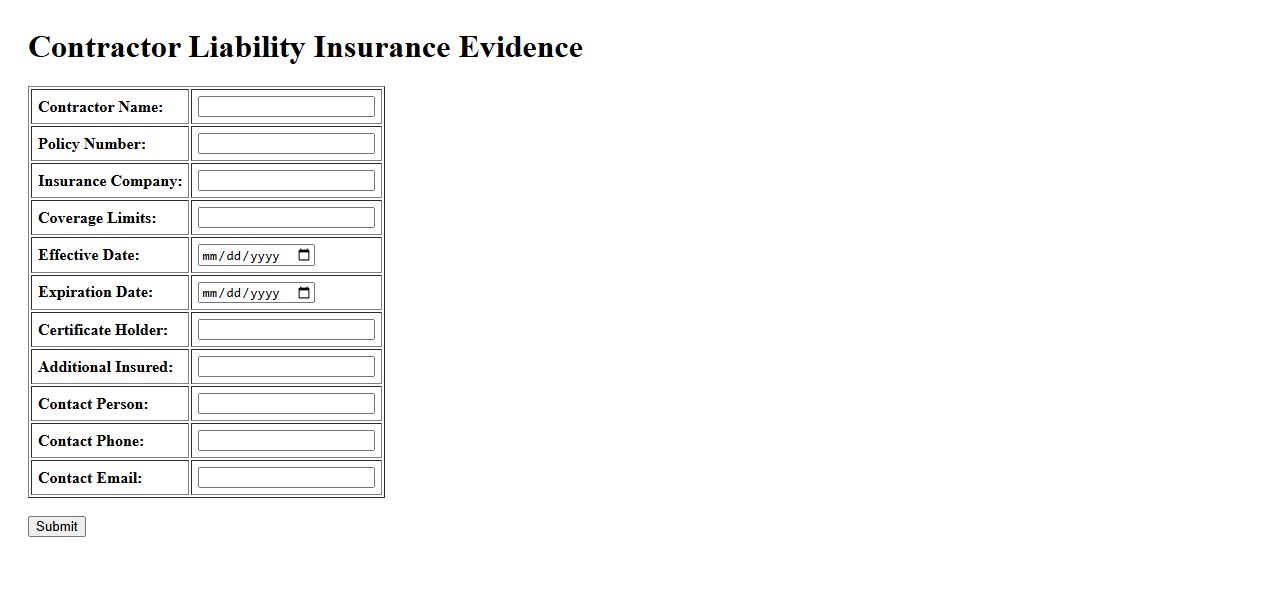

Contractor Liability Insurance Evidence

Contractor Liability Insurance Evidence is a crucial document that verifies a contractor's coverage against potential claims of property damage or bodily injury. This proof protects both the contractor and the client by ensuring financial responsibility in case of accidents during a project. It is essential for contractors to provide this evidence before commencing any work to guarantee compliance and peace of mind.

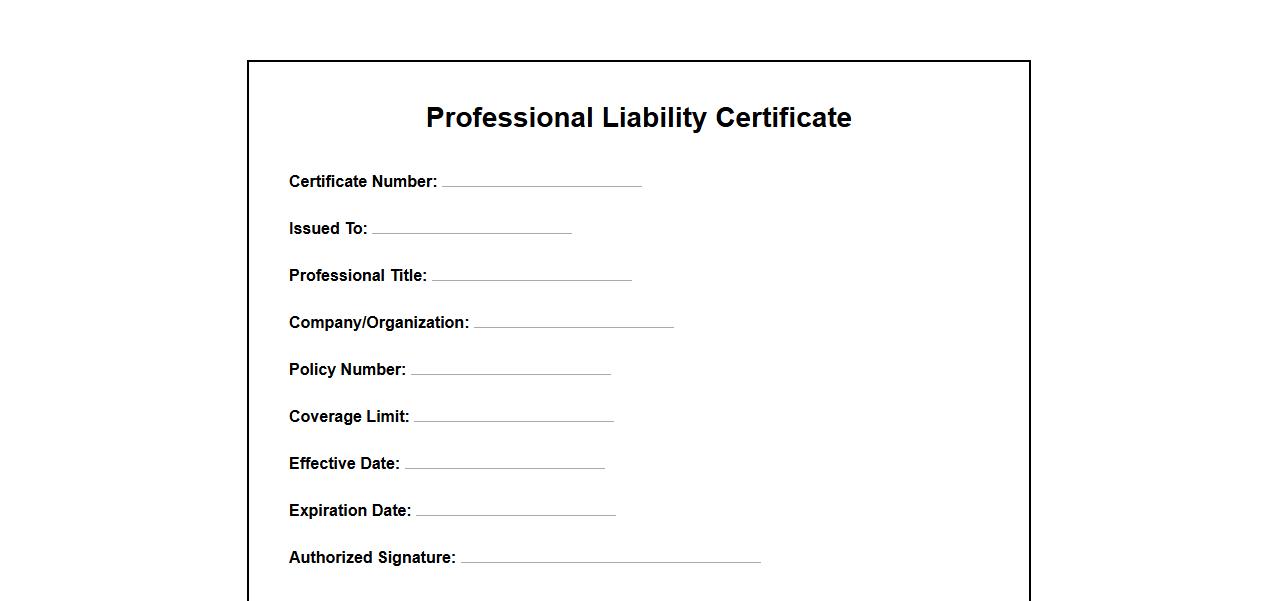

Professional Liability Certificate

A Professional Liability Certificate provides proof of insurance coverage for professionals against claims of negligence or errors in their services. It is essential for protecting businesses from financial loss due to lawsuits related to professional mistakes. This certificate reassures clients and partners of the insured's commitment to accountability and quality.

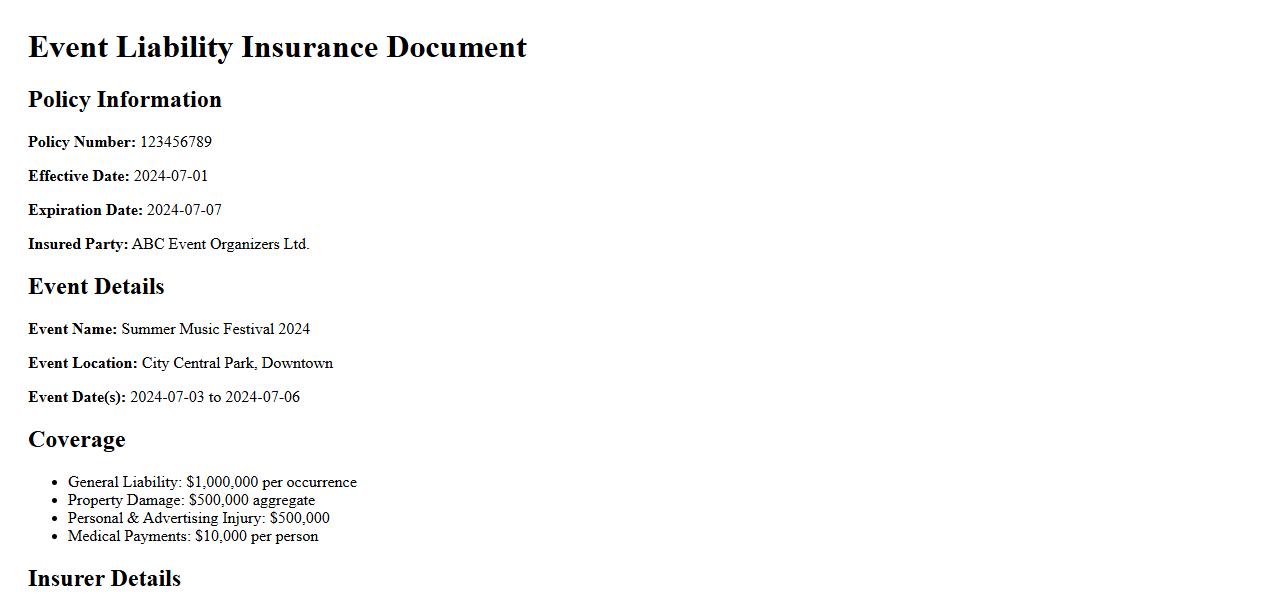

Event Liability Insurance Document

The Event Liability Insurance Document provides proof of coverage that protects event organizers from financial losses due to accidents or damages during an event. It outlines the scope of liability, coverage limits, and terms of the insurance policy. Having this document ensures that all parties are aware of the protection in place against potential risks.

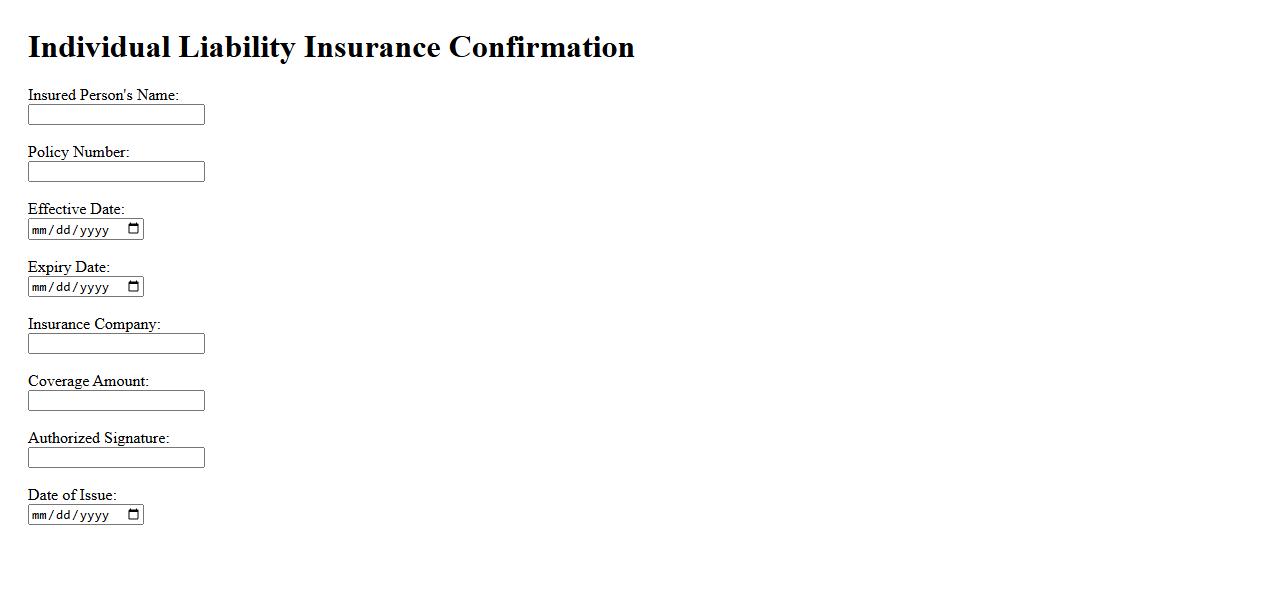

Individual Liability Insurance Confirmation

Individual Liability Insurance Confirmation verifies your personal coverage against potential claims of property damage or injury. This insurance confirmation serves as proof of financial protection, ensuring you meet legal or contractual requirements. It is essential for safeguarding your assets and providing peace of mind in daily activities.

What key information is typically included on a Certificate of Liability Insurance?

A Certificate of Liability Insurance usually includes the policyholder's name, the insurance company's details, and the policy number. It specifies the types of coverage, policy limits, and effective dates. Additionally, it lists any endorsements or special conditions relevant to the coverage.

How does a Certificate of Liability Insurance confirm policyholder coverage?

The certificate serves as a proof of insurance that outlines the coverage provided under the policy without detailing the full contract. It verifies that the policyholder maintains liability coverage as specified. This confirmation helps third parties ensure the policyholder's financial protection against certain liabilities.

What is the purpose of listing additional insured parties on the certificate?

Listing additional insured parties on the certificate extends protection to those entities besides the policyholder. It provides legal and financial coverage to these parties under the primary policy in case of claims. This inclusion is essential in business contracts and partnerships to share risk.

How does the certificate differ from the actual insurance policy document?

The certificate is a summary document that offers proof of coverage but does not contain the full terms and conditions of the insurance policy. The actual policy document is a detailed legal contract outlining all rights, responsibilities, exclusions, and coverage specifics. Therefore, the certificate alone cannot be used to resolve disputes or claims.

When and why might a third party request a Certificate of Liability Insurance?

Third parties often request a certificate during contracts or agreements to verify the policyholder's insurance coverage. It ensures that adequate liability protection is in place before work begins or partnerships proceed. This step reduces financial risk and promotes trust between involved parties.