A Certificate of Health Insurance is an official document that verifies an individual's health insurance coverage. It typically includes details such as the policyholder's name, coverage dates, and the extent of benefits provided. This certificate is often required for travel, employment, or participation in specific programs to confirm proof of health insurance.

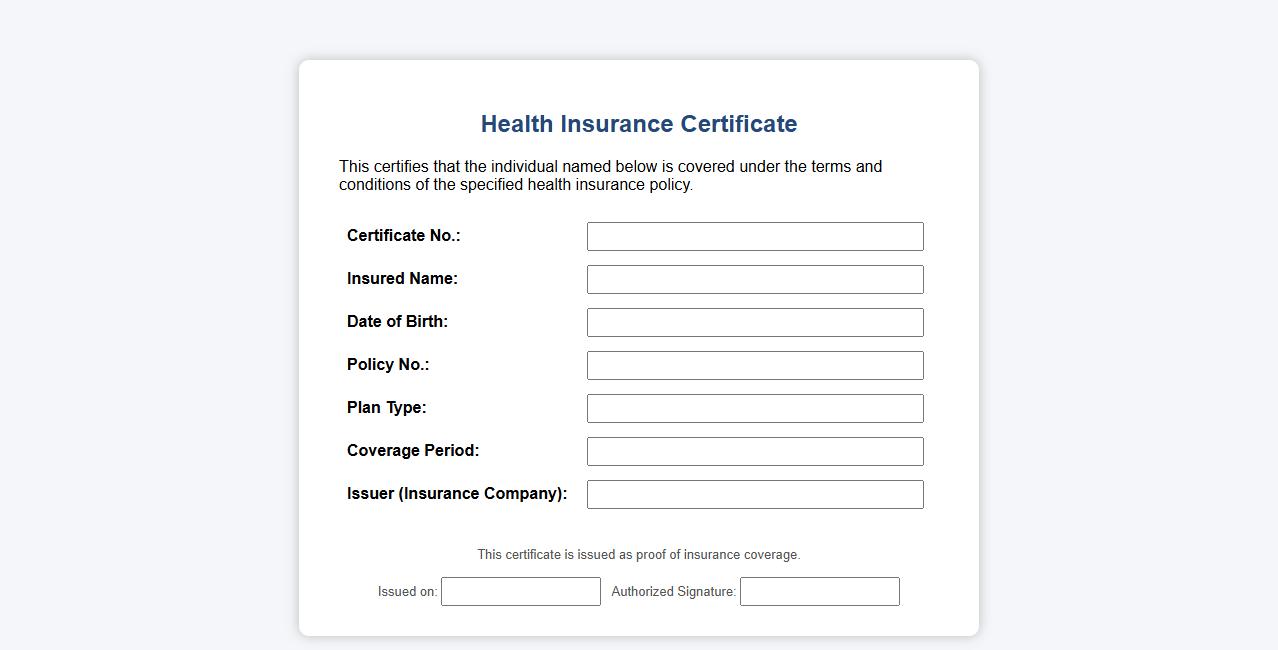

Health Insurance Certificate

A Health Insurance Certificate is an official document that verifies an individual's health insurance coverage. It provides proof of policy details, coverage limits, and validity periods. This certificate is essential for accessing medical services and insurance claims.

Medical Coverage Certificate

A Medical Coverage Certificate is an official document verifying an individual's eligibility for medical benefits. It serves as proof of insurance and ensures access to healthcare services. This certificate is essential for availing treatments and medical reimbursements.

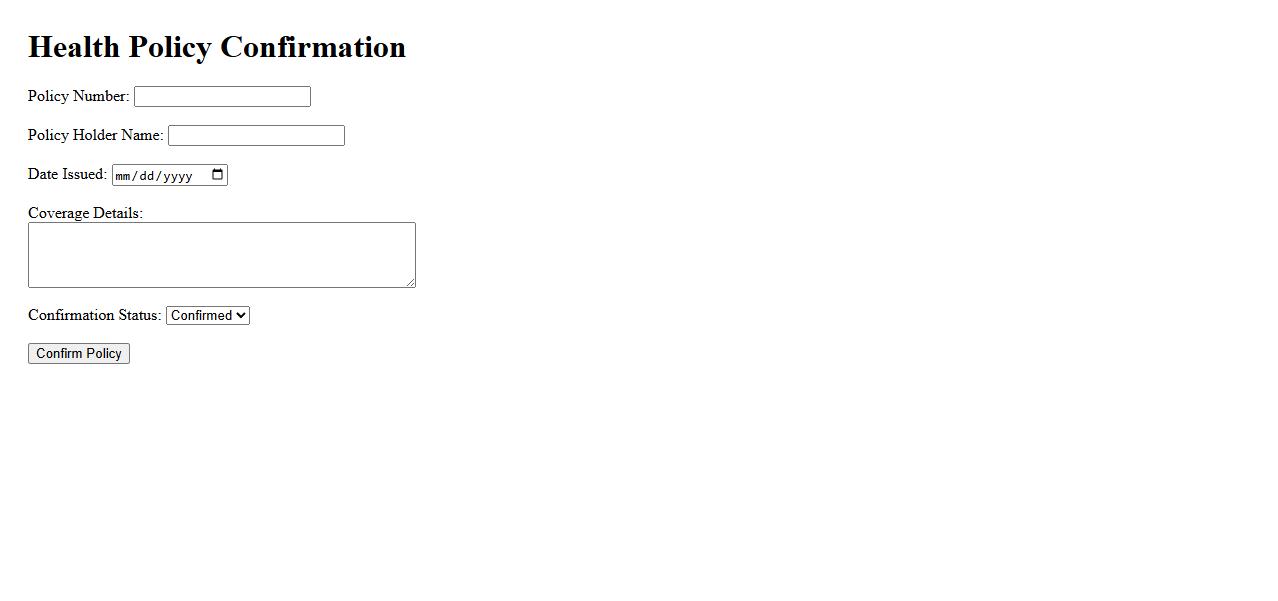

Health Policy Confirmation

Health Policy Confirmation ensures that all health-related policies are accurately verified and documented. This process guarantees compliance with regulatory standards and provides clarity for both providers and patients. Timely confirmation helps maintain trust and transparency in healthcare services.

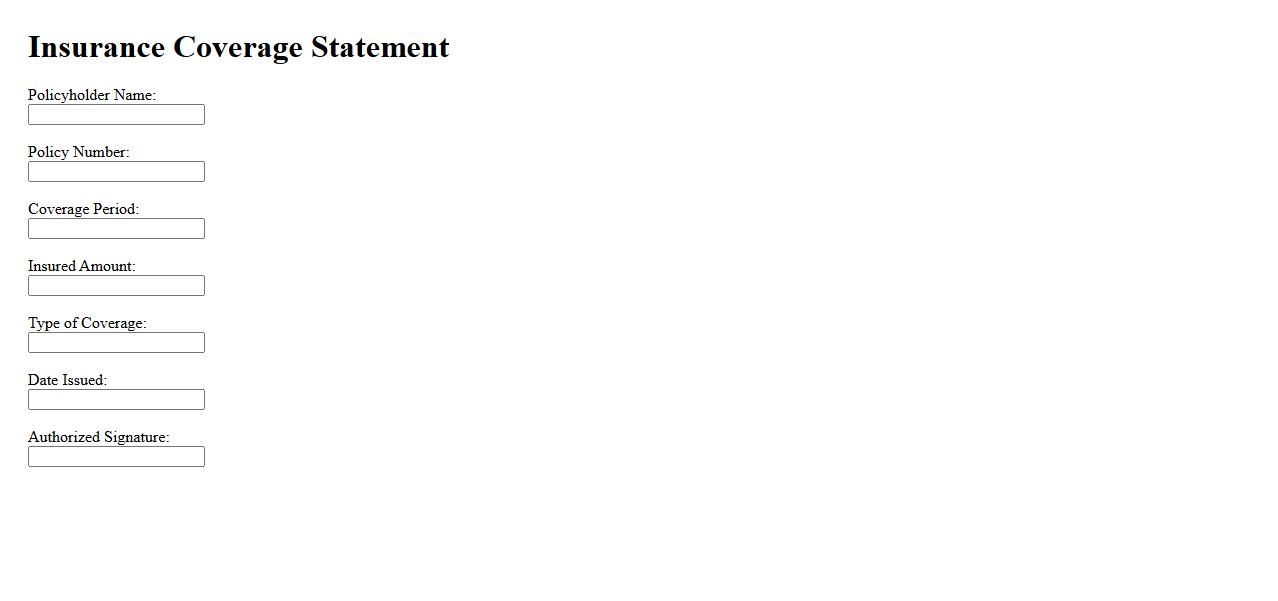

Insurance Coverage Statement

Insurance Coverage Statement provides a detailed summary of the benefits and protections offered by an insurance policy. It outlines the scope of coverage, including what risks are insured and any limitations or exclusions. This document is essential for policyholders to understand their financial protection and responsibilities.

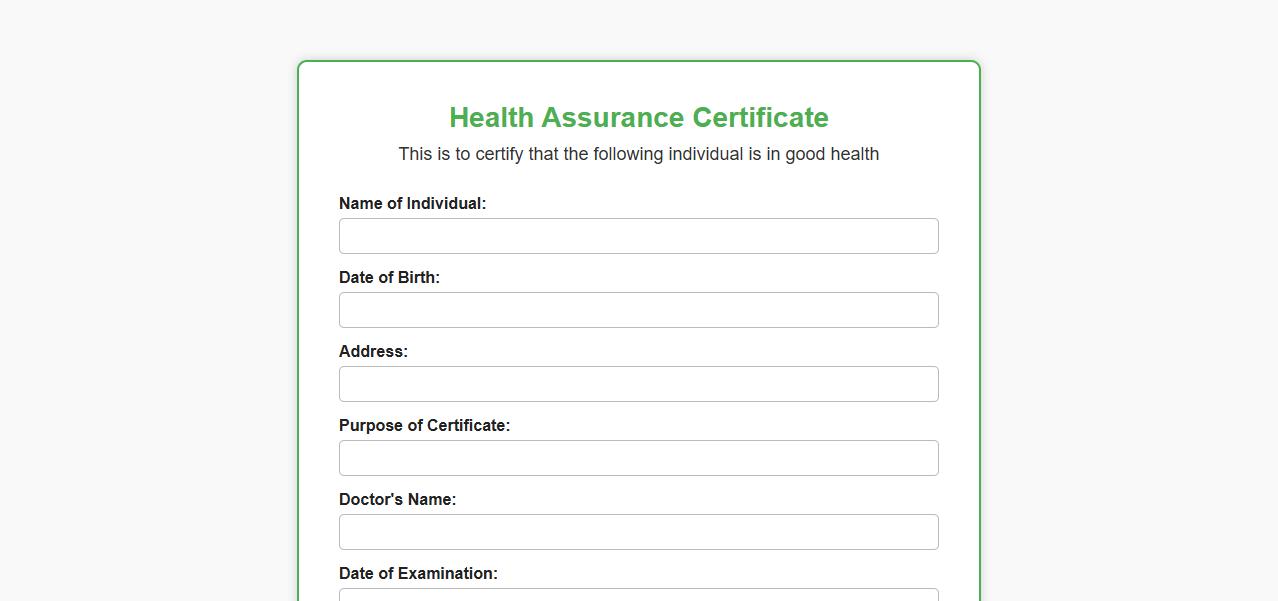

Health Assurance Certificate

The Health Assurance Certificate verifies that an individual meets specific health standards required for various purposes, such as employment or travel. It provides official confirmation of good health status, ensuring safety and compliance with regulations. Obtaining this certificate helps prevent the spread of illnesses in public and professional environments.

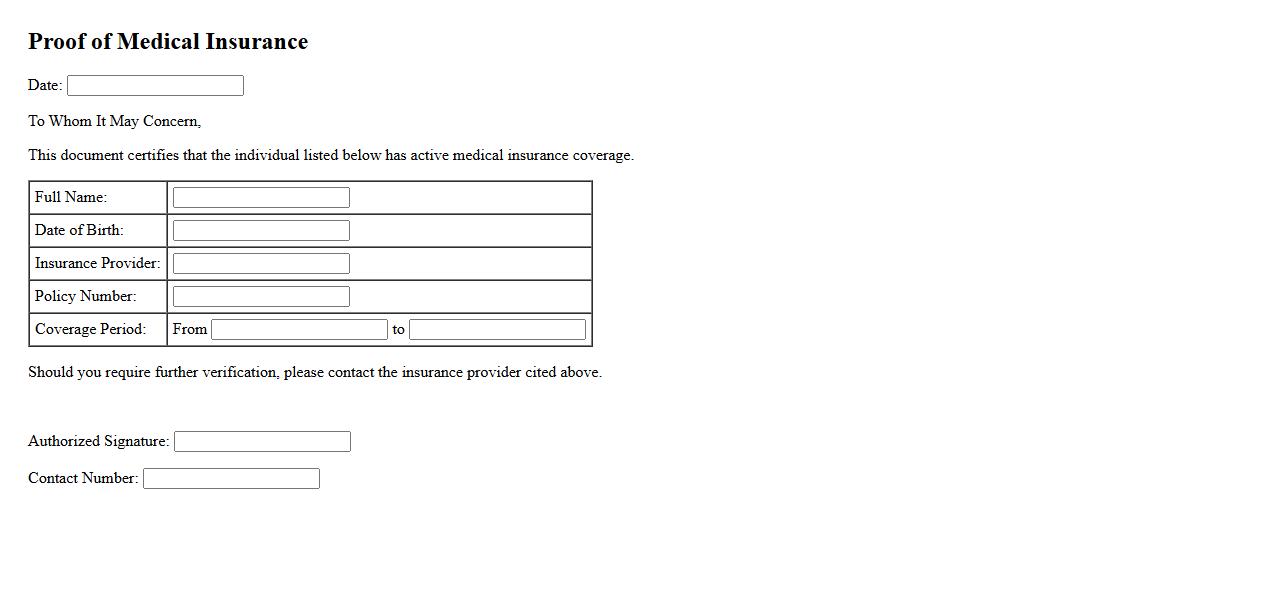

Proof of Medical Insurance

Proof of Medical Insurance is a document that verifies an individual has valid health coverage. It is often required for travel, employment, or admission to certain institutions. This proof ensures access to medical services without financial burden in emergencies.

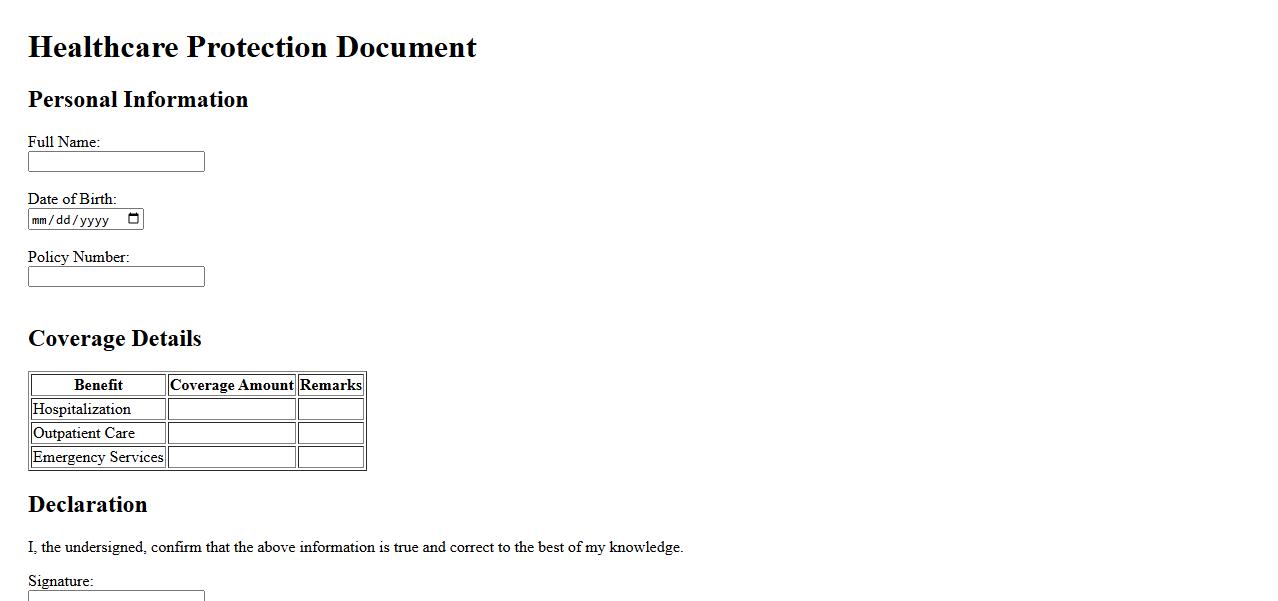

Healthcare Protection Document

The Healthcare Protection Document is essential for ensuring comprehensive medical care and safeguarding patient rights. It outlines critical health directives and authorization for treatments in various situations. This document provides peace of mind by clearly defining healthcare preferences and legal protections.

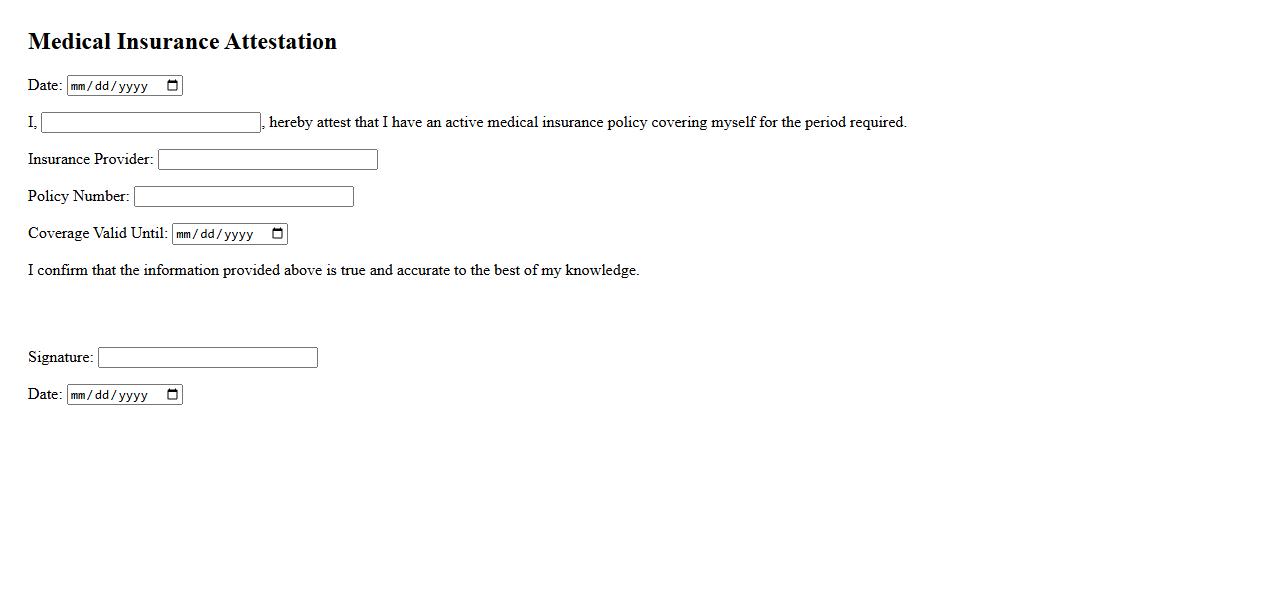

Medical Insurance Attestation

Medical Insurance Attestation is a formal document that verifies an individual's health insurance coverage. It serves as proof for employers, institutions, or agencies requiring confirmation of medical insurance status. This attestation helps ensure compliance with healthcare policies and regulations.

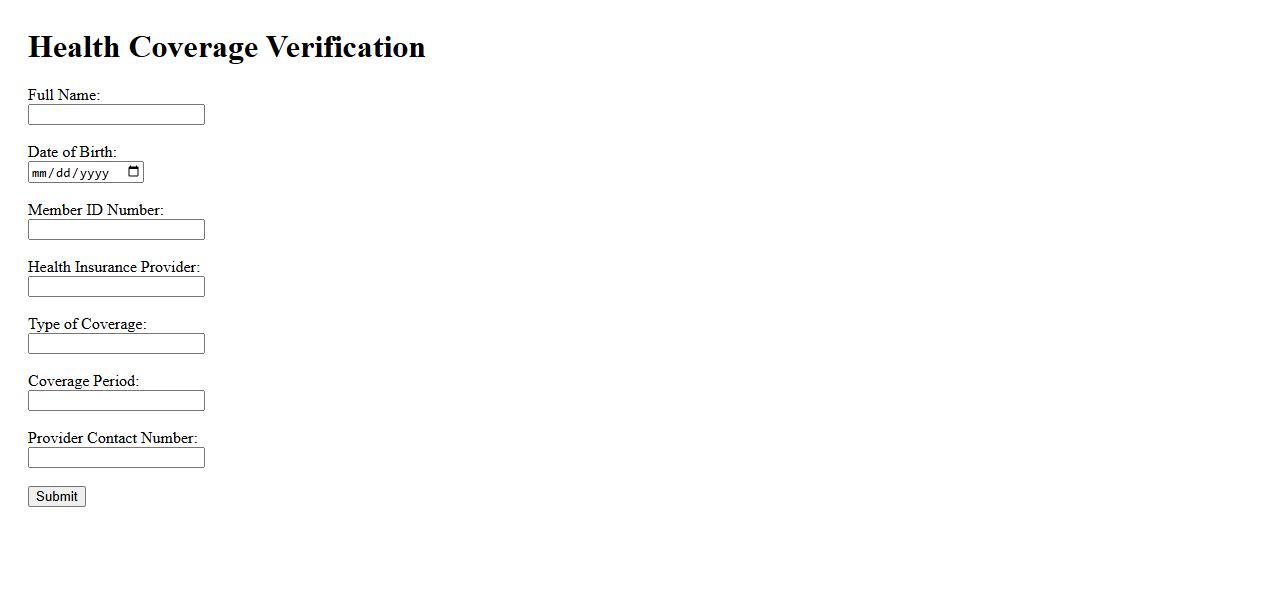

Health Coverage Verification

Health Coverage Verification is the process of confirming a patient's insurance benefits and eligibility before receiving medical services. Accurate verification helps prevent claim denials and ensures smooth billing procedures. It is essential for healthcare providers to maintain efficient patient care and reduce financial risks.

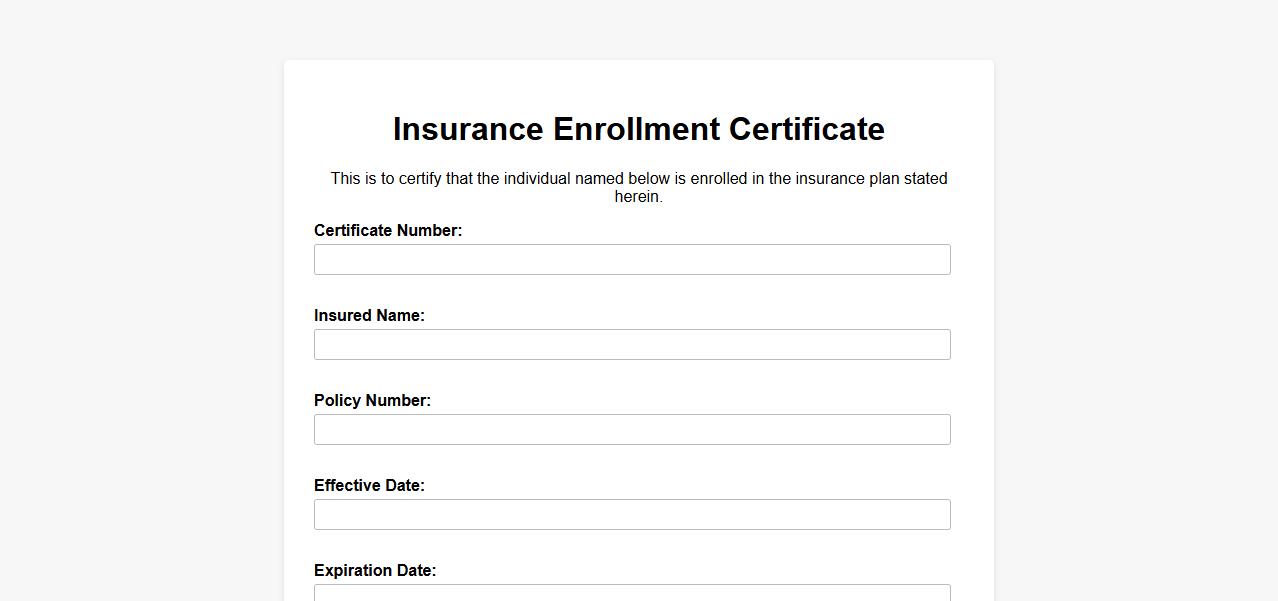

Insurance Enrollment Certificate

An Insurance Enrollment Certificate serves as official proof that an individual or entity is covered under a specific insurance policy. It outlines key details such as coverage dates, policy number, and beneficiary information. This document is essential for verifying insurance status in various legal and administrative processes.

What essential information must be included in a Certificate of Health Insurance?

A Certificate of Health Insurance must contain policyholder details such as name and identification number. It also includes the insurance provider's information and policy number for verification purposes. Additionally, the certificate specifies the effective dates of the coverage to confirm the period of protection.

How does a Certificate of Health Insurance define covered services and exclusions?

The certificate clearly lists all covered medical services such as hospital care, prescription drugs, and preventive services. It also outlines exclusions, specifying which treatments or conditions are not covered. This ensures the policyholder understands the scope and limitations of their insurance protection.

In what ways does the Certificate of Health Insurance outline coverage limits and deductibles?

Coverage limits are described to show the maximum amount the insurer will pay for various services, providing a clear financial cap. The document details deductibles, which are the out-of-pocket expenses the insured must pay before insurance benefits apply. This helps the policyholder anticipate potential costs involved in using the insurance.

How does the document specify the process for filing a health insurance claim?

The certificate explains the step-by-step procedure for submitting claims, including necessary forms and documentation. It specifies the timelines within which a claim must be filed to be considered valid. This clarity helps ensure timely reimbursement and reduces claim processing delays.

What are the policyholder's rights and responsibilities as detailed in the Certificate of Health Insurance?

The certificate outlines the policyholder's rights, including access to information and the dispute resolution process. It also details responsibilities such as paying premiums on time and providing accurate information. Understanding these aspects fosters a transparent and trustworthy relationship between insurer and insured.