The Authorization to Release Insurance Information is a legal document that permits healthcare providers to share a patient's insurance details with designated parties. This authorization facilitates efficient claims processing and ensures that insurers receive necessary information for payment. Patients must sign this form to comply with privacy regulations and streamline billing procedures.

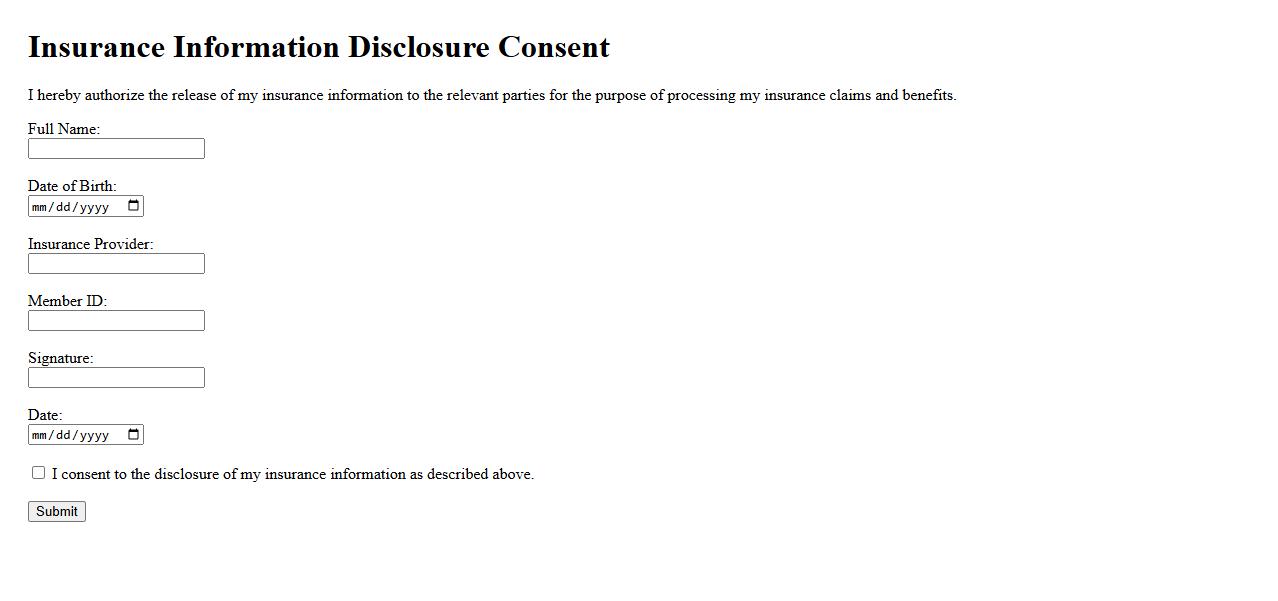

Insurance Information Disclosure Consent

The Insurance Information Disclosure Consent is a document that authorizes the sharing of personal insurance details with relevant parties. It ensures transparency and compliance with privacy regulations during the insurance process. This consent helps facilitate smooth communication between insurers and service providers.

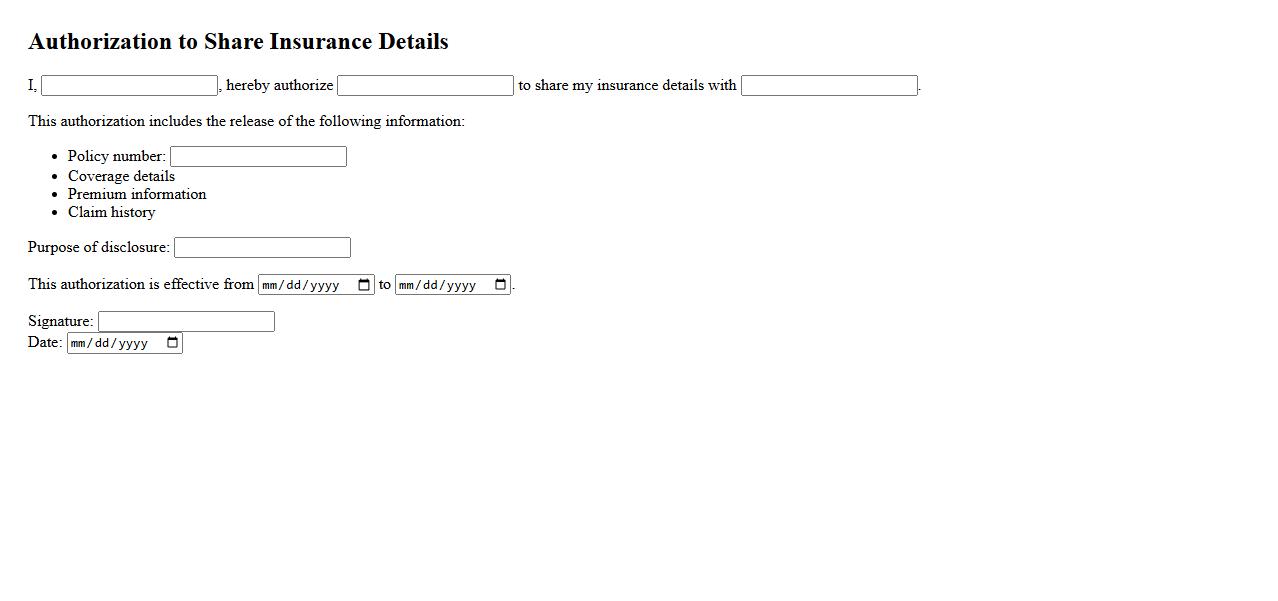

Authorization to Share Insurance Details

Authorization to Share Insurance Details is a formal consent allowing an individual or entity to disclose insurance information to designated parties. This authorization ensures that sensitive data is shared securely and only with authorized recipients. It plays a crucial role in facilitating communication between insurers, healthcare providers, and other relevant stakeholders.

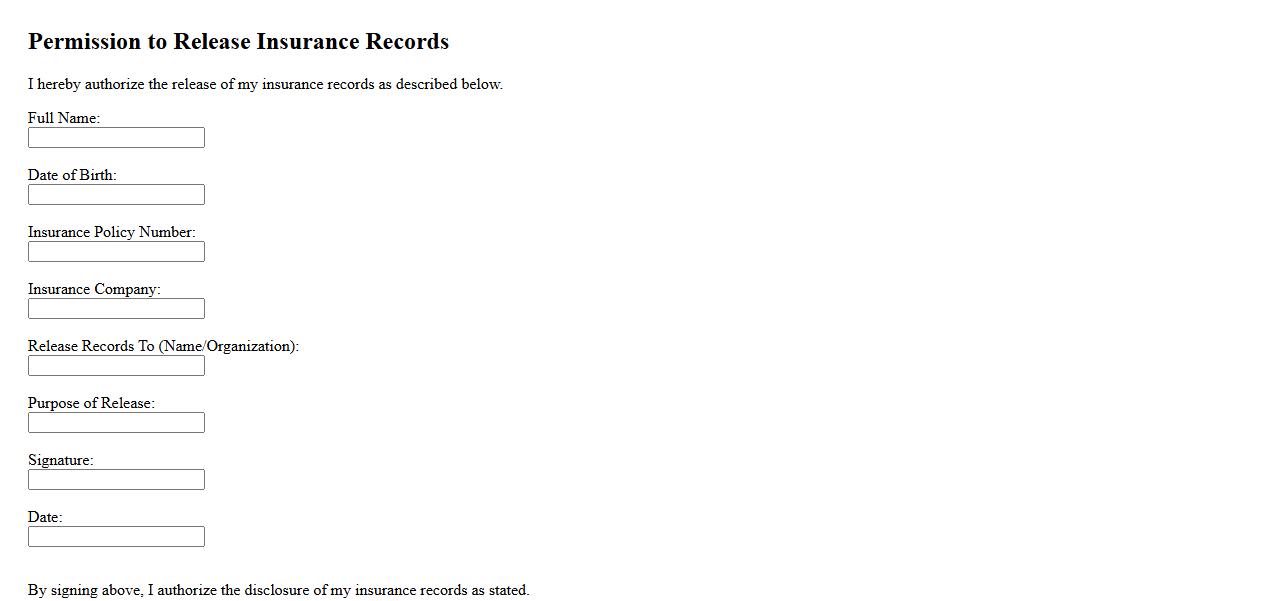

Permission to Release Insurance Records

Obtaining permission to release insurance records is essential for ensuring privacy and compliance with legal standards. This authorization allows authorized parties to access important insurance information securely. It facilitates verification and processing of claims efficiently while protecting personal data.

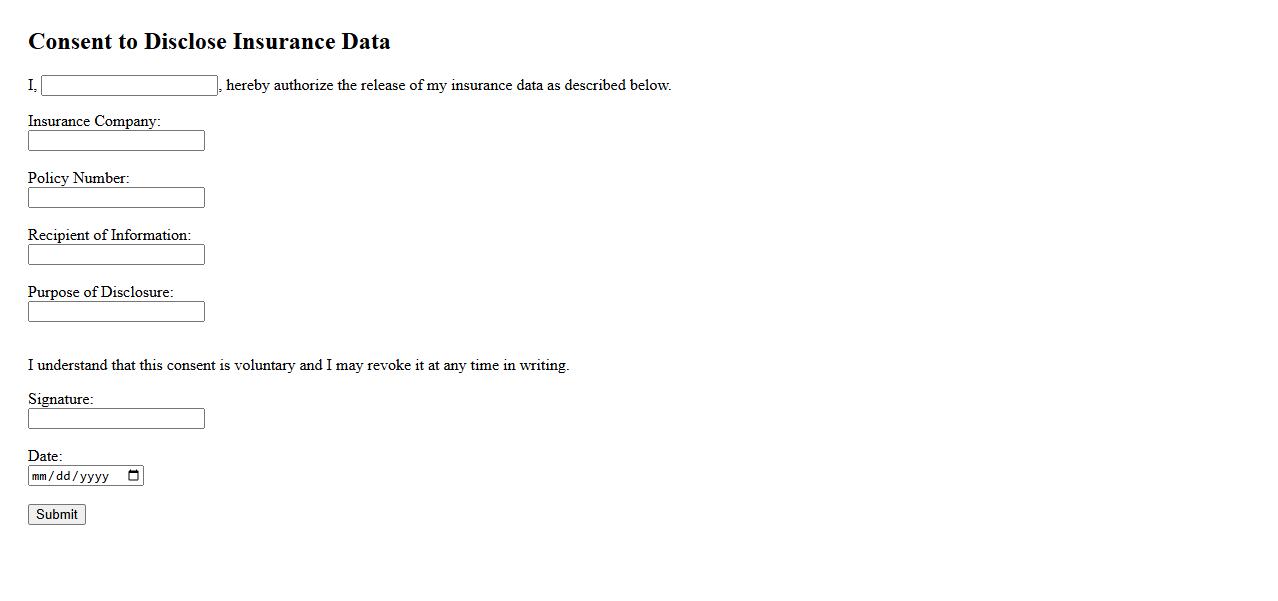

Consent to Disclose Insurance Data

Consent to Disclose Insurance Data is a legal authorization allowing insurers or healthcare providers to share an individual's insurance information with third parties. This consent ensures transparency and protects personal data while facilitating necessary communication for claims processing or benefits verification. Obtaining explicit consent is essential to comply with privacy regulations and maintain trust.

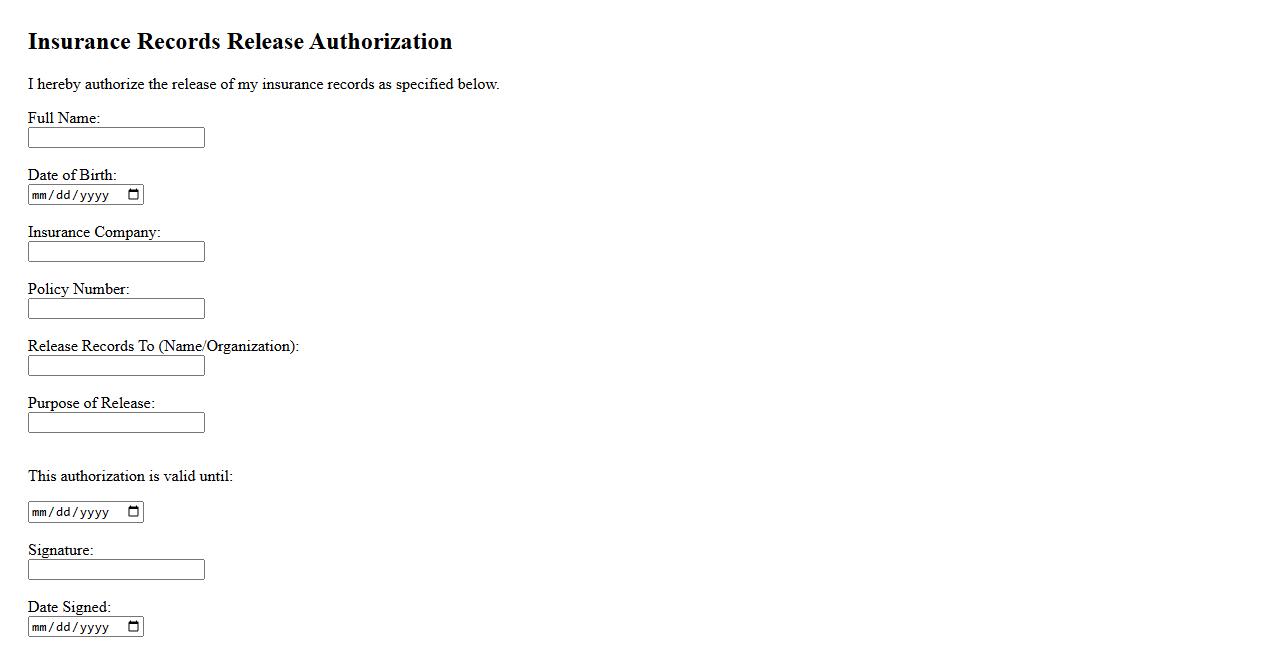

Insurance Records Release Authorization

The Insurance Records Release Authorization is a crucial document that permits the sharing of personal insurance information between parties. It ensures legal compliance and protects individual privacy while facilitating efficient claims processing. This authorization streamlines communication between insurers, healthcare providers, and policyholders.

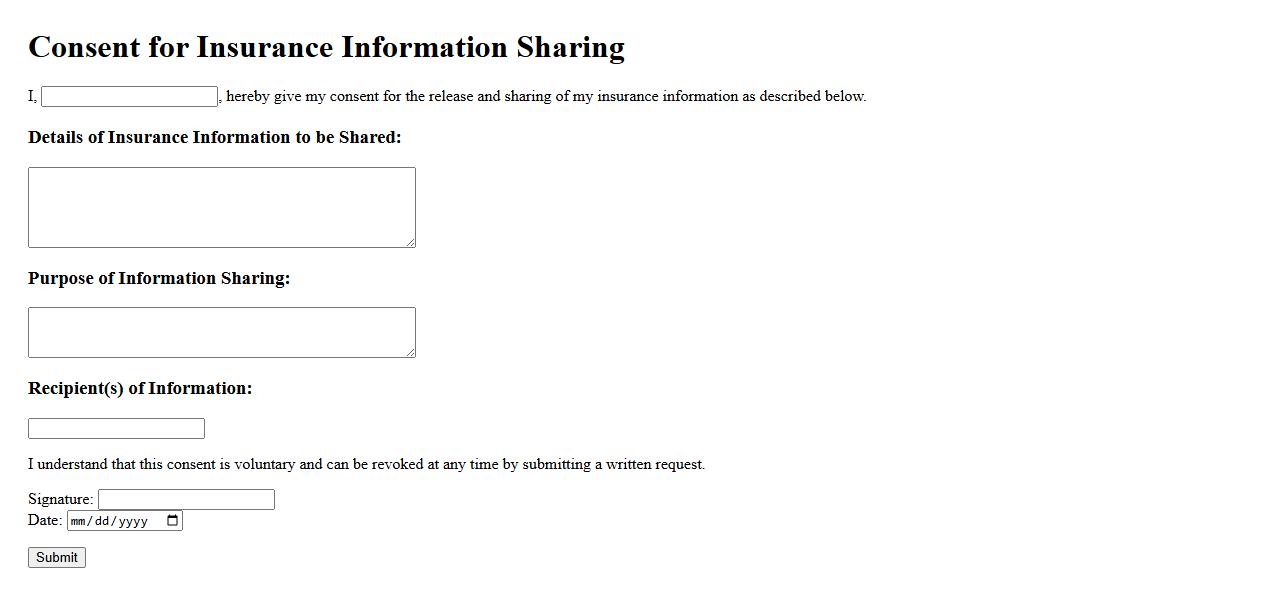

Consent for Insurance Information Sharing

Consent for Insurance Information Sharing refers to the permission given by an individual to allow the exchange of their insurance details between authorized parties. This consent ensures that sensitive information is shared securely and used appropriately for claims processing or coverage verification. It is a crucial step to maintain privacy and comply with legal regulations.

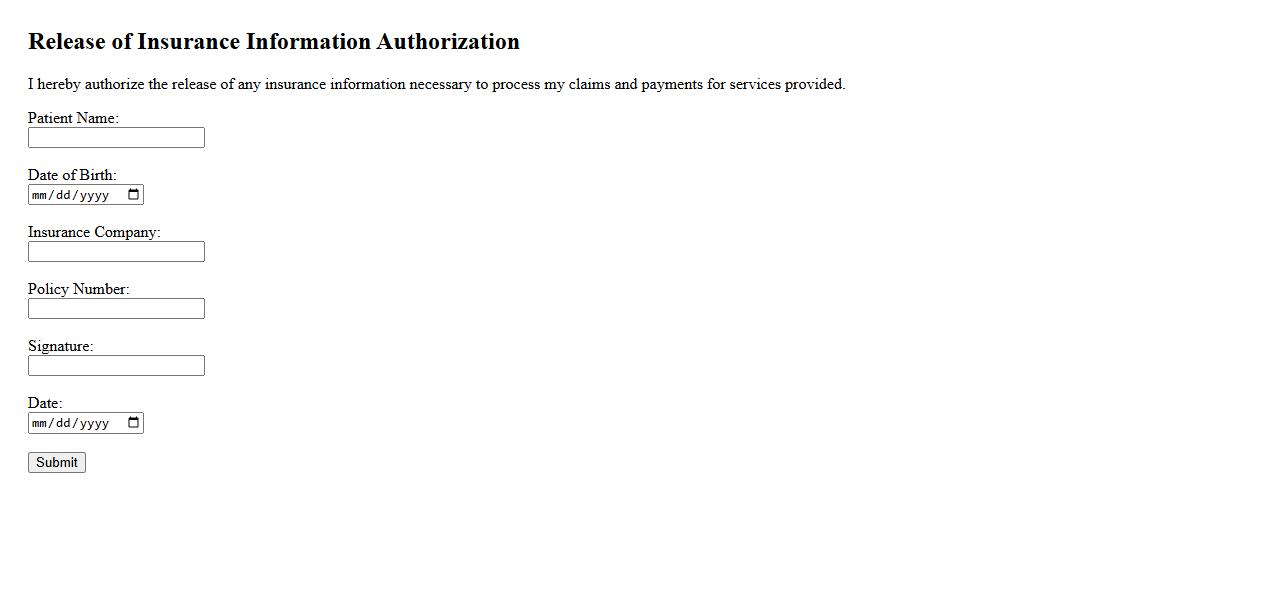

Release of Insurance Information Authorization

The Release of Insurance Information Authorization allows healthcare providers to access and share a patient's insurance details for billing and claims purposes. This authorization ensures accurate processing of insurance claims and timely payment. Patients must provide consent to protect their privacy while facilitating efficient healthcare services.

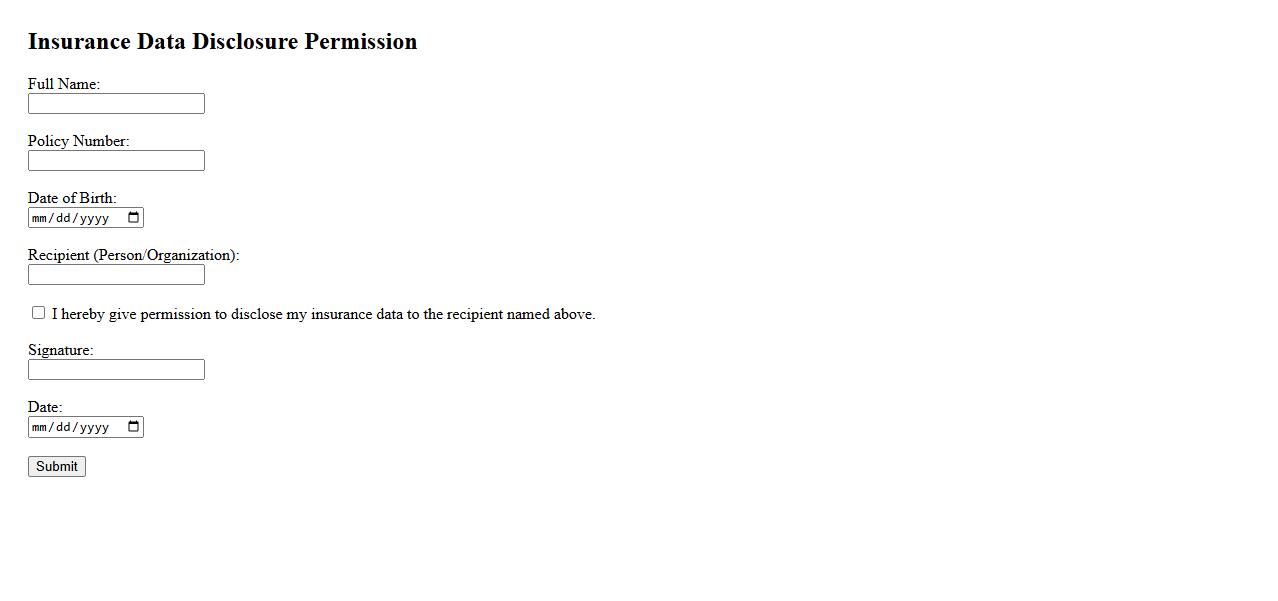

Insurance Data Disclosure Permission

Insurance Data Disclosure Permission is a crucial consent that allows insurers to access and share your personal and policy information securely. This permission ensures transparent communication between you and insurance providers, facilitating accurate claims processing and risk assessment. Granting this authorization helps protect your interests while complying with regulatory standards.

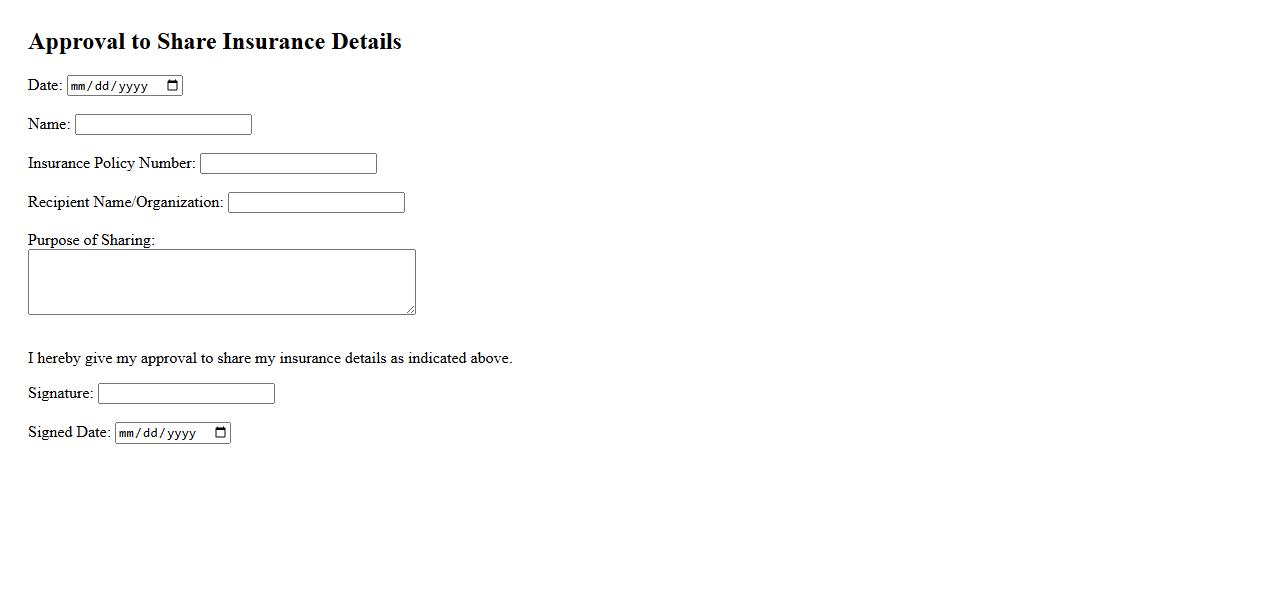

Approval to Share Insurance Details

Obtaining approval to share insurance details ensures the privacy and confidentiality of sensitive information. This permission is essential for authorized parties to access and verify insurance coverage. It protects individuals' rights while facilitating necessary communication between stakeholders.

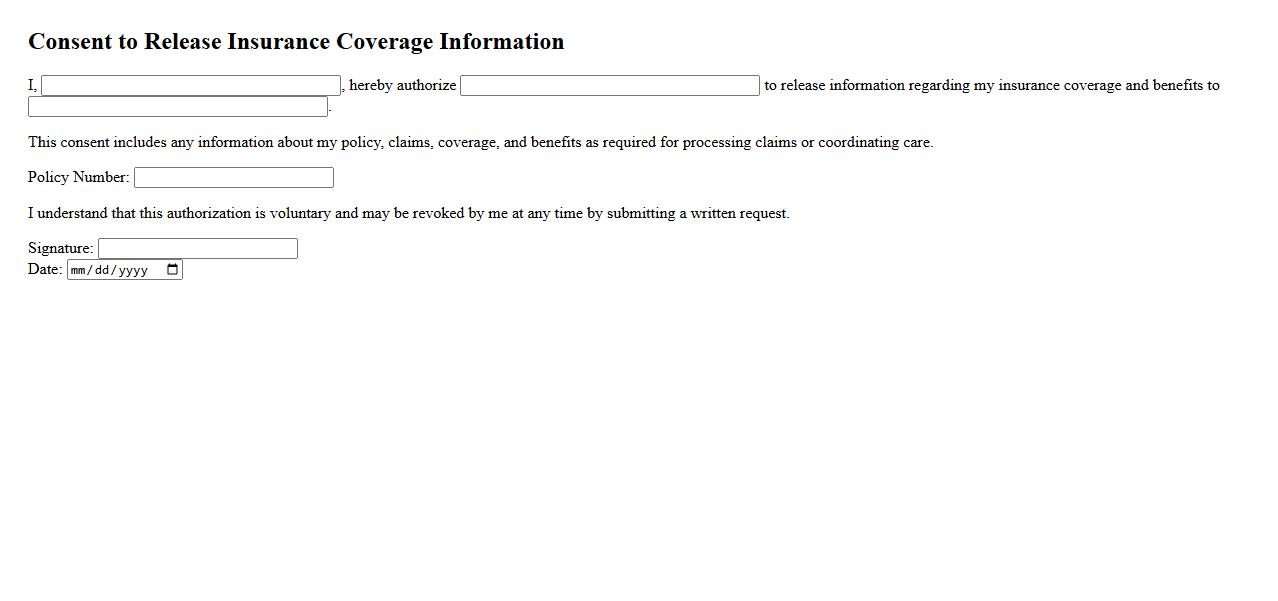

Consent to Release Insurance Coverage Information

Consent to release insurance coverage information is a critical authorization allowing healthcare providers to share a patient's insurance details with relevant parties. This consent ensures accurate billing and facilitates communication between insurers and providers. It protects patient privacy while enabling efficient claim processing.

What specific types of insurance information are authorized for release in this document?

This document authorizes the release of personal insurance details, including policy numbers, coverage limits, and payment history. It may also include information related to claim status and medical billing associated with the insurance. All disclosed information is carefully selected to ensure compliance with privacy regulations while facilitating accurate processing.

Who is permitted to receive the released insurance information according to the authorization?

The authorization permits designated healthcare providers, insurance companies, and billing agencies to access the released insurance data. Additionally, authorized third-party agents involved in claims processing or coverage verification may receive the information. Access is granted strictly to parties specified within the authorization to maintain confidentiality.

For what intended purpose(s) can the released insurance information be used?

The insurance information can be used for claims processing, billing, and verification of coverage eligibility. It may also assist in determining benefits and resolving disputes related to insurance claims. The use of this information is limited solely to activities that support insurance administration and patient care coordination.

What is the effective period or duration for this authorization to release insurance information?

The authorization remains effective for a specified period, typically defined in the document, such as one year from the date of signature. After this period, the release privileges automatically expire unless renewed or extended. This timeframe ensures timely access while protecting the individual's privacy over the long term.

What are the procedures for revoking this authorization before its expiration?

The individual can revoke the authorization by providing a written notice to the entity that holds their insurance information. Upon receiving the revocation, all future disclosures must cease unless already processed. This procedure guarantees that the individual maintains control over their personal insurance data.