Authorization for Debit Card is the process by which a financial institution verifies and approves a transaction using a debit card. This ensures that the cardholder has sufficient funds and that the transaction is legitimate before the payment is processed. Secure authorization helps prevent fraud and unauthorized use of the debit card.

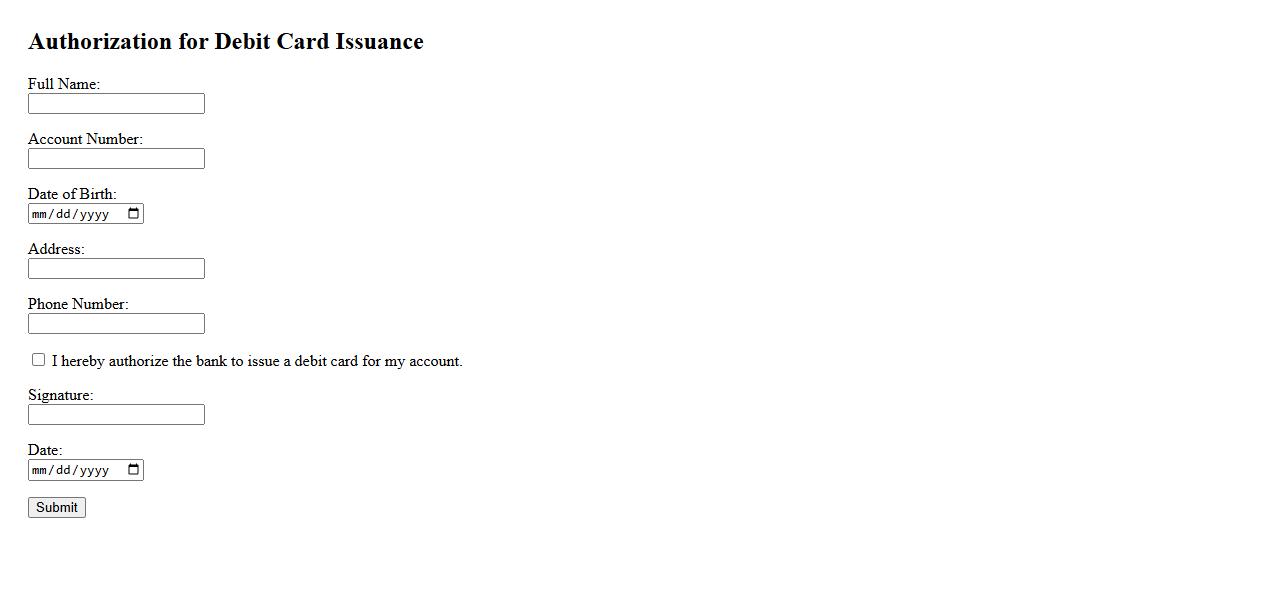

Authorization for Debit Card Issuance

Authorization for Debit Card Issuance is a critical process that grants permission to issue a debit card linked to a specific bank account. This authorization ensures secure access and control over funds, protecting both the bank and the account holder. It is a mandatory step to verify identity and consent before activating the card for transactions.

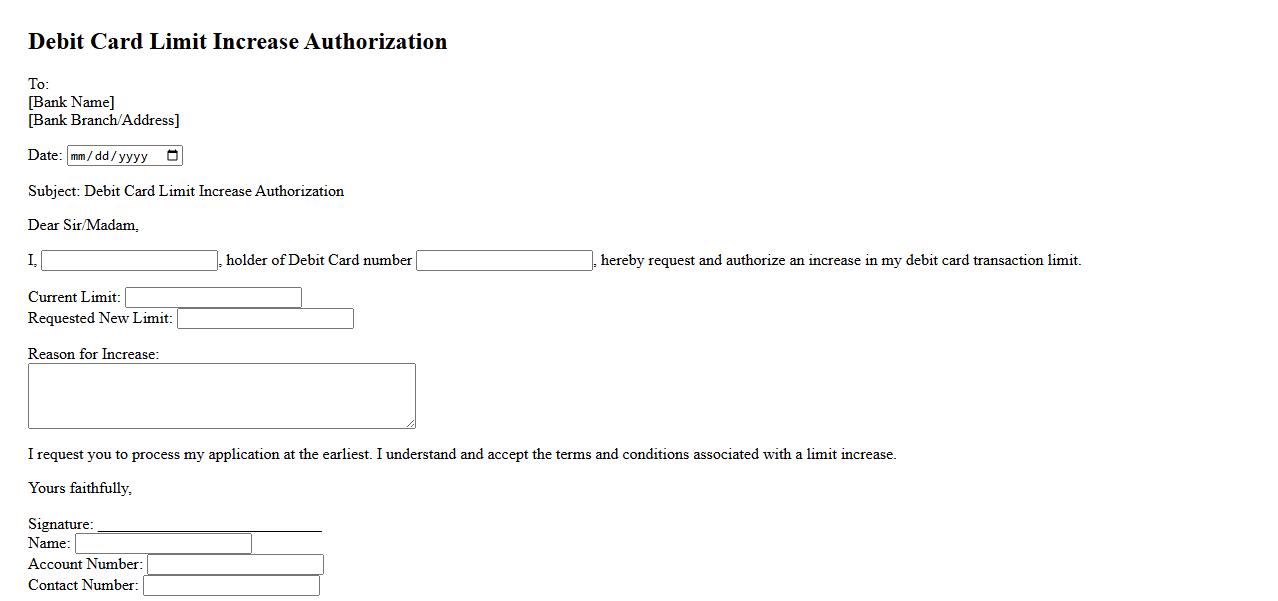

Debit Card Limit Increase Authorization

The Debit Card Limit Increase Authorization allows cardholders to request a higher spending or withdrawal limit on their debit cards. This process ensures enhanced access to funds while maintaining security protocols. Customers must follow specific steps to obtain approval for an increased limit.

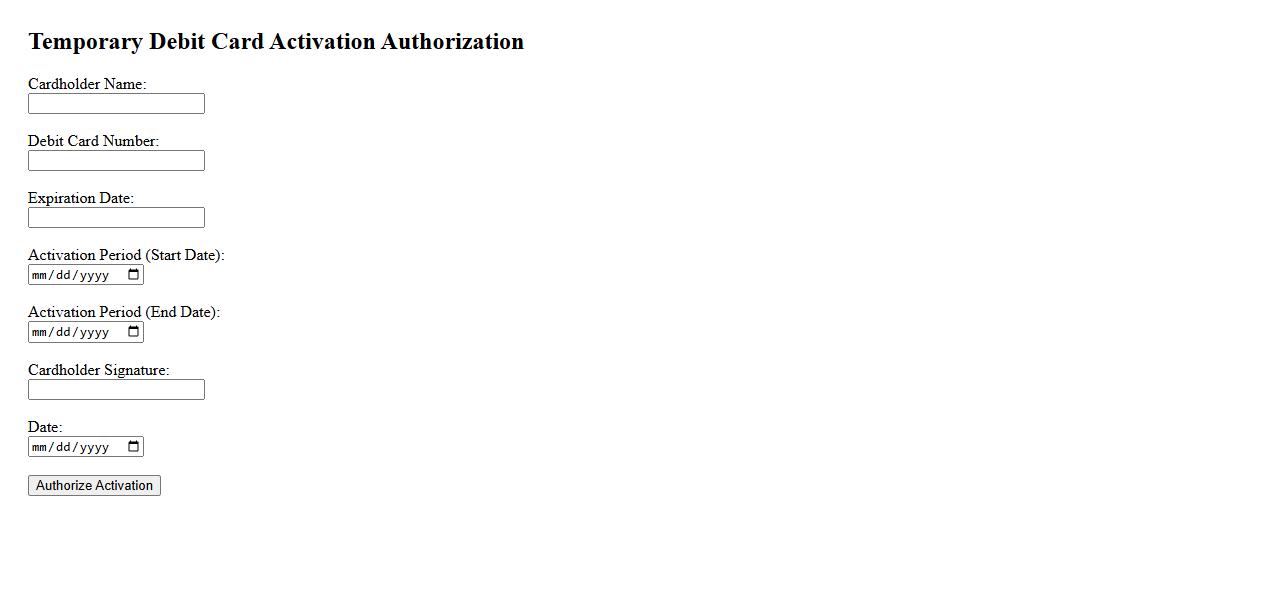

Temporary Debit Card Activation Authorization

To use your Temporary Debit Card Activation Authorization, you must verify your identity through a secure process. This ensures that the card is activated safely and only by the authorized user. Follow the provided instructions to complete the activation quickly and securely.

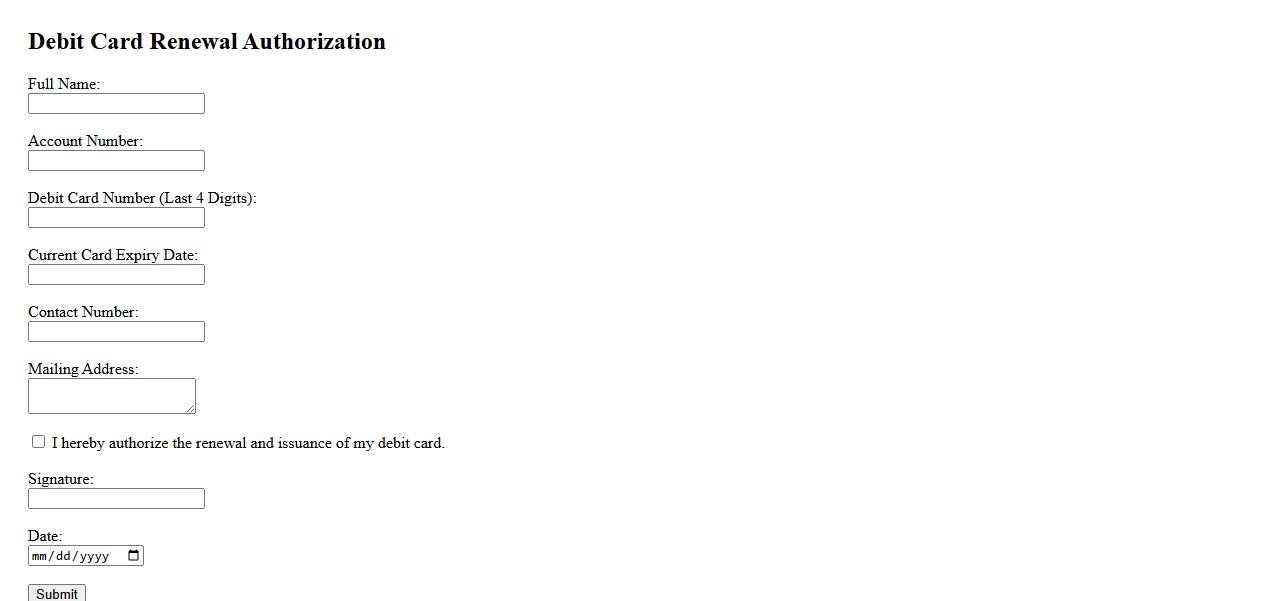

Debit Card Renewal Authorization

The Debit Card Renewal Authorization process ensures your card remains active and secure for future transactions. It involves verifying your identity and updating your details to receive a new card before the current one expires. Timely renewal helps avoid interruptions in accessing your funds and services.

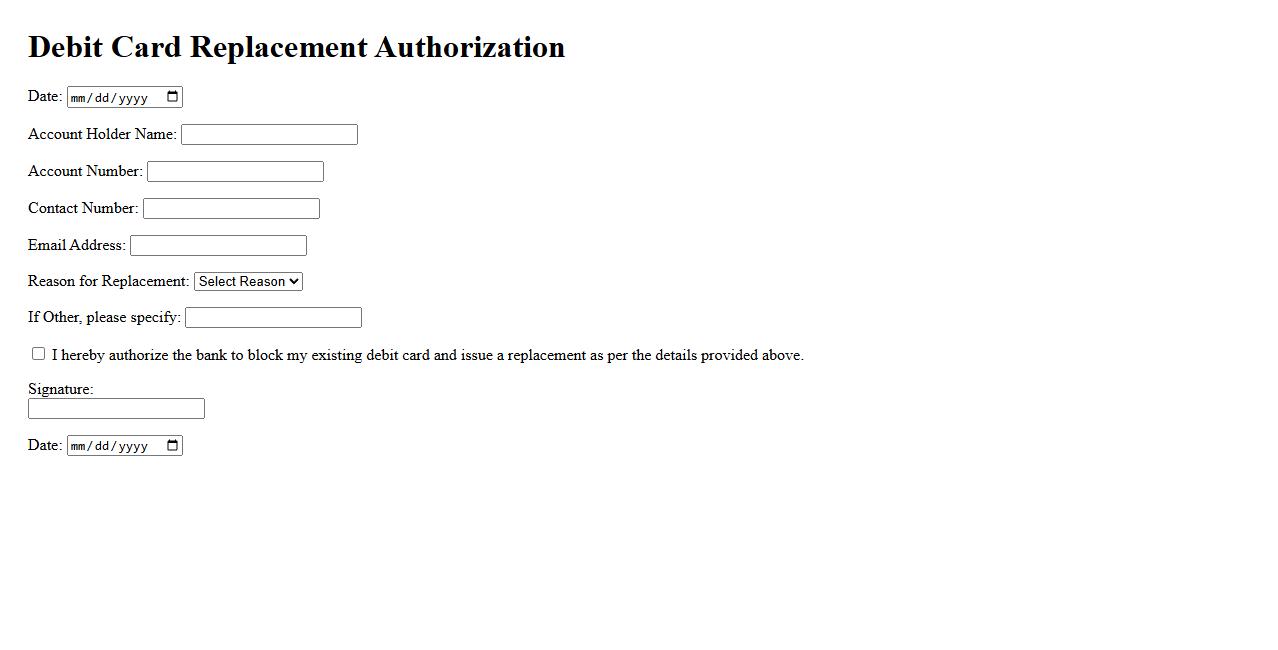

Debit Card Replacement Authorization

The Debit Card Replacement Authorization is a secure process that allows cardholders to request a new debit card in case of loss, theft, or damage. This authorization ensures the protection of your account and enables quick issuance of a replacement card. Promptly completing the authorization minimizes disruptions to your financial activities.

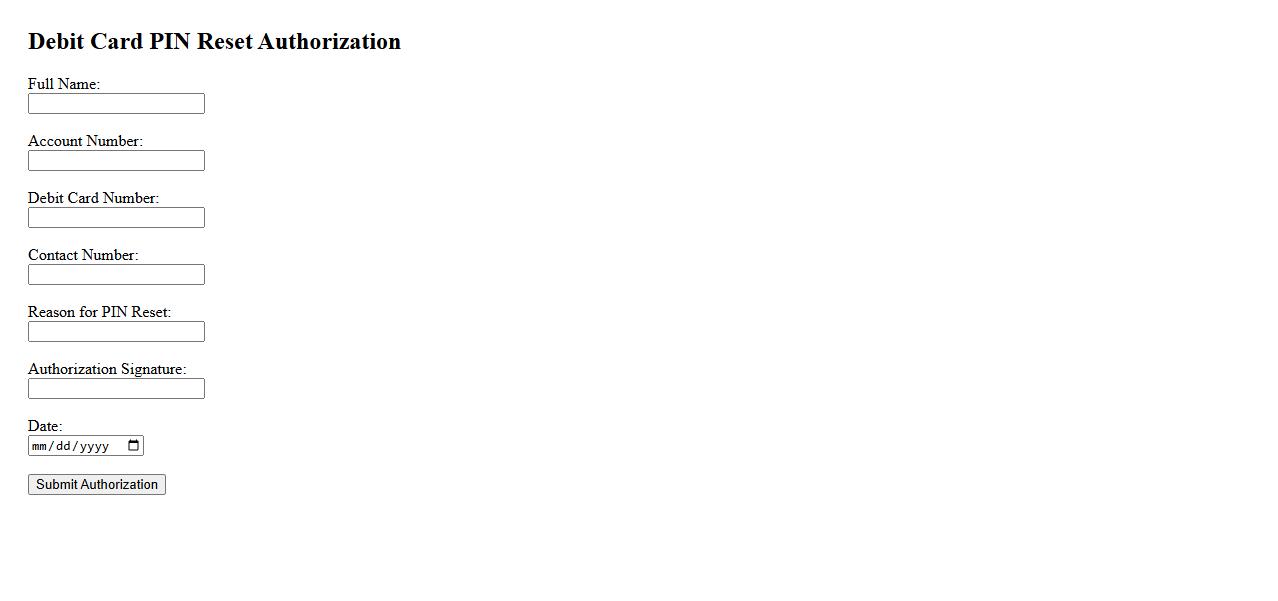

Debit Card PIN Reset Authorization

To ensure security, Debit Card PIN Reset Authorization is required before you can change your PIN. This process verifies your identity to prevent unauthorized access. Once authorized, you can easily reset your PIN and continue using your debit card safely.

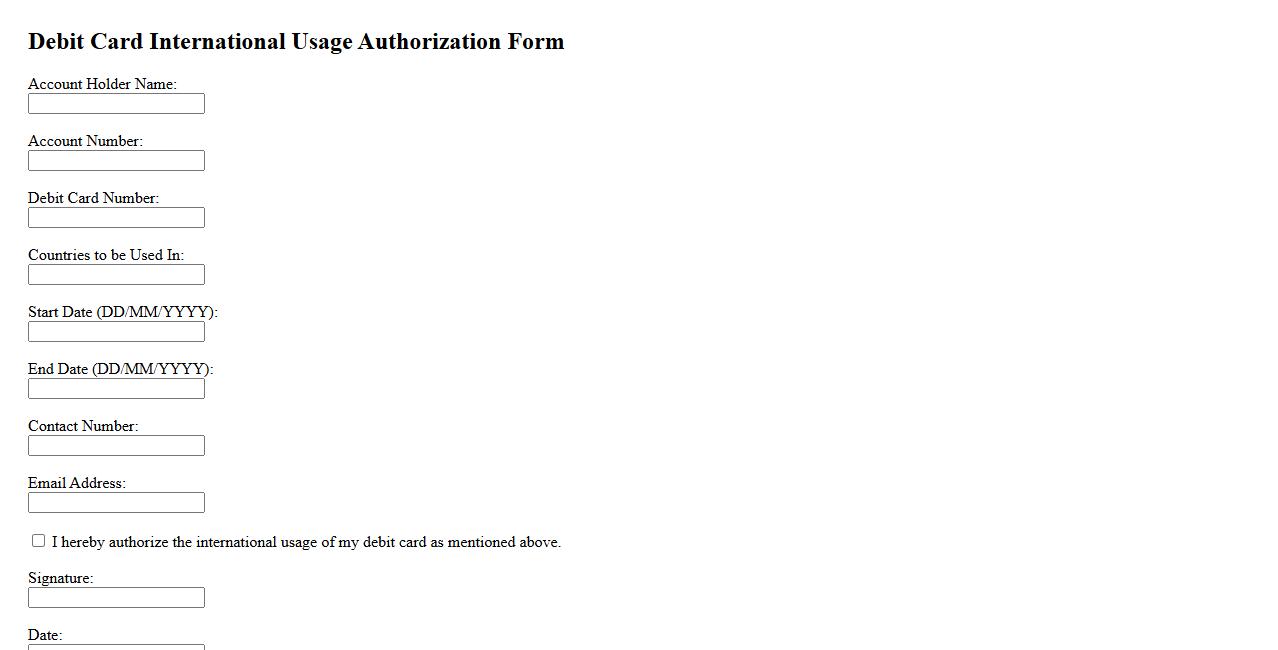

Debit Card International Usage Authorization

The Debit Card International Usage Authorization allows cardholders to make transactions abroad securely. This feature ensures your debit card is enabled for purchases and withdrawals in foreign countries. Activate this authorization to enjoy seamless access to your funds while traveling internationally.

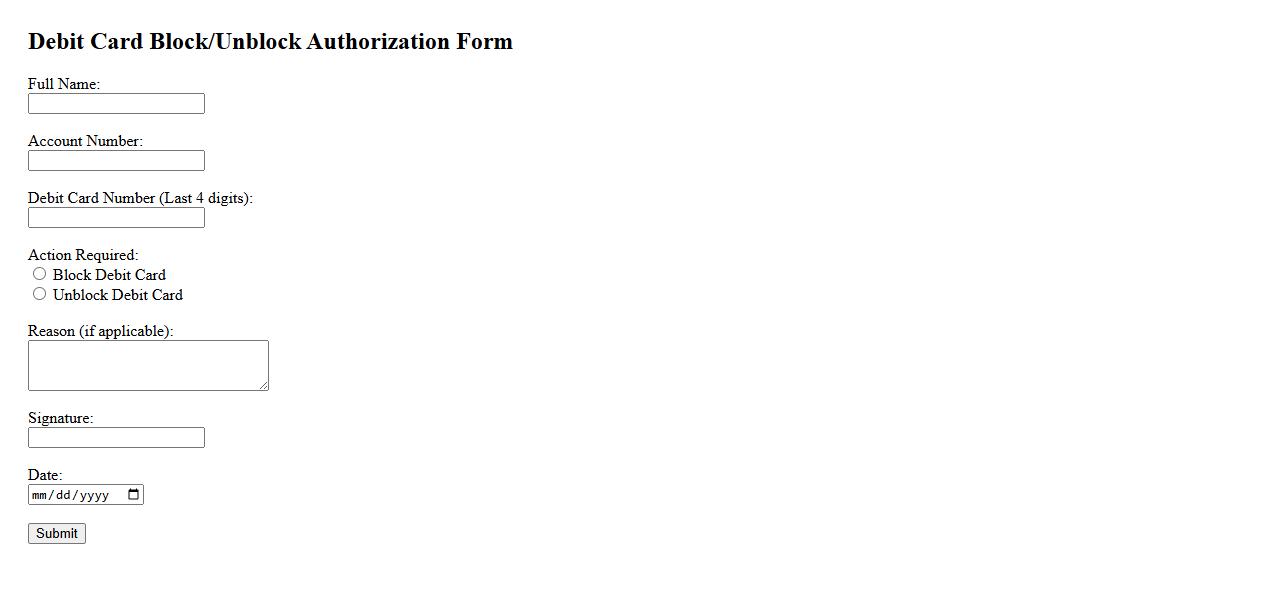

Debit Card Block/Unblock Authorization

Manage your Debit Card Block/Unblock Authorization easily to ensure your card's security. This feature allows you to temporarily disable or enable your debit card for transactions, providing control over unauthorized usage. Use this service whenever necessary to protect your account and maintain financial safety.

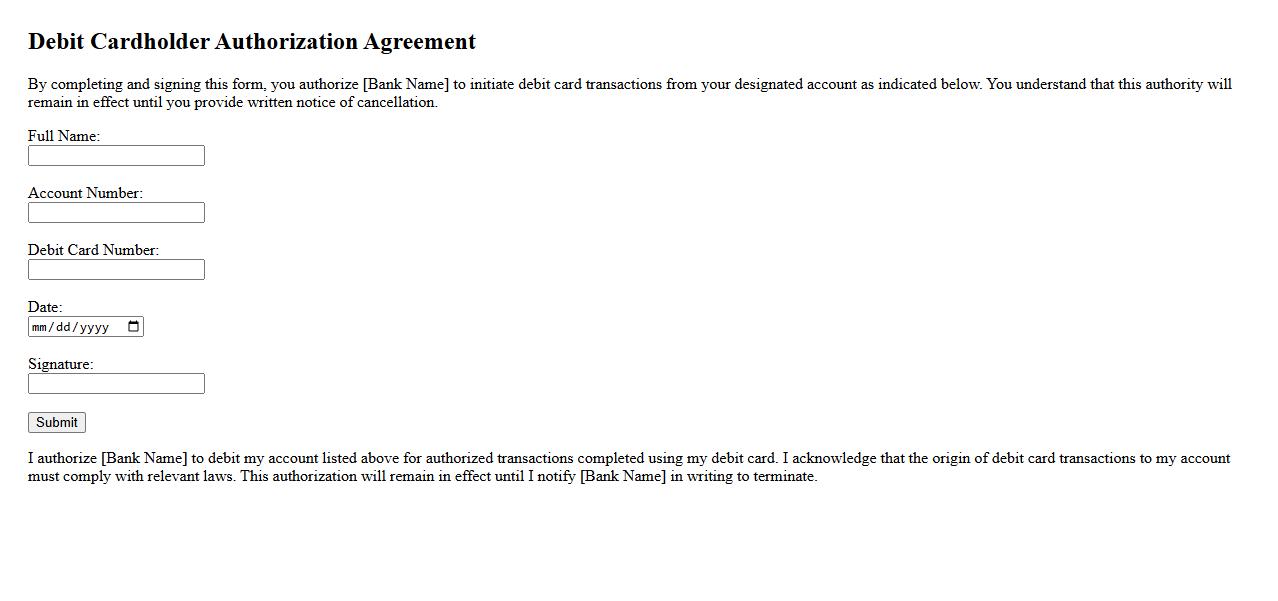

Debit Cardholder Authorization Agreement

The Debit Cardholder Authorization Agreement is a legal document that outlines the terms and conditions under which a cardholder is permitted to use their debit card. It ensures that users understand their responsibilities and the proper use of their card to prevent unauthorized transactions. This agreement protects both the financial institution and the cardholder by clearly defining authorization protocols.

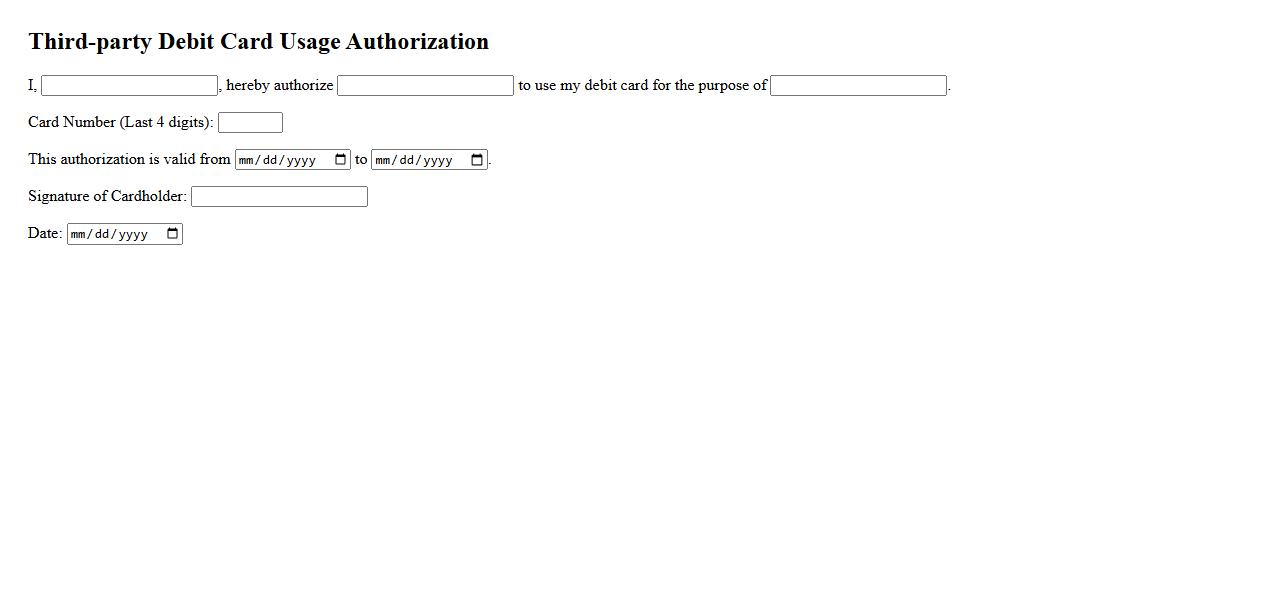

Third-party Debit Card Usage Authorization

The Third-party Debit Card Usage Authorization is a formal consent allowing an individual or organization to permit another party to use their debit card for transactions. This authorization ensures security and clarity in financial dealings by outlining specific permissions and limitations. It is essential for protecting both the cardholder and the authorized user from unauthorized charges.

What personal information is required to authorize a debit card?

To authorize a debit card, you need to provide your full name, date of birth, and contact details. Additionally, the associated bank account number and Social Security Number (SSN) or Tax Identification Number (TIN) are commonly requested. This information ensures secure verification and compliance with banking regulations.

What specific transactions or accounts does the authorization cover?

The authorization typically covers all transactions linked to the specific bank account tied to the debit card. This includes purchases, ATM withdrawals, and electronic funds transfers. The document will outline any limitations or exclusions on transaction types or maximum amounts allowed.

How long is the debit card authorization valid for?

The validity period of a debit card authorization varies but is often valid until the card's expiration date or until the cardholder revokes it. Some authorizations may be set for a fixed term, such as one year. It is important to review the terms in the authorization document to confirm the exact duration.

What are the cardholder's rights and responsibilities stated in the document?

Cardholders have the right to dispute unauthorized transactions and request account statements. They are responsible for safeguarding their debit card and PIN and promptly reporting lost or stolen cards. The document also outlines liability limits and procedures for resolving errors or fraud.

What procedures are outlined for revoking or amending the authorization?

To revoke or amend the authorization, the cardholder must notify the issuing bank in writing or through their online banking platform. The document specifies required advance notice periods and any applicable fees. Upon receipt, the bank will update or terminate the authorization according to their policy.