Authorization for Credit Card Payment is a crucial process where the cardholder's bank verifies the availability of funds and approves the transaction amount. This approval ensures that the payment can be securely processed without exceeding the credit limit. Merchants rely on this authorization to confirm that the transaction is legitimate before completing the purchase.

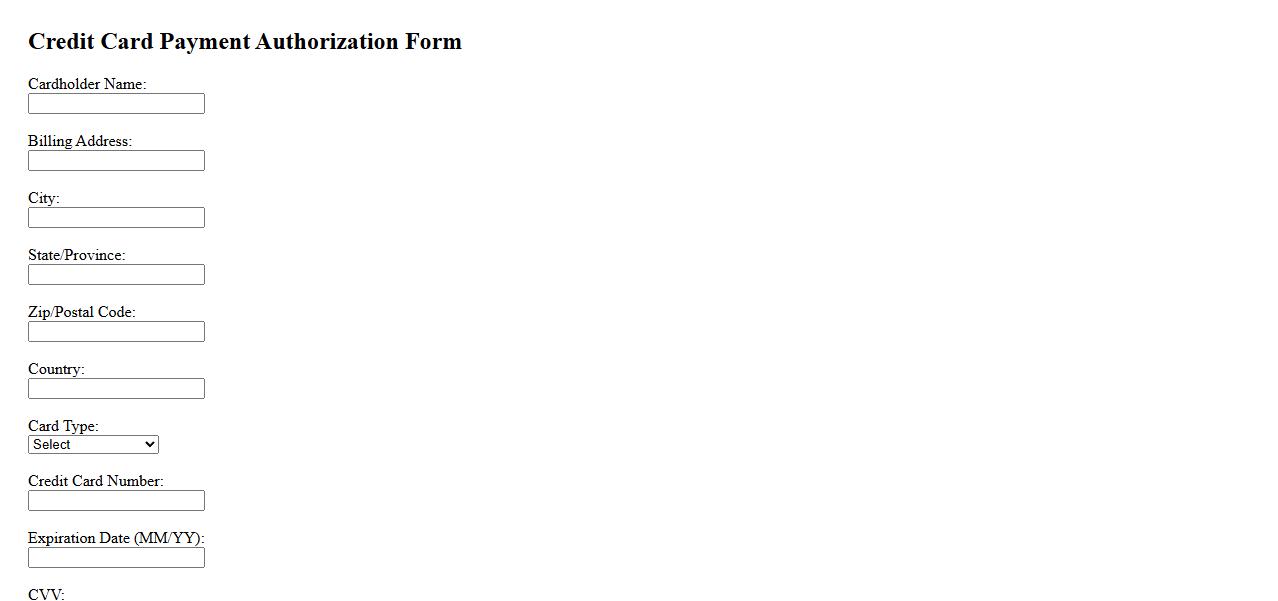

Credit Card Payment Authorization Form

The Credit Card Payment Authorization Form allows individuals or businesses to grant permission for charges to be made on their credit card. This form ensures secure and authorized transactions, protecting both parties from unauthorized use. It includes essential details such as cardholder information, payment amount, and transaction date.

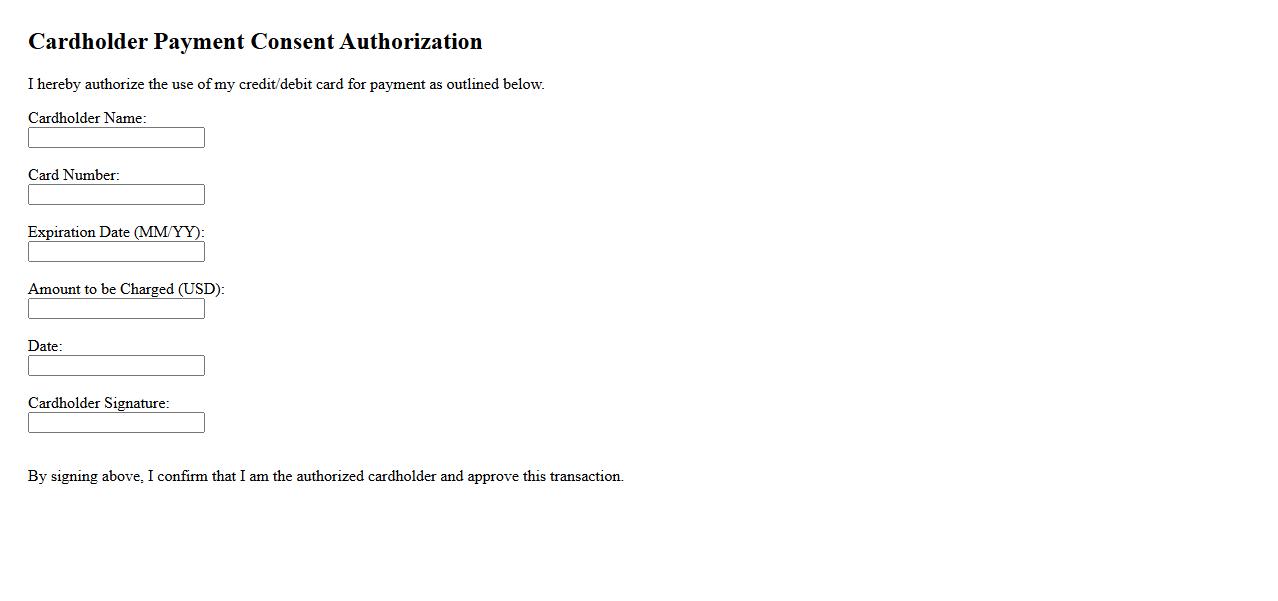

Cardholder Payment Consent Authorization

The Cardholder Payment Consent Authorization is a formal agreement allowing merchants to securely process payments using the cardholder's information. This authorization ensures compliance with legal and financial regulations, protecting both parties in the transaction. It is essential for verifying consent and preventing unauthorized charges.

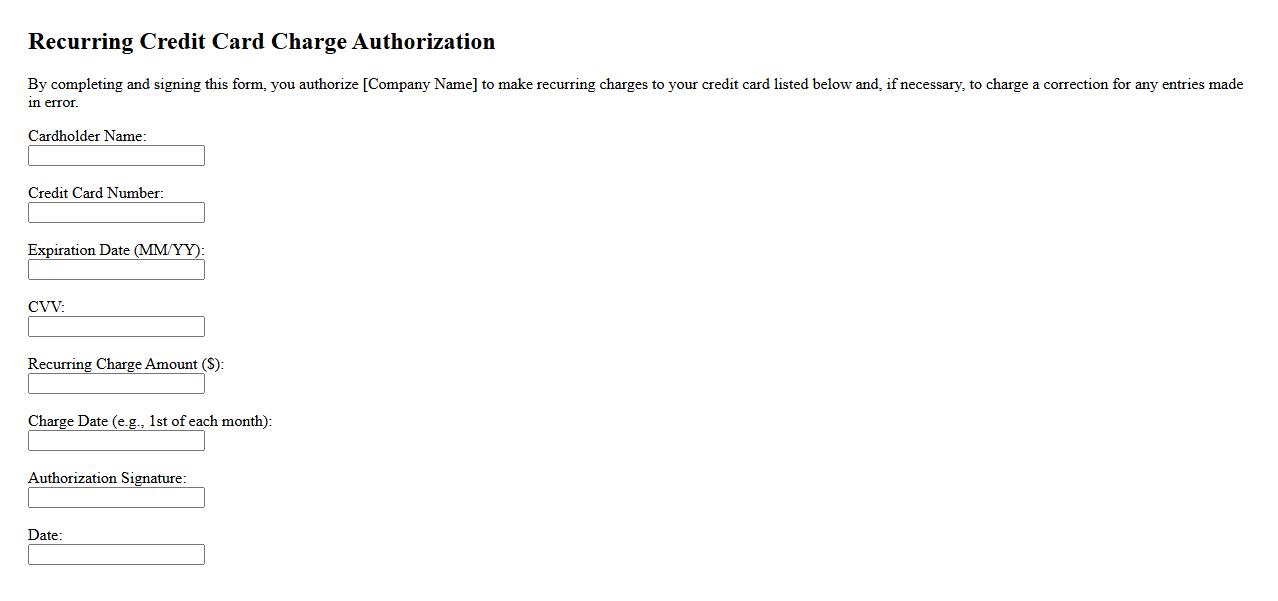

Recurring Credit Card Charge Authorization

Recurring Credit Card Charge Authorization allows businesses to securely charge customers' credit cards at regular intervals without requiring repeated approvals. This process streamlines subscription payments and ensures timely billing. Customers grant permission once, enabling automatic transactions for ongoing services.

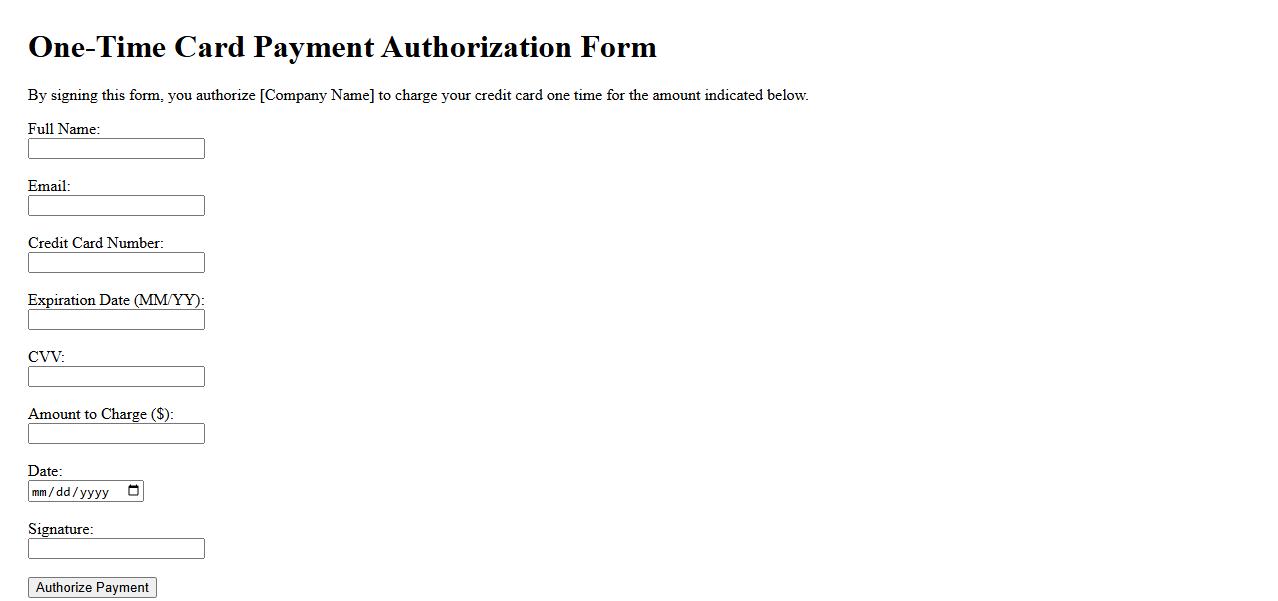

One-Time Card Payment Authorization

One-Time Card Payment Authorization is a secure process that allows users to authorize a single transaction using their credit or debit card. This method ensures immediate payment without storing card details for future use. It offers convenience and enhanced security for both merchants and customers.

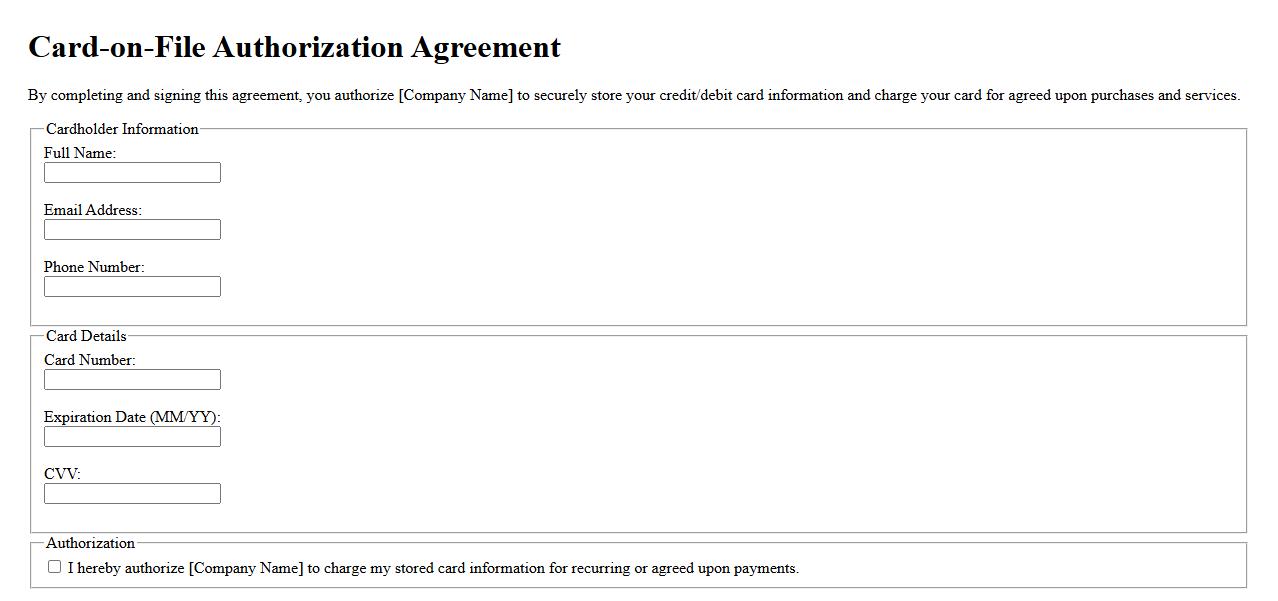

Card-on-File Authorization Agreement

The Card-on-File Authorization Agreement allows businesses to securely store a customer's payment information for future transactions. This agreement ensures that recurring payments or subscriptions are processed smoothly without requiring repeated authorization. It enhances convenience while maintaining compliance with payment security standards.

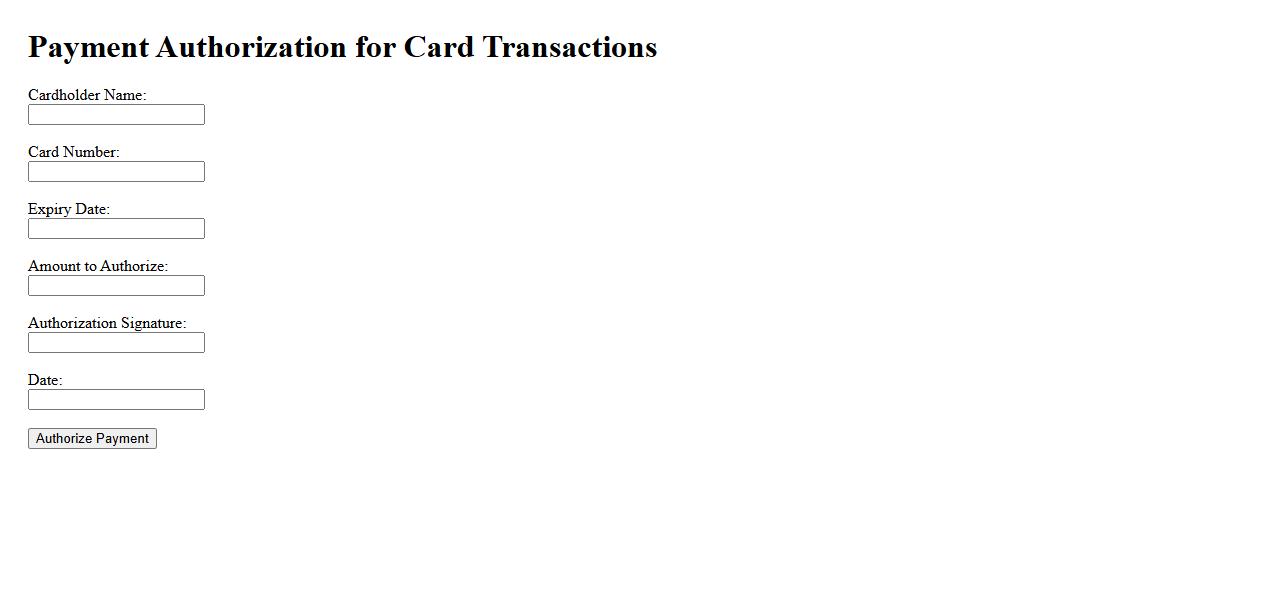

Payment Authorization for Card Transactions

Payment Authorization for Card Transactions is a crucial process that verifies the validity of a credit or debit card before completing a purchase. This step ensures that funds are available and protects both merchants and customers from fraudulent activities. Efficient authorization helps to streamline transactions and enhance security in online and in-store payments.

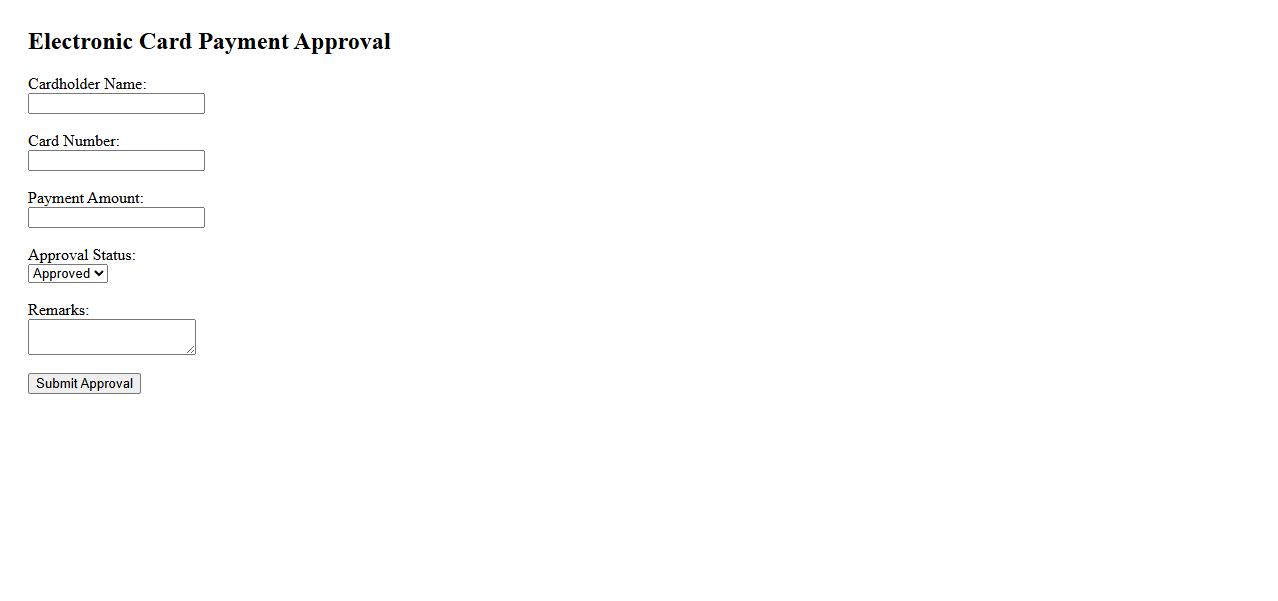

Electronic Card Payment Approval

Electronic Card Payment Approval is a secure process that verifies transactions made with credit or debit cards. It ensures the cardholder's information is authenticated before payment is confirmed. This approval system helps prevent fraud and guarantees seamless digital purchases.

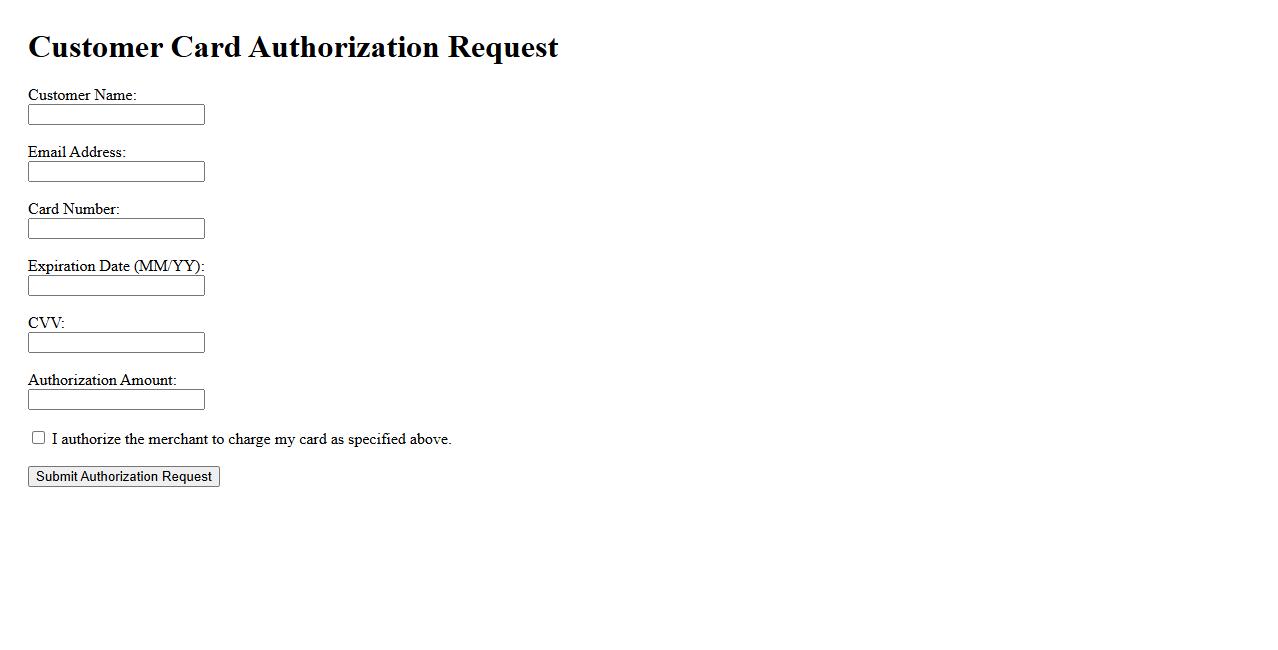

Customer Card Authorization Request

The Customer Card Authorization Request is a secure process used to verify and approve payment card transactions. It ensures that the cardholder's information is valid and funds are available before completing a purchase. This authorization step helps prevent fraud and protects both businesses and customers.

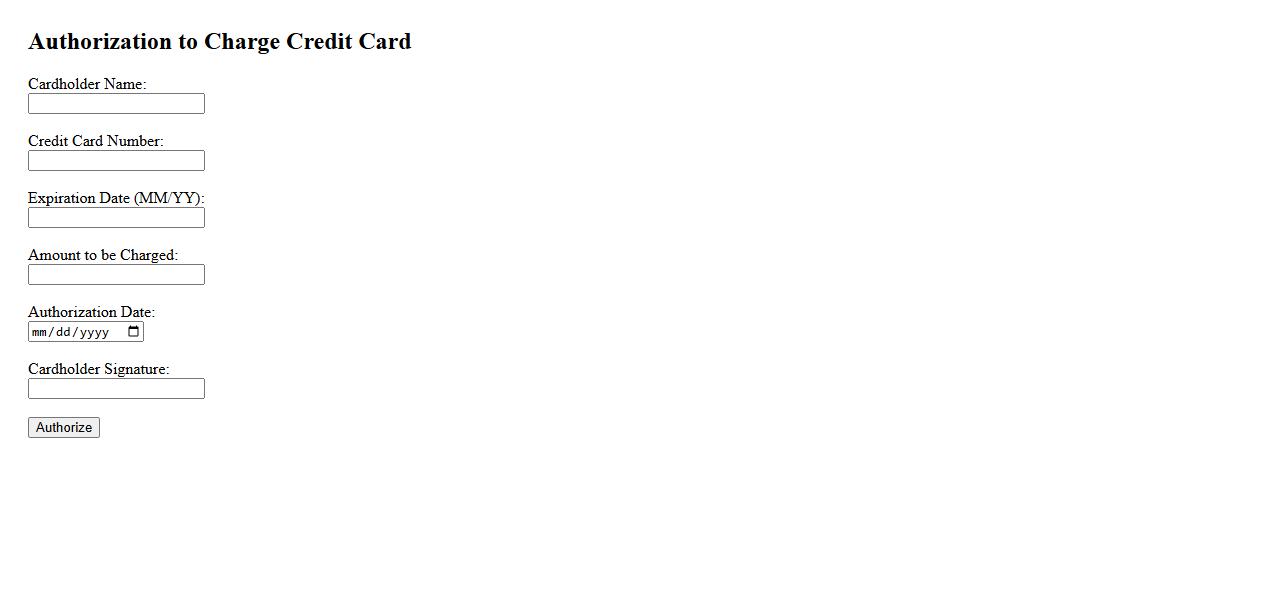

Authorization to Charge Credit Card

Authorization to Charge Credit Card is a formal consent given by the cardholder allowing a business to process payments using their credit card. This authorization ensures secure and legally compliant transactions. It is essential for validating and protecting both parties during online or in-person purchases.

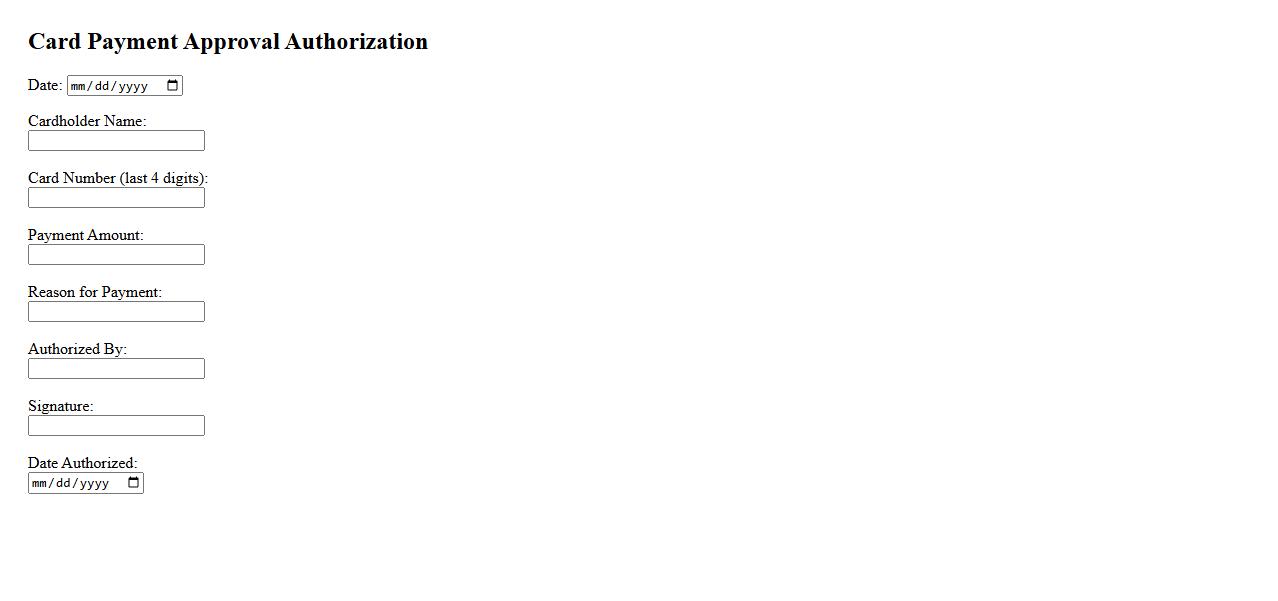

Card Payment Approval Authorization

Card Payment Approval Authorization is a crucial process that ensures the security and validity of credit or debit card transactions. It involves verifying the cardholder's information and available funds before confirming the payment. This authorization step helps prevent fraud and guarantees smooth payment processing.

What is the purpose of the Authorization for Credit Card Payment document?

The Authorization for Credit Card Payment document serves as a formal consent from the cardholder to allow a business or individual to charge their credit card. It ensures transparency between the customer and the merchant regarding the payment process. This document helps prevent unauthorized transactions and protects both parties involved.

Which details must be included to validate the credit card authorization?

To validate the credit card authorization, essential details such as the cardholder's full name, credit card number, expiration date, and CVV must be included. Additionally, the payment amount and transaction date should be clearly stated. Including these details confirms the authenticity and scope of the authorization.

Who is authorized to sign and approve the credit card payment?

The cardholder or authorized user of the credit card is responsible for signing and approving the payment. In some cases, a designated representative with power of attorney may also authorize the transaction. Proper identification must be verified to ensure valid approval.

What specific transaction or services does this authorization cover?

The authorization typically specifies the exact transaction or services for which the credit card payment is approved. This can include single purchases, recurring payments, or specific contracts. Clearly defining the coverage helps avoid disputes and clarifies financial commitments.

How long is the credit card payment authorization valid according to the document?

The validity period of the credit card payment authorization is usually stated within the document, often lasting until the transaction is completed or a specified expiration date. Some authorizations remain valid for recurring payments until revoked. Clear validity terms ensure proper usage and control over payments.