Authorization to Charge Credit Card is a formal consent given by a cardholder allowing a business to charge their credit card for goods or services. This authorization ensures the transaction is legitimate and helps prevent unauthorized charges. It is commonly required for recurring payments, reservations, or one-time purchases.

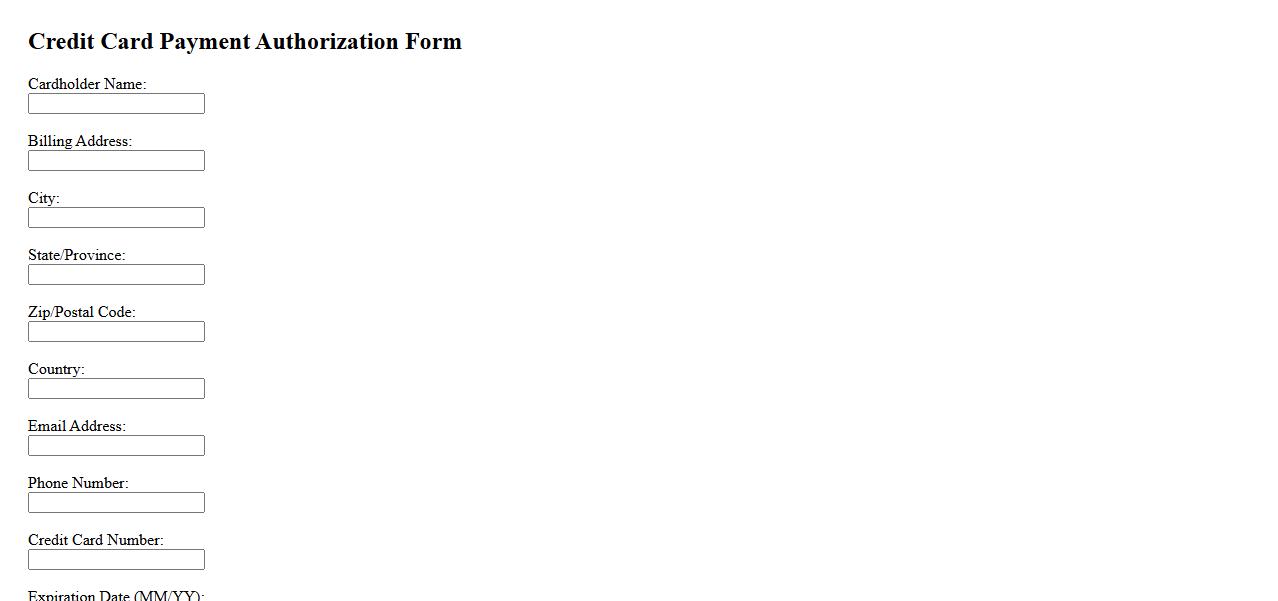

Credit Card Payment Authorization Form

The Credit Card Payment Authorization Form is a secure document that allows businesses to obtain permission from customers to charge their credit cards. It ensures transparent and authorized transactions, minimizing the risk of fraud. This form typically includes essential details such as cardholder information, payment amount, and signature.

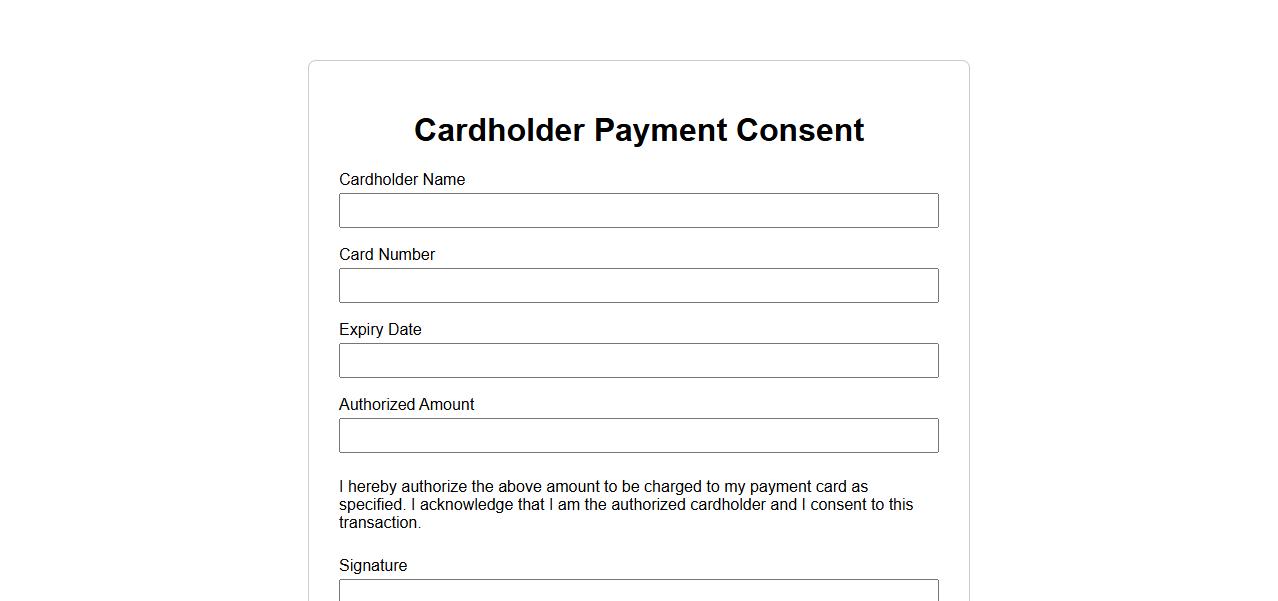

Cardholder Payment Consent Document

The Cardholder Payment Consent Document is a crucial form that authorizes transactions on a payment card. It ensures the cardholder's agreement to the terms and conditions related to payment processing. This document helps protect both merchants and cardholders by providing clear consent for charges.

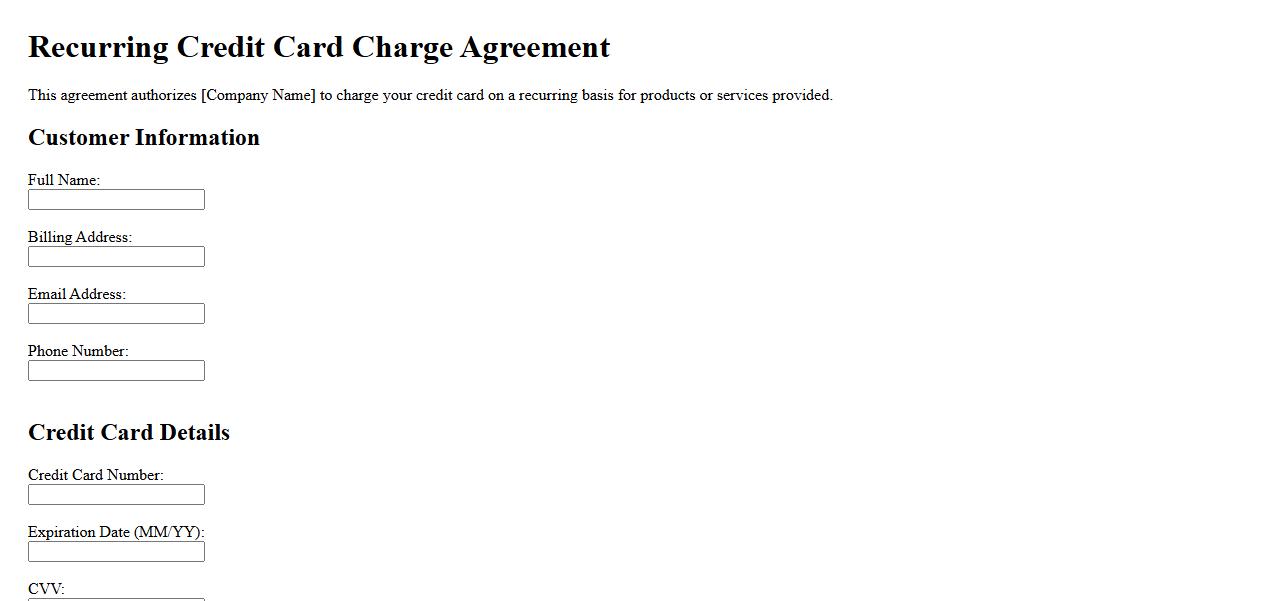

Recurring Credit Card Charge Agreement

A Recurring Credit Card Charge Agreement is a contract that authorizes a merchant to charge a customer's credit card automatically at regular intervals. This agreement ensures continuous payment for subscription services or membership fees without the need for manual authorization each time. It provides convenience for both businesses and customers by streamlining the billing process.

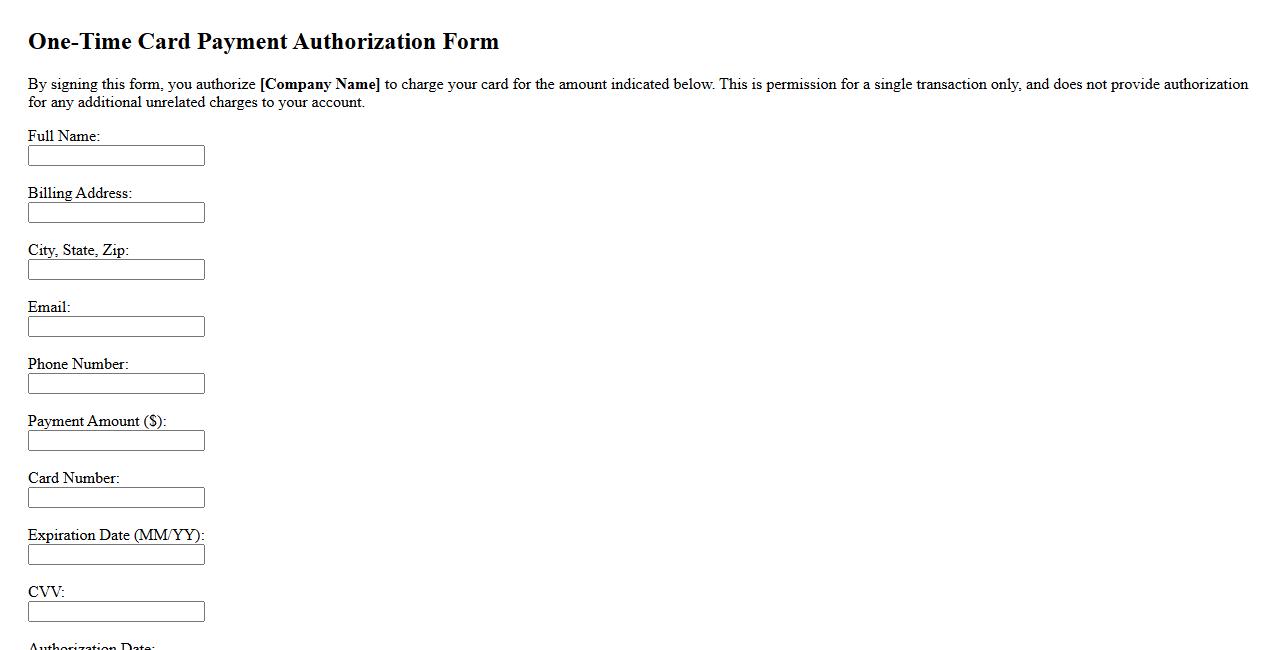

One-Time Card Payment Authorization

One-Time Card Payment Authorization allows users to securely authorize a single transaction using their credit or debit card without saving payment details. This method enhances transaction security by reducing the risk of unauthorized charges. It is ideal for businesses seeking convenient and safe payment processing for individual purchases.

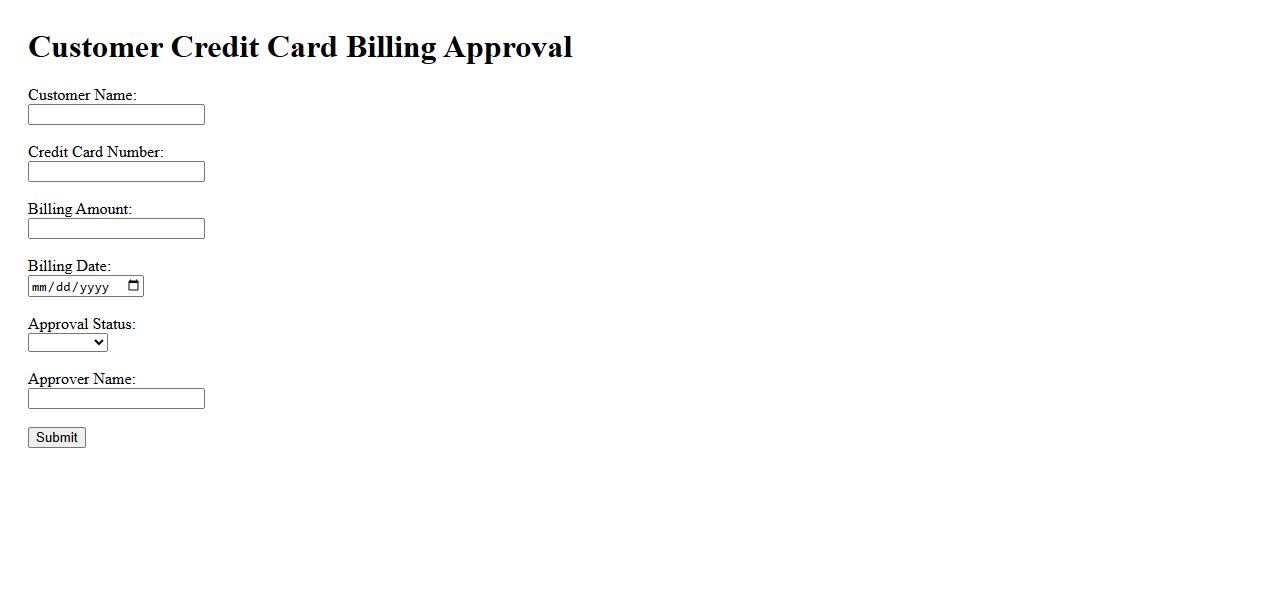

Customer Credit Card Billing Approval

The Customer Credit Card Billing Approval process ensures all transactions are authorized and verified before charging the customer's card. This step enhances payment security and helps prevent fraudulent charges. Efficient approval systems provide a seamless experience for both businesses and customers.

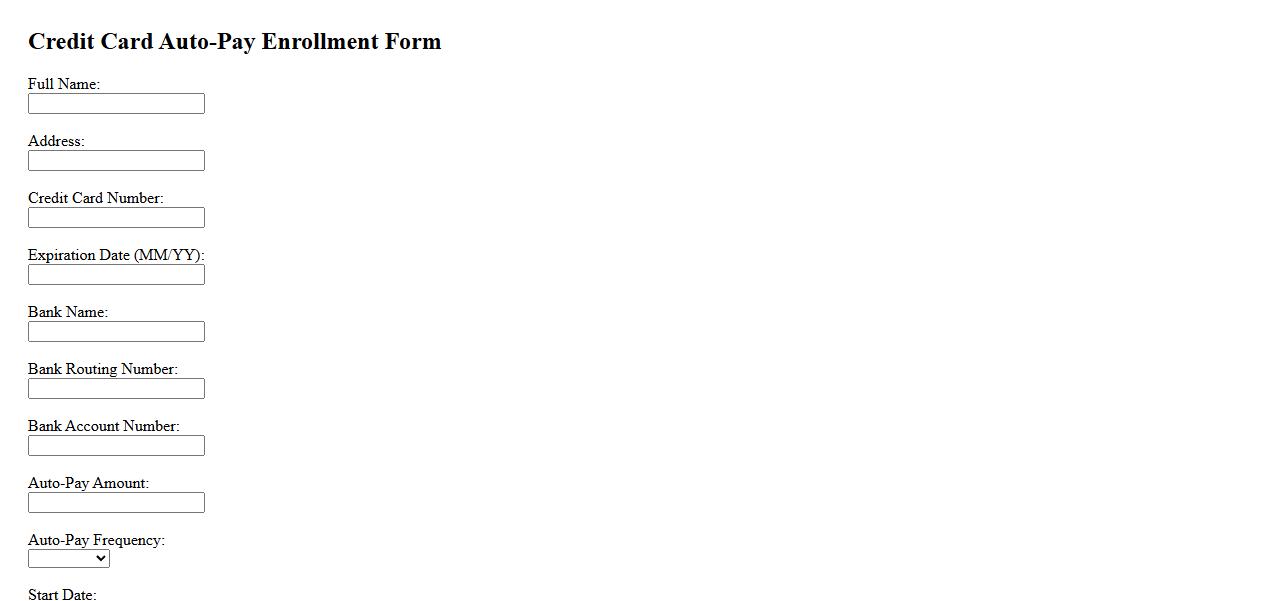

Credit Card Auto-Pay Enrollment Form

Use the Credit Card Auto-Pay Enrollment Form to easily set up automatic payments for your credit card bills. This convenient option helps you avoid late fees and manage your finances efficiently. Simply complete and submit the form to ensure timely payments every month.

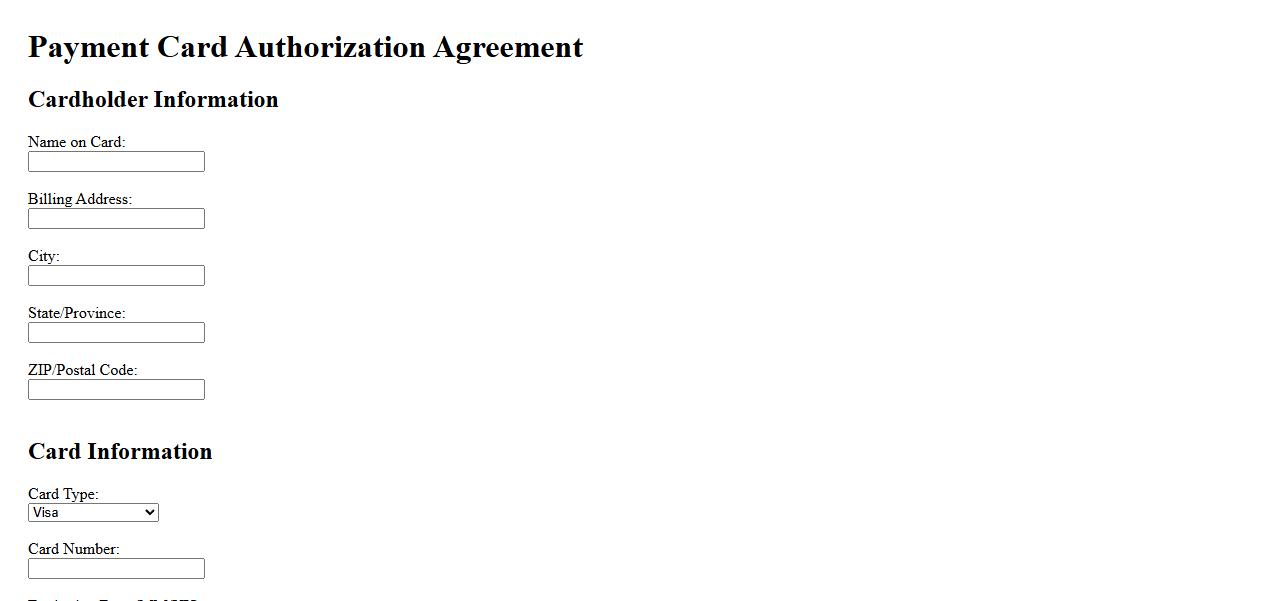

Payment Card Authorization Agreement

The Payment Card Authorization Agreement is a document that grants permission for processing payments using a credit or debit card. It ensures secure transactions by outlining terms between the cardholder and the merchant. This agreement helps prevent unauthorized use and protects both parties during payment processing.

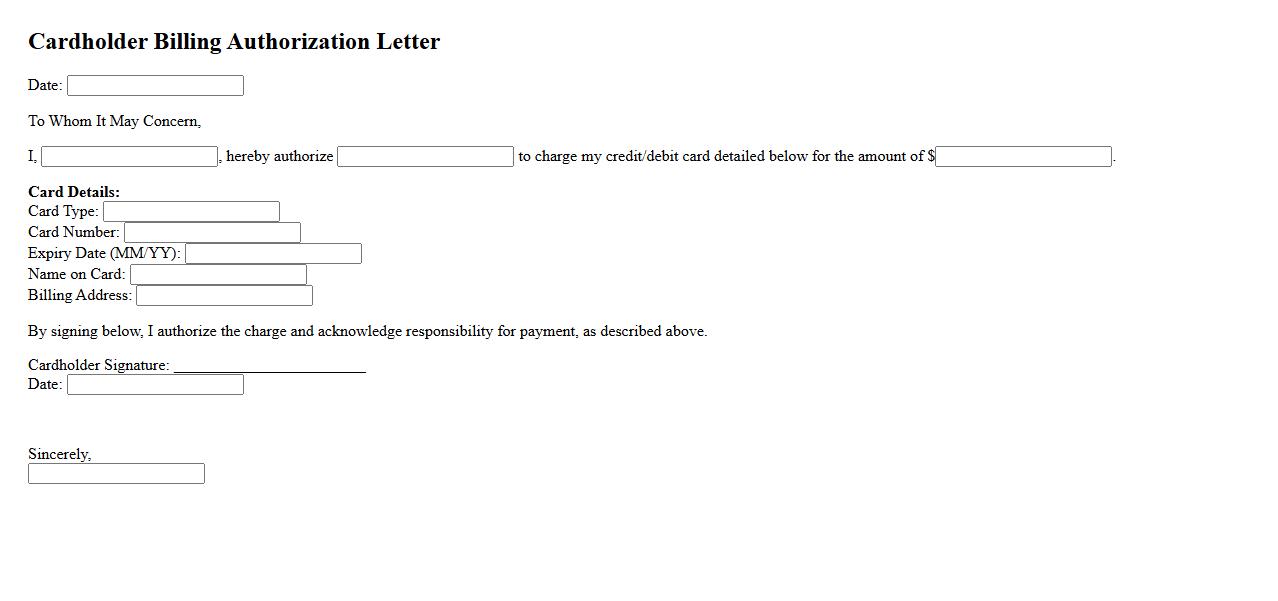

Cardholder Billing Authorization Letter

A Cardholder Billing Authorization Letter is a formal document that grants permission for charges to be billed to a specific credit or debit card. This letter ensures clear communication and authorization between the cardholder and the billing party. It is essential for preventing unauthorized transactions and maintaining accurate financial records.

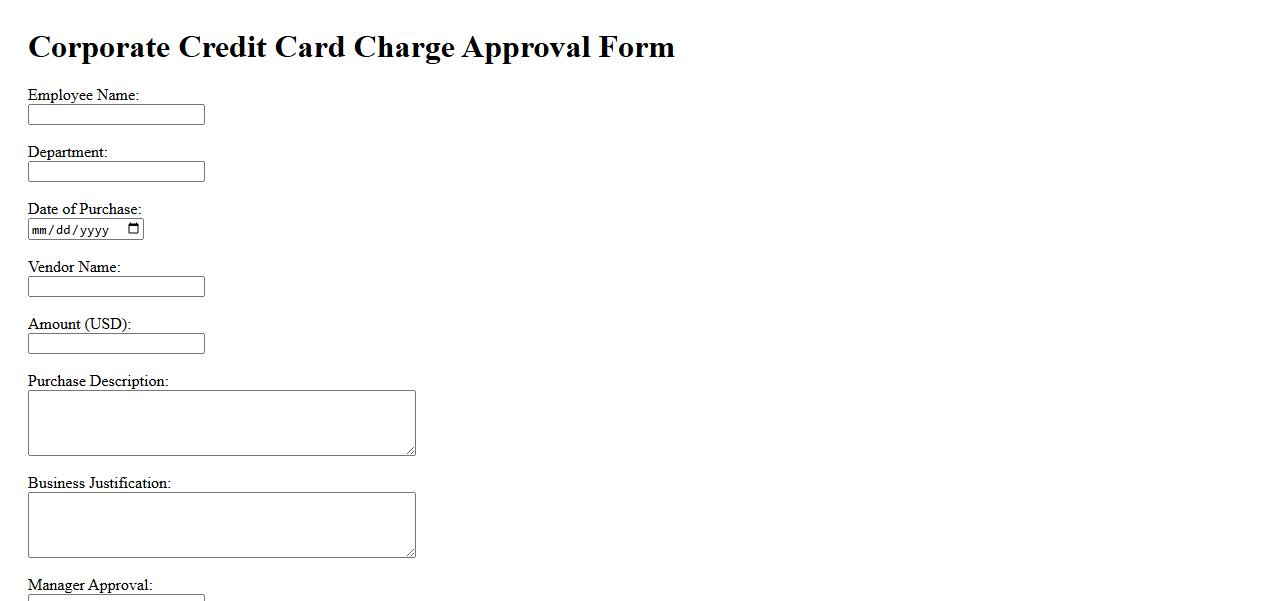

Corporate Credit Card Charge Approval

The Corporate Credit Card Charge Approval process ensures all expenses are reviewed and authorized before being charged to the company account. This system helps maintain financial control and prevents unauthorized spending. It streamlines reconciliation and promotes transparency within the organization.

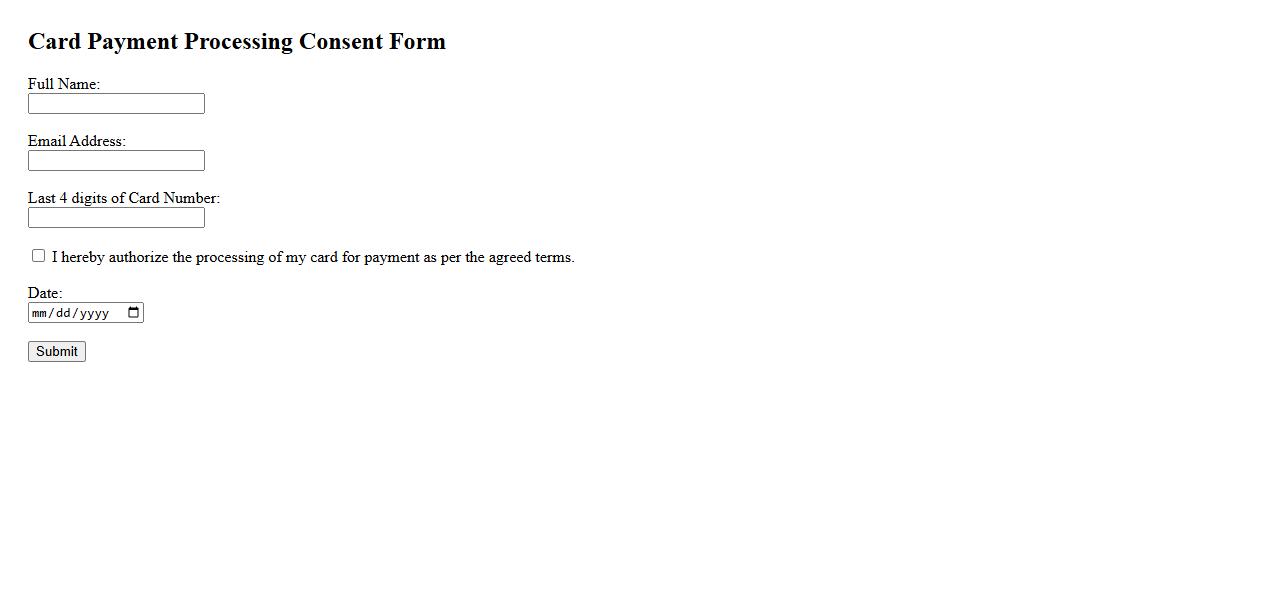

Card Payment Processing Consent Form

The Card Payment Processing Consent Form is a crucial document that authorizes businesses to securely handle and process customer payment information. It ensures compliance with legal and security standards, protecting both parties involved. This form clarifies the terms of consent, enhancing transparency and trust in financial transactions.

What specific amount is being authorized for the credit card charge?

The authorized amount for the credit card charge is clearly defined to ensure proper financial handling. This amount represents the exact sum the cardholder agrees to be debited. Accurate authorization helps prevent any discrepancies or disputes regarding the transaction.

Which credit card (type and last four digits) is being authorized for payment?

The credit card type and last four digits are provided to identify the payment method securely. This information verifies the source of funds and ensures correct processing. Transparency in card details promotes trust and safeguards against fraud.

Who is the cardholder granting authorization for the transaction?

The cardholder's name is crucial as it confirms the individual's consent for the charge. Authorization links the transaction to a verified identity, enhancing security. Knowing the cardholder helps resolve any future queries or disputes effectively.

What is the purpose or description of the charge being authorized?

The description of the charge outlines the reason or service linked to the payment. Clear explanations inform both parties about the nature of the transaction. This detail supports transparency and aids in record-keeping for financial accountability.

What is the date and duration of authorization for charging the credit card?

The authorization date and validity period specify when the charge can be applied and for how long. This ensures the transaction occurs within an agreed timeframe. Defining these parameters protects both the merchant and cardholder from unauthorized or outdated charges.