Authorization for Wage Garnishment is a legal document that permits an employer to deduct a specified amount from an employee's paycheck to satisfy a debt or court-ordered obligation. This authorization ensures compliance with federal and state regulations governing wage garnishments. Employers use this document to accurately withhold wages while protecting the employee's rights.

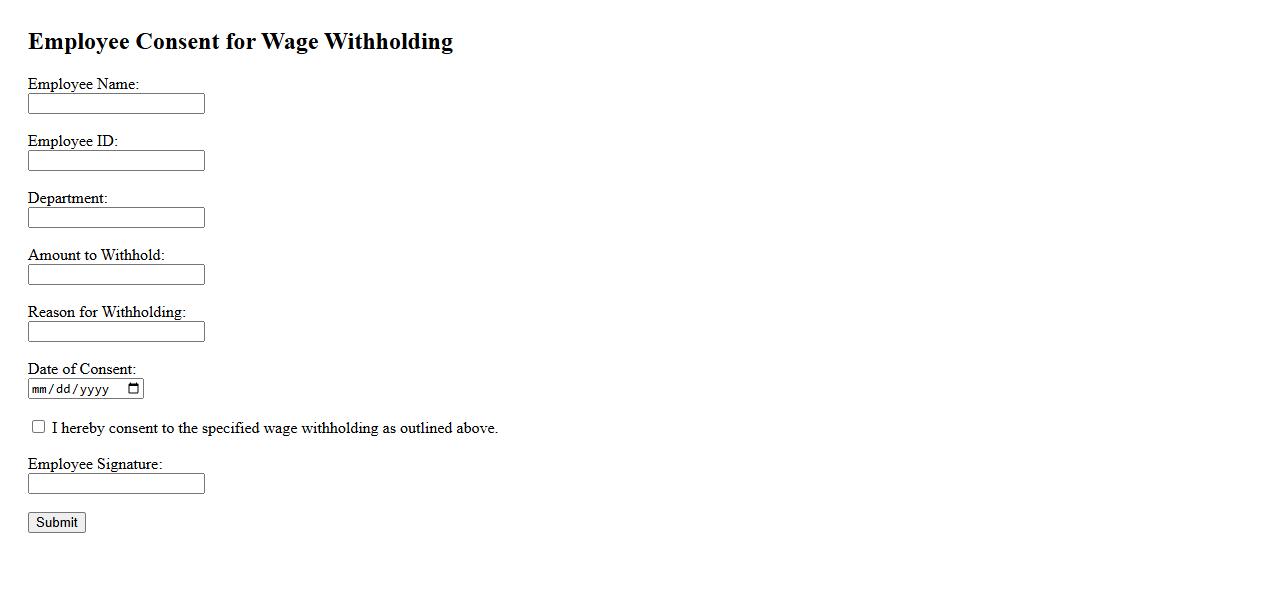

Employee Consent for Wage Withholding

Employee Consent for Wage Withholding is a formal agreement where an employee authorizes their employer to deduct specified amounts from their paycheck. This consent ensures transparency and mutual understanding regarding any wage deductions. It is essential for compliance with labor laws and maintaining trust between employer and employee.

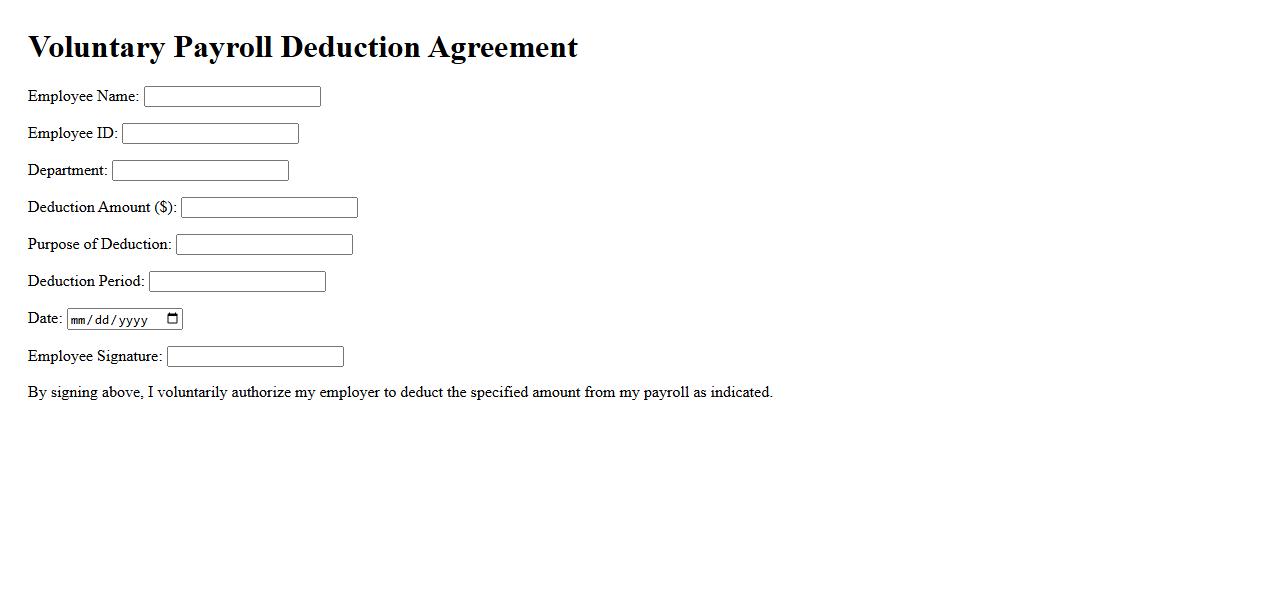

Voluntary Payroll Deduction Agreement

The Voluntary Payroll Deduction Agreement allows employees to authorize automatic deductions from their wages for specific purposes. This agreement simplifies payments for benefits, donations, or loan repayments. It ensures convenience and timely processing directly from an employee's paycheck.

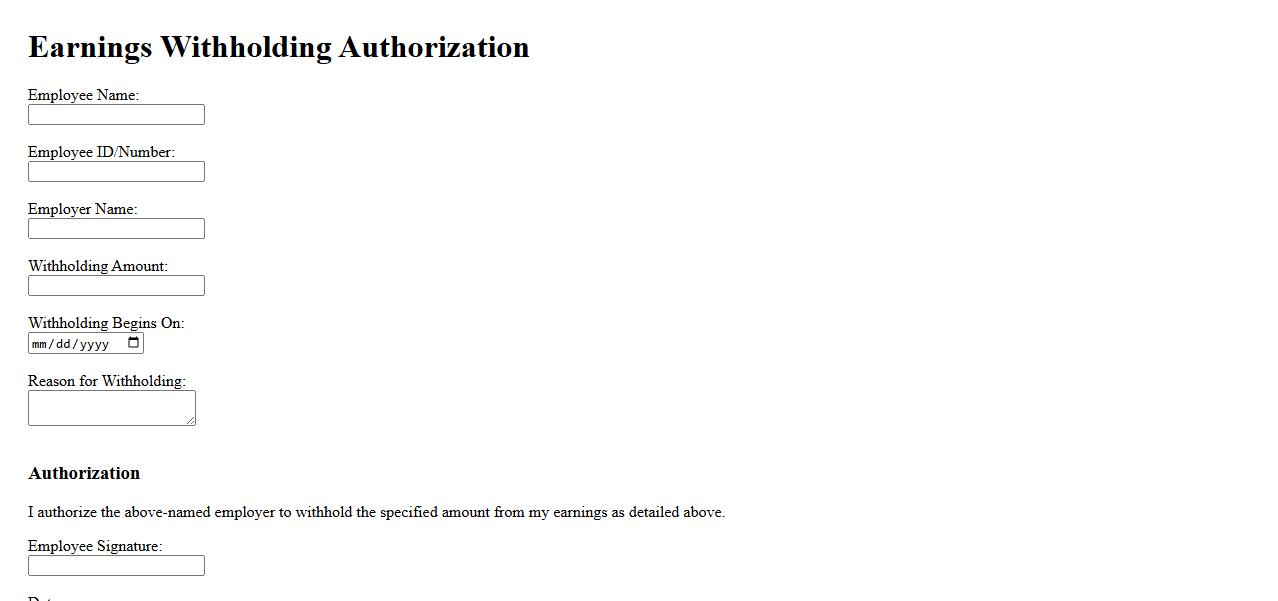

Earnings Withholding Authorization

Earnings Withholding Authorization is a legal document that allows an employer to deduct a specified amount from an employee's paycheck. This deduction is typically used to collect payments for debts such as child support, taxes, or court-ordered obligations. It ensures timely and automatic repayment directly from the employee's earnings.

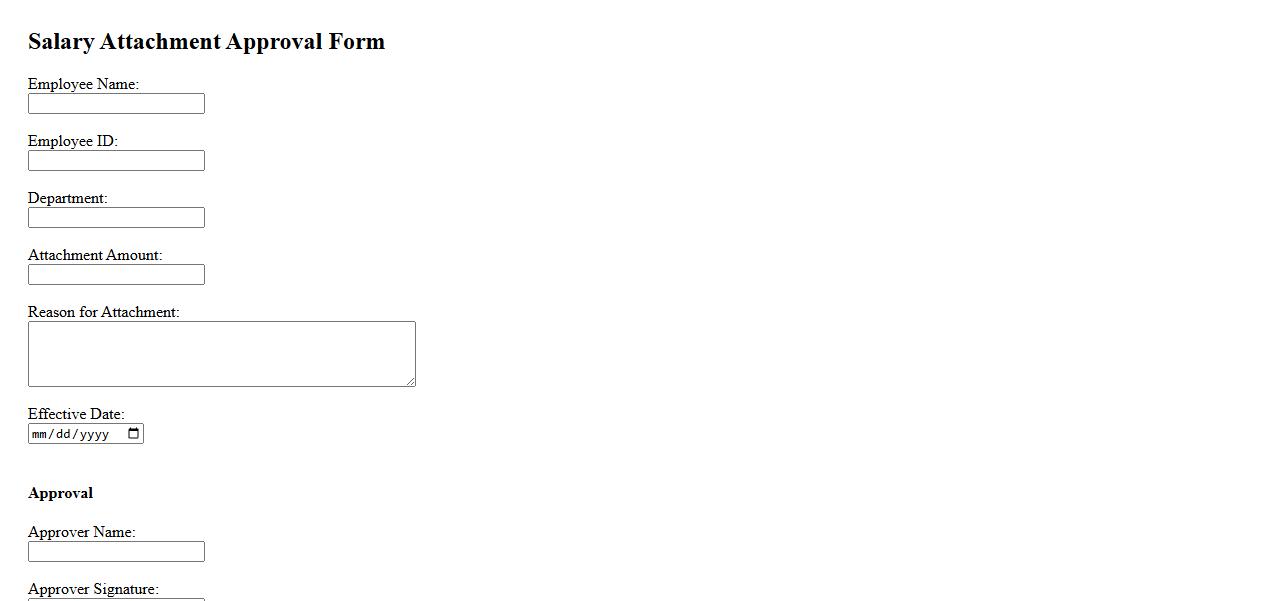

Salary Attachment Approval Form

The Salary Attachment Approval Form is a crucial document used by organizations to officially authorize salary deductions for specific obligations. It ensures transparent communication between employers and employees regarding the attachment details. This form streamlines the approval process, safeguarding compliance with legal and financial policies.

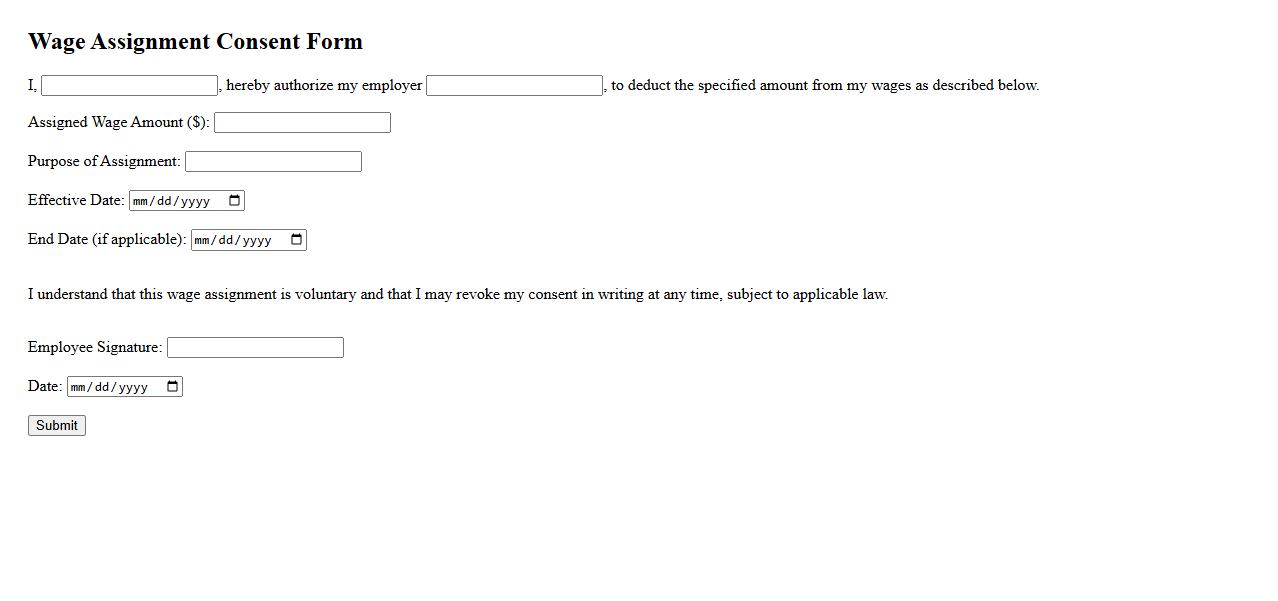

Wage Assignment Consent Form

The Wage Assignment Consent Form is a legal document that authorizes an employer to deduct a specified amount from an employee's paycheck to repay a debt. This form ensures transparent communication between the employee, employer, and creditor, providing clear terms of the deduction process. It is essential for managing debt repayment efficiently and legally.

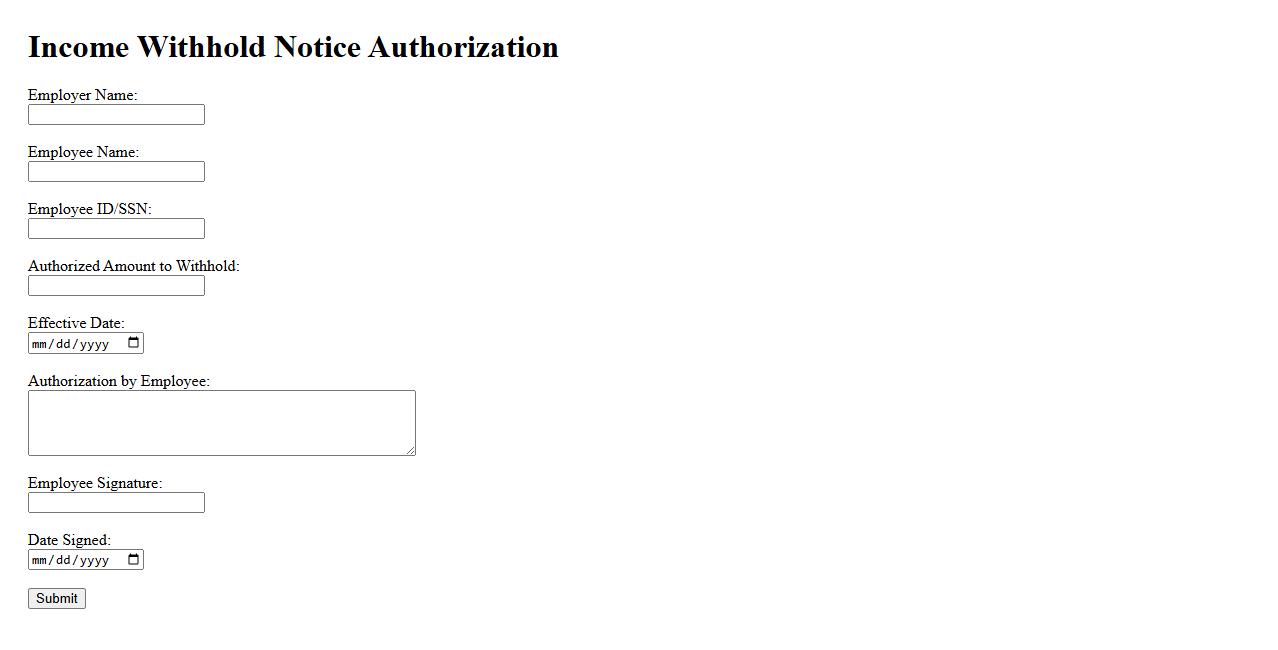

Income Withhold Notice Authorization

An Income Withhold Notice Authorization is a legal document that permits an employer to deduct a specified amount from an employee's paycheck. This deduction is typically used to fulfill obligations such as child support or debt repayment. It ensures timely and automatic payments directly from income sources.

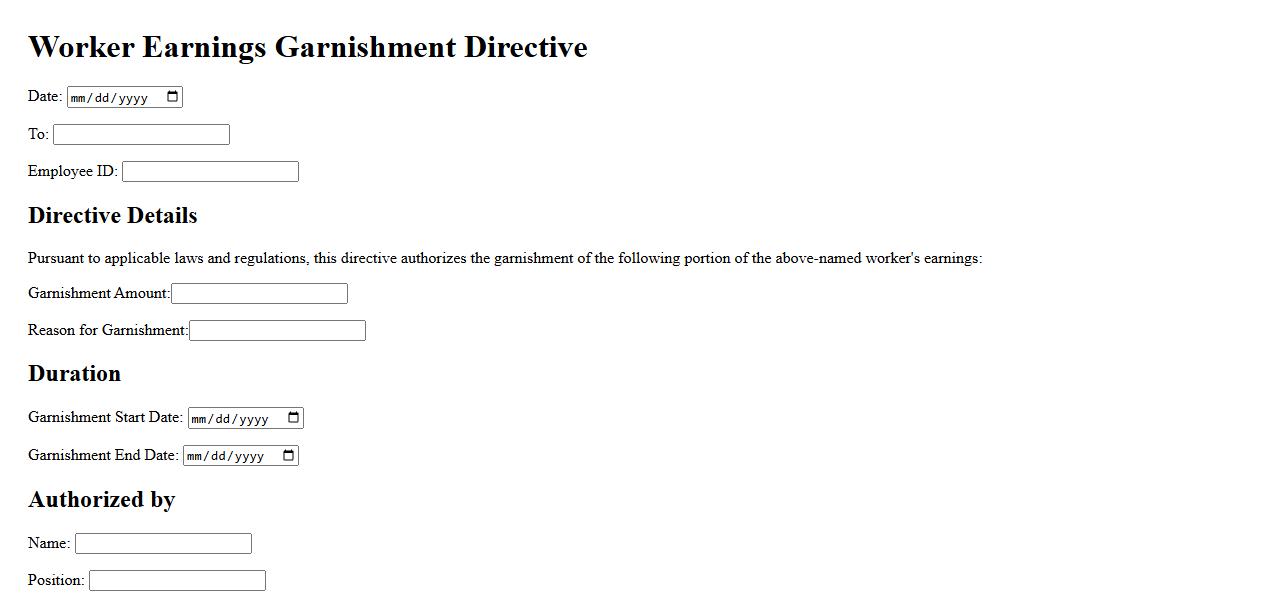

Worker Earnings Garnishment Directive

The Worker Earnings Garnishment Directive regulates the maximum portion of an employee's earnings that can be garnished to repay debts. It ensures fair treatment by protecting a significant part of the worker's income from compulsory deductions. This directive helps balance creditor rights with employee financial stability.

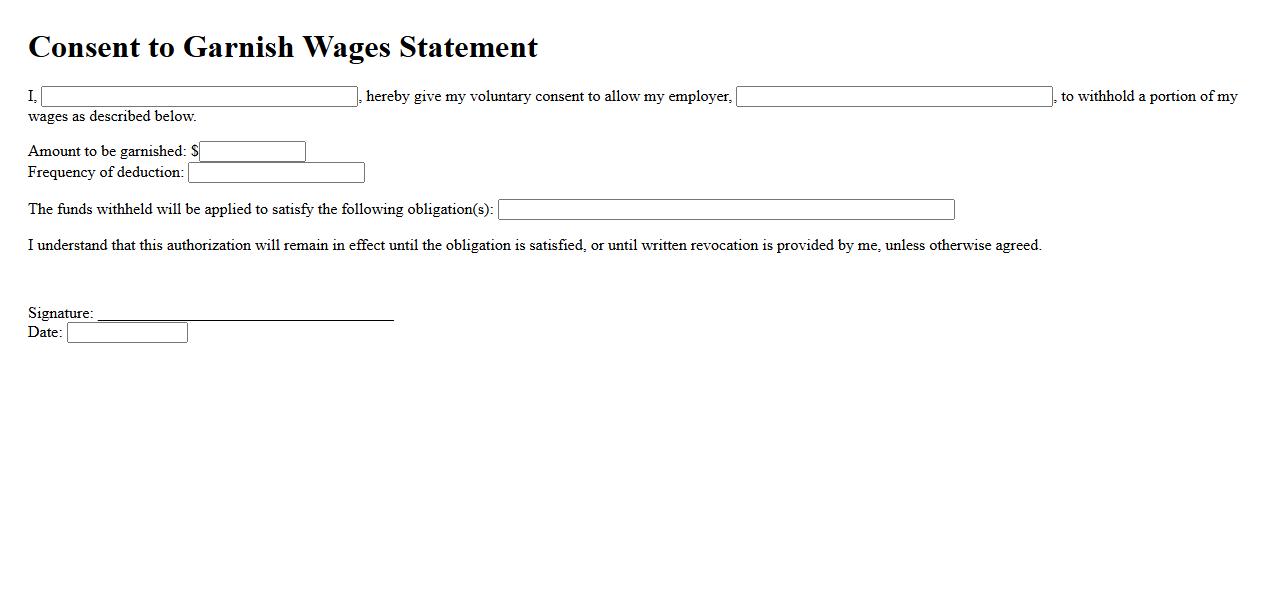

Consent to Garnish Wages Statement

The Consent to Garnish Wages Statement is a legal document where an employee agrees to allow their employer to deduct a portion of their wages to satisfy a debt. This statement protects both parties by ensuring clear permission is granted prior to any wage garnishment. It is essential for maintaining transparency and compliance with employment and debt collection laws.

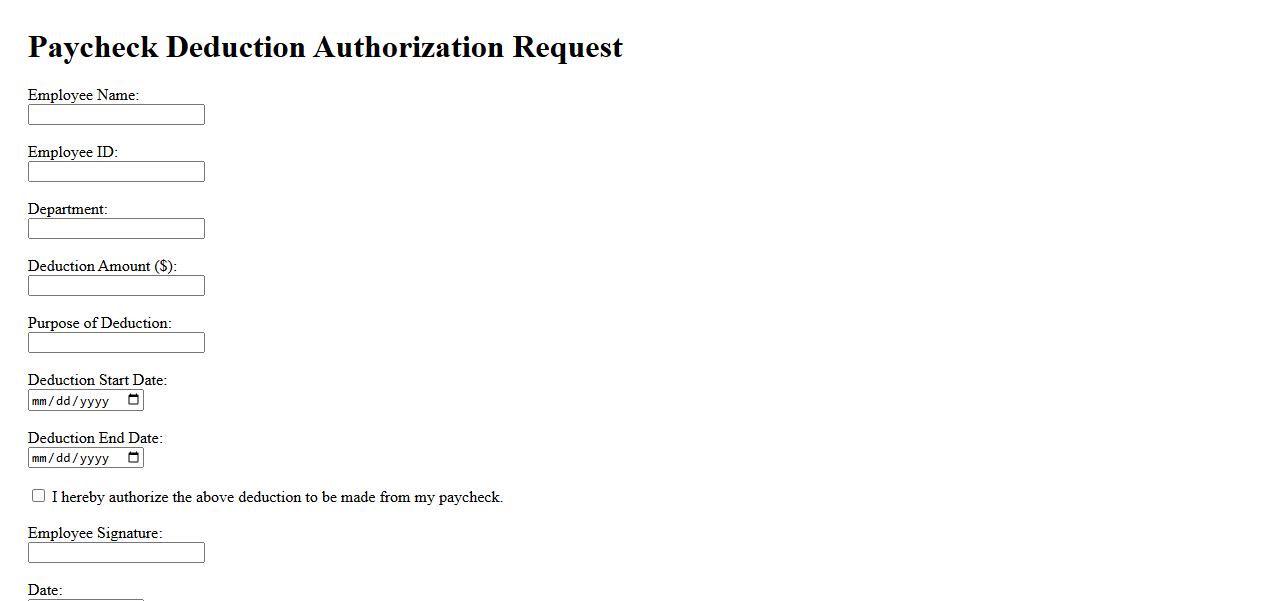

Paycheck Deduction Authorization Request

The Paycheck Deduction Authorization Request is a formal document that allows employees to authorize their employer to deduct specific amounts from their paycheck. This request ensures convenient and timely payments for services such as insurance premiums, loan repayments, or charitable contributions. Proper authorization guarantees transparency and compliance with company policies.

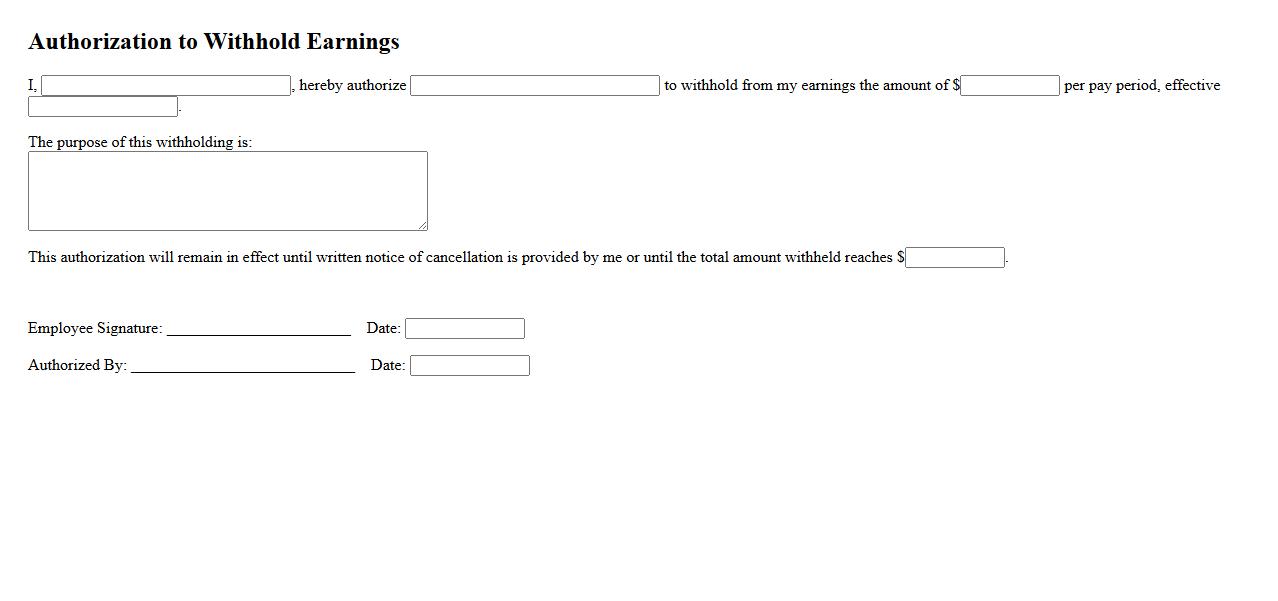

Authorization to Withhold Earnings

Authorization to Withhold Earnings is a legal or administrative directive allowing an employer to deduct a specified amount from an employee's paycheck. This authorization is typically used to satisfy debts, such as child support, taxes, or loan repayments. It ensures timely payment while complying with relevant laws and regulations.

What Information is Required from the Debtor to Authorize Wage Garnishment?

The debtor's full name and contact details are essential to identify the individual accurately. Details about the employer, including name and address, are also necessary to process the garnishment. Additionally, the debtor must provide information on income and employment status to ensure correct wage deductions.

Which Parties Must Receive Notification About the Wage Garnishment Authorization?

The employer must be formally notified to initiate the wage garnishment process. The debtor has to receive a notification to inform them of the legal action being taken. Finally, the court or relevant administrative agency overseeing the garnishment must be kept informed of the authorization status.

What Percentage or Amount of Wages Can Legally Be Garnished Under This Authorization?

The legally allowable percentage of wages garnished is typically capped by federal or state law, often not exceeding 25%. Alternatively, a fixed amount based on the debtor's disposable income may be permitted. These limits ensure the debtor retains enough income for basic living expenses.

For How Long Is the Wage Garnishment Authorization Valid?

The authorization for wage garnishment generally remains valid until the debt is fully paid. In some cases, it may have a specified expiration date set by the court or agreement terms. Renewals or extensions require additional legal approval.

Under What Conditions Can the Authorization for Wage Garnishment Be Revoked or Modified?

The authorization can be revoked if the debtor fully repays the debt or enters into a settlement agreement. Changes in the debtor's financial situation may allow for modification of garnishment amounts. Additionally, a court may adjust or terminate garnishment based on new legal rulings or petitions.