Authorization to Transfer Funds is a formal approval process that permits the movement of money from one account to another. This authorization ensures the transaction adheres to established financial controls and security protocols. It is essential for preventing unauthorized transfers and maintaining accurate records.

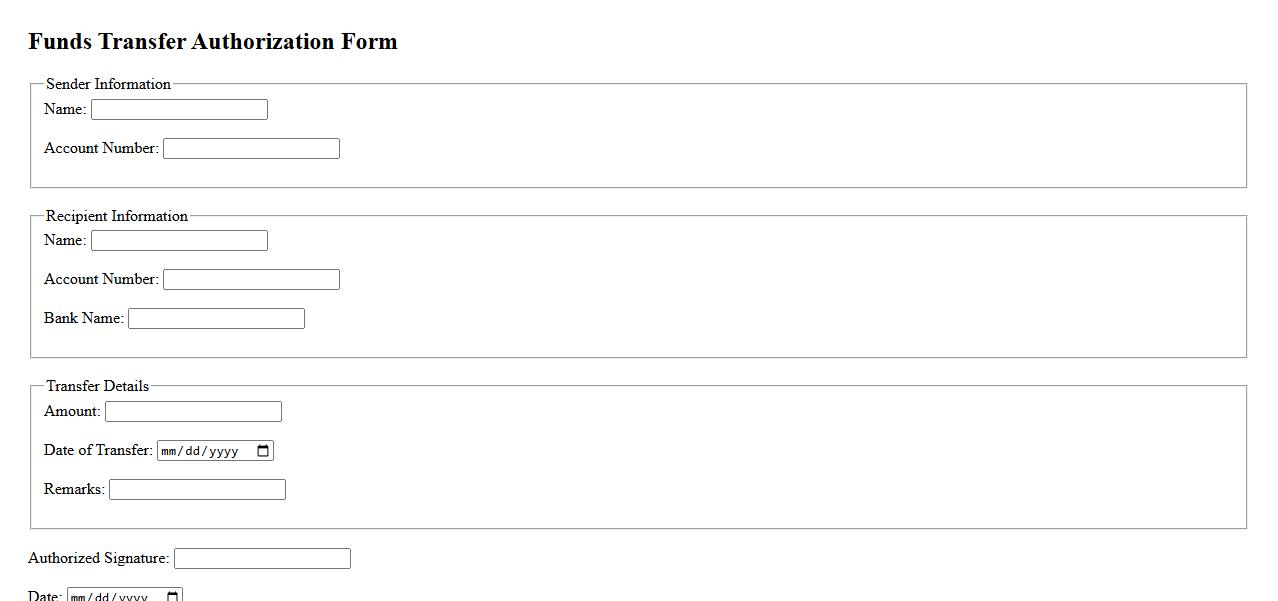

Funds Transfer Authorization Form

The Funds Transfer Authorization Form is a secure document used to grant permission for the transfer of money between accounts. It ensures accuracy and compliance by detailing the sender, recipient, amount, and transfer date. This form is essential for both personal and business financial transactions to maintain clear records.

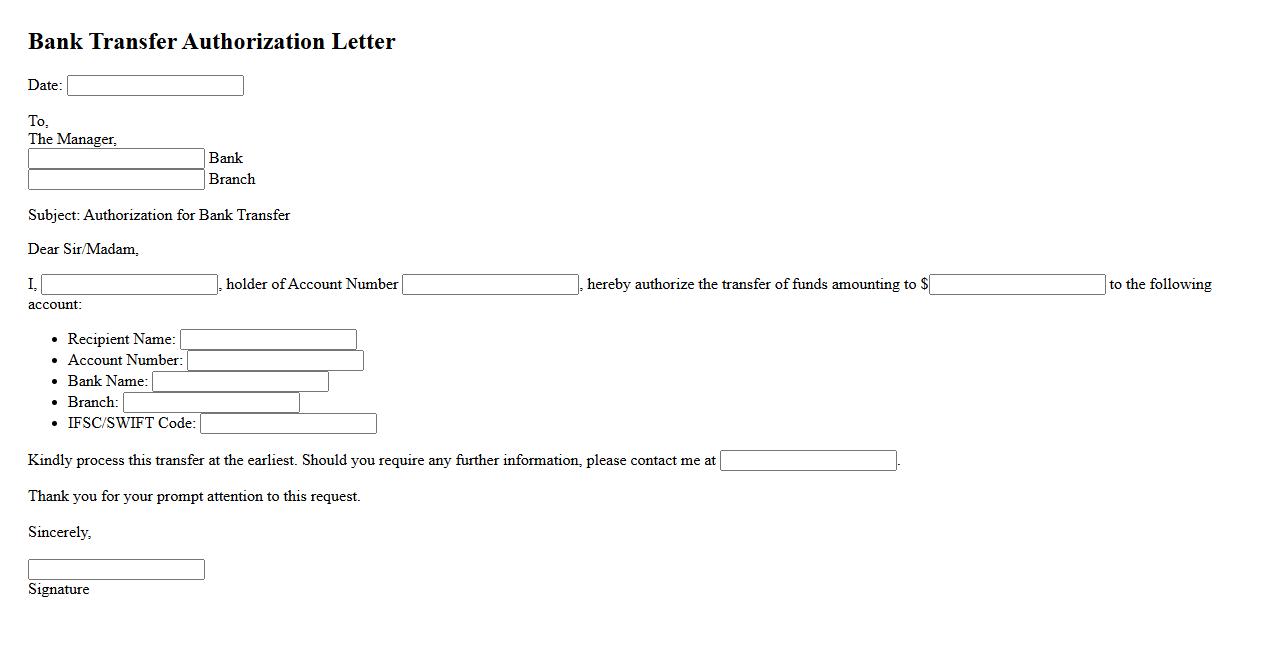

Bank Transfer Authorization Letter

A Bank Transfer Authorization Letter is a formal document that grants permission to a bank or authorized party to initiate a transfer of funds from one account to another. This letter typically includes the account holder's details, the recipient's information, and the specific instructions for the transaction. It ensures secure and verified processing of the bank transfer as per the account holder's consent.

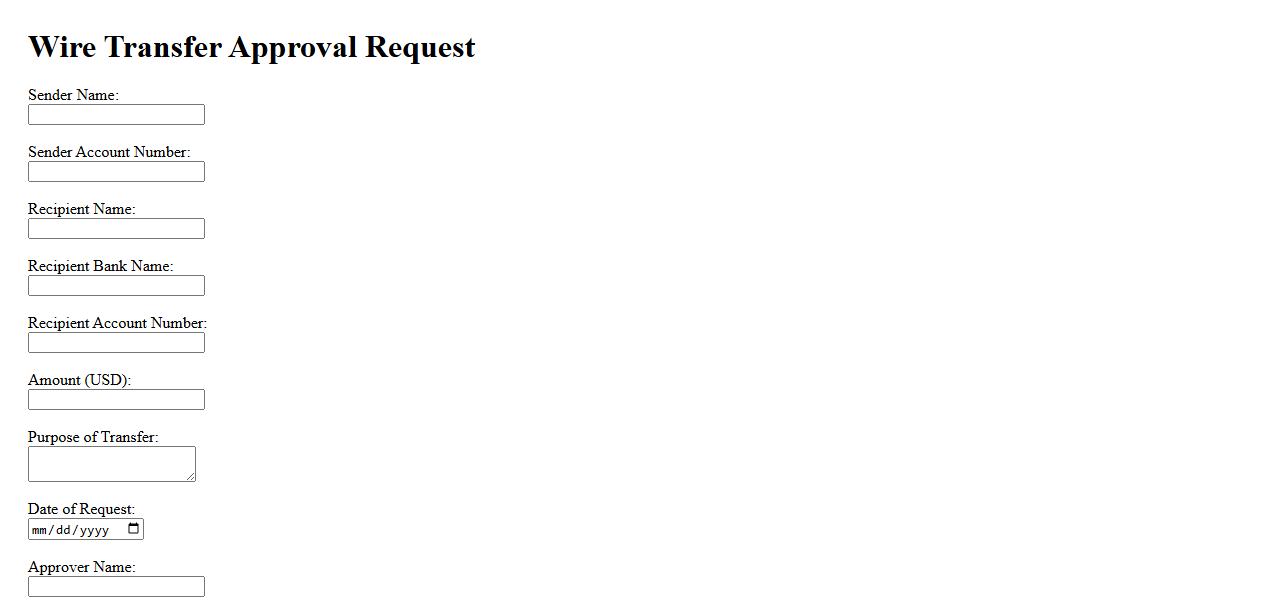

Wire Transfer Approval Request

The Wire Transfer Approval Request is a crucial step in ensuring secure and authorized fund transfers between bank accounts. This process involves verifying details and obtaining necessary consents before the transaction is executed. It helps prevent fraud and errors in electronic money transfers.

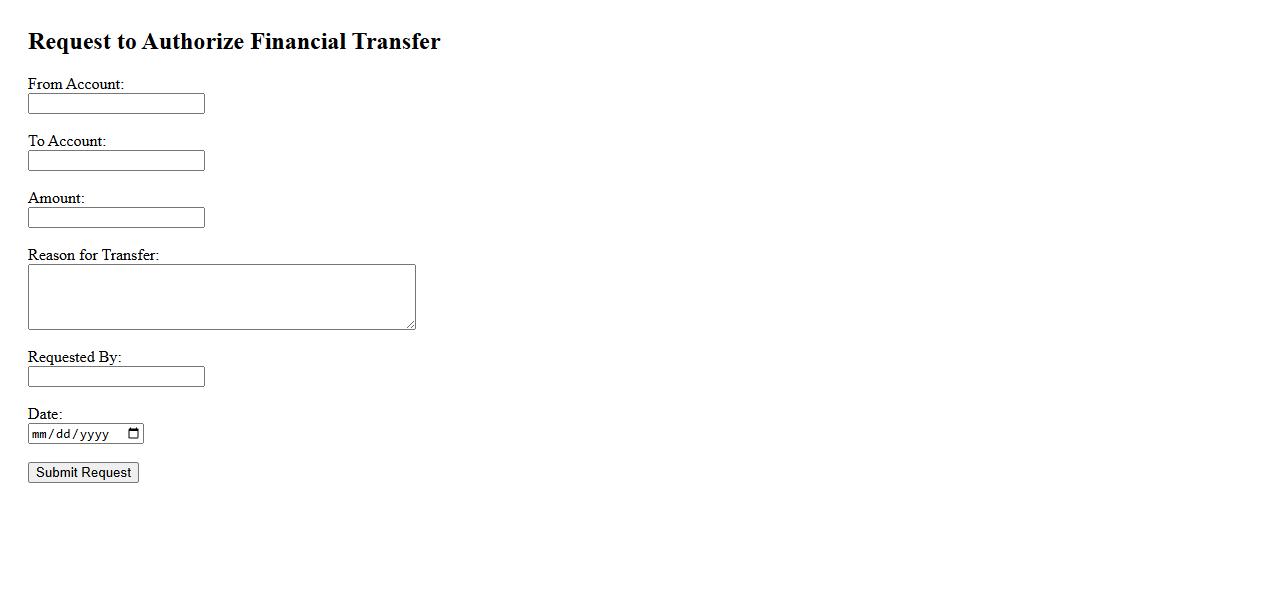

Request to Authorize Financial Transfer

A Request to Authorize Financial Transfer is a formal document used to seek approval for moving funds between accounts or entities. This request ensures proper authorization and accountability in financial operations. It typically includes details such as the amount, recipient, and purpose of the transfer.

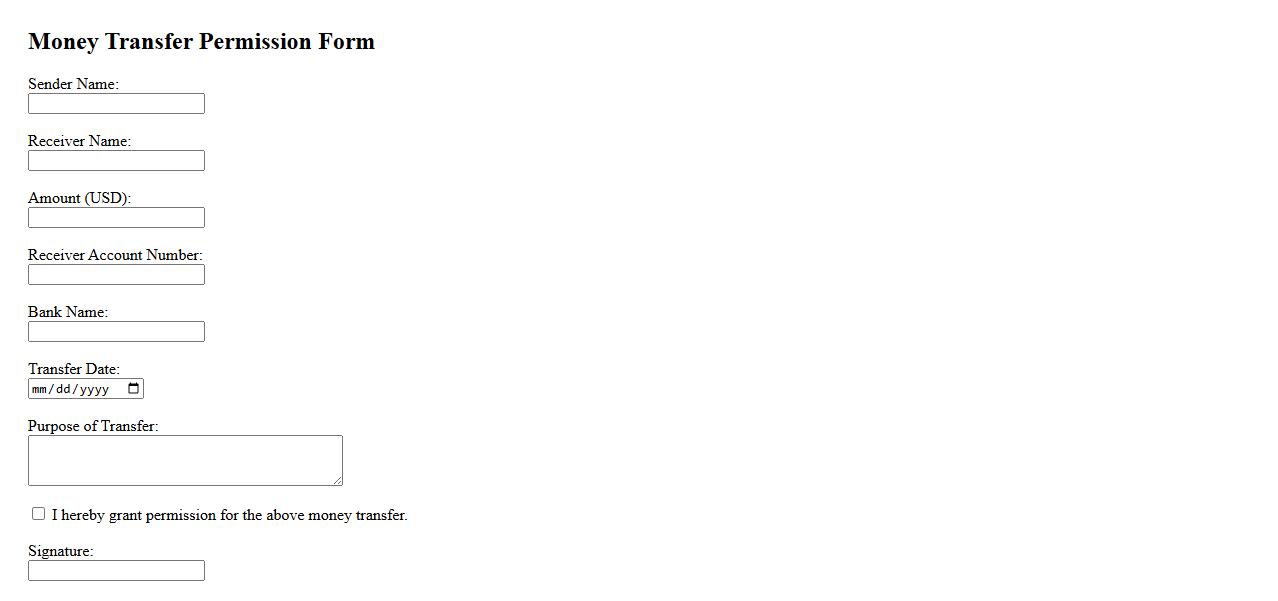

Money Transfer Permission Form

The Money Transfer Permission Form is a crucial document that authorizes the transfer of funds between accounts or individuals. It ensures legal compliance and safeguards against unauthorized transactions. Filling out this form accurately helps facilitate smooth and secure money transfers.

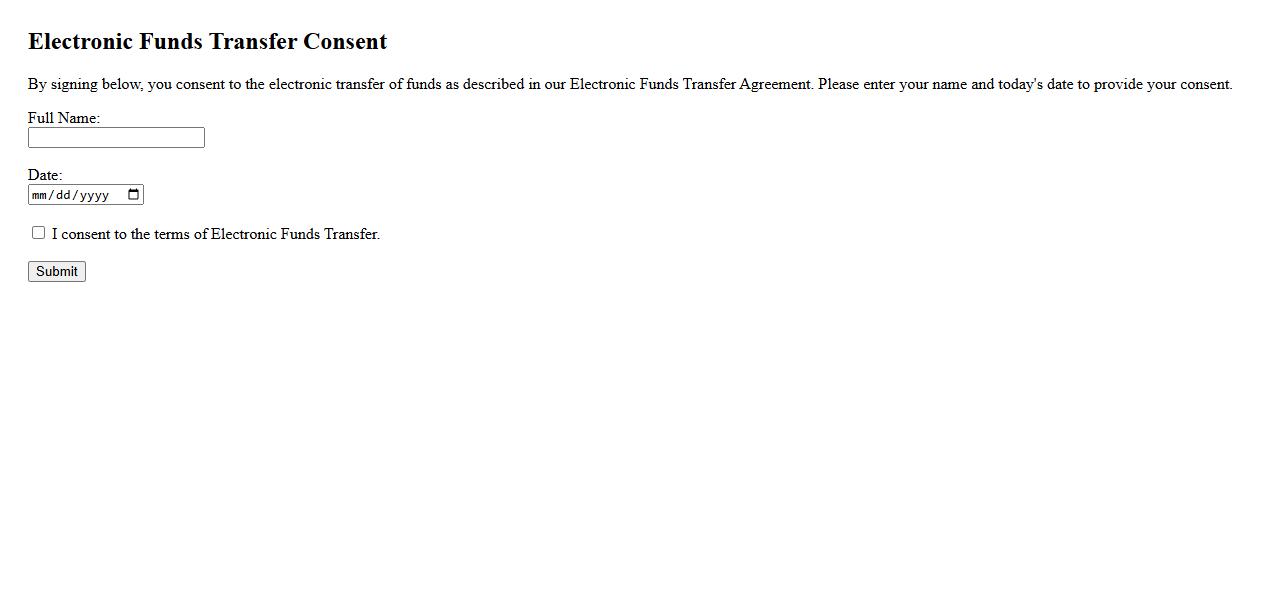

Electronic Funds Transfer Consent

Electronic Funds Transfer Consent is the authorization given by an individual or business to allow electronic transfers of funds from their bank account. This consent enables secure and efficient processing of payments or deposits without the need for paper checks. It is essential for automated transactions such as bill payments, payroll deposits, and online purchases.

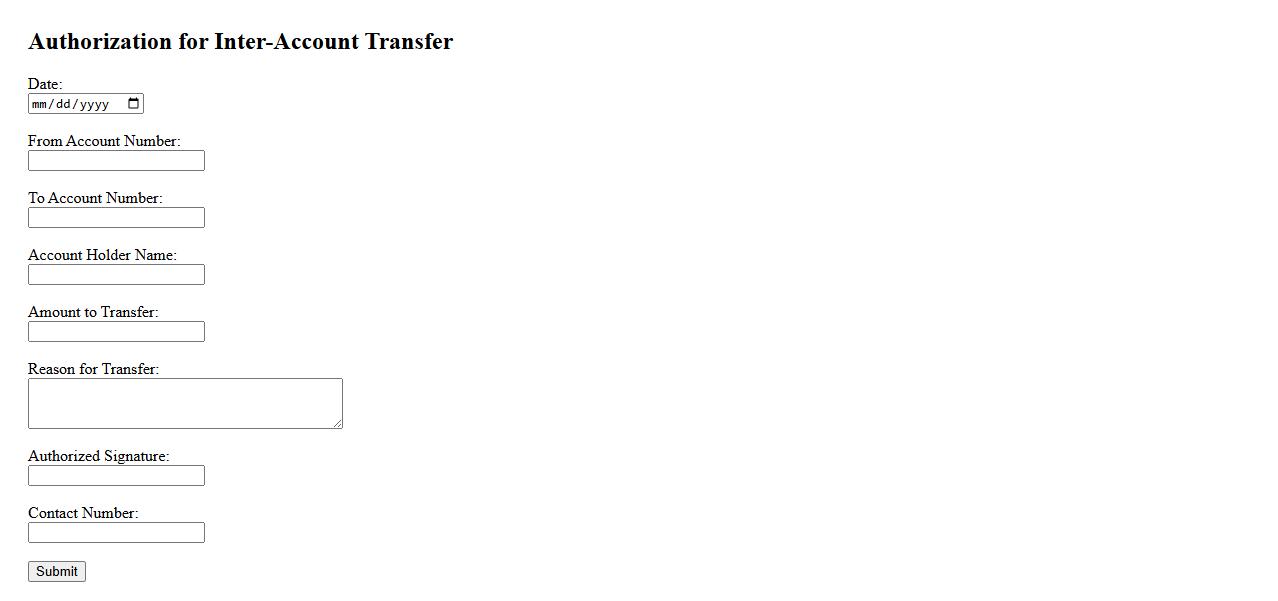

Authorization for Inter-Account Transfer

Authorization for Inter-Account Transfer is a formal approval that allows the movement of funds between different accounts held by the same individual or entity. This ensures secure and verified transactions within banking or financial platforms. Proper authorization helps prevent unauthorized access and enhances account management efficiency.

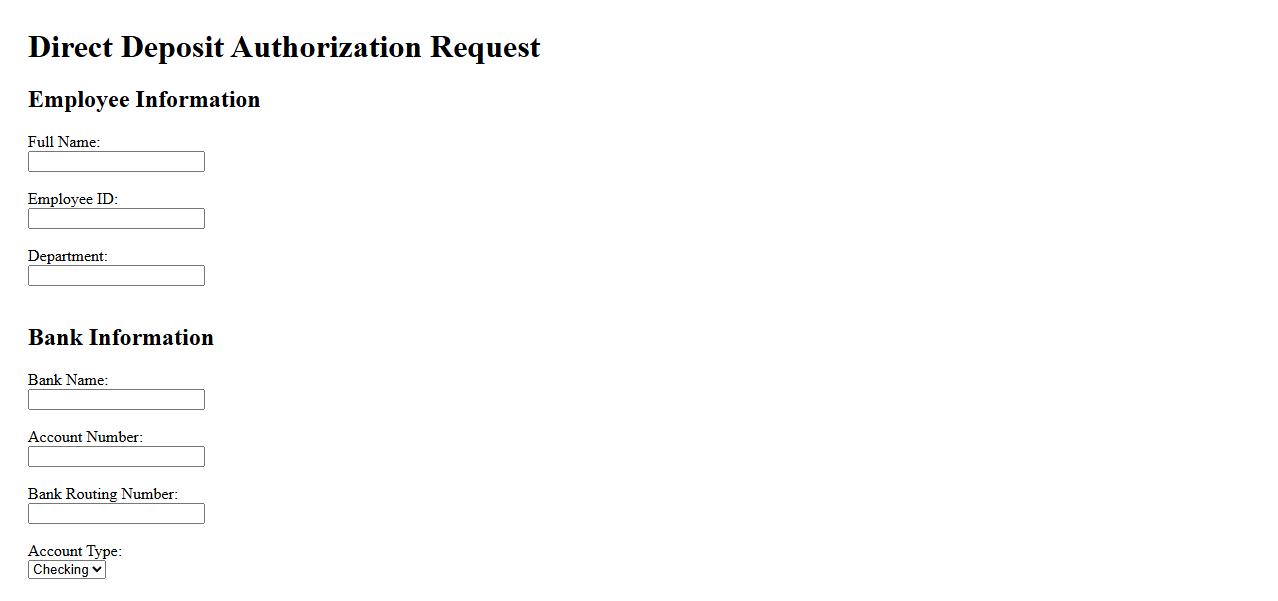

Direct Deposit Authorization Request

The Direct Deposit Authorization Request allows employees to provide their bank information securely for electronic payment of wages. This method ensures timely and convenient transfer of funds directly into the employee's bank account. Submitting this form helps eliminate paper checks and streamline payroll processing.

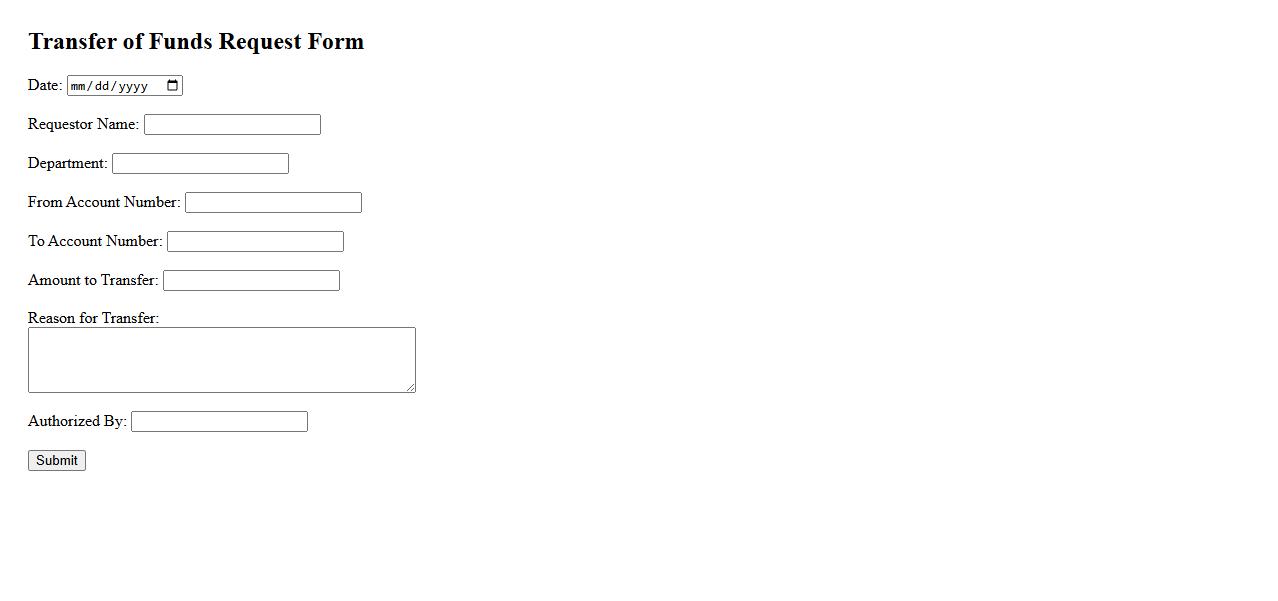

Transfer of Funds Request Form

The Transfer of Funds Request Form is a secure document used to authorize the movement of money between accounts. It ensures accurate and timely processing by capturing essential transaction details. This form helps streamline financial operations while maintaining compliance and accountability.

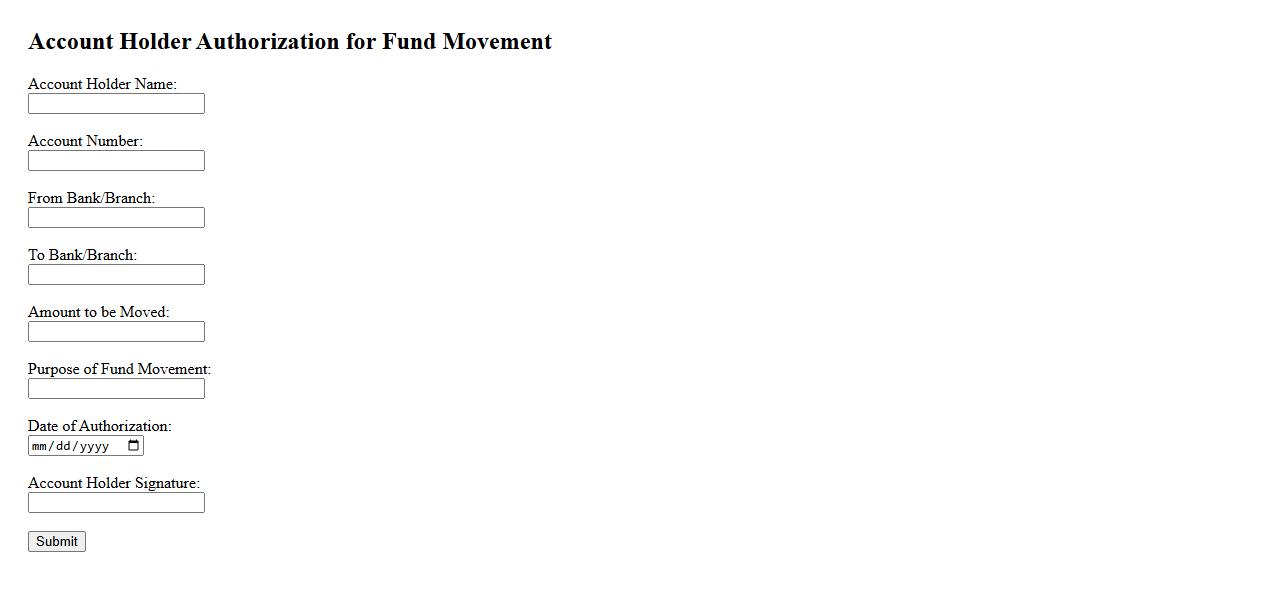

Account Holder Authorization for Fund Movement

The Account Holder Authorization for Fund Movement is a crucial document that grants permission to transfer funds between accounts. It ensures security and compliance with financial regulations by verifying the identity of the account holder. This authorization protects both the institution and the account holder from unauthorized transactions.

What is the purpose and scope of the Authorization to Transfer Funds document?

The Authorization to Transfer Funds document serves as a formal approval to move money from one account to another. It clearly defines the limits within which transactions can take place, ensuring compliance with financial policies. This document protects both the sender and recipient by establishing a legal basis for the fund transfer.

Who are the authorized parties permitted to initiate or approve the fund transfer?

Typically, only authorized personnel such as company officers or designated financial managers can initiate or approve fund transfers. These individuals must be listed explicitly in the document to uphold accountability. This restriction minimizes the risk of unauthorized transactions and fraud.

What is the specified amount and destination account for the authorized transfer?

The document must specify the exact amount of funds authorized for transfer along with the destination account details. This ensures clarity and prevents errors or misdirection of funds. Providing accurate information safeguards the integrity of the transaction process.

What security measures or verification steps are required before the transfer occurs?

Prior to executing the transfer, multiple security verifications such as authentication codes, dual-signature requirements, or IT system checks are mandatory. These measures ensure the request is legitimate and prevent unauthorized access. Robust verification protocols are essential for maintaining financial security.

What are the terms and conditions regarding revocation or amendment of the authorization?

The document should outline clear provisions for revoking or amending the authorization, including any required notice periods or procedural steps. This enables flexibility while maintaining control over approved transfers. Strict terms help avoid unauthorized changes and maintain compliance with regulatory standards.