An Agreement for Loan Repayment outlines the terms and conditions under which a borrower agrees to repay a loan to the lender. It specifies the repayment schedule, interest rate, and any penalties for late or missed payments. This legally binding document protects both parties by clearly defining their obligations and rights throughout the loan term.

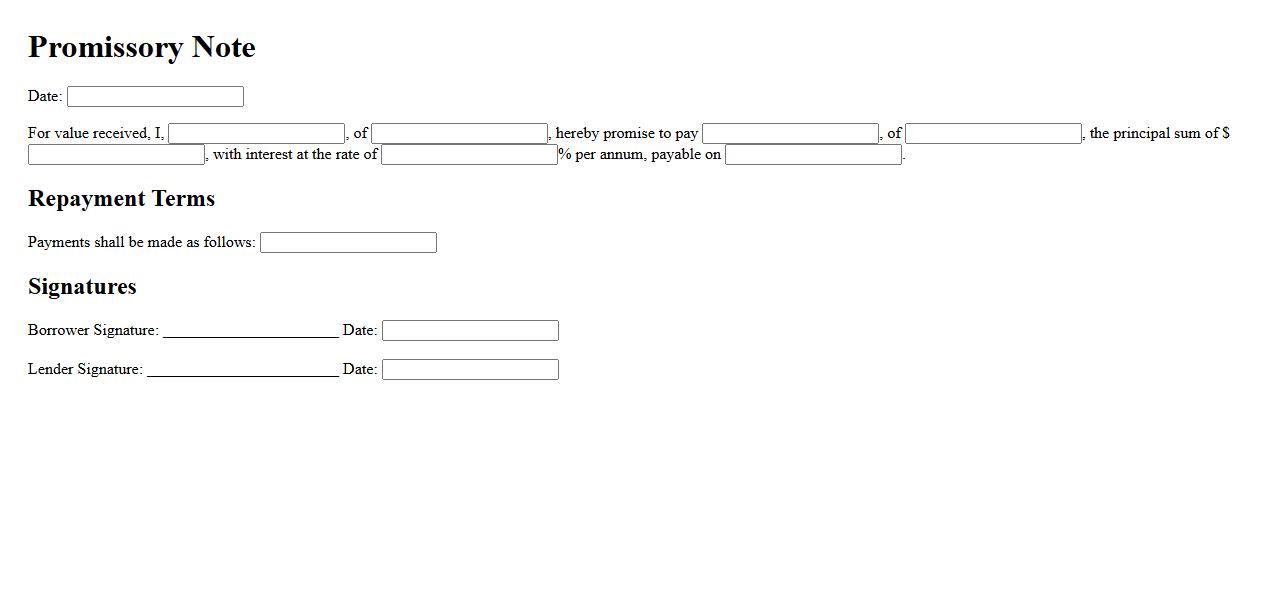

Promissory Note

A Promissory Note is a legal document that outlines a borrower's written promise to repay a specified sum of money to a lender within a defined timeframe. It typically includes the loan amount, interest rate, repayment schedule, and signatures of both parties. This note serves as a binding contract ensuring clear terms for both debtor and creditor.

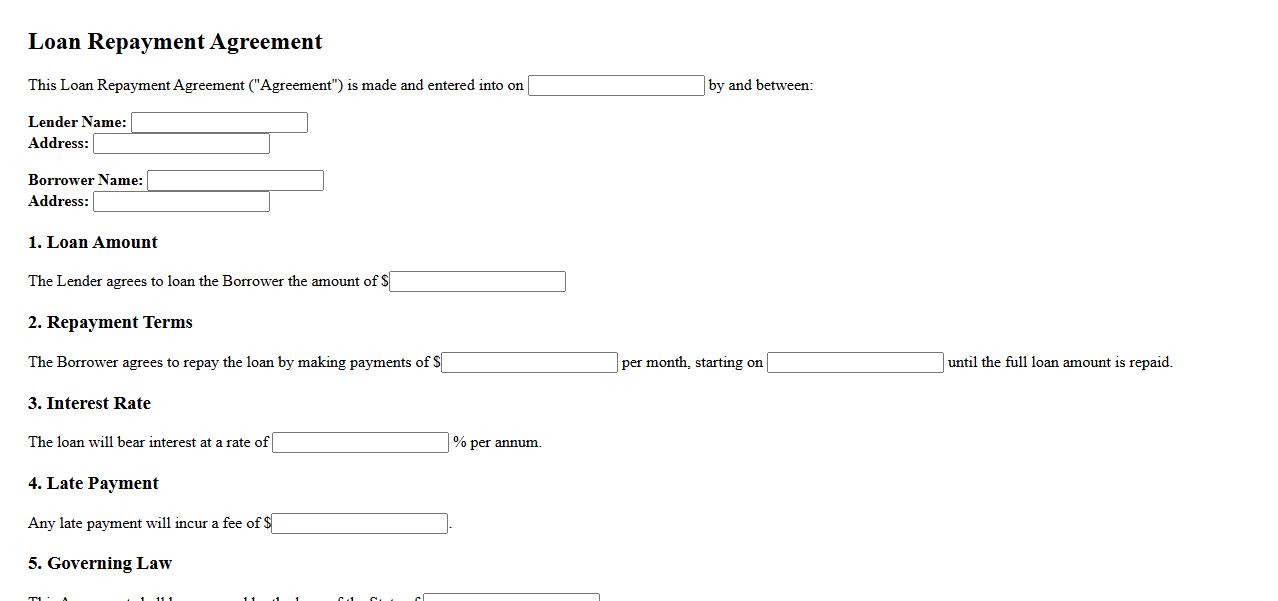

Loan Repayment Agreement

A Loan Repayment Agreement is a legal document outlining the terms and conditions under which a borrower agrees to repay a loan to a lender. It specifies the repayment schedule, interest rates, and any penalties for late payments. This agreement ensures clarity and protects both parties involved in the loan transaction.

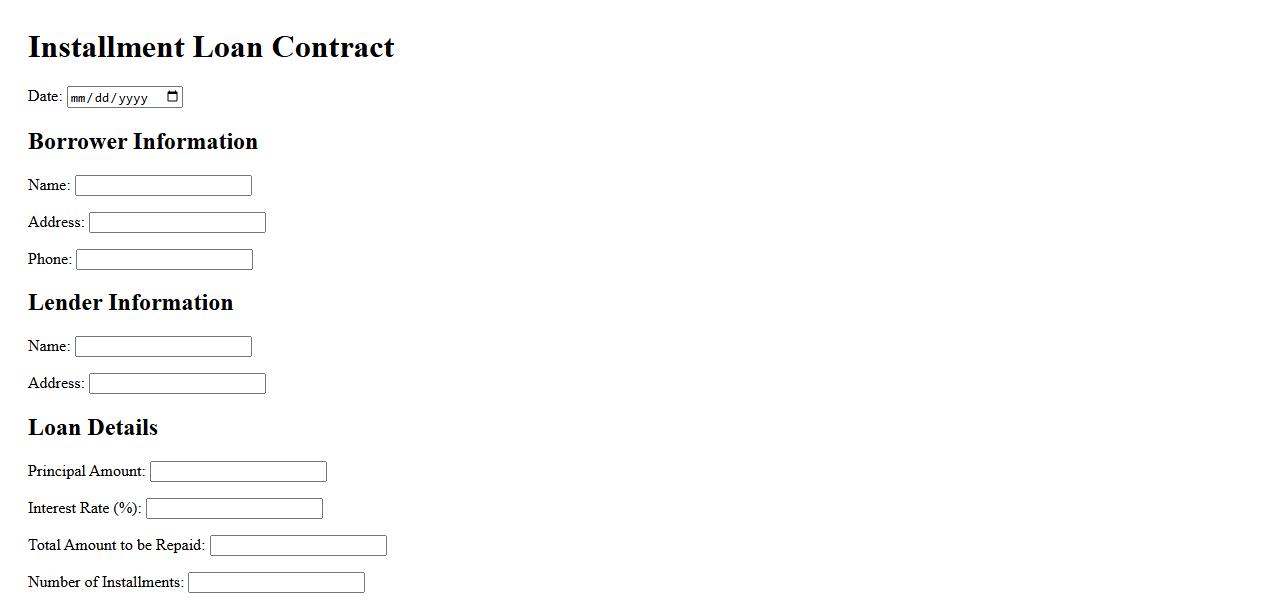

Installment Loan Contract

An Installment Loan Contract is a legal agreement between a borrower and a lender outlining the terms for repaying a loan in regular, scheduled payments. This contract specifies the loan amount, interest rate, payment schedule, and consequences of default. It provides clear guidelines to ensure both parties understand their obligations and rights.

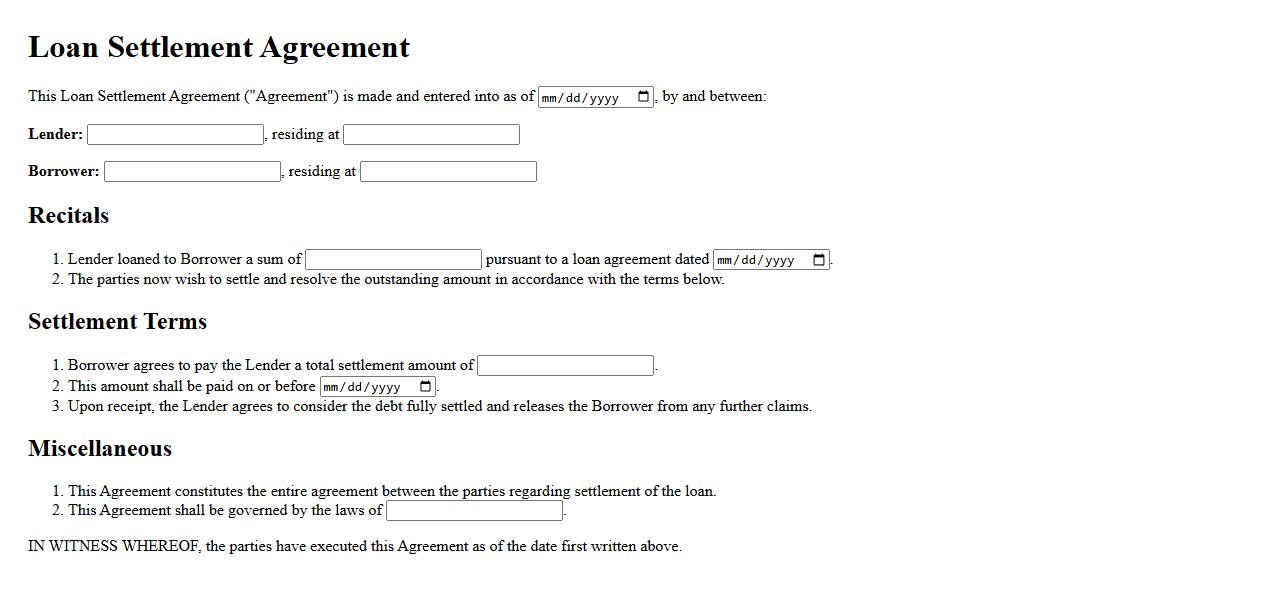

Loan Settlement Agreement

A Loan Settlement Agreement is a legal contract between a borrower and lender that outlines the terms for resolving an outstanding loan debt. It specifies the repayment conditions, including any reductions or modifications agreed upon to settle the loan. This agreement helps both parties avoid litigation by providing a clear, enforceable resolution.

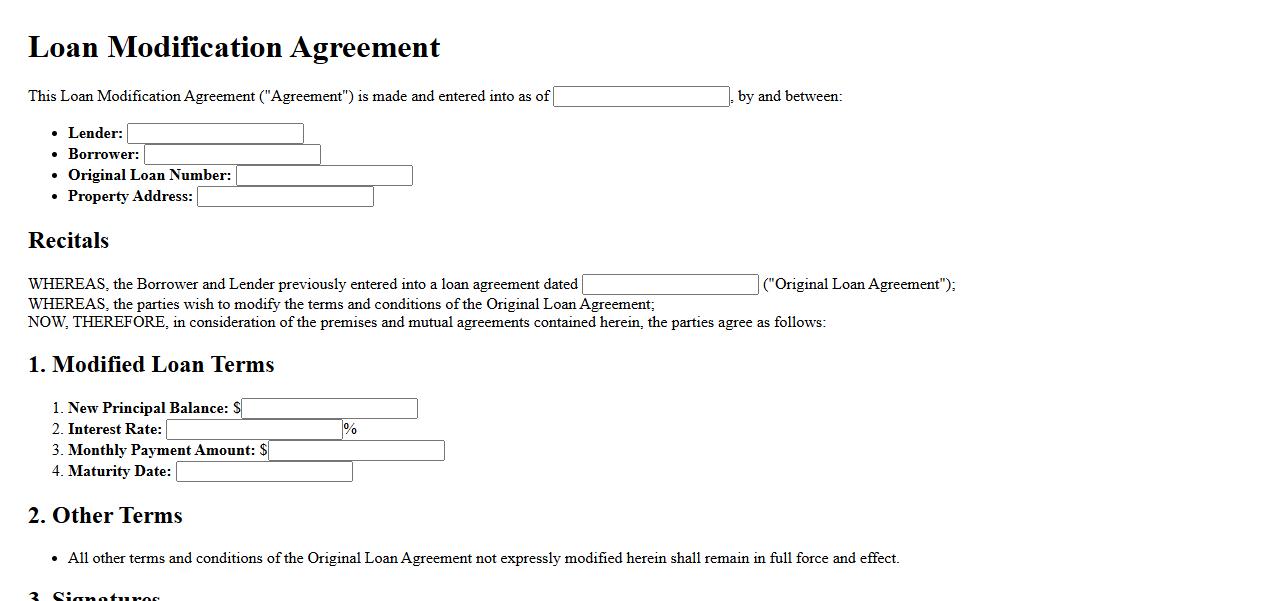

Loan Modification Agreement

A Loan Modification Agreement is a contract between a borrower and lender that alters the original terms of a loan. This agreement typically helps make loan payments more affordable by adjusting interest rates, extending the loan term, or changing other conditions. It provides borrowers relief while ensuring lenders continue to receive payments.

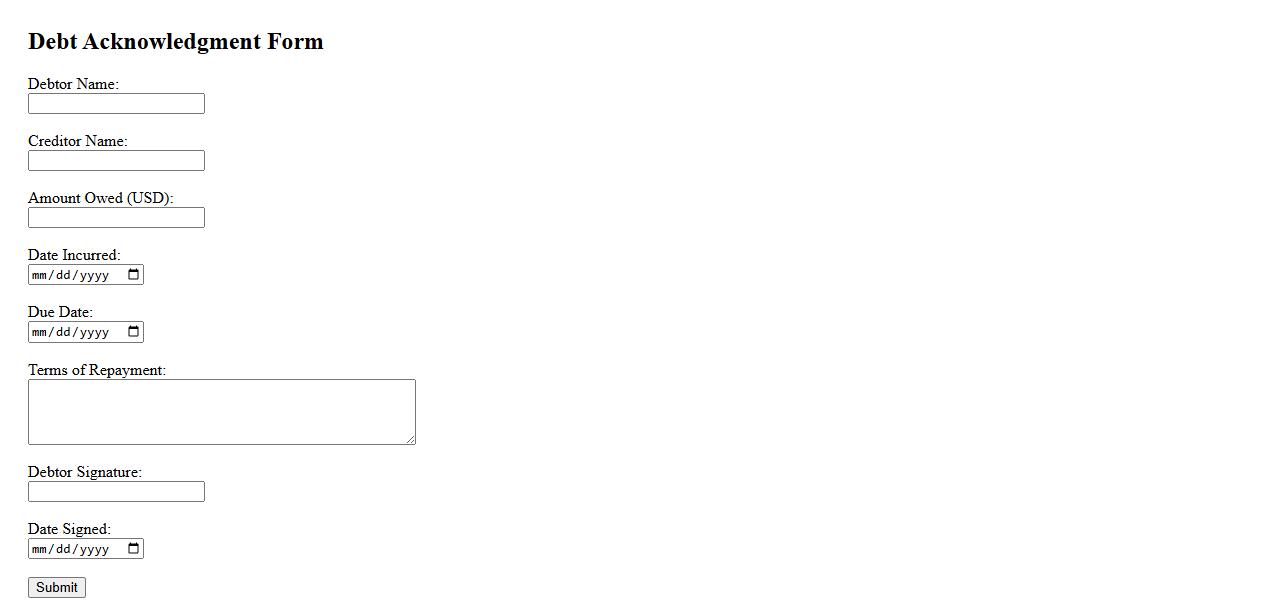

Debt Acknowledgment Form

A Debt Acknowledgment Form is a legal document used to confirm the existence and terms of a debt between a debtor and a creditor. This form helps to clearly outline the amount owed, repayment schedule, and any other relevant conditions. It provides both parties with a written record to avoid future disputes and ensure transparency in financial agreements.

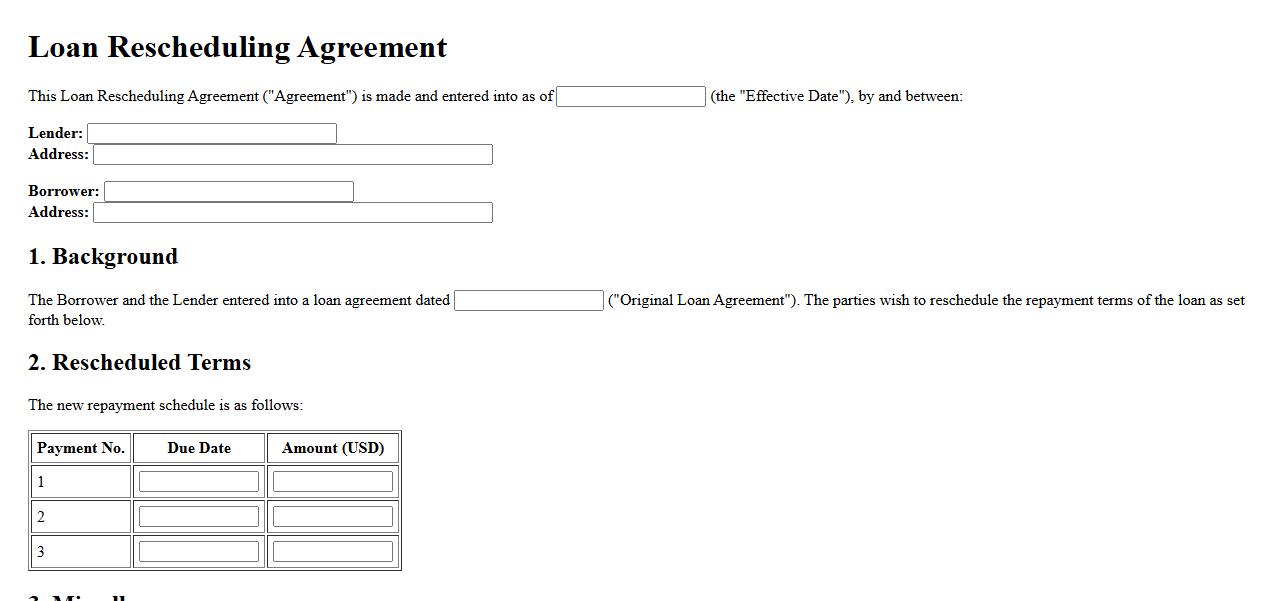

Loan Rescheduling Agreement

A Loan Rescheduling Agreement is a formal contract between a borrower and lender to modify the original loan terms. This agreement typically adjusts the repayment schedule, interest rates, or loan duration to better suit the borrower's financial situation. It helps manage debt more effectively and avoid default.

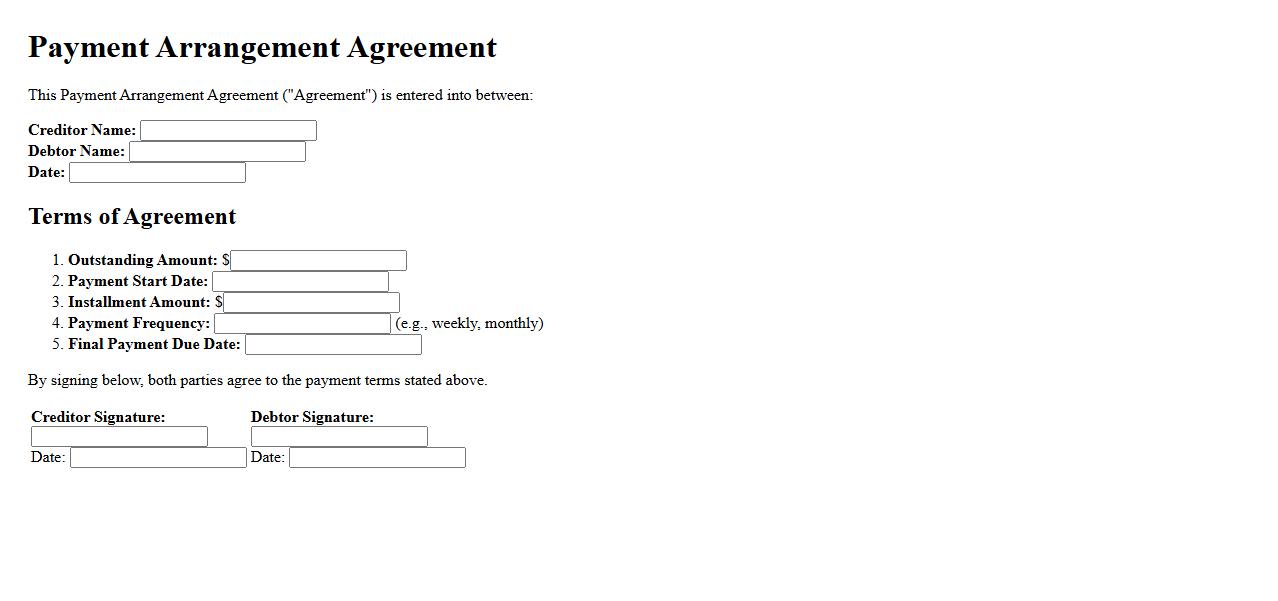

Payment Arrangement Agreement

A Payment Arrangement Agreement is a formal contract between a debtor and creditor outlining the terms for repaying a debt in installments. This agreement helps both parties avoid legal disputes by clearly defining payment amounts, due dates, and obligations. It ensures a structured and manageable process for resolving outstanding financial commitments.

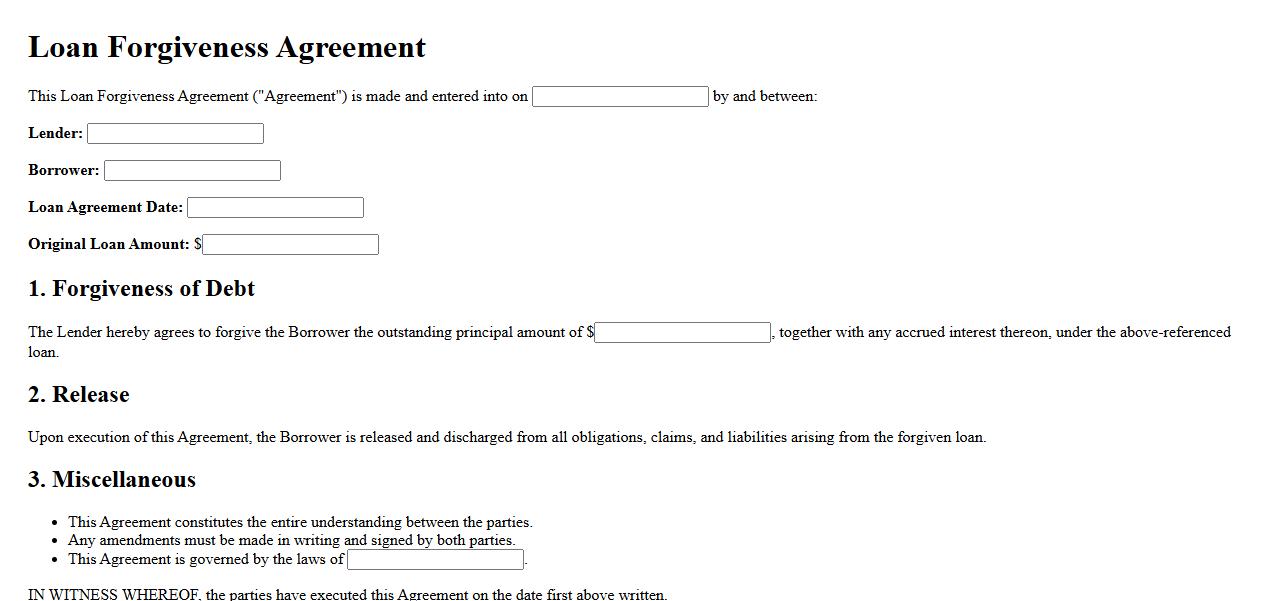

Loan Forgiveness Agreement

A Loan Forgiveness Agreement is a legal document outlining the conditions under which a loan can be partially or fully forgiven. This agreement specifies the responsibilities of both the lender and borrower, including any required actions to qualify for forgiveness. It serves to protect all parties by clearly defining the terms of loan discharge.

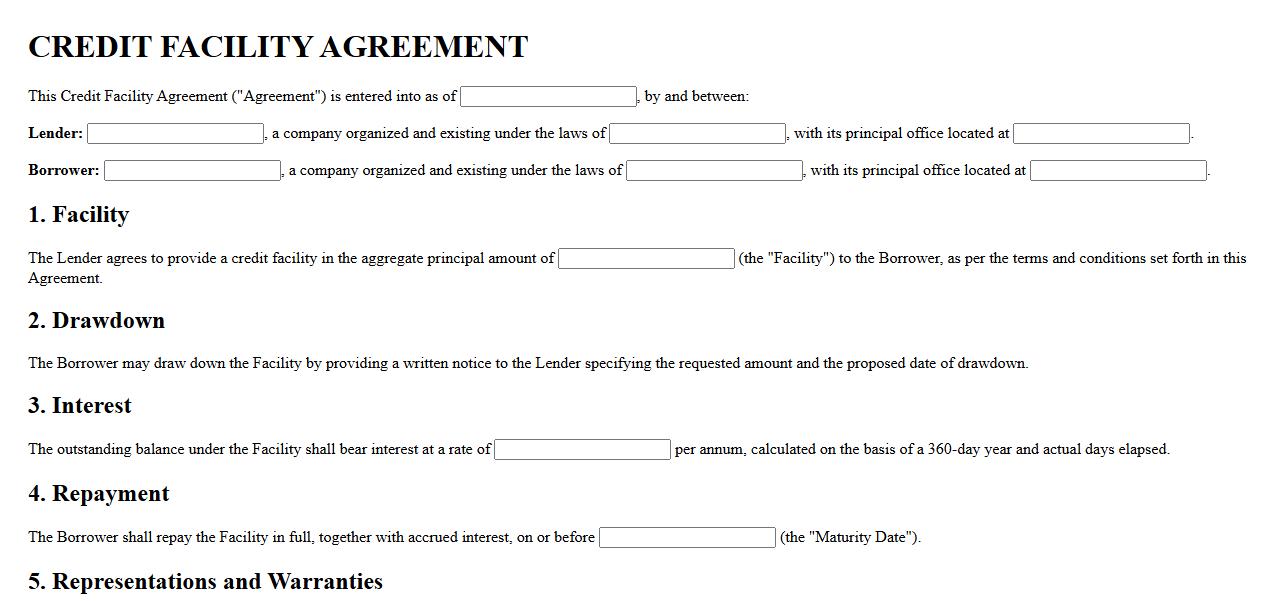

Credit Facility Agreement

A Credit Facility Agreement is a legal contract between a borrower and a lender that outlines the terms and conditions of a loan. It specifies the credit amount, interest rates, repayment schedule, and other obligations. This agreement ensures clarity and protection for both parties throughout the loan period.

Specific Parties Identified in the Agreement for Loan Repayment

The Agreement clearly identifies the Borrower and the Lender as the primary parties involved. It also often includes any guarantors or third-party agents related to the repayment process. These parties are explicitly named with their roles and responsibilities clearly outlined to avoid confusion.

Defined Terms and Conditions for the Repayment Schedule

The repayment schedule is detailed under the Terms and Conditions section, specifying the amounts, due dates, and frequency of payments. It includes provisions for early repayment or partial payments if applicable. The document ensures transparency by listing all repayment milestones and penalties for late payments.

Collateral or Security Arrangements Detailed in the Document

The agreement specifies any collateral or security interests securing the loan, including property, equipment, or other assets. It defines how these assets are to be held, maintained, and potentially liquidated in case of default. Clear terms protect both parties by outlining the rights related to the pledged collateral.

Events Constituting a Default Under This Agreement

Default events include failure to make timely repayments, insolvency, or breach of any agreement terms. The document meticulously lists these triggers to ensure both parties recognize the consequences of non-compliance. This clarity supports enforcement and remedies if a default occurs.

Addressing Amendments, Waivers, or Modifications to the Agreement

Any amendments, waivers, or modifications must be documented in writing and signed by all parties. The agreement stipulates that informal or verbal changes are invalid to maintain legal integrity. This process ensures that all adjustments are mutually agreed upon and clearly recorded.