An Agreement for Installment Payment outlines the terms between a buyer and seller to pay a debt or purchase price over multiple scheduled payments. It specifies the payment amounts, due dates, interest rates if applicable, and consequences of missed payments. This legal document ensures clarity and protects both parties during the installment repayment process.

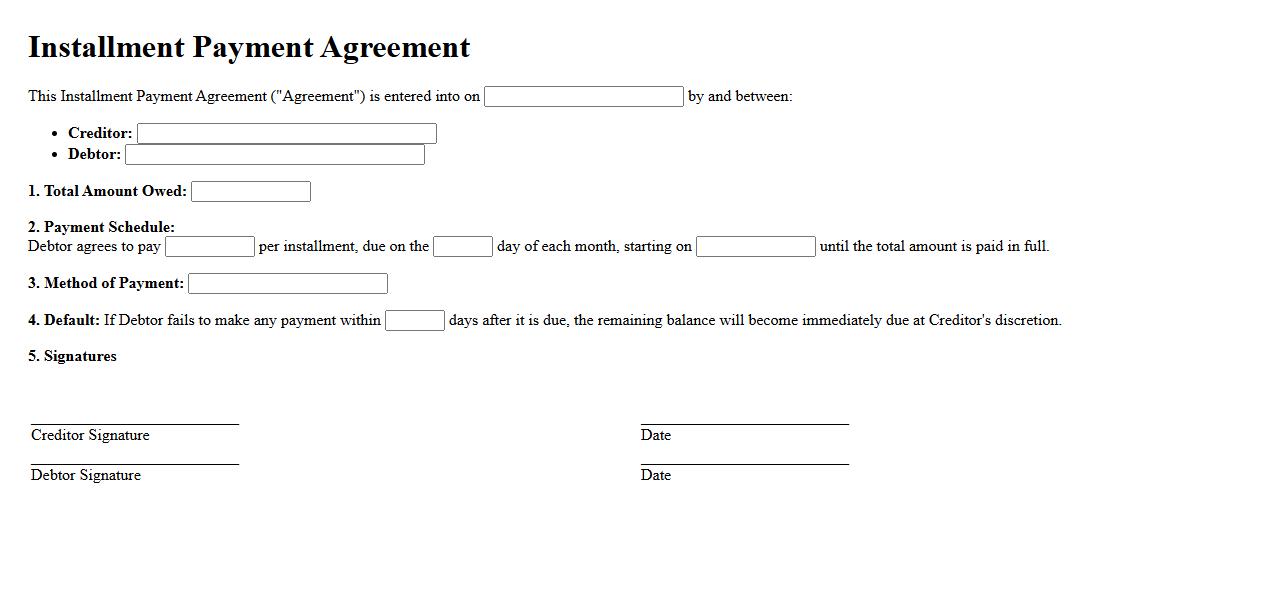

Installment Payment Agreement

An Installment Payment Agreement allows individuals or businesses to pay a debt in smaller, manageable amounts over time. This arrangement helps avoid financial strain while fulfilling payment obligations promptly. It is often used by creditors to facilitate easier repayment plans for outstanding balances.

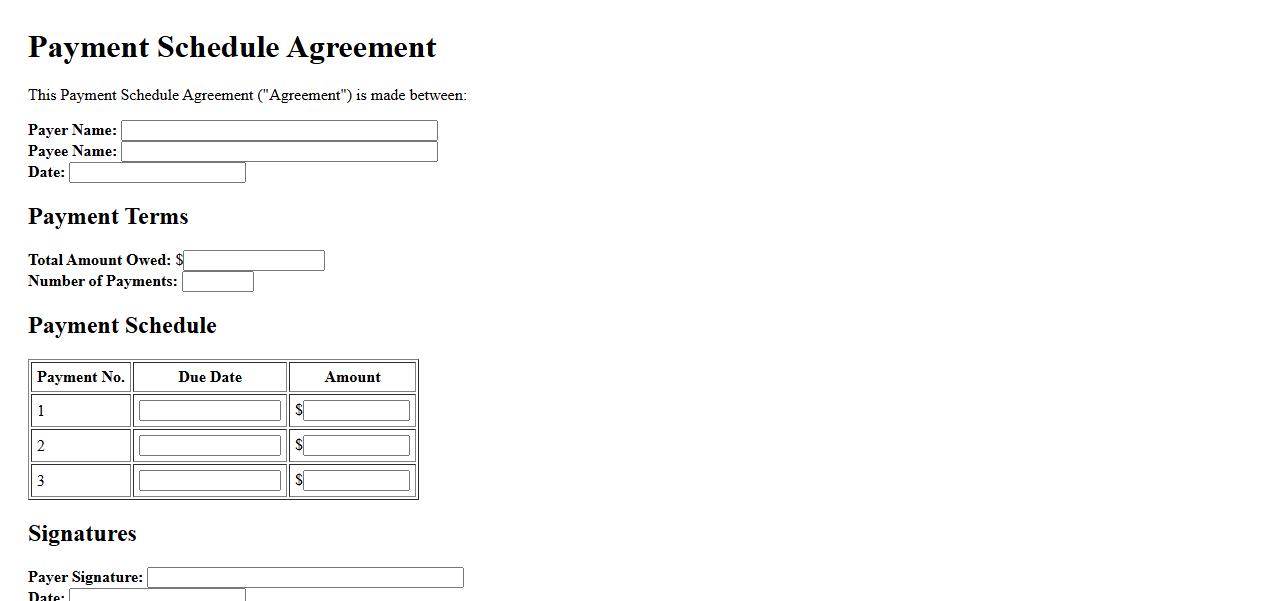

Payment Schedule Agreement

A Payment Schedule Agreement outlines a clear plan for installment payments between parties to ensure timely and structured financial transactions. This document helps avoid misunderstandings by specifying amounts, due dates, and payment methods. It is essential for maintaining transparency and accountability in financial arrangements.

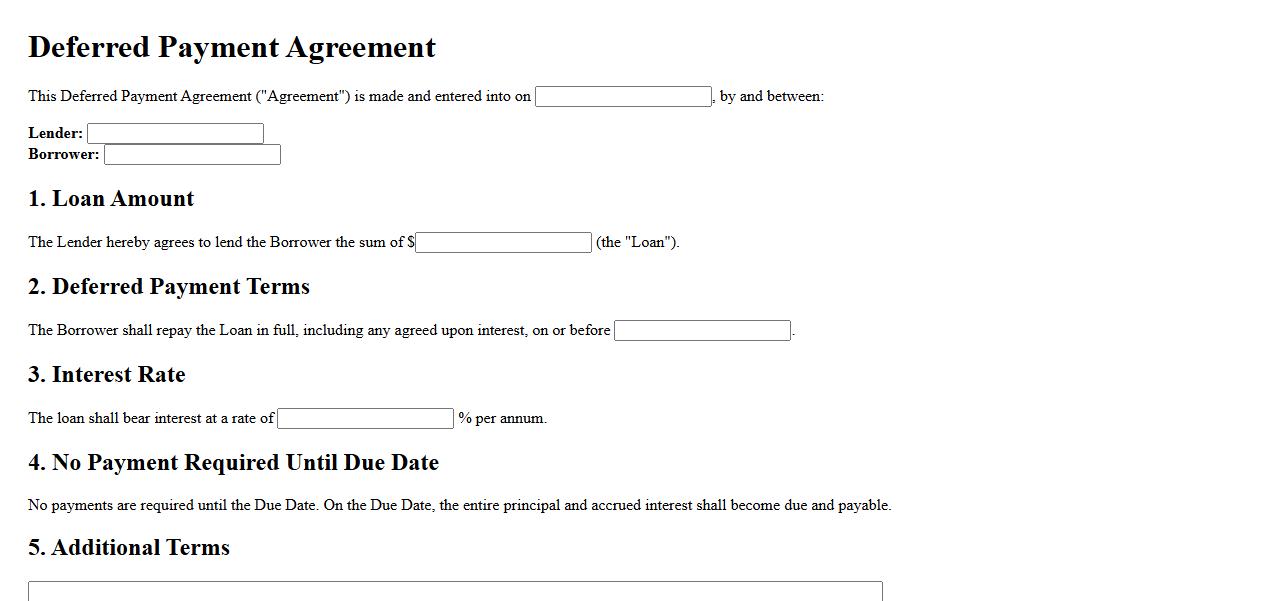

Deferred Payment Agreement

A Deferred Payment Agreement is a contract allowing a buyer to postpone payment until a later date. This arrangement helps improve cash flow and provides flexibility in managing financial obligations. Businesses often use it to accommodate customers facing temporary financial constraints.

Payment Plan Agreement

A Payment Plan Agreement is a formal arrangement between a buyer and a seller that outlines the terms for paying a debt over a specified period. This agreement helps manage financial obligations by breaking down the total amount into manageable installments. It ensures clarity and mutual understanding regarding payment schedules and amounts.

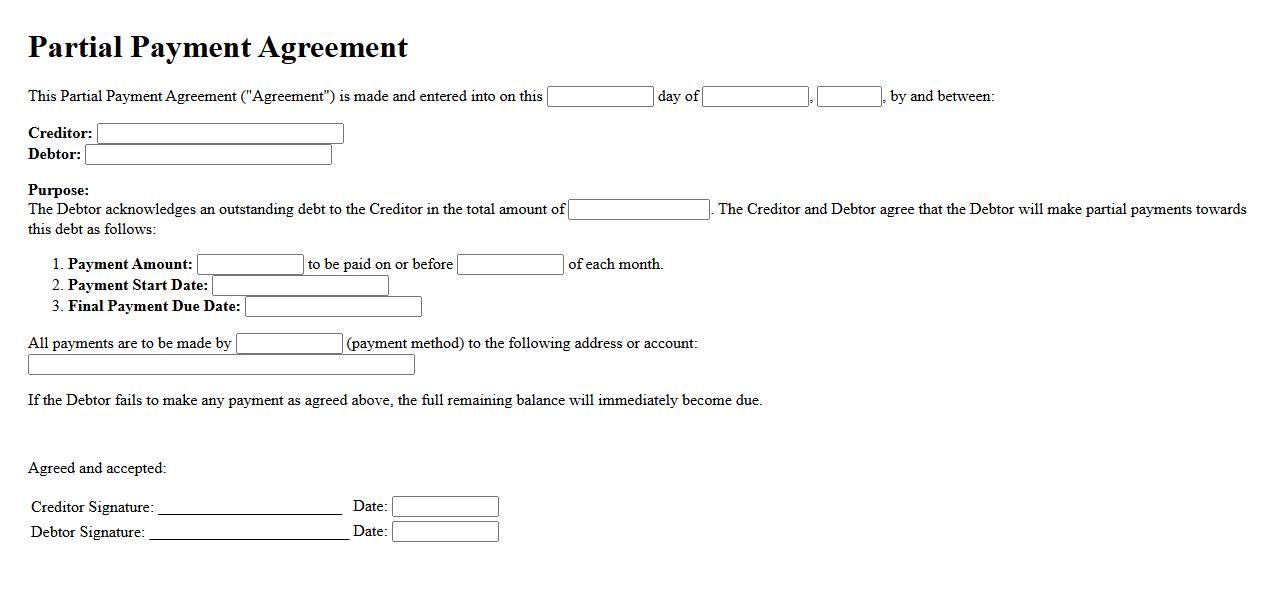

Partial Payment Agreement

A Partial Payment Agreement is a contract between a debtor and a creditor outlining the terms for paying a portion of the total debt. This agreement helps avoid default and potential legal actions by formalizing reduced payment options. It benefits both parties by providing a clear, manageable repayment plan.

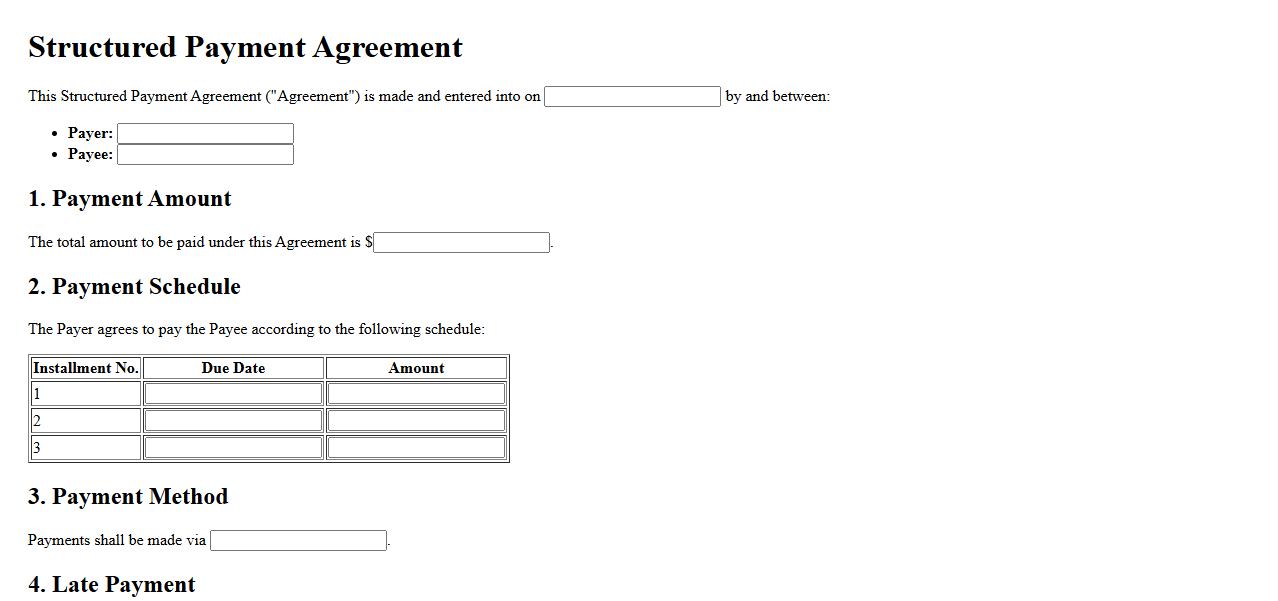

Structured Payment Agreement

A Structured Payment Agreement is a financial arrangement that allows individuals or businesses to pay off debts in a series of scheduled installments. This method provides flexibility and helps in managing cash flow by breaking down large payments into manageable amounts. It is commonly used to resolve tax liabilities or other financial obligations efficiently.

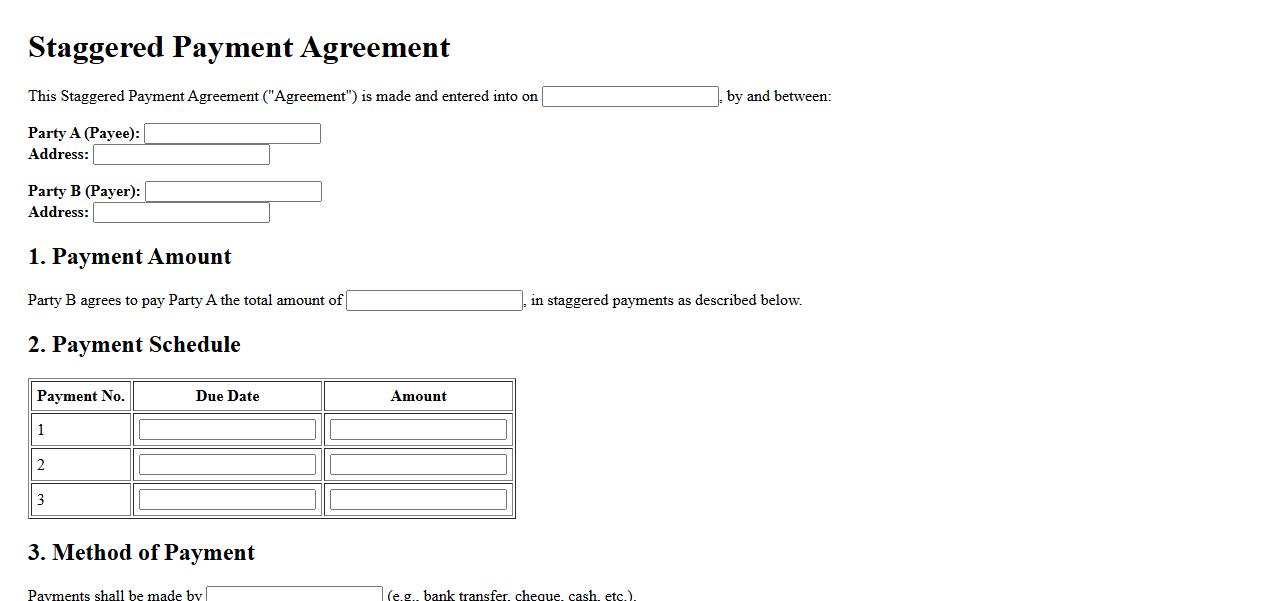

Staggered Payment Agreement

A Staggered Payment Agreement allows parties to spread out payments over a set period, enhancing financial flexibility. This arrangement helps manage cash flow by breaking a large payment into smaller, manageable installments. It is commonly used in business transactions to accommodate budget constraints.

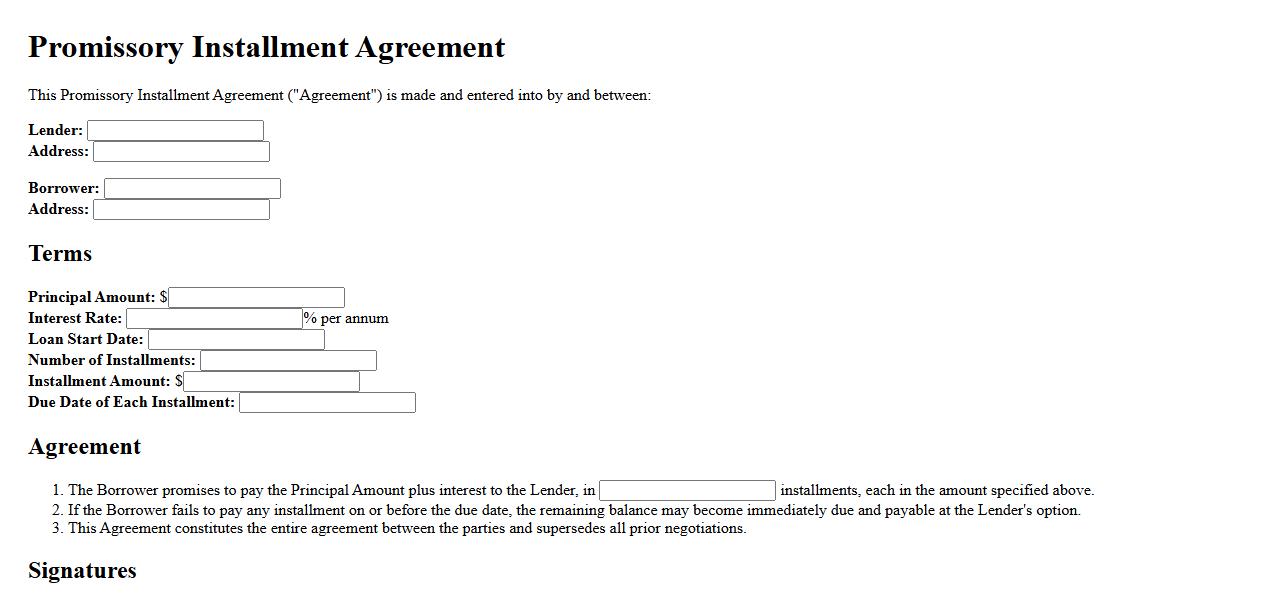

Promissory Installment Agreement

A Promissory Installment Agreement is a legal contract where a borrower commits to repay a debt through a series of scheduled payments. This agreement outlines the payment amount, due dates, and any interest applied. It offers a structured and clear repayment plan to benefit both parties involved.

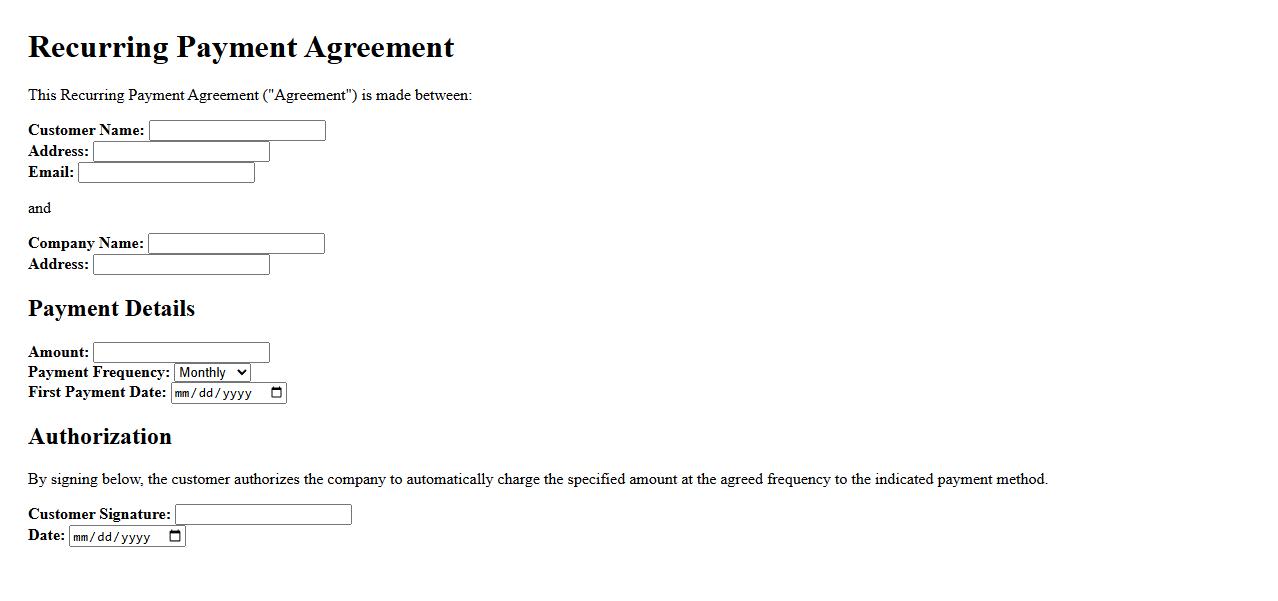

Recurring Payment Agreement

A Recurring Payment Agreement is a contract between a service provider and a customer that authorizes automatic, scheduled payments. This agreement ensures convenience by allowing payments to be deducted regularly without manual intervention. It is commonly used for subscriptions, memberships, and ongoing services.

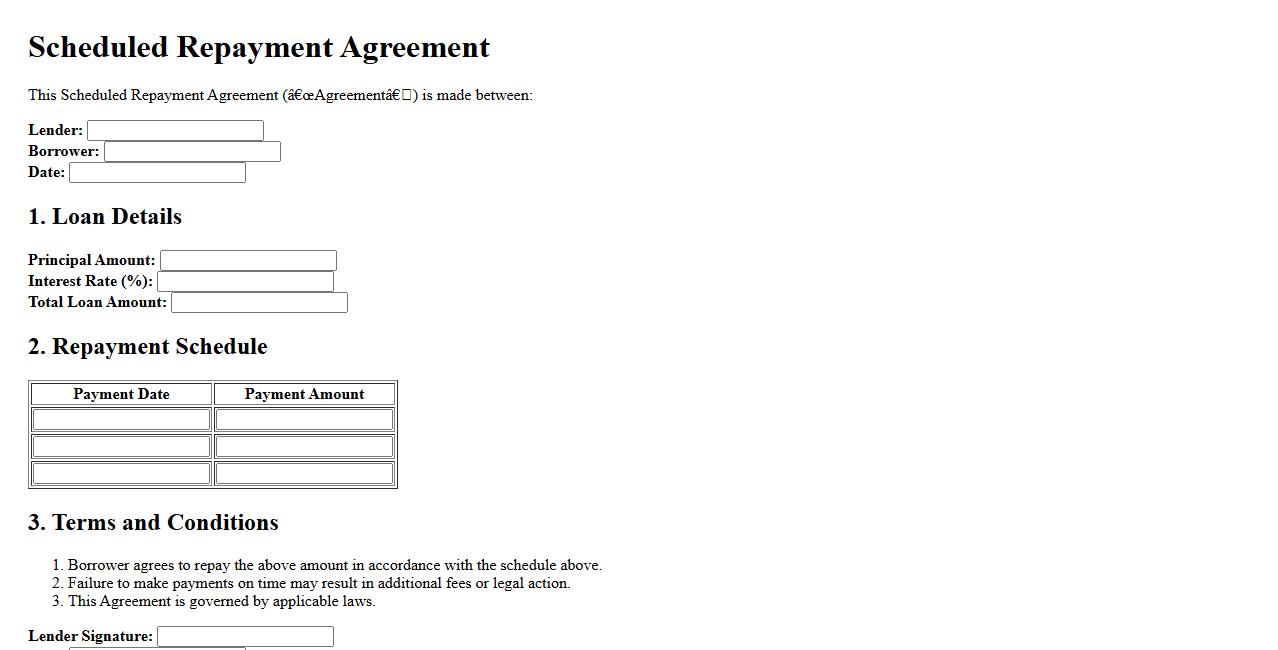

Scheduled Repayment Agreement

A Scheduled Repayment Agreement is a formal contract outlining a borrower's plan to repay a debt in predetermined installments. This agreement ensures clarity and commitment between the lender and borrower by specifying the payment amounts and due dates. It helps maintain financial organization and prevents misunderstandings throughout the repayment period.

What parties are involved in the Agreement for Installment Payment?

The Agreement for Installment Payment involves two primary parties: the payer and the payee. The payer is responsible for making the installment payments, while the payee is the one receiving the payments. Both parties must agree to the terms outlined in the contract for it to be legally binding.

What is the total amount owed as specified in the agreement?

The total amount owed is clearly stated in the agreement to avoid any confusion. This total encompasses the principal debt and any applicable fees or charges agreed upon by both parties. Accurate specification of the total amount is crucial for transparency and enforcement.

What are the payment schedule and installment amounts outlined in the document?

The payment schedule details the timing and frequency of each installment payment. Each installment amount is specified, ensuring the payer knows exactly how much to pay and when. This structured plan helps both parties maintain clear expectations throughout the payment period.

What remedies are described in case of default or missed payments?

The agreement outlines specific remedies for default or missed payments to protect the payee's interests. These may include late fees, acceleration of the remaining balance, or legal action. Having these provisions ensures accountability and encourages timely payments.

What terms regarding interest rates and additional fees are included in the agreement?

The document specifies the interest rate applied to the outstanding balance, if any, along with any additional fees associated with the installment plan. These terms affect the total cost of the agreement and must be clearly communicated. Transparent disclosure of such charges helps prevent disputes during the payment period.