A Waiver of Late Filing Penalty allows taxpayers to avoid penalties for submitting tax returns past the deadline due to reasonable cause or circumstances beyond their control. To qualify, individuals must provide valid explanations and supporting documentation to the tax authority. Approval of the waiver helps maintain good standing and prevents financial burdens from late filing fees.

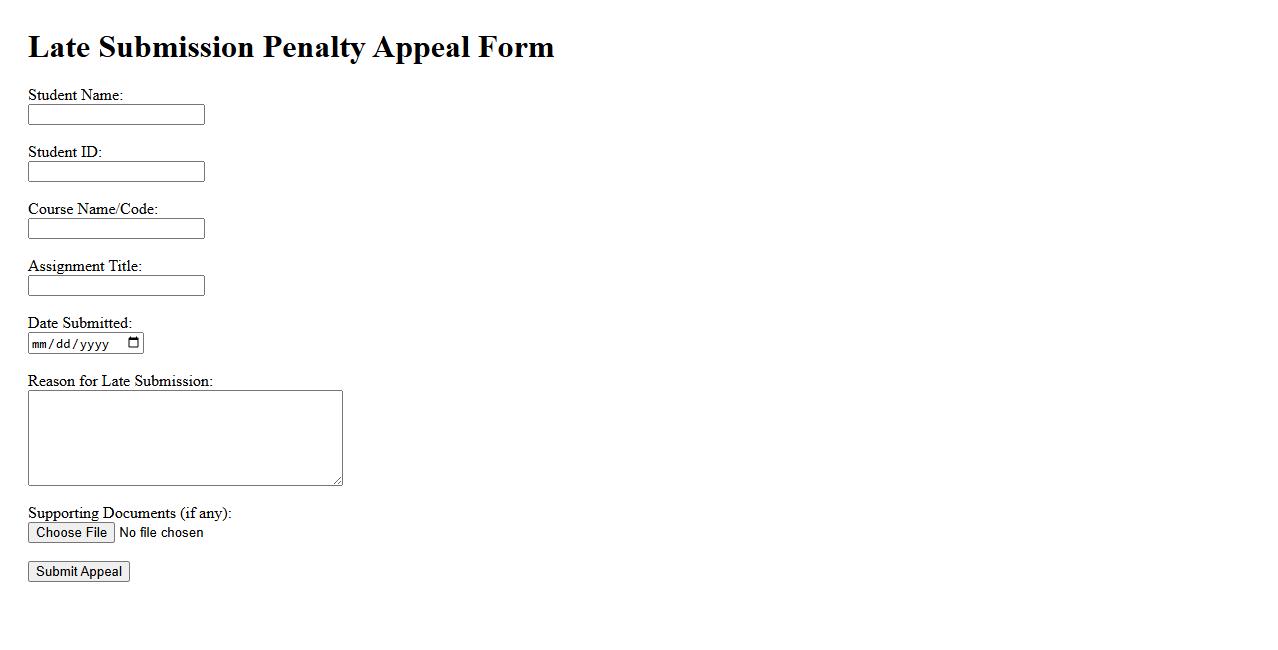

Late Submission Penalty Appeal

If you have missed a deadline, you can submit a Late Submission Penalty Appeal to request leniency due to valid reasons. This appeal provides an opportunity to explain the circumstances that caused the delay. Successful appeals may result in reduced penalties or deadline extensions.

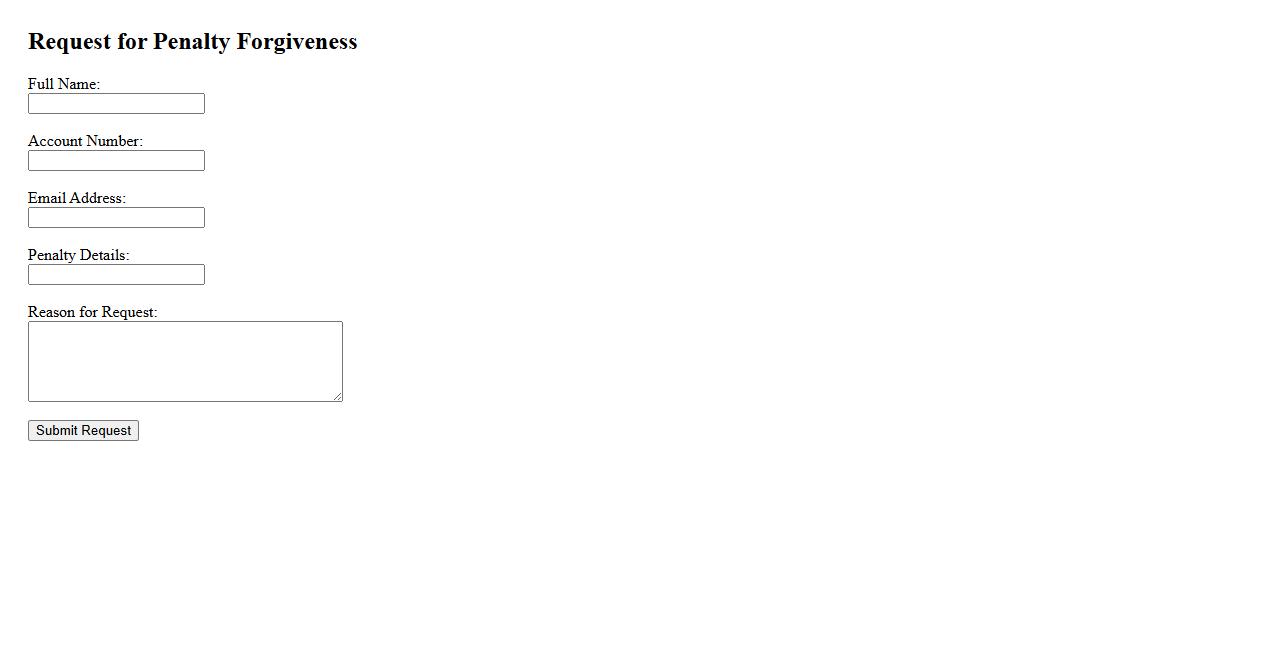

Request for Penalty Forgiveness

Submitting a Request for Penalty Forgiveness allows individuals or businesses to appeal for the waiver of penalties imposed by tax authorities. This request typically requires demonstrating reasonable cause or circumstances beyond control. Proper documentation and timely submission increase the likelihood of forgiveness approval.

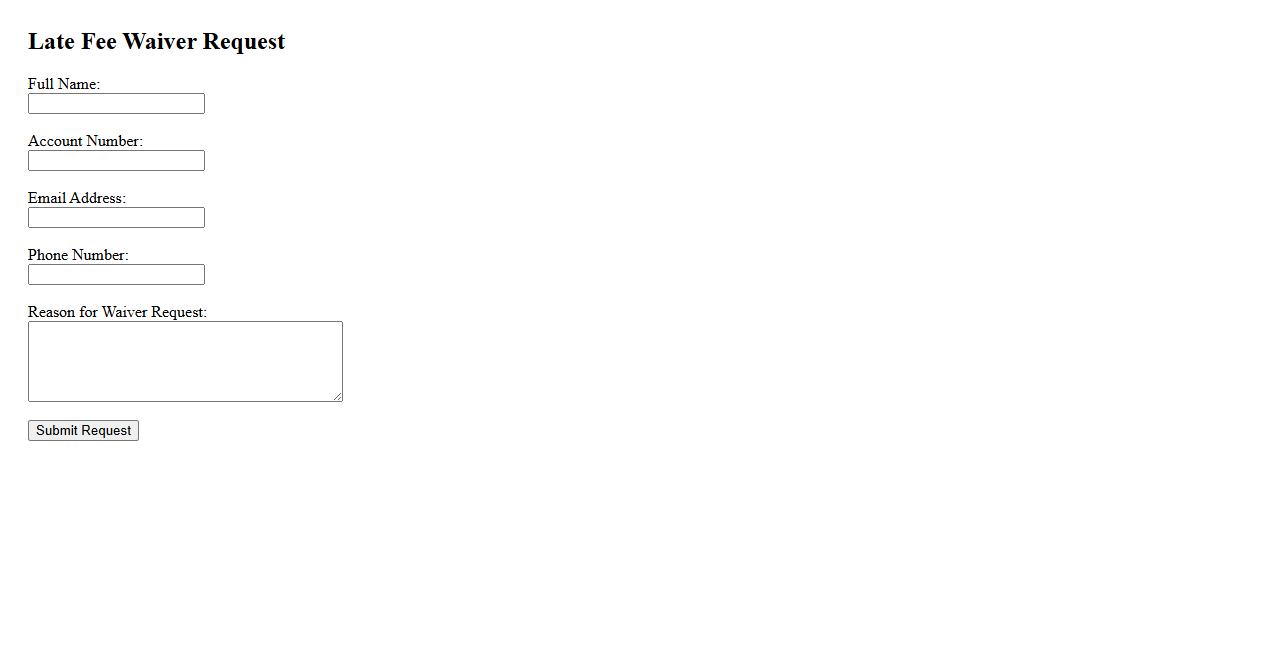

Late Fee Waiver Request

If you encountered unexpected delays causing a payment to be late, you can submit a Late Fee Waiver Request to avoid additional charges. This request allows you to explain your situation and potentially have the late fee removed. It's important to contact the billing department promptly to increase your chances of approval.

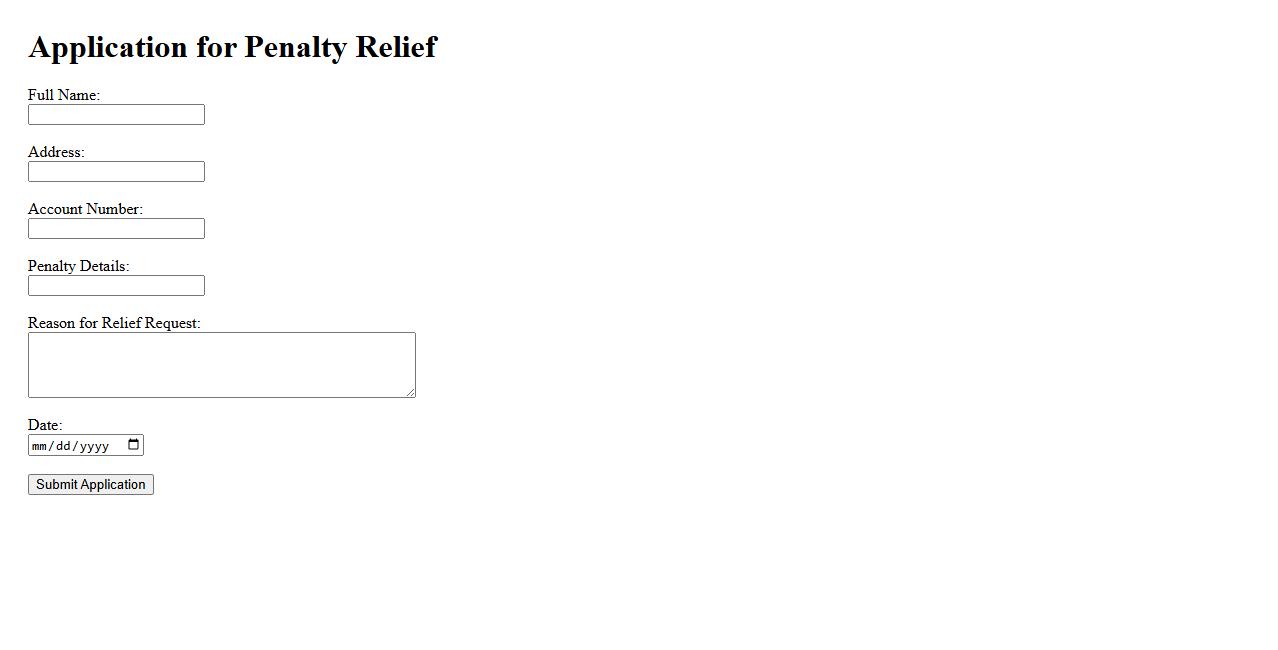

Application for Penalty Relief

Application for Penalty Relief is a formal request submitted to tax authorities to reduce or eliminate penalties incurred due to late payments or filing errors. This process helps taxpayers who faced reasonable cause or unavoidable circumstances. Successfully applying can alleviate financial burdens and restore compliance status.

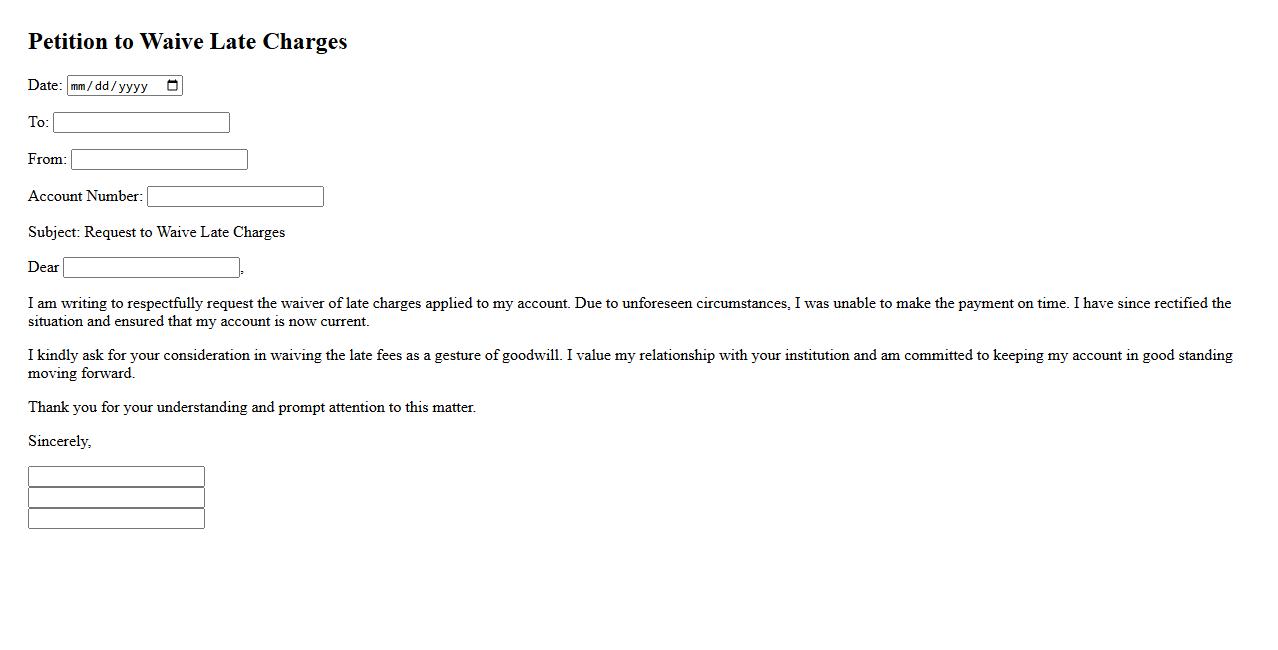

Petition to Waive Late Charges

A Petition to Waive Late Charges is a formal request submitted to a company or organization asking for the removal of fees incurred due to overdue payments. This petition typically explains valid reasons for the delay, such as financial hardship or billing errors. Successfully waiving these charges can help individuals avoid additional financial strain and maintain good credit standing.

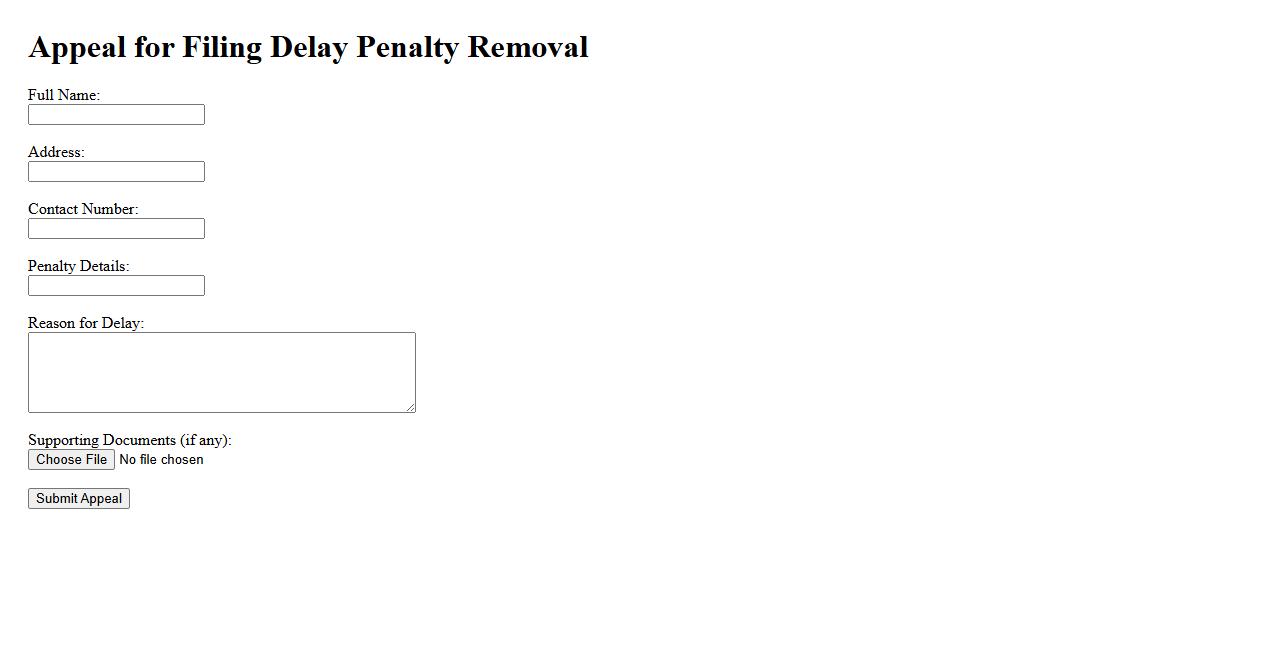

Appeal for Filing Delay Penalty Removal

If you have been charged a penalty due to a late filing, you may submit an appeal for filing delay penalty removal to request reconsideration. This process allows you to explain valid reasons, such as unforeseen circumstances or errors, that caused the delay. Successful appeals can lead to waiver or reduction of the penalty, easing your financial burden.

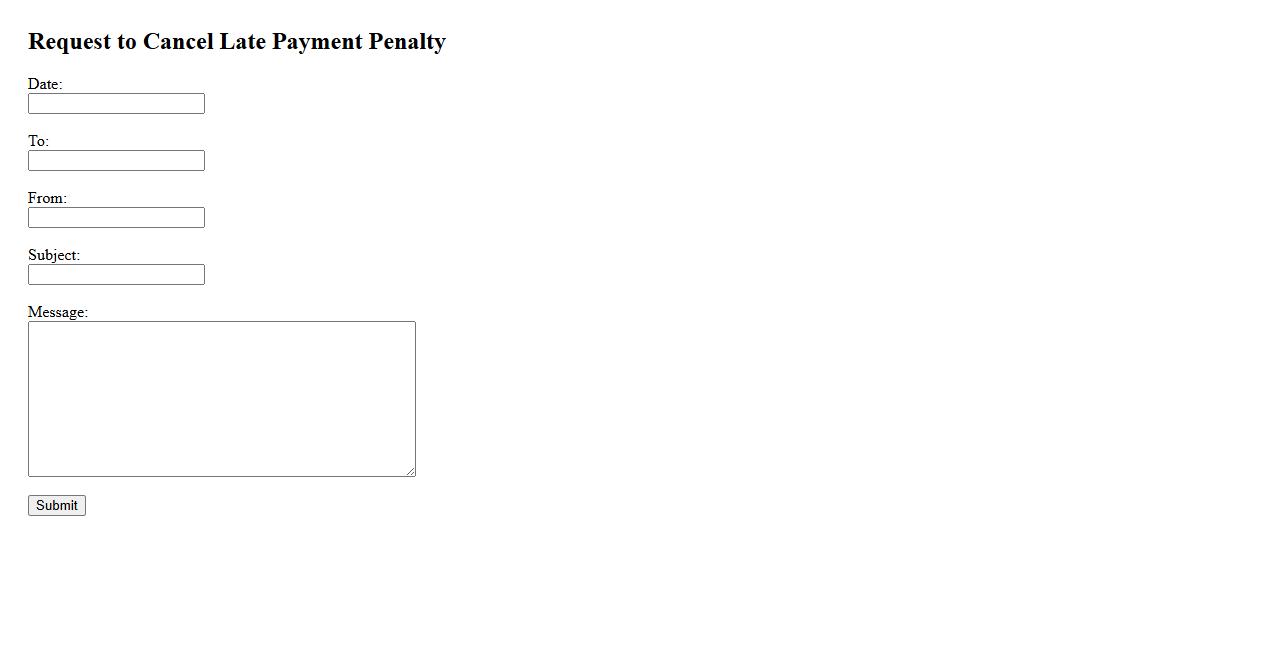

Request to Cancel Late Payment Penalty

If you believe a late payment penalty was applied in error or due to unforeseen circumstances, you can submit a formal request to cancel the fee. Provide clear details and any supporting documentation to justify your case. Timely communication increases the chances of a favorable resolution.

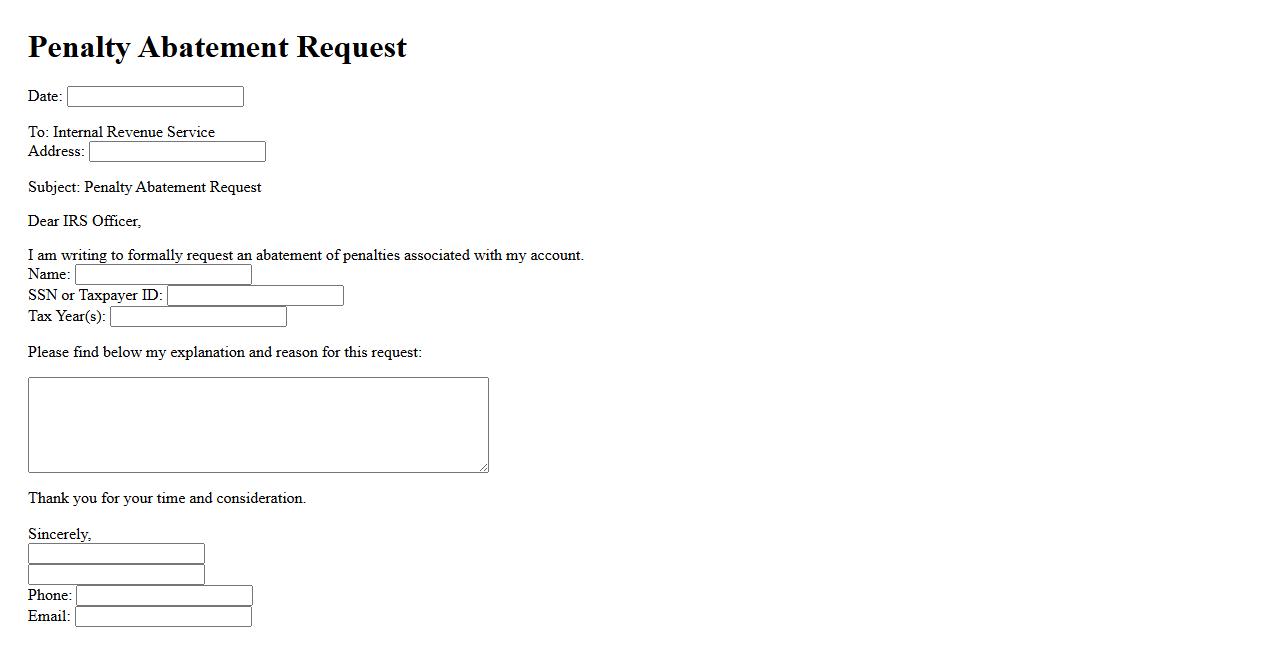

Penalty Abatement Request

A Penalty Abatement Request is a formal appeal submitted to the tax authorities to reduce or eliminate penalties assessed on a taxpayer's account. This request typically provides valid reasons such as reasonable cause or administrative errors to justify relief. Successful penalty abatement can help alleviate financial burdens resulting from late payments or filing mistakes.

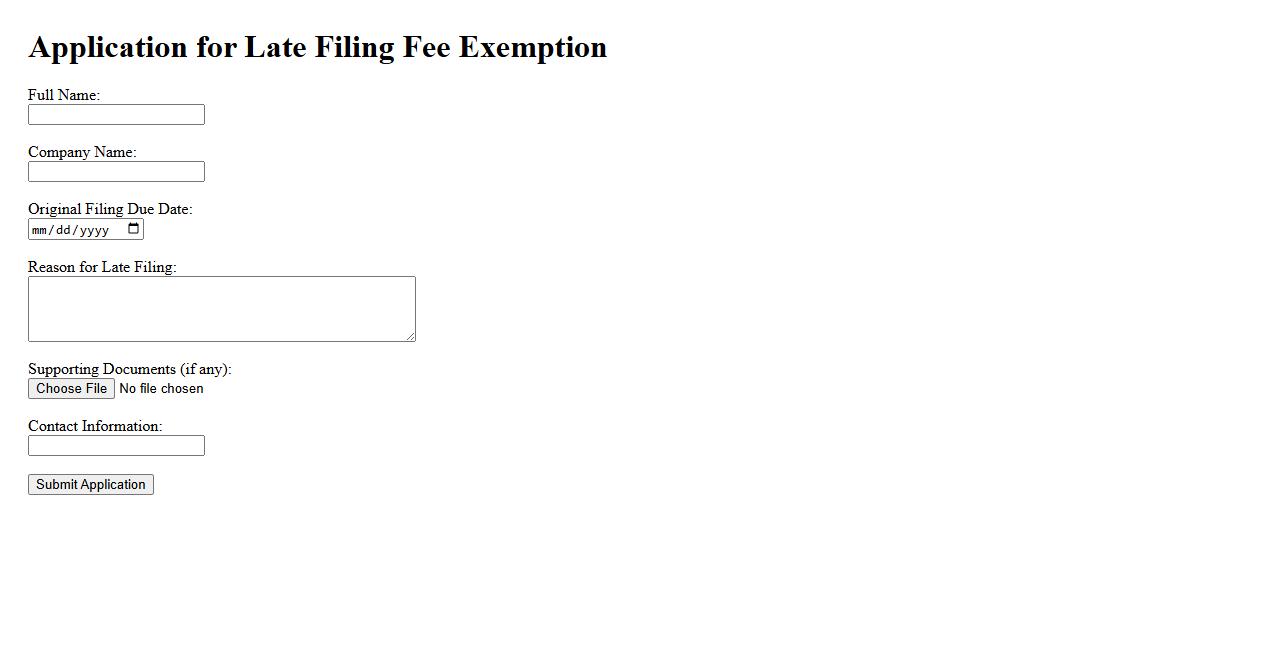

Application for Late Filing Fee Exemption

Submitting an Application for Late Filing Fee Exemption allows individuals or businesses to request a waiver of penalties due to delayed submission. This application must include valid reasons or justifications for the delay, supported by appropriate documentation. Authorities review these requests carefully to ensure fair assessment and potential fee exemption.

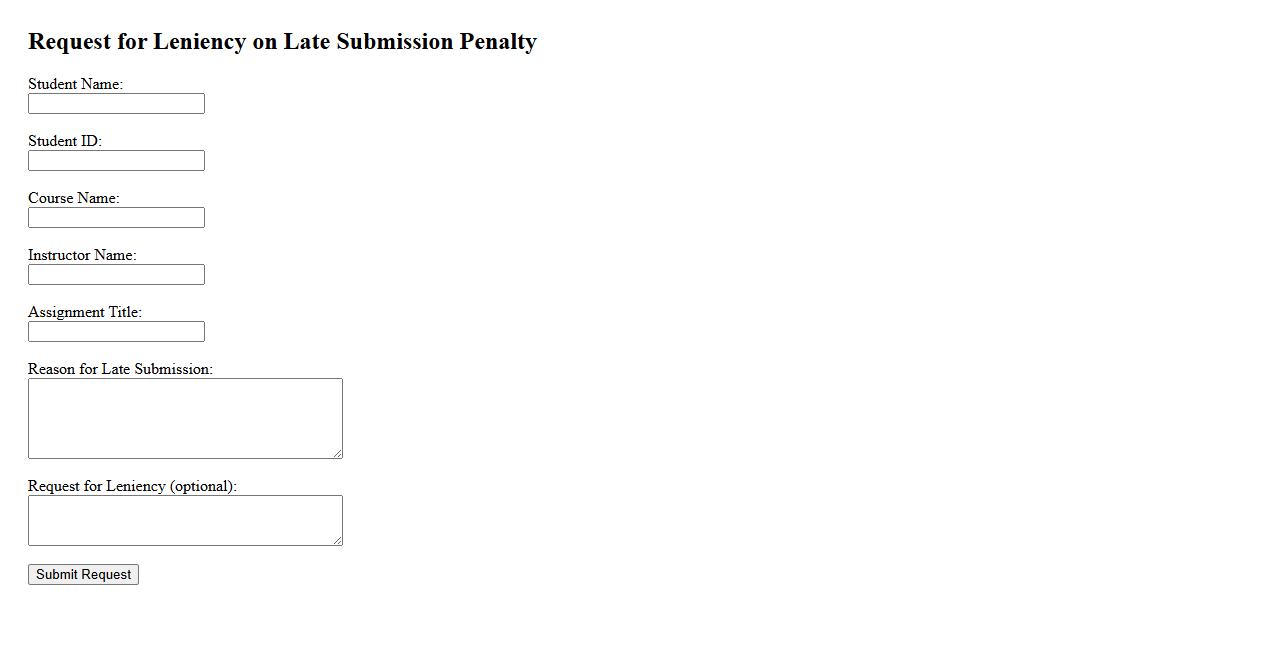

Request for Leniency on Late Submission Penalty

If you have faced unforeseen circumstances causing a delay, you may submit a Request for Leniency on Late Submission Penalty. This request allows consideration for reduced or waived penalties, ensuring fairness. Make sure to provide valid reasons and supporting evidence to strengthen your appeal.

What criteria must a taxpayer meet to qualify for a waiver of late filing penalty?

To qualify for a waiver of late filing penalty, a taxpayer must demonstrate that the failure to file on time was due to reasonable cause and not due to willful neglect. The taxpayer should have made a genuine effort to comply with the filing requirements but was prevented by circumstances beyond their control. Additionally, the taxpayer should have a history of compliance or a valid explanation for the delay, such as serious illness or natural disasters.

How does reasonable cause differ from willful neglect in the context of penalty waivers?

Reasonable cause refers to situations where the taxpayer exercised ordinary business care and prudence but was still unable to file on time due to unforeseen circumstances. In contrast, willful neglect implies a conscious, intentional failure or reckless disregard of filing responsibilities. The IRS generally denies penalty waivers when willful neglect is evident because it reflects intentional noncompliance.

What documentation is required to support a request for waiver of late filing penalty?

Supporting documentation typically includes evidence that corroborates the reasonable cause claim, such as medical records, death certificates, or proof of natural disasters. Taxpayers may also submit correspondence showing attempts to comply or repair the issue promptly after discovering the filing failure. A detailed written statement explaining the circumstances is essential to strengthen the waiver request.

Can a waiver of late filing penalty be granted automatically, or does it require formal application?

A waiver of late filing penalty generally requires a formal application submitted to the appropriate tax authority, often accompanied by a written request and supporting evidence. In some cases, minor first-time offenses may be automatically waived under the IRS First-Time Penalty Abatement policy. However, most waiver requests are reviewed on a case-by-case basis and require official approval.

Are there limitations on the number of times a taxpayer can request a late filing penalty waiver?

Yes, there are limitations on how often a taxpayer can request a waiver of the late filing penalty, particularly under programs like the IRS First-Time Penalty Abatement, which typically allows one waiver within a specified period. Repeated requests require stronger justification and documentation to prove reasonable cause. Taxpayers with frequent late filings are less likely to receive multiple waivers without exceptional circumstances.