A Waiver of Certain Overpayment Recovery allows the government or agency to forgo the collection of debt when recovering overpayments from individuals or entities. This waiver is typically granted when recovery would cause undue hardship or is not in the interest of equity and good conscience. It ensures fair treatment by preventing unfair financial burdens from overpayment adjustments.

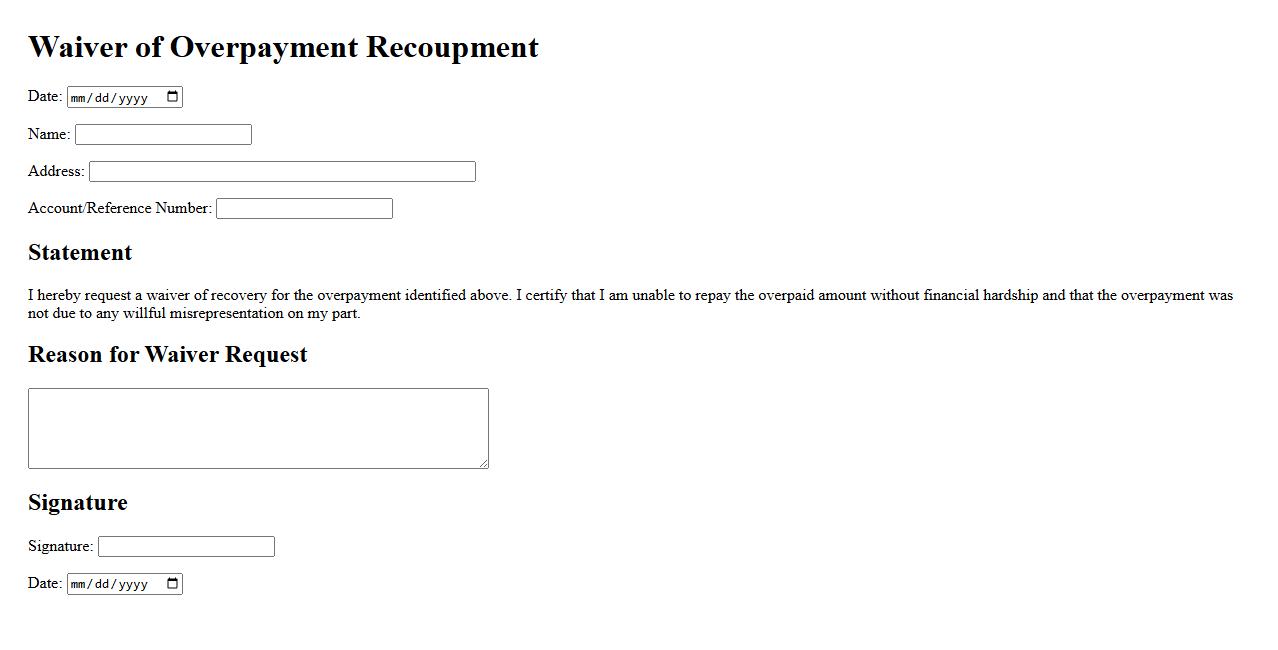

Waiver of Overpayment Recoupment

The Waiver of Overpayment Recoupment is a formal request allowing beneficiaries to avoid repayment of funds incorrectly paid to them by a government agency. This waiver is considered when the recovery would cause financial hardship or inequity. It ensures fairness by evaluating each case individually to determine if repayment should be waived.

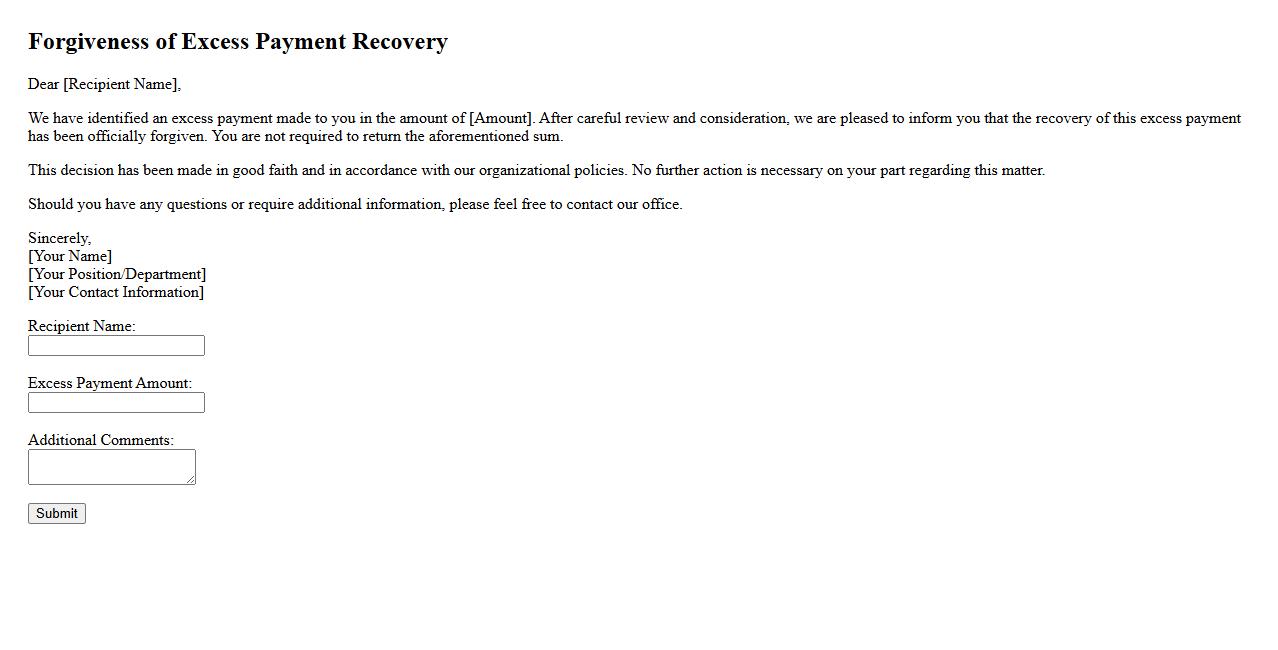

Forgiveness of Excess Payment Recovery

Forgiveness of Excess Payment Recovery refers to the process where an individual or organization is exempted from repaying surplus funds previously collected. This forgiveness typically occurs when recovery efforts are deemed unnecessary or unjust due to specific circumstances. It helps alleviate financial burdens and promotes fair treatment in financial transactions.

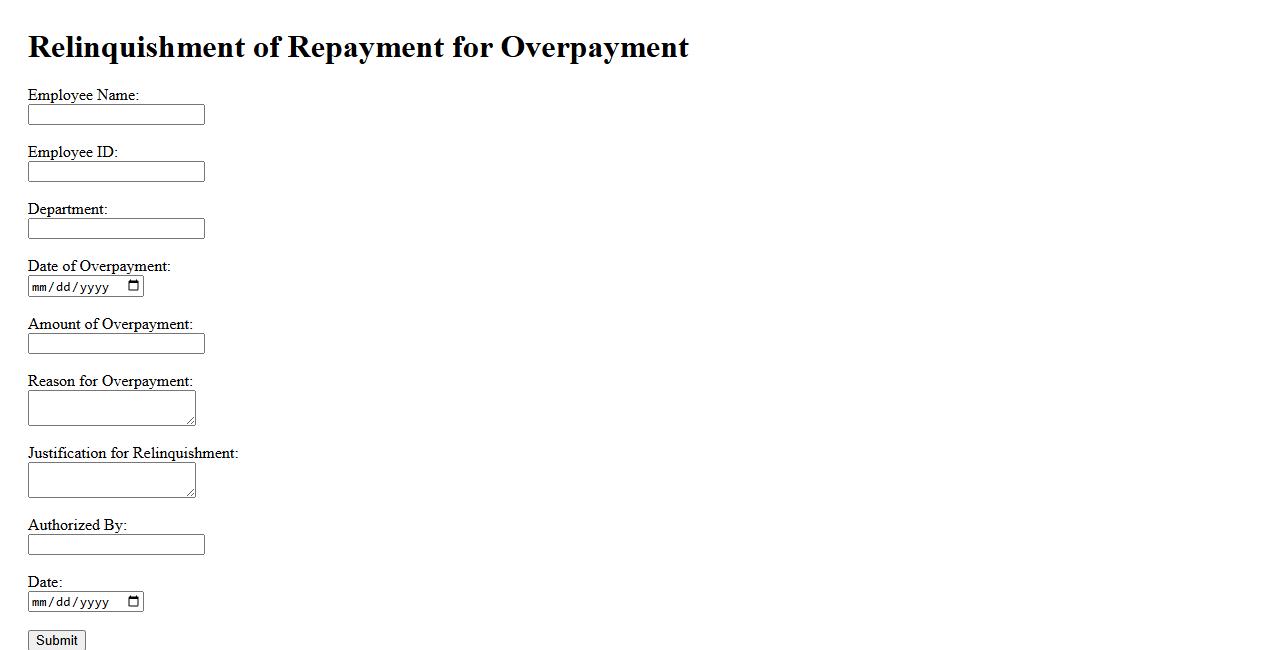

Relinquishment of Repayment for Overpayment

The Relinquishment of Repayment for Overpayment occurs when a payer decides to forgo reclaiming funds mistakenly paid in excess. This process ensures that overpaid amounts are not recovered, relieving the payee from repayment obligations. It is often used to maintain goodwill and avoid administrative complexities.

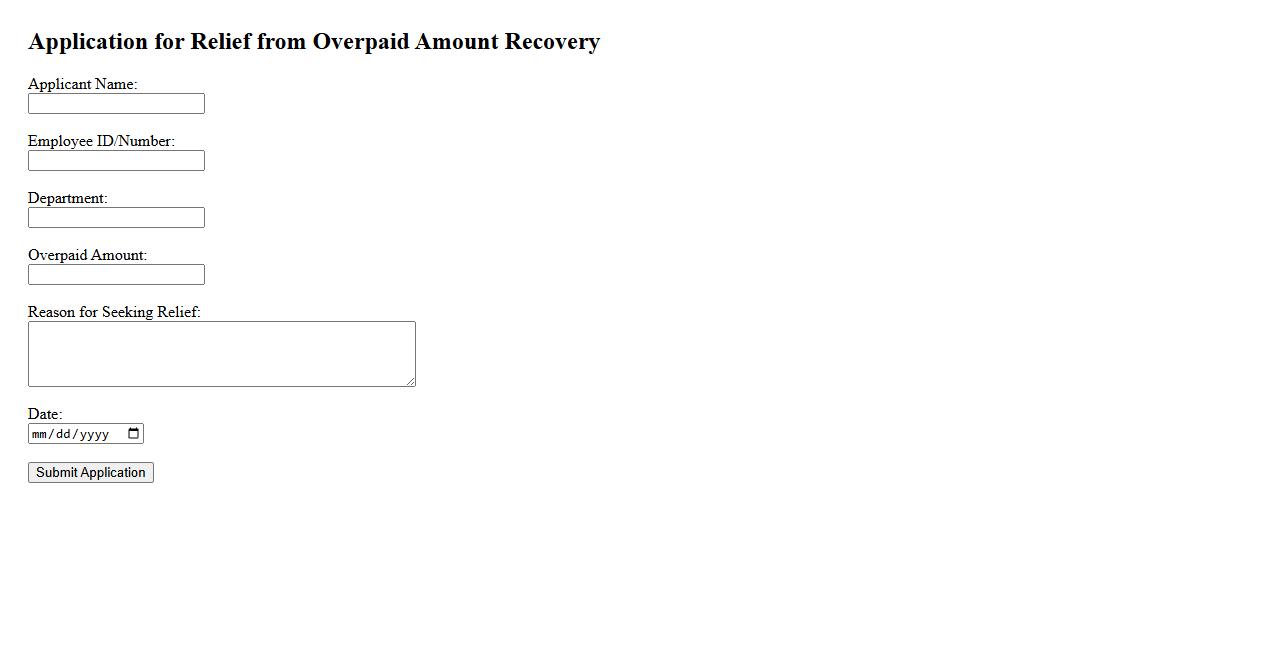

Relief from Overpaid Amount Recovery

Experiencing relief from overpaid amount recovery ensures financial stability and peace of mind. Relief from overpaid amount recovery helps individuals avoid undue stress by offering solutions to reclaim excess payments efficiently. This process streamlines reimbursement, making recovery straightforward and fair.

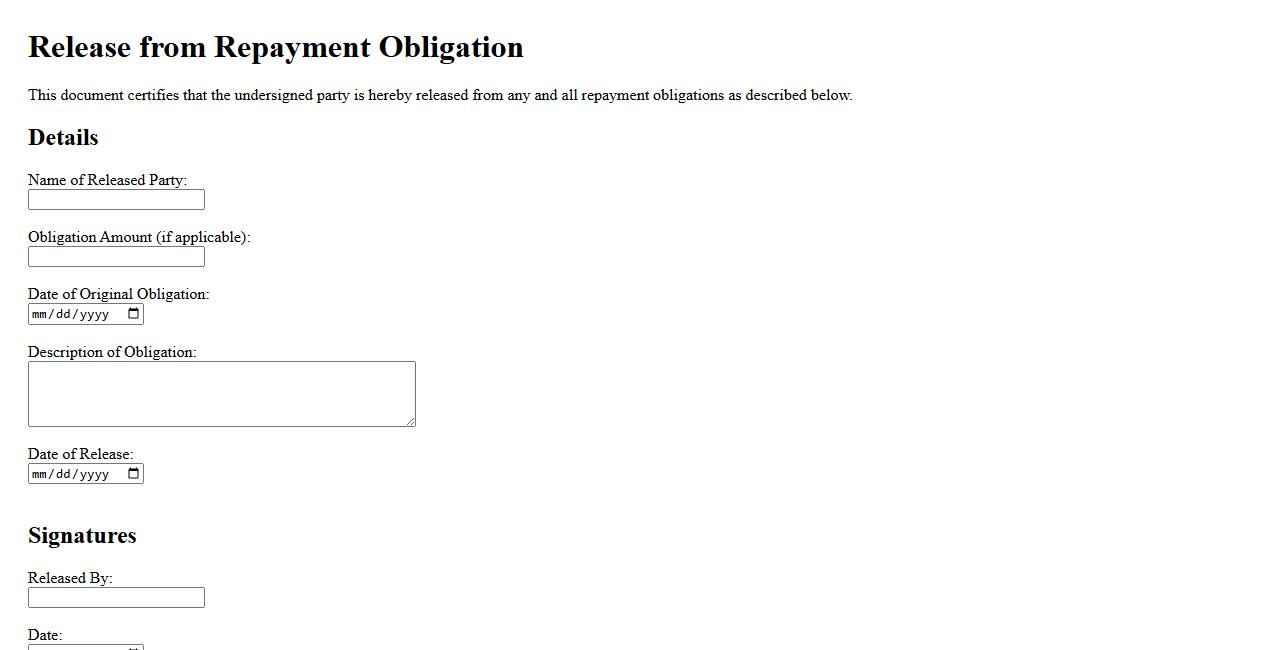

Release from Repayment Obligation

Release from Repayment Obligation occurs when a borrower is formally exempted from the responsibility to repay a loan or debt under specific conditions. This release typically happens due to forgiveness programs, error corrections, or exceptional circumstances. It provides significant financial relief and can improve the borrower's credit standing.

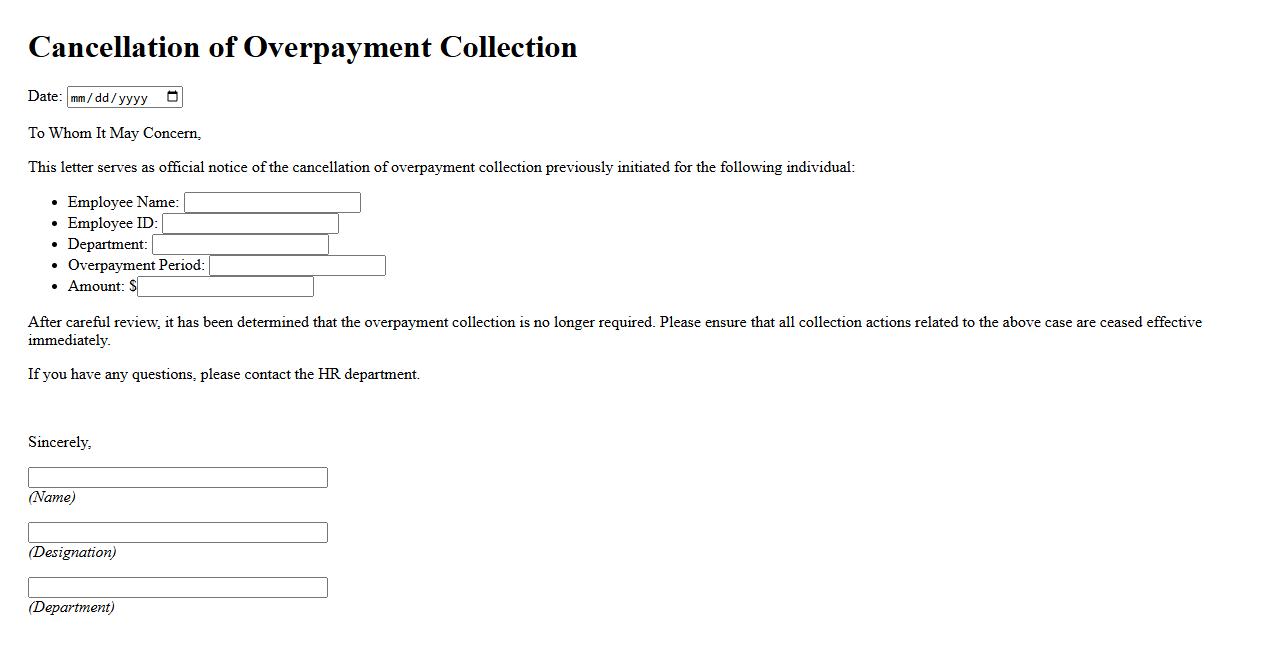

Cancellation of Overpayment Collection

The Cancellation of Overpayment Collection refers to the process of stopping the recovery of funds that were previously identified as an overpayment. This action is typically taken when the initial determination of overpayment is found to be incorrect or unjustified. It ensures that no further deductions or repayments occur, protecting the individual's financial interests.

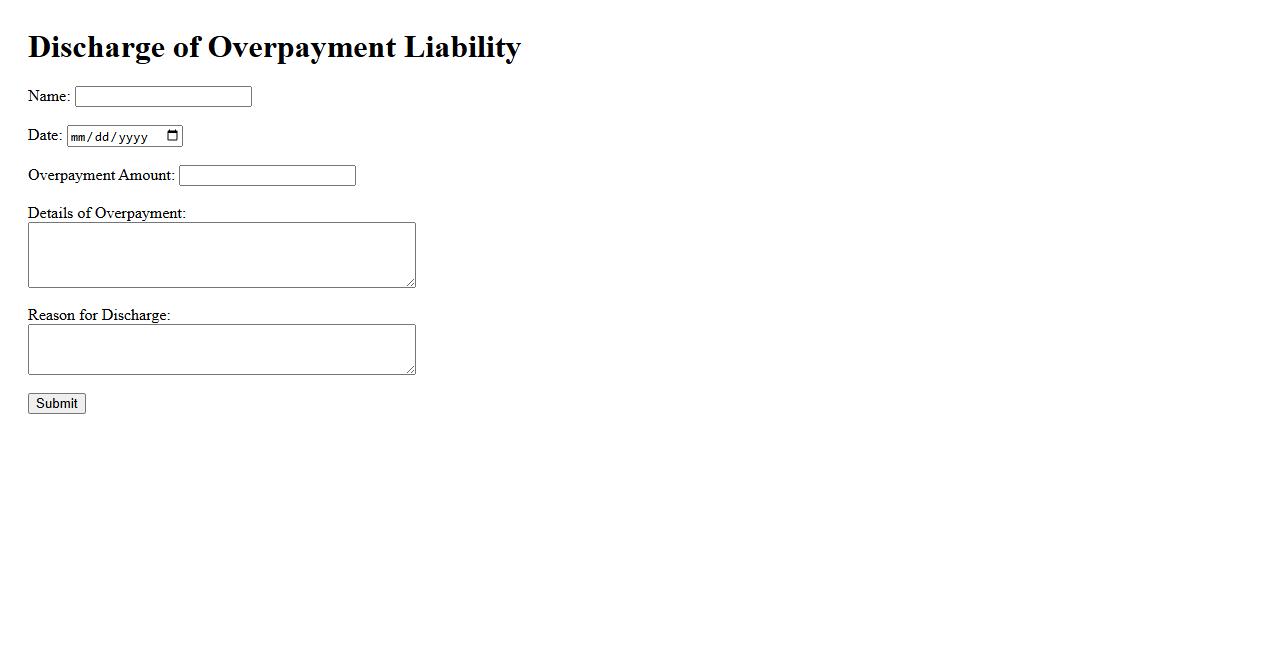

Discharge of Overpayment Liability

The discharge of overpayment liability occurs when a debtor is relieved from the obligation to repay funds that were overpaid, often through legal or administrative processes. This discharge can be granted in cases such as bankruptcy or financial hardship, ensuring fair resolution for both parties. It helps maintain financial balance and protects individuals from undue debt burdens.

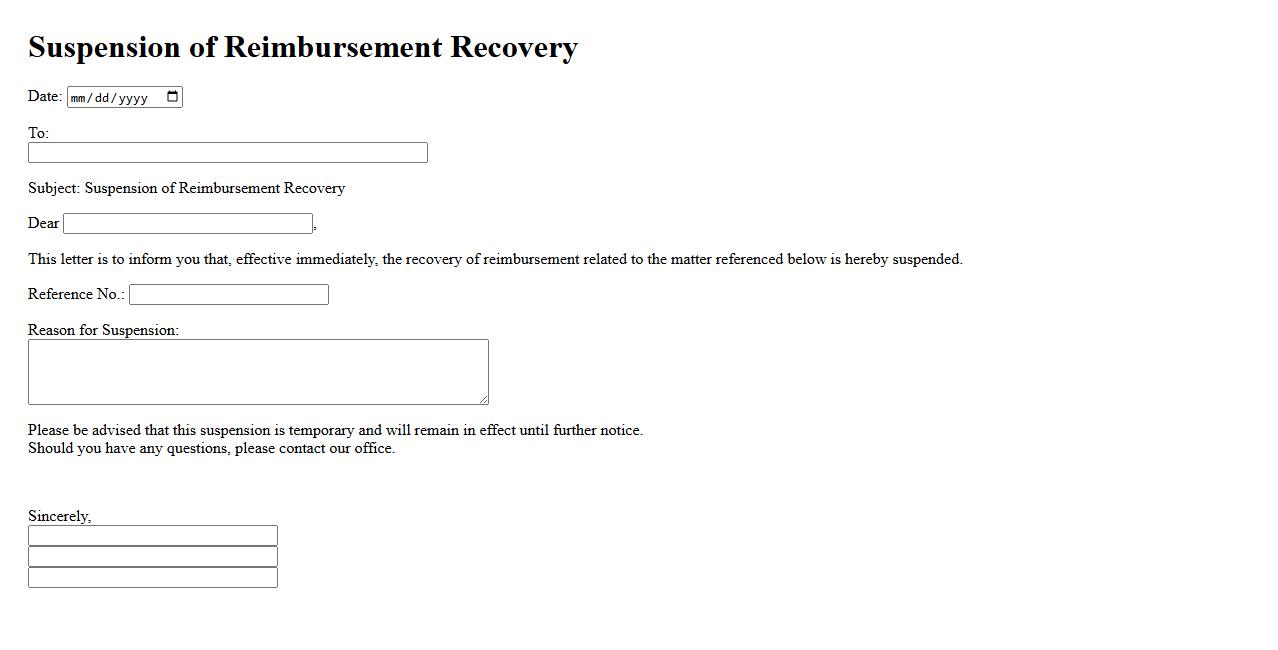

Suspension of Reimbursement Recovery

Suspension of Reimbursement Recovery refers to the temporary halt in the process of reclaiming funds previously disbursed. This suspension allows organizations to review and address any disputes or discrepancies before resuming recovery efforts. It ensures fairness and accuracy in financial adjustments.

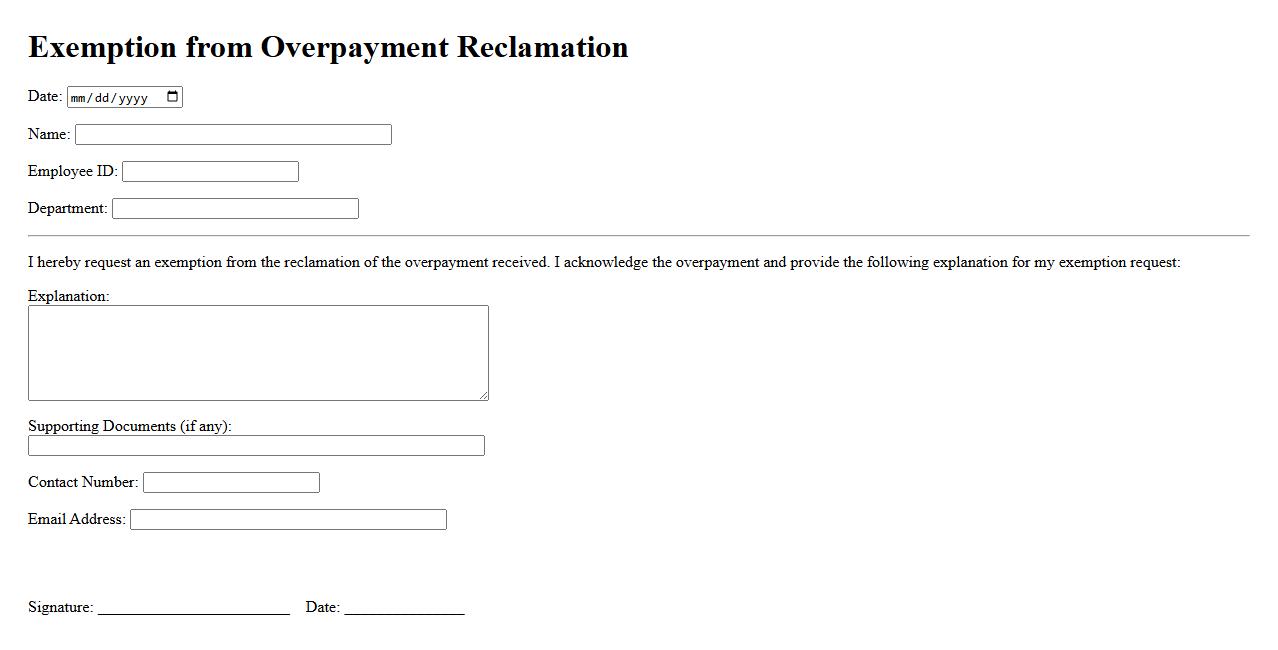

Exemption from Overpayment Reclamation

Exemption from Overpayment Reclamation protects recipients from having to repay excess funds that were mistakenly issued. This safeguard ensures financial stability by preventing undue hardship caused by reclaiming overpayments. It is crucial for maintaining fairness in benefit programs and preventing undue stress on individuals.

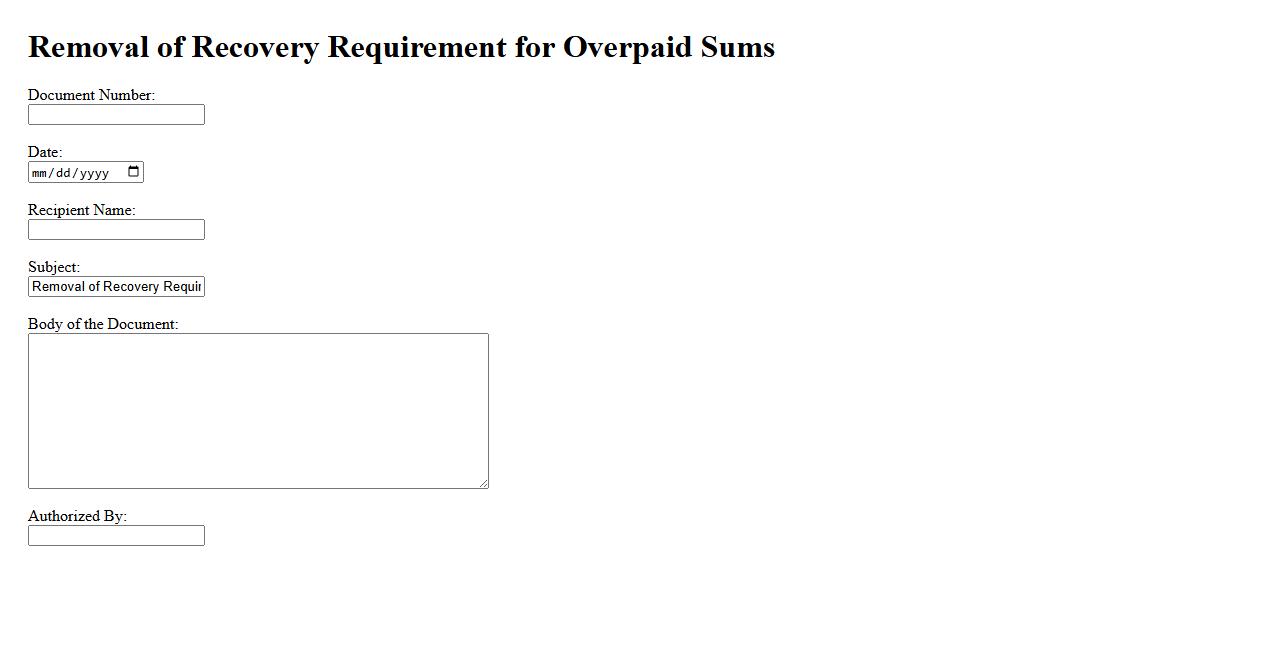

Removal of Recovery Requirement for Overpaid Sums

The removal of recovery requirement for overpaid sums allows individuals or entities to retain funds previously identified as overpayments without the obligation to repay. This policy simplifies administrative processes and reduces financial burdens on recipients. It ensures fair treatment by acknowledging errors in payment calculations or processing.

What criteria determine eligibility for a waiver of overpayment recovery in the document?

Eligibility for a waiver of overpayment recovery is primarily based on the claimant's financial hardship and ability to repay. The document emphasizes that the overpayment must not be due to the claimant's fault or negligence. Additionally, the claimant must demonstrate that recovery would be against equity or good conscience under the specified guidelines.

Under what circumstances can recovery of overpaid amounts be considered against equity or good conscience?

Recovery is considered against equity or good conscience if repayment causes undue hardship or if the claimant has relied on the funds to their detriment. The document highlights situations where the claimant relinquishes a valuable right or changes their position based on the overpaid funds. Such circumstances justify waiving recovery to avoid unfair outcomes.

What procedural steps must a claimant follow to request a waiver of overpayment recovery?

A claimant must submit a formal written request clearly stating the reasons for the waiver. The document requires inclusion of relevant evidence of financial hardship and any factors impacting good conscience. The request is then reviewed by the designated authority to determine eligibility for the waiver.

Which types of overpayments are explicitly excluded from waiver consideration in the document?

Overpayments resulting from the claimant's intentional fraud or willful misrepresentation are explicitly excluded from waiver consideration. The document also disallows waivers for overpayments caused by administrative errors attributable to the claimant's negligence. These exclusions ensure that waivers are reserved for unintentional and mitigating circumstances only.

How does the document define administrative error in relation to granting an overpayment recovery waiver?

Administrative error is defined as a mistake made by the agency or its representatives during the processing of benefits. The document clarifies that if an overpayment arises solely from such an error, the claimant may be eligible for a waiver. This distinction underscores the agency's responsibility in preventing improper recoveries due to its own errors.