A Waiver of Medical Coverage allows employees to decline employer-provided health insurance when they have alternate coverage. This waiver helps avoid duplicate premiums and ensures compliance with company policies. Employees must typically provide proof of other valid medical insurance to qualify for the waiver.

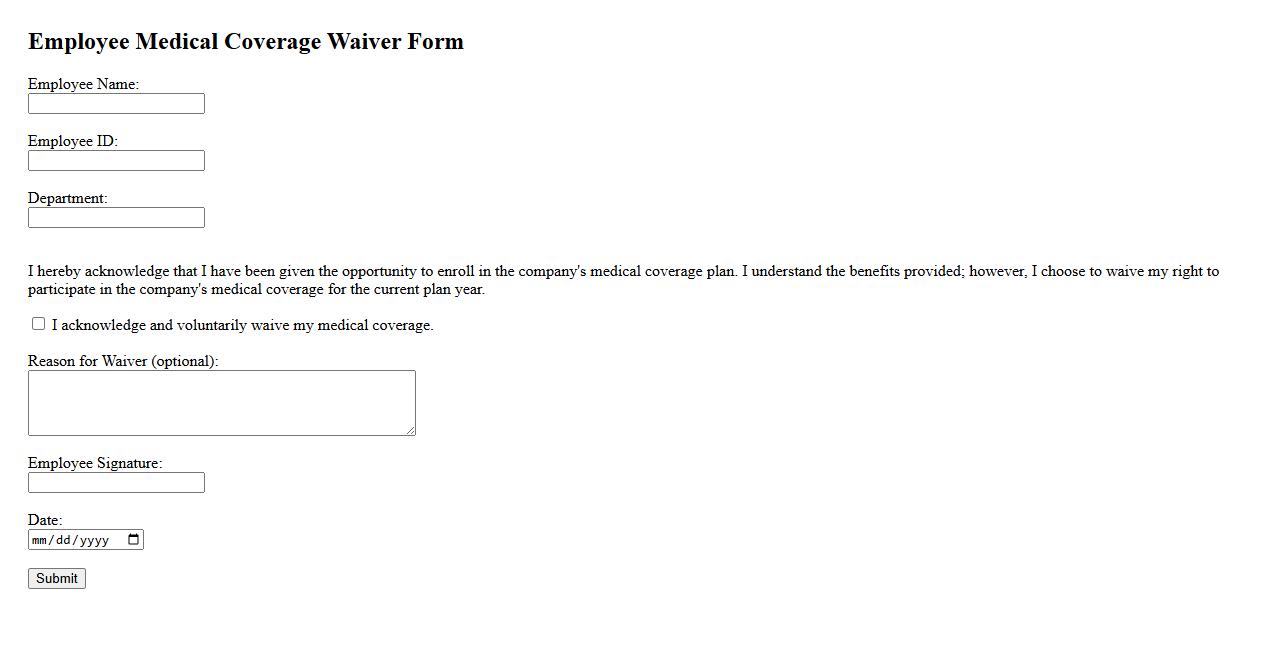

Employee Medical Coverage Waiver

The Employee Medical Coverage Waiver allows eligible employees to opt out of employer-provided health insurance plans. This waiver is typically used when employees have alternative medical coverage through a spouse or other means. It helps reduce costs for both the employee and employer while ensuring necessary healthcare options are maintained.

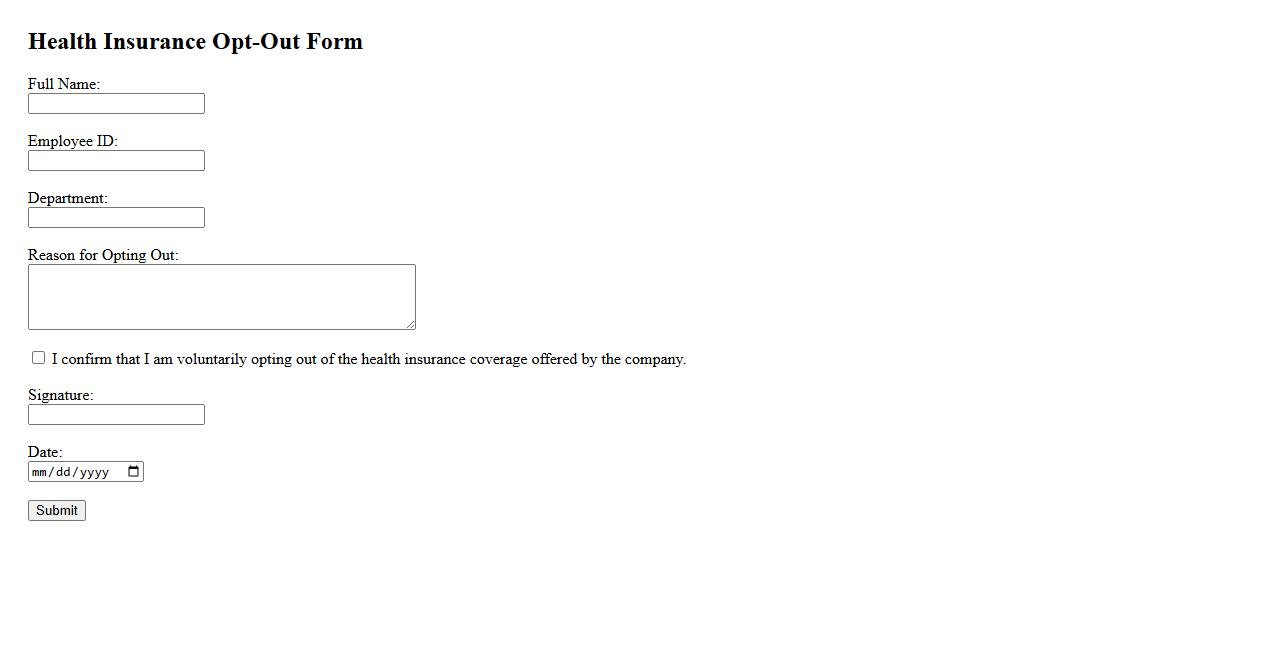

Health Insurance Opt-Out Form

The Health Insurance Opt-Out Form allows employees to decline employer-provided health insurance coverage. This form is essential for those who have alternative insurance plans or do not require coverage. Submitting the form ensures proper documentation and compliance with company policies.

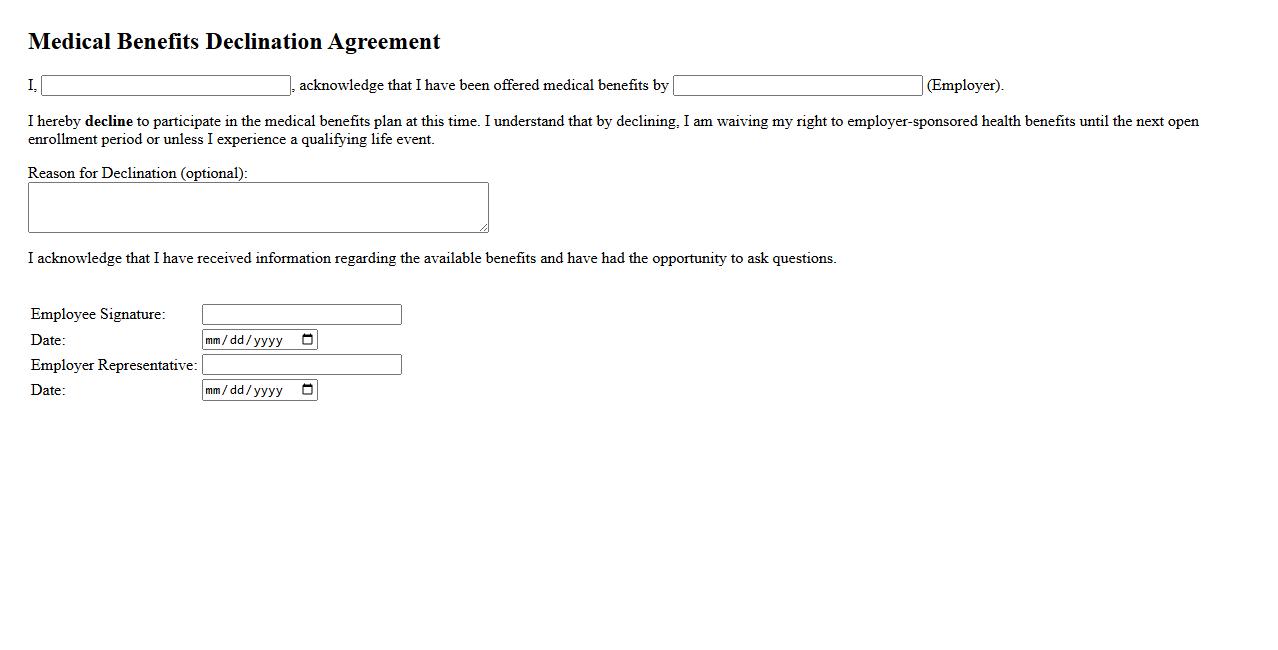

Medical Benefits Declination Agreement

A Medical Benefits Declination Agreement is a formal document that allows employees to waive their employer-provided health insurance coverage. This agreement ensures that the employee acknowledges the choice to decline benefits and understands the potential implications. It is important for both legal protection and clarity in employment records.

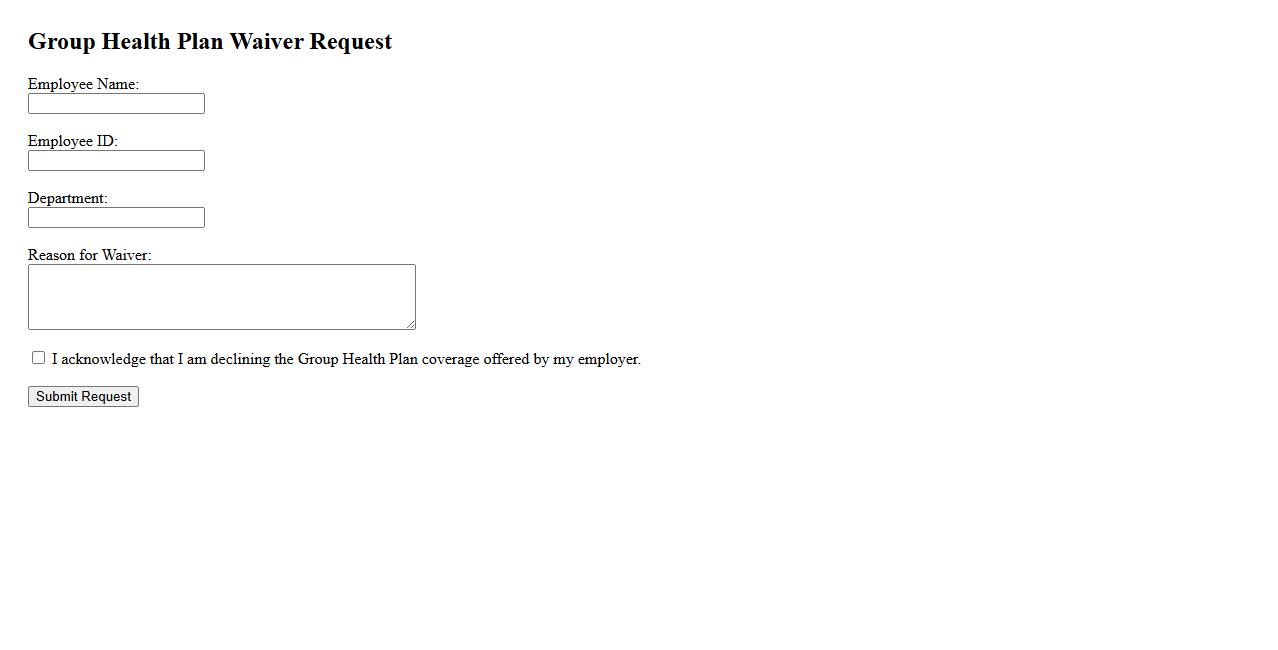

Group Health Plan Waiver Request

A Group Health Plan Waiver Request allows employees to decline coverage under their employer's health insurance plan, often because they have alternative insurance. This request helps streamline benefits management and ensures accurate payroll deductions. Employers typically require this waiver to confirm that employees understand their coverage options.

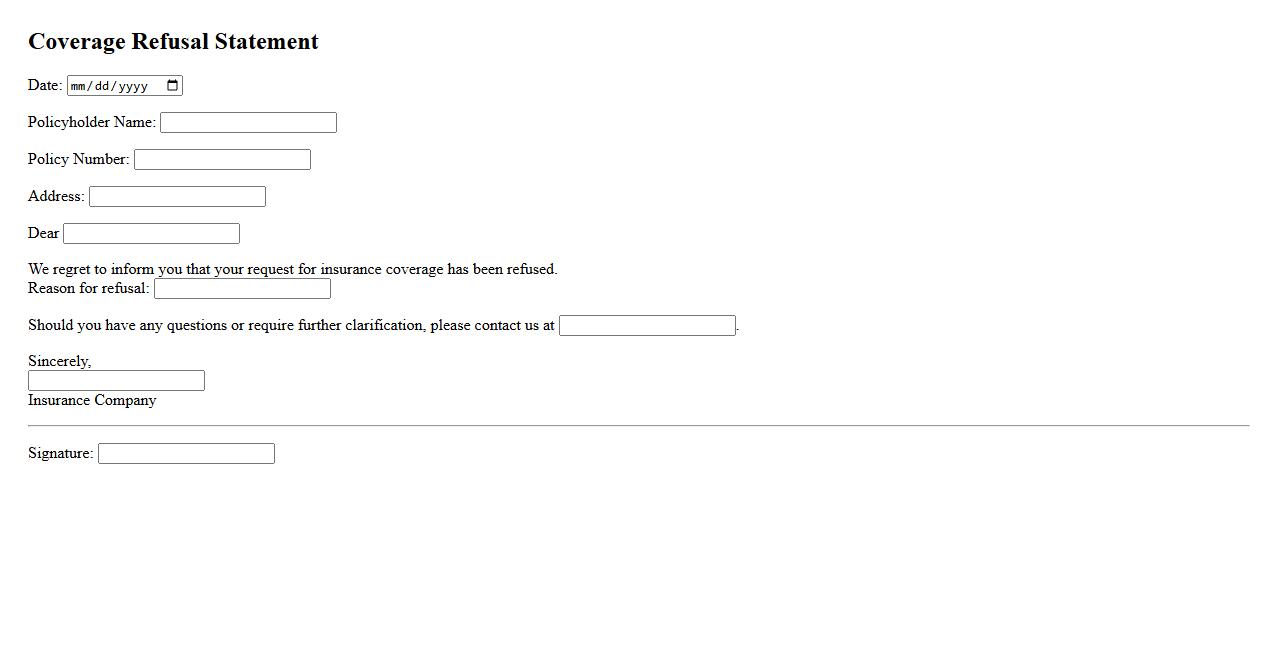

Coverage Refusal Statement

The Coverage Refusal Statement is a document used to formally decline insurance coverage offered by a provider. It ensures that all parties acknowledge the refusal and understand the potential risks involved. This statement is important for maintaining clear communication and avoiding future disputes regarding coverage.

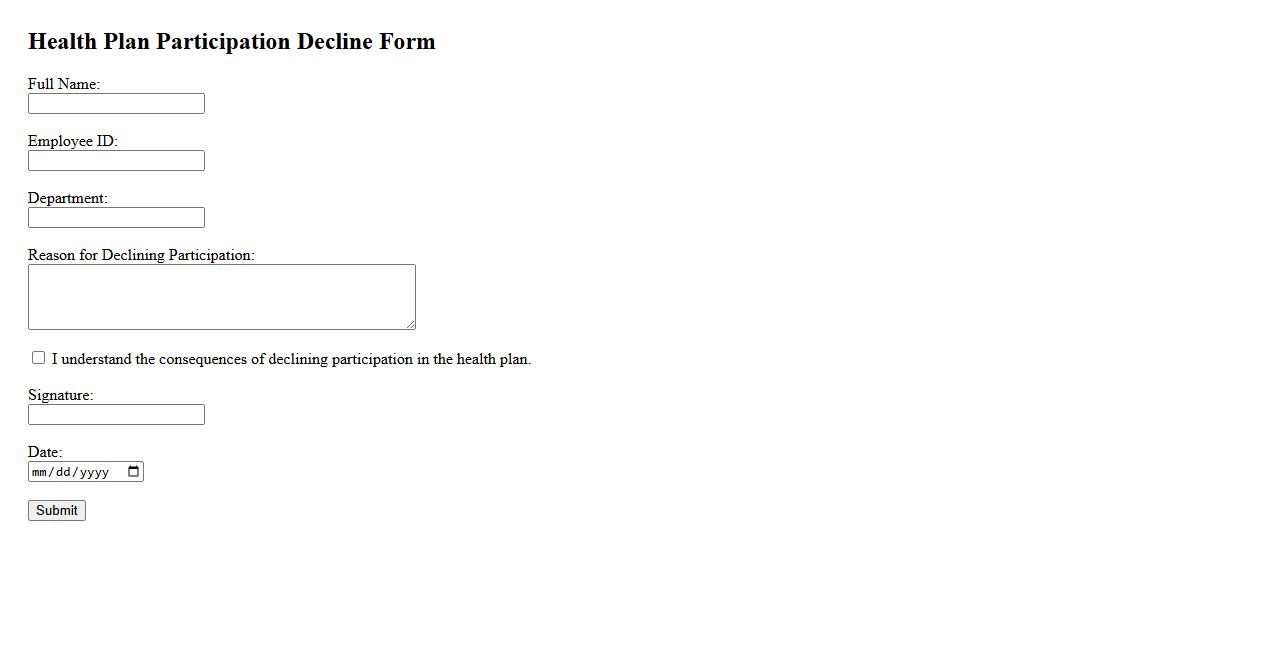

Health Plan Participation Decline

The recent health plan participation decline highlights a growing concern among insurance providers and policyholders. Factors such as rising premiums and limited coverage options contribute to fewer individuals enrolling in available plans. Understanding this trend is crucial for developing strategies to improve access and affordability in healthcare.

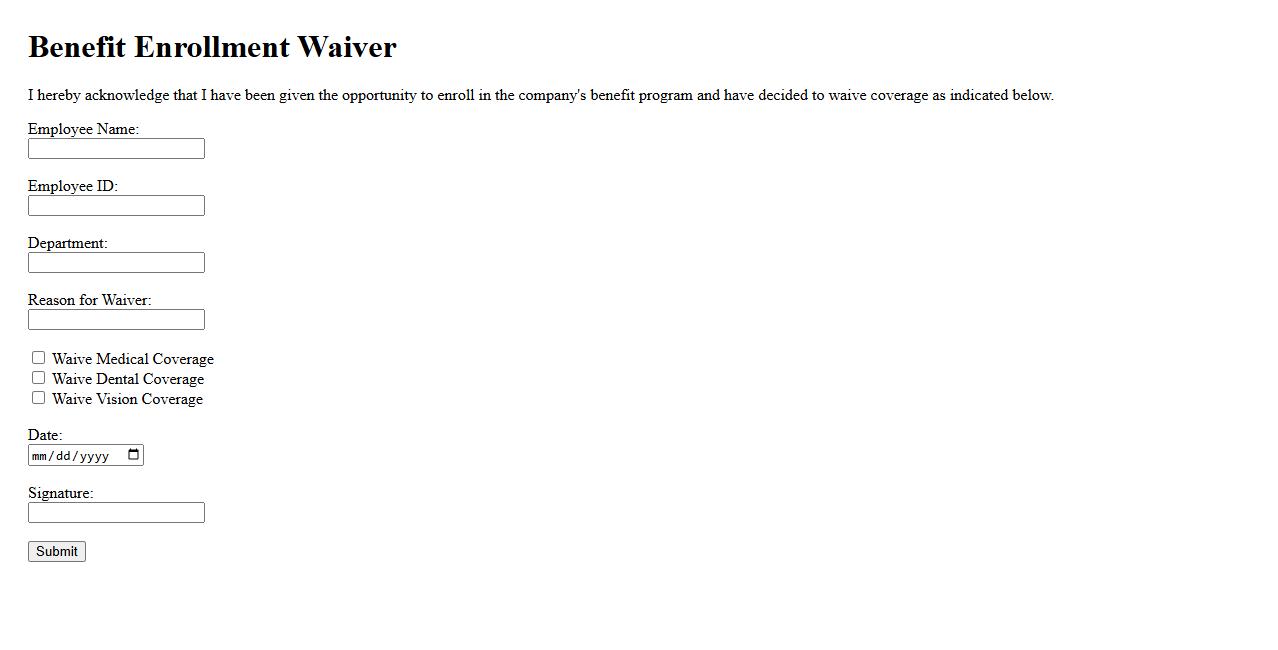

Benefit Enrollment Waiver

The Benefit Enrollment Waiver allows employees to opt out of employer-sponsored health plans, often due to alternative coverage options. This waiver is essential for those who have valid reasons not to participate, ensuring they understand the implications of not enrolling. Proper submission of this waiver helps maintain accurate records and compliance with company policies.

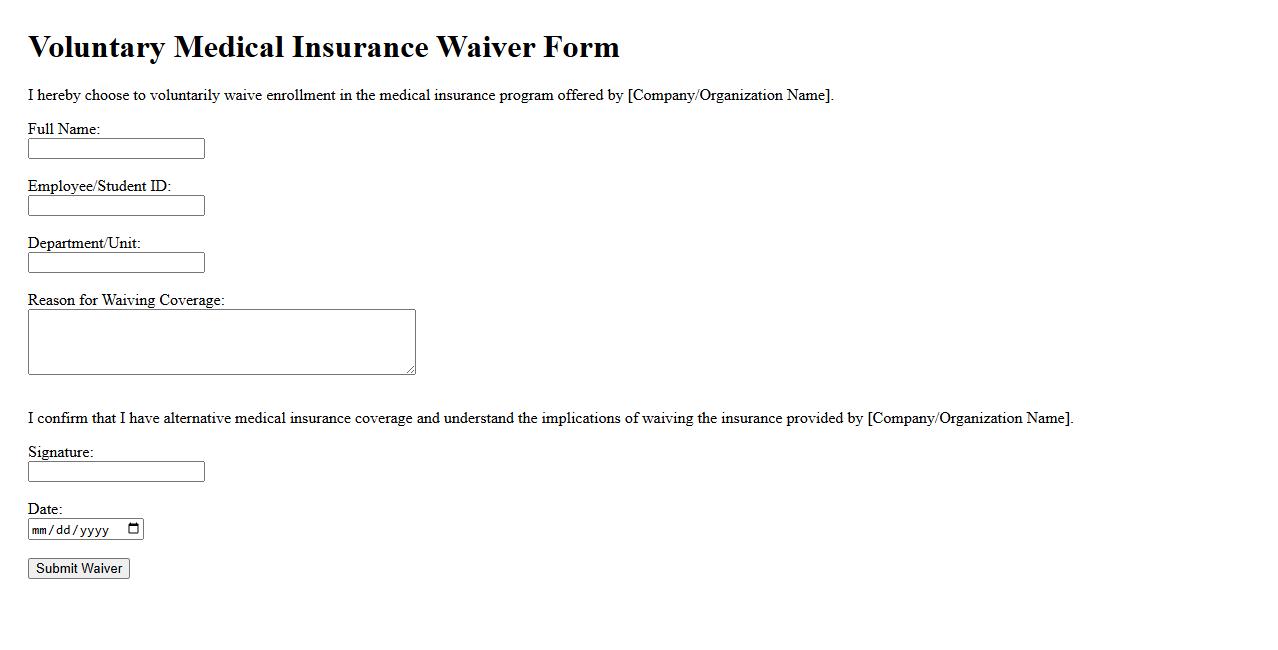

Voluntary Medical Insurance Waiver

The Voluntary Medical Insurance Waiver allows individuals to opt out of standard medical insurance coverage if they have alternative valid insurance. This waiver ensures that participants are not duplicated in coverage unnecessarily, reducing costs. It is important to review eligibility criteria carefully before applying for the waiver.

Medical Coverage Exemption Form

The Medical Coverage Exemption Form is a crucial document for individuals seeking to opt out of standard health insurance plans due to specific medical circumstances. This form ensures that qualified applicants are exempted from mandatory coverage requirements without penalties. Proper submission and approval of the Medical Coverage Exemption Form allow for compliance with health regulations while addressing unique medical needs.

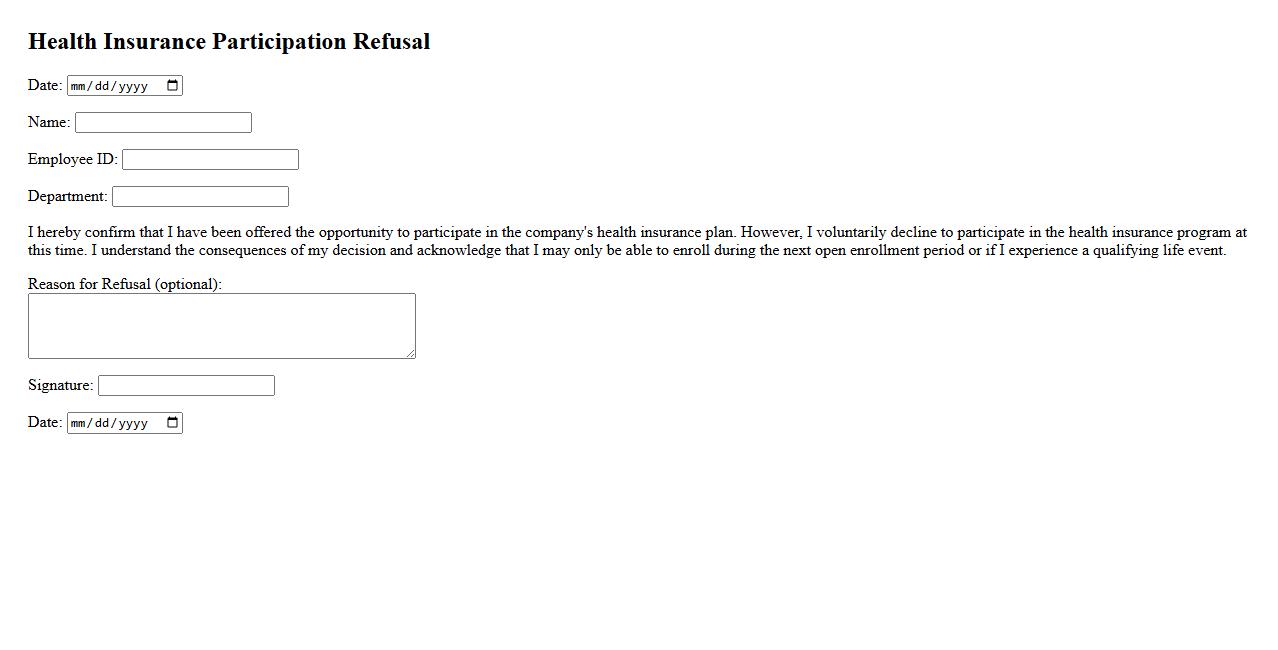

Health Insurance Participation Refusal

Health Insurance Participation Refusal occurs when an individual or employer declines to enroll in a health insurance plan, often due to cost concerns or personal beliefs. This refusal can lead to significant financial risks, especially in cases of medical emergencies. Understanding the implications of opting out is crucial for making informed healthcare decisions.

What is the primary purpose of a Waiver of Medical Coverage document?

The primary purpose of a Waiver of Medical Coverage document is to allow employees or individuals to officially decline or opt out of employer-sponsored medical insurance. This document ensures that the individual acknowledges their decision to not participate in the offered health plan. It protects the employer by confirming that coverage was offered and refused voluntarily.

Which types of alternative coverage generally qualify for waiving employer-sponsored medical insurance?

Common types of alternative coverage that qualify for waiving employer-sponsored medical insurance include coverage through a spouse's health plan, government programs such as Medicare or Medicaid, and individual health insurance plans purchased independently. These options must provide comparable benefits for the waiver to be valid. Employers often require proof of this alternative coverage before approving a waiver.

What are the potential consequences of signing a Waiver of Medical Coverage form?

By signing a Waiver of Medical Coverage form, individuals may lose employer-sponsored benefits and could face gaps in health insurance coverage. In some cases, they might not be able to re-enroll until the next open enrollment period or a qualifying event occurs. It is important to understand that waiving coverage can also lead to out-of-pocket medical expenses if alternative insurance is insufficient.

Who is eligible to complete and submit a Waiver of Medical Coverage?

Eligibility to complete a Waiver of Medical Coverage typically extends to employees who are offered health insurance through their employer or plan administrators. Dependents or family members generally cannot submit a waiver on behalf of the employee. The person waiving coverage must have access to alternative acceptable medical insurance.

What information must be provided when filling out a Waiver of Medical Coverage?

When filling out a Waiver of Medical Coverage form, individuals are usually required to provide personal details, including name, employee ID, and date of birth. They must also specify the type of alternative coverage they have, details about that coverage, and sometimes attach proof of insurance. Additionally, the form requires a signature and date to validate the waiver.