The Waiver of Overpayment of Federal Benefits allows recipients to avoid repaying amounts mistakenly issued due to no fault of their own. This process requires demonstrating financial hardship or error to qualify for relief from repayment obligations. It ensures fairness by preventing undue burden on beneficiaries facing overpayment situations.

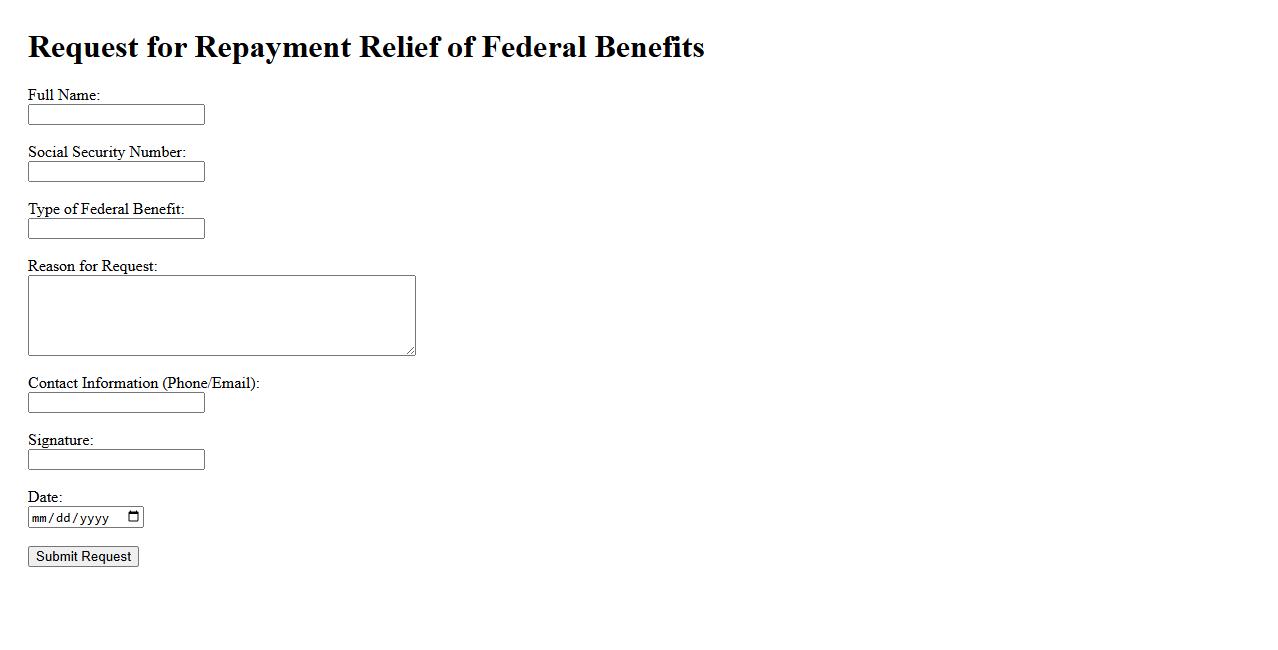

Request for Repayment Relief of Federal Benefits

If you are facing financial difficulties, you may consider submitting a Request for Repayment Relief of Federal Benefits. This allows individuals to seek modifications or forgiveness of repayment obligations on federal funds. Timely applications can provide essential assistance during periods of economic hardship.

Appeal for Federal Benefits Overpayment Forgiveness

Filing an Appeal for Federal Benefits Overpayment Forgiveness allows individuals to challenge and potentially reduce repayments required for received federal benefits. This process ensures that claimants have an opportunity to explain circumstances leading to overpayment. Timely and properly submitted appeals can result in forgiveness or adjustment of the debt.

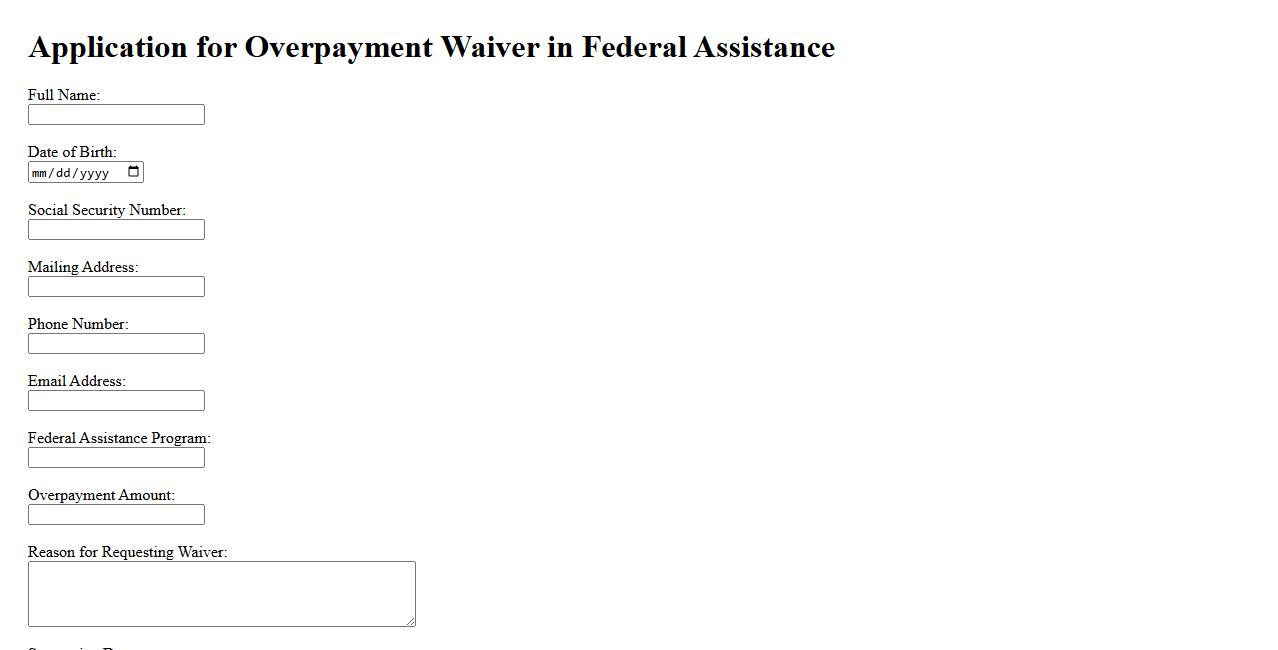

Application for Overpayment Waiver in Federal Assistance

The Application for Overpayment Waiver in Federal Assistance allows individuals to request forgiveness of an overpaid amount in government benefits. This process ensures that borrowers can seek relief when repayment of excess funds causes financial hardship. Proper submission of the application can help maintain eligibility and avoid repayment obligations.

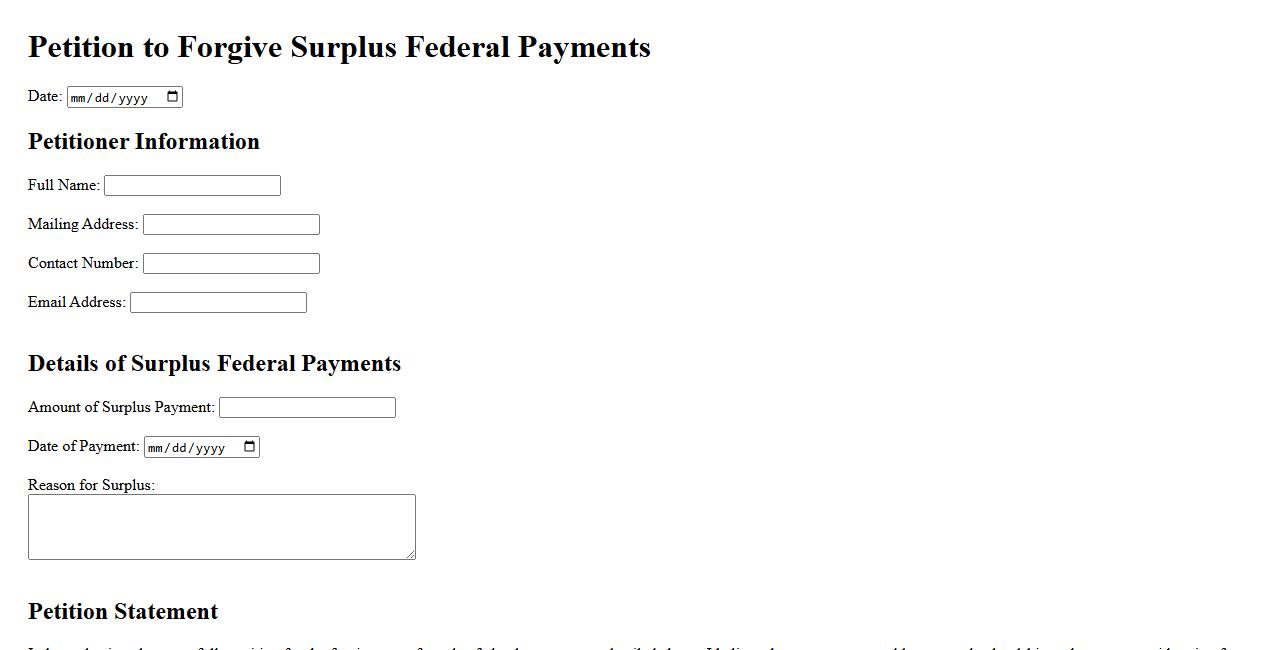

Petition to Forgive Surplus Federal Payments

The Petition to Forgive Surplus Federal Payments allows individuals to formally request the cancellation of excess funds paid to the federal government. This process helps taxpayers avoid financial hardship by seeking relief from overpayments. Timely submission and proper documentation are essential for successful petition consideration.

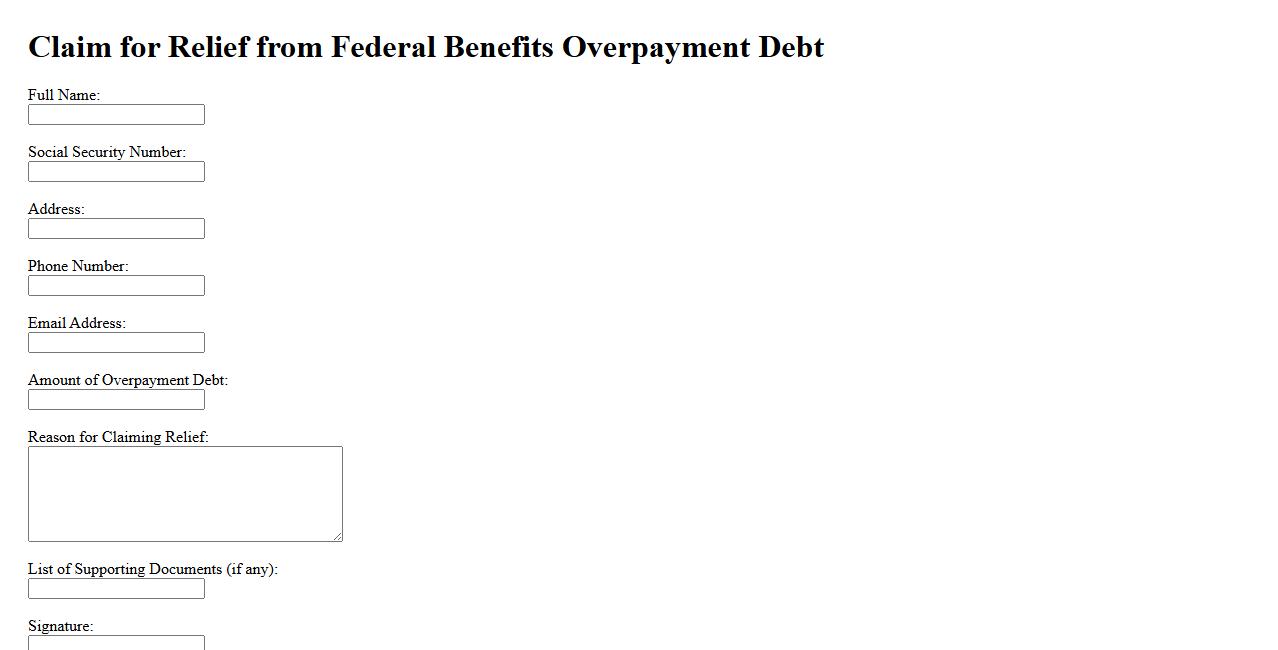

Claim for Relief from Federal Benefits Overpayment Debt

If you believe you have been wrongly charged, you can file a Claim for Relief from Federal Benefits Overpayment Debt to seek a reduction or waiver of the repayment. This process is designed to provide financial relief when recovering the full amount would cause hardship. Timely submission with supporting evidence is essential to improve your chances of approval.

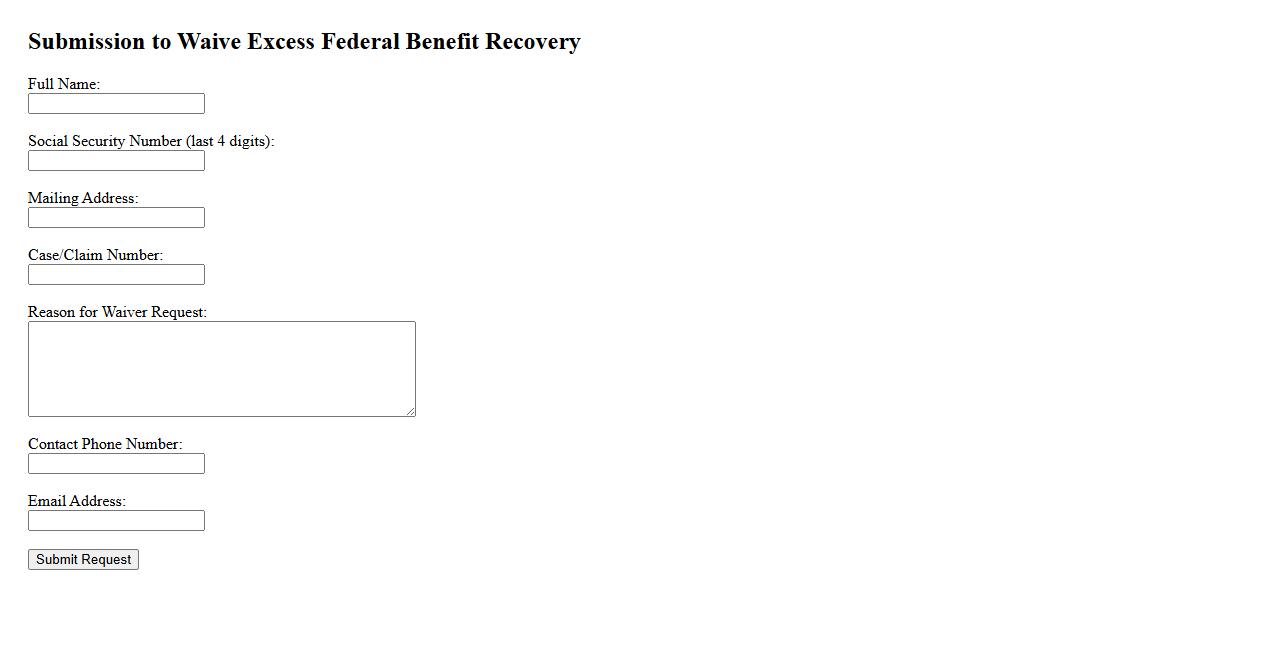

Submission to Waive Excess Federal Benefit Recovery

The Submission to Waive Excess Federal Benefit Recovery is a formal request to forgive the repayment of benefits overpaid by federal programs. This process helps individuals avoid financial hardship caused by repayment demands. It requires thorough documentation and justification to support the waiver request.

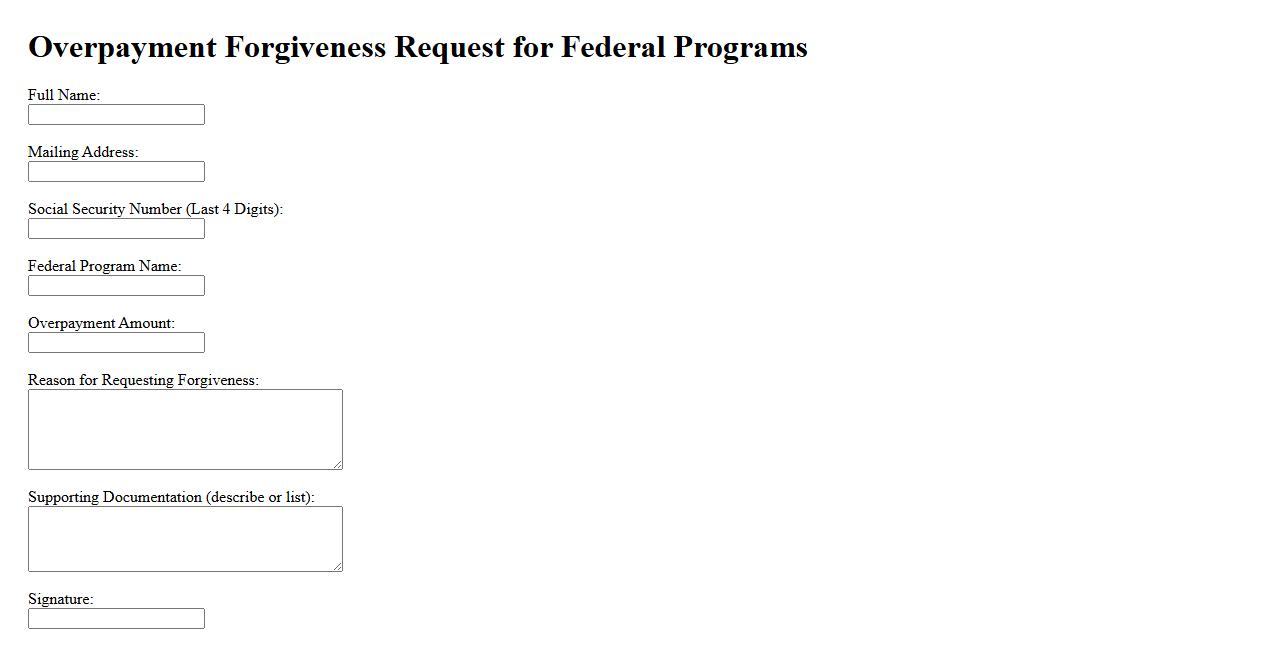

Overpayment Forgiveness Request for Federal Programs

Submitting an Overpayment Forgiveness Request for Federal Programs allows individuals to seek relief from repayment obligations when financial hardship or errors have led to an overpayment. This process ensures fairness by reviewing cases for potential forgiveness under specific federal guidelines. Timely and accurate submission of such requests is crucial to avoid unnecessary financial burdens.

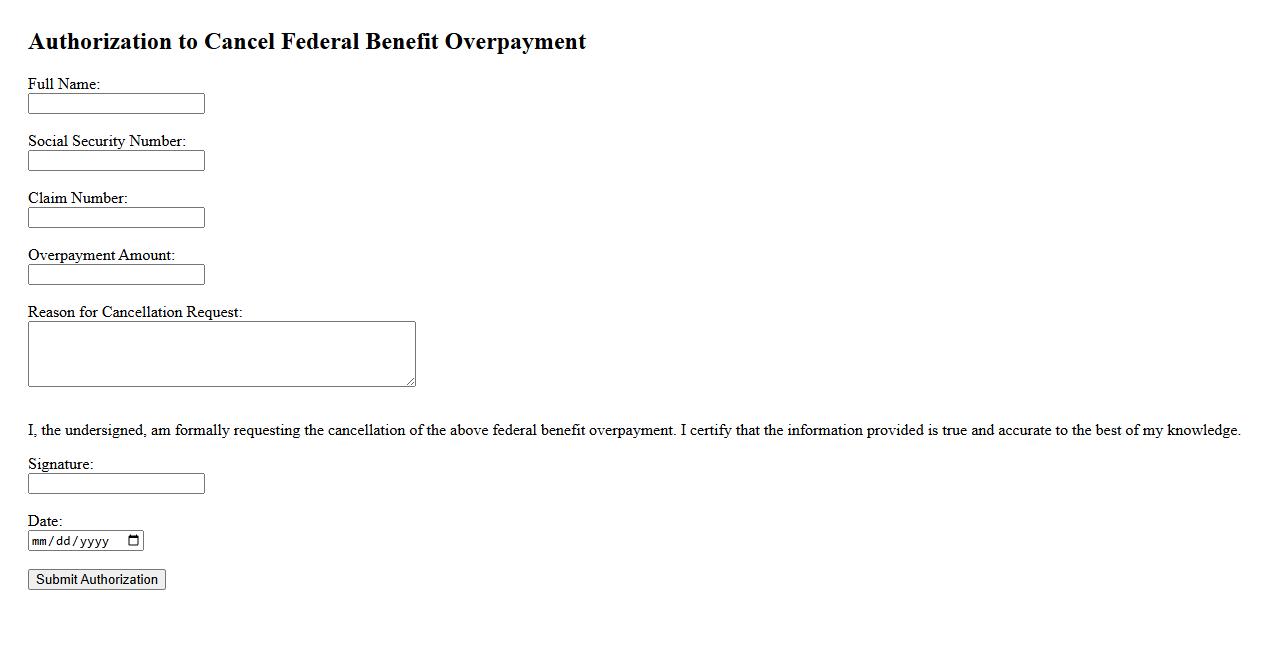

Authorization to Cancel Federal Benefit Overpayment

The Authorization to Cancel Federal Benefit Overpayment is a formal process that allows individuals to request the cancellation of an overpayment made to them by federal benefit programs. This authorization ensures the proper adjustment of accounts and prevents erroneous debt collection. It is essential for maintaining accurate records and protecting beneficiaries from undue financial burdens.

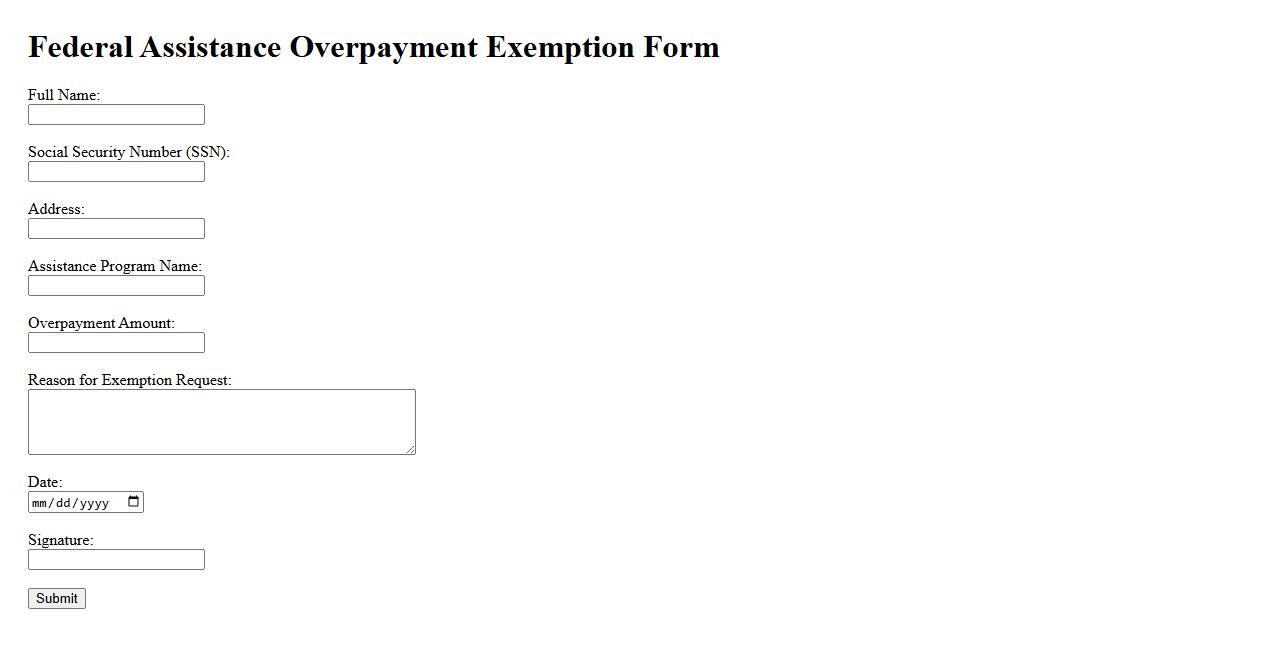

Federal Assistance Overpayment Exemption Form

The Federal Assistance Overpayment Exemption Form is used to request exemption from repayment of federally overpaid benefits. This form helps individuals demonstrate eligibility for exemption based on specific criteria. Completing it accurately ensures timely processing and potential relief from repayment obligations.

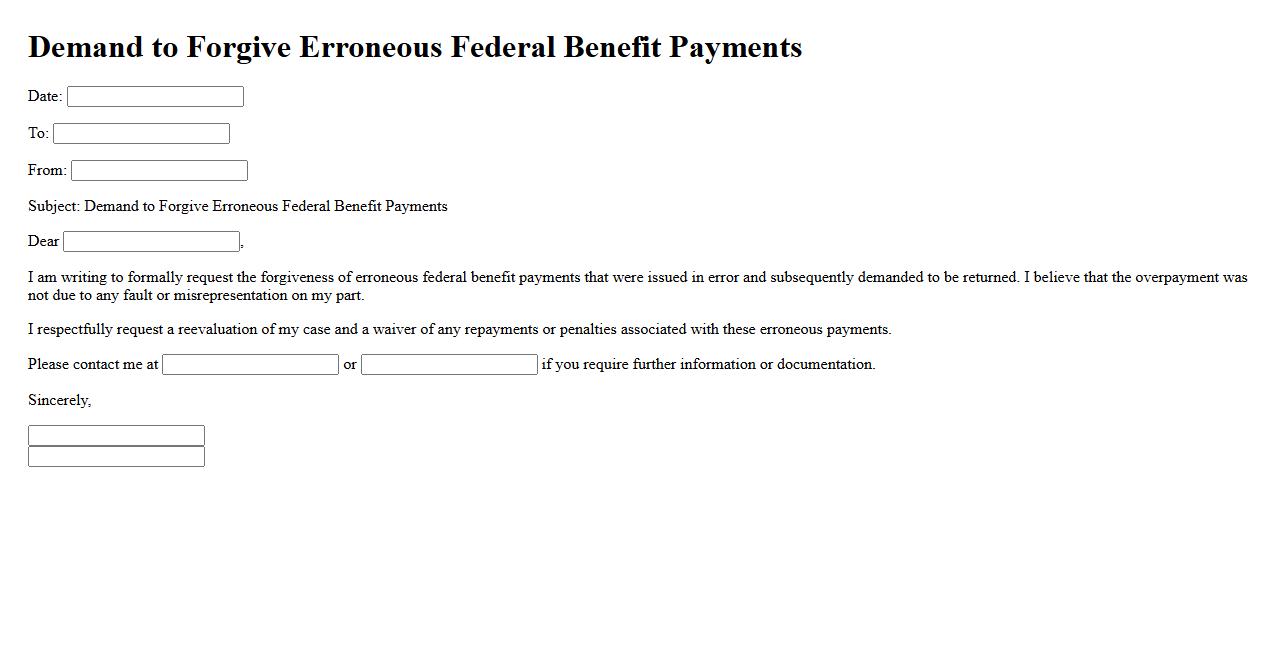

Demand to Forgive Erroneous Federal Benefit Payments

The growing demand to forgive erroneous federal benefit payments highlights the need for compassionate government policies. Many recipients face undue hardship due to repayment demands for benefits they received in error. Addressing this issue would promote fairness and ease financial stress for affected individuals.

What constitutes an overpayment of federal benefits according to the document?

An overpayment of federal benefits occurs when an individual receives more funds than they are entitled to under a federal program. This can happen due to errors in reporting income, eligibility changes, or administrative mistakes. Identifying overpayments is crucial to ensure the integrity of federal benefit programs.

Under what circumstances can an individual request a waiver of repayment for overpaid federal benefits?

An individual may request a waiver of repayment if the overpayment was not their fault and repayment would cause financial hardship. Waivers are considered when the overpayment resulted from factors beyond the recipient's control. This ensures fair treatment for beneficiaries facing unforeseen circumstances.

What are the eligibility criteria for approval of an overpayment waiver outlined in the document?

Eligibility for an overpayment waiver requires proof that the recipient was not responsible for the overpayment. Additionally, the recipient must demonstrate that repaying the overpayment would be against equity and good conscience. Meeting these criteria is essential for waiver approval.

What supporting documentation is required to apply for a waiver of overpayment?

Applicants must provide supporting documentation such as financial statements, proof of income, and evidence of hardship. Documentation must clearly show the circumstances that justify the waiver request. Accurate and thorough paperwork increases the likelihood of approval.

What is the appeals process if a waiver request for overpayment is denied?

If a waiver request is denied, the individual has the right to file an appeal. The appeal must be submitted within a specified timeframe and include reasons for contesting the denial. A fair review process is conducted to reconsider the waiver decision.