A Request for Wage and Income Transcript allows individuals to obtain detailed records of their reported earnings and income from the IRS. This transcript helps verify wage information for tax filing or loan applications. It is accessible online or via mail through the IRS website.

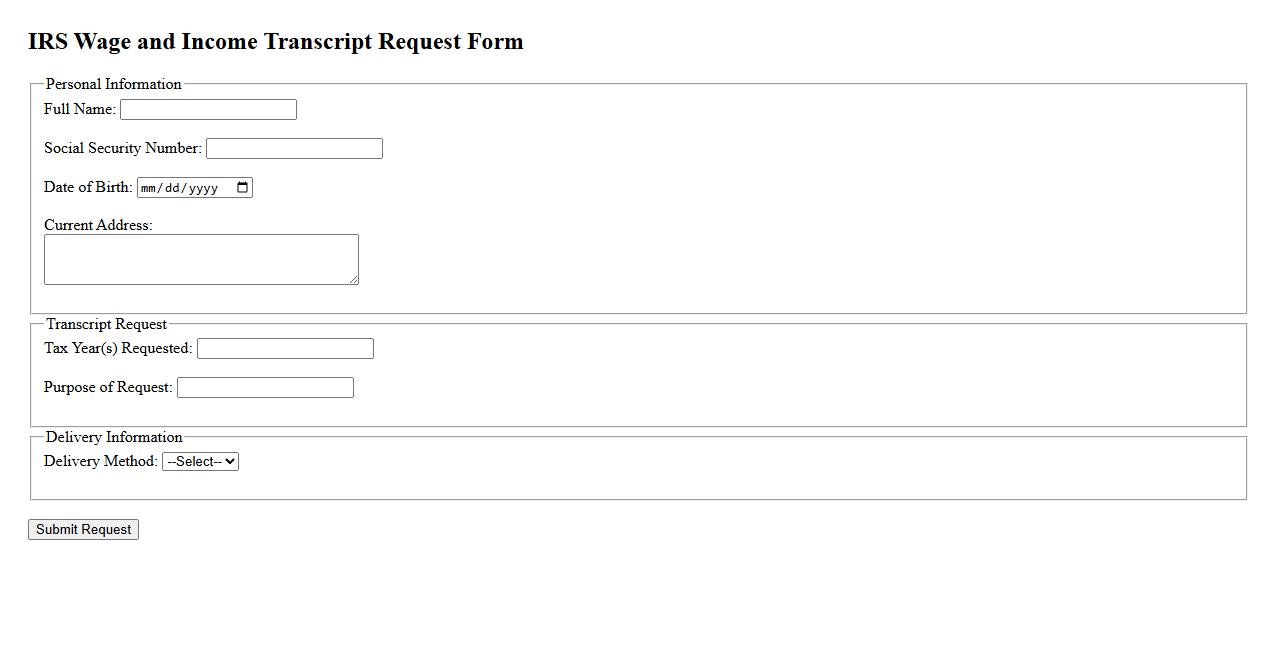

IRS Wage and Income Transcript Request Form

The IRS Wage and Income Transcript Request Form allows taxpayers to obtain a detailed record of their income as reported to the IRS. This transcript includes information from W-2s, 1099s, and other income documents submitted by employers and financial institutions. Accessing this form helps individuals verify income and ensure accurate tax reporting.

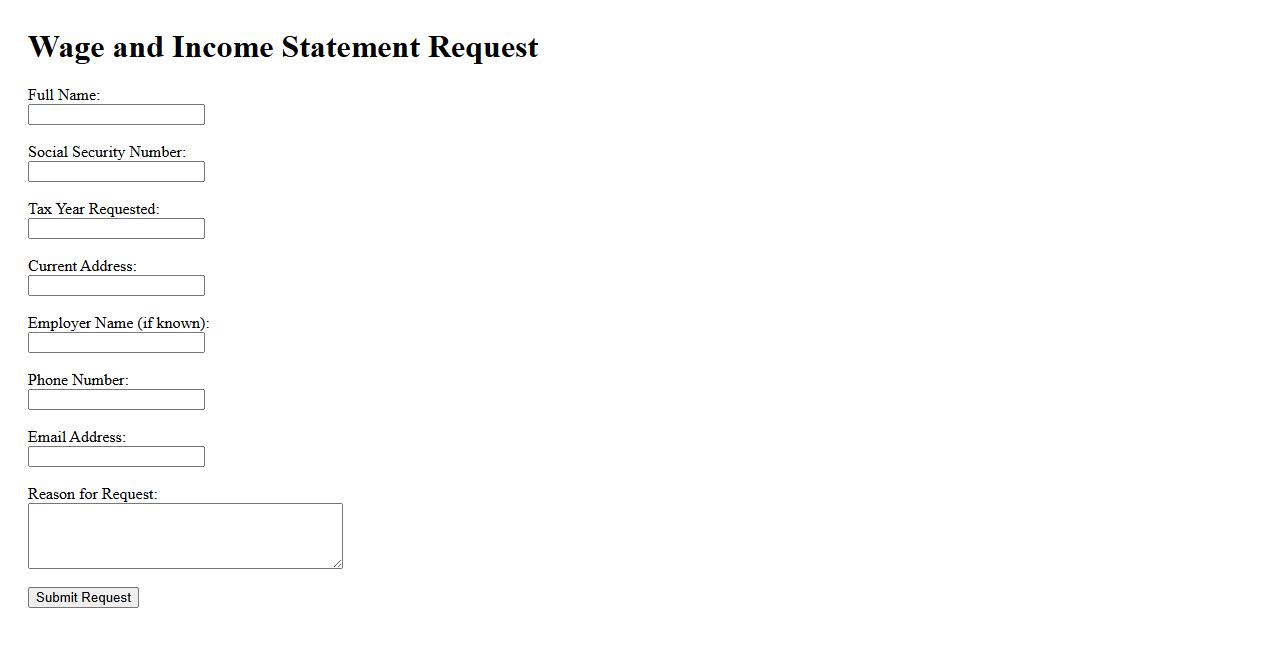

Wage and Income Statement Request

A Wage and Income Statement Request is a formal document used to obtain detailed records of an individual's earnings and income sources. This statement is essential for verifying employment and financial status in various legal and financial proceedings. It ensures accurate reporting for tax purposes and loan applications.

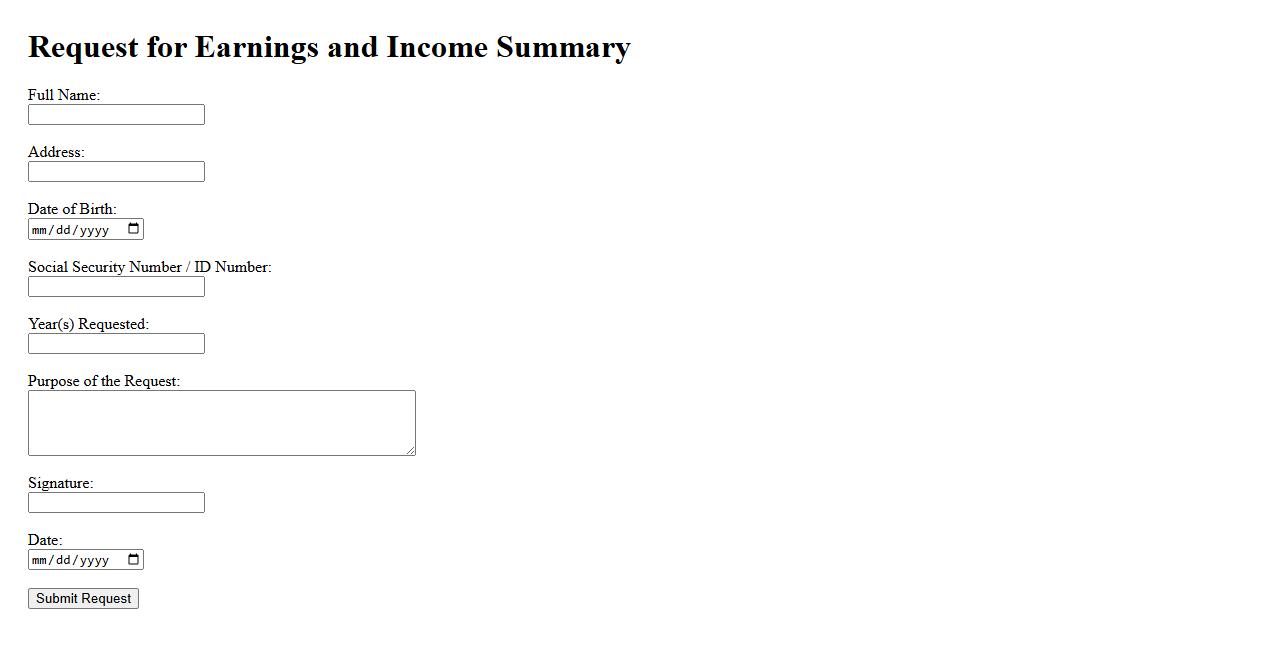

Request for Earnings and Income Summary

The Request for Earnings and Income Summary is a formal document used to obtain a detailed report of an individual's financial income and earnings. This summary helps verify income sources, ensuring accurate financial assessments for applications or audits. It is essential for transparency and accountability in financial transactions.

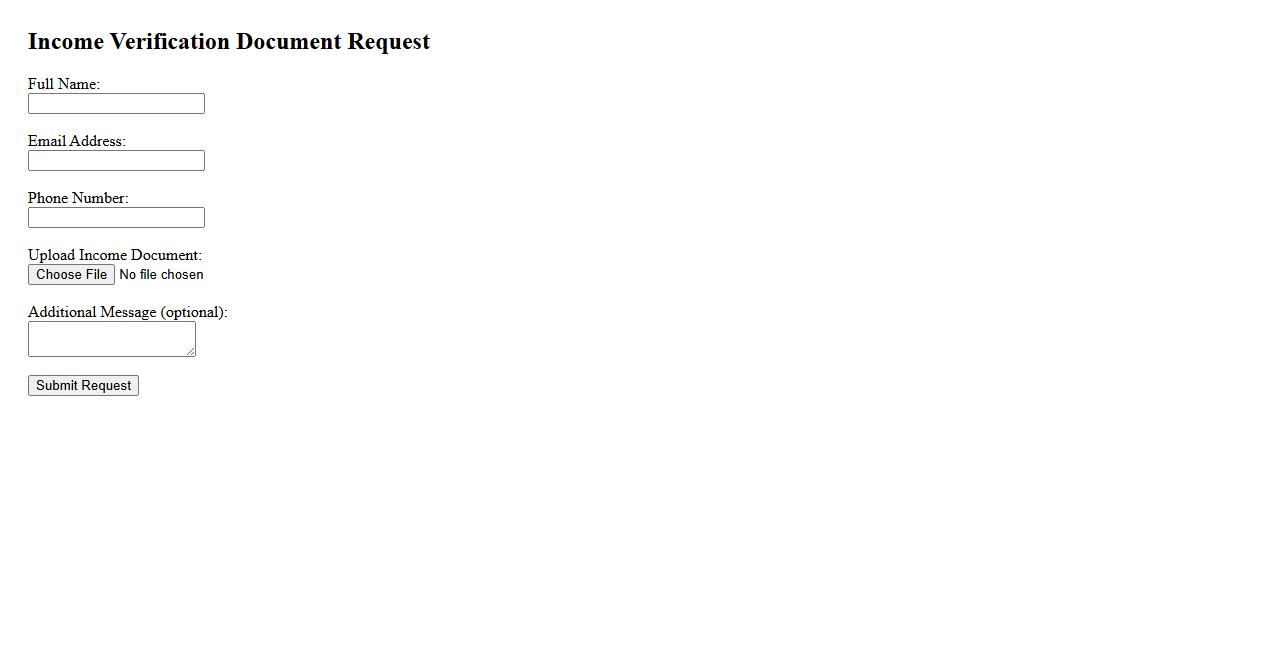

Income Verification Document Request

An Income Verification Document Request is a formal procedure used by organizations to confirm an individual's financial earnings. This document is often required for loan applications, rental agreements, or government assistance programs. Providing accurate income verification helps ensure eligibility and trustworthiness in various financial transactions.

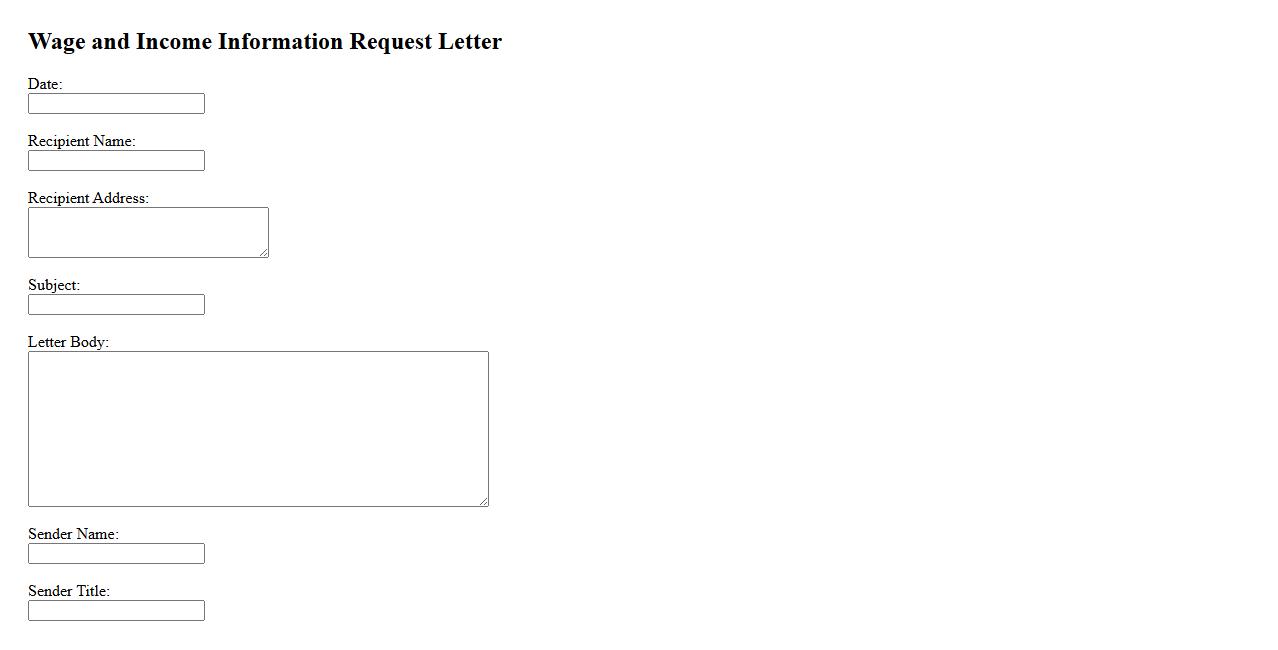

Wage and Income Information Request Letter

A Wage and Income Information Request Letter is a formal document used to obtain detailed records of an individual's earnings and income sources. This letter is typically requested by financial institutions, employers, or government agencies to verify income for loans, tax purposes, or eligibility assessments. Providing accurate wage and income information ensures transparency and supports important financial decisions.

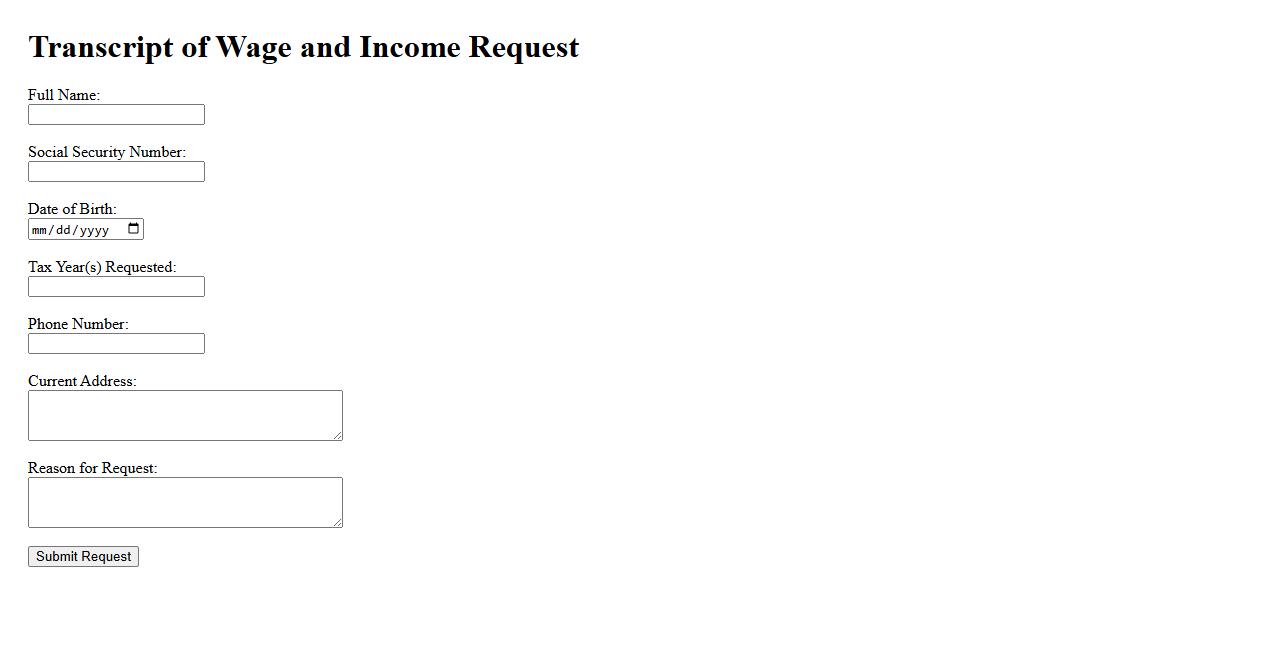

Transcript of Wage and Income Request

The Transcript of Wage and Income Request provides a detailed record of an individual's reported earnings and income information from various sources. This transcript is essential for verifying income when applying for loans, financial aid, or preparing tax returns. It ensures accuracy and transparency in financial documentation.

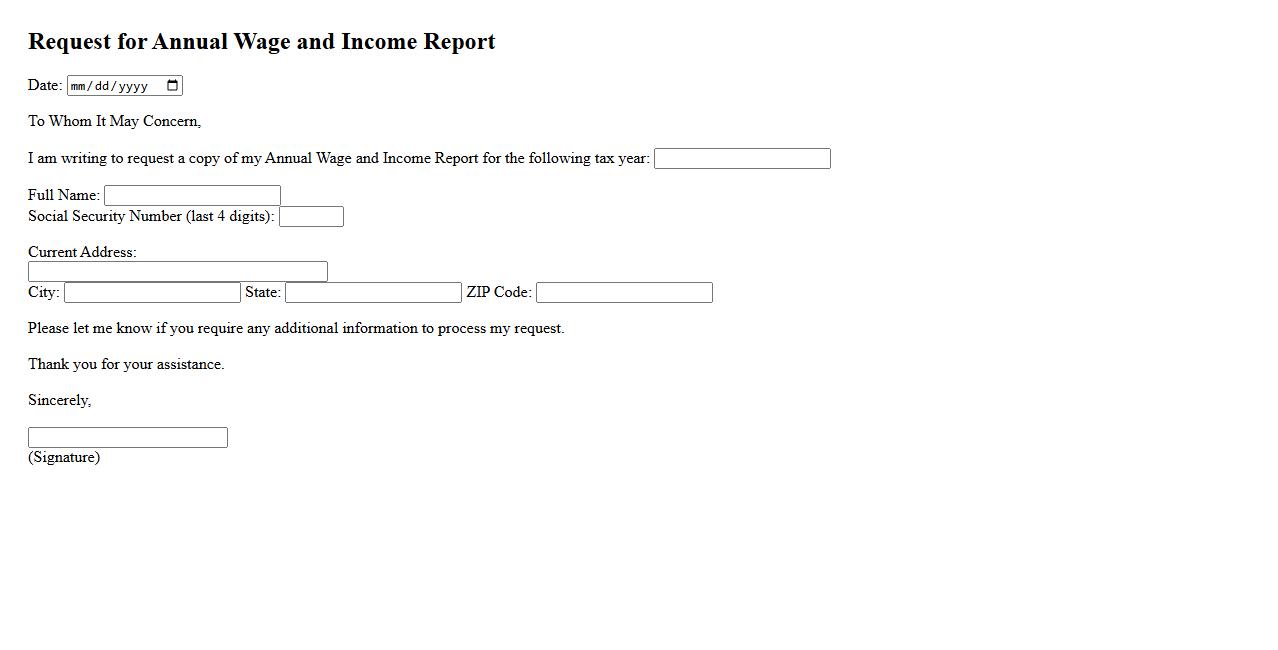

Request for Annual Wage and Income Report

The Request for Annual Wage and Income Report allows individuals to obtain a detailed summary of their earnings and tax withholdings for the year. This report is essential for accurate tax filing and financial planning. Accessing this document helps ensure compliance with tax regulations and supports effective income verification.

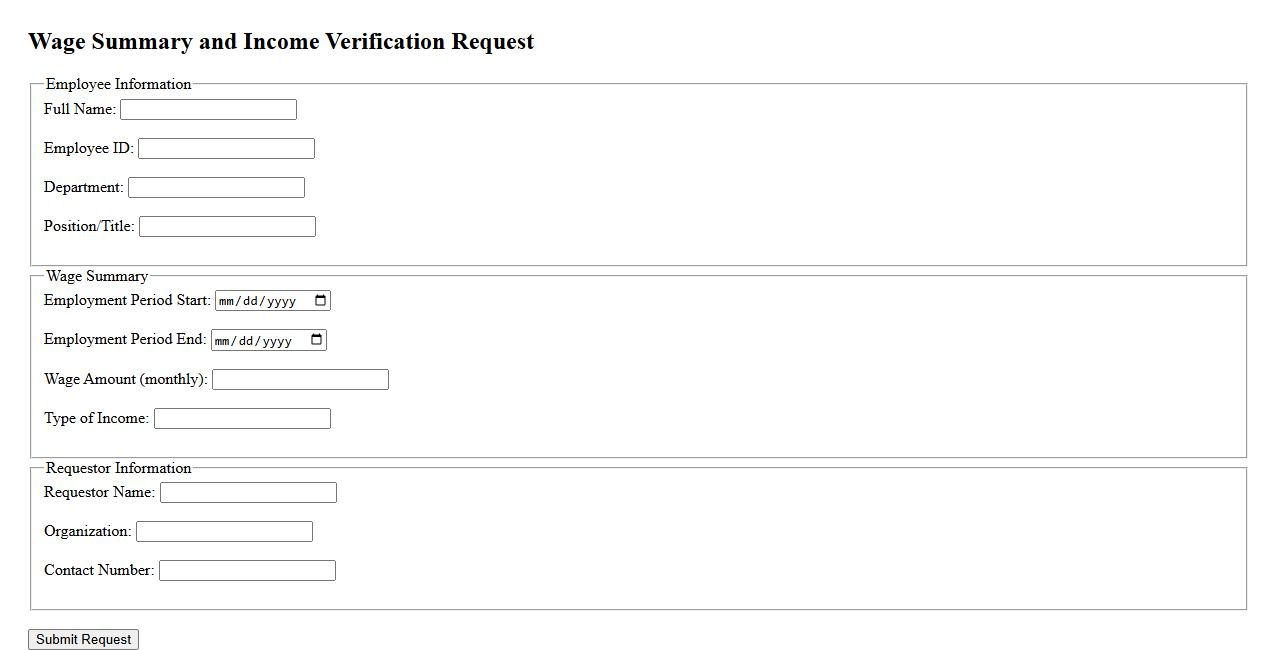

Wage Summary and Income Verification Request

The Wage Summary and Income Verification Request is a formal document used to confirm an individual's employment earnings. This verification helps employers, lenders, and government agencies validate income details accurately. It ensures transparency and assists in decision-making processes related to financial assessments.

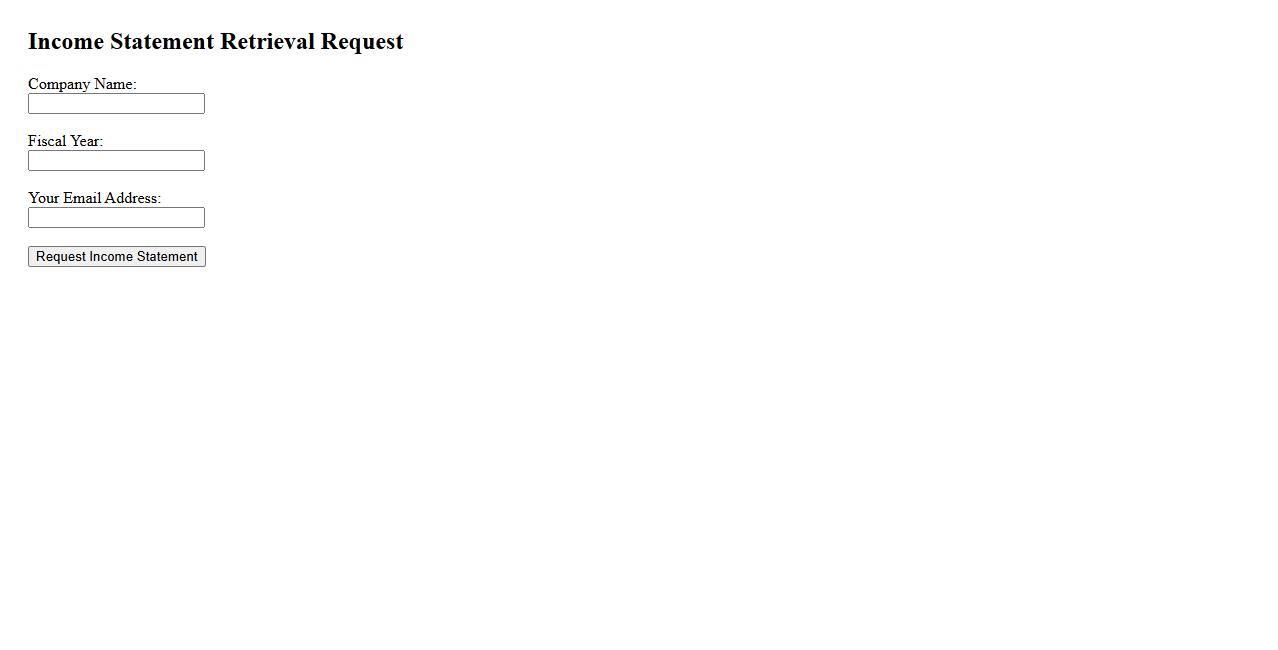

Income Statement Retrieval Request

An Income Statement Retrieval Request is a formal inquiry made to obtain detailed financial performance reports of a company. This statement provides a summary of revenues, expenses, and profits over a specific period. Accessing these records helps stakeholders analyze business profitability and make informed decisions.

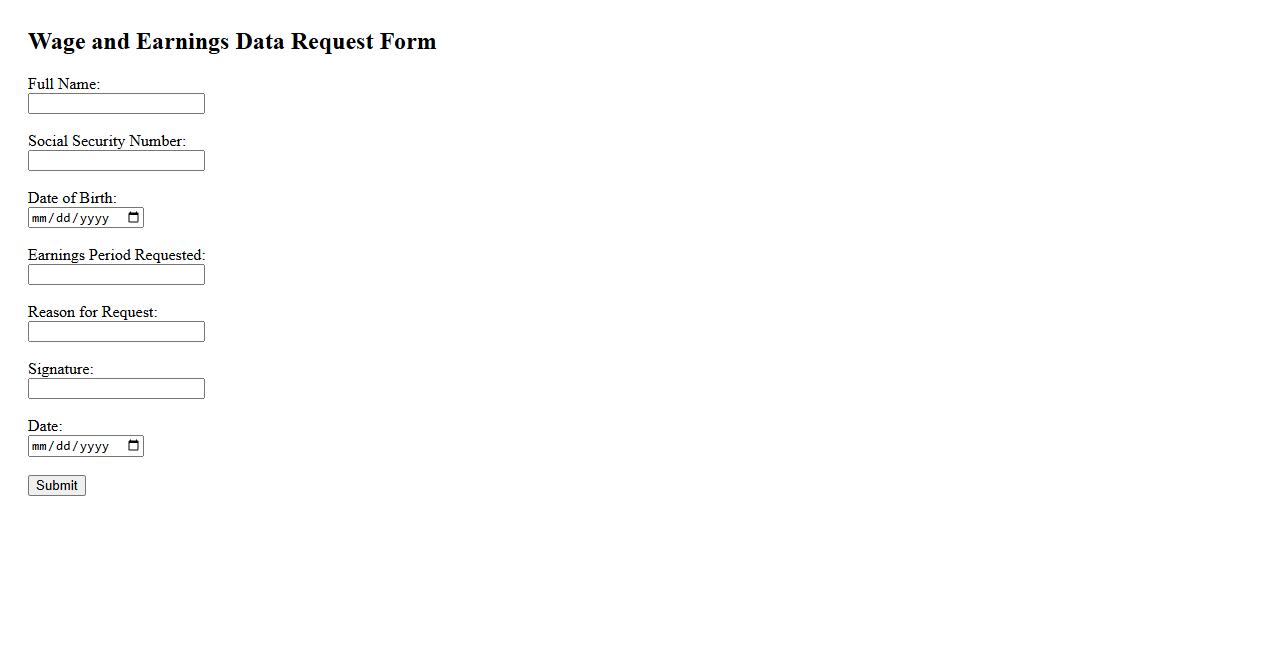

Wage and Earnings Data Request

The Wage and Earnings Data Request allows individuals or organizations to obtain detailed information regarding income history. This data is essential for verifying employment records, calculating benefits, or conducting financial assessments. Requests must follow specific procedures to ensure privacy and accuracy of the earnings information provided.

What is the primary purpose of a Wage and Income Transcript request?

The primary purpose of a Wage and Income Transcript request is to obtain a detailed record of an individual's reported earnings and tax information directly from the IRS. This transcript helps taxpayers verify their income details as reported by employers, financial institutions, and other third parties. It is used for tax filing accuracy, loan applications, or resolving discrepancies in reported income.

Which tax years are covered by the requested Wage and Income Transcript?

The Wage and Income Transcript typically covers the last 10 tax years from the date of the request. This extensive period allows individuals and tax professionals to review multiple years of income data for consistency and tax compliance. However, availability for recent years may vary depending on the IRS data processing timeline.

Who is authorized to access or request the Wage and Income Transcript?

Access to the Wage and Income Transcript is generally restricted to the taxpayer, their authorized representative, or entities with proper authorization. Tax professionals, such as accountants or attorneys, can request it on behalf of taxpayers with a valid Power of Attorney (Form 2848). Financial institutions may also request it with taxpayer consent for loan or financial verification purposes.

What specific types of income information are included in the Wage and Income Transcript?

The Wage and Income Transcript includes detailed information on wages, salaries, tips, interest income, dividends, IRA distributions, and other reported income sources. It aggregates data from forms such as W-2, 1099, and 1098, providing a comprehensive view of an individual's income as reported to the IRS. This information assists in validating income for tax and lending purposes.

How can discrepancies in the Wage and Income Transcript data be addressed or corrected?

Discrepancies in the Wage and Income Transcript should be addressed by contacting the IRS and the income reporting entities (employers or financial institutions) to verify and correct information. Taxpayers may need to file amended returns if the transcript data affects their tax filings. Prompt action ensures accurate tax reporting and avoids potential IRS penalties or delays in tax processing.