A Request for Hardship Withdrawal allows individuals to access funds from their retirement accounts in cases of financial hardship, such as medical expenses or eviction. This process typically requires documentation proving the hardship and may involve tax implications or penalties. Understanding the specific rules set by the plan administrator is vital to ensure eligibility and compliance.

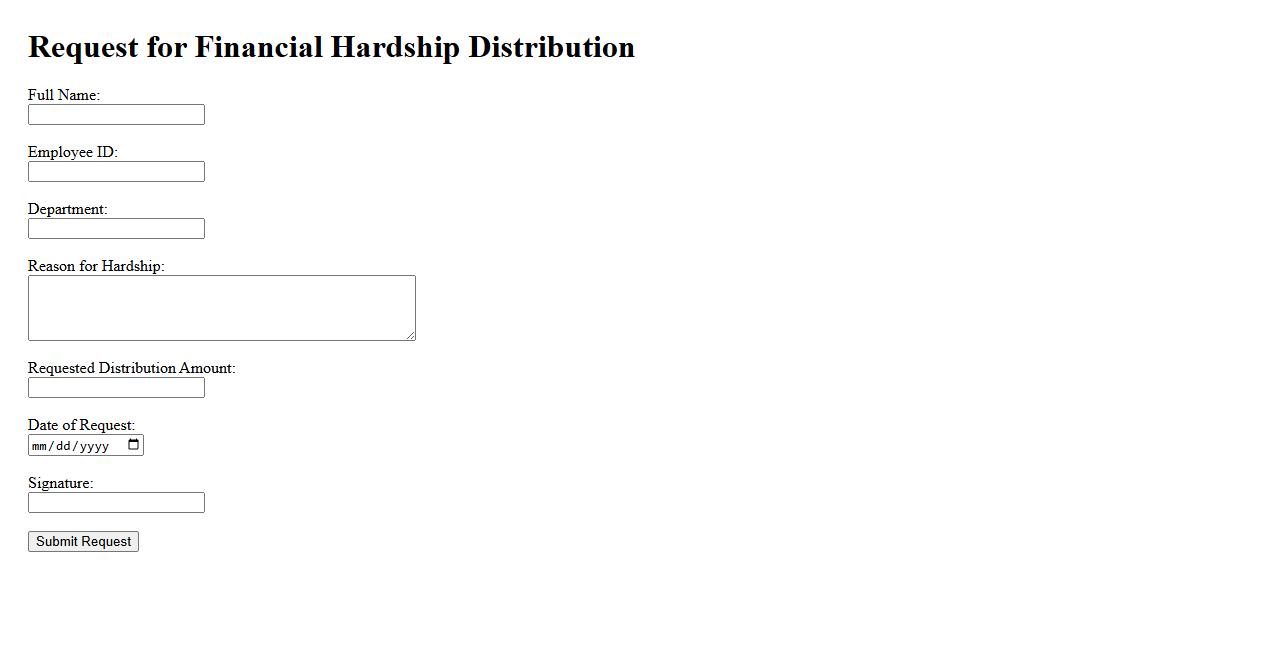

Request for Financial Hardship Distribution

A Request for Financial Hardship Distribution allows individuals to access funds from their retirement accounts during times of significant financial need. This process requires meeting specific criteria to qualify for early withdrawal without penalties. It is essential to provide appropriate documentation to support the hardship claim.

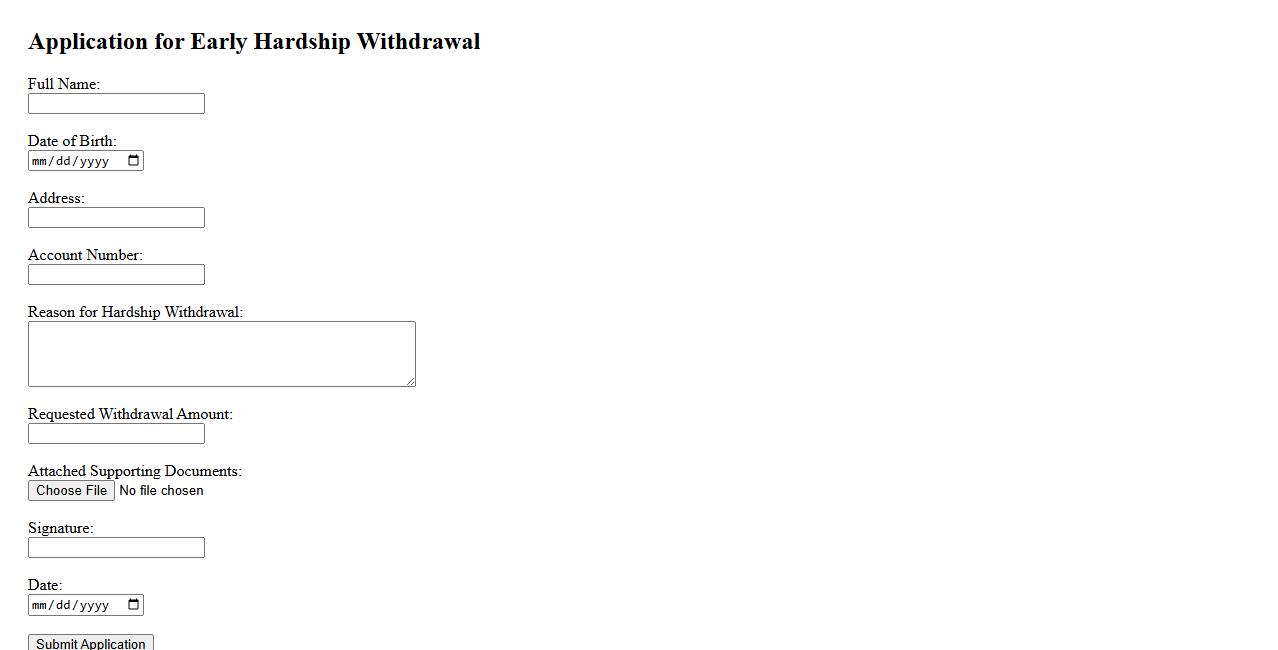

Application for Early Hardship Withdrawal

An Application for Early Hardship Withdrawal allows individuals to access their retirement funds before the standard age due to financial hardship. This process requires submitting specific documentation to prove eligibility and the nature of the hardship. Early withdrawals may be subject to penalties and tax implications, so careful consideration is essential.

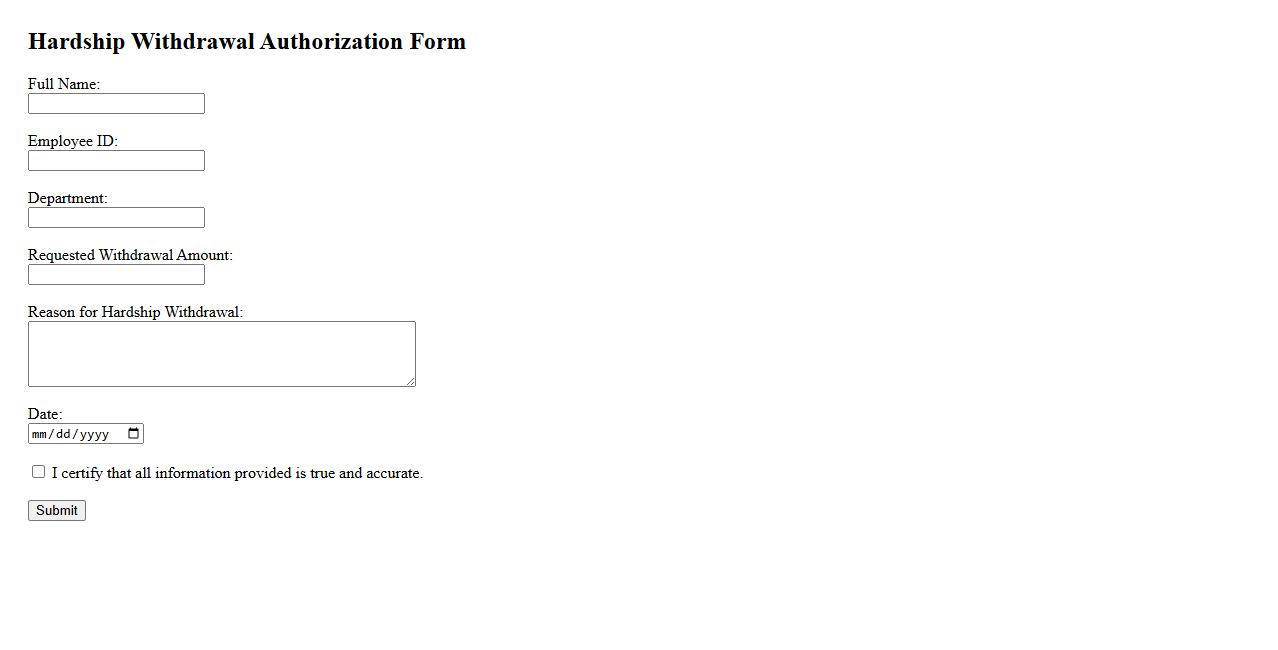

Hardship Withdrawal Authorization Form

The Hardship Withdrawal Authorization Form is used to request early access to retirement funds due to urgent financial needs. This form verifies eligibility and provides necessary details for processing the withdrawal. Proper completion ensures compliance with plan rules and IRS regulations.

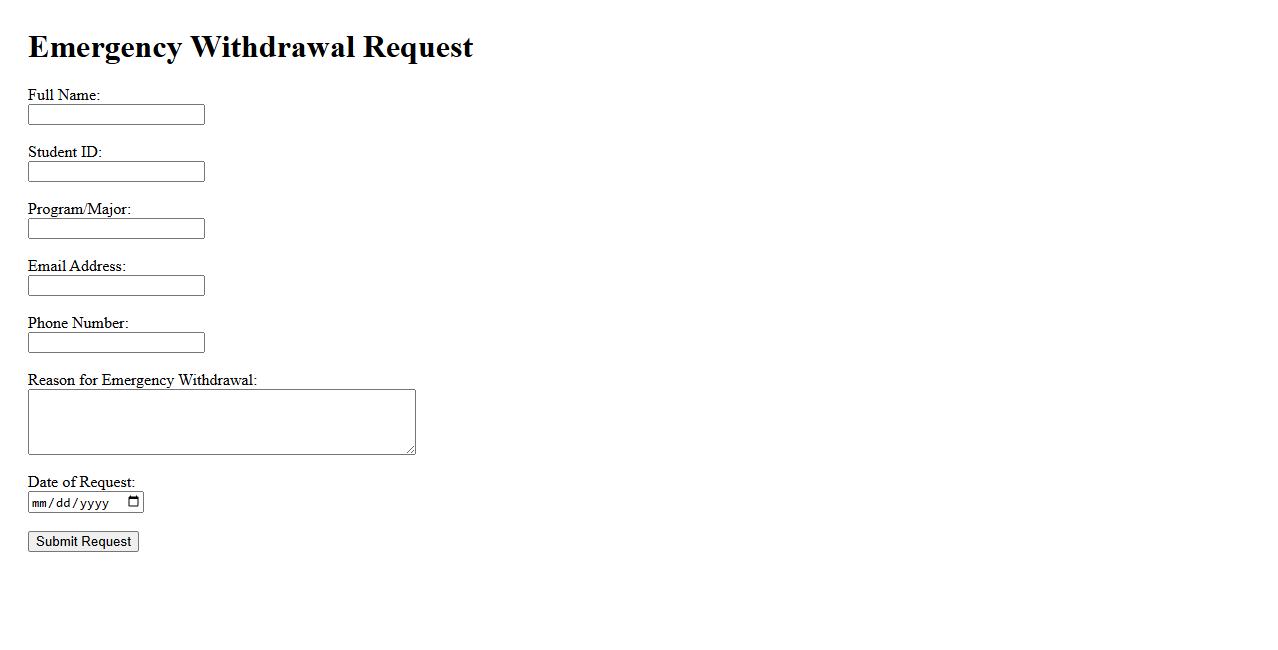

Emergency Withdrawal Request

An Emergency Withdrawal Request allows individuals to access funds quickly in urgent situations without the usual processing delays. This option is designed to provide immediate financial relief during unforeseen circumstances. It is important to review the specific terms and eligibility criteria before submitting the request.

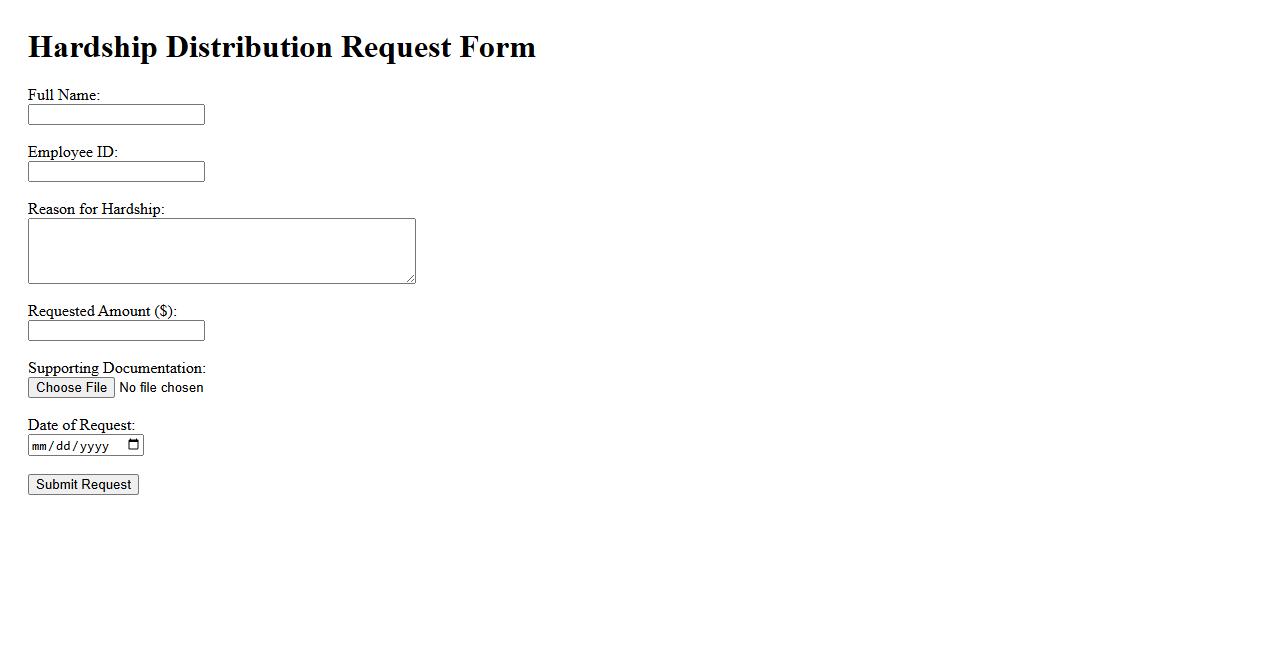

Hardship Distribution Request Form

The Hardship Distribution Request Form is a crucial document used to request early withdrawal of funds from retirement accounts due to severe financial hardship. It ensures compliance with legal requirements while providing necessary information to assess eligibility. This form helps individuals access funds in emergencies without penalties.

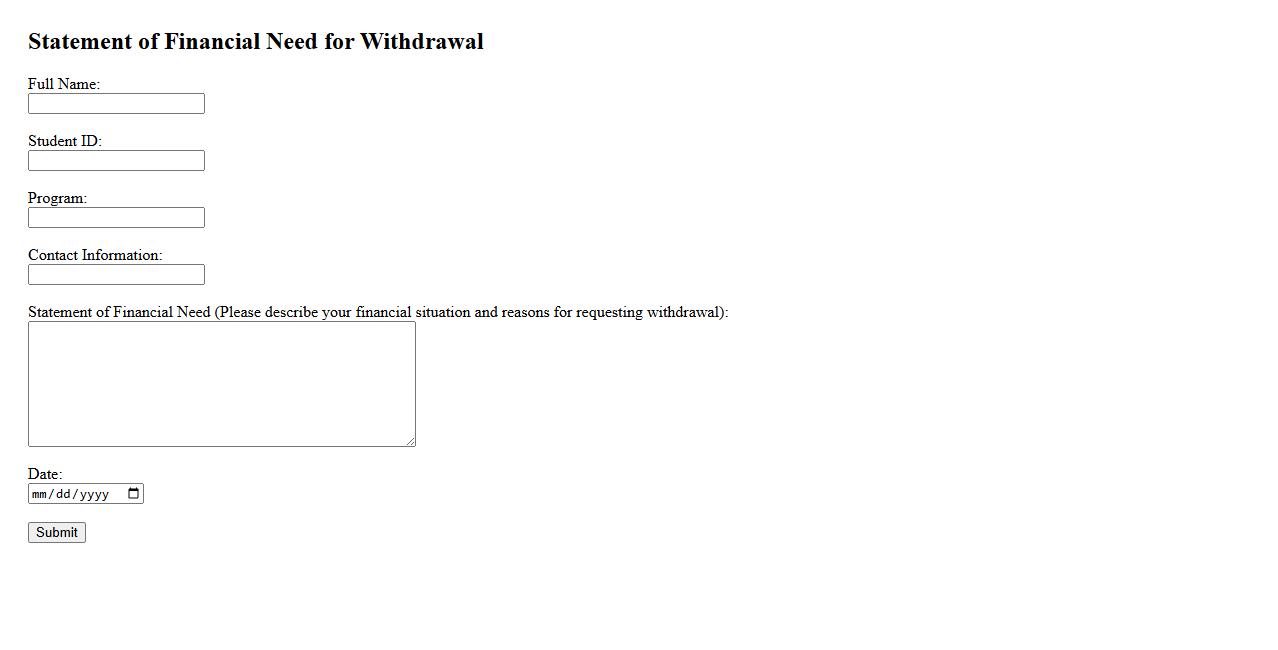

Statement of Financial Need for Withdrawal

The Statement of Financial Need for Withdrawal is a formal document submitted to explain the financial reasons behind a student's decision to withdraw from an institution. It highlights the urgency and necessity of the withdrawal due to unexpected monetary challenges. This statement helps the institution understand and potentially support the student's circumstances.

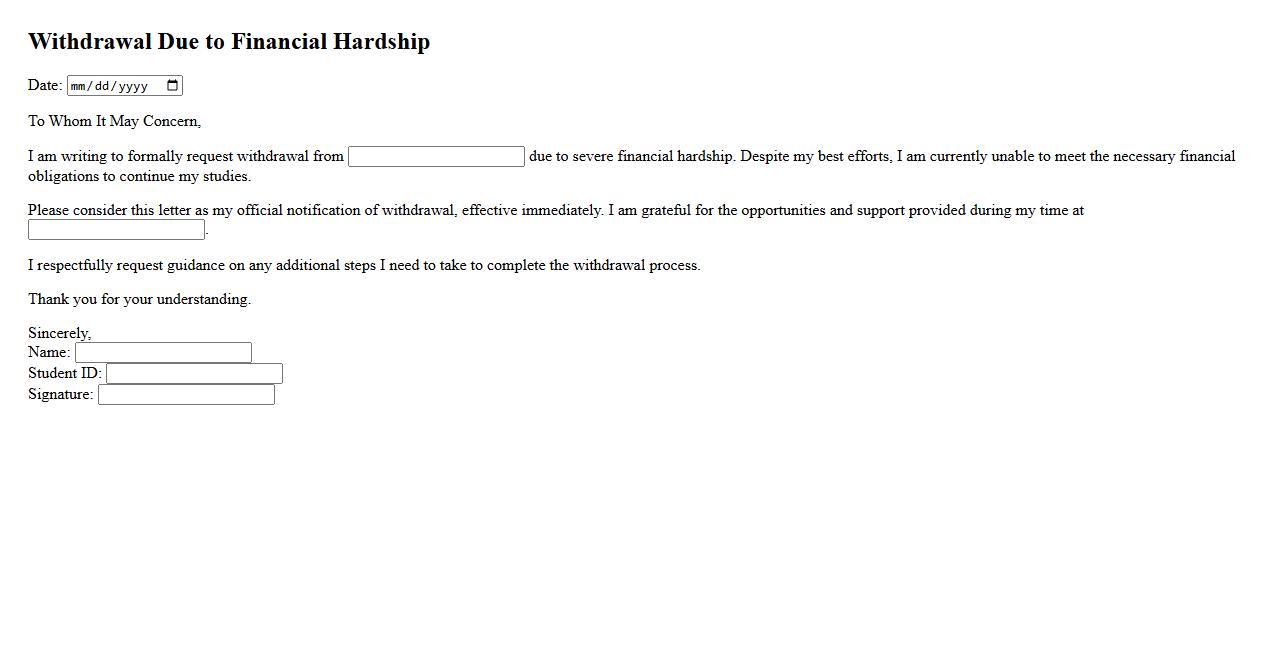

Withdrawal Due to Financial Hardship

Withdrawal Due to Financial Hardship allows students to temporarily leave their studies when facing severe financial difficulties. This option provides relief without academic penalty, ensuring they can resume their education once their situation improves. Institutions often require proof of hardship to approve such withdrawals.

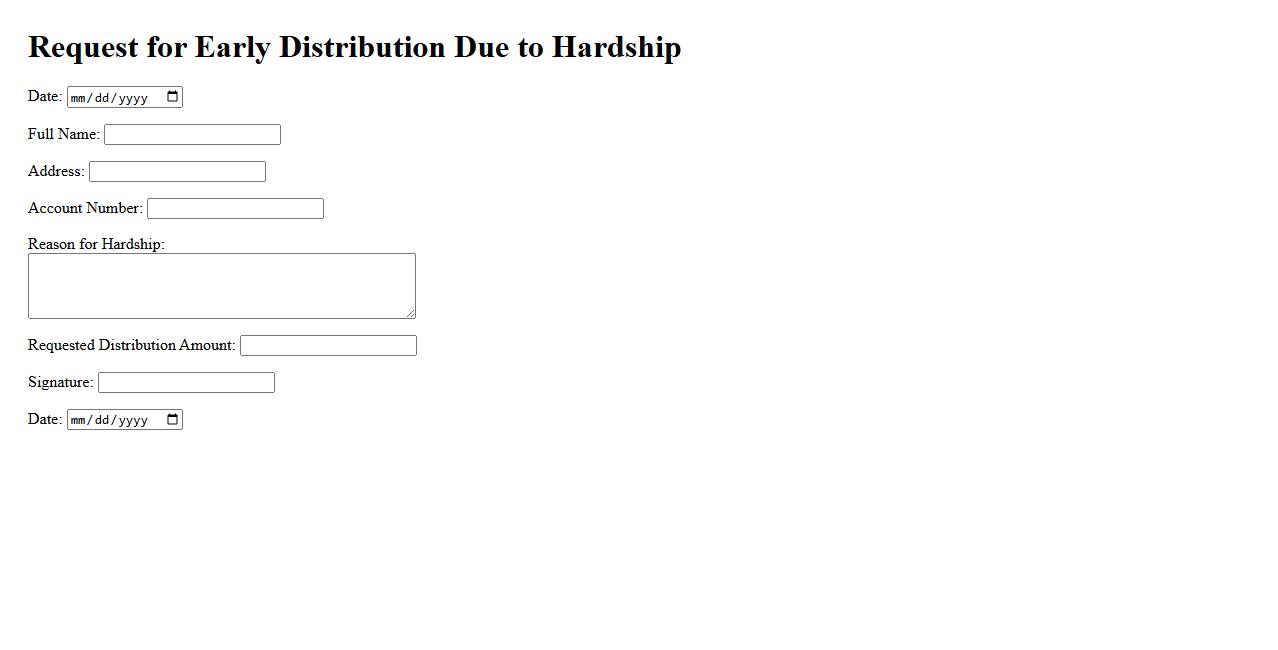

Request for Early Distribution Due to Hardship

If you are facing financial difficulties, you may be eligible to submit a Request for Early Distribution Due to Hardship. This allows access to funds before the usual withdrawal age under specific circumstances. It's important to provide proper documentation to support your hardship claim.

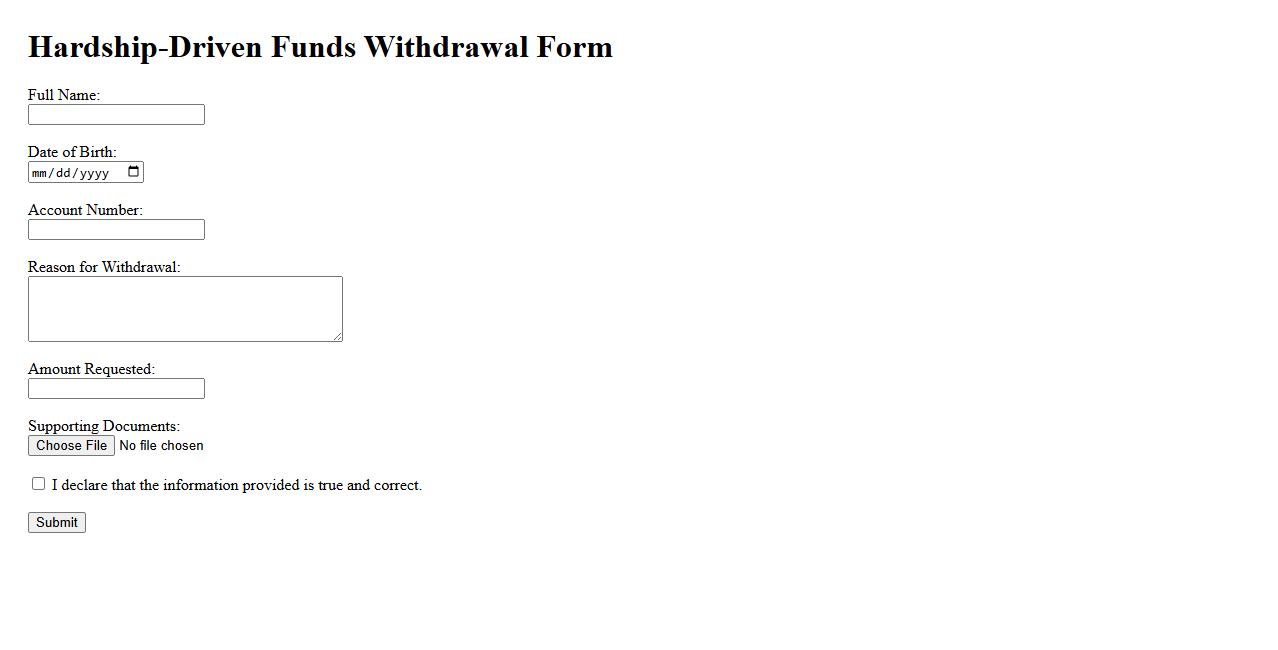

Hardship-Driven Funds Withdrawal Form

The Hardship-Driven Funds Withdrawal Form allows individuals to access their funds under specific financial hardships. This form is designed to facilitate urgent withdrawals while ensuring compliance with regulatory requirements. It provides a streamlined process for those experiencing qualifying hardships to receive necessary financial assistance promptly.

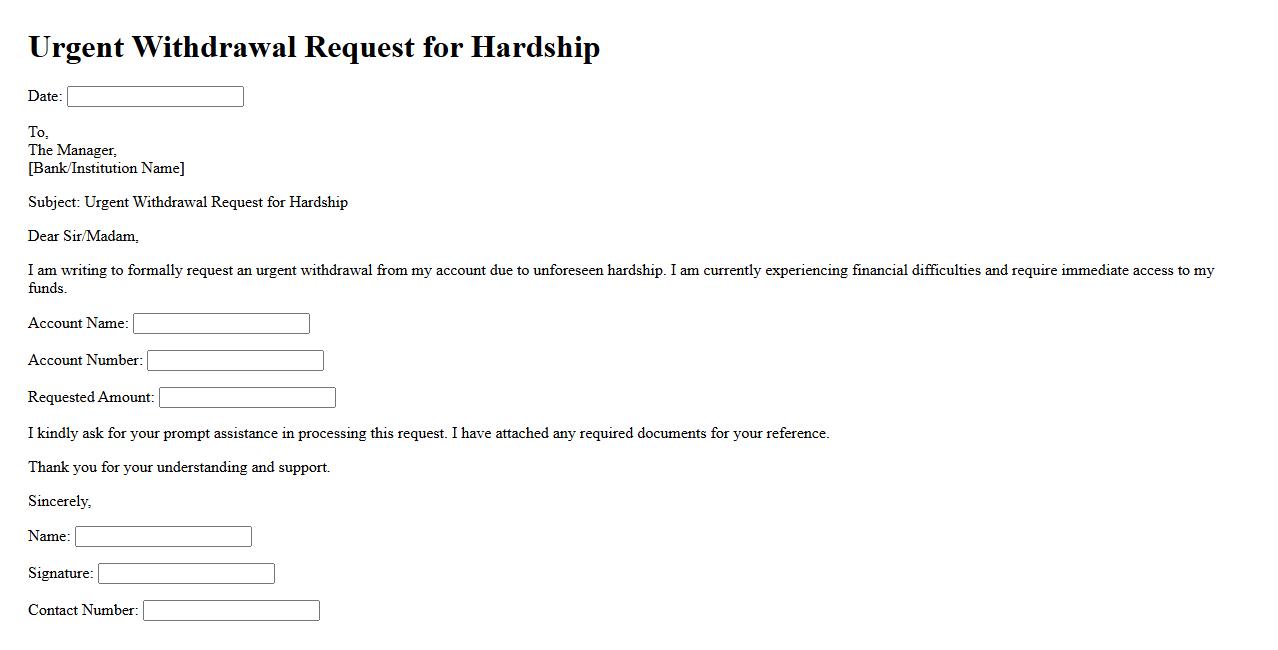

Urgent Withdrawal Request for Hardship

If you are facing financial difficulties, an Urgent Withdrawal Request for Hardship allows you to access your funds quickly. This option is designed to provide immediate relief during unexpected emergencies. Make sure to submit the necessary documentation to support your hardship claim.

What qualifies as a hardship for requesting a withdrawal from this document?

A hardship withdrawal is typically approved when an individual experiences an immediate and heavy financial need. Common qualified hardships include medical expenses, funeral costs, or expenses related to the purchase of a primary residence. The documentation must demonstrate that the hardship is genuine and unavoidable.

Which specific supporting documents are required to validate your hardship claim?

Validating a hardship claim requires official documents that clearly prove the nature of the hardship. Common supporting documents include medical bills, funeral receipts, or mortgage statements. These documents must be current and directly related to the financial need stated.

What potential penalties or tax implications are associated with a hardship withdrawal?

Hardship withdrawals often incur penalties and tax consequences, including income tax on the amount withdrawn. In some cases, a 10% early withdrawal penalty may apply if the individual is under a certain age. It is essential to consult tax regulations to understand the full financial impact.

How does the requested withdrawal amount correspond to the demonstrated financial need?

The withdrawal amount must not exceed the actual amount of hardship demonstrated by the submitted documents. The purpose is to cover immediate financial needs only, ensuring no excess funds are withdrawn. This restriction helps maintain the integrity of the withdrawal process.

Are there restrictions or limitations on future contributions after a hardship withdrawal is approved?

After a hardship withdrawal, there may be limitations on future contributions to allow account recovery. Certain plans enforce a waiting period before contributions can resume, while others may impose reduced or suspended contribution options. These rules aim to balance access to funds with long-term savings goals.