A Request for Taxpayer Identification Number is a formal process used by organizations to obtain an individual's or entity's TIN for tax reporting purposes. This information ensures accurate identification in tax filings and compliance with government regulations. Proper submission of the request helps avoid delays in processing transactions or tax documents.

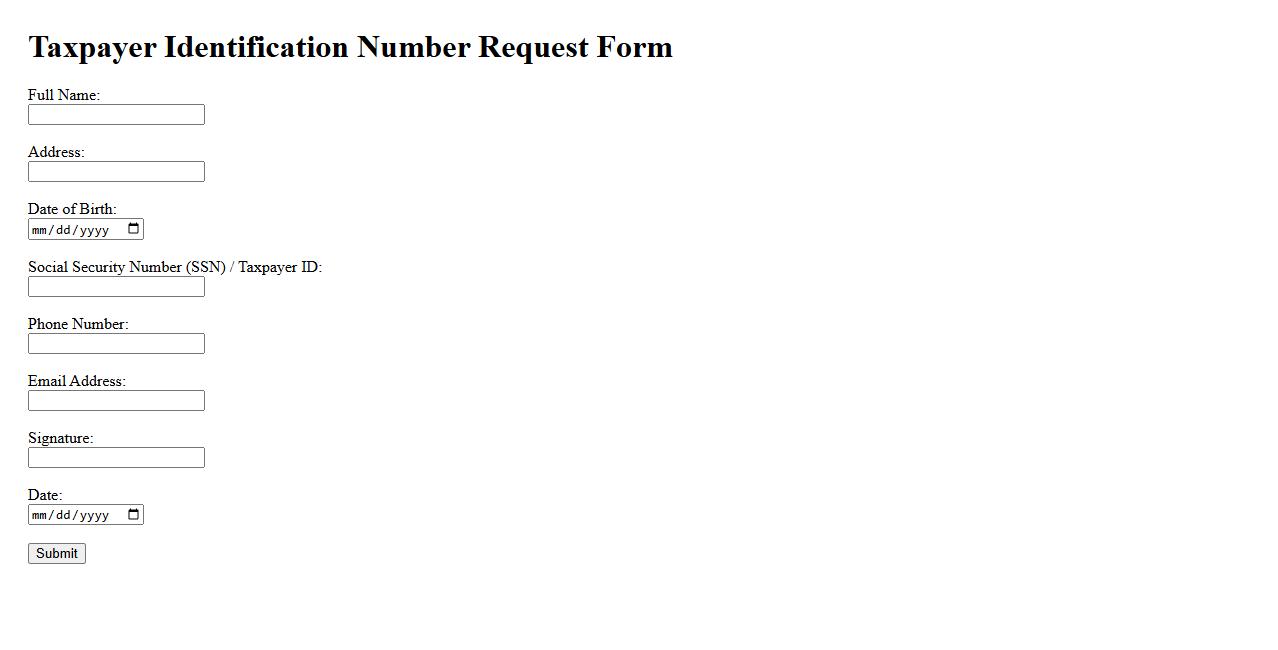

Taxpayer Identification Number Request Form

The Taxpayer Identification Number Request Form is essential for individuals and entities seeking to obtain a unique identification number for tax purposes. This form ensures accurate tracking and reporting of tax obligations by the relevant authorities. Completing it properly helps streamline the tax filing process and compliance.

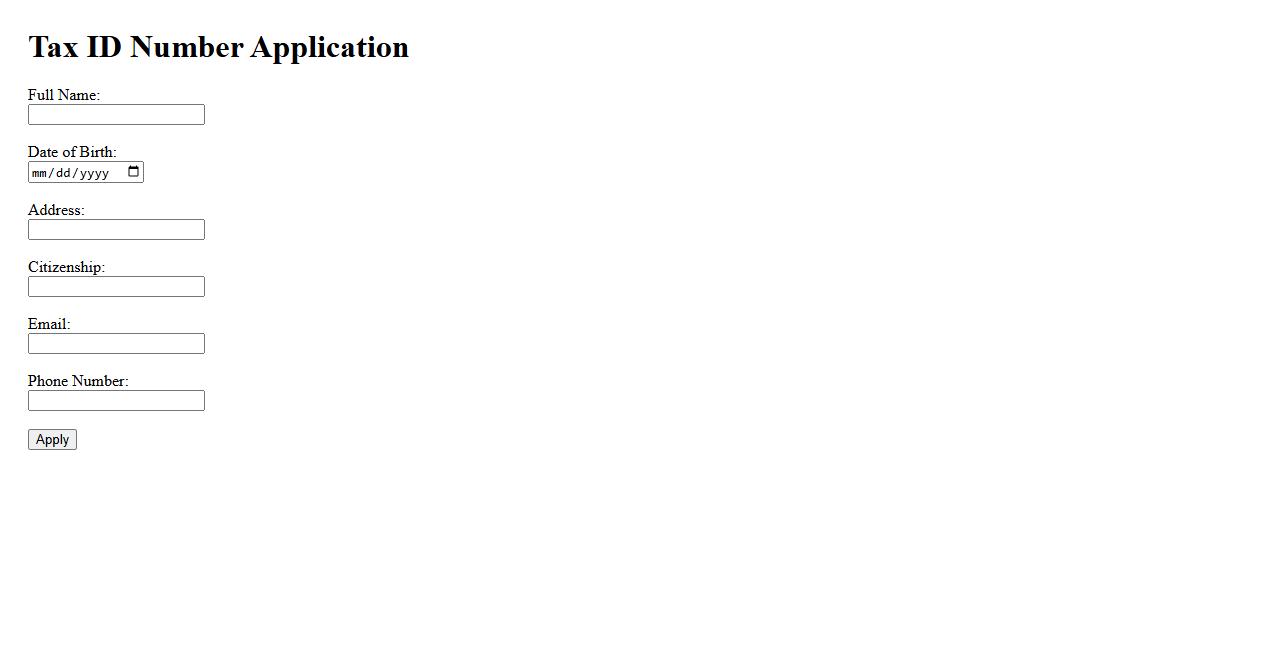

Tax ID Number Application

The Tax ID Number Application is a process used by businesses and individuals to obtain a unique identification number for tax purposes. This number is essential for filing taxes, opening bank accounts, and conducting other financial activities. Applying for a Tax ID ensures compliance with government regulations and streamlines financial management.

Taxpayer ID Number Submission Request

The Taxpayer ID Number Submission Request is a formal process used to provide your unique identification number to relevant authorities or institutions. This number is essential for tax reporting and compliance purposes. Accurate submission ensures proper tracking of your tax obligations and benefits.

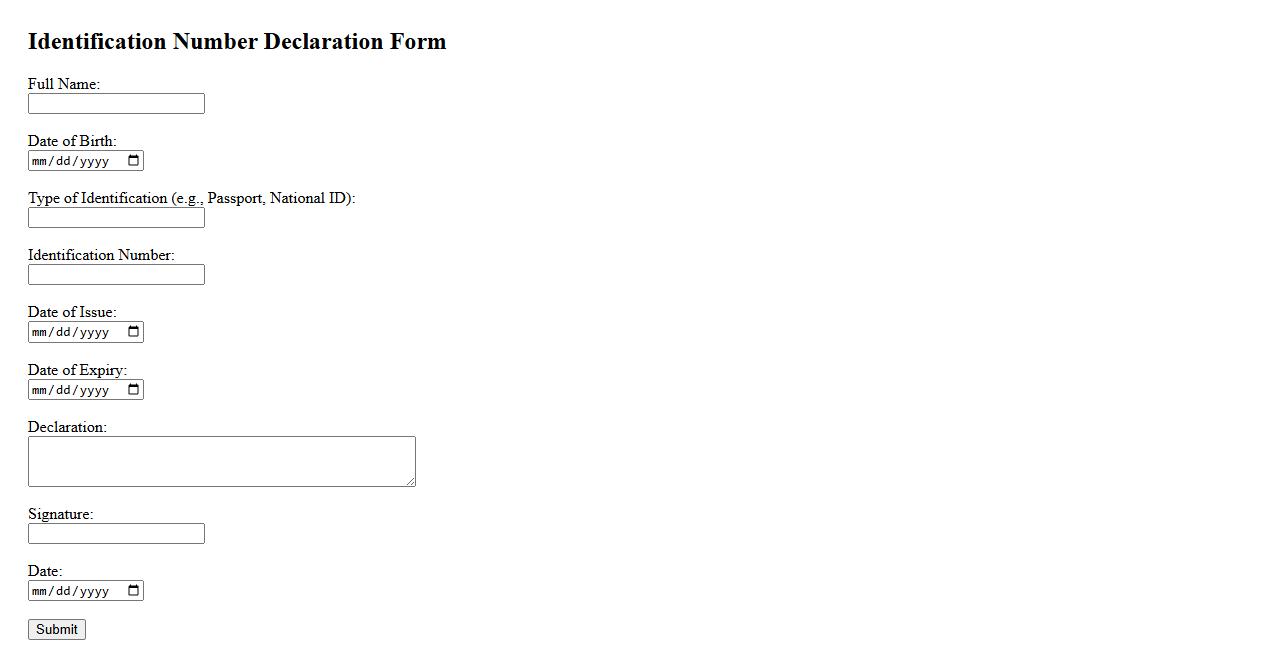

Identification Number Declaration Form

The Identification Number Declaration Form is a crucial document used to declare and verify an individual's unique identification number. It ensures accurate record-keeping and compliance with regulatory requirements. This form helps organizations confirm identity and prevent fraud effectively.

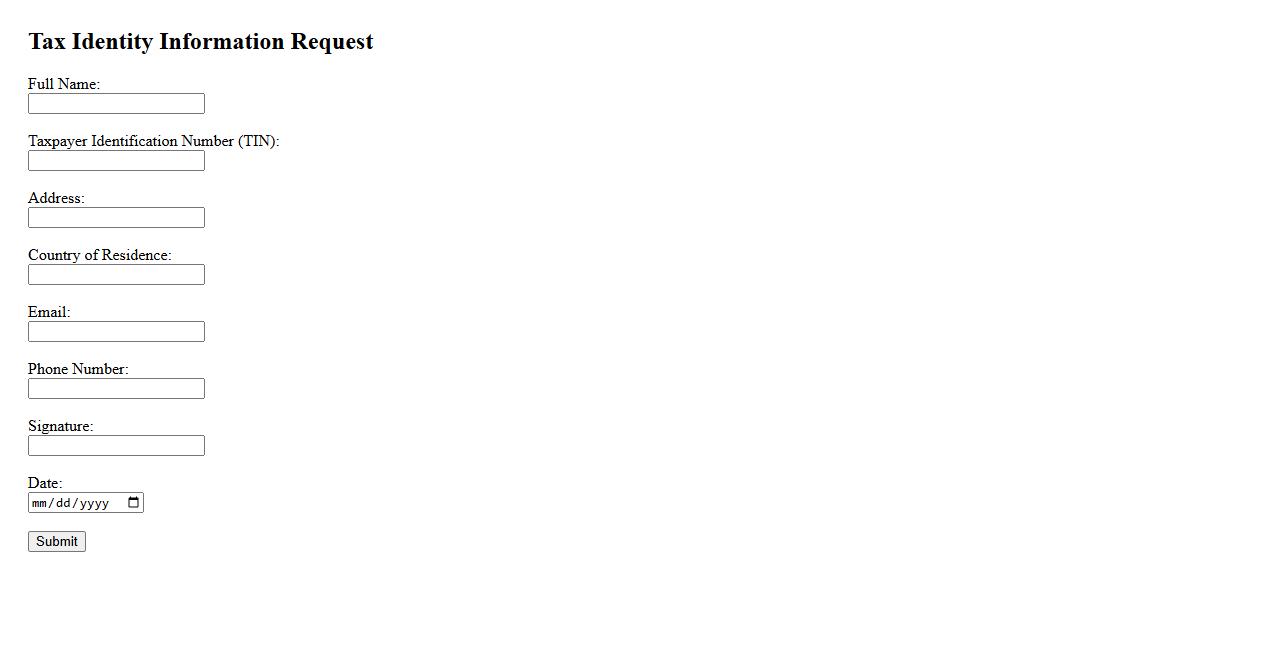

Tax Identity Information Request

The Tax Identity Information Request is a formal procedure used to verify a taxpayer's identity for tax-related purposes. This process helps prevent fraud and ensures accurate processing of tax documents. Providing the requested information promptly is essential to avoid delays in tax filings or refunds.

TIN Data Collection Form

The TIN Data Collection Form is designed to efficiently gather Tax Identification Number details from individuals or entities. It ensures accurate data entry for tax reporting and compliance purposes. This form streamlines the verification process, reducing errors and improving record keeping.

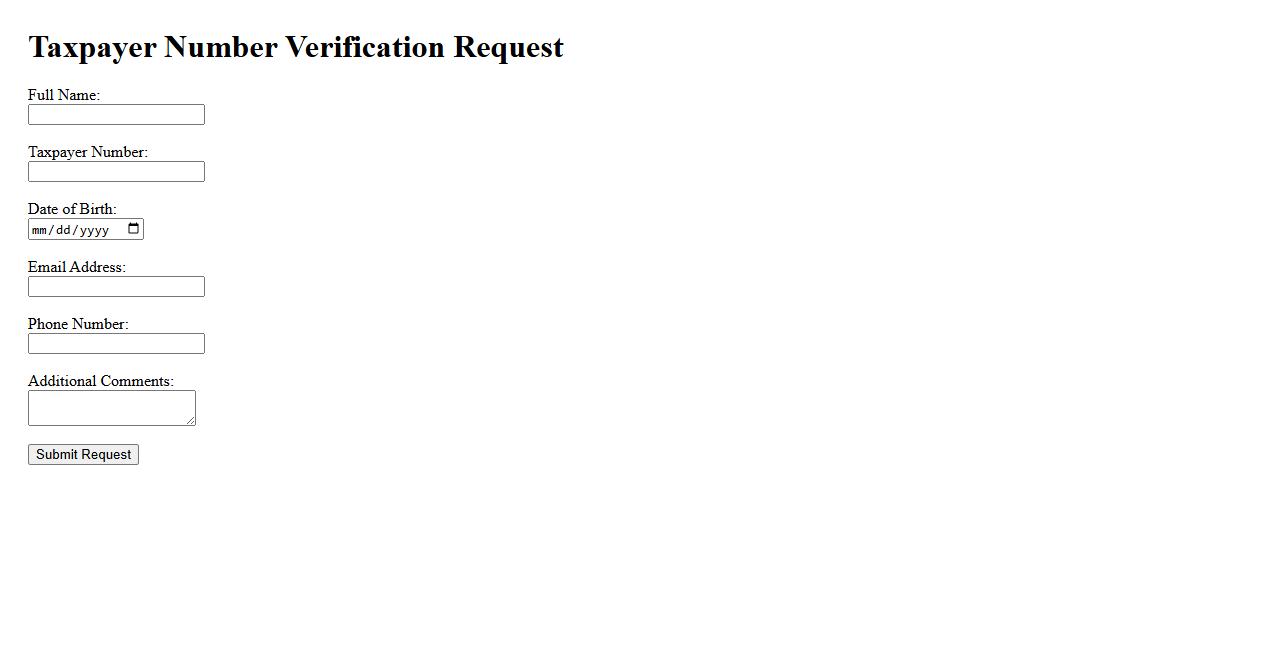

Taxpayer Number Verification Request

The Taxpayer Number Verification Request is a crucial process used to confirm the authenticity and accuracy of a taxpayer's identification number. This verification ensures compliance with tax regulations and helps prevent fraudulent activities. It is commonly required by businesses and government agencies during financial transactions.

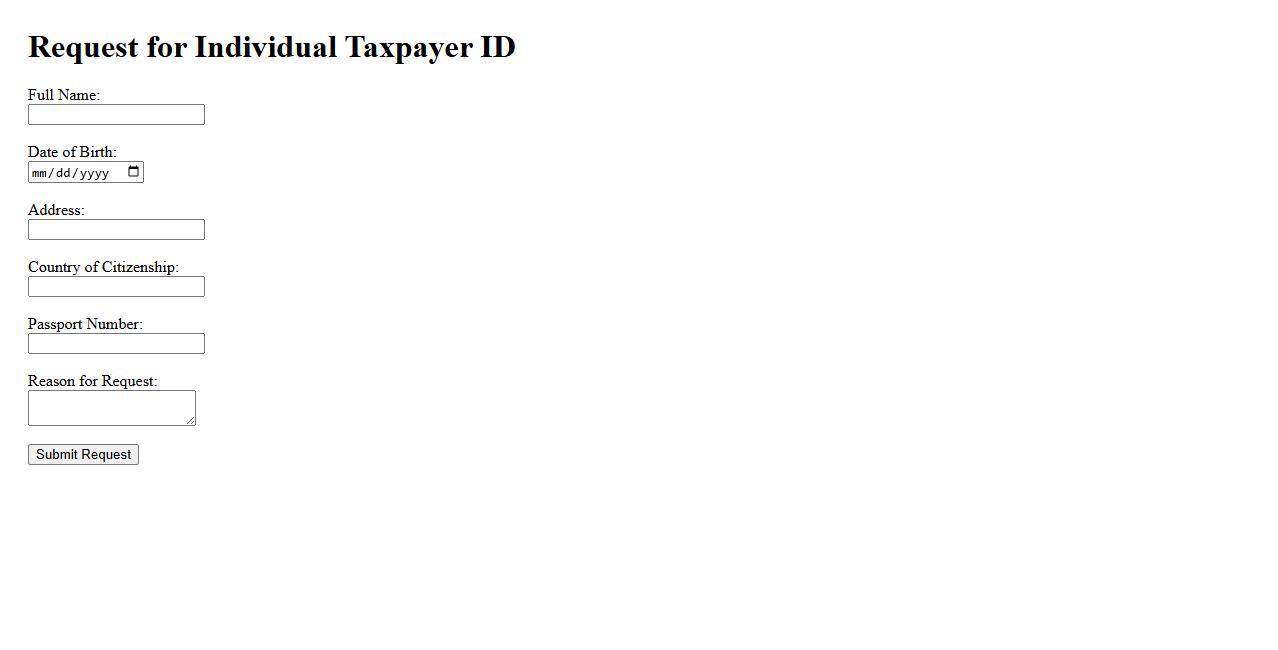

Request for Individual Taxpayer ID

A Request for Individual Taxpayer ID is a formal application required for individuals who are not eligible for a Social Security Number but need an identification number for tax purposes. This process ensures the proper reporting and payment of taxes to the IRS. It is essential for non-residents, foreign nationals, and others who have U.S. tax obligations.

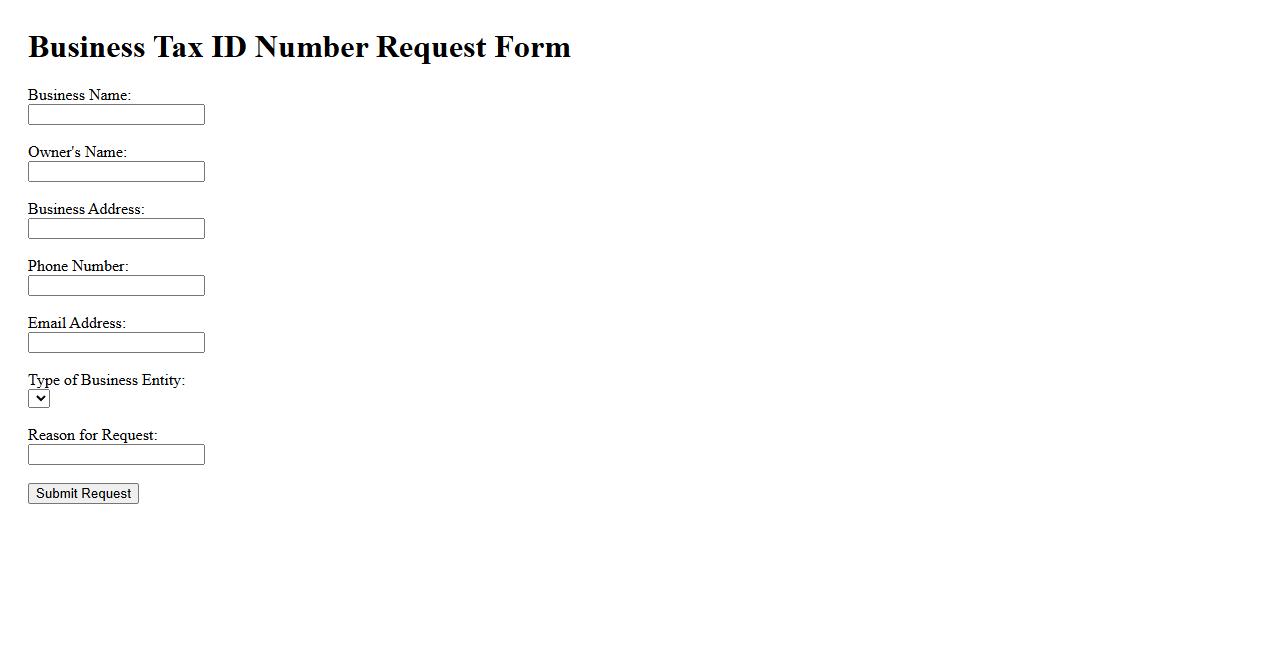

Business Tax ID Number Request

Requesting a Business Tax ID Number is essential for identifying your company for tax purposes. This unique identifier allows your business to file taxes, open bank accounts, and apply for licenses. The process is straightforward and can be completed online through the IRS.

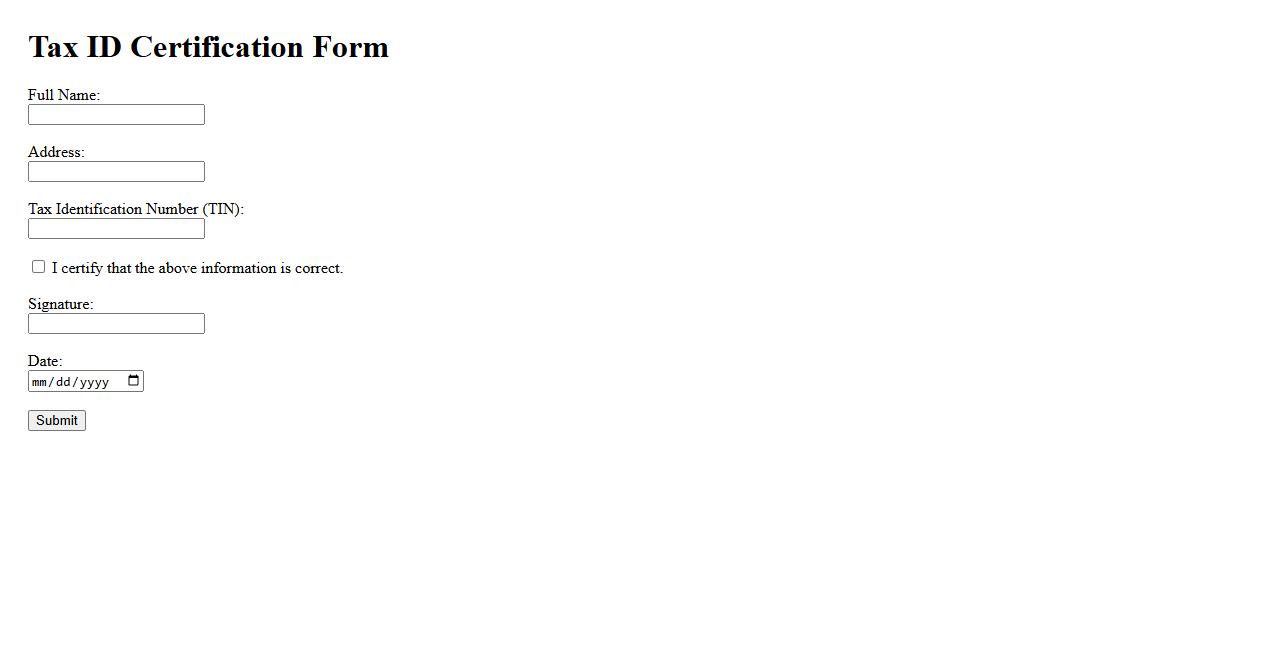

Tax ID Certification Form

The Tax ID Certification Form is an essential document used to verify a business or individual's taxpayer identification number for tax reporting purposes. It ensures compliance with government regulations and facilitates accurate processing of tax-related transactions. Completing this form accurately helps prevent withholding errors and streamlines financial operations.

What is the primary purpose of a Request for Taxpayer Identification Number document?

The primary purpose of a Request for Taxpayer Identification Number (TIN) document is to collect accurate identification details from individuals or entities. This ensures proper reporting and tax withholding compliance by payers. It helps the IRS track income tax obligations effectively.

Which sections of the document require personal information disclosure?

The document requires personal information disclosure in sections asking for the individual's full name, TIN, and address. Additionally, fields related to citizenship and entity type require accurate completion. These details are crucial for tax identification and verification purposes.

Who is typically responsible for completing and submitting the form?

The individual or entity receiving income is usually responsible for completing and submitting the form. This ensures that the information provided is accurate and up to date. Employers or payers rely on this data for correct tax reporting and withholding.

What legal obligations arise from providing false information on the form?

Providing false information on this form can lead to serious legal consequences including fines and penalties. It may also result in criminal charges for tax fraud or misrepresentation. Accurate reporting is mandated to maintain tax system integrity.

Which types of income payments trigger the requirement to request an identification number?

Income types such as interest, dividends, rents, royalties, and certain nonemployee compensation typically trigger the requirement to request an identification number. These payments must be reported to the IRS to ensure proper tax withholding. Requesting the TIN helps in accurate tax reporting and compliance.