A Request for Payment Arrangement is a formal proposal by a debtor to negotiate new terms for settling outstanding debts. It aims to establish a manageable payment plan that suits both parties, preventing default or further penalties. This process enhances communication and ensures clarity on payment schedules and obligations.

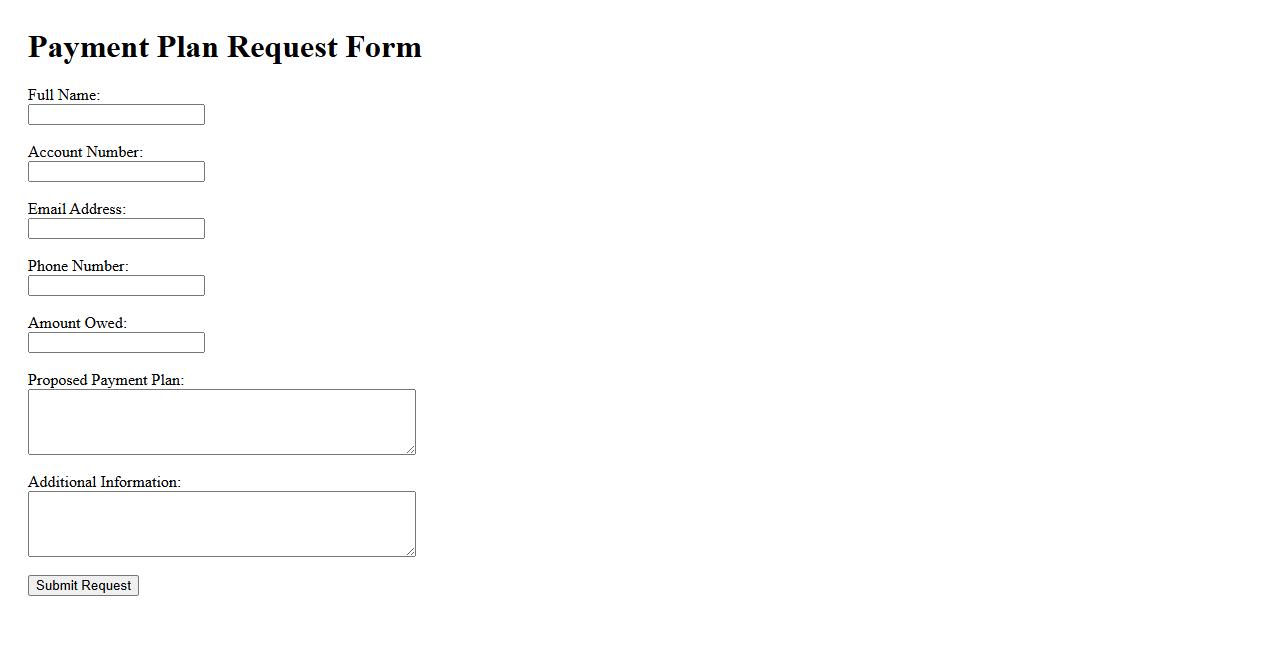

Payment Plan Request

A Payment Plan Request allows customers to arrange flexible payment options tailored to their financial needs. This process helps manage expenses by breaking down a total amount into smaller, manageable installments. It ensures timely payments while providing financial relief and convenience.

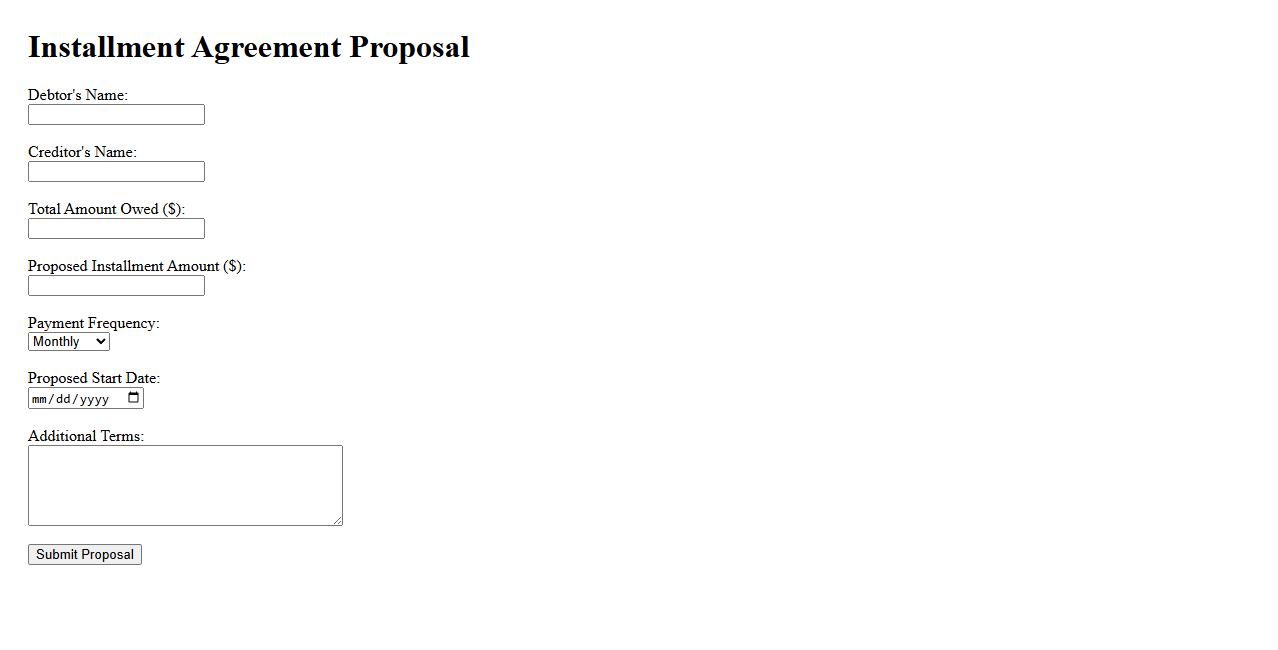

Installment Agreement Proposal

An Installment Agreement Proposal allows taxpayers to request a structured payment plan with the IRS for their outstanding tax debts. This proposal outlines the terms and conditions for monthly payments, making it easier to manage liabilities over time. Submitting a clear and accurate proposal increases the chance of approval and helps avoid penalties.

Deferred Payment Request

A Deferred Payment Request allows customers to postpone their payment obligations to a later date, providing financial flexibility. This option is commonly used in business transactions to manage cash flow effectively. It helps both parties by ensuring the continuation of services or delivery without immediate payment.

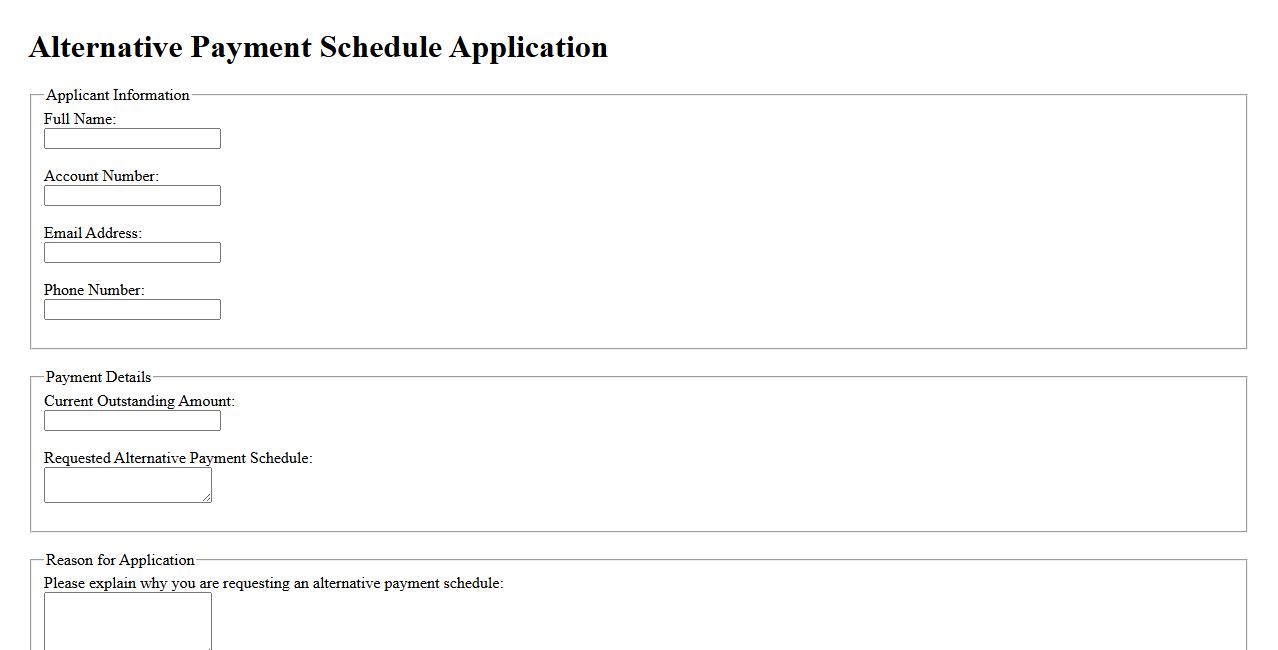

Alternative Payment Schedule Application

The Alternative Payment Schedule Application allows users to customize their payment plans according to their unique financial situations. This tool provides flexibility by enabling adjustments to standard payment timelines, ensuring better affordability and convenience. It is ideal for managing debts, loans, or subscription services with tailored payment options.

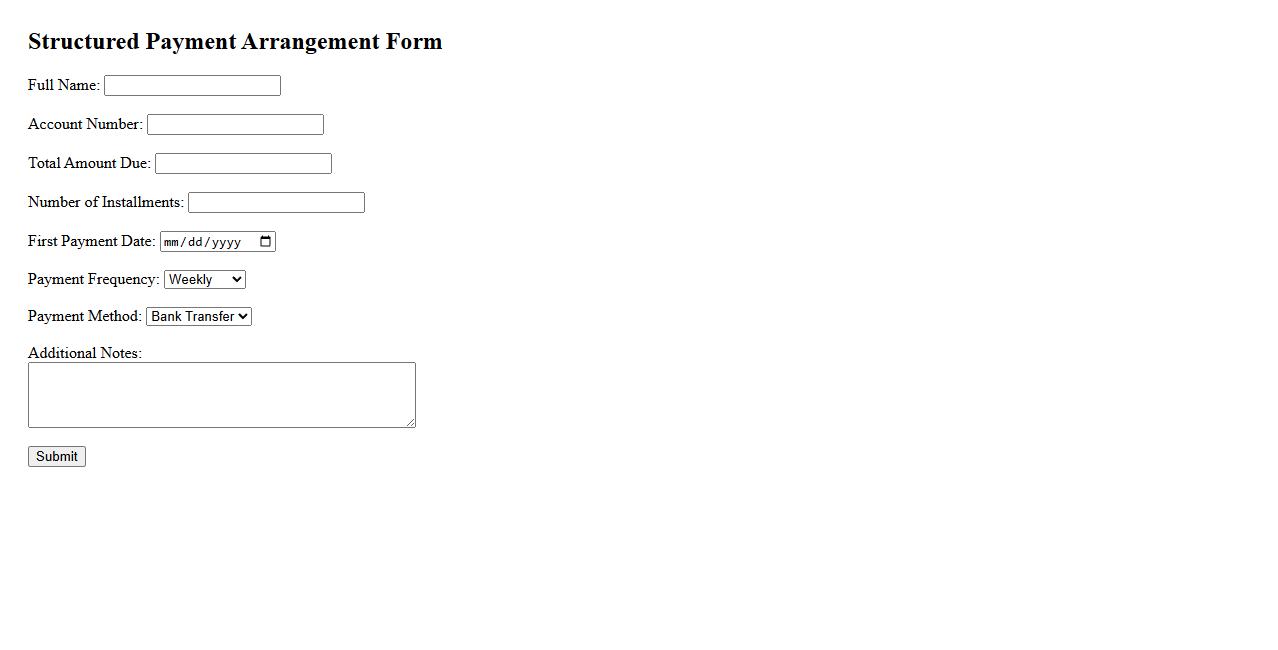

Structured Payment Arrangement Form

The Structured Payment Arrangement Form is designed to help individuals outline clear and manageable payment plans for outstanding balances. This form ensures both parties agree on terms, fostering transparency and accountability. Utilizing this document simplifies financial negotiations and promotes timely payments.

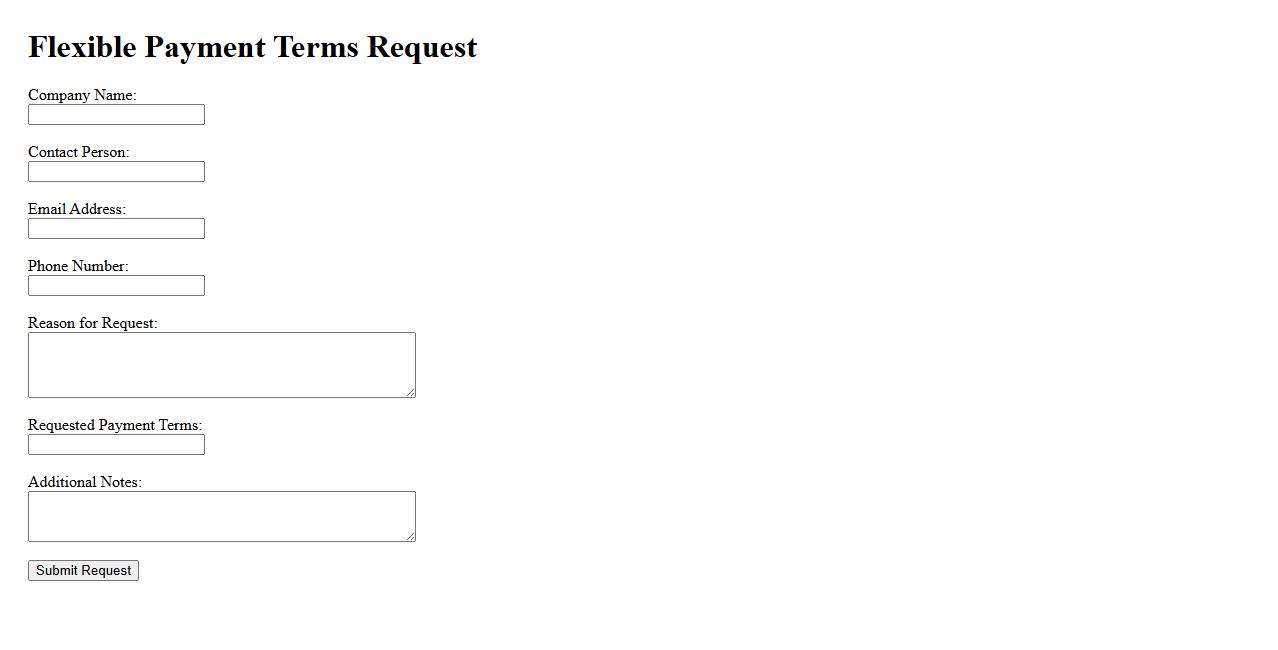

Flexible Payment Terms Request

When submitting a Flexible Payment Terms Request, customers can negotiate customized payment schedules that better suit their financial situation. This option helps improve cash flow management and builds stronger relationships between businesses and clients. Clear communication and mutual agreement are essential for successful flexible payment arrangements.

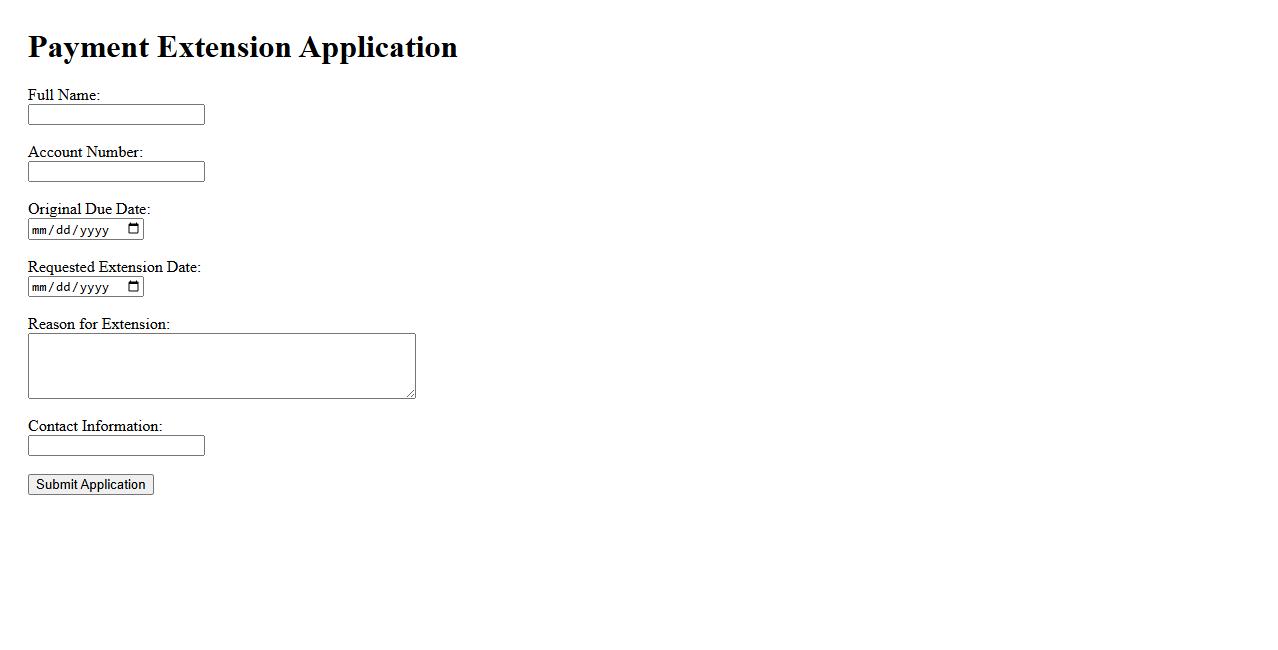

Payment Extension Application

The Payment Extension Application allows users to request additional time to fulfill their payment obligations. This tool streamlines the process, providing flexibility and improving cash flow management. By submitting an application, users can avoid late fees and maintain a positive payment history.

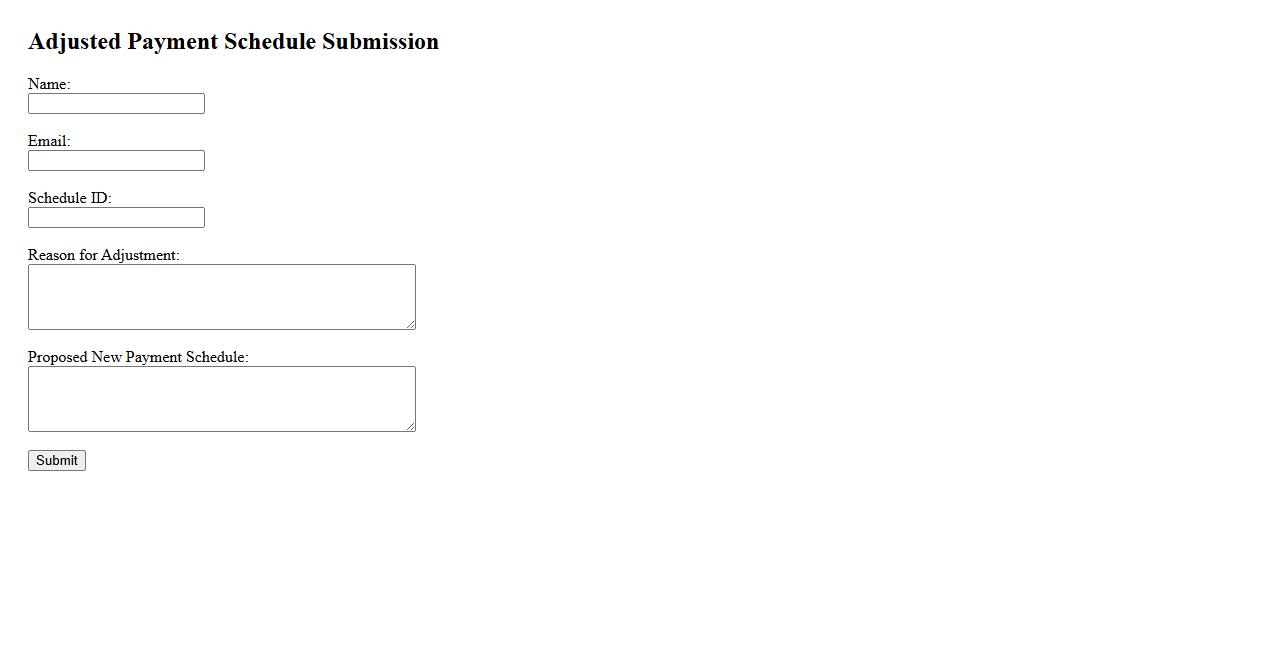

Adjusted Payment Schedule Submission

The Adjusted Payment Schedule Submission allows clients to propose changes to their original payment timeline for improved financial management. This process ensures flexibility and clarity between both parties, facilitating timely and accurate transactions. Submitting an adjusted schedule helps maintain transparent communication regarding payment expectations.

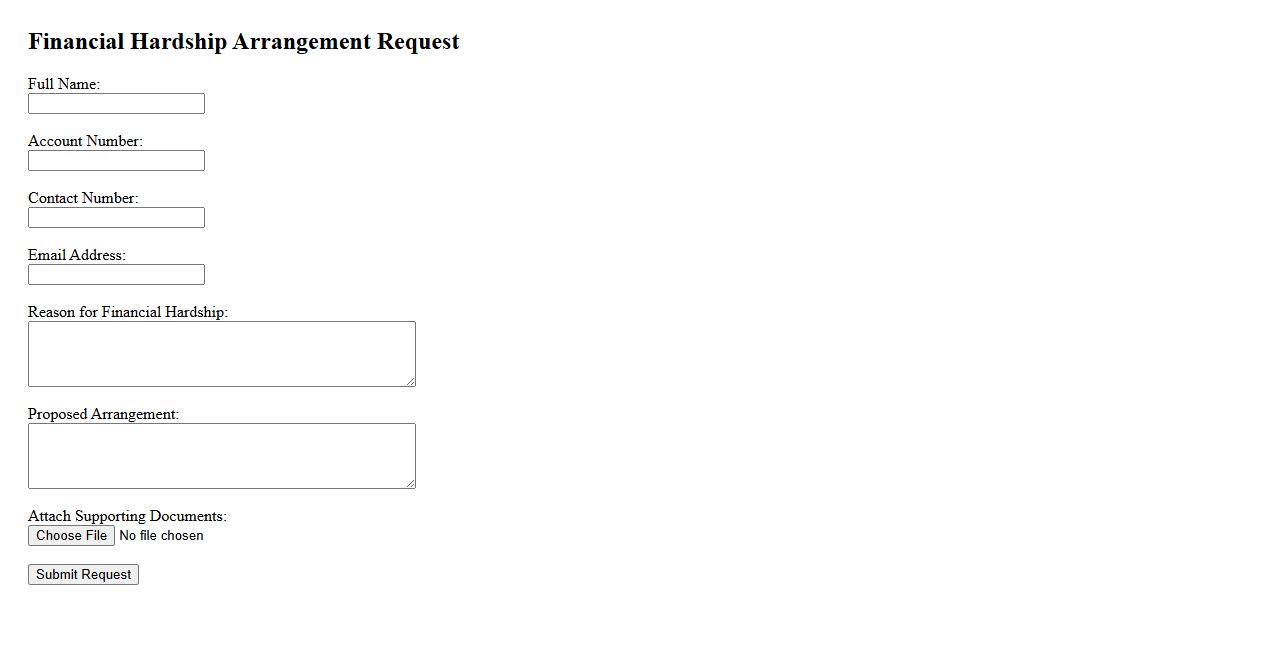

Financial Hardship Arrangement Request

A Financial Hardship Arrangement Request is a formal appeal made by individuals or businesses facing difficulty in meeting their financial obligations. It allows them to negotiate revised payment terms with creditors or service providers. This process aims to provide temporary relief and avoid further financial distress.

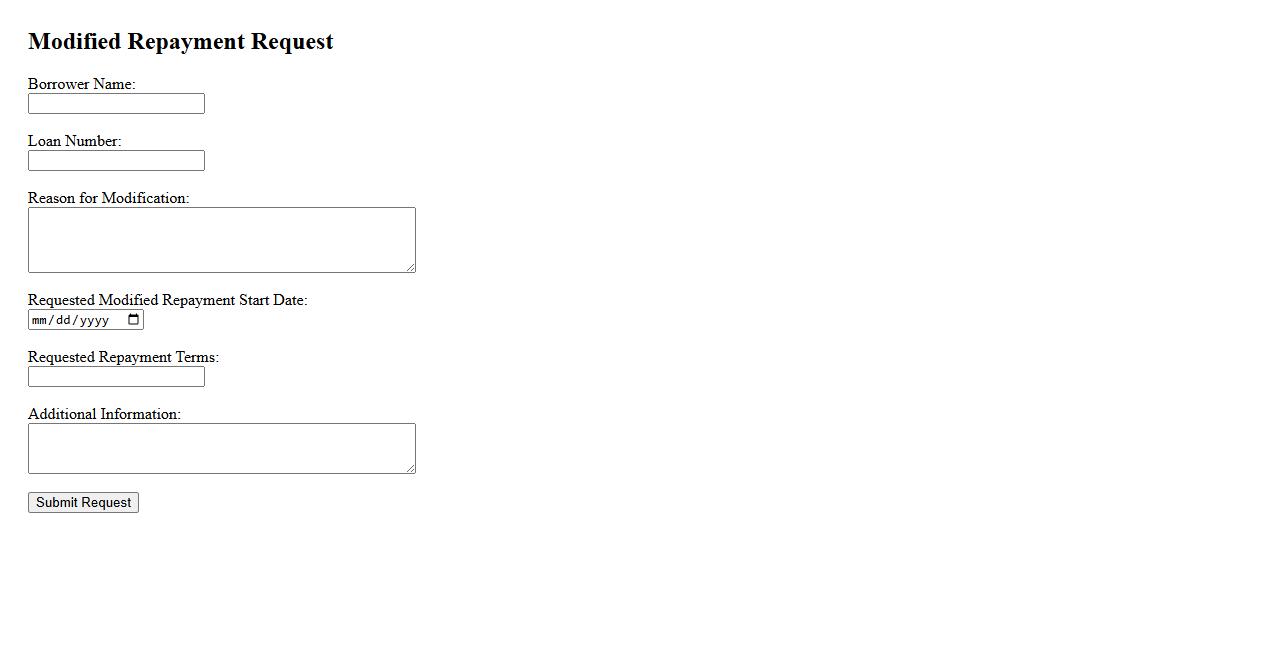

Modified Repayment Request

A Modified Repayment Request allows borrowers to adjust the terms of their loan repayment to better fit their financial situation. This option typically includes changes to the loan amount, interest rate, or payment schedule to provide relief. It's essential for borrowers seeking manageable payments during temporary hardships.

What specific amount and payment dates are being requested in the arrangement?

The arrangement requests a specific payment amount to be paid on designated dates to ensure timely compliance. The payment dates are typically scheduled at regular intervals, such as monthly or bi-weekly, to facilitate financial planning. These details are essential for both parties to maintain transparency and avoid any confusion.

What is the primary reason for requesting a payment arrangement?

The primary reason for requesting a payment arrangement is to provide financial flexibility to the payer during challenging circumstances. It allows the payer to manage their obligations without defaulting on payments. This arrangement helps maintain a positive relationship between the parties involved.

What supporting documents or evidence are required to validate the request?

Supporting documents such as income statements, bank statements, or proof of hardship are often required to validate the payment arrangement request. These documents provide evidence of the payer's financial condition and justify the need for modified payment terms. Proper documentation is crucial for the approval process.

What are the possible outcomes if the payment arrangement is not approved?

If the payment arrangement is not approved, the payer may face late fees, penalties, or legal actions as consequences of non-compliance. This can lead to increased financial burden and potential damage to credit ratings. The denial may also result in the acceleration of the full payment amount.

Who are the authorized parties involved in approving or reviewing the arrangement request?

The approval or review of the payment arrangement request is typically conducted by authorized representatives such as finance managers, account officers, or legal advisors. These parties ensure that the arrangement is fair and complies with organizational policies. Their role is critical in balancing the interests of both the payer and the payee.