A Request for Loan Payoff Statement is a formal inquiry made to a lender to obtain the exact amount needed to fully repay a loan. This statement details the current balance, including principal, interest, and any applicable fees, ensuring transparency before final payment. Receiving a payoff statement helps borrowers avoid underpayment or overpayment during loan closure.

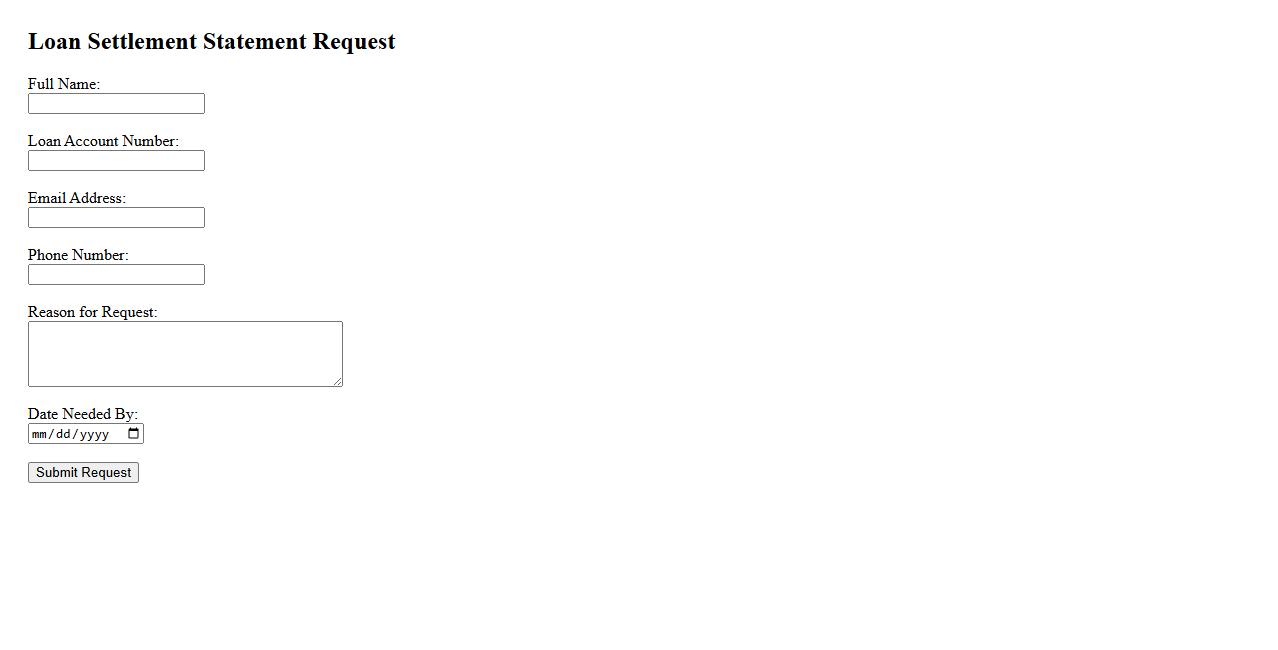

Loan Settlement Statement Request

A Loan Settlement Statement Request is a formal document used to obtain a detailed statement showing the outstanding balance required to pay off a loan in full. This statement includes all fees, interest, and principal amounts up to the settlement date. It helps borrowers understand the exact payoff amount and avoid any discrepancies during loan closure.

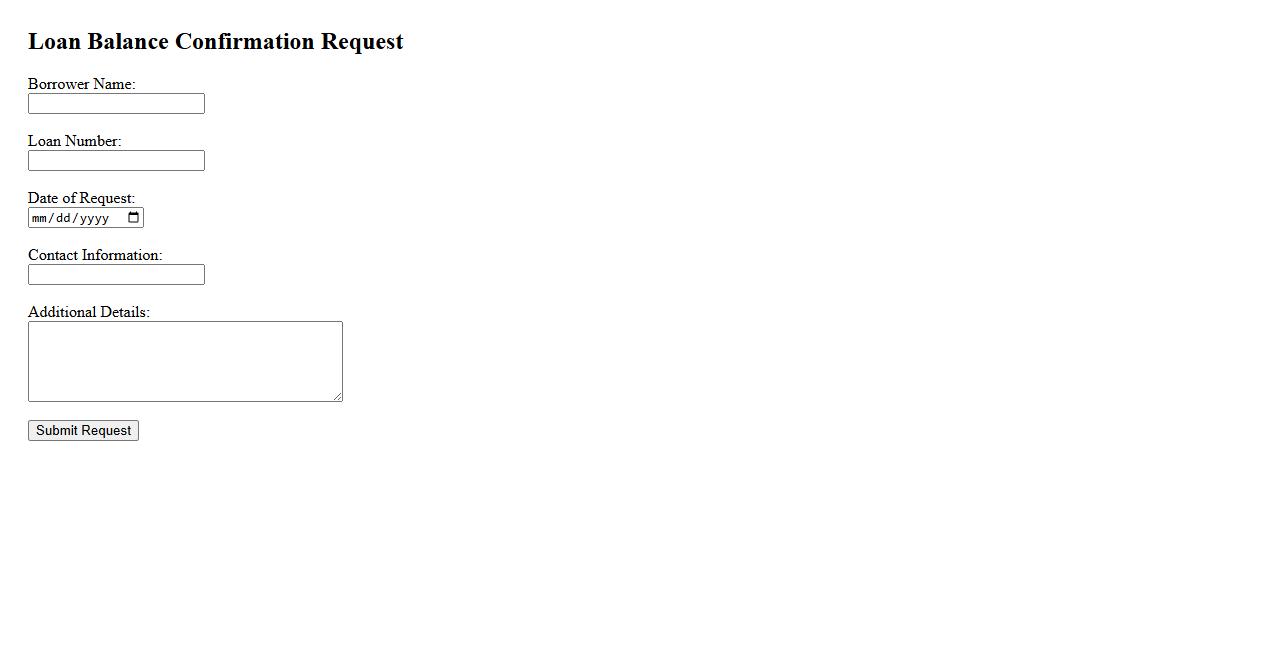

Loan Balance Confirmation Request

A Loan Balance Confirmation Request is a formal inquiry made to verify the outstanding amount owed on a loan. This document is essential for both lenders and borrowers to ensure accuracy in financial records. It helps in maintaining transparency and preventing discrepancies in loan repayments.

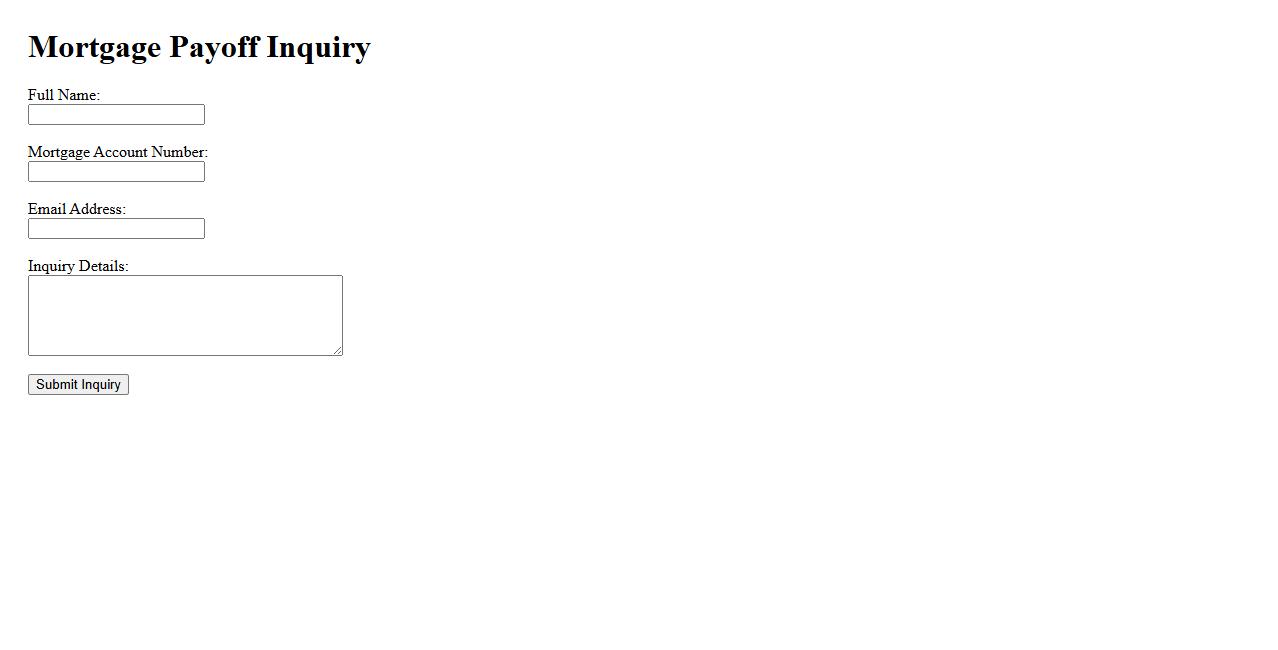

Mortgage Payoff Inquiry

A Mortgage Payoff Inquiry allows homeowners to obtain the exact amount needed to fully pay off their mortgage loan. This important information helps borrowers plan financial decisions and avoid any unexpected charges. It typically includes the principal balance, accrued interest, and any applicable fees.

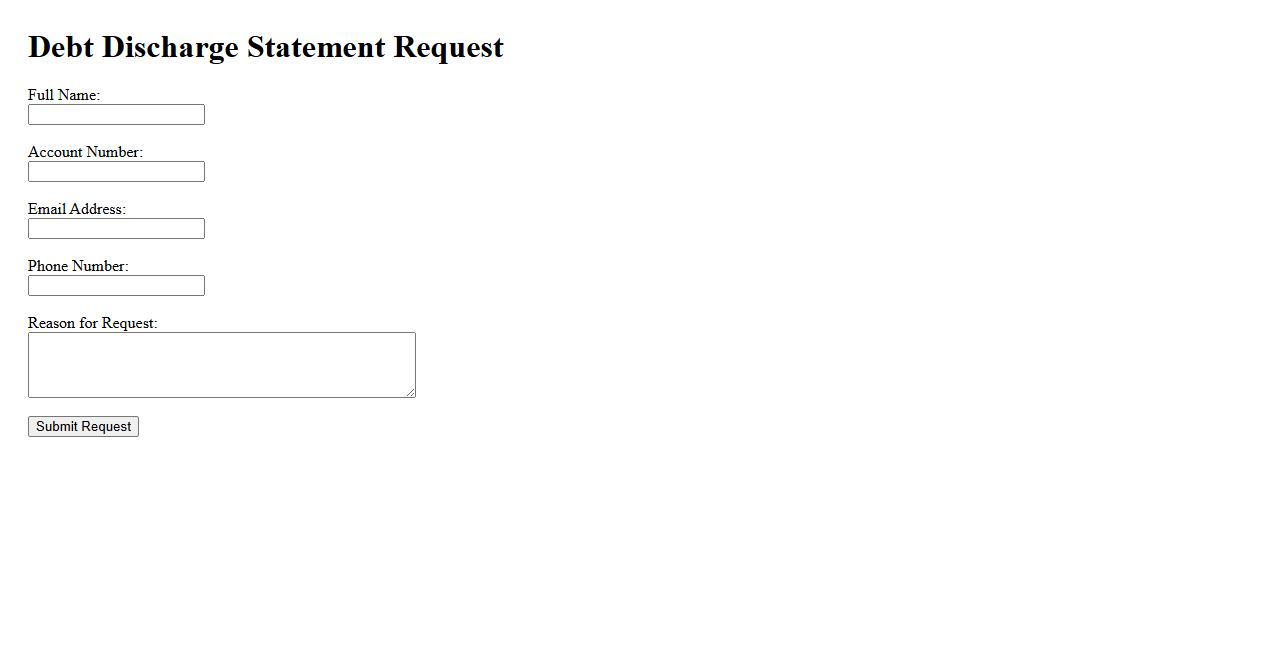

Debt Discharge Statement Request

A Debt Discharge Statement Request is a formal application submitted to verify that a debt has been fully paid and released. This statement provides official proof that the borrower is no longer liable for the outstanding balance. It is essential for clearing credit records and ensuring financial transparency.

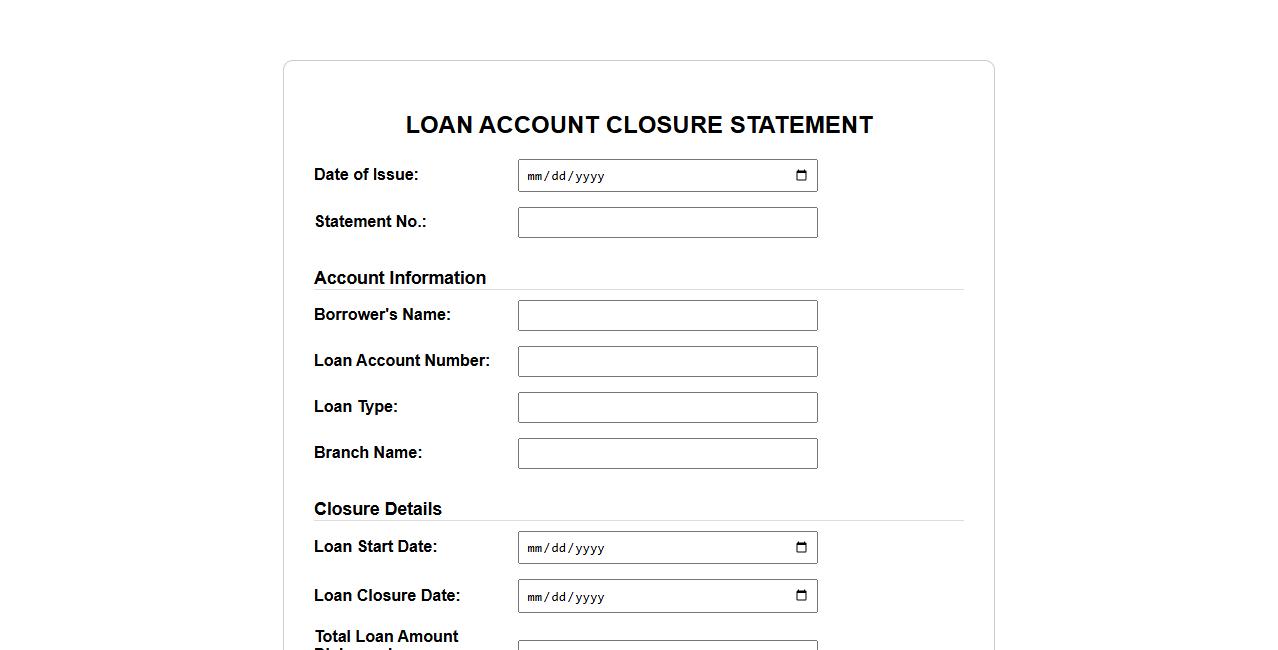

Loan Account Closure Statement

The Loan Account Closure Statement is an official document provided by a lender when a loan has been fully repaid. It confirms that the borrower has met all financial obligations and the loan account is now closed. This statement is essential for maintaining accurate financial records and can be used for future reference or credit verification.

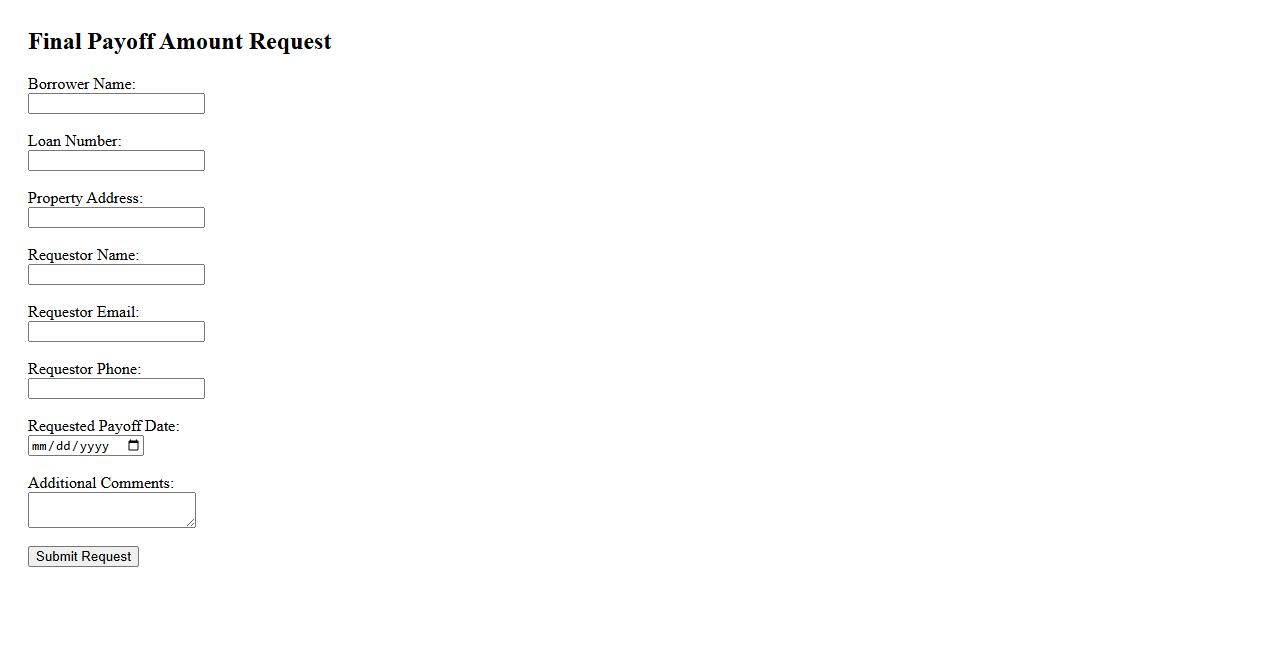

Final Payoff Amount Request

The Final Payoff Amount Request is a formal inquiry made to determine the exact amount needed to fully settle a loan or mortgage. This amount includes the remaining principal, interest, and any applicable fees up to the payoff date. Obtaining this figure ensures clarity and accuracy before completing the payment process.

Mortgage Payoff Letter Request

A Mortgage Payoff Letter Request is a formal document submitted to a lender to obtain the exact amount needed to fully repay a mortgage loan. This letter details the outstanding balance, including interest and any applicable fees, ensuring a clear understanding of the total payoff cost. It is essential for borrowers planning to refinance, sell, or close their mortgage account efficiently.

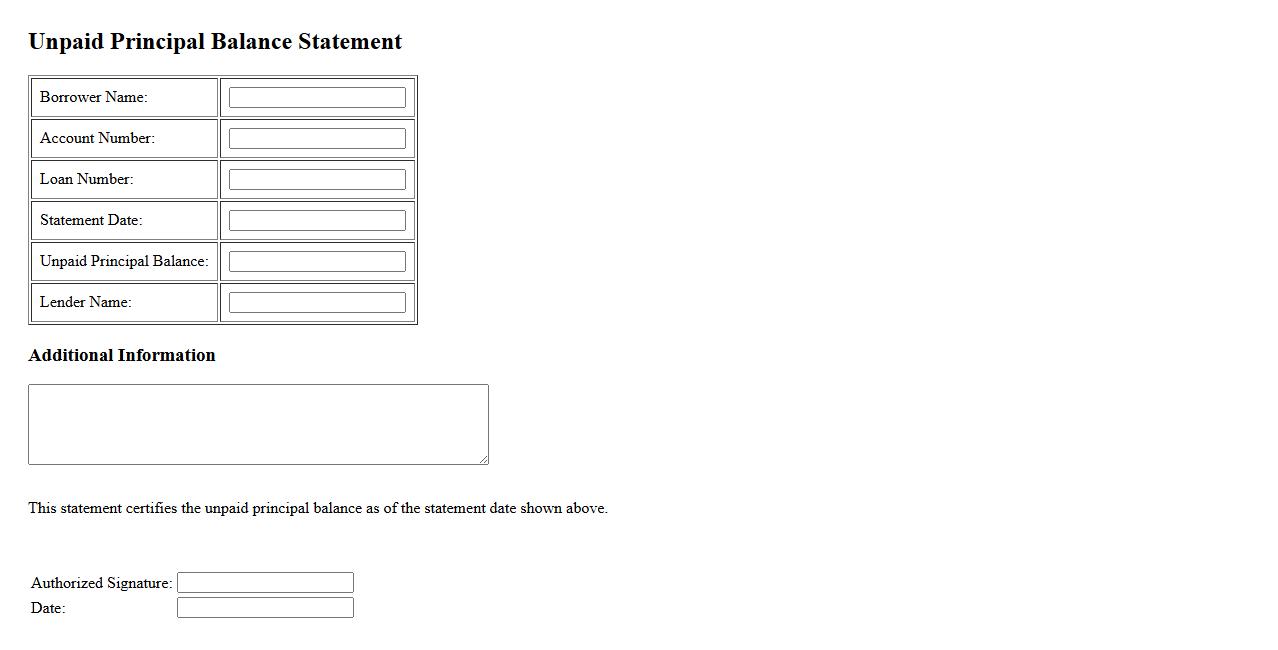

Unpaid Principal Balance Statement

The Unpaid Principal Balance Statement provides a detailed summary of the remaining amount owed on a loan or mortgage. It outlines the exact balance that has not yet been paid, excluding any interest or fees. This document is essential for borrowers to track their debt status and plan future payments effectively.

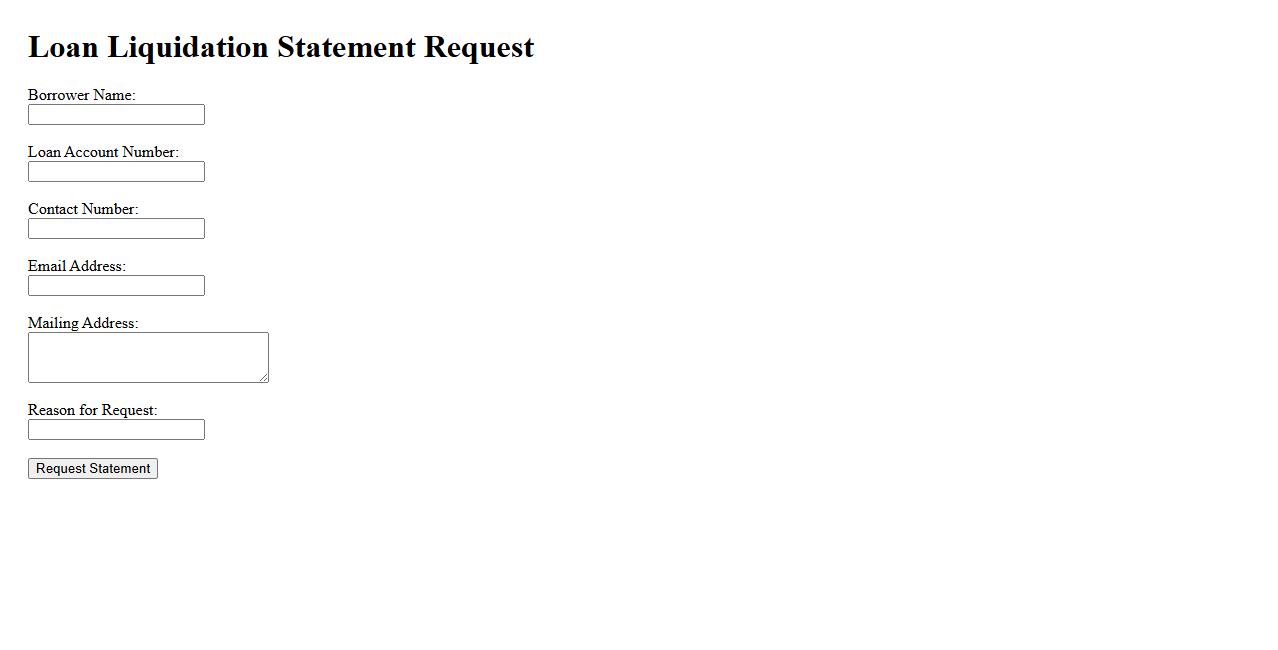

Loan Liquidation Statement Request

A Loan Liquidation Statement Request is a formal document used to obtain the detailed summary of the remaining balance on a loan. This statement helps borrowers understand the total amount required to fully pay off their loan, including any interest and fees. It is essential for managing loan closure and ensuring accurate payments.

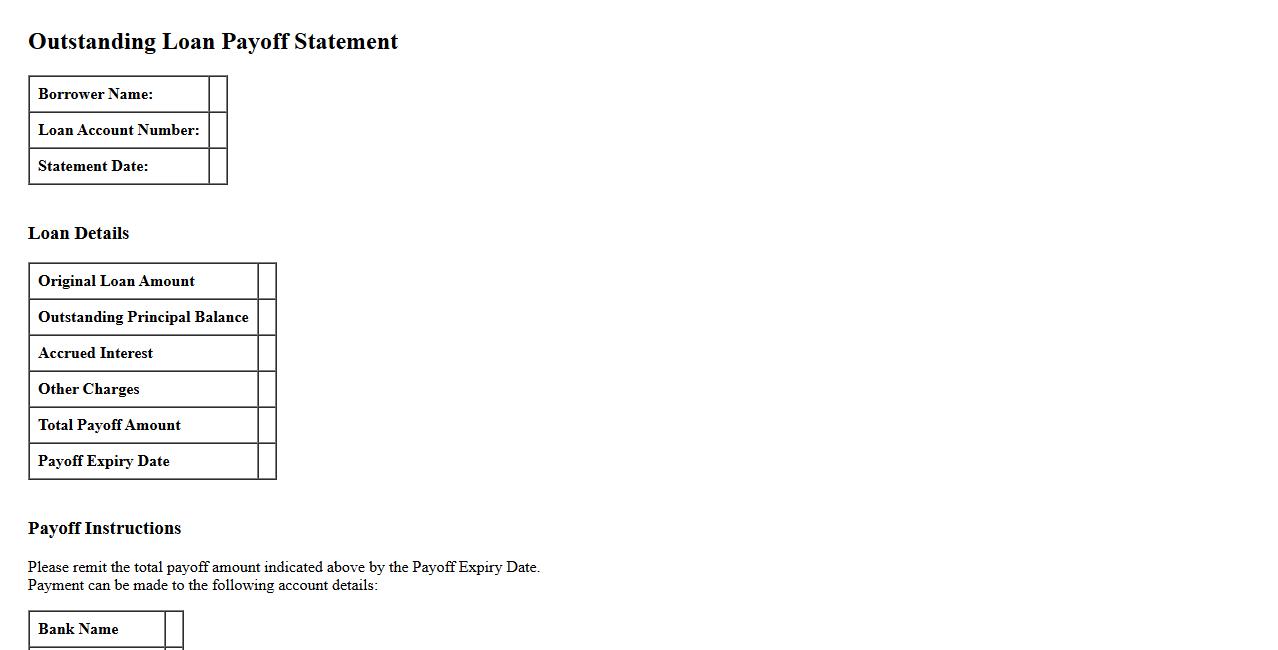

Outstanding Loan Payoff Statement

The Outstanding Loan Payoff Statement provides a detailed summary of the remaining balance on a loan, including principal, interest, and any applicable fees. It serves as an essential document for borrowers planning to fully settle their loan ahead of schedule. This statement ensures transparency and helps in precise financial planning.

What is the purpose of a Loan Payoff Statement in the context of a loan agreement?

A Loan Payoff Statement serves as an official document that details the exact amount required to completely satisfy a loan. It helps borrowers understand the total cost needed to close out their loan agreement early or at maturity. This statement is essential for ensuring clarity between the lender and borrower regarding any outstanding obligations.

Which critical information must be included when requesting a Loan Payoff Statement?

When requesting a Loan Payoff Statement, it is crucial to provide the borrower's name, loan account number, and contact details. Additionally, the current date for which the payoff amount is calculated must be specified to ensure accuracy. Including a written request or proper authorization helps maintain the security of the loan information.

How does the payoff amount differ from the outstanding loan balance?

The payoff amount may include interest accrued up to the payoff date, late fees, and other charges, which can make it higher than the outstanding loan balance. The outstanding loan balance is often the principal amount remaining without additional costs. Understanding this difference helps borrowers plan their repayment accurately.

Who is authorized to request a Loan Payoff Statement from the lender?

Only the borrower or an authorized representative can request a Loan Payoff Statement from the lender. Authorization is typically documented via a power of attorney or written permission. This restriction ensures that sensitive financial information is protected.

What is the typical response time for a lender to provide a Loan Payoff Statement after receiving a request?

Lenders generally respond within one to five business days after receiving a Loan Payoff Statement request. This timeframe allows them to accurately calculate the current payoff amount including any pending interest or fees. Prompt responses facilitate smoother loan closings or settlements.