A Request for Employer Identification Number is a formal application process used by businesses to obtain a unique nine-digit number assigned by the IRS for tax identification purposes. This number is essential for opening business bank accounts, filing tax returns, and hiring employees. Employers must complete Form SS-4 to apply for an EIN quickly and securely online, by mail, or fax.

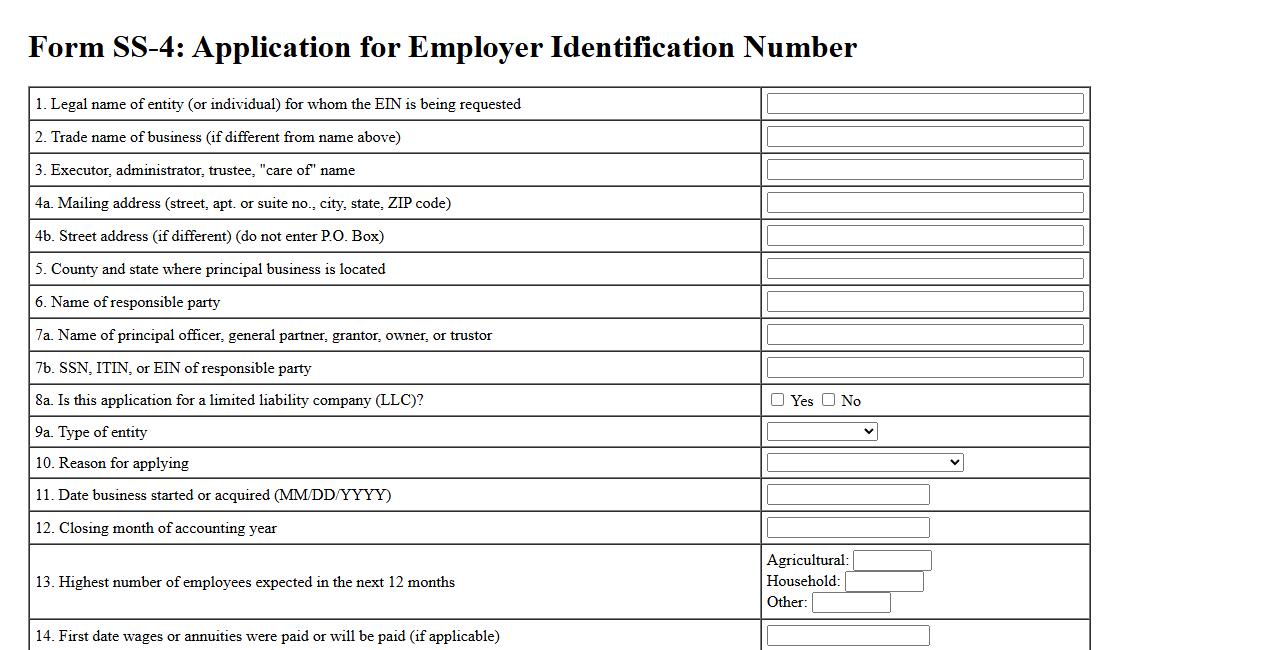

IRS Form SS-4

The IRS Form SS-4 is used to apply for an Employer Identification Number (EIN), which is essential for business entities to identify themselves for tax purposes. This form collects information about the business structure and ownership. Completing Form SS-4 correctly ensures smooth processing of EIN applications by the IRS.

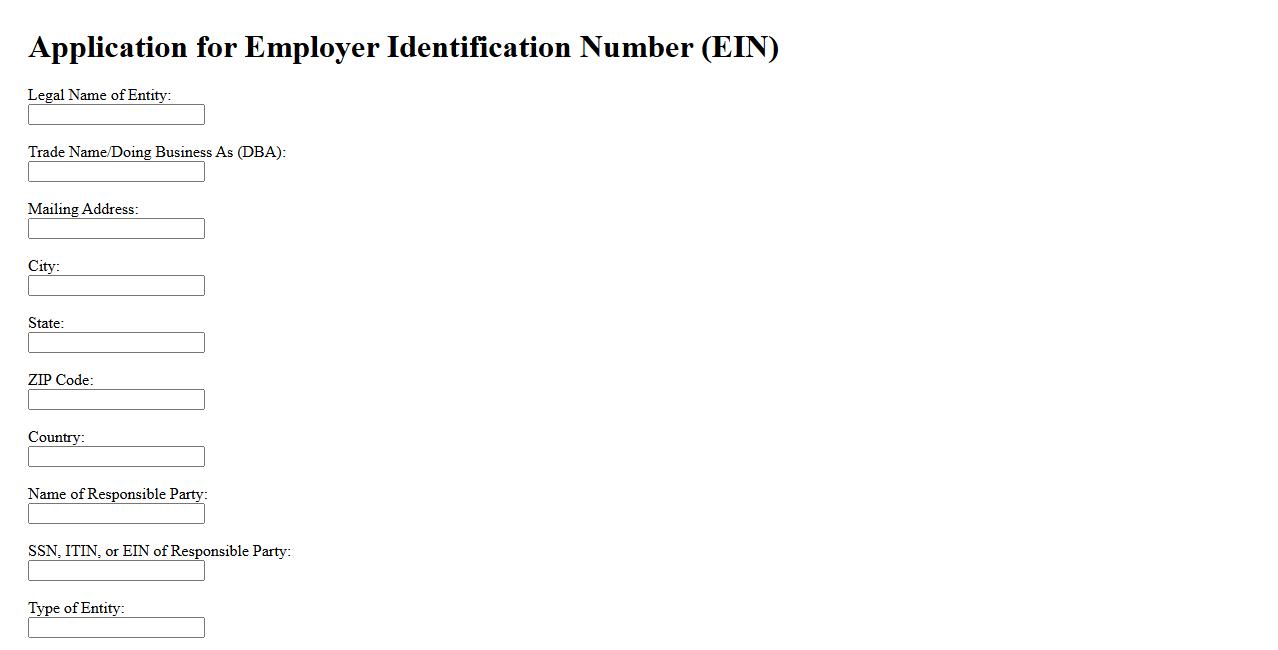

Application for EIN

Applying for an Employer Identification Number (EIN) is essential for businesses to legally identify themselves for tax purposes. The application process is straightforward and can be completed online through the IRS website. Obtaining an EIN helps streamline tax filings and business operations.

EIN Request Form

The EIN Request Form is a crucial document used to apply for an Employer Identification Number from the IRS. This number is essential for business identification and tax reporting purposes. Completing the form accurately ensures timely processing and compliance with federal regulations.

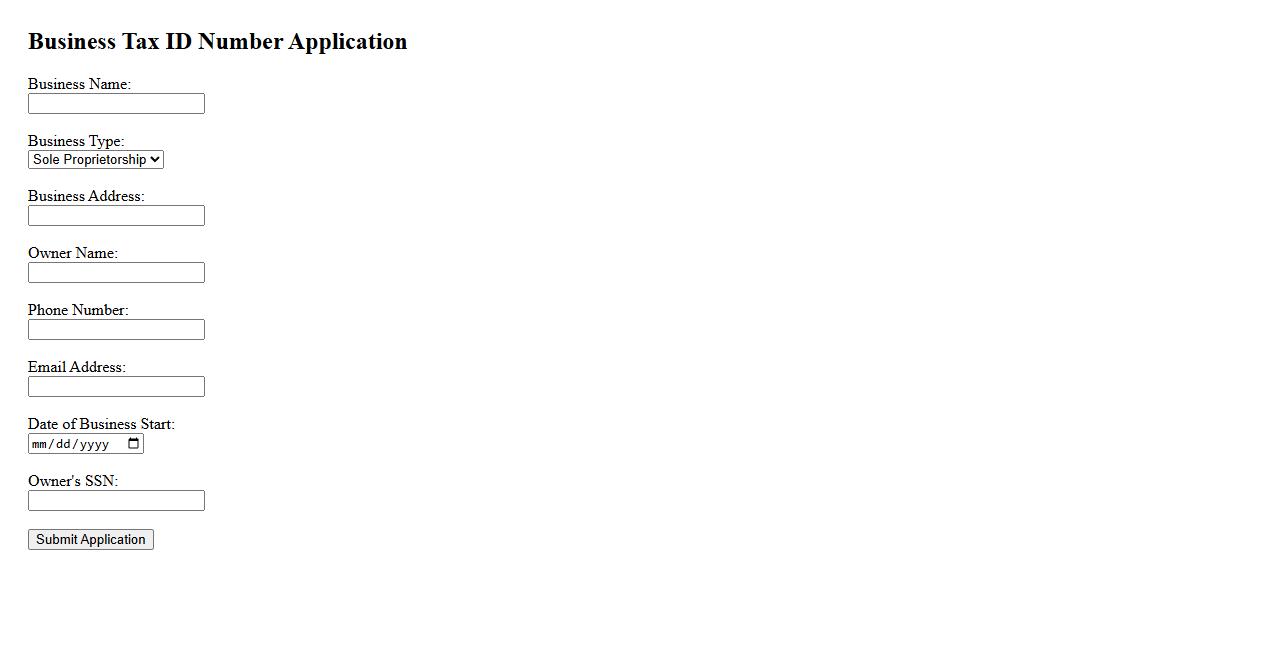

Business Tax ID Number Application

Applying for a Business Tax ID Number is essential for identifying your company to federal and state tax authorities. This unique identifier simplifies tax filing, hiring employees, and opening business bank accounts. Securing your Business Tax ID ensures compliance and smooth operation of your enterprise.

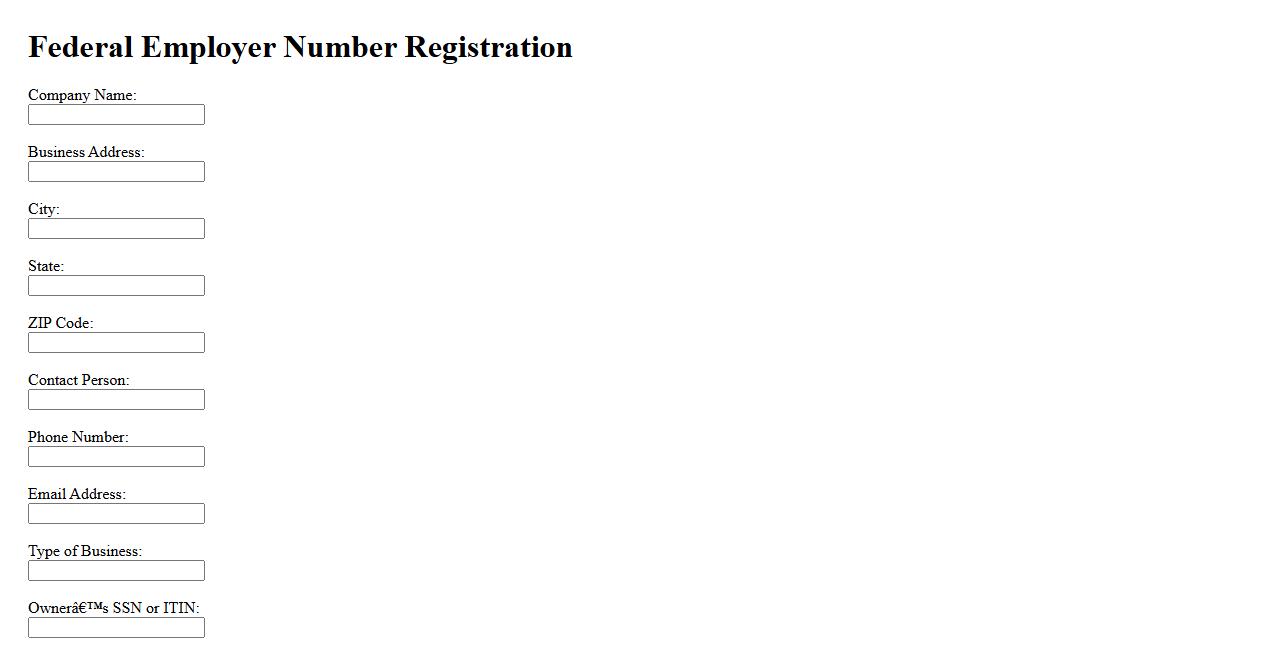

Federal Employer Number Registration

Federal Employer Number Registration is the process businesses must complete to obtain an Employer Identification Number (EIN) from the IRS. This unique number is essential for tax reporting, hiring employees, and opening business bank accounts. Registering ensures compliance with federal regulations and streamlines business operations.

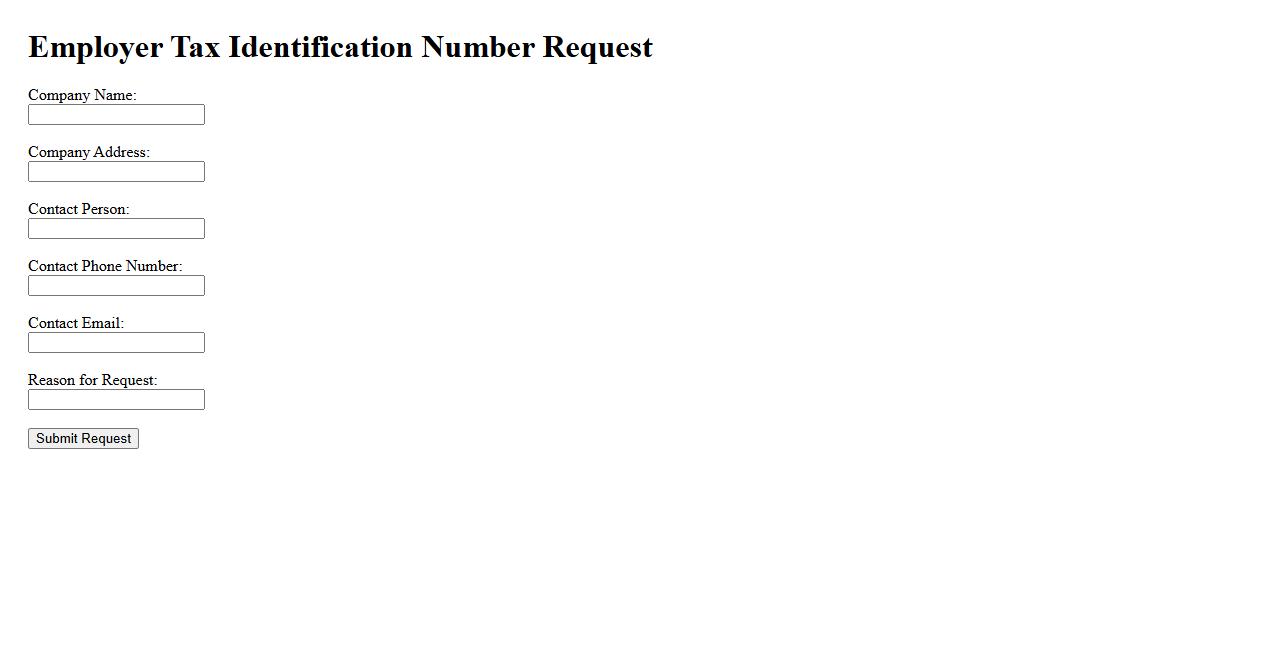

Employer Tax Identification Number Request

The Employer Tax Identification Number Request is a formal application process used by businesses to obtain a unique identifier for tax purposes. This number is essential for reporting employment taxes and other business-related tax obligations. Properly securing an Employer Tax Identification Number ensures compliance with federal tax regulations.

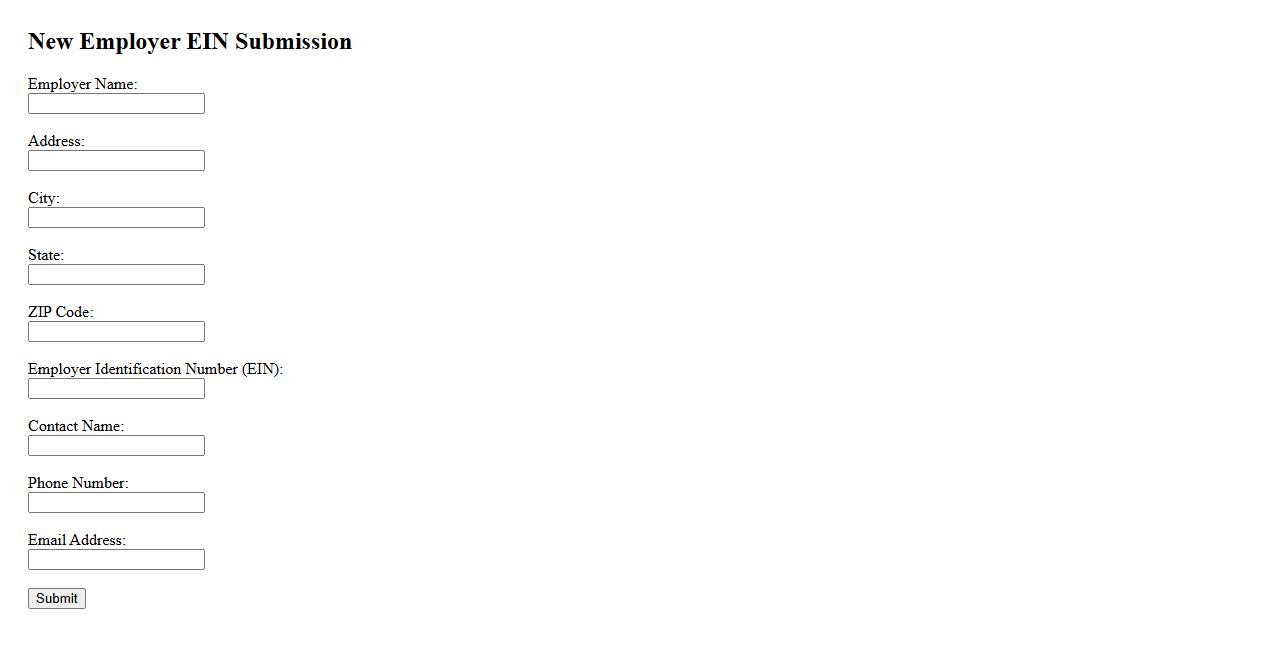

New Employer EIN Submission

The New Employer EIN Submission process involves applying for an Employer Identification Number to legally identify a business entity for tax purposes. This unique number is essential for reporting taxes, opening bank accounts, and hiring employees. Timely submission ensures compliance with federal regulations and smooth operation of the business.

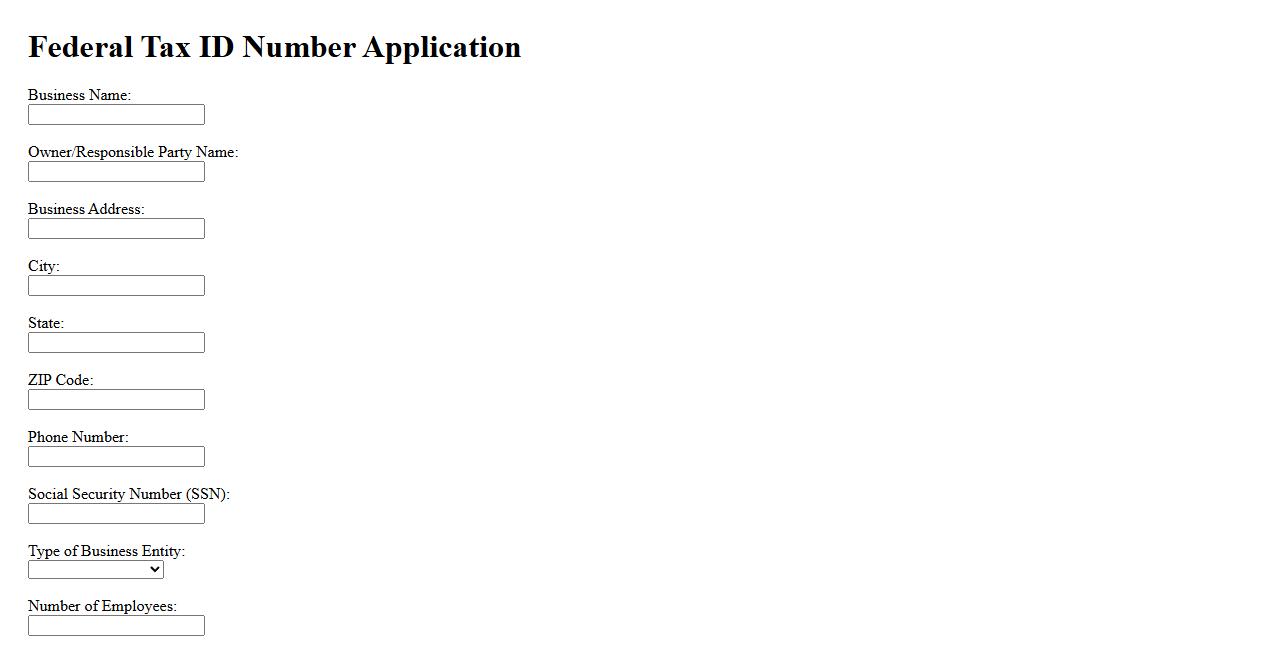

Federal Tax ID Number Application

Applying for a Federal Tax ID Number is essential for businesses to legally operate and fulfill tax obligations. This unique identifier, also known as an Employer Identification Number (EIN), is issued by the IRS. It simplifies the process of filing taxes and opening business accounts.

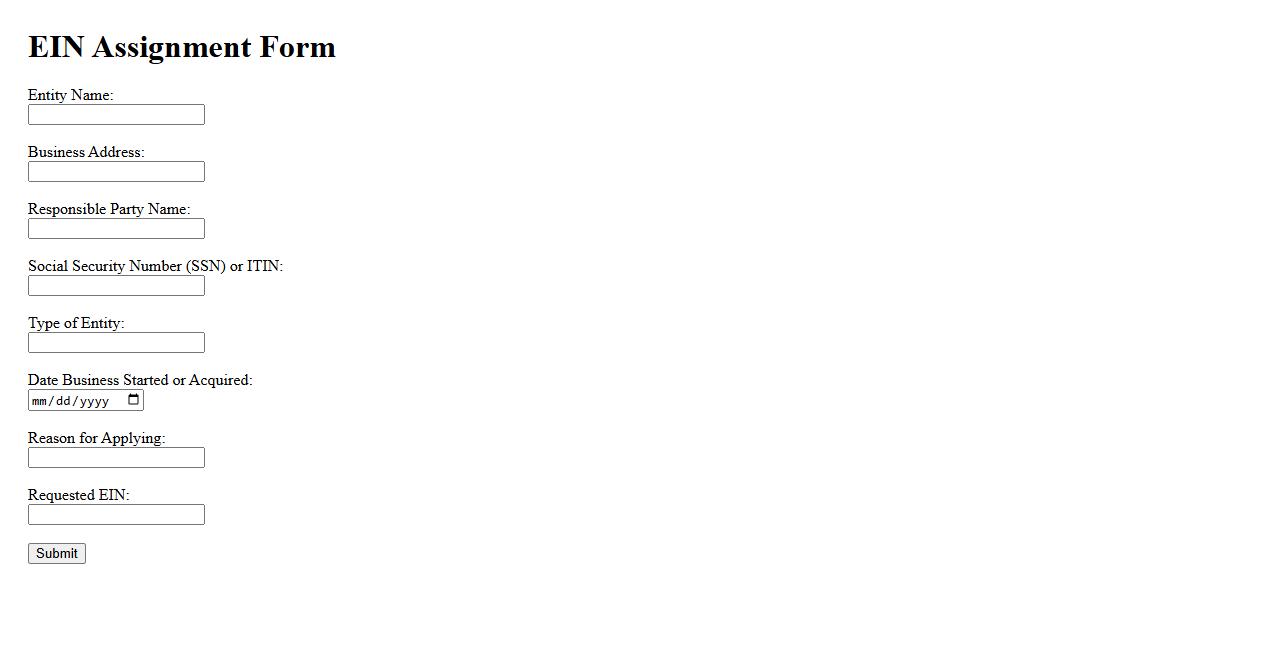

EIN Assignment Form

The EIN Assignment Form is a crucial document used to assign an Employer Identification Number to a business entity. It ensures proper identification for tax purposes and compliance with regulatory agencies. This form streamlines the process of EIN allocation, making it essential for new businesses and organizational changes.

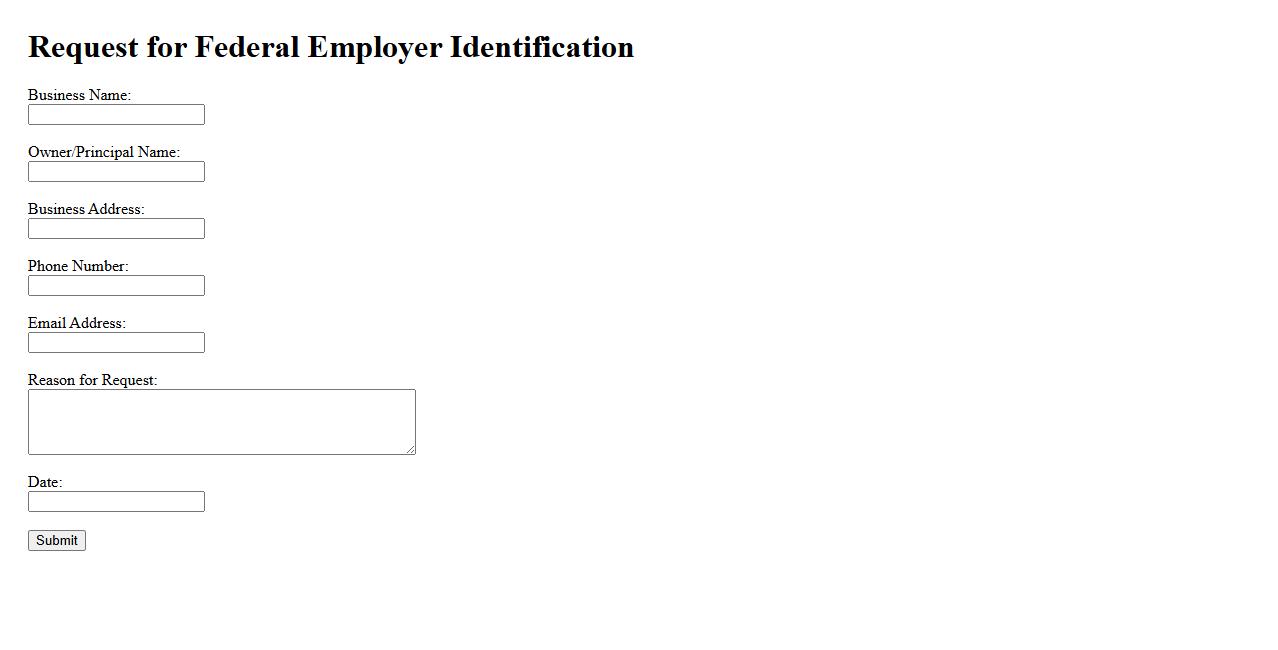

Request for Federal Employer Identification

The Request for Federal Employer Identification is a formal process used by businesses to obtain their unique Employer Identification Number (EIN) from the IRS. This number is essential for tax reporting, opening bank accounts, and hiring employees. Applying can be done online, by mail, or fax, ensuring compliance with federal regulations.

Primary Purpose of an Employer Identification Number (EIN)

The Employer Identification Number (EIN) is primarily used for tax administration purposes by the Internal Revenue Service (IRS). It serves as a unique identifier for businesses operating in the United States, similar to a Social Security Number for individuals. This number facilitates reporting and payment of taxes, as well as other business-related legal activities.

Eligible Business Entities for EIN Application

The form allows various types of business entities to apply for an EIN, including corporations, partnerships, sole proprietorships, estates, trusts, and non-profit organizations. It ensures that all legally recognized entities involved in business activities can obtain this crucial identification number. Eligibility is integral for entities that need to comply with federal tax regulations and reporting requirements.

Required Information About the Responsible Party

The document mandates the inclusion of detailed information about the responsible party, who must be an individual with control over the entity's funds and assets. This includes the responsible party's name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), and contact details. Accurate identification of the responsible party is essential for accountability and IRS correspondence.

Circumstances Requiring a New EIN

The form clearly outlines that an entity must obtain a new EIN when there is a significant change in ownership, structure, or legal status. Examples include incorporation, partnership changes, or bankruptcy proceedings. These rules ensure that the EIN accurately reflects the current status of the business for tax and legal purposes.

Methods for Submitting the EIN Request

The document specifies multiple submission methods, such as online application, fax, mail, and phone for international applicants. The online method is often the fastest, while written methods provide a paper trail. These options ensure flexible accessibility for all applicants.