To obtain a Request for Copy of Tax Return, individuals must submit Form 4506 to the IRS, authorizing the release of their tax return documents. The process typically requires providing personal identification information and specifying the tax year for the requested copies. Fees may apply depending on the number of years requested, and processing times vary based on the IRS workload.

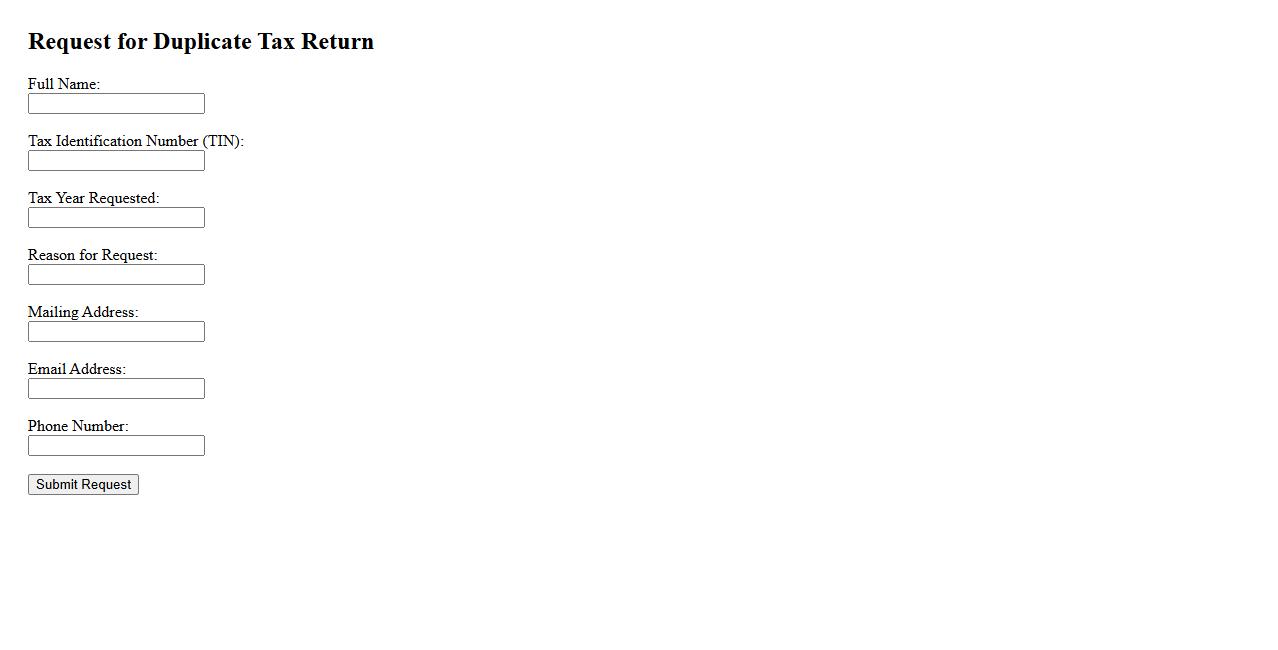

Request for Duplicate Tax Return

If you need a copy of your filed tax documents, a Request for Duplicate Tax Return is essential. This process allows you to obtain official records in case of loss or damage. Ensure to submit the required identification and details to receive your duplicate promptly.

Application for Tax Return Copy

Filing an Application for Tax Return Copy allows individuals and businesses to obtain duplicate copies of their previously filed tax returns. This service is essential for record-keeping, auditing, or resolving discrepancies with tax authorities. It ensures taxpayers have access to accurate and official documentation when needed.

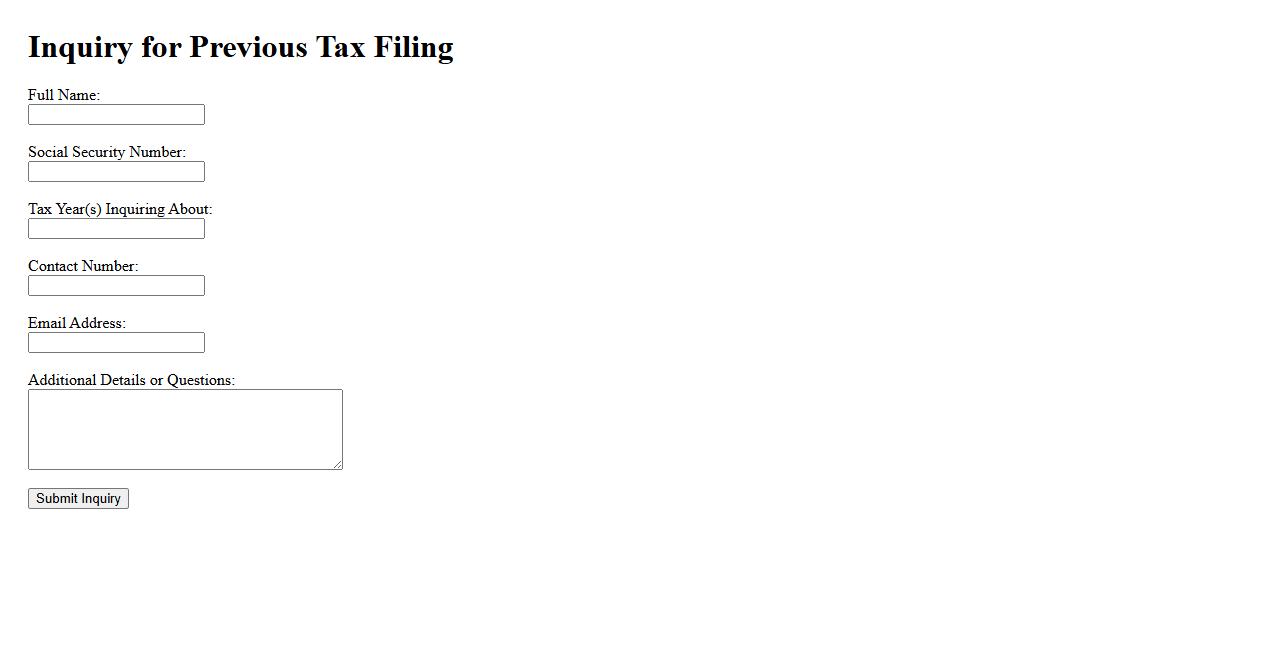

Inquiry for Previous Tax Filing

Submit an inquiry for previous tax filing to review your tax records or resolve discrepancies. This process ensures accurate and up-to-date financial information with tax authorities. Contact your tax office for detailed instructions on how to proceed.

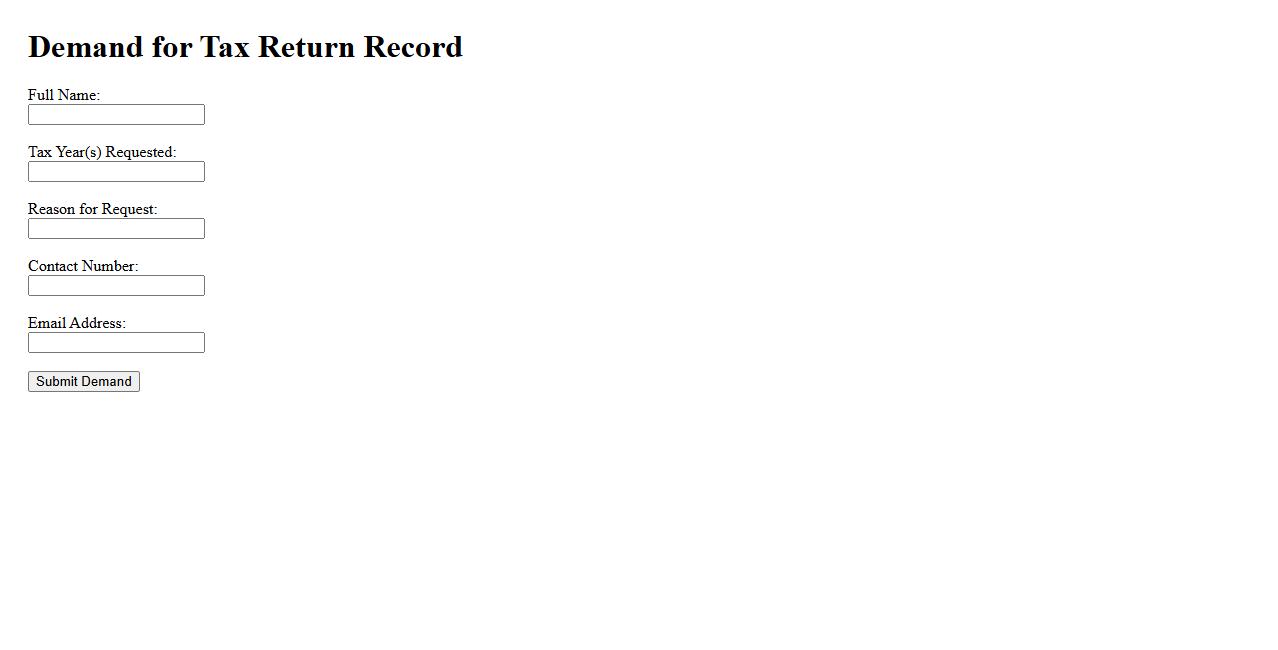

Demand for Tax Return Record

The Demand for Tax Return Record is a formal request made to obtain copies of previously filed tax returns. This document is often required for financial verification, loan applications, or legal purposes. Ensuring accurate and timely access to tax records helps maintain transparency and compliance.

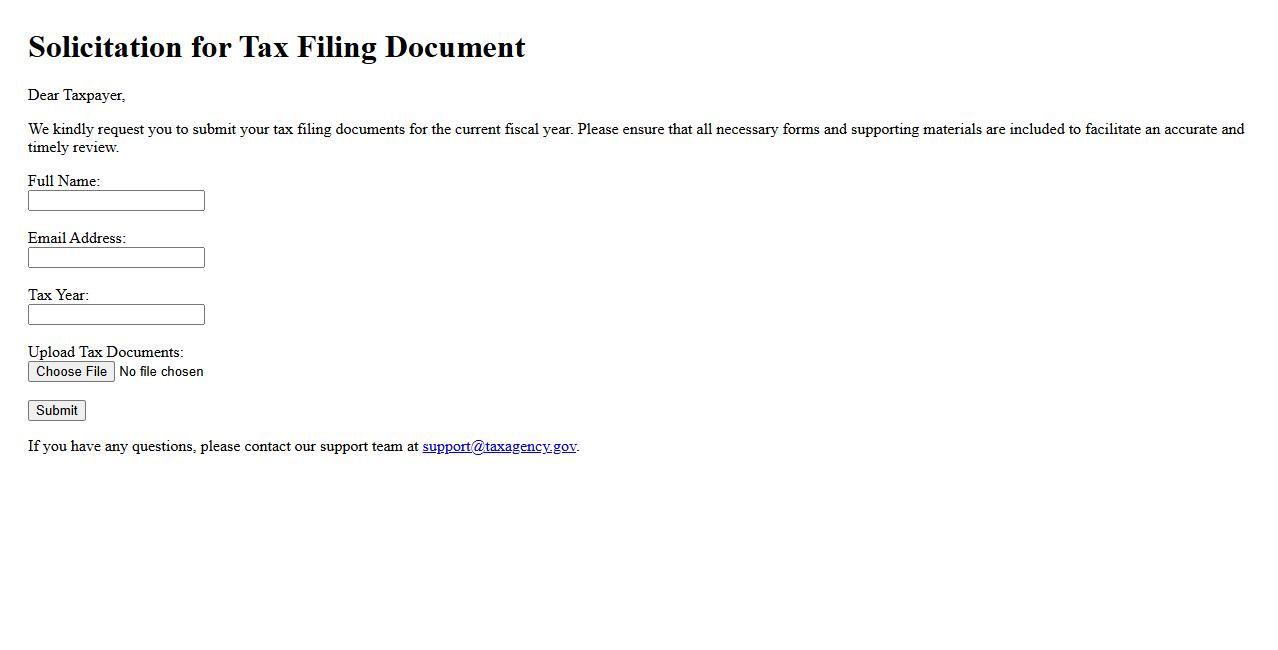

Solicitation for Tax Filing Document

A Solicitation for Tax Filing Document is a formal request sent to taxpayers or tax professionals to submit necessary tax-related papers. It ensures accurate and timely filing by gathering all required financial information. This process helps maintain compliance with tax regulations and avoids potential penalties.

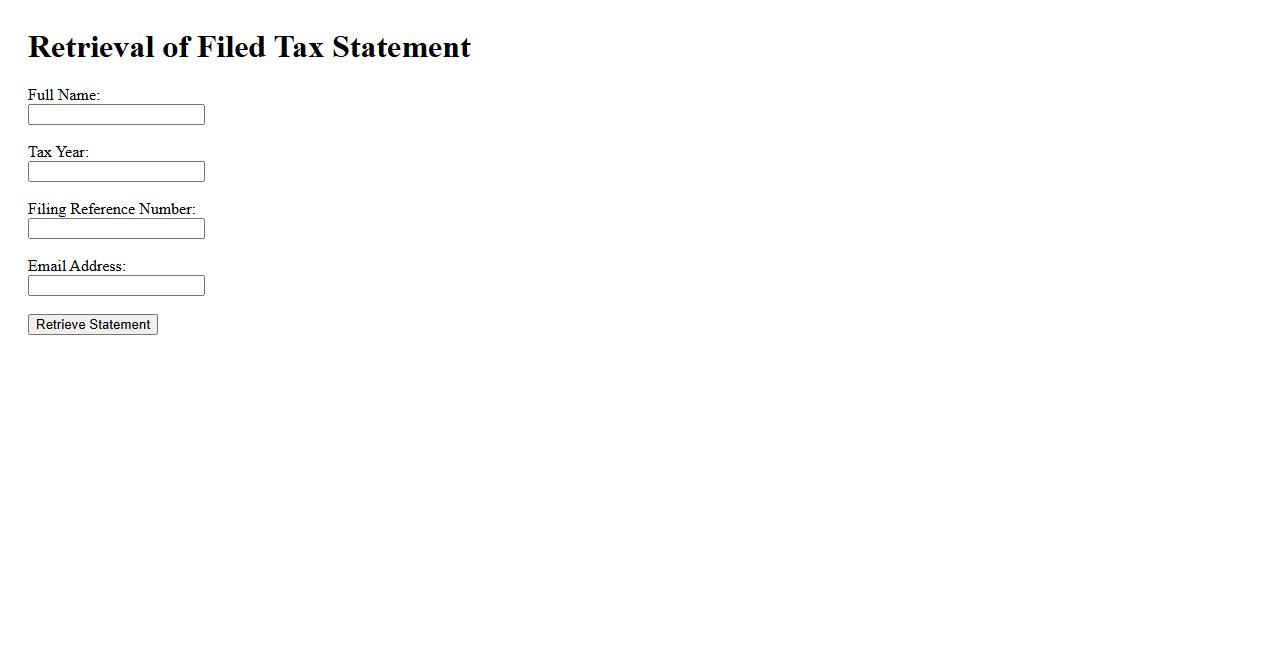

Retrieval of Filed Tax Statement

The retrieval of filed tax statements is a crucial process for accessing previously submitted tax documents. This enables individuals and businesses to review, verify, or update their financial records efficiently. Timely retrieval ensures compliance with tax regulations and aids in accurate financial planning.

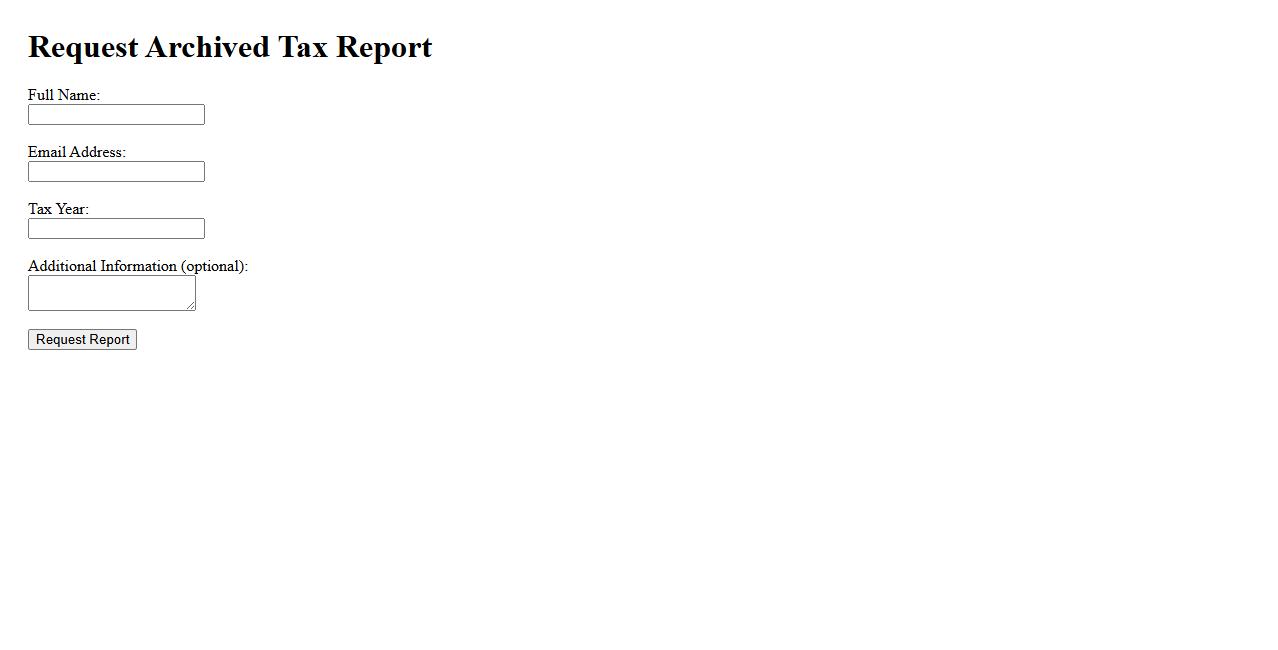

Ask for Archived Tax Report

Requesting an Archived Tax Report allows you to obtain detailed financial records from previous years for accurate tax filing and auditing purposes. These reports provide comprehensive insights into your past tax transactions and compliance status. Accessing archived tax data ensures transparency and supports efficient financial management.

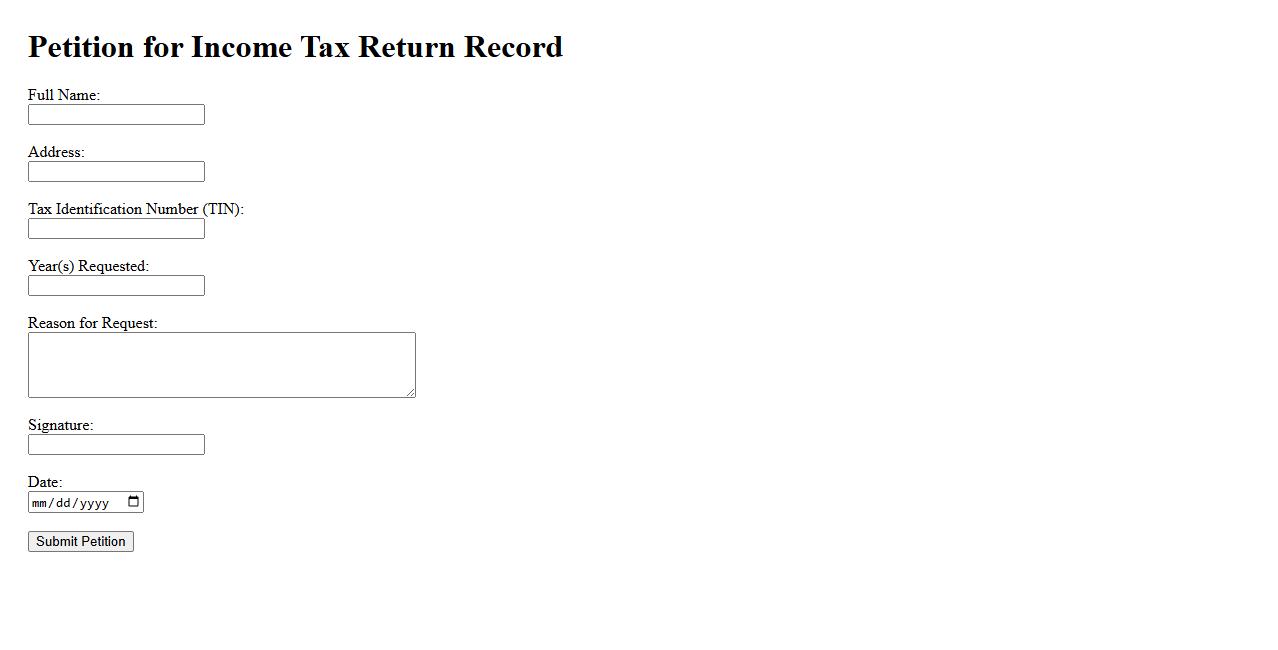

Petition for Income Tax Return Record

The Petition for Income Tax Return Record is a formal request submitted to tax authorities to obtain copies of previously filed tax returns. This document is essential for verifying income, resolving discrepancies, or supporting loan applications. Ensuring accurate and complete records helps maintain compliance with tax regulations.

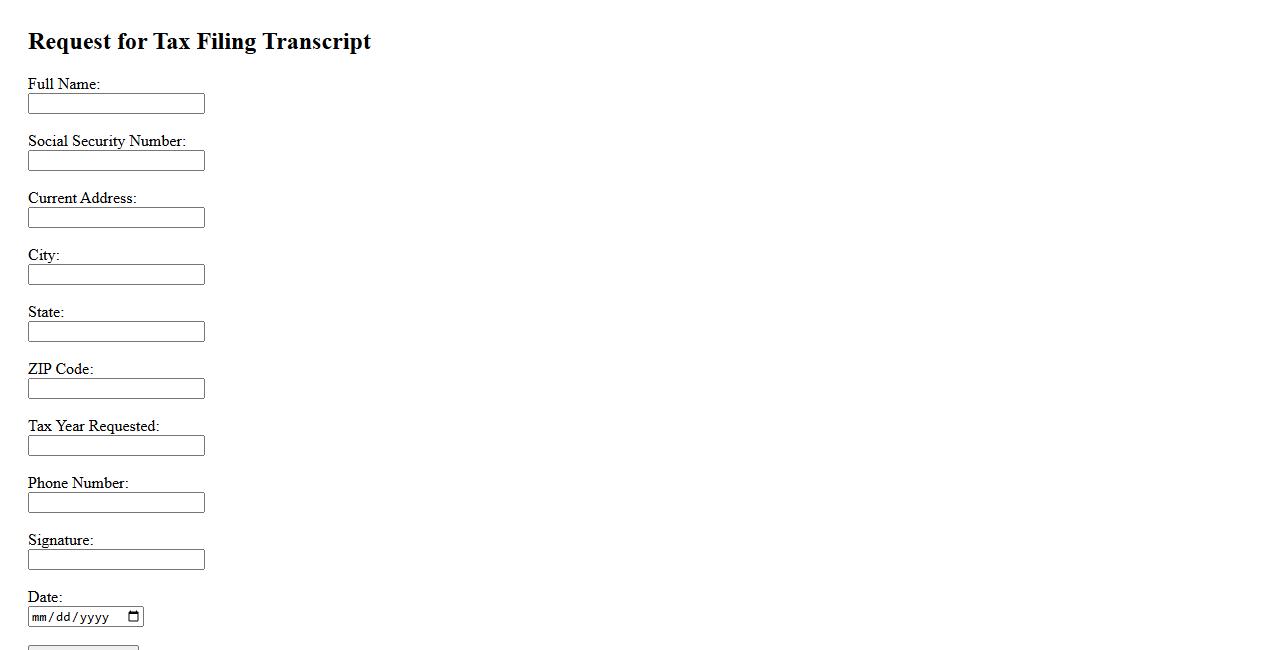

Request for Tax Filing Transcript

A Request for Tax Filing Transcript allows individuals to obtain an official summary of their tax return information from the IRS. This document is essential for verifying income and completing financial applications. It provides a detailed record without disclosing sensitive personal data.

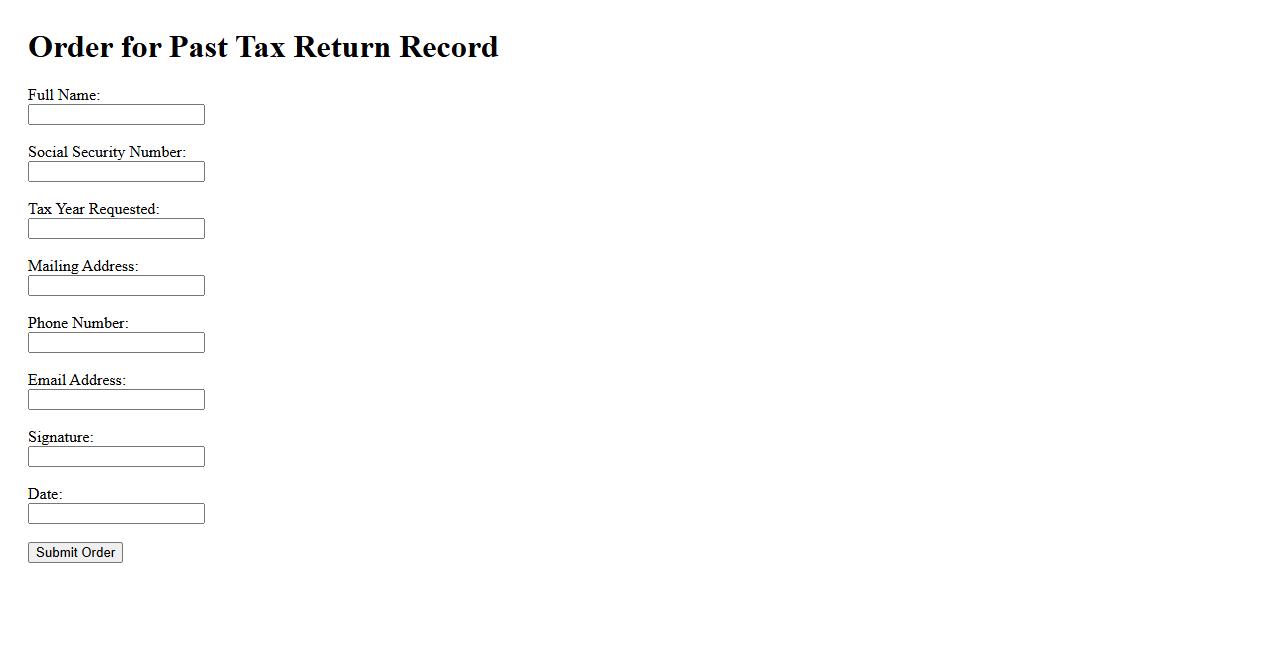

Order for Past Tax Return Record

Request an Order for Past Tax Return Record to access your previous tax documents securely. This service helps you retrieve important financial information for accurate record-keeping or tax filing purposes. Ensure timely submission by obtaining your past tax records promptly.

What is the primary purpose of a "Request for Copy of Tax Return" document?

The primary purpose of a Request for Copy of Tax Return document is to formally obtain a copy of an individual's or entity's filed tax return. This document is used when the original tax return is lost or needed for verification purposes. It ensures that the requester has official and accurate tax information from the tax authority.

Which specific tax year(s) does the request pertain to?

The request must clearly specify the tax year(s) for which the copy of the tax return is being sought. This helps the tax authority identify and locate the exact return needed from their records. Accurate specification of the tax year is essential to avoid delays in processing the request.

Who is the authorized individual or entity submitting the request?

The authorized individual or entity submitting the request is typically the taxpayer or their legal representative. Authorization may also extend to a tax professional or a company authorized to handle tax matters on behalf of the taxpayer. Proper identification and authorization credentials are required to process the request securely.

What type of tax return (e.g., individual, business, partnership) is being requested?

The document must specify the type of tax return requested, such as individual income tax, business tax, partnership return, or corporate tax returns. Identifying the correct type ensures that the appropriate documents are retrieved. Different tax return types have unique formats and filing requirements, making precise identification crucial.

What method of delivery is preferred for receiving the copy of the tax return?

The request should state the preferred method of delivery for receiving the tax return copy, such as mail, electronic download, or in-person pickup. Specifying this ensures the requester receives the documents in a convenient and timely manner. Some tax authorities may also offer secure online portals for delivery to enhance privacy and speed.